Professional Documents

Culture Documents

Overview of India's Debt Market and Declining Interest Rates

Uploaded by

Sandeep Borse0 ratings0% found this document useful (0 votes)

14 views19 pagesThe document discusses the Indian debt market in September 2003. It notes that interest rates had declined due to a rise in liquidity from increased foreign exchange reserves growing from almost zero in 1991 to $73.82 billion in March 2003. Liquidity was the main factor driving lower interest rates in the past and continued to be important. Government borrowing and inflation were also influencing rates. The document examines factors like inflows, outflows, and liquidity positions that were impacting rates. It also reviews different debt instruments and funds available in the market at the time.

Original Description:

Birla Meeting Sept 031

Original Title

Birla Meeting Sept 031

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the Indian debt market in September 2003. It notes that interest rates had declined due to a rise in liquidity from increased foreign exchange reserves growing from almost zero in 1991 to $73.82 billion in March 2003. Liquidity was the main factor driving lower interest rates in the past and continued to be important. Government borrowing and inflation were also influencing rates. The document examines factors like inflows, outflows, and liquidity positions that were impacting rates. It also reviews different debt instruments and funds available in the market at the time.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views19 pagesOverview of India's Debt Market and Declining Interest Rates

Uploaded by

Sandeep BorseThe document discusses the Indian debt market in September 2003. It notes that interest rates had declined due to a rise in liquidity from increased foreign exchange reserves growing from almost zero in 1991 to $73.82 billion in March 2003. Liquidity was the main factor driving lower interest rates in the past and continued to be important. Government borrowing and inflation were also influencing rates. The document examines factors like inflows, outflows, and liquidity positions that were impacting rates. It also reviews different debt instruments and funds available in the market at the time.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

May 12, 2014 1

OVERVIEW OF DEBT MARKET

MUMBAI SEPTEMBER 17

TH

2003

May 12, 2014 2

May 12, 2014 3

DECLINE IN INTEREST RATES

INFLATION

CREDIT DEMAND

GOVTS BORROWING

EVENT RISKS

May 12, 2014 4

MARCH 2003

BANKS DEPOSITS RS 1,278,000 CR

FX RESERVES USD 73.82 BILLION

APRIL 1991

FX RESERVES ALMOST ZERO

FX RESERVES GROWTH

FROM 1991 TO 2003 RS 300,000 CR

EFFECT ON BANKING DEPOSIT RS 600,000

CR

LIQUIDITY

May 12, 2014 5

LIQUIDITY

May 12, 2014 6

LIQUIDITY WAS THE SINGLE MOST

IMPORTANT FACTOR FOR LOWER

INTEREST RATES IN THE PAST

May 12, 2014 7

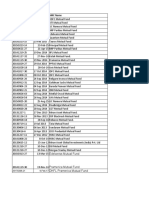

INFLOW OUTFLOW

REDEMPTION 0.58 FEDERAL 1.66

COUPON 0.65 STATE 0.20

DEPOSIT 1.79 CREDIT 1.60

TOTAL 3.02 TOTAL 3.46

SLIPPAGE 0.20

FX FLOWS ???? TOTAL 3.66

YTD : USD 13

BILLION

0.61

LIQUIDITY FY 04

May 12, 2014 8

May 12, 2014 9

May 12, 2014 10

May 12, 2014 11

May 12, 2014 12

THE GOD

FATHERS

DICTATE

May 12, 2014 13

SUMMARY

STABLE RATES

EXCESSIVE SHORT TERM VOLATILITY

COUPON INCOME

May 12, 2014 14

DEBT EQUITY

May 12, 2014 15

May 12, 2014 16

NO CREDIT RISK

NO LIQUIDITY RISK

ACTIVE MANAGEMENT OF

INTEREST RATE RISK

May 12, 2014 17

JUN

03

MAR

03

DEC

02

SEP

02

JUN

02

MAR

02

TGSF 1 1 1 1 1 1

IBA 1 2 1 2 2 2

TIIF 3 3 3 3 3 3

FIBF 1 1 1 1 2

TMA 3 1 1 1 1 1

TILF 4 3 4 4 3 3

STIP 3 3

CPR RANKING

May 12, 2014 18

FLOATING RATE FUNDS

MONTHLY INCOME FUNDS

ACTIVELY MANAGED

INCOME FUNDS

LIQUID AND SHORT TERM FUNDS

May 12, 2014 19

THANK YOU

You might also like

- 16 Tips & TricksDocument20 pages16 Tips & Tricksvidyashreegv99No ratings yet

- 14 Inventory ValuationDocument29 pages14 Inventory Valuationvidyashreegv99No ratings yet

