Professional Documents

Culture Documents

University of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements Analysis

Uploaded by

Barby Angel0 ratings0% found this document useful (0 votes)

23 views6 pagesFin unit3

Original Title

FM_Unit_3

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFin unit3

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views6 pagesUniversity of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements Analysis

Uploaded by

Barby AngelFin unit3

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 6

University of Technology, Jamaica

Fundamentals of Finance (FOF) Unit 3: Financial Statements Analysis

Learning Objective #1: Using Ratio Analysis as the first step in the analysis of a ompany!s

Financial Statements

Ratio Analysis involves examining the relationship between pieces of information in the financial

statements for a given accounting period.

Ratios are useful because: (i) They summarize much data and put it in a usable format (ii) They facilitate

comparison across different firms and also of the same firm over different periods of time (iii) They are

used to highlight the strengths and weanesses of a company relative to its industry (iv) They can be

used as an early warning system! as a means of monitoring management and as a screening tool (v)

"rom an investor#s standpoint! predicting the future is the purpose of financial statement analysis. (vi)

"rom management#s standpoint! it is useful both as a way to anticipate future conditions! and also as a

starting point for planning actions that will influence the future course of events.

$ote that several ratios should be reviewed during an analysis. %hen one ratio deviates from the norm!

other related ratios should be studied to help determine the cause of the deviation.

%e will examine & categories of ratios. 'ifferent staeholder groups have different needs! and tend to

focus on different categories of ratios. (i) (uppliers and short)term lenders are most interested in

li*uidity ratios (ii) (tocholders and potential investors are most interested in profitability and maret

value ratios (iii) +ong)term debt holders are most interested in debt and asset management ratios (iv)

,anagers of the firm would be interested in all ratios because they are responsible for satisfying the

interests of all staeholder groups. (v) Analysts usually perform long)run trend analysis over a &)-. year

period looing for long)term stoc maximization.

Li"#i$ity Ratios

#rrent Ratio % #rrent Assets &#ic' (or Aci$) Ratio % (#rrent Assets * +nventory)

#rrent Liabilities #rrent Liabilities

ash Flo, Ratio % Operating ash Flo,

#rrent Liabilities

+i*uidity ratios refer to the firm#s ability to meet short)term obligations. They show the relationship of a

company#s cash and other current assets to its current liabilities. "irms with poor li*uidity are more

liely to fail and default on their debts. Therefore! a higher ratio is better! but one that is too high may

suggest inefficient use of resources and reduced returns.

/urrent Ratio (i) (hows how well the company can meet0cover its short)term obligations. (ii) 1rovides a

margin of safety in shrinage of non)cash current assets. (iii) 1rovides a reserve of li*uid funds against

uncertainties and shocs to cash flows. (ome of its limitations are: (i) 2t can easily become outdated as

short)term assets and liabilities are easily changed. (ii) /ompanies sometimes choose a 3year)end4 when

they are liely to have less short)term debt and more cash. (iii) 2t is not able to measure and predict the

pattern of future cash inflows and outflows. (iv) 2t is not able to measure the ade*uacy of future cash

inflows to outflows.

5uic or Acid Ratio: This is a more stringent test of a company#s li*uidity as it ignores inventory which

can tae some time to be converted to cash depending on the length of the company#s operating cycle.

/ash "low Ratio6 This ratio shows how well a company can cover its current liabilities from cash

generated from its operating activities.

Asset -anagement Ratios

.otal Asset .#rnover % Sales Fi/e$ Asset .#rnover % Sales

(Average) .otal Assets (Ave)Fi/e$ Assets

Acco#nts Receivable .#rnover % Sales or re$it Sales +nvent0 .#rnover % ost of 1oo$s Sol$

(Ave) Acc0 Rec0 +nventory

2ays sales in Receivables % Acco#nts Receivable

or Ave0 ollection 3erio$ Average sales per $ay

or 2ays Sales O#tstan$ing (2SO)

2ays sales in +nventory % +nventory

Average sales (or O1S) per $ay

Asset ,anagement Ratios show how efficiently the company uses its assets to generate sales

-

Total Assets Turnover Ratio (TAT) can be improved if the firm (i) increases sales6 (ii) 2mproves

efficiency in the use of assets6 (iii) 'isposes of or replaces some assets6 (iv)A combination of the above.

