Professional Documents

Culture Documents

Center For Governmental Research Final Report 5-12-14

Uploaded by

WXXI NewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Center For Governmental Research Final Report 5-12-14

Uploaded by

WXXI NewsCopyright:

Available Formats

The University of Rochester

Economic Impact

May, 2014

The University of Rochester

Economic Impact

May, 2014

Prepared for:

The University of Rochester Office of Government and

Community Relations

Prepared By:

Scott Sittig, M.P.P.

Project Director

1 South Washington Street

Suite 400

Rochester, NY 14614

585.325.6360

www.cgr.org

Copyright CGR Inc. 2014 All Rights Reserved

i

The University of Rochester

Economic Impact

May, 2014

SUMMARY

In late 2013, the University of Rochester engaged CGR (Center for

Governmental Research, Inc.) to conduct an economic impact assessment

of the entire University. Using data for the calendar year 2013 along with

interviews of key stakeholders, CGR analyzed the broad diversity of

specialized academic schools and affiliated organizations to develop a

profile of the Universitys wide ranging economic and fiscal impact on the

region.

Every region is made stronger by the presence of a catalytic economic

engine. The University of Rochester (UR) is the economic engine for the

Rochester Metropolitan Region. As New York States eighth largest

private employer, the University of Rochester is Rochesters largest

employer and it continues to grow, spur new innovation, spin off new

technology, and attract new research and other investment dollars to the

region. It has created new public/private partnerships that are changing the

physical landscape through new off-campus development, changes to the

local roadway system and continued development on the campus itself. By

2018, it envisions itself as one of the nations leading research universities

and an integral support and ongoing catalyst of economic development

locally and globally.

The University also continues to expand its footprint now expanding

medical locations to Brockport and Canandaigua as well as distance

learning opportunities for undergrad and graduate students. Despite

challenges in the local economy, and despite the cost of higher education

which continues to rise, the institution is continuing to draw in new

students, attract new faculty and staff, and expand its footprint in the area.

In its strategic plan

1

approved in October of 2013, UR President Joel

Seligman declared and the Board of Trustees affirmed that:

The University of Rochester has evolved from a regional leader

into a leading national research university with growing

opportunities to contribute to local, national, and global progress.

This transformation is gathering momentum as we have

1

http://www.rochester.edu/strategic-plan/

ii

strengthened our faculty, programs, and staff, translated

innovation from our campus to a broader community, while

increasing our geographic and cultural diversity.

University Profile

The following metrics represent the primary ways the UR is contributing

to the Rochester economy. The University:

purchased goods and services in excess of $854 million in 2013. Of this

total, 23% (about $196 million) was spent to purchase goods and

services in the Rochester metro area.

spent an average of $241 million per year (in 2013 dollars) for capital

improvements including building and fixed and movable equipment over

the last five years.

provided employment to 25,773 people (full-time, part-time, and time-

as-reported) at year-end, December 31, 2013.

2

paid over $1.5 billion in wages of which 97% ($1.48 billion) was to

employees living in the Rochester metro and an additional $21.3 million

was to employees living outside the Rochester metro but still in close

proximity to Rochester.

3

received more than $3.4 billion in external funding (federal and non-

federal agencies) from FY 2005 to FY 2013.

Visitors to UR:

booked over 24,700 hotel reservations; and

lodged in regional hotels more than 37,100 nights.

2

Employees of University of Rochester include all adjunct faculty, faculty, post

doctorates, research and teaching fellows, medical residents, and staff at the University of

Rochester. In addition, all employees of Strong Memorial Hospital, Thompson Health,

Visiting Nurse Service (VNS), Visiting Nurse Signature Care, Highland Hospital, High

Tech Rochester, Excell Partners, Inc., Rochester BioVenture Center, The Highlands at

Brighton, and the Highlands Living Center are included. CGR will refer to this entire

body as University of Rochester employees. We do not include undergraduate students

and graduate students in the employee spending part of the report, but rather in the

student spending component of the economic impact. Including graduate students, UR

provided employment to 25,773 as of 12/31/13.

3

Includes employees living in Allegany, Cattaraugus, Cayuga, Chemung, Genesee,

Schuyler, Seneca, Tompkins, or Yates counties.

iii

The students of UR also contribute to the economic activity of the

Rochester metro. More than 9,300 undergraduate and graduate students

4

per semester:

lived off-campus, contributing their living expenses to the Rochester

economy; and

purchased food off-campus on a regular basisspending their money

locally in restaurants or shopping at grocery stores.

Economic Impact Results

CGR translates these metrics into economic impact estimates using two

scenarios.

Local and Traded Sector Combined: This scenario sums all

contributions of the UR and its affiliates to the Rochester regional

economy into one measure of economic impact.

Traded Sector: A more conservative estimate of the economic impact,

this scenario attempts to discern which elements of UR are the results of

a trading relationship with the economy outside the Rochester region.

Few communities the size of Rochester contain an academic medical

center like the University of Rochester Medical Center (URMC).

Without URMC, millions of dollars in National Institutes of Health

research funding would flow elsewhere. If routine obstetric services

were no longer available from Strong Memorial or Highland hospitals,

however, these services would be provided by others.

Analyzing the Local and Traded Sector combined the University of

Rochester and its affiliates generated:

approximately 50,300 jobs (direct and spillover) in the Rochester metro;

more than $2.8 billion in wages (direct and spillover) in the Rochester

metro; and

approximately $160 million in sales tax, personal income tax, and local

property taxes to the Rochester metro and NYS economy.

4

The UR had 10,357 students enrolled in spring semester 2013, 3,187 students enrolled

in summer semester 2013 and 11,044 enrolled in the fall semester of 2013. 9,300

represent only those who lived off campus or did not buy a meal plan in each semester.

iv

In the Traded Sector scenario, the University of Rochester and its

affiliates generated:

more than 33,900 jobs (direct and spillover) in the Rochester metro;

close to $1.9 billion in wages (direct and spillover) in the Rochester

metro; and

slightly more than $110 million in sales tax, personal income tax, and

local property taxes to the Rochester metro and NYS economy.

Institute for Data Science

In addition to the ongoing operations, the University is continually

planning for new growth and expansion of programs and impact. In 2010,

the University entered into a partnership with IBM to establish a $100

million supercomputing center known as the Health Sciences Center for

Computational Innovation (HSCCI). It is dedicated to applying high

performance computing solutions to the nations health challenges.

Building upon the success of the HSCCI, the UR has announced the

signature project of the 20132018 University strategic plan is the creation

of a university-wide Institute for Data Science. The IDS will position the

UR as one of only a handful of elite research facilities across the country

with super-computing capacity on the cutting edge of the rapidly growing

field of big data in higher education and business.

The proposed Institute for Data Science (IDS) will be housed in a new,

state-of-the-art building located adjacent to Hopeman Hall. The URs

expertise in data science is currently dispersed across many different

departments and divisions. While there are collaborations between

individual groups of researchers, there is no umbrella structure that brings

them all together. The distinct advantage of creating this institute is that it

will enable the coalescence of multiple individual centers in data science

that are emerging from domain specific applications and facilitate

enhanced external partnerships with organizations such as Xerox and IBM

(among many others).

