Professional Documents

Culture Documents

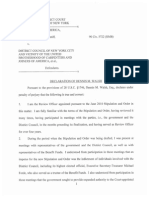

Carpenters Welfare Fund 990 2006

Uploaded by

Latisha WalkerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carpenters Welfare Fund 990 2006

Uploaded by

Latisha WalkerCopyright:

Available Formats

efile GRAPHIC rint - DO NOT PROCESS

As Filed Data -

DLN:93490103001527

Return of Organization Exempt From Income Tax

2005

Form990

OM8 No 1545-0047

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

Department of the Treasury

Internal Revenue Service

"The organization may have to use a copy of this return to satisfy state reporting requirements

Open to Public Inspection

A For the 2005 calendar year or tax year beginning 07-01-2005 and ending 06-30-2006

B Check If applicable r Address change

r Name change r Initial return

r

C Name of organization D Employer identification number

Please NYC DISTRICT COUNCIL OF CARPENTERS WELFARE FUND 13-5615576

use IRS WELFARE FUND

label or

print or Number and street (or PObox If mall IS not delivered to street address) I Room/suite

type. See 395 HUDSON STREET

Specific E Telephone number

Instruc- City or town, state or country, and ZIP + 4 (212) 366-7300

tions. NEW YORK, NY 10014

F Accounting method r Cash F Accrual , Final return

r Amended return , Application pend Ing

, Other (specify) ..

i> Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable H and I are not applicable to section 527 orqentzettons

trusts must attach a completed Schedule A (Form 990 or 990-EZ). H(a) Is this a g roup return for affiliates) I Yes F No

H(b) If "Yes" enter number of affiliates ....

G Web site:" wwwnyccbfcom , Yes , No

H(c) Are all affiliates Included)

J Organization type (check only one) .... F 501(c) (9) .... (Insert no ) , 4947(a)(1) or ,527 (If "No," attach a list See Instructions)

Check here ""f the orqarnzation's gross receipts are normally not more than $25,000 The H(d) Is this a separate return filed by an organization

K covered by a group ruling) ,Yes F No

organization need not file a retum With the IRS, but If the organization received a Form 990 Package In

the mall, It should file a return Without financial data Some states require a complete return. I Group Ex e mptto n Number"

M Check .. P- If the organization IS not required to

L Gross receipts Add lines 6b, 8b, 9b, and lOb to line 12 .. 525,829,895 attach Sch B (Form 990, 990-EZ, or 990-PF)

Revenue Expenses and Changes in Net Assets or Fund Balances (See the mstructrons.)

1 Cont nb uttons , giftS, grants, and Similar amounts received

a Direct public support la

b Indirect pubhe support lb

c Government contributions (grants) lc

d Total (add lines 1a through 1c) (cash $ noncash $ ) ld

2 Program service revenue Including government fees and contracts (from Part VII, line 93) 2 191,132,095

3 Membership dues and assessments 3

4 Interest on savings and temporary cash Investments 4 643,722

5 DIVidends and Interest from s e c urrtre s 5 7,963,831

6a Gross rents I 6a I

b Less rental expenses 6b

c Net rental Income or (loss) (subtract line 6b from line 6a) 6c

7 Other Investment Income (describe .... ) 7

lJ,J

;jj Sa Gross amount from sales of assets (A) SeCUrities (8) 0 ther

c- ather than Inventory

ru 326,079,668 8a

cr:

b Less cost or other baSIS and sales expenses 326,217,198 8b

c Gain or (loss) (attach schedule) ~ -137,530 8c

d Net gain or (loss) (combine line 8c, columns (A) and (8» 8d -137,530

9 Special events and activities (attach schedule) Ifany amount IS from gaming, check here",

a Gross revenue (not Including $ of

contributions reported on line 1a) I 9a I

b Less direct expenses other than fundrars mq expenses 9b

c Net Income or (loss) from special events (subtract line 9b from line 9a) 9c

lOa Gross sales of Inventory, less returns and allowances I lOa I

b Less cost of goods sold lOb

c Gross profit or (loss) from sales of Inventory (attach schedule) (subtract line lOb from line lOa) lOc

11 Other revenue (from Part VII, line 103) 11 10,579

12 Total revenue (add lines 1d, 2, 3,4,5, 6c, 7, 8d, 9c, 10c, and 11) 12 199,612,697

13 Program services (from line 44, column (8» 13

"" 14 Management and general (from line 44, column (C» 14

~

ru 15 Fundr aismq (from line 44, column (D» 15

Q.