"ixed Asset Turnover: A high ratio may indicate that the company is efficient or it may be woring

close to capacity with older assets. 2t may thus prove difficult to generate further business without an

increase in invested capital. A low ratio may indicate an inefficient use of assets or resources.

Accounts Receivable Ratios: (i) A high turnover ratio indicates that the company is efficient in the

collection of its receivables. (ii) days sales outstanding ('(7) show the number of days it taes the

company to collect amounts outstanding. A low figure is desirable but may also indicate an unduly

restrictive credit policy. (iii) Remember that when one ratio deviates from the norm! other related

ratios should be studied to help determine the cause.

2nventory Ratios (i) 2nventory turnover measures the average speed that inventories move through the

company i.e. 8 the number of times per year that the company fills up and then completely empties its

warehouses or stores. (i) A high ratio may be a sign of efficiency! high sales or that the company is

living from hand to mouth! providing little variety to customers and may sometimes be out of stoc.

(ii)A low ratio may indicate that the company is holding too much stoc or holding damaged or obsolete

stoc. (iii) The days sales in inventory ratio shows the number of days it taes to sell inventory and is

useful in assessing purchasing and production policies.

2ebt -anagement Ratios

.otal 2ebt Ratio % .otal Assets * .otal 4"#ity % .otal 2ebt

.otal Assets .otal Assets

2ebt to 4"#ity Ratio % .otal 2ebt

.otal 4"#ity

4"#ity -#ltiplier % .otal Assets % 1 5 2ebt to e"#ity ratio .+4 % 46+.7+nterest

.otal 4"#ity

Fi/e$ harges overage % 46+.7 (+nt0 4/p0 5 Lease payts0)

ash overage % (46+. 5 2epreciation)7+nterest

'ebt management ratios show how well the company manages or uses debt. /ompanies use borrowed

funds to increase the returns to company owners. 9y raising funds through debt! the firm avoids diluting

stocholder ownership. To have a positive leverage! the company must be able to earn a greater return

on the assets the borrowed money is invested in! than the interest cost. 2f the rate of return on assets is

less than the rate of interest on the borrowed money! the interest must be paid! and it will come from the

owners of share capital.

+ong)term creditors are most interested in debt management ratios. %hat do they loo for: (i) A margin

of safety provided by e*uity capital. ;igher e*uity levels indicate lower ris for creditors (ii) /reditors

loo at the firm#s past payment history and at the level of income being generated to determine if it can

cover repayment of loans with interest (T2<! "ixed /harges /overage = /ash /overage) (iii)The debt

ratio is used to determine creditworthiness (iv) The expected return on investment should be higher than

the interest rate on loan.

Total 'ebt Ratio: shows how the firm is financed 8i.e. 8 the percentage of the firm that is financed by

borrowed funds. %hen business is good or normal! firms with relatively high debt ratios have higher

expected returns! however! when business is poor! they are exposed to ris of loss. The ris of

banruptcy is further increased and there is less cushion against creditors loss in the event of li*uidation.

/reditors may be reluctant to lend more. 2t may be costly to raise additional debt capital without first

raising more e*uity capital

3rofitability Ratios

1ross 3rofit -argin % Reven#es * ost of 1oo$s Sol$

8et Sales

3rofit -argin on Sales % 8et +ncome after .a/ Ret#rn on .otal Assets (ROA) % 8+A.

or 8et 3rofit Ratio 8et Sales (Ave) .otal

Assets

% 3rofit -argin 9 Asset .#rnover

Ret#rn on ommon 4"#ity (RO4) % 8et +ncome after .a/

(Average) .otal 4"#ity

% Ret#rn on Assets 9 4"#ity -#ltiplier

Ret#rn on apital 4mploye$ % 8et +ncome after .a/

(RO4) .otal apital

6asic 4arning 3o,er Ratio % 4arnings before +nterest : .a/

(643) .otal Assets

>

46+.2A overage Ratio % 46+.2A 5 Lease payments

+nterest 5 3rincipal 5 Lease

1rofitability relates to a company#s ability to earn a satisfactory income. 1rofitability is closely lined to

its li*uidity because earnings ultimately produce cash flow. All financial statements are pertinent to

profitability analysis. 1rofitability ratios show the combined effects of li*uidity! asset management and

debt on operating results.

?ross 1rofit ,argin(?1,): (i) A high ?1, might indicate that the company is efficient or that its

prices are high. (ii) A low ?1, could indicate that sales are too low or costs or too high! or both.