The IDS is planned to have about 20 principal investigators at full

implementation in approximately 10 years. These investigators will have

support staff which will total about 100 people, spurring an additional 50

jobs within the regional economy. The staff will attract over $530 million

of new research funding to the community in the first 10 years of

operation.

The IDS also has catalytic potential to spur new business startups (e.g.

technology spinoffs). Big data startups harness the power of computing

potential with contextual expertise. CGR estimates that new business

v

startups could yield 80 new jobs in the region with over $5.4 million in

new labor income.

2013 Results in Perspective

The economic impact of the University of Rochester and its affiliates on

this region is difficult for some to comprehend. To put this impact into

perspective, University of Rochesters traded sector impact of 33,900 jobs

equated to about 7% of the entire labor force of the Rochester

Metropolitan Statistical Area (RMSA) in 2013.

5

Were this number of jobs

to be lost, the unemployment rate in the RMSA would double to about

14%.

6

Intangible Contributions

Led by the University of Rochester, the regions colleges and universities

have facilitated the regions transition from a manufacturing-based

economy to one that is based on knowledge creation. This is the goal of all

mature economies worldwide.

Collectively, educational institutions have enabled countless individuals to

successfully move to new careers, either by re-directing their energies into

new fields or by enhancing their capacity through further education. The

URs commitment to education in the context of cutting edge research

fosters a dynamic environment for students and faculty to collaborate. The

region benefits from this environment in countless ways as students and

faculty alike invest in the social networks of the community in both

tangible and intangible ways.

Led particularly by URs Eastman School of Music and the Memorial Art

Gallery, the colleges and universities have created a cultural environment

that is unmatched in accessibility and depth. As researchers like the

University of Torontos Richard Florida have described, the vitality of a

communitys cultural life is becoming an ever-more important factor in

the attraction of footloose firms and creative class individuals.

The University of Rochester is a pillar of strength for the Rochester

community. As defined by its own strategic plan, the University creates a

culture of transformative ideas where educational innovation thrives in a

broad array of academic programs and applied service organizations. The

University is positioned to make significant contributions not only to the

5

Source for Labor Force: Local Area Unemployment Statistics (LAUS) Bureau of

Labor Statistics (BLS) for 2013 RMSA. This is defined as those actively employed or

actively looking for work.

6

The 2013 unemployment rate for the RMSA was 7.3% according to LAUS - BLS.

vi

local and regional economy, but the national and global marketplace for

many years to come.

Acknowledgements

This report is a team effort between CGR and many University of

Rochester employees. CGR wishes to thank everyone who helped to

provide the data necessary to perform the analysis. In particular, we thank

Josh Farrelman and Mark Michaud for their time in coordinating data

requests, answering questions, and providing feedback on the report.

Staff Team

Scott Sittig, M.P.P., Associate Director, served as the Project Director and

Manager and oversaw data collection, organization and analysis of the

data, provided input on methodological concerns, and was responsible for

drafting and edited the final report.

Kent Gardner, Ph.D., Chief Economist, provided oversight and input to

methodological process, advised the study team and reviewed impact

results.

Mike Silva, Data Analyst, organized and analyzed data, helped define

consistent methodology, and contributing to drafting portions of the

report.

Rachel Rhodes, Research Assistant, assisted with data collection, report

writing and editing.

Eric Hepler, Intern, assisted with developing the NYS largest employer

list.

vii

TABLE OF CONTENTS

Summary ............................................................................................................ i

University Profile ........................................................................................................... ii

Economic Impact Results ............................................................................................. iii

Institute for Data Science ............................................................................................ iv

2013 Results in Perspective ......................................................................................... v

Intangible Contributions ................................................................................................ v

Acknowledgements ..................................................................................................... vi

Staff Team ................................................................................................................... vi

Table of Contents .............................................................................................vii

Introduction ....................................................................................................... 1

The University and its Affiliates .................................................................................... 2

Outline of Report .......................................................................................................... 3

Our Approach .................................................................................................... 4

Terminology .................................................................................................................. 4

Direct Impact .......................................................................................................... 4

Spillover Impact...................................................................................................... 4

Traded Sector Impacts ........................................................................................ 5

Methodology and Assumptions .................................................................................... 6

Geographic Scope ................................................................................................. 6

Time Period Examined ........................................................................................... 6

Data Sources and Modeling ................................................................................... 7

Our Findings ..................................................................................................... 8

Economic Impact Summary.......................................................................................... 8

Employment Impacts ............................................................................................. 8

Labor Income Impacts ........................................................................................... 9

Purchases ............................................................................................................ 10

Purchasing Impact ......................................................................................... 10

Capital Investments ............................................................................................. 11

Capital Projects in Progress .......................................................................... 11

Capital Investments Impact ........................................................................... 13

Employee Wages and Spending.......................................................................... 13

UR Remains One of New York States Top 10 Private Employers ............... 15

Employment Impact ....................................................................................... 16

Visitor Activity ....................................................................................................... 17

Admissions .................................................................................................... 18

viii

Athletics ......................................................................................................... 18

Graduation/Alumni Events ............................................................................. 19

Music ............................................................................................................. 19

Strong Visitors ............................................................................................... 19

Academics and the Arts................................................................................. 20

Visitor Activity Impact .................................................................................... 20

Students Spending ............................................................................................... 20

Student Spending Impact .............................................................................. 21

Fiscal Impact Summary .............................................................................................. 21

Other Benefits to the Region ...........................................................................23

Research Funding ...................................................................................................... 23

Grant Activity ........................................................................................................ 23

Patents, Royalties, and Start-Ups ........................................................................ 24

Patents Issued ............................................................................................... 24

Invention Disclosures .................................................................................... 25

Royalty Revenue ........................................................................................... 25

Start-up Companies ....................................................................................... 26

The Institute for Data Science .................................................................................... 27

Institute for Data Science Impact ......................................................................... 28

Community Investment in the Region ........................................................................ 30

Brooks Landing, Riverview, Mortgage Support ................................................... 30

Admissions Support for City School Students ..................................................... 30

Hospital Contributions to the Community ............................................................ 31

UR Footprint ......................................................................................................... 31

Conclusion .......................................................................................................32

1

INTRODUCTION

In 2013, The Office of Government and Community Relations within the

University of Rochester engaged CGR (Center for Governmental

Research, Inc.) to conduct an economic impact assessment of the entire

University. The report was commissioned to update the previous study

conducted by CGR in 2011. Using data for the calendar year 2013 along

with interviews of key stakeholders, CGR analyzed the broad diversity of

specialized academic schools and affiliated organizations to develop a

profile of the Universitys wide ranging economic and fiscal impact on the

region.

The UR has continued its growth and expanded its influence in the region

in several ways in the last two years. In December 2012, it formally

affiliated with Pluta Cancer Center. It finalized its purchase of the former

Lakeside Health facilities located in Brockport, NY which now provides a

far west side medical presence for UR and offers access to quality

ambulatory care for people living in that part of the region. Similarly, the

UR finalized an affiliation with Thompson Health based in Canandaigua,

NY bringing it under the UR Medicine umbrella, which encompasses the

patient care services of the University of Rochester Medical Center

(URMC) and its affiliates, assuring that the quality care offered by

Thompson could continue for the foreseeable future.

