Professional Documents

Culture Documents

Capital Blue Cross Sanction 05-28-14

Uploaded by

PennLive0 ratings0% found this document useful (0 votes)

8K views10 pagesCapital Blue Cross Sanction 05-28-14

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCapital Blue Cross Sanction 05-28-14

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8K views10 pagesCapital Blue Cross Sanction 05-28-14

Uploaded by

PennLiveCapital Blue Cross Sanction 05-28-14

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

Page 1 of 10

DEPARTMENT OF HEALTH & HUMAN SERVICES

Centers for Medicare & Medicaid Services

7500 Security Boulevard

Baltimore, Maryland 21244-1850

MEDICARE PARTS C AND D OVERSIGHT AND ENFORCEMENT GROUP

May 28, 2014

Gary D. St. Hilaire

President & CEO

Capital Blue Cross

2500 Elmerton Avenue

Harrisburg, PA 17177

Re: Notice of Immediate Imposition of Intermediate Sanctions (Suspension of Enrollment

and Marketing) for Medicare Advantage-Prescription Drug and Prescription Drug Plan

Contract Numbers: H3923, H3962, and S8067

Dear Mr. St. Hilaire,

Pursuant to 42 C.F.R. 422.756 and 423.756, the Centers for Medicare & Medicaid Services

(CMS) is providing notice to Capital Blue Cross (CBC) that CMS has made a determination to

immediately impose intermediate sanctions on the following Medicare Advantage-Prescription

Drug and Prescription Drug Plan Contract Numbers: H3923, H3962, and S8067.

These intermediate sanctions will consist of the suspension of enrollment of Medicare

beneficiaries into CBC plans (42 C.F.R. 422.750(a)(1) and 423.750(a)(1)), and the

suspension of all marketing activities to Medicare beneficiaries (42 C.F.R. 422.750(a)(3) and

423.750(a)(3)). CMS is imposing these intermediate sanctions immediately, effective May 28,

2014, at 11:59 p.m. EST, pursuant to 42 C.F.R. 422.756(c)(2) and 423.756(c)(2), because it

has determined that CBCs conduct poses a serious threat to the health and safety of Medicare

beneficiaries. Pursuant to 42 C.F.R. 422.756(c)(3) and 423.756(c)(3), the intermediate

marketing and enrollment sanctions will remain in effect until CMS is satisfied that the

deficiencies upon which the determination was based have been corrected and are not likely to

recur. CMS will provide CBC with detailed instructions regarding the marketing and enrollment

suspensions in a separate communication.

CMS has determined that CBC failed to provide its enrollees with services and benefits in

accordance with CMS requirements. A Medicare Advantage organization and Prescription Drug

Plan sponsors central mission is to provide Medicare enrollees with medical services and

prescription drug benefits within a framework of Medicare requirements that provide enrollees

with a number of protections.

Page 2 of 10

Summary of Noncompliance

CMS conducted an audit of CBCs Medicare operations from April 7, 2014 through April 18,

2014. During the audit, CMS conducted reviews of numerous operational areas to determine if

CBC is following CMS rules, regulations, and guidelines. CMS auditors concluded that CBC

substantially failed to comply with CMS requirements regarding Part C and Part D appeals and

grievances, organization/coverage determinations, and Part D formulary and benefit

administration in violation of 42 C.F.R. Part 422, Subparts C and M and 42 C.F.R. 423, Subparts

C, J , and M. CMS found that CBCs failures in these areas were widespread and systemic.

Violations resulted in enrollees experiencing delays or denials in receiving prescription drugs,

and increased out of pocket costs for medical services and prescription drugs.

Part C and Part D Organization/Coverage Determination, Appeal, and Grievance Relevant

Requirements

(42 C.F.R. Part 422, Subpart M; 42 C.F.R. Part 423, Subpart M; IOM Pub. 100-18 Medicare

Prescription Drug Benefit Manual, Chapter 18; IOM Pub. 100-16 Medicare Managed Care

Manual, Chapter 13)

Medicare enrollees have the right to contact their plan sponsor to express general dissatisfaction

with the operations, activities, or behavior of the plan sponsor or to make a specific complaint

about the denial of coverage for drugs or services to which the enrollee believes he or she is

entitled. Sponsors are required to classify general complaints about services, benefits, or the

sponsors operations or activities as grievances. Sponsors are required to classify complaints

about coverage for drugs or services as organization determinations (Part C medical services)

or coverage determinations (Part D drug benefits). It is critical for a sponsor to properly

classify each complaint as a grievance or an organization/coverage determination or both.