" 16 Payments to affiliates (attach schedule) 16

w

17 Total expenses (add II nes 16 and 44, column (A» 17 203,801,866

"" 18 Excess or (defrc rt) for the year (subtract line 17 from line 12) 18 -4,189,169

~ 19 Net assets orfund balances at beginning of year (from line 73, column (A» 19 210,390,063

""

"'-. Other changes In net assets or fund balances (attach explanation) ~

iii 20 20 1,832,486

2: 21 Net assets orfund balances at end of year (combine lines 18,19, and 20) 21 208,033,380 For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat No 11282Y Form 990 (2005)

"T1 o

3

IQ IQ C

N

o o lJ1

"

3 m

o ~ c m ::J ., ~ ...... " _.

......

o :;:

n m

"

~ " m",

a.",

o~

:;;:~

" m ::J

" "

~ ~

3 C m ::J ::J ~ ~ 0

" ..." ::J ~

a.iif

'" VI m m

~o

n -c o 0 3 C 0' " ::J .,

m '" 0.0- m

a. 0

::; ~

ru ::J ~'" o (fl

~ 0

'U

:;: <D ., 3 0> [lJ ~ "'C N

-Ill- n ru

:;: '"

~ ::J

VI

ru -Ill- ::J a.

" ::J

a.

o n 0 ::J ru n

~ ru ...... m ~ III a.m

~ a. 'U o ~ ., "T1 0 0 C "U ~

::J ru

~.g 3

" ., VI

~ 3 CD

~ :;::

\0 VI

-IIl-~

<

o m VI

-Ill- ...

ru

2'

::J a. .,

ru VI ::J \0

VI o

...

/D

c..

n

DI (fl m m

l>

a. a.

m x

~ "C1

m ::J VI m VI

o ::J

"

o

" ~

ru

--I w 0' m

o 0

~ m :::r "C1 m

::J o ~

n o < CD

0;

a.

g. ~

o ~ < ru CD n

zr

~ CD

3

N CD

., CD n

ru ~ o ::J

a. m "C1

'"

o ::J

CD ~ n

VI n :::r

'" a.

C

'"

::J

~ CD

0;

VI

n o ::J

~

.,

m ::J n m VI

n o ::J < m

~

o ::J VI

ru ::J a.

3

CD CD

::J \0 VI

--I

.,

w <

'"

m ..Q n ::J C n

~ "C1 C

3 ~

m ::J

~ ~

::J '"

ru ::J a.

"C1 C 0'

n ru ~

o ::J VI

aN '" N

~W ......... 0

N N a- 0> >-' >-'

N '"

., CD ::J ~ ru

ru ::J a.

3

ru

::J ~

m ::J ru ::J n m

W III

o

'U o VI ~ W \0

'" ru

::J a.

VI :::r

"C1 "C1

::J

'"

--I '" '" 'C

:::r o ::J

'"

w rw a w

(fl C 'C 'C

m VI

r m

'" ru

~

m VI

l> n n o C ::J ~

::J '"

