Professional Documents

Culture Documents

Yangon Myanmar Property Market Report December 2012 Colliers

Uploaded by

Ko NgeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yangon Myanmar Property Market Report December 2012 Colliers

Uploaded by

Ko NgeCopyright:

Available Formats

PROPERTY MARKET REPORT

YANGON (MYANMAR)

BRIEF

www.colliers.co.th

MYANMAR OVERVIEW

ECONOMY

1ST HALF 2012 | PROPERTY MARKET

Even compared to the poorest countries in South East Asia, Myanmar

has fallen considerably behind. Both Cambodia and Laos emerged from

devastating wars and extremist economic policies in the 1970s and 80s

that wrecked their economies. Since the 1990s they have developed into

market orientated economies and have begun on the export based

development model that propelled so many other countries out of

poverty. Myanmar is now ranked at the bottom of the economic league

table where once it was at the top.

Source: CIA Fact book and Colliers International Thailand Research

MYANMAR IN COMPARISON WITH CAMBODIA AND LAOS

COLLIERS INTERNATIONAL | P. 3

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

DEMOGRAPHICS

INDUSTRIAL ESTATE

PERCENTAGE OF POPULATION BETWEEN 15-64

SUPPLY OF INDUSTRIAL ESTATE IN YANGON BY LOCATION, H1 2012

Source: UN Population Division and Colliers International Thailand Research

Source: Department of Human Settlement and Housing Development (DHSHD) and

Colliers International Thailand Research

The population between the ages of 15-64 is seen as the most active in

terms of productivity. Most have fnished their education, especially in

developing countries and have yet to retire. Economic growth in many

countries can be traced to the period when the country had a signifcant

ratio of its population potentially active economically. For Myanmar the

next twenty years represent an opportunity for the country to progress

with its youthful population.

Almost100% of the total industrial estate area in Yangon is outside the

Yangon City Area with just one small industrial estate being located in

the City area. More than 40% of the industrial estate area in Yangon is

located in the Northern City area, which is close to the airport.

COLLIERS INTERNATIONAL | P. 4

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

ZOINNG

COLLIERS INTERNATIONAL | P. 5

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

UPPER SCALE HOTELS

CUMULATIVE OF FUTURE SUPPLY BY YEAR AND LOCATION, H1 2012

NUMBER OF TOURIST ARRIVALS TO YANGON FROM JANUARY TO MAY 2012

Source: Colliers International Thailand Research

Source: Pacifc Asia Travel Association (PATA) and Colliers International Thailand Research

No new supply is scheduled to be completed in 2012, due to one hotel in

the Downtown Area rescheduling their completion date to 2013. Two

other hotels are in the pipeline and are expected to be fnished in 2014

in the Inner City Area. area.

The total number of foreign tourists arriving in Myanmar in the frst four

months of 2012 was approximately 225,300 an increase of 37% or more

than 30,000, over the same period last year.

Average rental rates in the Downtown Area and Outer City Area increased by approximately 5 - 7% from the second half of 2011.

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

SERVICED APARTMENT

SERVICED APARTMENT RATE

The most popular area for the serviced apartment market in Yangon is

the Inner City area, where supply increased within only three years from

nothing to approximately 370 rooms. There is only one serviced

apartment in Downtown, while the Outer City area remains popular

partly on account of the location of many oil and gas companies that are

operating in Myanmar around the Inya Lake area. All serviced apartment

projects in Yangon recorded high occupancy rates because of limited

supply and high demand. Two new serviced apartment projects in

Yangon are in the planning stages.

Source: Colliers International Thailand Research

Source: Colliers International Thailand Research

Note: The average rental rate is based on the rental rate located on the ground foor of the building.

SUPPLY BY LOCATION

AVERAGE RENTAL RATE OF RETAIL BY LOCATION, H1 2012

COLLIERS INTERNATIONAL | P. 6

COLLIERS INTERNATIONAL | P. 7

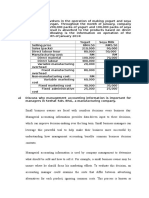

OFFICE BUILDING

CONDOMINIUMS/VILLAS AS OFFICE SPACE

A few condominium projects in Yangon have one or two foors for ofce

space and they are usually sold rather than rented. The size of ofce

space in condominium projects ranges between 20 - 65 sq m and the

selling price is from US$2,250 to US$ 3,220 per sq m, although this kind

of ofce space is still not popular with foreign companies, due to limited

natural light, lack of parking space and normally no electricity back up

apart from the common areas. Most Myanma and some international

companies rent or purchase a house or villa unit and convert it to ofce

space, for more privacy, easy accessibility and better parking in landed

property.