$et 1rofit ,argin ($1,): A low $1, may indicate that: (i) /osts are too high (ii) 7perations may be

inefficient (iii) The company may be heavily in debt! leading to high interest charges

Return on Assets (R7A): This ratio can be derived from multiplying the net profit margin by the asset

turnover. The profit margin measures the profitability of the company relative to sales! while the asset

turnover ratio measures the effectiveness of the company in generating sales from assets.

Return on /apital <mployed (R7/<):(i) is an indicator of the company#s overall profitability. (ii) 2t

relates profits with all methods of financing! (iii) /onveys return on invested capital from different

financing perspectives. (iii) is sometimes used in evaluating managerial effectiveness as management is

responsible for all company activities. (iv) depends on the sill! resourcefulness! ingenuity and

motivation of management.

9asic <arning 1ower Ratio (9<1): measures the raw earning power of the firm#s assets. 2t is useful for

comparing companies with different financing structures and tax rates.

Return on <*uity (R7<)

This ratio can also be derived by multiplying R7A by the <*uity ,ultiplier. This shows that R7< is

affected by profit margins! asset use efficiency and financial leverage.

-ar'et ;al#e Ratios

4arnings per Share % 8et +ncome for common sharehol$ers

.otal # of common shares o#tstan$ing

3rice74arnings (374) Ratio % -ar'et 3rice per Share

4arnings per Share

-ar'et to 6oo' ;al#e % -ar'et 3rice per Share

6oo' ;al#e per Share

-ar'et to ash Flo, % -ar'et 3rice per Share

ash Flo, per Share

6oo' ;al#e per share % .otal ommon 4"#ity

.otal # of common shares

,aret @alue Ratios relate the company#s stoc price to the internal performance of the company. They

give an indication of how investors feel about the company#s future prospects based on its past

performance. ;igh ratios indicate good prospects and is expected if all other ratios are good. (toc

prices are expected to be high if all ratios are good.

The 10< ratio shows how much investors are willing to pay per dollar of reported profits. A high 10<

ratio may indicate that the maret expects an increase in earnings in the future. 10< ratio is usually

higher for firms with strong growth prospects. A low 10< ratio usually indicates poorer growth prospects

or higher ris or both. "irms that earn high returns on their assets! usually have share prices well in

excess of their boo values.

Learning Objective #<: Using .ren$ Analysis to compare financial statements

Trend Analysis is the evaluation of consecutive financial statements or ratios over time. 2t shows the

direction! speed and extent of any trends in the company#s performance. Trend Analysis is also nown

as =ori>ontal Analysis because it loos at information horizontally across time. 2t shows the year)to)

year changes in ratios and reveals whether the firm#s condition is improving or deteriorating over time.

Learning Objective #3: 3erform a comparative analysis of financial statements

/omparative Analysis sees to brea down each item in the financial statements to enable better

comparison. 2t is also nown as ;ertical Analysis or ommon?si>e Analysis! because it breas down

all figures into percentages. /omparative or vertical analysis shows the relationship of each item to a

specified base! which is the -..A figure. <very other item on the financial statement is then reported as

a percentage of that base. 7n a common)size income statement (profit = loss account)! each item is

expressed as a percentage of net sales 8 which is shown as -..A. 7n a common)size balance sheet! each

item is expressed as a percentage of total assets 8 which is shown as -..A.

B

2n using comparative analysis! companies should be adCusted for impact of size before maing

comparisons.

6enchmar'ing is the practice of comparing a company to other companies both inside and outside its

own industry. /ommon)size statements are also used to compare a company to other companies in

benchmaring.

Learning Objective #@: Limitations of #sing financial statement analysis in $ecision ma'ing

$o single ratio or one)year figure is sufficient to provide an assessment of a company#s performance.

"inancial analysis may indicate that something is wrong! but it may not identify the specific problem or

show how to correct it. 2n using financial statement analysis a single ratio may serve more than one

purpose! eg indicating profitability0performance as well as flexibility0adaptability (i) Dse ratios in

conCuction with other supporting ratios and within the context of the industry! remembering the impact

of inflation and size. 2nflation can distort a firm#s balance sheet and profits. (ii) (easonal factors can

distort ratios (iii) (ometimes comparing a company with an industry average can be misleading if the

company operates in more than one industry. (iv) 2nterpreting the results of your analysis re*uires a

sound understanding of the company! the industry and the general economic environment. (v) 'ifferent

accounting practices can distort comparisons.