~

'" VI

'U

., ru

o -<

~

VI VI

o ::J ru

..." C ::J a. .,

ru VI ::J <C

~

CD VI

., o

~ " X

CD VI

o

~

:::r m

m

3

'C

o -c m m

0' m ::J m :::!' ~ VI

'U CD ::J VI

o ::J

"C1

" ::J

n o ::J ~

=

0' ::; C ru

~ <C

o CD

::J VI

VI

!-" .!'J

>-' N -.J 0>

... w .. w

-.J a >-' N N 0>

'" QI

'" III

m

crVll> ., 0

o 0

~ .,

:::rn", m:::=::[l)

~~~

...... ru ru (f)::::J ~ ma.o

~----~-~~-~--~~~-~--+_~~-~--+_~-----.---r--.---r--.---r--'---.--'---.---r--.---r--.---r--.---r--,---r--,---.-------~------~: ~ ~

t ~ ~ lG' ~ W ~ ~ i: e c!!; ~ ~ ~ li: !il ~ ~ ~ ~ ~ ~ ~ ~ ~ tI: ~ t;: ~ iif; 3

~----~--+---~~---+--~--+------+--~--+---~~--~--~--+-~---+--~--+---~~--~--+---+-~---+--~--+-------~------~~ ~ ~

VI ru

., ::J n C N 0

8- ~~

o 0 CD

::J ::J ~ VI VI '"

ru n

~o

C

~ 3

n ::J

~~

o l>

::J~

o

n o

3

'C

'" ::J

VI

"

~ .g>

::J '"

~ ~ ~ n

'0

" 5.

8'

VI l1li CD~

< -e - a

n<.C

~ OJ 3

n CD VI

"

VI ru ru = CD

VI

ru ::J a.

o ::J

o ..."

o

::ll

n CD .,

VI

3 (1)

3

n

,,~

::J 3: c." <.Cl::J

'" " ::J<'c

CD (1)

ill 3 -(1)

~

I

-< /D III

I

z o

C' (1)

Vl

a.

0;

n ~ o

.,

VI

m ~ n

""n

~o

--.lC

w~

VI ..... ~ ~ OJ ::J~ o

~n

x~

m " 3 ::J 'C a.

~~

n 0 :::r~

" ru = .,

~ CD

" 0'0;

ro.o

~ C ., .,

C '"

~a.

VI 0- 0'

C VI ~ '" o n

~ 0 "U

o ::::J ~

~ m

IIJ

"T1 o

3

\D \D o

N ." II) 0 C rOo 0 :::l I» lJ1 nrOo rOotD

-'3 g tD

I» :::l

_rOo

mO )( .....

'C

tD

:::l

1/1

tD

1/1

...

'" :::T

o C

0.. CD .a c ID

n o c

3

::J

-u ..... o IC ..... ID

3

'" CD

..... <

o CD

'"

'" "',

~o G),..,.

~ ~

~ .....

'" "'C

ID d ::J IC 0.. .....

ID ID 3

o '" n CD

ID .....

<

o n ::J CD

'" '" -\II-~

ID ,..,. ,..,.

ID n :::T

'" n

:::T CD 0.. C

CD

...... ..." r-r:::T

'" ID

3

o C ::J ,..,.

::J n

c 0.. CD

'"

0'

..,

CD

IC ::J IC ..,

ID ::J ,..,.

'"

n :::T CD n A

:::T CD ..,

CD

~

G)

.., ID ::J r-r-

'" ID

::J 0..

ID

o n ID

o ::J

'" -\II-

...... ..." r-r:::T

'" ID

3

o C ::J ,..,.

::J n

c 0.. CD

'"

0'

..,

CD

IC ::J IC ..,

ID ::J ,..,.

'"

n :::T CD n A

:::T CD ..,

CD

~

G)

.., ID ::J r-r-

'" ID

::J 0..

ID

o n ID

o ::J

'" -\II-

...... ..." r-r:::T

'" ID

3

o C ::J ,..,.

::J n

c 0.. CD

'"

0'

..,

CD

IC ::J IC ..,

ID ::J ,..,.

'"

n :::T CD n A

:::T CD ..,

CD

n

~

G)

.., ID ::J r-r

'" ID

::J 0..

ID

o n ID

o ::J

'" -\II-

...... ..." r-r :::T

'" ID

3

o C ::J ,..,.

::J n

c 0.. CD

'"

0'

..,

CD

<C ::J <C ..,

ID ::J ,..,.

'"

n :::T CD n A

:::T CD ..,

CD

cr

~

G)

.., ID ::J r-r-

'" ID

::J 0..

ID

o n ID

o ::J

'" -\II-

...... ..." r-r:::T

'" ID

3

o C ::J ,..,.

::J n

c 0.. CD

'"

0'

..,

CD

<C ::J <C ..,

ID ::J ,..,.

'"

n :::T CD n A

:::T CD ..,

CD

'" ,

AI --I o

'"

r-r :::T CD

o ..... <C ID ::J N ID

3

ID ..... -c

CD X CD

3

"'C

"'C C ..... "'C o

'" CD

-v

'" --I

o

-u ;0 o <

o m

:::I: m ~ r --I :::I: n ~ ;0 m

OJ m z m ""T1

--I if)

~

IV o o 1Jl

'" ,

'" ,

'" ,

-u ;0 o <

o m

:::I: m ~ r --I :::I:

~ Z o

:;E

m r ""T1 ~ ;0 m

OJ m z m ""T1

......

--I if)

--I o

m r

G) OJ r m

3: m 3:

OJ m ;0 if)

~ z o --I :::I: m

;0 o m -u m z o m z --I if)

~

IV o o 1Jl

""T1 o

3

<D <D o

ID 0 '"

::J ::J 0

0.. 3 ID ::J CD

n '" "'C n c CD c n 0 W :::r"'O

..,

::J n c

ID

-u ID <C CD

W

Form 990 (2005)

Page 4

l::F.t.Iii"J Ba la nee Sheets (See the instructions)

Note: Where required, attached schedules and amounts within the des cnptron (A) (8)

column should be for end-of-year amounts only. Beginning of year End of year

45 Cas h-non- int e res t- bea ring 7,065,520 45 6,462,231

46 Savings and temporary cash Investments 4,058,445 46 3,943,230

47a Accounts receivable 47a 26,184,425

b Less allowance for doubtful accounts 47b 15,900,000 9,435,881 47c 10,284,425

48a Pledges receivable 48a

b Less allowance for doubtful accounts 48b 48c

49 Grants receivable 49

50 Receivables from officers, directors, trustees, and key employees

(attach schedule) 50