COMPARISON BETWEEN HO CHI MINH CITY AND YANGON FOR SUPPLY, 2011

Source: Colliers International Thailand Research

In 1996 Ho Chi Minh recorded a similar amount of supply as exists in

Yangon in 2012. Since 1996 supply in Vietnams main commercial city

has surged as a result of the opening up of the country to foreign

investment. The graph may give an indication of how far the Yangon

ofce market will develop over the course of the next ffteen years. It

must also be mentioned that Yangon is very likely to remain the main

commercial city while in Vietnam, Hanoi is also host to a signifcant

amount of ofce space.

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

COLLIERS INTERNATIONAL | P. 8

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

CONDOMINIUM

There were approximately 550 newly launched units in the frst half of

2012 or around 66% of the total of newly launched units for all of2011.

Most newly launched units in 2011 were sold out and many developers

plan to launch new projects in the second half of 2012.

CONDOMINIUM/APARTMENT DISTINCTION

There is no legal defnition of what constitutes a condominium as no law

has been enacted to defne it, as was the case in Thailand following the

Condominium Act of1979. It is understood that legislation establishing a

legal framework may be in the pipeline. At present the diference between

a condominium and an apartment building is that the former contains a

lift whereas the latter does not.

Source: Colliers International Thailand Research

NEWLYLAUNCHED UNITS FROM 2010 UNTIL H1 2012 BY YEAR (REVISED)

COLLIERS INTERNATIONAL | P. 9

CONDOMINIUM DEMAND

COMPARISON OF TAKE-UP RATES OF ALL CONDOMINIUM UNITS IN THE MARKET BETWEEN IN H1 2012 BY LOCATION

Source: Colliers International Thailand Research

The average take-up rate of all available condominium units on the

market was approximately 85%, an increase of approximately 8% from

the second half of 2011.

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

COLLIERS INTERNATIONAL THAILAND

MANAGEMENT TEAM

RESEARCH

Surachet Kongcheep | Senior Manager

RETAIL SERVICES

Asharawan Wachananont | Associate Director

PROJECT SALES & MARKETING

Monchai Orawongpaisan | Associate Director

RESIDENTIAL SALES & LEASING

Napaswan Chotephard | Manager

OFFICE & INDUSTRIAL SERVICES

Narumon Rodsiravoraphat | Associate Director

ADVISORY SERVICES | HOSPITALITY

Jean Marc Garret | Director

ADVISORY SERVICES

Napatr Tienchutima | Associate Director

REAL ESTATE MANAGEMENT SERVICES

Prasert Saiphrawan | Senior Manager

INVESTMENT SERVICES

Nukarn Suwatikul | Associate Director

Wasan Rattanakijjanukul | Senior Manager

VALUATION & ADVISORY SERVICES

Phachsanun Phormthananunta | Director

Wanida Suksuwan | Associate Director

PATTAYA OFFICE

Mark Bowling | Senior Sales Manager

Supannee Starojitski | Senior Business Development

Manager / Ofce Manager

HUA HIN OFFICE

Sunchai Kooakachai | Senior Manager

COLLIERS INTERNATIONAL THAILAND:

Bangkok Ofce

17/F Ploenchit Center,

2 Sukhumvit Road, Klongtoey,

Bangkok 10110 Thailand

TEL +662 656 7000

FAX +662 656 7111

EMAIL info.th@colliers.com

Pattaya Ofce

519/4-5, Pattaya Second Road (Opposite Central Festival

Pattaya Beach), Nongprue, Banglamung, Chonburi 20150

TEL +6638 427 771

FAX +6638 427 772

EMAIL info.pattaya@colliers.com

Hua Hin Ofce

27/7, Petchakasem Road, Hua Hin,

Prachuap Khiri Khan 77110 Thailand

TEL +6632 530 177

FAX +6632 530 677

EMAIL info.huahin@colliers.com

RESEARCHER:

Thailand

Tony Picon

Associate Director

EMAIL antony.picon@colliers.com

RESEARCHER:

Thailand

Surachet Kongcheep

Senior Manager | Research

EMAIL surachet.kongcheep@colliers.com

522 ofces in 62 countries

on 6 continents

This report and other research materials may be found on our website at www.colliers.co.th. Questions related to

information herein should be directed to the Research Department at the number indicated above. This document has

been prepared by Colliers International for advertising and general information only. Colliers International makes no

guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but

not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own

inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied

terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising

there from. Colliers International is a worldwide afliation of independently owned and operated companies.

www.colliers.co.th

Accelerating success.