Learning Objective #A: onsi$ering "#alitative factors in the analysis of financial statements

(ome other factors to be considered in analyzing a company: (i) Are the company#s revenues tied to -

ey customer: (ii) To what extent are the company#s revenues tied to - ey product: (iii) To what extent

does the company rely on a single supplier: (iv) %hat percentage of the company#s business is

generated overseas: (v) +evel of competition to which the company is exposed (vi) "uture prospects for

growth and expansion (vii) +egal and regulatory environment

&#antitative +nformation So#rces: "inancial (tatements! 2ndustry (tatistics! <conomic 2ndicators!

Regulatory "ilings! Trade Reports

&#alitative +nformation So#rces: ,anagement discussion and analysis! /hairman#s and /<7#s letter.

Annual Report! ,ission (tatement! /ompany web sites! "inancial 1ress! /ompany 1ress Releases

Financial Statements 1ublic firms are re*uired to publish several different financial statements which

together give a picture of the firm#s operations and financial condition. %e shall examine two of the

most important ones! namely the 2ncome (tatement which gives a summary of the firm#s revenues and

expenses over an accounting period (eg a year or a *uarter) and the 9alance (heet

The income statement reports on operations over a period of time! usually a *uarter or a year. 2t starts

with a topline figure or revenue from operations! followed by a series of deductions! and ending in the

bottom line or net income. $ote that taxes are deducted after most costs are met! as they are regarded as

business expenses payable from operating revenue. $et income remains after all expenses are paid! and

belongs to the firm#s common shareholders.

The balance sheet reports the firm#s state of affairs at a particular point in time. 2t lists the firm#s assets

on one side (in order of li*uidity)! and the claims against those assets. /laims are of two inds6 liabilities

(money the firm owes)! and stocholder#s e*uity (their ownership stae). /laims are listed in the order

in which they must be paid. Thus accounts payable! a liability usually due in B. days or less! is at the

top! while at the bottom is stocholders e*uity which never needs to be 3paid off4. 7f the assets!

although all are stated in E! only 3cash4 is actual money.

F

+8O-4 S.A.4-48. (3 : L)

<BBC (D) <BBA (D)

(ales G!.B&!H.. H!.BF!...

/ost of goods sold (/.7.?.() &!IG&.JJ> &!&>I!...

7ther <xpenses &&.!... &-J!JII

<arnings before 2nterest = Taxes (<92T'A) H.J!H.I (-B!JII)

'epreciation = Amortization --H!JH. --H!JH.

<arnings before 2nterest = Taxes (<92T) FJ>!HFI (-B.!JFI)

2nterest G.!..I -BH!.->

<arnings before Taxes (<9T) F>>!HF. (>HH!JH.)

Taxes -HJ!.&H (-.H!GIF)

$et 2ncome ($2) >&B!&IF (-H.!-GH)

6ALA84 S=44.

Assets

/ash I&!HB> G!>I>

Accounts Receivable (debtors! AR) IGI!... HB>!-H.

2nventory -!G-H!FI. -!>IG!BH.

Total Current Assets >!HI.!--> -!J>H!I.>

"ixed Assets I-G!.F. JBJ!GJ.

Total Assets B!FJG!-&> >!IHH!&J>

Liabilities : 4"#ity

Accounts 1ayable FBH!I.. &>F!-H.

$otes 1ayable B..!... HBH!I.I

Accruals F.I!... FIJ!H..

Total Current Liabilities -!-FF!I.. -!H&.!&HI

+ong Term 'ebt F..!... G>B!...

Total Liabilities -!&FF!I.. >!BGB!&HI

/ommon (toc -!G>-!-GH FH.!...