51a Other notes and loans receivable (attach

schedule) ISla I

-To

a:: b Less allowance for doubtful accounts Sib Sic

-To

-To 52 Lnv e nt o ne s for sale or use 52

.:(

53 Prepaid expenses and deferred charges 136,971 53 158,959

54 Investments-securities (attach schedule) .. I Cost F FMV 198,936,706 54 ~ 195,737,412

55a Investments-land, burldrnqs , and

equipment bas IS ssa

b Less acc umulated deprec iat ro n (attac h

schedule) ssb ssc

56 Investments-other (attach schedule) 56

s7a Land, burldrnqs , and equipment baSIS s7a 3,869,979

b Less acc umulated deprec iat ro n (attac h

schedule) s7b 3,643,820 333,629 s7c ~ 226,159

58 Other assets (describe .. ) 44,952,615 58 ~ 44,590,773

59 Total assets (must equal line 74) Add lines 45 through 58 264,919,767 59 261,403,189

60 Accounts payable and accrued expenses 916,066 60 686,153

61 Grants payable 61

62 Deferred revenue 62

<~ 63 Loans from officers, directors, trustees, and key employees (attach

I

schedule) 63

" 64a Tax-exempt bond liabilities (attach schedule) 64a

h,

b Mortgages and other notes payable (attach schedule) 64b

65 Other lrabhhtre s (describe .. ) 53,613,638 65 ~ 52,683,656

66 Total liabilities Add lines 60 through 65 54,529,704 66 53,369,809

Organizations that follow sFAs 117, check here .. I and complete lines

67 through 69 and lines 73 and 74

-To 67 Unrestricted 67

G!

g 68 Temporarily restricted 68

I']

'i'i 69 Permanently restricted 69

(0

u Organizations that do not follow SFAS 117, check here .. F and

:::

~ complete lines 70 through 74

(:; 70 Capital stock, trust prmcrpal, or current funds 70

-To 71 Paid-In or capital surplus, or land, burldmq, and equipment fund 71

a::

-To 72 Retained earnings, endowment, accumulated Income, or other funds 210,390,063 72 208,033,380

~

a:: 73 Total net assets or fund balances (add lines 67 through 69 or lines

Z 70through72,

column (A) must equal line 19, column (B) must equal line 21) 210,390,063 73 208,033,380

74 Total liabilities and net assets / fund balances Add hnes 66 and 73 264,919,767 74 261,403,189 Form 990 (2005)

Form 990 (2005)

Page 5

lihii"b·j Reconciliation of Revenue per Audited Financial Statements With Revenue per Return (See

the instructions.)

a Total revenue, gains, and other support per audited financial statements a

b A mounts Included on line a but not on line 12

1 Net unrealized gains on Investments bl

2 Donated services and use of facihtre s b2

3 Recoveries of prior year grants b3

4 Other (s p e cifv )

b4

A dd lines bl through b4 b

c Subtract line b from line a c

d Amounts Included on line 12, but not on line a

1 Investment expenses not Included on line 6b dl

2 Other (s p e cifv )

d2

A dd lines dl and d2 d

e Total revenue (line 12) Add lines c and d ... e

.:r.u.,'.c:II:. Reconciliation of Expenses per Audited Financial Statements With Expenses per Return

a Total expenses and losses per audited financial statements a

b A mounts Included on line a but not on line 17

1 Donated services and use of facihtre s bl

2 Prior year adjustments reported on line 20 b2

3 Losses reported on line 20 b3

4 Other (s p e cifv )

b4

A dd lines bl through b4 b

c Subtract line b from line a c

d Amounts Included on line 17, but not on line a:

1 Investment expenses not Included on line 6b dl

2 Other (s p e cifv )

d2

A dd lines dl and d2 d

e Total expenses (line 17) Add lines c and d ... e

• :l'Ti"'J:J!W Current Officers, Directors, Trustees, and Key Employees (List each person who was an officer, director, trustee, or key employee at any time durrnq the year even If they were not compensated.) (See the

instructions.)

(D) Contnbunons to (E) Expense

(8) Title and average hours (C) Compensation employee benefit plans &

(Al Name and address per week devoted to position (If not paid, enter -0-.) deferred compensation account and other

plans allowances

See Additional Data Table Form 990 (2005)

Form 990 (2005)

Page 6

• :E.TiI"'J:J!. Current Officers, Directors, Trustees, and Key Employees (continued) Yes No