In addition to the affiliations and purchases of new assets, the UR

continued its own aggressive growth strategy on its River and Medical

Campuses. Two of the signature projects included breaking ground for

College Town on Mount Hope and also for the new Golisano Childrens

Hospital. The Childrens Hospital will be a state of the art facility that will

enhance the URs capacity for training, research and quality care. College

Town is transforming the landscape of a major corridor around the campus

spurring retail development, enhancing residential property values, and

opening up new economic development opportunities in the immediate

area.

In October of 2013 the UR released its strategic plan for 2013-2018. The

pattern of steady and sustainable growth remains at the core of the new

plan with the signature project built around existing strengths and

emerging technological competitive advantages. The UR will create an

Institute for Data Science (IDS) over the next couple of years with the

help of a $10 million donation from the Wegmans Charitable Foundation,

partnership from local businesses such as Xerox and IBM, and public

investment from New York State to create a Center of Excellence for Data

Science located on the UR campus. This initiative will put UR in an elite

category of research universities around the country which have super-

computing capacity and a growing expertise in the field of big data. The

2

investment will attract new research dollars across many disciplines and

streamline the work of many faculties in different schools to position the

UR for cutting edge research for many years to come.

The UR also maintains its commitment to the Rochester community in

countless intangible ways. It intercedes and lobbys with the State as part

of its contribution to new projects such as College Town, Brooks Landing,

or the new I-390 interchange. It encourages faculty and staff to buy and

live locally in the City of Rochester, and has created scholarship funds for

city school students who want to attend the UR. Its medical faculty and

practitioners participate in community forums and conduct outreach

through health fairs and other community events to promote health and

educate parents and children about healthy lifestyles. The UR President

co-chairs the local regional economic development council and designated

staff supports the process demonstrating the Universitys commitment to

the economic wellbeing of the region and the vital role they play in the

community.

This report documents both the tangible economic and fiscal impacts of

the UR, as well as the intangible but valuable contributions the UR makes

in the community.

The University and its Affiliates

This UR is comprised of the River Campus, the UR Medicine and its

affiliates, and the Memorial Art Gallery.

The River Campus includes:

The College of Arts, Sciences and Engineering

The School of Arts and Sciences

Hajim School of Engineering and Applied Sciences (including the

Laboratory for Laser Energetics LLE);

William E. Simon Graduate School of Business Administration;

Margaret Warner Graduate School of Education and Human

Development; and

The Eastman School of Music.

UR Medical Center (URMC)/UR Medicine (URM) includes:

School of Nursing;

School of Medicine and Dentistry;

Eastman Institute for Oral Health;

Strong Memorial Hospital;

University of Rochester Medical Faculty Group; and

Health Sciences Division.

The UR Medicine Affiliates are:

3

Visiting Nurse Service (VNS) and Visiting Nurse Signature Care

(VNSC);

Highland Hospital;

Highlands at Brighton and the Highlands Living Center; and

Thompson Health.

Other UR Affiliates include:

Excell Partners;

HTR (High Technology Rochester); and

Rochester BioVenture Center.

Memorial Art Gallery

Outline of Report

This report details the economic and fiscal impacts that result from the

operations of the University and its affiliates. It also highlights the variety

of investments the University is making to stimulate the Rochester region.

CGRs report is presented in three major parts:

1) Our Approach which provides explanations of terminology as well

as the methodological procedures CGR used to estimate the economic

impact.

2) Our Findings which provides estimates of the economic impact of

UR including; purchases, employee wages and spending, capital spending,

student spending, and visitor spending. The impact is estimated both in

terms of employment and labor income and focused solely on calendar

year 2013. CGR also provides estimates of the fiscal impact in terms of

sales, income and property tax revenue generated.

3) Other Benefits to the Region which outlines significant impacts the

UR is making in the community that are sometimes difficult to quantify or

are too early in their development to have data to analyze. This section

also includes information about the research productivity of UR in terms

of grant activity, patents, and royalty revenues.

The report is summarized in a brief conclusion following the third section.

4

OUR APPROACH

CGR technical approach to analyzing economic impact is largely

consistent with standard industry practices in the field. Below we outline

several methodological considerations that will aid in understanding the

terms used throughout the report.

Terminology

Direct Impact

The direct economic impact consists of the actual expenditures of the

University of Rochester in the community - i.e., the institution is directly

involved with the transaction. Added to the direct expenditures is the

local spending of students and visitors to campus and/or the hospitals.

Examples of direct expenditures include:

UR and its affiliates payroll expenditures for faculty, physicians, staff,

residents, and students;

UR and its affiliates purchases of goods and services from a variety of

suppliers; and

URs payment to a construction firm for a capital improvement project

(new building).

Spillover Impact

Spillover expenditures result from the subsequent spending of the

recipients of the direct expenditures. In some studies this is subdivided for

analysis into indirect and induced impact. For example, a vendor

company that supplies a product or service to the University of Rochester

uses the proceeds of that sale to make expenditures of its own, typically

for both materials and labor. Similarly, employees of the University of

Rochester spend their wages, which become income for other businesses

in the region. These types of expenditures are categorized as spillover.

Specific examples of types of spillover impacts include:

The firm hired to construct a new building buys materials from local

businesses. The local businesses will, in turn, have income to hire

workers. Those workers will then spend money in the community. The

spending of the businesses affected by the construction, and also the

spending of the employees of those businesses, is considered spillover.

A resident or lab tech purchases dinner in a restaurant, and the restaurant

then uses the money to pay suppliers or staff.

5

Traded Sector Impacts

The traded sector is defined as those elements of UR that expand the

economy and attract additional income from outside the region.

The goal of any economic impact study is to assess how the economy in

question is larger as a consequence of the activity being studied. In

laymans terms the question posed is this: How would the economy be

smaller if the activity were to disappear?

In answering this question, economists distinguish between economic

activities that bring dollars into a region from those that simply reallocate

dollars already earned from other regions. A new grocery, for example,

will not attract shoppers from another region. Income to support a grocery

must be earned some other way. A new grocery will only reallocate

spending from another store.

While this is an important distinction, it is impossible to divide every

dollar of revenue flowing to a complex institution like the University of

Rochester according to source. For example, strictly speaking, tuition

from students who would have attended another college or University in

the region had they not been accepted at the University of Rochester

should be excluded from the impact assessment. We do not have the

information available to make this kind of distinction.

One adjustment that CGR has made in this analysis, however, is in health

services revenue. Consistent with the many previous studies of the

economic impact of URMC/URM, CGR distinguishes between clinical

service revenue to Strong or Highland hospitals that would likely be

earned in the local economy anyway if these hospitals were to close.

Routine surgeryan appendectomy, for examplewould be performed in

the Rochester area regardless. Yet Strongs highly regarded (and quite

large) liver transplant program is unusual and attracts patients from

outside the region. Local residents who receive liver transplants would

otherwise travel to another city if Strong did not provide this service.

URMC/URM staff estimate that approximately 37% of clinical revenue

flowing to Strong Memorial Hospital is highly specialized. This is the

component of the clinical service revenue that CGR includes as part of the

URs unique contribution to the Rochester economy.