Retained <arnings >B-!-GH B>!&J>

Total Stockholders Equity -!J&>!B&> FJ>!&J>

Total Liabilities & Equity B!FJG!-&> >!IHH!&J>

&

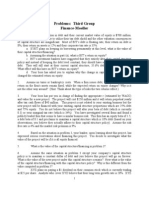

U8+. 3: .U.OR+AL &U4S.+O8S

-. 7ver the past year ,' Ryngaert = /o has realized an increase in its current ratio and a drop in

its total assets turnover ratio.. ;owever the company#s sales! *uic! and fixed assets turnover

ratios have been constant. %hat explains these changes: (B.-)

>. 2f a firm#s R7< is low and management wants to improve it! explain how using more debt might

help (B.H)

B. 9aer 9rothers has a '(7 of F. days. The company#s annual sales are EG.B,. what is its level

of accounts receivable: (Assume a year of BH& days) (B.-)

F. ?raser Trucing has E->9 in assets and its tax rate is F.A. The firm#s basic earning power ratio

is -&A and its return on assets (R7A) &A. %hat is ?raser#s T2< ratio: (B.&)

&. The ;.R 1icett /orp has E&..!... of debt outstanding and it pays an annual average interest

rate of -.A. Annual sales are E>,! its tax rate is B.A! and its net profit margin is &A. 2ts ban

will refuse to renew its loan! a move which would banrupt the firm! if it does not maintain a

T2< ratio of at least &. %hat is its present T2< ratio: (B.I)

H. ,idwest 1acaging#s R7< last year was only BA! but management has developed plans to

improve it. The new plans call for a total debt ratio of H.A! which will result in interest charges

of EB..!...0year. ,anagement proCects an <92T of E-, on sales of E-., and expects a total

asset turnover of >... The tax rate is expected to be BFA. 2f the changes are made! what will be

the firm#s new R7<: (B.-.)

G. ;arriett 2ndustries has EG.&9 in total assets. 2ts basic earning power ratio is -.A and its T2< ratio

is >.&. ;arriett#s depreciation and amortization expenses total E-.>&9. 2t has EGG&, in lease

payments and E&.., must go towards principal payments on its loans and long term debt. %hat

is ;arriett#s <92T'A coverage ratio: (B.-F)

I. A<2 incorporated has E&9 in assets and its tax rate is F.A.2ts basic earning power ratio is -.A

and its R7A is &A. %hat is A<2#s times interest earned (T2<) ratio: (B.-&)

J. ?iven the following information! calculate the maret price of the firm#s stoc: (tocholder#s

e*uity K EB.G&9! 10< ratio K B.&! common stoc outstanding K &.,! and maret to boo ratio K

-.J. (B.-H)

-.. ;arrelson 2nc. currently has EG&.!... in accounts receivable. 2ts days sales outstanding ('(7) is

&& days. 2t wants to reduce its '(7 to the industry average of B& days by pressuring customers to

pay on time. The /hief "inancial 7fficer (/"7) estimates that average sales will fall by -&A if

the policy is adopted. Assuming the firms achieves the '(7 of B& days and suffers the -&A sales

decline! what will be the new level of accounts receivable: Assume - year KBH& days (B.-G)

--. <bersoll ,anufacturing /o. has EH, in sales. 2ts R7< is ->A and total assets turnover is B.>

times. <bersoll is &.A e*uity financed. %hat is its net income: (B.-J)

->. /omplete the following balance sheet using the given information: 'ebt ratio K&.A. Total assets

turnover K -.&! current ratio K-.I! '(7 K BH.& days! gross profit margin on sales L(sales 8 cost of

goods sold)0salesM K >&A! 2nventory turnover ratio K &. (B.>-)

ASS4.S (E) L+A6+L+.+4S : 4&U+.E (E)

/ash Accounts 1ayable

Accounts Receivable +ong Term 'ebt H.!...

2nventories /ommon (toc

"ixed Assets NNNNNNNNNN Retained <arnings JG!&..

.otal Assets B..!... .otal Liabilities : 4"#ity OOO..

Sales ost of 1oo$s Sol$

H

You might also like

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Ratio Analysis FormulaDocument7 pagesRatio Analysis FormulaHozefadahodNo ratings yet

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraNo ratings yet

- FM Unit 2 Lecture Notes - Financial Statement AnalysisDocument4 pagesFM Unit 2 Lecture Notes - Financial Statement AnalysisDebbie DebzNo ratings yet

- Categories of RatiosDocument6 pagesCategories of RatiosNicquainCTNo ratings yet

- Chapter 23 Ratio Analysis: 1. ObjectivesDocument26 pagesChapter 23 Ratio Analysis: 1. Objectivessamuel_dwumfourNo ratings yet

- Return On Assets (ROA) - Meaning, Formula, Assumptions and InterpretationDocument4 pagesReturn On Assets (ROA) - Meaning, Formula, Assumptions and Interpretationakashds16No ratings yet