75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at board

meetings ... 12

b A re any officers, directors, trustees, or key employees listed In Form 990, Part V-A, or highest compensated

employees listed In Schedule A, Part I, or highest compensated professional and other Independent

contractors listed In Schedule A, Part II-A or II-B, related to each other through family or business

relatrons hrps ? If"Yes," attach a statement that Identifies the Individuals and explains the re l atrons hrp (s ) 75b No

c Do any officers, directors, trustees, or key employees listed In Form 990, Part V-A, or highest compensated

employees listed In Schedule A, Part I, or highest compensated professional and other Independent

contractors listed In Schedule A, Part II-A or II-B, receive compensation from any other organizations, whether

tax exempt or taxable, that are related to this organization through common s up e rvts to n or common control? 75c No

Note. Related organizations Include section 509(a)(3) supporting organizations

If"Yes," attach a statement that Identifies the Individuals, explains the relationship between this

organization and the other oro aruzatro nj s ), and describes the compensation arrangements,

Including amounts paid to each Individual by each related organization

d Does the organization have a written conflict of Interest p o hc v ? 75d No

• :E.TiI .. '.cII:. Former Officers, Directors, Trustees, and Key Employees That Received Compensation or Other Benefits (If any former officer, director, trustee, or key employee received compensation or other benefits (described below) durrnq the year, list that person below and enter the amount of compensation or other

benefits In the appropriate column. See the mstructions.)

(D) Contnbutions to

(A) Name and address (8) Loans and Advances (C) Com pensation employee benefit plans (E) Expense account and

and deferred compensation other allowances

plans

• :fl"i"T,. Other Information (See the instructions.) Yes No

76 Old the organization engage In any activity not previously reported to the IRS? If "Yes,' attach a detailed descnption of each activity 76 No

77 Were any changes made In the organizing or governing documents but not reported to the IRS7 77 No

If"Yes," attach a conformed copy of the changes

78a Old the organization have unrelated busrness gross Income of $1,000 or more dunnq the year covered by thts return> 78a No

b If "Yes," has It flied a tax return on Form 990-T for t his y e ar? 78b

79 Was there a hquidanon, dissolution, termination, or substantial contraction dunng the vear> If "Yes," attach a statement 79 No

80a Is the organization related (other than by association With a statewide or nationwide organization) through common membership,

governing bodies, trustees, officers, etc I to any other exempt or nonexempt orqaruzation? 80a Yes

b If "Yes," enter the name of the organization" See Additional Data Table

and check whether It IS I exempt or I nonexempt

81a Enter direct or Indirect political expenditures (See line 81 Instructions) ·181a I

b Did the organization file Form 1120-POL for this ve ar> 81b No Form 990 (2005)

Form 990 (2005)

Page 7

No

1:E.Ti;a.Ti. Other Information (continued)

82a

Yes

Yes

No

82a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value?

No

b If "Yes," you may Indicate the value of these Items here Do not Include this amount as revenue In Part lor as an expense In Part II (See instructions In Part III )

182b I

83a Did the organization comply with the public Inspection requirements for returns and exemption applications? b Did the organization comply with the disclosure requirements relating to quid pro quo contributions?

84a Did the organization solicit any contributions or gifts that were not tax deductible?

b If "Yes," did the organization Include with every solicitation an express statement that such contributions or gifts were not tax deductible?