Improper classification of an organization or coverage determination denies an enrollee the

applicable due process and appeal rights and may delay an enrollees access to medically

necessary or life-sustaining services or drugs.

The enrollee, the enrollees representative, or the enrollees treating physician or prescriber may

make a request for an organization determination or coverage determination. The first level of

review is the organization determination or coverage determination, which is conducted by the

plan sponsor, and the point at which beneficiaries or their physicians submit justification for the

service or benefit. Coverage decisions must be made in accordance with Medicare coverage

guidelines, Medicare covered benefits, and each sponsors CMS-approved coverage policies and

prescription drug benefits (see below for Part D Formulary and Benefit Administration Relevant

Requirements).

If the organization or coverage determination is adverse (not in favor of the beneficiary), the

beneficiary has the right to file an appeal. The first level of the appeal called a reconsideration

(Part C) or redetermination (Part D) is handled by the plan sponsor and must be conducted by a

physician who was not involved in the organization determination or coverage determination

decision. The second level of appeal is made to an independent review entity (IRE) contracted

by CMS.

Page 3 of 10

There are different decision making timeframes for the review of organization determinations,

coverage determinations, and appeals. CMS has a beneficiary protection process in place that

requires plans to forward organization determinations, coverage determinations, and appeals to

the IRE when the plan has missed the applicable adjudication timeframe.

Violations Related to Part C and Part D Organization/Coverage Determinations, Appeals,

and Grievances

CMS identified multiple, serious violations of Part C and Part D organization/coverage

determination, appeal, and grievance requirements that resulted in CBCs enrollees experiencing

inappropriate denials or delays of medications at the point of sale and within enrollees coverage

determinations or appeals. Additionally, enrollees experienced inappropriate out of pocket cost

for covered Medicare services and medications. These failures pose a serious threat to the health

and safety of enrollees. Many of these issues stem from a complete ineffective monitoring and

oversight of CBCs Pharmacy Benefit Manager (PBM), which is responsible for CBCs coverage

determinations. Additionally, CBCs lack of internal controls and of consistent procedures

resulted in a breakdown in other processes with Part D redeterminations, Part C organization

determinations, Part C reconsiderations and grievances. CBCs violations include:

Part D

Failure to properly effectuate prior authorization or exception requests. This is in

violation of 42 C.F.R. 423.120(b)(2); and IOM Pub. 100-18 Medicare Prescription

Drug Manual, Chapter 6, Section 30.2.2 and Chapter 18, Section 130.

Failure to properly administer its CMS-approved formulary by applying unapproved

utilization management practices. This is in violation of 42 C.F.R. 423.104(a) and

423.120(b)(2); and IOM Pub. 100-18 Medicare Prescription Drug Benefit Manual,

Chapter 6, Sections 30.2 and 30.3.3.3 and Chapter 7, Section 20.4.

Failure to process redetermination requests. This is in violation of 42 C.F.R. 423.580,

423.582(a), 423.584(b), and 423.590(a), (b), and (d); and IOM Pub. 100-18

Medicare Prescription Drug Benefit Manual, Chapter 18, Sections 70.2, 70.7, 70.8 and

70.8.1.

Inappropriate denials of medications when processing coverage determinations. This is

in violation of 42 C.F.R. 423.566(a) and (b); and IOM Pub. 100-18 Medicare

Prescription Drug Benefit Manual, Chapter 18, Section 30.

Failure to conduct sufficient outreach to the prescriber or beneficiary to obtain additional

information necessary to make appropriate clinical decisions. This is in violation of 42

C.F.R. 423.566(a) and 423.586; and IOM Pub.100-18 Medicare Prescription Drug

Benefit Manual, Chapter 18 , Sections 10.2, 30.2.1.3, 30.2.2.3, 70.5, and 70.7.

Failure to implement a favorable decision by the Independent Review Entity (IRE) or

other appeal entity for the beneficiary within CMS required timeframes. This is in

Page 4 of 10

violation of 42 C.F.R. 423.636(b); and IOM Pub. 100-18 Medicare Prescription Drug

Benefit Manual, Chapter 18, Sections 130.3.1, 130.3.2, and 130.3.3.