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Analyzing Financial Statements: Learning ObjectivesDocument15 pagesAnalyzing Financial Statements: Learning Objectivesindlaf85No ratings yet

- Chap 3Document5 pagesChap 3Tahir Naeem JattNo ratings yet

- Ratio Analysis: Submitted To Shruti MamDocument48 pagesRatio Analysis: Submitted To Shruti MamMD Gulshan100% (1)

- Chapter 3 (14 Ed) Analysis of Financial StatementsDocument25 pagesChapter 3 (14 Ed) Analysis of Financial StatementsSOHAIL TARIQNo ratings yet

- BE Sols - FM14 - IM - Ch3Document25 pagesBE Sols - FM14 - IM - Ch3ashibhallauNo ratings yet

- Ratio ExplainDocument4 pagesRatio ExplainAnendya ChakmaNo ratings yet

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To Selected End-Of-Chapter Questionsfeitheart_rukaNo ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsSandraNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- Chapter 4 (Group 1)Document50 pagesChapter 4 (Group 1)Amal Fitra IriansahNo ratings yet

- Profitability Sustainability RatiosDocument3 pagesProfitability Sustainability RatiosRhodelbert Rizare Del SocorroNo ratings yet

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDebasish PahiNo ratings yet

- FIN621 Final solved MCQs under 40 charsDocument23 pagesFIN621 Final solved MCQs under 40 charshaider_shah882267No ratings yet

- Chapter 04Document32 pagesChapter 04Phuong TrangNo ratings yet

- Financial Statement AnalysisDocument30 pagesFinancial Statement AnalysisHYUN JUNG KIMNo ratings yet

- Calculations and Interpretations of 14 Key Financial RatiosDocument6 pagesCalculations and Interpretations of 14 Key Financial RatioswarishaaNo ratings yet

- Primer of Financial RatiosDocument2 pagesPrimer of Financial RatiosBeauNo ratings yet

- Accountancy Viva QuestionDocument13 pagesAccountancy Viva Questionadhishreesinghal24No ratings yet

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiNo ratings yet

- Comparative Financial Analysis of Prism Cement and Ambuja CementDocument55 pagesComparative Financial Analysis of Prism Cement and Ambuja Cementsauravv7No ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument15 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsAditya R HimawanNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument57 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDMitul KathuriaNo ratings yet

- Analysis of Financial StatementsDocument31 pagesAnalysis of Financial StatementsCadet ShaniNo ratings yet

- Chapter 11-Expanded Analysis: Multiple ChoiceDocument17 pagesChapter 11-Expanded Analysis: Multiple ChoiceAsma JamshaidNo ratings yet

- 2111122153MBA320115Unit 3 Bqualitative Factors That Are Considered When Evaluating A Company's Financial Performance.Document7 pages2111122153MBA320115Unit 3 Bqualitative Factors That Are Considered When Evaluating A Company's Financial Performance.Mohammad Rafiq DarNo ratings yet

- Financial Ratios and Quality IndicatorsDocument7 pagesFinancial Ratios and Quality IndicatorsSanny MostofaNo ratings yet

- Basics of Accounting and Finance: by S.S. BarmaDocument29 pagesBasics of Accounting and Finance: by S.S. BarmaArya BarmaNo ratings yet

- Ratio Analysis GuideDocument9 pagesRatio Analysis GuiderakeshkchouhanNo ratings yet

- Investment Analysis and Portfolio ManageDocument14 pagesInvestment Analysis and Portfolio ManageSannithi YamsawatNo ratings yet

- Chapter 3 Solutions & NotesDocument17 pagesChapter 3 Solutions & NotesStudy PinkNo ratings yet

- Price Earning (P/E) RatioDocument8 pagesPrice Earning (P/E) RatioKapilNo ratings yet

- Analysis of Financial Statements 1-10-19Document28 pagesAnalysis of Financial Statements 1-10-19Shehzad QureshiNo ratings yet

- RATIOSDocument16 pagesRATIOSantra10tiwariNo ratings yet

- Analyzing Asset Turnover RatiosDocument8 pagesAnalyzing Asset Turnover RatiosLavanya RanganathanNo ratings yet

- RATIO ANALYSIS Unit 1Document18 pagesRATIO ANALYSIS Unit 1DWAYNE HARVEYNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Ratio Analysis GuideDocument11 pagesRatio Analysis GuideRohit J SaraiyaNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument57 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDRajudimple100% (1)