85 501(c)(4), (5), or (6) organizations. a Were substantially all dues nondeductible by members? b Did the organization make only In-house lob b v mq expenditures of$2,000 or less?

If"Yes," was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed the prior year

e Dues assessments, and Similar amounts from members d Section 162 (e) l o b b y rnq and political expenditures

e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices

f Taxable amount of l o b b y rnq and political expenditures (line 85d less SSe)

asr

8se

8sd

8se

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f?

h If s e c tro n 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line S5fto Its reasonable estimate of dues allocable to nondeductible lo bbvmq and political expenditures for the following tax year?

86 501(c)(7) orgs. Enter a Initiation fees and capital contributions Included on line 12 1-8_6_a---i ---1

86b

b Gross receipts, Included on line 12, for public use of club facilities

87 501(c)(12) orgs. Enter a Gross Income from members or shareholders

b Gross Income from other sources (Do not net amounts due or paid to other sources against amounts due or received from them)

88 At any time durrnq the year, did the organization own a 50% or greater Interest In a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 7701-2 and 301 7701-3? If"Yes," complete Part IX

87a

87b

89a 501(c)(3) organizations Enter Amount of tax Imposed on the organization durrnq the year under

section 4911 ..

I section 4912 ..

, sectio n 4955 ..

b 501(c)(3) and 501(c)(4) orgs. Did the organization engage In any section 4958 excess benefit transaction durrnq the year or did It become aware of an excess benefit transaction from a prior year? If "Yes," attach a statement explaining each transaction

e Enter Amount of tax Imposed on the organization managers or disqualified persons durmc the year under

sections 4912,4955, and 4958 ..

83a

83b

84a

84b

8sa

8sb

8sg

8sh

88

89b

No

No

d Enter Amount of tax on line 89c, above, reimbursed by the organization 90a List the states with which a copy of this return IS flied ..

b N umber of employees employed In the pay period that Includes March 12,2005 (See Instructions)

...

90b

142

91a The books are In care of .. _B_O_A_R_D_O_F_T_R_U_S_T_E_E_S _

395 HUDSON STREET Lo c at e d at js- NEWYORK, NY

Telephone no .. (212) 366-7300

ZI P + 4 .. _1_0_0_1_4 _

b At any time durmq the calendar year, did the organization have an Interest In or a signature or other authority over a financial account In a foreign country (such as a bank account, s e c untre s account, or other financial account)?

If"Yes," enter the name of the foreign country .. _

See the Instructions for exceptions and filing requirements for Form TO F 90-22.1, Report of Foreign Bank and Financial Accounts

e At any time durmq the calendar year, did the organization maintain an office o ut s rd e of the United States?

If"Yes," enter the name of the foreign country .. _

92 Section 4947(a)(1) nonexempt chantable trusts filing Form 990 In lieu of Form lD41-C hec k here

and enter the amount of tax-exempt Interest received or accrued d urrnq the tax year

92

Yes No

91b No

91e No ...

Form 990 (2005)

Form 990 (2005)

Page 8

~Tii"'''' Analysis of Income-Producing Activities (See the instructions,

Note: Enter gross amounts unless otherwise Indicated, Unrelated business Income Excluded by section 512, 513, or 514 (E)

(A) (e) Related or

Business (8) Exclusion (D) exempt function

code Amount code Amount Income

93 Program service revenue

a EM PLO YE R CO NTRI BUTIO N S 189,550,583

b COBRA CONTRIBUTIONS 1,581,512

c

d

e

f Medicare/Medicaid payments

9 Fees and contracts from government agencies

94 Membership dues and assessments

95 Interest on savings and temporary cash Investments 14 643,722

96 DIvidends and Interest from s e c urrtte s 14 7,963,831

97 Net rental Income or (loss) from real estate

a debt-financed property

b non debt-financed property

98 Net rental Income or (loss) from personal property