A leader in real estate consultancy worldwide

2nd most recognized commercial real estate brand globally

2nd largest property manager

1.25 billion square feet under management

Over 12,300 professionals

Best Agent (Eastern Seaboard) 2010

Best Bangkok Agent 2010

Best Agency Deal 2011

Best Commercial Agent 2011

Best Property Management Company 2011

Best Property Consultancy 2011

Best Residential Agent (Resort) 2011

Thailand Property Awards

YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012 YANGON (MYANMAR) PROPERTY MARKET REPORT | 1ST HALF 2012

Download full report

please visit

www.colliers.co.th

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- China's Political Instituions and Leaders in Charts PDFDocument30 pagesChina's Political Instituions and Leaders in Charts PDFYOHANNESNo ratings yet

- The Role of Hydropower in MyanmarDocument8 pagesThe Role of Hydropower in MyanmarKo NgeNo ratings yet

- SEA Baseline Assessment Hydropower!Document127 pagesSEA Baseline Assessment Hydropower!Ko NgeNo ratings yet

- Hydropower in Myanmar Sector Analysis and Related Legal Reforms enDocument6 pagesHydropower in Myanmar Sector Analysis and Related Legal Reforms enKo NgeNo ratings yet

- Developing A Strategic Environmental Assessment (SEA) of The Hydropower Sector in MyanmarDocument38 pagesDeveloping A Strategic Environmental Assessment (SEA) of The Hydropower Sector in MyanmarKo NgeNo ratings yet

- TOR For Myanmar Hydropower SEA v2fDocument21 pagesTOR For Myanmar Hydropower SEA v2fKo NgeNo ratings yet

- The Strategic Environmental Assessment (SEA) of The Hydropower Sector in Myanmar 2017Document56 pagesThe Strategic Environmental Assessment (SEA) of The Hydropower Sector in Myanmar 2017Ko NgeNo ratings yet

- Food Safety and Standards Eastasia 2013 CDocument60 pagesFood Safety and Standards Eastasia 2013 CKo NgeNo ratings yet

- List of Revoked Employment Agencies - Singapore CompanyDocument17 pagesList of Revoked Employment Agencies - Singapore Companyyuly12No ratings yet

- Myanmar Travel & Tourism Economic Impact 2017Document24 pagesMyanmar Travel & Tourism Economic Impact 2017Let's Save MyanmarNo ratings yet

- SME Financing in Myanmar (8 September 2013)Document19 pagesSME Financing in Myanmar (8 September 2013)THAN HANNo ratings yet

- Myanmar Tourism Statistics 2016 1Document2 pagesMyanmar Tourism Statistics 2016 1Ko NgeNo ratings yet

- Myanmar Tourism Statistics 2016 1Document2 pagesMyanmar Tourism Statistics 2016 1Ko NgeNo ratings yet

- AML/CFT Risk Based Management Guidance Note (27th January, 2015)Document6 pagesAML/CFT Risk Based Management Guidance Note (27th January, 2015)Ko NgeNo ratings yet

- Regulatory and Supervisory Framework For Anti-Money Laundering and Combating The Financing of Terrorism (AML/CFT)Document2 pagesRegulatory and Supervisory Framework For Anti-Money Laundering and Combating The Financing of Terrorism (AML/CFT)Ko NgeNo ratings yet

- FDA Myanmar Department of HealthDocument21 pagesFDA Myanmar Department of HealthTHAN HANNo ratings yet

- Food Safty and Quiity Standard!Document36 pagesFood Safty and Quiity Standard!THAN HANNo ratings yet

- Trade Situation of Myanmar 2011-2016 Fiscal YearDocument13 pagesTrade Situation of Myanmar 2011-2016 Fiscal YearKo NgeNo ratings yet

- Food Safety in MyanmarDocument4 pagesFood Safety in MyanmarKo NgeNo ratings yet

- 2015cif 2010 2015Document26 pages2015cif 2010 2015Ko NgeNo ratings yet

- Myanmar New Tax LawDocument4 pagesMyanmar New Tax LawKo NgeNo ratings yet

- Fully Online Licensing System User Guide Book - 1Document29 pagesFully Online Licensing System User Guide Book - 1sulapyaeNo ratings yet

- 2015cif 2003 2009Document14 pages2015cif 2003 2009Ko NgeNo ratings yet

- blogger or blogspot ႔ google .....Document2 pagesblogger or blogspot ႔ google .....Ko NgeNo ratings yet