Denial letters do not include an adequate rationale and/or contain incorrect information

specific to the denial. This is in violation of 42 C.F.R. 423.568(g), 423.572(c)(2),

and 423.590(g); and IOM Pub. 100-18 Medicare Prescription Drug Benefit Manual,

Chapter 18, Sections 40.3.4, 50.5.1, and 70.9.1.

Approval letters do not accurately or fully explain the conditions of approval. This is in

violation of 42 C.F.R. 423.568(e), 423.572(c)(1), and 423.590(h); and IOM Pub.

100-18 Medicare Prescription Drug Benefit Manual, Chapter 18, Section 40.3.5.

Misclassifying coverage determinations and appeals as grievances. This in violation of

42 C.F.R. 423.564(b); and IOM 100-18 Medicare Prescription Drug Benefit Manual,

Chapter 18, Section 20.2, 20.2.4.1, 20.2.4.2, and 30.4.

Failure to take appropriate action, including a full investigation and/or appropriately

addressing all issues identified in the grievance. This is in violation of 42 C.F.R.

423.564(a); and IOM 100-18 Medicare Prescription Drug Benefit Manual, Chapter 18,

Section 20.3.

Failure to resolve the grievances within CMS required timeframes. This is in violation

of 42 C.F.R. 423.564(e) and (f); and IOM 100-18 Medicare Prescription Drug Benefit

Manual, Chapter 18, Section 20.3.

Failure to provide the beneficiary with written notice of his/her right to file with, and the

contact information for, the Quality Improvement Organization (QIO). This is in

violation of 42 C.F.R. 423.564(c) and (e); and IOM 100-18 Medicare Prescription

Drug Benefit Manual, Chapter 18, Section 20.2.1.

Failure to properly oversee CBCs delegated entity regarding guidance in 42 C.F.R. Part

423 Subpart M Grievances, Coverage Determinations, Redeterminations, and

Reconsiderations. This is in violation of 42 C.F.R. 423.562(a)(4).

In addition to the above violations related to the Part D coverage determination, appeal and

grievance requirements, CMS auditors discovered an additional failure while reviewing CBCs

grievance logs. CBC failed to perform timely retroactive claims adjustments, in violation of 42

C.F.R. 423.466(a); and IOM Pub. 100-18 Medicare Prescription Drug Benefit Manual, Chapter

14, Section 50.14.3. As a result of this failure, over 3,000 enrollees were overcharged a total of

$27,667 for their medications.

Part C

Failure to hold the enrollee harmless when services were provided by a contracted plan

provider or a provider referred by a contracted plan provider. This is in violation of 42

Page 5 of 10

C.F.R. 422.100(a) and 422.105(a); and IOM 100-16 Medicare Managed Care

Manual, Chapter 4, Section 170.

Inappropriate denials of payment for emergency medical services. This is in violation of

42 C.F.R. 422.113(b)(2) and (c)(2); and IOM 100-16 Medicare Managed Care Manual,

Chapter 4, Section 20.2.

Failure to state the specific reason for denial or provide a description of the appeal

process in the remittance advice/notice when denying a request for payment from a non-

contracted provider. This is in violation of IOM 100-16 Medicare Managed Care

Manual, Chapter 13, Section 40.2.3.

Denial letters do not include an adequate rationale, contain incorrect information specific

to the denial, and/or are written in a manner not easily understandable to the beneficiary.

This is in violation of 42 C.F.R. 422.568(e) and 422.572 (e); and IOM 100-16

Medicare Managed Care Manual, Chapter 13, Section 40.2.2.

Failure to conduct sufficient outreach to the provider or beneficiary to obtain additional

information necessary to make an appropriate clinical decision. This is in violation of 42

C.F.R. 422.566(a) and 422.586; and IOM 100-16 Medicare Managed Care Manual,

Chapter 13, Sections 70.7.1 and 70.7.2.

Misclassifying organization determinations or reconsiderations as grievances. This is in

violation of 42 C.F.R. 422.564(b); and IOM 100-16 Medicare Managed Care Manual,

Chapter 13, Section 20.2.

Failure to take appropriate action, including a full investigation and/or appropriately

addressing all issues identified in the grievance. This is in violation of 42 C.F.R.