The traded sector can be defined as those aspects of UR that would

disappear if UR were not in existence. There are certain portions on the

clinical side of URMC/URM that would still remain in the community if it

were to close. The need for routine medical procedures, for example,

would be satisfied by other health care providers were these services not

available from Strong or Highland Hospitals. Employees and direct

6

spending related to these types of procedures are considered local and

are not counted in the economic impact analysis of the traded sector.

Methodology and Assumptions

Geographic Scope

The five-county Rochester metro area (Monroe, Livingston, Orleans,

Ontario and Wayne Counties) provides the geographic scope for the

analysis of economic impact.

7

New York State is the level of analysis for

estimates of the fiscal impact. Other programs and initiatives are defined

in each section according to scope and expected impact.

CGR provides the economic impact in terms of labor income and

employment (number of jobs). In addition, we estimate the fiscal impact

in terms of sales tax revenue and personal income tax (both to NYS and

the Rochester metro). The economic impact is reported in two portions:

direct and spillover.

In calculating the economic impact, CGR only includes the wages of those

employees living and spending in the Rochester metro, though we

recognize that many employees living just outside of the Rochester metro

(e.g. Leroy in Genesee County) spend some of their wages inside the

Rochester metro. Given the definition of the Rochester metro and the

case-by-case nature of these situations, CGR chose to include only wages

for employees who resided in the Rochester metro based upon their zip

code.

Time Period Examined

Where possible, CGR has captured all dollars and estimated impacts for

the calendar year of 2013. For reference, the fiscal year at UR is defined

as July 1 to June 30. Thus, fiscal year 2013 ran from July 1, 2012 to June

30, 2013. Therefore, our analysis spans the fiscal years of 2013 and 2014.

Given the variable nature of capital expenditures, CGR uses a rolling

average over five years to estimate the economic impact of capital

expenditures.

7

In previous studies, the region was the Rochester Metropolitan Statistical Area

(RMSA). In 2013, the U.S. Office of Management and Budget (OMB) changed the

definition of the RMSA to include Yates County. In an effort to maintain consistency

with previous studies, CGR decided to continue using the five county definition.

However, since we have not included Yates County, we refer to the region as the

Rochester metro.

7

Data Sources and Modeling

All data for the study was provided by the UR. The data was gathered

independently by CGR from the various academic schools and affiliated

organizations and compiled for analysis independent of the UR. Where

necessary, CGR consulted with external sources to obtain realistic

benchmarks for analysis (e.g. the average hotel room rate was obtained by

calling several local hotels). We also consulted census sources, Bureau of

Economic Analysis (BEA) data, Bureau of Labor Statistics (BLS) and

New York State Tax and Finance reports among other sources.

CGR used IMPLAN, a regional input-output modeling system, for

estimating the economic impact. IMPLAN is widely acknowledged as

one of the best models of economic activity available. The IMPLAN

database, created by MIG, Inc., consists of two major parts: 1) a national-

level technology matrix and 2) estimates of sectorial activity for final

demand, final payments, industry output and employment for each county

in the U.S. along with state and national totals. Data are updated annually.

IMPLAN estimates the direct, indirect and induced impacts of economic

change through the use of multipliers, and estimates the impact of an

increase in demand in a particular sector on 440 different

industries/sectors of the local economy. CGR rolls the indirect and

induced effects together in our estimates of spillover.

8

OUR FINDINGS

CGRs economic impact studies estimate the wages and jobs that an

institution stimulates as a result of its business operations. Essentially, we

answer the question, How is the economy larger because of this

institutions activity in the community? We analyze five primary areas

of business activity conducted by the UR and its affiliates in order to

quantify the economic impact. The five areas include:

Purchases;

Capital investments;

Employee wages and spending;

Visitor activity; and

Student spending.

Economic Impact Summary

CGR provides economic impact estimates for two scenarios. The first

scenario assumes that every component of UR will provide an economic

impact. This is known as the local and traded sector combined scenario.

The second scenario only considers the impact of the traded sector (see

definition in previous section) and is a more conservative estimate.

Employment Impacts

The employment impact can be interpreted as the number of jobsdirect

and spillover within the Rochester metro that are attributed to UR.

CGR reports employment impacts in terms of thousands of jobs.

If one considers the traded sector only, CGR estimates that UR and its

affiliates generate about 34,000 jobs (direct and spillover) in the

Rochester metro.

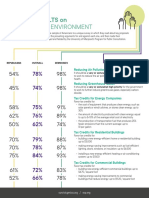

Economic Impact on Rochester: Traded Sector Only

Employment (thousands of jobs) Direct Spillover Total

Employment Impact 14.7 13.4 28.0

Purchases Impact 1.1 0.6 1.7

Capital Investments Impact 1.6 1.2 2.8

Student Spending Impact 0.8 0.3 1.1

Visitor Activity Impact 0.1 0.1 0.2

Total 18.3 15.6 33.9

For both the local and traded sector combined, more than 50,000 jobs

(direct and spillover) are generated in the Rochester metro. As noted in

9

the table and in our detailed summaries that follow, the largest impact is

generated by the direct employment of over 22,500 FTE workers at UR.

The money spent by UR to pay them is the single largest source fueling

the economic engine at the UR.

Economic Impact on Rochester:

Local and Traded Sector Combined

Employment (thousands of jobs) Direct Spillover Total

Employment Impact 22.5 20.2 42.7

Purchases Impact 2.2 1.2 3.4

Capital Investments Impact 1.6 1.2 2.8

Student Spending Impact 0.8 0.3 1.1

Visitor Activity Impact 0.1 0.1 0.2

Total 27.3 23.0 50.3

The UR continues to expand its employee base and its overall footprint

resulting in yet more impact on the Rochester economy. Since the last

study of calendar year 2011, the URs has increased its employment

impact by 8% for the local and traded sector combined and 7% for just the

traded sector.

Labor Income Impacts

Jobsmany well-paidtranslate into paychecks for the thousands of

employees identified above. The wages spent by employees fuel the

economy in countless ways. CGR estimates UR helps to generate:

Nearly $1.9 billion in wages (direct and spillover) in the Rochester

region in the traded sector; and

Economic Impact on Rochester: Traded Sector Only

Labor Income (millions of dollars) Direct Spillover Total

Employment Impact $974.5 $650.7 $1,625.2

Purchases Impact $56.3 $24.2 $80.5

Capital Investments Impact $82.5 $58.2 $140.7

Student Spending Impact $25.3 $14.6 $39.9

Visitor Activity Impact $2.8 $1.9 $4.7

Total $1,141.4 $749.6 $1,891.0

Over $2.8 billion in wages (direct and spillover) in the Rochester region

when considering the local and traded sector combined.

10

Economic Impact on Rochester:

Local and Traded Sector Combined

Labor Income (millions of dollars) Direct Spillover Total

Employment Impact $1,479.8 $985.4 $2,465.2

Purchases Impact $107.7 $49.5 $157.2

Capital Investments Impact $82.5 $58.2 $140.7

Student Spending Impact $25.3 $14.6 $39.9

Visitor Activity Impact $2.8 $1.9 $4.7

Total $1,698.1 $1,109.7 $2,807.7

The total wage impact changed from the previous studys level by 11% for

the traded sector only, and by 17% for the local and traded sector

combined.