- Twilight Over Burma မႈံရီဆိုင္း တိုင္းျမန္မာDocument289 pagesTwilight Over Burma မႈံရီဆိုင္း တိုင္းျမန္မာဂါ မဏိ100% (1)

- Application Form For AY14-15Document14 pagesApplication Form For AY14-15Ko NgeNo ratings yet

- 2015cif 2010 2015Document26 pages2015cif 2010 2015Ko NgeNo ratings yet

- Yangon Circular Railway Development Project: Graspp Working Paper SeriesDocument36 pagesYangon Circular Railway Development Project: Graspp Working Paper SeriesKo NgeNo ratings yet

- Infrastructure Development Plans of Yangon CityDocument36 pagesInfrastructure Development Plans of Yangon CityKo Nge100% (2)

- Myanmar Money Inflate RateDocument37 pagesMyanmar Money Inflate RateKo NgeNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Activist Investing White Paper by Florida State Board of AdmistrationDocument48 pagesActivist Investing White Paper by Florida State Board of AdmistrationBradley TirpakNo ratings yet

- Cracking The Next Growth Market - AfricaDocument14 pagesCracking The Next Growth Market - AfricaPraveen KumarNo ratings yet

- BBAP2103 Management AccountingDocument4 pagesBBAP2103 Management AccountingTeam JobbersNo ratings yet

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- Cima E2 NotesDocument102 pagesCima E2 Notesimmaculate79No ratings yet

- Financial Performance of NBFCsDocument13 pagesFinancial Performance of NBFCsAli Raza SultaniNo ratings yet

- Asian PaintsDocument19 pagesAsian PaintsAnkita DasNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Baji Rout BrochureDocument12 pagesBaji Rout Brochureparul vyasNo ratings yet

- Case Study Solution - Cola Wars PDFDocument7 pagesCase Study Solution - Cola Wars PDFSixhatsconsulting100% (2)

- G.R. No. L-18216 October 30, 1962Document2 pagesG.R. No. L-18216 October 30, 1962iceiceice023No ratings yet

- Roberts, Rod - Rod Roberts For Iowa House - 1110 - DR2 - SummaryDocument1 pageRoberts, Rod - Rod Roberts For Iowa House - 1110 - DR2 - SummaryZach EdwardsNo ratings yet

- RAPDocument42 pagesRAPJozua Oshea PungNo ratings yet

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- Strategic Analysis of Indian Life Insurance IndustryDocument40 pagesStrategic Analysis of Indian Life Insurance IndustryPunit RaithathaNo ratings yet

- 1242Document6 pages1242Prince McGershonNo ratings yet

- Mba 3 Sem Enterprise Performance Management P (13) Jun 2017Document2 pagesMba 3 Sem Enterprise Performance Management P (13) Jun 2017Rohit ParmarNo ratings yet

- Business Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorDocument41 pagesBusiness Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorRajeshwari RosyNo ratings yet

- New Venture Development Process-TruefanDocument34 pagesNew Venture Development Process-Truefanpowerhanks50% (2)

- Managerial Theories of FirmDocument12 pagesManagerial Theories of Firmkishorereddy_btech100% (1)

- HDFC Bank DetailsDocument12 pagesHDFC Bank DetailsAlkaAroraNo ratings yet

- Case 2 AuditDocument8 pagesCase 2 AuditReinhard BosNo ratings yet

- Trading Indicator BlueprintDocument55 pagesTrading Indicator BlueprintAndrey Scholdea100% (3)

- Housing Production Trust Fund AuditDocument56 pagesHousing Production Trust Fund AuditChristina SturdivantNo ratings yet

- Motion of Appeal by Aurelius CapitalDocument329 pagesMotion of Appeal by Aurelius CapitalDealBook100% (1)

- 2016-FAC611S-Chapter 15 Property Plant and Equipment 2013Document32 pages2016-FAC611S-Chapter 15 Property Plant and Equipment 2013Bol Sab SachNo ratings yet

- SMEDA Polo T-Shirts Stitching UnitDocument24 pagesSMEDA Polo T-Shirts Stitching UnitMuhammad Noman0% (1)

- JP Morgan DR Whitepaper - Unsponsored ADR ProgramsDocument3 pagesJP Morgan DR Whitepaper - Unsponsored ADR ProgramsIRWebReport.com Investor Relations Research and Intelligence100% (1)

- International Financial Reporting StandardsDocument23 pagesInternational Financial Reporting StandardsAneela AamirNo ratings yet