Professional Documents

Culture Documents

Colliers 2014 1Q Walnut Creek 680 Corridor Research & Forecast

Uploaded by

Bill Gram-ReeferOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Colliers 2014 1Q Walnut Creek 680 Corridor Research & Forecast

Uploaded by

Bill Gram-ReeferCopyright:

Available Formats

Q1 2014 | OFFICE

WALNUT CREEK | NORTH I-680 CORRIDOR

RESEARCH & FORECAST REPORT

Market Fundamentals

Improve Across All Office Classes

The North I-680 Office leasing market improved across all class segments during the first

quarter 2014. Class A vacancy decreased 40 basis points to 15.0 percent, Class B vacancy fell

130 basis points to 13.8 percent and Class C vacancy decreased 20 basis points to 21.4 percent.

These changes combined to result in total vacancy falling 60 basis points to 15.6 percent. The

market as a whole absorbed 117,436 square feet.

MARKET INDICATORS

Q1

PROJECTED

Q2

VACANCY RATE

NET ABSORPTION

CONSTRUCTION

RENTAL RATE

The Walnut Creek Downtown submarket absorbed space in the first quarter. Class A vacancy

decreased 10 basis points to 14.2 percent. Class A registered 3,482 square feet of net absorption

during the quarter. Class B registered 15,163 square feet of net absorption as vacancy fell 100 basis

points to 12.3 percent. At 1850 Mt. Diablo Boulevard, Legacy Risk & Insurance Services leased 9,620

square feet on the fourth floor. Rudolph & Sletten took 3,320 square feet at 800 S Broadway. At 1801

Oakland Boulevard, Proforma Partners leased 2,760 square feet on the second floor.

The Walnut Creek Pleasant Hill BART Class A submarket registered a 230 basis point decrease

in vacancy. The submarket tracked 41,011 square feet of net absorption. Vacancy now stands at

11.5 percent returning to a level seen one year ago. The most significant lease transaction was

Del Monte Foods 26,835 square foot, sixth floor lease at PMI Plaza.

NORTH I-680 CORRIDOR > VACANCY VS. ASKING RENTS

20%

$2.20

18%

$2.10

16%

$2.00

14%

$1.90

12%

$1.80

10%

2Q12

3Q12

4Q12

1Q13

Vacancy Rate

VACANCY RATE

www.colliers.com/walnutcreek

2Q13

3Q13

Asking Rents

4Q13

1Q14

ASKING RENTAL RATE

$1.70

The North I-680

corridor improved

across all class

segments. Rents

have increased

for six consecutive quarters.

RESEARCH & FORECAST REPORT | Q1 2014 | OFFICE

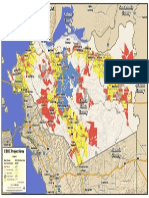

SUBMARKET MAP

1. Walnut Creek / Pleasant Hill

BART Station

2. Walnut Creek Downtown

3. Shadelands

4. Pleasant Hill

5. Lamorinda

6. Martinez

7. Concord

8. Alamo / Danville

Concord as a whole improved during the first

quarter. Class A vacancy gave back space as

vacancy increased 20 basis points to 16.2

percent. Class B vacancy fell 90 basis points

to 16.8 percent. Class C vacancy dipped 40

basis points to 27.8 percent. The Class A

submarket tracked 7,579 square feet of

negative net absorption for the quarter. There

were several significant transactions during

the first quarter. At Concord Gateway II, Old

Republic Title leased 10,787 square feet on

the second floor. At Concord Gateway I, Dekra

Certification renewed 7,457 square feet on

the ninth floor. Anka Behavioral leased 7,051

square feet at 1957 Parkside Drive. At One

Concord Center, Equifax renewed 3,872

square feet on the fifth floor. Ambitech took

2,759 square feet on the third floor.

The Shadelands submarket registered

negative net absorption in the first quarter as

vacancy increased 30 basis points to 26.9

percent. The Shadelands and Lamorinda

submarkets were the only markets to post

negative net absorption for the quarter.