- Ratio Analysis:: Liquidity Measurement RatiosDocument8 pagesRatio Analysis:: Liquidity Measurement RatiossammitNo ratings yet

- Chap 3 Problem SolutionsDocument31 pagesChap 3 Problem SolutionsAhmed FahmyNo ratings yet

- Ratio Analysis: Theory and ProblemsDocument51 pagesRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (1)

- LenovoDocument5 pagesLenovoamin233No ratings yet

- Analysis of Financial StatementsDocument28 pagesAnalysis of Financial StatementsCorolla GrandeNo ratings yet

- Solutions To Chapter 12Document8 pagesSolutions To Chapter 12Luzz LandichoNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisMilcah QuisedoNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument56 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDBhushan NagalkarNo ratings yet

- Analyzing Financial Statements and RatiosDocument17 pagesAnalyzing Financial Statements and Ratiosanonymathieu50% (2)

- Financial Statements Analysis - Q&aDocument6 pagesFinancial Statements Analysis - Q&aNaga NagendraNo ratings yet

- Financial Statement Analysis Ratios GuideDocument25 pagesFinancial Statement Analysis Ratios GuideFor ProjectsNo ratings yet

- Good Ethics ISNT Good BusinessDocument1 pageGood Ethics ISNT Good BusinessBarby AngelNo ratings yet

- Carrot Cake RecipeDocument1 pageCarrot Cake RecipeBarby AngelNo ratings yet

- PageantDocument23 pagesPageantBarby Angel0% (1)

- Career Development (Question 3)Document1 pageCareer Development (Question 3)Barby AngelNo ratings yet

- MOME Treasurer's Report Dec 2014: $17K Income, Expenses Handed to PresidentDocument1 pageMOME Treasurer's Report Dec 2014: $17K Income, Expenses Handed to PresidentBarby AngelNo ratings yet

- What Is Stress and The CausesDocument4 pagesWhat Is Stress and The CausesBarby AngelNo ratings yet

- Walk Through Audit WtA of Lillian S Restaurant NICKYDocument9 pagesWalk Through Audit WtA of Lillian S Restaurant NICKYBarby AngelNo ratings yet

- MOME Treasurer's Report Dec 2014: $17K Income, Expenses Handed to PresidentDocument1 pageMOME Treasurer's Report Dec 2014: $17K Income, Expenses Handed to PresidentBarby AngelNo ratings yet

- Corporate Level StrategiesDocument7 pagesCorporate Level StrategiesBarby AngelNo ratings yet

- Unit 6 Example 2Document2 pagesUnit 6 Example 2RicardoMoody100% (1)

- Intro To Admin ManagementDocument25 pagesIntro To Admin ManagementBarby AngelNo ratings yet

- Unit 6 ExampleDocument1 pageUnit 6 ExampleBarby AngelNo ratings yet

- RIM Image TechnologyDocument25 pagesRIM Image TechnologyBarby AngelNo ratings yet

- Conference Day Checklist Venue CheckDocument2 pagesConference Day Checklist Venue CheckBarby AngelNo ratings yet

- Corporate Level StrategiesDocument1 pageCorporate Level StrategiesBarby AngelNo ratings yet

- Conference Day Checklist Venue CheckDocument2 pagesConference Day Checklist Venue CheckBarby AngelNo ratings yet

- Question: What Are Quality Costs? How Are They Used in An Organization?Document3 pagesQuestion: What Are Quality Costs? How Are They Used in An Organization?Barby AngelNo ratings yet

- Chapter 4 and 5 QuestionsDocument2 pagesChapter 4 and 5 QuestionsBarby AngelNo ratings yet

- Steps in The Reading ProcessDocument1 pageSteps in The Reading ProcessBarby AngelNo ratings yet

- TQMDocument1 pageTQMBarby AngelNo ratings yet

- TQM AnswersDocument125 pagesTQM AnswersBarby AngelNo ratings yet

- Ob Draft To Get NotesDocument1 pageOb Draft To Get NotesBarby AngelNo ratings yet

- What is Six Sigma and Which Companies Use the SystemDocument1 pageWhat is Six Sigma and Which Companies Use the SystemBarby AngelNo ratings yet

- TECHNOLOGY'S ROLE IN SERVICES CHAPTER QUIZDocument4 pagesTECHNOLOGY'S ROLE IN SERVICES CHAPTER QUIZBarby AngelNo ratings yet