422.564(a); and IOM 100-16 Medicare Managed Care Manual, Chapter 13, Section

20.3.

Failure to recognize, investigate and appropriately act on, quality of care grievances

contained within beneficiary complaints. This is in violation of 42 C.F.R. 422.564(c);

and IOM 100-16 Medicare Managed Care Manual, Chapter 13, Section 20.2.

Failure to provide the beneficiary with written notice of his/her right to file with, and the

contact information for, the Quality Improvement Organization. This is in violation of 42

C.F.R. 422.564(e)(3)(iii); and IOM 100-16 Medicare Managed Care Manual, Chapter

13, Section

Part D Formulary and Benefit Administration Relevant Requirements

Medicare Part D Prescription Drug Program requirements apply to stand-alone Prescription Drug

Plan sponsors and to Medicare Advantage sponsors that offer prescription drug benefits.

Sponsors of these plans (Part D Sponsors) are required to enter into an agreement with CMS by

Page 6 of 10

which the sponsor agrees to comply with a number of requirements based upon statute,

regulations, and program instructions.

Formulary

(42 C.F.R. 423.120(b)(2)(iv) and 423.120(b)(4)-(6); Internet Only Manual (IOM) Pub.100-18

Medicare Prescription Drug Benefit Manual, Chapter 6, Section 30.3)

Each Part D sponsor maintains a drug formulary or list of prescription medications covered by

the sponsor. A number of Medicare requirements govern how Part D sponsors create and

manage their formularies. Each Part D sponsor is required to submit its formulary for review

and approval by CMS on an annual basis. A Part D sponsor can change its formulary mid-year,

but in order to do so must first obtain prior CMS approval, and then notify its enrollees of any

changes, in addition to changes in cost-sharing amounts for formulary drugs. The CMS

formulary review and approval process includes a review of the Part D sponsors proposed drug

utilization management processes to adjudicate Medicare prescription drug claims (Part D

claims).

Utilization Management Techniques

(42 C.F.R. 423.272(b)(2); IOM Pub.100-18 Medicare Prescription Drug Benefit Manual

Chapter 6, Section 30.2; Health Plan Management System (HPMS) Memo, CMS Part D

Utilization Management Policies and Requirements Memo, October 22, 2010)

Prior authorization is a utilization management technique used by Part D sponsors (as well as

commercial and other health insurers) that requires enrollees to obtain approval from the sponsor

for coverage of certain prescriptions prior to being dispensed the medication. Part D enrollees

can find out if prior authorization is required for a prescription by asking their physician or

checking their plans formulary (which is available online). Prior authorization guidelines are

determined on a drug-by-drug basis and may be based on Food and Drug Administration (FDA)

and manufacturer guidelines, medical literature, safety, appropriate use, and benefit design.

Quantity limits are another utilization management technique used by Part D sponsors. A

sponsor may place a quantity limit on a drug for a number of reasons. A quantity limit may be

placed on a medication as a safety edit based on FDA maximum daily dose limits. Quantity

limits may also be placed on a drug for dosage optimization, which helps to contain costs.

In addition, Part D sponsors (as well as commercial and other health insurers) use step therapy to

ensure that when enrollees begin drug therapy for a medical condition, the first drug chosen is

cost-effective and safe and other more costly or risky drugs are only prescribed if they prove to

be clinically necessary. The goal of step therapy is to control costs and minimize clinical risks.

Transition of Coverage

(42 C.F.R. 423.120(b)(3) and IOM Pub.100-18 Medicare Prescription Drug Benefit Manual,

Chapter 6, Section 30.4)

Additionally, a Part D sponsor must provide for an appropriate transition process for enrollees

prescribed any Part D drugs that are not on its formulary in certain designated situations. A Part

Page 7 of 10

D Sponsors transition process must address situations in which an individual brings a

prescription for a drug that is not on the formulary to a participating pharmacy. This may be

particularly true for full-benefit dual eligible (i.e., Medicare and Medicaid) enrollees who are

auto-enrolled in a plan and do not make an affirmative choice based on review of a plans benefit

relative to their existing medication needs. Part D sponsors must have systems capabilities that

allow them to provide a one-time, temporary supply of a non-formulary Part D drug (including

Part D drugs that are on a sponsors formulary but require prior authorization or quantity limits

under a sponsors utilization management rules). In the long-term care setting, the temporary

supply of non-formulary Part D drugs must be for at least 91 days, and may be up to at least 98

days, consistent with the dispensing increment, with refills provided, if needed. The transition

process is designed to accommodate the immediate needs of an enrollee, as well as to allow the

sponsor and/or the enrollee sufficient time to work out an appropriate switch to a therapeutically

equivalent medication or the completion of an exception request to maintain coverage of an

existing drug based on medical necessity reasons.