There were several significant sales

transactions in the first quarter. In Concord,

One and Two Corporate Centre sold.

Prudential Realty Investors purchased the two

office buildings totaling 338,989 square feet

from Westcore Properties. In Danville, the

74,599 square foot Danville San Ramon

Medical Center on San Ramon Valley

Boulevard sold, Rassier Properties was the

buyer. Two buildings within Civic Executive

Park in Concord sold. Prosper Holdings

purchased the buildings from Thomas

Properties. Shadelands Executive Center on

North Wiget Lane traded, with Steve Kafka

purchasing the two office buildings totaling

43,832 square feet from The Charles

Company. 2055 North Broadway in Walnut

Creek sold; the 11,818 square foot building was

purchased by Mark OBrien. Hall Equities

purchased a 3,524 square foot office building

on Alpine Road.

SIGNIFICANT TRANSACTIONS

SALES ACTIVITY

PROPERTY NAME/ADDRESS

SALES DATE

SIZE SF

BUYER

CLASS

One & Two Corporate Centre

Mar-14

338,989

Highridge Partners

Danville San Ramon Medical Center

Feb-14

74,599

Rassier Properties

1465-1485 Civic Court

Feb-14

64,266

Prosper Holdings

Shadelands Executive Center

Jan-14

53,832

Steve Kafka

2055 N Broadway

Mar-14

11,818

Mark O'Brien

1204 Alpine Road

Jan-14

3,524

Hall Equities

PROPERTY NAME/ADDRESS

LEASE DATE

SIZE SF

TENANT

CLASS

PMI Plaza

Feb-14

26,835

Del Monte Foods

Concord Gateway II

Mar-14

10,787

Old Republic Title Company

Gateway Centre

Mar-14

9,620

Legacy Risk & Insurance Services

Concord Gateway I

Feb-14

7,457

Dekra Certification Inc

1957 Parkside Drive

Feb-14

7,051

Anka Behavioral Health

One Concord Center

Mar-14

3,872

Equifax

325 N Wiget Lane

Feb-14

3,848

Entegris Inc

800 S Broadway

Feb-14

3,320

Rudulph & Sletten

LEASING ACTIVITY

P. 2

| COLLIERS INTERNATIONAL

RESEARCH & FORECAST REPORT | Q1 2014 | OFFICE

Q1 2014 | MARKET COMPARISONS

OFFICE MARKET

Existing Properties

TYPE

BLDGS

Absorption

TOTAL

DIRECT

DIRECT

SUBLEASE

SUBLEASE

TOTAL

INVENTORY

VACANCY

VACANCY

VACANT

VACANCY

VACANT

SF

SF

RATE

SF

RATE

SF

VACANCY

VACANCY

RATE

RATE

CURRENT

PREVIOUS

QUARTER

QUARTER

Construction

Rents

NET

NET

COMPLETED

UNDER

ABSORPTION

ABSORPTION

CURRENT

CONSTRUCT.

WEIGHTED

ASKING

CURRENT SF

YTD SF

QTR SF

SF

RENTAL RATE

WALNUT CREEK DT

A

20

2,745,998

321,628

11.7%

68,539

2.5%

390,167

14.2%

14.3%

3,482

3,482

$2.78

54

1,521,893

186,677

12.3%

867

0.1%

187,544

12.3%

13.3%

15,163

15,163

$2.20

22

487,569

37,513

7.7%

1,268

0.3%

38,781

8.0%

8.2%

1,158

1,158

$1.94

Total

96

4,755,460

545,818

11.5%

70,674

1.5%

616,492

13.0%

13.4%

19,803

19,803

$2.55

WALNUT CREEK PH BART

A

10

1,623,999

187,706

11.6%

0.0%

187,706

11.6%

14.4%

45,649

45,649

$2.91

164,226

13,452

8.2%

4,952

3.0%

18,404

11.2%

8.4%

(4,638)

(4,638)