In the next several sections we provide details on the impacts calculated

for each of these economic categories. Following that, we provide an

overview of the fiscal impacts generated by the UR for the Rochester

metro and NYS. In the section on Other Benefits to the Region we

elaborate on activities that are central to the culture and vibrancy of the

Rochester community but do not have a quantifiable contribution to the

estimates of economic impact.

Purchases

During 2013, the University of Rochester and its affiliates purchased

goods and services in excess of $854 million. Of this total, about $196

million was spent in the Rochester metro. Over 75% of UR purchases flow

outside the Rochester Metro to vendors in other parts of New York, other

states and around the world.

Purchasing Impact

CGR estimates that the purchases of goods and services by the University

of Rochester and its affiliates sustain approximately 3,400 jobs in the

region. The traded sector is responsible for 48% of the jobs.

Purchasing Impact

Direct Spillover Total

Local & Traded Sectors Combined

Employment (thousands of jobs) 2.2 1.2 3.4

Labor Income (millions of dollars) 107.7 49.5 157.2

Traded Sector Only

Employment (thousands of jobs) 1.1 0.6 1.7

Labor Income (millions of dollars) 56.3 24.2 80.5

11

Capital Investments

Given the variable nature of capital expenditures, CGR uses a rolling

average over five years to estimate the economic impact of the capital

investments. During the past five fiscal years (FY2009 FY2013), the

University of Rochester and its affiliates:

Spent a total of $1.2 billion (in 2013 dollars) on capital (including

building new infrastructure, renovating existing facilities and purchasing

construction equipment) over the five year period; and

Spent an average of $241 million per year (in 2013 dollars) on capital

investments.

Fiscal year 2013 saw a decline in capital spending from fiscal year 2012,

but spending during the year was on par with the five-year average.

Capital Projects in Progress

Institute for Data Science ($50 million)

In October 2013, the University of Rochester committed $50 million to

creation of a new Institute for Data Science, on top of more than $50

million dedicated in recent years. This is the top University priority for

the University's 2013-18 strategic plans and includes a new, $25 million,

50,000 sq. ft. state-of-the-art facility that will be home for the Institute and

the newly New York State-designated Center of Excellence for Data

Science. (See later in this report for more detail on the Institute and its

potential impact.)

Golisano Childrens Hospital ($145 million)

The new Golisano Childrens Hospital tower will provide infants,

children, and families with more space and access to improved care,

$0

$50

$100

$150

$200

$250

$300

$350

FY09 FY10 FY11 FY12 FY13

Capital Expenditure (millions of 2013 dollars)

12

including 52 private patient rooms and a greatly expanded Neonatal

Intensive Care Unit. The eight-story, 245,000 square foot building will

cost approximately $145 million, and will supply the area with an

estimated 1,066 construction jobs. Funds were raised for the project

through a combination of equity, loans, and the Golisano Childrens

Hospital $100 million campaign.

The new hospital, which is the largest capital project in the Universitys

history, is slated to open in the summer of 2015.

College Town ($100 million)

The University of Rochester partnered with the City of Rochester,

Fairmont Properties, Gilbane Development, and Mt. Hope neighborhood

leaders to develop a comprehensive plan for a College Town on 14 acres

of university-owned property along Mt. Hope Avenue. Like Brooks

Crossing the University is the anchor tenant and committed to leasing

50,000 square feet in office space and relocating the Universitys

Bookstore. The project will create a vibrant community hub and serve not

only the Mt. Hope and university communities, but the entire city.

College Town is a $100 million development project in part financed with

local, state, and federal grants and loans. The project will include street-

level retail shops, office space, parking, a hotel, and rental residential

space, and is slated for completion in 2014. College Town is projected to

create approximately 1,200 new jobs and contribute nearly $4.5 million in

taxes annually. In addition, the City of Rochester invested $17 million in

improvements to the main intersection flanking the College Town

development.

Development is currently underway and an opening is slated for the fall of

2014.

HTR Business Accelerator Cooperative ($15 million)

With $5 million in funding from NYS, High Tech Rochester (HTR) and

Empire State Development partnered to develop the Finger Lakes

Business Accelerator Cooperative. The Business Accelerator is designed

to coordinate and consolidate current business services across the 9-county

Finger Lakes region, and provide start-up and incubation services for a

range of businesses in the service, technology, and biology industries. As

part of this effort, HTR has taken steps towards identifying a new facility

in Rochester that will give early stage companies access to space and

resources including labs for prototype manufacturing, wet labs for biotech

companies, an auditorium, and office space. The Business Accelerator

Cooperative is expected to bring about 1,000 new jobs to the region within

five years of completion.

The Flats at Brooks Crossing ($18.7 million)

13

Development at Brooks Landing is fundamentally changing the face of

Rochester's southwest side. The University, the City of Rochester,

neighborhood groups, and private developers all partnered in the

development of Brooks Landing a waterfront development between

Brooks Avenue and Genesee Street. Ground was broken in 2013 on the

latest addition to the Brooks Landing Revitalization Project, The Flats at

Brooks Crossing.

Brooks Crossing, an $18.7 million project, will house 170 University of

Rochester upperclassmen, a boathouse, and a restaurant when

completed. Brooks Crossing is projected to bring $9.9 million to the

Brooks Landing community as new residents patronize local services and

restaurants. The City of Rochester also contributed to the project in the

form of $6 million in area public improvements.

I-390 ($90 million)

A multi-phase plan to improve access to the University of Rochester and

the surrounding area via the I-390 interchange began in 2012-13 and will

wrap up in 2015. Funding all phases of the $90 million project has been

committed and is estimated to create 850 construction jobs (indirect and

direct) and $42 million in labor income. In total, the project is supporting

and accommodating increased traffic from almost $450 million in new

development that is underway within 2 square miles of the project. The

project is also expected to ease traffic, increase safety, and provide future

economic development opportunities in the community.

Capital Investments Impact

CGR estimates the University of Rochesters average annual capital

investments support around 2,800 jobs and bring in about $141 million of

labor income to the regional economy.

Capital Investments Impact

Direct Spillover Total

Employment (thousands of jobs) 1.6 1.2 2.8

Labor Income (millions of dollars) 82.5 58.2 140.7

Employee Wages and Spending

For the purposes of this report, employees of University of Rochester

include all adjunct faculty, full time faculty, post-doctoral fellows,

research and teaching fellows, medical residents, and staff at the

University of Rochester. In addition, CGR includes all employees of

Strong Memorial Hospital, Visiting Nurse Service (VNS), Visiting Nurse

Signature Care, Highland Hospital, High Tech Rochester, Excell Partners,

Inc., Rochester BioVenture Center and both Highlands Pittsford and

Brighton. Since the last report, UR has formally affiliated with FF

Thompson Health Care based in Canandaigua, NY. Since they are

14

considered in our definition of the Rochester Metro and were fully

absorbed during the calendar year, we have included them in this analysis

for 2013. In expressing the economic impact, CGR will refer to this entire

body as University of Rochester employees.