99 Other Investment Income

10D Gam or (loss) from sales of assets other than Inventory 18 -137,530

101 Net Income or (loss) from special events

102 Gross profit or (loss) from sales of tnv e ntory

103 Other revenue a MISCELLANEOUS INCOME 01 10,579

b

c

d

e

104 Subtotal (add columns (B), (D), and (E» 8,480,602 191,132,095 105 Total (add line 104, columns (B), (D), and (E»

Note: Line 105 plus line ld, Part I, should equal the amount on line 12, Part l.

• .. 1_9_9..:.,_6_1_2-'-,6_9_7

Did the organization, dunnq the year, receive any funds, directly or Indirectly, to pay premiums on a personal benefit contract?

Did the organization, durrnq the year, pay premiums, directly or Indirectly, on a personal benefit contract? NOTE: If "Yes" to (b), file Form 8870 and Form 4720 (see instructions),

[""" Yes P" No

Under penalties of perjury. I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief. It IS true. correct. and complete Declaration of preparer (other than officer) IS based on all Information of which preparer has any knowledge

Please ~ ****** 12007-04-03

Sign 51g nature of officer Date

Here ~

MICHAELl FORDE TRUSTEE/CO-CHAIRMAN

Type or print name and title

Date Check If Preparer's SSN or PTIN (See Gen Inst W)

Pre parer's ~

Paid signature self-

empolyed ·r

Preparer's

Use Firm's name (or yours ~

If self-employed). EIN •

Only address, and ZIP + 4 NOVAK FRANCELLA Ll.C

450 SEVENTH AVENUE SUITE 3500 •

Phone no (212) 279-4262

NEW YORK, NY 10123 Form 99D (2005)

~--~~--~--~--~--~~--~----~--~----,~

o ""I

3 'D 'D o

...

tD x

---r--+-~---r--+-~--~--+----+--~--~~

tD

~ ~ ~ ~ ~ ~ ~ ~ ~

~ ~ ~ ~ ~ ~ ~ ~ ~

--~---+--_r--_r--~--+_--+_--r_----r_~----~tD ~

~ o

..

n

o < tD ""I tD Q.

.....

o c n

......

~ :;0 -< r ......

~ OJ

......

r

......

--l

-<

......

:2 (f) C :;0 ~ :2 n m

~ IN

.....

~ o -u

o ~ --l ~

-u :;0 o n m (f) (f)

......

:2 G)

"TI m m (f)

......

:2 < m (f) --l 3: m :2 --l "TI m m (f)

n o 3: -u c --l m :;0

m x -u m :2 (f) m (f)

...

n o :2 (f) C r --l

......

:2 G)

"TI m m (f)

-u ~ -< :;0 o r r

~ C o

m X -u m :2 (f) m

Q.

(f) --l ~ :2 o ~ :;0 o

o ~ --l ~

m X -u m :2 (f) m (f)

n

m(f) xn -UI

~~

(f)~ m:;o (f)(f)

I

......

-u

~ o 3:

:2

......

(f) --l :;0 ~ --l

< m

G) m :2 m :;0 ~ r

(f) m n c :;0

......

--l

-<

:2 (f) C :;0 ~ :2 n m

" DI

""I ..

1-1 1-1

...

-

s

III

--

>

--

C

.......

"T1 C :::I Q.

; iii' S· IC

o

..

::r tD

""I

~--------~------~----~~----~------~------~------~------~------~------~-------,~

o ..,

3 \D \D o

..

IN ...... 0 ()O AN (fl

<

r r m

2 -<

...... ...... CO o ......

-...1'-' 0'10 2(fl

O~

;oI -l IO

r OJ ......

;0< 0 ...... ~m

O~ :;E

~ -< ;0 o o 3:

o

N()m OI3:

O~-O ...... r

;00 -< m ;0

-l ;0 C (fl -l m m n o

m

...... o lJ1

2 G)

'-'

;0

OOJG) rOm OxO

OJ""";o ;oO'lG) ...... wm

o G) m

2

'-'

o co co lJ1 -...I

G) ;0 m ()

o

(fl ...... -l 0;0 om ...... m ./lo.-l

2 w'-'

mlDg. :;ElJ1::J -< I <0 Ocn; ;oOID

(fl::J

_A 0 ~ 22

-<

(fl

...... -l 0;0 om ......m ./lo.-l

2 -l ;0 C (fl -l m m

2 -l ;0 C (fl -l m m

N-lC 0;02 OC ......

(flO -l2 m

m

()

I

~

o

.....

>

<

I

>

2 III

~

III = C.

III C. C.

;

1/1 1/1

" AI

..,

....

n I: .., ..,

tD

= ....

------~r_----r_----+_----~----_r----_+----_;------r_----+_----~----~O

3!

n tD ..,

In

..

Nm 03: 0-0

r o -< m ;0 -l ;0 C (fl -l m m

Nm 03: 0-0

r o -< m ;0 -l ;0 C (fl -l m m

Nm 03: 0-0

r o -< m ;0

-l ;0 C (fl -l m m

Nm 03: 0-0

r o -< m ;0 -l ;0 C (fl -l m m

NC 02

00

2 -l ;0 C (fl -l m m

NC 02

00

2 -l ;0 C (fl -l m m

NC 02

00

NC 02

00

=-

0 .....

C IJI iii ....

... 'C ;;!

o tD

.. 15"

-g :IE III

1/1 tD = :.tDc.

O' =-:- III = C. e

~ ~

o III .. \C tD tD C.

2

..,

tD n ....

o ..,

In

..

-I

, ..,

---------+------1-------~----_+------1_------+_----_1------~------+_----~~------~1:

In ....

tD tD

!f!

.....

.... .........

= n 0 ....

.. n 'C 0 III 3

~~-g

tD =

a ~

tD ... .. o·

I = o

I

AI = c.

;ill: tD <

