Professional Documents

Culture Documents

EZCORP (EZPW) - Fast Growth, Solid Profits, Low Price

Uploaded by

sommer_ronald5741Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EZCORP (EZPW) - Fast Growth, Solid Profits, Low Price

Uploaded by

sommer_ronald5741Copyright:

Available Formats

Measured Approach

EZCORP, INC. (NASDAQ: EZPW) Data as of: 11/15/2009

Industry: Retail (Specialty Non-Apparel)

Current Data

Current Price $14.43 PEG 0.2

Market Cap ($M) $711.25 EPS TTM ($) 1.42

Shares Outstanding (M) 49.2 P/E TTM 10.2X

Institutional Holdings % 75.6 EPS Estimated 2010 ($) 1.66

Insider Holdings % 21.8 P/Estimated EPS 8.7X

Beta 1.04 MA Value ($) 16.65

Latest Quarter Reported 09/30/2009 Price Value Ratio 0.87

EZCORP (EZPW) – Fast Growth, Solid Profits, Low Price

EZCorp offers pawn loans in 294 U.S.-based pawn shops and at 38 Mexico pawn shops.

The company also sells forfeited collateral from its pawn shop operations. In 477

EZMONEY stores and 71 of its pawn shops, EZPW offers short-term, non-collateralized

loans (pay-day loans.)

HIGHLIGHTS

EZCORP Inc. (EZPW) reported net income of $20.9 million or $0.42 per share for

the fourth quarter, compared to $16.0 million or $0.37 per share in the prior

year quarter. Total Revenues for the fourth quarter increased 34% to $164.8

million from $123.4 million in the previous year quarter.

For the trailing twelve month period ending 09/30/09, EPS was $1.44. Consensus

estimate for FY10 is $1.66.

The company announced that it has completed its acquisition of 108.22 million

newly issued ordinary shares of Cash Converters International Limited,

headquartered in Perth, Australia. EZCORP paid AUS $0.50 per share, for a total

investment of AUS $54.11 million or about US$49.4 million U.S., and now owns

about 30% of the outstanding ordinary shares of Cash Converters. The Cash

Converters shares are listed on the Australian Stock Exchange and the London

Stock Exchange (symbol, "CCVU"). EZCORP funded the investment primarily with

cash on hand and expects the investment to be immediately accretive to

earnings.

The PE ratio relative to the average 3-year, 5-year and 7-year EPS growth rate is

0.25X

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

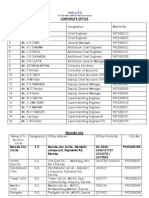

Analysis of the Balance Sheet

The schedule presented below shows the year-end balance sheets for the years

between September 30, 2004 and September 30, 2009. Accounts receivable and

inventory comprise approximately 72 percent of the business’s current assets.

Approximately 16 percent of current assets are cash. The company reports no short-

term investments.

Fixed assets (net property, plant and equipment) make up approximately 24 percent of

the business’s non-current assets. As the company’s revenues have increased, the fixed

assets also have risen.

Overall, the business’s total assets have approximately tripled during the period

presented below. The increase in total assets has been due primarily to increases in

accounts receivable and secondarily to increases in inventory and other current assets.

Accounts payable comprise the largest segment of current liabilities. They comprise

approximately 70 percent of current liabilities. The company carries a modest amount of

short term and long term debt.

As the company’s earnings steadily increased, so did its equity. The company increased

equity by approximately 166% during the period presented.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Balance Sheet

(Amounts in Millions)