The table below provides the employee count as of 12/31/13. This

includes full-time, part-time and time as reported (TAR)

8

individuals and

is not a full-time equivalent number. The table does not include graduate

students and undergraduate students. Overall, the UR expanded its

headcount by 10% as compared to December 2011. The addition of

Thompson as an affiliate is partially responsible. Taking out this addition

the UR expanded by 3.8% over the two year period.

All Employees of University of Rochester and its Affiliates

University of Rochester 20,397

Highland Hospital 2,581

The Highlands* 692

FF Thompson 1,403

Visiting Nurse Service/Signature Care 683

High Tech Rochester/BioVenture** 17

Total 25,773

*Includes Highlands at Brighton, Highlands at Pittsford, and Highlands Living Center

**Includes Excell Partners, Inc.

The table below summarizes the full-time equivalent number of UR

employees reported on December 31, 2013. The FTE count is 10% higher

than the end of December 2011. Again, after adjusting for the addition of

8

Includes per diem, casual, and temporary workers

Full-Time Equivalent University of Rochester Employees

Counts by FTE Full-Time Part-Time TAR/Per Diem Total

University of Rochester 16,000 1,597 502 18,099

Highland Hospital 1,676 306 181 2,163

The Highlands* 339 81 71 491

FF Thompson 895 139 81 1,115

Visiting Nurse Service/Signature Care 451 99 17 567

High Tech Rochester/BioVenture** 15 1 0 16

Total 19,376 2,223 852 22,451

*Includes Highlands at Brighton, Highlands at Pittsford, and Highlands Living Center

**Includes Excell Partners, Inc.

15

Thompson Health, the UR FTE count is about 5% higher than its

December 2011 level.

During the 2013 calendar year, UR:

Paid wages of more than $1.5 billion, of which about $1.48 billion was

to employees living in the Rochester metro.

The geographic distribution of wages for all employees (not including

graduate and undergraduate students) is presented in the table below:

Distribution of Wages by Region

Rochester Metro* $1,475,788,840

Rest of Finger-Lakes Region** $21,314,063

Rest of NYS $16,090,333

Outside NYS $5,928,873

Outside USA $9,185,199

Total $1,532,307,307

*Defined as Monroe, Livingston, Orleans, Ontario and Wayne counties.

**Defined as Allegany, Cattaraugus, Cayuga, Chemung, Genesee,

Schuyler, Seneca, Tompkins, or Yates counties.

CGR only includes the wages of those employees with zip codes in the

Rochester metro ($1.48 billion) to estimate the economic impact of UR on

the Rochester metro. However, it is clear that an employee living in

nearby Genesee County, for example, might still spend a large portion of

their income in the Rochester metro. Thus, the economic impact estimates

presented later in this report may be slightly underestimated as they do not

include any expenses of employees living outside the Rochester metro.

In addition, there are a few employees who have a permanent address

outside NYS. However, some of them may rent an apartment as well as

buy groceries and gas in the Rochester metro during the week. Due to the

case-by-case nature of these situations, CGR chose to only include those

wages of employees with a zip code in the Rochester metro.

Not included in these counts are the reported employment totals of 9,533

undergraduate and graduate students during the 2013 calendar year. The

student employees were paid a total of $41.2 million in wages.

UR Remains One of New York States Top 10 Private Employers

With nearly 26,000 employees (22,000 FTE) UR is by far the largest

employer in the Rochester metro; a distinction it has held for several years

now. CGR has updated its list of New York States top private employers

for this study to put URs employment in a statewide context. Since

private employment figures arent public information, CGR has used

various business journals, market research reports, and self-reported

16

numbers to provide the most accurate data. With each new publication of

this list, we have grown more confident that we are capturing the right

firms and institutions. However, we remain cautiously aware that with no

publicly available statewide source to independently verify our findings,

there is a possibility that the list is incomplete.

The following is what CGR believes to be the largest private sector

employers in New York State and their full-time equivalent employment

numbers for the year ended 2013. We have used full time equivalents to

provide a better comparison of employment impact.

Top 20 Private Employers in NYS 2013

Full-time equivalent employees located in the state

Rank Company Name NYS Employment

1 North Shore-LIJ Health System 40,000

2 Mount Sinai Health System 31,000

3 Walmart* 28,000

4 Verizon NY Inc. 27,000

5 JP Morgan Chase 25,000

6 Citigroup Inc. 25,000

7 Macy's Inc. 25,000

8 University of Rochester 22,000

9 New York Presbyterian Hospital 20,000

10 Montefiore Health System 18,000

11 NYU/Medical Center 18,000

12 Wegmans Food Markets 17,000

13 Columbia University 16,000

14 Cornell University/Weill Medical College 15,000

15 Consolidated Edison 15,000

16 Bank of America 14,000

17 IBM Corp. 14,000

18 Morgan Stanley 13,000

19 Memorial Sloan-Kettering Cancer Center 12,000

20 Kaleida Health 10,000

*75% of total reported by each company to adjust for likely part-time workers.

With more than 22,000 FTE employees, the University of Rochester

ranked as the eighth largest employer in New York State in 2013. Across

the board, higher education and healthcare remain the dominant players in

New York States economy. The majority of the largest firms are

headquartered downstate, in New York City and on Long Island; though a

few (including UR, Wegmans, and Kaleida Health) are located Upstate.

Employment Impact

The largest component of the URs economic impact in the regional

economy is based on the wages it pays to its employees and the

subsequent buying power that generates for them. Not only does the UR

directly employ nearly 22,500 full-time equivalent workers, but the

17

spending by these employees spurs on an estimated 20,200 jobs in the

regional economy. When adjusting to account only for traded sector

impact the UR direct employment figure drops to an estimated 14,700

workers and the spending of those employees spurs on an additional

13,400 jobs in the regional economy.

Employment Impact

Direct Spillover Total

Local & Traded Sectors Combined

Employment (thousands of jobs) 22.5 20.2 42.7

Labor Income (millions of dollars) 1,479.8 985.4 2,465.2

Traded Sector Only

Employment (thousands of jobs) 14.7 13.4 28.1

Labor Income (millions of dollars) 974.5 650.7 1,625.2

In summary, the local and traded sector impact for UR employees results

in over 42,000 jobs and almost $2.5 billion in labor income.

Visitor Activity

The University of Rochester hosted visitors throughout the year for events

such as Meliora weekend, graduation, concerts, recitals, athletic events,

and admission visits. The visitors include alumni; prospective students and

their families; family and friends of current students; visiting faculty that

attend conferences or use research equipment; family and friends of

Strong Memorial Hospital patients; musicians; athletic opponents and their

fans; and UR fans and families of student athletes. Visitors are a vital

source of economic impact because they bring new dollars to the

Rochester community and they are exposed to the rich culture, geography

and lifestyles of Upstate NY.

During 2013 CGR estimates visitors to UR:

Booked around 24,700 hotel reservations (up 13% from the 2011 study);

and

Lodged for more than 37,100 nights (up by 8% from the 2011 study).

18

The largest activities and events that draw visitors to the UR are discussed

below.