- 13 PartnershipDocument114 pages13 Partnershipvidyashreegv99No ratings yet

- 1 5001 Mayank Garg Cardiologist Professor SICK LEAVE (SL) 15/03/2022Document27 pages1 5001 Mayank Garg Cardiologist Professor SICK LEAVE (SL) 15/03/2022AbhishekNo ratings yet

- In - English 2003 04Document137 pagesIn - English 2003 04Parmita ShresthaNo ratings yet

- Focus Writing Vault by Md. Arifur RahmanDocument27 pagesFocus Writing Vault by Md. Arifur RahmanUmma KulsumNo ratings yet

- Date: 16/07/2014 Bajaj Finance Limited Account Statement From ToDocument2 pagesDate: 16/07/2014 Bajaj Finance Limited Account Statement From ToamanvirbNo ratings yet

- Neighbourhood Support NewsletterDocument5 pagesNeighbourhood Support NewsletterPlimmerton Residents' AssociationNo ratings yet

- e-StatementBRImo 387401005051509 Dec2023 20240110 170833Document2 pagese-StatementBRImo 387401005051509 Dec2023 20240110 170833MaarifNo ratings yet

- Banking Interview Topics NutshellDocument122 pagesBanking Interview Topics NutshellAmarnath AkellaNo ratings yet

- Virtual Account ManagerDocument243 pagesVirtual Account ManagerChibby GoodhopeNo ratings yet

- Monetary Mangement Eco SurveyDocument17 pagesMonetary Mangement Eco SurveyDimppy GandhiNo ratings yet

- Statement Should Read As Follows (Example For First Transaction)Document7 pagesStatement Should Read As Follows (Example For First Transaction)upgrade1990No ratings yet

- Mumbai Real Estate: Slackness Across SegmentsDocument5 pagesMumbai Real Estate: Slackness Across SegmentsDealCurryNo ratings yet

- Corporate Benefit Trigger 08072013Document5 pagesCorporate Benefit Trigger 08072013Bawonda IsaiahNo ratings yet

- Aibl TBML GuidelineDocument119 pagesAibl TBML GuidelineMd. Helal UddinNo ratings yet

- 99th AGM AR WEB 16 07 2018 PDFDocument184 pages99th AGM AR WEB 16 07 2018 PDFpks009No ratings yet

- at General LedgerDocument8 pagesat General Ledgerapi-273897399No ratings yet

- TallyDocument172 pagesTallyEzhil Kumar100% (1)

- NAV Not Great For AnythingDocument5 pagesNAV Not Great For AnythingjefftraderNo ratings yet

- SK 2024Document9 pagesSK 2024cebusgod619No ratings yet

- Universidad Abierta para Adultos Uapa: MercadeoDocument6 pagesUniversidad Abierta para Adultos Uapa: MercadeoJose LoraNo ratings yet

- Handbook On Promotion 2021Document489 pagesHandbook On Promotion 2021GKT 1No ratings yet

- Problems Cash Book II 1 4Document4 pagesProblems Cash Book II 1 4Racquel ReyesNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedDocument17 pagesInterim Order Cum Show Cause Notice in The Matter of Polaris Realtors India LimitedShyam SunderNo ratings yet

- UntitledDocument9 pagesUntitledPuskesmas SidamulyaNo ratings yet

- CA Darshan JainDocument41 pagesCA Darshan JainadiNo ratings yet

- Upcoming Event: Events at Kunbi'S PlaceDocument6 pagesUpcoming Event: Events at Kunbi'S Placeplaycharles89No ratings yet

- Nepal Rastra Bank Monetary Policy for 2016/17 Unofficial TranslationDocument48 pagesNepal Rastra Bank Monetary Policy for 2016/17 Unofficial Translationits4krishna3776No ratings yet