- Average Productiondown-Time For Cooling: Project Name: Name of Data Recorder: Location: Data Collection DatesDocument1 pageAverage Productiondown-Time For Cooling: Project Name: Name of Data Recorder: Location: Data Collection DatesBarby AngelNo ratings yet

- Formula Sheet TQM FinalDocument2 pagesFormula Sheet TQM FinalBarby AngelNo ratings yet

- Question: What Are Quality Costs? How Are They Used in An Organization?Document3 pagesQuestion: What Are Quality Costs? How Are They Used in An Organization?Barby AngelNo ratings yet

- TQM Pp3aDocument20 pagesTQM Pp3aBarby AngelNo ratings yet

- Lean Manufacturing Calculations QuestionsDocument1 pageLean Manufacturing Calculations QuestionsBarby AngelNo ratings yet

- OEE Benchmarks - World Class 100% Considered Good ScoreDocument4 pagesOEE Benchmarks - World Class 100% Considered Good ScoreBarby AngelNo ratings yet

- Auditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleDocument6 pagesAuditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleSherlock HolmesNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Week 1 - Lesson 1 Managerial Accounting Basic FrameworkDocument6 pagesWeek 1 - Lesson 1 Managerial Accounting Basic FrameworkReynold Raquiño AdonisNo ratings yet

- Systems Design: Activity-Based Costing: Brewer, Introduction To Managerial Accounting, 3/eDocument37 pagesSystems Design: Activity-Based Costing: Brewer, Introduction To Managerial Accounting, 3/eMCI100% (1)

- ACC102 Financial Statement AnalysisDocument18 pagesACC102 Financial Statement Analysiscraigkrupski12No ratings yet

- ACCT1198Document6 pagesACCT1198RuthNo ratings yet

- Ch01 TB RankinDocument9 pagesCh01 TB RankinAnton VitaliNo ratings yet

- Sales journal summaryDocument9 pagesSales journal summarySalwa Anisa0% (1)

- AFR 2022 BilingualDocument232 pagesAFR 2022 BilingualGracia ChristabelleNo ratings yet

- Different Types of Vouchers in Accounting - Meaning and Benefits PDFDocument6 pagesDifferent Types of Vouchers in Accounting - Meaning and Benefits PDFVanita Valluvan100% (1)

- Invoice: Depo Pasir SedoganDocument1 pageInvoice: Depo Pasir SedoganChandra PriatamaNo ratings yet

- Kunal Kumar ResumeDocument3 pagesKunal Kumar Resumekunal kumarNo ratings yet

- Quiz 2Document4 pagesQuiz 2zainabcomNo ratings yet

- Chapter 1. Introduction To The Analysis of Financial Statements. SlidesDocument32 pagesChapter 1. Introduction To The Analysis of Financial Statements. SlidesElizaPopescuNo ratings yet

- Combination of 2 or More Single Propietorship Into PartnershipDocument8 pagesCombination of 2 or More Single Propietorship Into PartnershipABCNo ratings yet

- AICPA Volunteer Recruitment LetterDocument2 pagesAICPA Volunteer Recruitment Letterjda_23No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument74 pagesChapter 4 - Completing The Accounting CycleNgân TrươngNo ratings yet

- MeghaDocument1 pageMeghaMovie PostersNo ratings yet

- Ind As, IfRS and Applicability-2Document2 pagesInd As, IfRS and Applicability-2sandeepNo ratings yet

- Standards on Auditing IndexDocument90 pagesStandards on Auditing Indexneeraj sharmaNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Gibson10e ch02Document23 pagesGibson10e ch02SHAMRAIZKHANNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Financial Accounting Case StudiesDocument2 pagesFinancial Accounting Case StudiesRodlyn LajonNo ratings yet

- AIS Module 3 Kahoot PDFDocument7 pagesAIS Module 3 Kahoot PDFShiela UyNo ratings yet

- CHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Document13 pagesCHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Kimberly Claire Atienza100% (3)

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- Test Bank Chapter10 Standard CostingDocument35 pagesTest Bank Chapter10 Standard Costingxxx101xxxNo ratings yet

- How ABC Analysis Helped Classic Brass Improve Decision MakingDocument41 pagesHow ABC Analysis Helped Classic Brass Improve Decision MakingZeyad Tareq Al Sarori0% (1)