TTM FYE FYE FYE FYE FYE

Assets 09/30/09 09/30/08 09/30/07 09/30/06 09/30/05 09/30/04

Cash 44.8 27.4 22.5 29.9 4.2 2.5

ST Investments 0.0 0.0 0.0 0.0 0.0 0.0

Accounts Receivable 136.0 101.2 81.7 65.4 67.3 66.5

Inventory 64.0 43.2 37.9 35.6 30.3 30.6

Other Current Assets 32.6 20.0 15.1 11.1 12.5 12.0

Total Current Assets 277.4 191.9 157.2 142.0 114.3 111.7

Net Property,Plant & Equip. 51.2 40.1 33.8 29.4 27.0 25.8

LT Investments 38.9 38.4 35.7 19.3 17.3 17.6

Goodwill/Intangibles 100.7 26.7 17.1 0.8 0.0 0.0

Other LT Assets 24.4 11.6 7.3 6.4 6.9 9.2

Total Assets 492.5 308.7 251.2 197.9 165.4 164.3

Liabilities

Accounts Payable 33.8 5.7 6.2 22.6 19.0 14.9

Short Term Debt 10.0 0.0 0.0 0.0 0.0 0.0

Other Current Liabilities 4.7 26.3 26.2 1.9 2.3 3.7

Total Current Liabilities 48.6 32.0 32.4 24.5 21.3 18.6

LT Debt 25.0 0.0 0.0 0.0 7.0 25.0

Other LT Liabilities 3.2 3.7 2.9 3.2 3.6 4.0

Total Liabilities 76.8 35.7 35.3 27.7 31.9 47.6

Preferred Stock 0.0 0.0 0.0 0.0 0.0 0.0

Common Stock Equity 415.7 273.1 215.9 170.1 133.5 116.7

Total Liabilities & Equity 492.5 308.8 251.2 197.8 165.4 164.3

Book Value Per Share 8.65 6.30 5.26 4.31 3.58 3.17

Analysis of the Income Statement

As part of my analysis, I analyzed EZPW’s income statements for the years ended

September 30, 2004 through September 30, 2009.

Revenues have increased from $227.8 million for the year ending September 30, 2004

to $597.5 million in the year ending September 30, 2009. During this period, gross

profit margins remained fairly steady ranging from 61.3 percent to 69.5 percent. The

result is a near tripling of gross profit dollars for the year ending September 30, 2009 as

compared to September 30, 2004.

Operating expenses as a percentage of sales have declined over the years. For the year

ending September 30, 2004, operating expenses as a percentage of sales was 93.7

percent. Operating expenses as a percent of sales declined to 83 percent in the year

ending September 30, 2009.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Income Statement

Amounts in Millions

TTM FYE FYE FYE FYE FYE

09/30/09 09/30/08 09/30/07 09/30/06 09/30/05 09/30/04

Sales 597.5 457.4 372.2 315.9 254.2

Cost of Goods Sold 203.6 139.4 118.0 106.9 90.7

Gross Income 393.9 318.0 254.2 209.0 163.5

Depreciation & Amortization 12.7 12.4 9.8 8.6 8.1

Research/Development n/a n/a n/a n/a n/a

Interest Expense n/a n/a n/a n/a n/a

Unusual Expenses/(Income) 0.0 0.0 0.0 0.0 0.0

Total Operating Expenses 496.0 383.7 316.7 272.9 231.9

Operating Income 101.5 73.7 55.5 43.0 22.3

Interest Expense - Non-Op. 1.4 0.4 0.3 0.4 1.5

Other Expenses/(Income) (5.2) (4.8) (4.7) (2.9) (2.3)

Pretax Income 105.3 78.1 59.9 45.5 23.1

Income Taxes 36.8 25.6 22.1 16.2 8.3

Income After Taxes 68.5 52.4 37.9 29.3 14.8

Adjustments to Income 0.0 0.0 0.0 0.0

Income for Primary EPS 68.5 52.4 37.9 29.3 14.8

Nonrecurring Items 0.0 0.0 0.0 0.0 0.0

Net Income 38.5 52.4 37.9 29.3 14.8

EPS Basic 1.42 1.21 0.92 0.74 0.40

EPS Diluted 1.42 1.21 0.88 0.69 0.36

Industry Comparative Analysis

EZCORP is identifies with the Retail (Specialty Non-Apparel) industry group. This is a

diverse group of companies operating in very different segments of the service industry.

Direct comparisons are difficult.

The following schedule presents a comparative ratio analysis of EZCORP and the median

company classified as Retail (Specialty Non-Apparel). Four categories of ratios

(profitability, liquidity, debt management and asset management) have been used to

compare the operating results of EZPW with that of the industry. EZPW has been

compared to the median ratio for the Retail (Specialty Non-Apparel) industry.

Liquidity ratios give an indication of a company’s ability to meet current obligations with

the use of current assets. As indicated by the comparative ratio analysis, EZPW liquidity

ratios are adequate to meet its current obligations and signify financial strength.

The profitability ratios measure management’s effectiveness in overseeing the

business’s resources. Compared to the industry median, EZPW is more effective than

the industry in producing earnings from its assets.