$2.07

Total

14

1,788,225

201,158

11.2%

4,952

0.3%

206,110

11.5%

13.8%

41,011

41,011

$2.83

17

3,901,864

551,474

14.1%

80,090

2.1%

631,564

16.2%

16.0%

(7,579)

(7,579)

$1.89

36

1,028,347

172,750

16.8%

0.0%

172,750

16.8%

18.7%

19,215

19,215

$1.65

CONCORD

36

988,165

275,132

27.8%

0.0%

275,132

27.8%

28.2%

3,299

3,299

$1.17

Total

89

5,918,376

999,356

16.9%

80,090

1.4%

1,079,446

18.2%

18.5%

14,935

14,935

$1.67

188,131

64,241

34.1%

0.0%

64,241

34.1%

31.8%

(4,485)

(4,485)

$2.25

16

752,263

50,335

6.7%

0.0%

50,335

6.7%

6.7%

(113)

(113)

$1.84

14

240,671

13,266

5.5%

0.0%

13,266

5.5%

8.5%

7,104

7,104

$1.75

Total

32

1,181,065

127,842

10.8%

0.0%

127,842

10.8%

11.0%

2,506

2,506

$1.84

$1.85

PLEASANT HILL

A

SHADELANDS

A

174,807

67,567

38.7%

0.0%

67,567

38.7%

36.0%

(4,604)

(4,604)

30

1,327,320

318,598

24.0%

18,400

1.4%

336,998

25.4%

25.6%

2,203

2,203

$1.79

16

423,477

109,477

25.9%

3,548

0.8%

113,025

26.7%

26.1%

(2,629)

(2,629)

$1.65

Total

48

1,925,604

495,642

25.7%

21,948

1.1%

517,590

26.9%

26.6%

(5,030)

(5,030)

$1.75

MARTINEZ

B

258,326

14,398

5.6%

0.0%

14,398

5.6%

26.3%

53,443

53,443

$1.50

266,864

107,389

40.2%

0.0%

107,389

40.2%

40.2%

$1.40

Total

17

525,190

121,787

23.2%

0.0%

121,787

23.2%

33.4%

53,443

53,443

$1.41

248,205

4,887

2.0%

0.0%

4,887

2.0%

2.0%

$3.35

26

621,572

55,147

8.9%

0.0%

55,147

8.9%

7.8%

(6,625)

(6,625)

$2.78

128,454

20,673

16.1%

0.0%

20,673

16.1%

11.7%

(5,609)

(5,609)

$2.25

Total

37

998,231

80,707

8.1%

0.0%

80,707

8.1%

6.9%

(12,234)

(12,234)

$2.68

LAMORINDA

ALAMO/DANVILLE

A

126,821

4,464

3.5%

0.0%

4,464

3.5%

5.2%

2,110

2,110

$2.35

28

552,793

26,351

4.8%

0.0%

26,351

4.8%

4.9%

892

892

$2.29

12

203,913

18,461

9.1%

0.0%

18,461

9.1%

9.1%

$2.23

Total

43

883,527

49,276

5.6%

0.0%

49,276

5.6%

5.9%

3,002

3,002

$2.27

MARKET TOTAL

A

60

9,009,825

1,201,967

13.3%

148,629

1.6%

1,350,596

15.0%

15.4%

34,573

34,573

$2.11

202

6,226,740

837,708

13.5%

24,219

0.4%

861,927

13.8%

15.1%

79,540

79,540

$1.93

114

2,739,113

581,911

21.2%

4,816

0.2%

586,727

21.4%

21.6%

3,323

3,323

$1.44

Total

376

17,975,678

2,621,586

14.6%

177,664

1.0%

2,799,250

15.6%

16.2%

117,436

117,436

$1.92

QUARTERLY COMPARISON AND TOTALS

1Q-14

376

17,975,678

2,621,586

14.6%

177,664

1.0%

2,799,250

15.6%

16.2%

117,436

117,436

4Q-13

376

17,975,678

2,690,266

15.0%

226,420

1.3%

2,916,686

16.2%

16.2%

(8,987)

(93,527)