m

3

---------;-------+-------r--------l-------;-------+-------r--------l------~------_+--------;~

n ..... 0 o'CtDC <

3 i»3';:; tD

-g s s s tD

=1/10= In

1/1 AO ~ ::::!c.tDC: o· tD C" C = .... tD ..

tD = 0-' 'C :::: tD i»tD .... =

= c.:.:! 1/1 0

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Final Report of The Review Officer RevisionDocument50 pagesThe Final Report of The Review Officer RevisionLatisha WalkerNo ratings yet

- IM 3rd Interim ReportDocument41 pagesIM 3rd Interim ReportLatisha WalkerNo ratings yet

- CourtTranscript2016 10 17Document86 pagesCourtTranscript2016 10 17Latisha WalkerNo ratings yet

- NYCDCC Report 07 ECFNo.1755 FourthInterimReportoftheIndependentMon...Document24 pagesNYCDCC Report 07 ECFNo.1755 FourthInterimReportoftheIndependentMon...Latisha Walker0% (1)

- Court Transcript NYCDC 4/18/2016Document57 pagesCourt Transcript NYCDC 4/18/2016Latisha WalkerNo ratings yet

- Government Response To Motion For StayDocument16 pagesGovernment Response To Motion For StayLatisha WalkerNo ratings yet

- IM 1st Interim Report-CDocument57 pagesIM 1st Interim Report-CLatisha WalkerNo ratings yet

- 2nd Interim Report of The IMDocument89 pages2nd Interim Report of The IMLatisha WalkerNo ratings yet

- DC LM2-070114-063015 FinalDocument217 pagesDC LM2-070114-063015 FinalLatisha WalkerNo ratings yet

- Mike DocumentDocument40 pagesMike DocumentLatisha WalkerNo ratings yet

- Motion For StayDocument103 pagesMotion For StayLatisha WalkerNo ratings yet

- U.S. v. D.C. Transcript of 11.19.14 ConferenceDocument53 pagesU.S. v. D.C. Transcript of 11.19.14 ConferenceLatisha WalkerNo ratings yet

- StipDocument22 pagesStipLatisha WalkerNo ratings yet

- LM2 2014Document52 pagesLM2 2014Latisha WalkerNo ratings yet

- Statushearingtranscript September.30.2014Document42 pagesStatushearingtranscript September.30.2014Latisha WalkerNo ratings yet

- Filed Complaint With Docket NumberDocument17 pagesFiled Complaint With Docket NumberLatisha WalkerNo ratings yet

- September.30.2014 CourtorderDocument1 pageSeptember.30.2014 CourtorderLatisha WalkerNo ratings yet

- Cross Claims Pleading Draft 6 ConformedDocument41 pagesCross Claims Pleading Draft 6 ConformedLatisha Walker100% (1)

- Barbra Jones Submission On 9-10-14Document3 pagesBarbra Jones Submission On 9-10-14Latisha WalkerNo ratings yet

- United States District Court Southern District of New York: DefendantsDocument20 pagesUnited States District Court Southern District of New York: DefendantsLatisha WalkerNo ratings yet

- 02-William Link v. David Rhodes McCarron Answering Brief - pdf.PdfCompressor-811437Document18 pages02-William Link v. David Rhodes McCarron Answering Brief - pdf.PdfCompressor-811437Latisha WalkerNo ratings yet

- Order PDFDocument11 pagesOrder PDFLatisha WalkerNo ratings yet

- Declaration of Dennis WalshDocument5 pagesDeclaration of Dennis WalshLatisha WalkerNo ratings yet

- 2014-08-25 Torrance Decl Re Nee RemandDocument43 pages2014-08-25 Torrance Decl Re Nee RemandLatisha WalkerNo ratings yet

- Response To BermanDocument9 pagesResponse To BermanLatisha WalkerNo ratings yet

- Letter To Judge Berman 8 6 14Document3 pagesLetter To Judge Berman 8 6 14Latisha Walker100% (1)

- 2014-08-25 USAO To RMB Re Nee RemandDocument6 pages2014-08-25 USAO To RMB Re Nee RemandLatisha WalkerNo ratings yet

- Wall Ceiling Arbitration Opinion and Award Fo Arb. Howard C. Edelman Dated 7-22-14 Received 7 25 14Document23 pagesWall Ceiling Arbitration Opinion and Award Fo Arb. Howard C. Edelman Dated 7-22-14 Received 7 25 14Latisha WalkerNo ratings yet

- Enright, Et Al. v. New York City District Council of Carpenters Welfare Fund, Et Al.Document3 pagesEnright, Et Al. v. New York City District Council of Carpenters Welfare Fund, Et Al.Latisha WalkerNo ratings yet

- Summary Order: United States Court of Appeals For The Second CircuitDocument8 pagesSummary Order: United States Court of Appeals For The Second CircuitLatisha WalkerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)