All in all, EZPW presents a strong showing when compared to the industry median.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Industry Comparative Analysis

Industry Industry

PROFITABILITY Company Median LIQUIDITY Company Median

Gross Profit 65.9 34.3 Quick ratio 4.4 0.6

Operating Margin 17.0 (2.4) Current Ratio 5.7 1.5

Net Profit Margin 11.4 (1.1) Payout Ratio 0.0 0.0

Return on Equity 17.6 0.0 Times Interest Earned 71.2 (1.3)

Return on Assets 14.5 (2.4)

Industry Industry

DEBT MANAGEMENT Company Median ASSET MANAGEMENT Company Median

Total Liab. / Total Assets 15.6 61.5 Receivables Turnover 4.8 32.1

LT Debt / Equity 6.0 12.4 Asset Turnover 1.3 1.8

LT Debt / Capital 5.7 14.2 Inventory Turnover 3.4 3.4

Summary of Analysis

Based on my analysis of EZCORP, the business appears to be in a strong financial

position. During the years presented here, both sales and earnings have increased

significantly as well as its equity position. In addition, compared to the industry, EZCORP

has more liquidity, less leverage, and operates more profitably. Based on the financial

analysis of EZCORP, the business has less risk than does the median company in the

Retail (Specialty Non-Apparel) industry.

Value Conclusion

Based on my analysis of the common stock of EZCORP, Inc., I conclude the fair market

value of EZPW to be $16.65 per share. This represents a 10X multiple to consensus

estimated EPS of $1.66 for FY10 and 11.7X multiple to FY09 EPS of $1.42.

Valuation Ratios

Current Industry

Company MA Value Median

Price Earnings 10.20 11.73 14.60

PE to Growth 0.20 0.29 1.30

Price to Book 1.70 1.92 1.60

Price to Sales 1.10 1.37 0.40

Price to Cash Flow 8.50 9.85 12.20

Price to Free Cash Flow 12.20 14.11 8.70

Disclosure: Author is long EZPW.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

You might also like

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741No ratings yet

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741No ratings yet

- Paper & Paper Products Industry SummaryDocument1 pagePaper & Paper Products Industry Summarysommer_ronald5741No ratings yet

- The Long Term Case For HumanaDocument2 pagesThe Long Term Case For Humanasommer_ronald5741No ratings yet

- Inter Digital ProfileDocument2 pagesInter Digital Profilesommer_ronald5741No ratings yet

- The Best in Coal SummaryDocument1 pageThe Best in Coal Summarysommer_ronald5741No ratings yet

- Global Telecom Opportunities SummaryDocument1 pageGlobal Telecom Opportunities Summarysommer_ronald5741No ratings yet

- A Small Cap Healthcare PickDocument1 pageA Small Cap Healthcare Picksommer_ronald5741No ratings yet

- DIY InvestingDocument2 pagesDIY Investingsommer_ronald5741No ratings yet

- Starting Lineup For 2011Document3 pagesStarting Lineup For 2011sommer_ronald5741No ratings yet

- 2010 Win Some Lose SomeDocument2 pages2010 Win Some Lose Somesommer_ronald5741No ratings yet

- Brinker International: Challenge For Casual DiningDocument2 pagesBrinker International: Challenge For Casual Diningsommer_ronald5741No ratings yet

- Core Laboratories: An Oil Patch OpportunityDocument3 pagesCore Laboratories: An Oil Patch Opportunitysommer_ronald5741No ratings yet

- GT SolarDocument2 pagesGT Solarsommer_ronald5741No ratings yet

- Dialing For Dollars in ArgentinaDocument2 pagesDialing For Dollars in Argentinasommer_ronald5741No ratings yet

- In Hog Heaven With Hormel FoodsDocument3 pagesIn Hog Heaven With Hormel Foodssommer_ronald5741No ratings yet

- LubrizolDocument2 pagesLubrizolsommer_ronald5741No ratings yet

- Tractor SupplyDocument2 pagesTractor Supplysommer_ronald5741No ratings yet

- Endo Pharmaceuticals - Steady GrowthDocument3 pagesEndo Pharmaceuticals - Steady Growthsommer_ronald5741No ratings yet

- Astrazeneca SummaryDocument1 pageAstrazeneca Summarysommer_ronald5741No ratings yet

- Navigate With GarminDocument2 pagesNavigate With Garminsommer_ronald5741No ratings yet

- Hawkins IncDocument2 pagesHawkins Incsommer_ronald5741No ratings yet

- ComTech Telecom SummaryDocument3 pagesComTech Telecom Summarysommer_ronald5741No ratings yet

- Profit From Western DigitalDocument3 pagesProfit From Western Digitalsommer_ronald57410% (1)

- The Game Is Not Over For GameStop Corp.Document4 pagesThe Game Is Not Over For GameStop Corp.sommer_ronald5741No ratings yet

- Sorl Auto Parts Inc. - No Stopping HereDocument2 pagesSorl Auto Parts Inc. - No Stopping Heresommer_ronald5741No ratings yet