$1.92

$1.88

3Q-13

376

17,975,678

2,702,205

15.0%

205,494

1.1%

2,907,699

16.2%

15.4%

(126,297)

(84,540)

2Q-13

376

18,031,548

2,625,368

14.6%

159,688

0.9%

2,785,056

15.4%

15.6%

20,936

41,757

1Q-13

376

18,031,548

2,682,706

14.9%

123,286

0.7%

2,805,992

15.6%

15.7%

20,821

20,821

COLLIERS INTERNATIONAL |

$1.87

$1.84

$1.83

P. 3

RESEARCH & FORECAST REPORT | Q1 2014 | OFFICE

NORTH I-680 > TOTAL VACANCY VS. UNEMPLOYMENT

20%

10.0%

16%

8.0%

12%

6.0%

8%

4.0%

4%

2.0%

0%

2Q12

3Q12

4Q12

1Q13

Vacancy Rate

VACANCY RATE

2Q13

3Q13

4Q13

1Q14

Unemployment

continues to hover

above 5%.

485 offices in

63 countries on

6 continents

United States: 146

Canada: 44

Latin America: 25

Asia Pacific: 186

EMEA: 84

> $2.1 Billion in annual revenue

> 1.46 Billion* square feet under management

> Over 15,800 professionals

0.0%

*Square footage includes office, industrial and retail property under management.

Residential property is excluded from this total. All statistics are for 2013.

Unemployment

UNEMPLOYMENT

COLLIERS INTERNATIONAL

CLASS A > DOWNTOWN WALNUT CREEK / PLEASANT HILL BART

> VACANCY RATE VS. NET ABSORPTION VS. ASKING RENTS

1,100,000

$3.00

Walnut Creek (no Shadelands)

$2.75

800,000

$2.50

$2.25

500,000

$2.00

$1.75

200,000

$1.50

$1.25

-100,000

2Q12

3Q12

4Q12

Vacant SF

Asking Rents

VACANCY RATE

1Q13

2Q13

Net Absorption

3Q13

NET ABSORPTION

4Q13

1Q14

Walnut Creek has

seen a considerable

upward shift in

asking rents.

1850 Mt. Diablo Blvd. Suite 200

Walnut Creek, CA 94596

TEL +1 925 279 0120

FAX +1 925 279 0450

MANAGING PARTNER:

Brooks Pedder, SIOR

Executive Managing Director

Executive Vice President

TEL +1 925 279 5581

CA License No. 00902154

RESEARCHER:

Derek Daniels, CPRC

Research Analyst II

TEL +1 925 279 4620

$1.00

ASKING RENTS

This report and other research materials may be found at

www.colliers.com. This report is a research document of

Colliers International - Walnut Creek, California. Questions

related to information herein should be directed to the Research

Department at +1 925 279 4620. Information contained herein

has been obtained from sources deemed reliable and no

representation is made as to the accuracy thereof. As new,

corrected or updated information is obtained, it is incorporated into

both current and historical data, which may invalidate comparison

to previously issued reports. 2014 Colliers International.

Accelerating success.

www.colliers.com/walnutcreek

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Class Prophecy 012Document11 pagesClass Prophecy 012Mythical Persues100% (2)

- World History SyllabusDocument8 pagesWorld History SyllabusBill Gram-ReeferNo ratings yet

- Lennar CNWS Red-Letter Term SheetDocument70 pagesLennar CNWS Red-Letter Term SheetBill Gram-ReeferNo ratings yet

- Keb Combivis 6 enDocument232 pagesKeb Combivis 6 enhaithamNo ratings yet

- Epri ManualDocument62 pagesEpri Manualdrjonesg19585102No ratings yet

- U.S. Immigrantion From Region 1820-2010Document3 pagesU.S. Immigrantion From Region 1820-2010Bill Gram-ReeferNo ratings yet

- Western Expansion by The NumbersDocument4 pagesWestern Expansion by The NumbersBill Gram-ReeferNo ratings yet

- Antebellum Growth of American Political PartiesDocument1 pageAntebellum Growth of American Political PartiesBill Gram-ReeferNo ratings yet