- List of Daily Work Tasks and SchedulesDocument17 pagesList of Daily Work Tasks and SchedulesKinjal ShahNo ratings yet

- Handbook of Statistics West Godavari District 2016 Andhra Pradesh PDFDocument312 pagesHandbook of Statistics West Godavari District 2016 Andhra Pradesh PDFpradeepthotaNo ratings yet

- PERUSAHAAN TRAVEL DENIS TIANTO TRIAL BALANCEDocument9 pagesPERUSAHAAN TRAVEL DENIS TIANTO TRIAL BALANCEPuspita SariNo ratings yet

- Results 1 - 1 of 1Document9 pagesResults 1 - 1 of 1ashNo ratings yet

- Macroeconomic Impact of DemonetisationDocument59 pagesMacroeconomic Impact of DemonetisationrdandapsNo ratings yet

- Australia Commonwealth Bank StatementDocument2 pagesAustralia Commonwealth Bank StatementЮлия П100% (2)

- Notice No. Date AMC Name: Edelweiss Mutual FundDocument2 pagesNotice No. Date AMC Name: Edelweiss Mutual FundAshokNo ratings yet

- Daily Report: Date Description of Work/ActivitiesDocument1 pageDaily Report: Date Description of Work/ActivitiesharrydeepakNo ratings yet

- Outstanding Government Securities As of September 29, 2016: 11 SPN12170608 09-Jun-2016 IDRDocument5 pagesOutstanding Government Securities As of September 29, 2016: 11 SPN12170608 09-Jun-2016 IDRShafa UfairaNo ratings yet

- Ocwen/PHH/ NewRez - Zoccali Exhibit Outline - Zoccali Motion To Intervene - 2:20-cv-00864-CFK - Eastern District of PADocument2 pagesOcwen/PHH/ NewRez - Zoccali Exhibit Outline - Zoccali Motion To Intervene - 2:20-cv-00864-CFK - Eastern District of PAMammaBear123No ratings yet

- Demonitization and Financial SystemDocument10 pagesDemonitization and Financial Systemvishal kumarNo ratings yet

- R R Export 1-Apr-2014 To 20-Mar-2015Document2 pagesR R Export 1-Apr-2014 To 20-Mar-2015Shahnawaz AlamNo ratings yet

- Class Xii Study Matarial Economics 2023-24Document90 pagesClass Xii Study Matarial Economics 2023-24singharajput9264No ratings yet

- Dilarang Masuk Tanpa Kebenaran: Pic - Pn. Agalya ArjunanDocument14 pagesDilarang Masuk Tanpa Kebenaran: Pic - Pn. Agalya ArjunannizzaramliNo ratings yet

- Financial Establishment Fraud Case ConvictionDocument19 pagesFinancial Establishment Fraud Case ConvictionSimon AlexNo ratings yet

- Employees DetailDocument4 pagesEmployees DetailAnonymous FFGjQUWgNo ratings yet

- Rahman Aspalella ADocument353 pagesRahman Aspalella Atan pleeNo ratings yet

- Economy: 1.how To Kick Start GS Preparation? 2.how To Prepare Economy? 3.banking: Monetary PolicyDocument109 pagesEconomy: 1.how To Kick Start GS Preparation? 2.how To Prepare Economy? 3.banking: Monetary PolicyaashishNo ratings yet

- Javed AlamDocument1 pageJaved Alamma.shehlaintNo ratings yet

- e-StatementBRImo 481101022806534 Dec2023 20231202 114638Document2 pagese-StatementBRImo 481101022806534 Dec2023 20231202 114638ikyrizky044No ratings yet

- Internal Audit ReportDocument4 pagesInternal Audit ReportJoni alauddinNo ratings yet

- Win22 Pill1A2 RBI Monetary Policy MrunalDocument13 pagesWin22 Pill1A2 RBI Monetary Policy MrunalVinay H PNo ratings yet

- Jawaban UTS ADocument23 pagesJawaban UTS AranjanisalsabilaaaNo ratings yet

- CIRCULATION OF CASH SPIKES IN INDIA AS CURRENCY IN PRINT RISES 15Document9 pagesCIRCULATION OF CASH SPIKES IN INDIA AS CURRENCY IN PRINT RISES 15jeffersonNo ratings yet