Admissions

Prospective students and their families represent a significant influx of

visitors throughout the year. The River Campus undergraduate admissions

office estimated that about 22,000 visitors came to campus in 2013

generating approximately 7,500 hotel nights. The Simon School, Warner

School, Graduate School of Arts, Sciences and Engineering, School of

Nursing and URMC combined attracted over 1,700 admissions visitors to

the area, many of whom also stayed overnight. The Eastman admissions

office also provided tours to nearly 1,200 prospective students during

2013, and about a third brought along at least one parent. A majority of

these people are from out of town and stay overnight in the Rochester

area. Since 2011, the number of visitors to Rochester for admissions or an

admissions-related event has increased by over 20%.

Athletics

Athletic events also draw a large number of visitors, comprised of the

visiting teammates as well as parents and other spectators from out of

town. There were cumulatively 128 home games across all sporting events

during the 2013 calendar year, with nearly 2,800 visiting players from

opposing teams participating. Opposing teams generated just over 1,000

hotel nights, with parents and fans of visiting players likely also staying in

a hotel on those occasions. Both the number of visiting players and hotel

nights stayed declined from 2011 totals despite the increase in the number

of home games. The likely culprit for the lower numbers was that fewer

tournaments were held on campus in 2013 compared with the previous

study year (2011).

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Admissions Athletics Graduation

/ Alumni

Events

Music Strong

Visitors

All Others

Visitor Impact on Area Hotels (2013)

Hotel Reservations Hotel Night Stays

19

Graduation/Alumni Events

Meliora Weekend (MW) is one of the biggest annual events on campus. It

is the combined weekend for Homecoming, Family, and Reunion and

includes events at the River Campus, URMC, and graduate schools.

Attendance for MW stayed flat between 2011 and 2013. In 2013, MW

attendees (specifically alumni, parents and guests) from out of the

Rochester region numbered 1,568 and booked approximately 784 hotel

rooms. The average length of stay was three days and two nights. These

visitors, and any out-of-town visitors to campus, affect the local economy

by spending money at places such as hotels, restaurants, retail

establishments, gas stations, car rental agencies, and the airport.

Another major visitor event is graduation weekend. The University

awarded 2,584 degrees during the May 2013 commencement. The

Conference and Events Office at UR estimates five visitors per graduate

attend the weekend for a total attendance of around 11,600. Many of these

are from out of town and bring out-of-town dollars into the Rochester

economy. Visitors also attend pinning ceremonies at the School of

Nursing in August and December and a White Coat Ceremony at the

School of Medicine and Dentistry in August.

Music

The Kodak Hall at Eastman Theatre draws thousands of outside visitors

for a number of different events such as the Rochester Philharmonic

Orchestra and local graduation ceremonies. Smaller events such as

Eastman School of Music student recital concerts and the Eastman

Rochester Organ Initiative Festival brought nearly 500 visitors from

outside the area. The International Society of Bassists Convention drew

the most visitors in 2013 with 1,300 attendees, many from outside of the

country.

In 2013, attendance for the Rochester International Jazz Festival (RIJF)

grew to 195,000, an increase of 7% from 2011. Of those visitors, 13,000

were for headline concerts at the Kodak Hall at Eastman Theatre and

9,000 attended Kilbourn Hall performances. RIJF is one of the top

attractions of the year in the whole of the Rochester region, and event

organizers estimate that 28% of all the visitors come from outside of the

area. The more than 1,200 musicians that come from out of town to

perform during the week of the festival also add to the economic and

cultural impact of the event.

Strong Visitors

Many visitors to patients of Strong Memorial Hospital come from out of

the area. The Strong Guest Hotel Services processed 5,863 guest

reservations for a total 13,601 hotel nights during 2013, a slight increase

from 2011. Strong Guest Services estimates that well over half of the hotel

20

rooms were paid by individual guests, with the remainder paid for by the

hospital and URMC departments.

Academics and the Arts

The faculty and world class research conducted at UR draws many visitors

for academic conferences. The Laser Lab (LLE) attracted 570 researchers

to use the facility, many of which came from abroad. These researchers

typically stay in local hotels for 4 days to perform their research. The

Medical Center also brought in over 3,300 out of town visitors for various

conferences and teaching series, accounting for about 625 hotel nights,

while the School of Nursing had 10 scholars from out of town visit in

2013.

The Memorial Art Gallery (MAG) had just over 47,500 visitors to their

exhibits during 2013, down 4% from 2011. More than 175,000 people

came to MAG for school tours, creative workshops, weddings, corporate

events, visits to the gift shop and restaurant, and the annual Clothesline

Festival. The Clothesline Festival drew 428 exhibiting artists, about half of

them from outside the Rochester region.

Visitor Activity Impact

CGR estimates that the influx of spending generated by visitors attending

all of these events and activities resulted in approximately 200 jobs and

over $4.5 million of labor income in the Rochester metro economy.

Visitor Activity Impact

Direct Spillover Total

Employment (thousands of jobs) 0.1 0.1 0.2

Labor Income (millions of dollars) 2.8 1.9 4.7

Students Spending

Students generally do not have significant buying power during their on-

campus experiences. However, the sheer volume of students means they

do contribute to the economic activity of the Rochester metro in a variety

of ways. During the 2013 spring semester, UR:

Enrolled 8,675 full-time undergraduate and graduate students;

Provided housing to 5,012 undergraduate and graduate students; and

Provided meal plans to 5,363 undergraduate and graduate students.

Many students continue classes during the summer. During the summer of

2013, UR:

Enrolled 3,187 full-time undergraduate and graduate students; and

Provided housing to 1,633 undergraduate and graduate students.

21

During the 2013 fall semester, UR:

Enrolled 9,308 full-time undergraduate and graduate students;

Provided housing to 5,201 undergraduate and graduate students; and

Provided meal plans to 5,415 undergraduate and graduate students.

Based on these numbers, it is reasonable to assume that during the 2013

calendar year more than 9,300 students either:

Ate off-campus on a semi-regular basisspending their money locally

to eat in restaurants or shopping at grocery stores; and/or

Lived off-campus, investing their living expenses in the Rochester

economy.

Student Spending Impact

CGR estimates that the spending by the students supports in total about

1,100 jobs in the regional economy as summarized in the table below.

Student Spending Impact

Direct Spillover Total

Employment (thousands of jobs) 0.8 0.3 1.1

Labor Income (millions of dollars) 25.3 14.6 39.9

Fiscal Impact Summary

CGRs estimates of the fiscal impact of University of Rochester and its

affiliates show that the UR helps to generate:

More than $108 million in sales tax, personal income tax, and local

property taxes to the Rochester metro and NYS when considering the

traded sector only.

University of Rochester Impact on New York State:

Traded Sector Only

Millions of Dollars Direct Spillover Total

NYS and Local Sales Tax $26.5 $17.7 $44.2

NYS Personal Income Tax $45.3 $16.9 $62.3

Local Property Tax paid by UR $1.8 N/A $1.8

Total $73.6 $34.6 $108.3

The labor income of the local and traded sector combined helps to

generate:

22

About $158 million in sales tax, personal income tax, and local property

taxes to the Rochester metro and NYS.