- Concord CNWS Jenkins ReportDocument43 pagesConcord CNWS Jenkins ReportBill Gram-ReeferNo ratings yet

- RFRA Letter To President To Maintain OLC Memo 9-10-2015Document6 pagesRFRA Letter To President To Maintain OLC Memo 9-10-2015Bill Gram-ReeferNo ratings yet

- Concord Master Developer Recommendation DraftsDocument2 pagesConcord Master Developer Recommendation DraftsBill Gram-ReeferNo ratings yet

- Sutton Rossi Correspondance To Concord City AttyDocument2 pagesSutton Rossi Correspondance To Concord City AttyBill Gram-ReeferNo ratings yet

- Public Relations: RAM EeferDocument1 pagePublic Relations: RAM EeferBill Gram-ReeferNo ratings yet

- Catellus Development Demands Investigation of Concord CNWS Master Developer Selection ProcessDocument5 pagesCatellus Development Demands Investigation of Concord CNWS Master Developer Selection ProcessBill Gram-ReeferNo ratings yet

- City of Richmond, California Employee CompensationDocument7 pagesCity of Richmond, California Employee CompensationBill Gram-ReeferNo ratings yet

- Mission Bay Alliance Press Release 7:27:2015.pagesDocument5 pagesMission Bay Alliance Press Release 7:27:2015.pagesBill Gram-ReeferNo ratings yet

- City of Richmond Employees Making $200K+ Per YearDocument8 pagesCity of Richmond Employees Making $200K+ Per YearBill Gram-ReeferNo ratings yet

- Report 1501 ComplianceAndContinuityCommitteeReportDocument42 pagesReport 1501 ComplianceAndContinuityCommitteeReportBill Gram-ReeferNo ratings yet

- Concord Reuse Project For Naval Weapons Station Staff ReportDocument70 pagesConcord Reuse Project For Naval Weapons Station Staff ReportBill Gram-ReeferNo ratings yet

- Flyer Opposing Chevron Richmond Refinery Modernization PlanDocument2 pagesFlyer Opposing Chevron Richmond Refinery Modernization PlanBill Gram-ReeferNo ratings yet

- UCSF-CCSF Mission Bay Warriors Arena CorrespondanceDocument4 pagesUCSF-CCSF Mission Bay Warriors Arena CorrespondanceBill Gram-ReeferNo ratings yet

- Nov 4 2014 Gubernatorial General Election Report For Contra Costa CountyDocument8 pagesNov 4 2014 Gubernatorial General Election Report For Contra Costa CountyBill Gram-ReeferNo ratings yet

- Political Ads Demean Local ElectionDocument6 pagesPolitical Ads Demean Local ElectionBill Gram-ReeferNo ratings yet

- Contra Costa County Grand Jury Report On Pension CostsDocument1 pageContra Costa County Grand Jury Report On Pension CostsBill Gram-ReeferNo ratings yet

- PGE On 4th Anniversary of Pipeline CatastropheDocument1 pagePGE On 4th Anniversary of Pipeline CatastropheBill Gram-ReeferNo ratings yet

- Contra Costa Board Order To Investigate New Sales Tax 2014Document2 pagesContra Costa Board Order To Investigate New Sales Tax 2014Bill Gram-ReeferNo ratings yet

- Concord Reuse Project For Naval Weapons Station Staff ReportDocument70 pagesConcord Reuse Project For Naval Weapons Station Staff ReportBill Gram-ReeferNo ratings yet

- Contra Costa County Proposed Supervisor Pay IncreaseDocument4 pagesContra Costa County Proposed Supervisor Pay IncreaseBill Gram-ReeferNo ratings yet

- John Muir CEO Cal Knight Discusses Proposed Partnership With UCSF Medical Center To Help Form A Regional Health Care Delivery Network in The San Francisco Bay AreaDocument2 pagesJohn Muir CEO Cal Knight Discusses Proposed Partnership With UCSF Medical Center To Help Form A Regional Health Care Delivery Network in The San Francisco Bay AreaBill Gram-ReeferNo ratings yet