- DIY For Cars - Advance Auto Parts Inc.Document3 pagesDIY For Cars - Advance Auto Parts Inc.sommer_ronald5741No ratings yet

- Oracle Corporation: The Road To RecoveryDocument7 pagesOracle Corporation: The Road To Recoverysommer_ronald5741No ratings yet

- Fuqi International: Finding Gold in ChinaDocument3 pagesFuqi International: Finding Gold in Chinasommer_ronald5741No ratings yet

- Stryker Corporation: Opportunity or Trap?Document6 pagesStryker Corporation: Opportunity or Trap?sommer_ronald5741100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- International Pepper Community: Report of The 36 Peppertech MeetingDocument26 pagesInternational Pepper Community: Report of The 36 Peppertech MeetingV Lotus Hbk0% (1)

- COGS Statement ProblemsDocument6 pagesCOGS Statement Problemsaljhondelacruz22No ratings yet

- Remittance and Its Economic Impacts On BangladeshDocument16 pagesRemittance and Its Economic Impacts On BangladeshM A Akad MasudNo ratings yet

- Macroeconomics course readings and assessment agreedDocument3 pagesMacroeconomics course readings and assessment agreeddheeraj sehgalNo ratings yet

- Economic growth with endogenous saving behavior and Ramsey-Cass-Koopmans modelDocument8 pagesEconomic growth with endogenous saving behavior and Ramsey-Cass-Koopmans modelMihaela PisoiNo ratings yet

- CV Khairul Dwiputro-2023Document5 pagesCV Khairul Dwiputro-2023Rezki FahrezaNo ratings yet

- Anjali 123Document2 pagesAnjali 123Rahul PNo ratings yet

- List of AP Solar BiddersDocument7 pagesList of AP Solar BiddersHarshith Rao VadnalaNo ratings yet

- GA55Document2 pagesGA55Rajneesh Khichar : MathematicsNo ratings yet

- Grafice in WordDocument8 pagesGrafice in WordJeNo ratings yet

- Tax Invoice: United Arab EmiratesDocument1 pageTax Invoice: United Arab Emiratesalihassan685777No ratings yet

- Petro Sluz 2023 Jan 03 Batangas Rizal QuezonDocument2 pagesPetro Sluz 2023 Jan 03 Batangas Rizal QuezonFloyd PantiNo ratings yet

- Trading Journal - CC 0.01BTC To 0.1BTC Challange IgorDocument70 pagesTrading Journal - CC 0.01BTC To 0.1BTC Challange IgorCryptoFlitsNo ratings yet

- Steel CH 1Document34 pagesSteel CH 1daniel workuNo ratings yet

- The Fashion Channel: Case StudyDocument4 pagesThe Fashion Channel: Case StudyRachit SrivastavaNo ratings yet

- GEC04 Module 2 To 4Document58 pagesGEC04 Module 2 To 4Alexs VillafloresNo ratings yet

- BCGDocument138 pagesBCGANKUSHSINGH2690No ratings yet

- SW DirDocument104 pagesSW DirFahad Ashfaq KhattakNo ratings yet

- QSM559 W 2 ProcDocument19 pagesQSM559 W 2 ProcM Helmi Yusri YeoNo ratings yet

- 5 LCDocument2 pages5 LCArlynSarsabaMendozaNo ratings yet

- Philippines Capital Gains Tax Return Form 1707Document2 pagesPhilippines Capital Gains Tax Return Form 1707Anne VallaritNo ratings yet

- Visit Report: Page 1 of 26Document26 pagesVisit Report: Page 1 of 26OğuzcanYazarNo ratings yet

- IBPS PO 2017 Full Set of Prelims Questions - 7th Oct 2017Document14 pagesIBPS PO 2017 Full Set of Prelims Questions - 7th Oct 2017Raj AryanNo ratings yet

- Poland A2Document5 pagesPoland A2KhanZsuriNo ratings yet

- TBC Sicav SolutionDocument5 pagesTBC Sicav SolutionSoùFian AitNo ratings yet

- Coworking - Collaborative Spaces For MicroentrepreneursDocument24 pagesCoworking - Collaborative Spaces For MicroentrepreneursAndrei HimseIf100% (1)

- CH 5 Market StructureDocument33 pagesCH 5 Market StructureEstifanos DefaruNo ratings yet

- 811-List of Participant - Email AddressesDocument20 pages811-List of Participant - Email AddressesVinodh0% (1)

- Contact UsDocument12 pagesContact UsShital KiranNo ratings yet

- Monetary PolicyDocument20 pagesMonetary PolicynitikaNo ratings yet