University of Rochester Impact on New York State:

Local and Traded Sector Combined

Millions of Dollars Direct Spillover Total

NYS and Local Sales Tax $39.7 $26.2 $65.9

NYS Personal Income Tax $62.9 $25.1 $88.0

Local Property Tax paid by UR $3.9 N/A $3.9

Total $106.5 $51.4 $157.8

23

OTHER BENEFITS TO THE REGION

The diversity of the Rochester region is due in part to the vibrancy created

by our cultural and educational institutions. Attracting world class faculty

and producing cutting edge research draws dollars to the region, which

spurs infrastructure improvements, and enhances the quality of life for

many people in the immediate vicinity of the campus and around the area.

The quality of life enhancements are not always easily quantified, but they

are none-the-less catalysts for a healthy and engaged community. The

following sections highlight some of the many ways the Rochester region

is benefitting from the UR that go beyond the basic definition of economic

and fiscal impact.

Research Funding

While the Universitys employment and spending are a critical foundation

of the regions economy, the catalytic impact of the institutions research

enterprise cannot be overstated. Research activities both basic science

and clinical research are an integral part of University of Rochester. UR

medical research has resulted in improved health care for our community

by bringing advances in health care technology to the practice of medicine

in physician offices and hospitals. Whether its medical research, the

research at the LLE facilities, the super computing power of the HSCCI

initiative (and now the new IDS) or the many other ongoing research

activities across URs campus, the advances are impressive and help to

create intellectual capacity in the Rochester region. URs growing

reputation as a leading health care research university is attracting talent

and research dollars from all over the globe and has contributed to

stemming disease through vaccinations and other treatments the world

over.

Grant Activity

UR has received nearly $2 billion in external funding (federal and non-

federal agencies) over the last five years. Total awards to the University of

Rochester averaged $407 million per year (in constant 2013 dollars) from

FY2009 to FY2013. This represents no real change from the average

computed in the 2011 study though 2013 saw more grant dollars than 2012

and reversed a two-year slide in declining grant funding. The Federal

Government sponsors about 79% of URs research.

24

Patents, Royalties, and Start-Ups

More patents were issued, and the total invention disclosures were up from

previous reports. Royalty revenue was down slightly from 2011 figures,

but the revenue per million of research funding remains high. The

tremendous value of these innovative concepts is in their potential to be

commercialized for economic development purposes.

Patents Issued

Until 2012, the number of foreign patents had been trending down while

the number of domestic patents was trending slightly up. 2013 reversed

the decline in foreign patents resulting in increases in both foreign and

domestic patents. Since the previous study (2011) the UR increased their

total number of patents issued by 14%.

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

FY

2011

FY

2012

FY

2013

External Funding Received (thousands of dollars)

Source: UR Office of Research and Project Administration Annual Report

0

10

20

30

40

50

60

70

80

90

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

FY

2011

FY

2012

FY

2013

Total Number of Patents Issued

United States Foreign Total

Source: UR Office of Technology Transfer

25

Invention Disclosures

The total invention disclosures have remained somewhat steady over the

nine years that we have data, averaging around 138 per year. Since 2011,

however, invention disclosures have increased by 9%. This increase is

driven by the URMC, which accounts for 92% of the change. Overall,

URMC is responsible for approximately 70% of the invention disclosures.

Invention Disclosures

FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013

LLE 2 2 5 7 3 2 0 2 1

Engineering 32 29 30 26 35 27 35 28 30

Arts and Sciences 9 8 7 6 4 7 7 8 12

URMC 92 101 107 109 106 87 86 94 97

Total 135 140 149 148 148 123 128 132 140

Royalty Revenue

According to the 2012 Association of University Technology Managers

(AUTM) Annual Report, 161 U.S. universities and 33 other research

institutions reported a total of $63.7 billion in research expenditures, with

a total of $2.6 billion in licensing revenue. These data imply that, on

average, each institution receives approximately $40,800 in royalty

revenue per $1 million in extramural funding (0.04).

Consistent with the latest 2012 AUTM report, CGR analyzed the URs

2012 research funding data and found that for every one million dollars in

extramural funding, an average of $113,400 in royalty revenue was

generated by UR. At almost three times the national average, the UR is

clearly on the cutting edge in terms of licensing revenue from research

expenditures.

UR royalty revenue has generally been declining from a high of about

$72M in FY 2008. However, according to data from AUTM, the

University of Rochester was ranked fourteenth nationally in 2012 in terms

of licensing revenues suggesting it remains a significant recipient of

licensing revenues relative to its peers.

26

Start-up Companies

University of Rochesters potential as an economic catalyst for new and

emerging technology is realized when commercial ventures sprout from its

research findings. Because these new companies often remain closely tied

to ongoing research and university-based faculty, many remain in the

region. With proper support and resources, these companies can form the

critical mass necessary to attract outside investment and skilled workers

and make the region a hub for technology research and industry.

From FY2005 through FY2013, there have been a total of 34 start-up

companies formed as a result of research at the University of Rochester,

both the River campus and URMC. Of those 34 companies, 25 are still

operating in the Rochester area. There were no recorded startups in 2013.

$0

$10

$20

$30

$40

$50

$60

$70

$80

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

FY

2011

FY

2012

FY

2013

Total Royalty Revenue (millions of dollars)

Source: UR Office of Technology Transfer

0

1

2

3

4

5

6

7

8

9

10

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

FY

2011

FY

2012

FY

2013

Local Start-up Companies - by FY of Formation

Still in Operation as of January 2014 Start-Ups Formed

Source: UR Office of Technology Transfer

27

The Institute for Data Science

IBM estimates the US creates 2.5 quintillion

9

bytes of data each day.

They further estimate that about 90% of the data in the world today has

been created in the last two years alone. This data comes from

everywhere: sensors used to gather climate information, posts to social

media sites, digital pictures and videos, purchase transaction records, and

cell phone GPS signals to name a few. The voluminous amounts of

information give rise to the name big data, a moniker for the emerging

field of data science.

Big data has offered some unique challenges and opportunities. From a

technical level, there is a question of storing and processing data, which is

often gathered in an unstructured format. There is also difficulty in

finding people with the skillset to capitalize on the data. McKinsey &

Company estimate by 2018 the United States will experience a shortage of

190,000 skilled data scientists, and 1.5 million managers and analysts

capable of reaping actionable insights from the big data deluge

10

.

However, big data has offered some interesting opportunities to

researchers. The UR has already begun responding to this opportunity. In

2010, the University entered into a partnership with IBM to establish a

supercomputing center known as the Health Sciences Center for

Computational Innovation (HSCCI). It is dedicated to applying high

performance computing solutions to the nations health challenges and

hosts an IBM Blue Gene/Q supercomputer. To date, HSCCI has been

awarded $10 million in support from the State of New York.

Building upon the success of the HSCCI, the UR has announced the

signature project of the 20132018 university strategic plan is the creation

of a university-wide Institute for Data Science. It will support the

recruitment of 20 new faculty members focused on three research topics:

predictive health analysis, cognitive systems and artificial intelligence, and

analytics on demand. Currently, more than 100 principal investigators

have been awarded a total of $307 million in research funding relying in

part upon high performance computation. The new Institute will also

leverage existing collaborations with companies such as IBM and Xerox

in data science. The Institute for Data Science is expected to influence the