- 2014 Strategic Plan Update For Homelessness in Contra Costa CountyDocument34 pages2014 Strategic Plan Update For Homelessness in Contra Costa CountyBill Gram-ReeferNo ratings yet

- Contra Costa County Voter Information Packet OmmissionDocument4 pagesContra Costa County Voter Information Packet OmmissionBill Gram-ReeferNo ratings yet

- Contra Costa County Graded BDocument1 pageContra Costa County Graded BBill Gram-ReeferNo ratings yet

- Gr.10 Music History ModuleDocument45 pagesGr.10 Music History ModuleKyle du PreezNo ratings yet

- ADD MATH ProjectDocument13 pagesADD MATH Projectmegazat27No ratings yet

- Brief Cop27 Outcomes and Cop28 EngDocument24 pagesBrief Cop27 Outcomes and Cop28 EngVasundhara SaxenaNo ratings yet

- Laptop repair messageDocument3 pagesLaptop repair messagePonpes Manbaul MaarifNo ratings yet

- Applying Graph Theory to Map ColoringDocument25 pagesApplying Graph Theory to Map ColoringAnonymous BOreSFNo ratings yet

- #1Document7 pages#1Ramírez OmarNo ratings yet

- A Study On Consumer Buying Behaviour Towards ColgateDocument15 pagesA Study On Consumer Buying Behaviour Towards Colgatebbhaya427No ratings yet

- Mumbai Tourist Attractions.Document2 pagesMumbai Tourist Attractions.Guru SanNo ratings yet

- E Series CatalystDocument1 pageE Series CatalystEmiZNo ratings yet

- Importance of Geometric DesignDocument10 pagesImportance of Geometric DesignSarfaraz AhmedNo ratings yet

- SBLO Jepp Charts PDFDocument12 pagesSBLO Jepp Charts PDFElton CacefoNo ratings yet

- Applied SciencesDocument25 pagesApplied SciencesMario BarbarossaNo ratings yet

- Adjective: the girl is beautifulDocument15 pagesAdjective: the girl is beautifulIn'am TraboulsiNo ratings yet

- Ajwin Handbuch enDocument84 pagesAjwin Handbuch enEnzo AguilarNo ratings yet

- Aluminium FOil SearchDocument8 pagesAluminium FOil SearchAtul KumarNo ratings yet

- Data Structures LightHall ClassDocument43 pagesData Structures LightHall ClassIwuchukwu ChiomaNo ratings yet

- Procedure For NC and CapaDocument2 pagesProcedure For NC and CapaSAKTHIVEL ANo ratings yet

- List of OperationsDocument3 pagesList of OperationsGibs_9122100% (3)

- Eladio Dieste's Free-Standing Barrel VaultsDocument18 pagesEladio Dieste's Free-Standing Barrel Vaultssoniamoise100% (1)

- Weakness and Hypotonia: Prepared by DR Hodan Jama MDDocument38 pagesWeakness and Hypotonia: Prepared by DR Hodan Jama MDabdisalaan hassanNo ratings yet

- Mediclaim - ChecklistDocument4 pagesMediclaim - ChecklistKarthi KeyanNo ratings yet

- Active Sound Gateway - Installation - EngDocument9 pagesActive Sound Gateway - Installation - EngDanut TrifNo ratings yet

- New Pacific Timber v. Señeris, 101 SCRA 686Document5 pagesNew Pacific Timber v. Señeris, 101 SCRA 686Ishmael AbrahamNo ratings yet

- CHEMOREMEDIATIONDocument8 pagesCHEMOREMEDIATIONdeltababsNo ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- The Diffusion of Microfinance: An Extended Analysis & Replication ofDocument33 pagesThe Diffusion of Microfinance: An Extended Analysis & Replication ofNaman GovilNo ratings yet

- Affidavit of 2 Disinterested Persons (Haidee Gullodo)Document1 pageAffidavit of 2 Disinterested Persons (Haidee Gullodo)GersonGamasNo ratings yet