- December 2, 2014 - AgendaDocument6 pagesDecember 2, 2014 - AgendaTimesreviewNo ratings yet

- Guideline - TBML 12 2019 PDFDocument94 pagesGuideline - TBML 12 2019 PDFA M FaisalNo ratings yet

- Unconfirmed No HelpdeskDocument40 pagesUnconfirmed No HelpdeskSai MustyNo ratings yet

- Data AnalysisDocument13 pagesData AnalysisJohn CarpenterNo ratings yet

- COVID-19 and the Finance Sector in Asia and the Pacific: Guidance NotesFrom EverandCOVID-19 and the Finance Sector in Asia and the Pacific: Guidance NotesNo ratings yet

- Gilt Funds Trailing Returns From 2019Document2 pagesGilt Funds Trailing Returns From 2019Sandeep BorseNo ratings yet

- Gilt Funds Traling Returns From 2015Document2 pagesGilt Funds Traling Returns From 2015Sandeep BorseNo ratings yet

- Representing Geographical FeaturesDocument1 pageRepresenting Geographical FeaturesSandeep BorseNo ratings yet

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Document1 pageCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorseNo ratings yet

- IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocument1 pageIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseNo ratings yet

- Eastings and NorthingsDocument1 pageEastings and NorthingsSandeep BorseNo ratings yet

- Cover Page PicsDocument3 pagesCover Page PicsSandeep BorseNo ratings yet

- Debt Fund Portfolio June 2017Document10 pagesDebt Fund Portfolio June 2017Sandeep BorseNo ratings yet

- 7th ScienceDocument22 pages7th ScienceSandeep BorseNo ratings yet

- CCP - One PagerDocument1 pageCCP - One PagerSandeep BorseNo ratings yet

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsDocument5 pagesARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorseNo ratings yet

- REC Capital Gain Bond-10200083Document4 pagesREC Capital Gain Bond-10200083viralshukla4290No ratings yet

- Basics of Asset Allocation Paradigm for Wealth CreationDocument29 pagesBasics of Asset Allocation Paradigm for Wealth CreationSandeep BorseNo ratings yet

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocument1 pageBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseNo ratings yet

- Nhai54ecapr16 21705523Document2 pagesNhai54ecapr16 21705523Sandeep BorseNo ratings yet

- Landmark Return Multiplier Fund: Capitalizing on Real Estate OpportunitiesDocument37 pagesLandmark Return Multiplier Fund: Capitalizing on Real Estate OpportunitiesSandeep BorseNo ratings yet

- DSP Focus 25Document1 pageDSP Focus 25Sandeep BorseNo ratings yet

- Large Funds Performance Jan 2016Document1 pageLarge Funds Performance Jan 2016Sandeep BorseNo ratings yet

- Project Sunrise Grande Floor PlanDocument6 pagesProject Sunrise Grande Floor PlanSandeep BorseNo ratings yet

- There'S Life Beyond Bank FdsDocument20 pagesThere'S Life Beyond Bank FdsSandeep BorseNo ratings yet

- Indiareit Apartment FundDocument18 pagesIndiareit Apartment FundSandeep BorseNo ratings yet

- PolicySchedule PDFDocument1 pagePolicySchedule PDFSandeep Borse100% (1)

- Transactions - Apartment FundDocument5 pagesTransactions - Apartment FundSandeep BorseNo ratings yet

- Atlantis C Wing Lower FLRDocument1 pageAtlantis C Wing Lower FLRSandeep BorseNo ratings yet

- Mahalaxmi Presentation InvestorsDocument29 pagesMahalaxmi Presentation InvestorsSandeep BorseNo ratings yet

- Khar PropertyDocument7 pagesKhar PropertySandeep BorseNo ratings yet

- Sunita RuiaDocument3 pagesSunita RuiaSandeep BorseNo ratings yet

- Magicbricks OfferDocument14 pagesMagicbricks OfferSandeep BorseNo ratings yet

- Melvin Jones FellowDocument4 pagesMelvin Jones FellowSandeep BorseNo ratings yet

- Non-Resident Home Loan ApplicationDocument2 pagesNon-Resident Home Loan ApplicationSharath BhavanasiNo ratings yet