Violations Related to Formulary & Benefit Administration

CMS identified serious violations of Part D formulary and benefit administration requirements

that resulted in CBCs enrollees experiencing inappropriate denials or delays of medications at

the point of sale and receiving incorrect transition notification letters. CBCs violations include:

Failed to properly administer its CMS-approved formulary by applying unapproved step

therapy edits and/or criteria. This is in violation of 42 C.F.R. 423.120(b)(2); and IOM

Pub. 100-18 Medicare Prescription Drug Benefit Manual, Chapter 6, Section 30.2.2.1.

Failure to properly administer the CMS transition policy by providing incorrect text in

beneficiary transition notification letters for prior authorization instead of step therapy

criteria. This is in violation of 42 C.F.R. 423.120(b)(3); and IOM Pub. 100-18

Medicare Prescription Drug Benefit Manual, Chapter 6, Sections 30.4.1, 30.4.10, and

30.4.4.2

Basis for Intermediate Sanctions

CMS has determined that CBCs deficiencies provide a sufficient basis for the immediate

imposition of intermediate sanctions (42 C.F.R. 422.752(b) and 423.752(b)). CBC failed

substantially:

To carry out the terms of its contracts with CMS (42 C.F.R. 422.510 (a)(1) and

423.509(a)(1));

To comply with the requirements in 42 C.F.R. Parts 422 and 423 Subpart M related to

grievances and appeals (42 C.F.R. 422.510 (a)(5) and 423.509(a)(5));

Page 8 of 10

CBCs Deficiencies Create a Serious Threat to Enrollee Health and Safety

CBC has experienced widespread and systemic failures impacting CBCs enrollees ability to

access prescription medications. Enrollee access to services and prescribed medications is the

most fundamental aspect of the Part C and Part D programs because it most directly affects

clinical care. CBC is denying enrollees access to drugs at the point of sale and within their

appeals and coverage determinations process. The ineffective oversight of CBCs PBM, coupled

with serious deficiencies with CBCs administration of its Part D coverage determinations,

appeals, and grievances and Part D formulary, resulted in enrollees being denied access to the

drugs that they are entitled to receive.

The nature of CBCs noncompliance provides sufficient basis for CMS to find the presence of a

serious threat to enrollees health and safety, supporting the immediate suspension of CBCs

enrollment and marketing activities. Consequently, these sanctions are effective on May 28,

2014 at 11:59 p.m. EST, pursuant to the authority provided by 42 C.F.R. 422.756(c)(2) and

423.756(c)(2).

Opportunity to Correct

Pursuant to 42 C.F.R. 422.756(c)(3) and 423.756(c)(3), the sanctions will remain in effect

until CMS is satisfied that the deficiencies that are the basis for the sanctions determination have

been corrected and are not likely to recur. Attached to this notice is a Corrective Action Plan

template with instructions for CBC to complete. CBC should submit its Corrective Action Plan

to CMS within seven (7) calendar days from the date of receipt of this notice, or by J une 5, 2014.

If CBC needs additional time beyond seven (7) days to submit its Corrective Action Plan, contact

your enforcement lead.

Once CBC has fully implemented its Corrective Action Plan, it must submit to CMS an

attestation from CBCs Chief Executive Officer, or most senior official, stating that CBC has

corrected the deficiencies that are the basis for the sanction and they are not likely to recur.

Pursuant to 42 C.F.R. 422.756(c)(3)(i) and 423.756(c)(3)(i), once CBC submits its

attestation, CMS will require CBC to hire an independent auditor to conduct validation in all

operation areas cited in this notice and to provide a validation report to CMS. Upon completion

of the validation, CMS will make a determination about whether the deficiencies that are the

basis for the sanctions have been corrected and are not likely recur.

Pursuant to 42 C.F.R. 422.506(b)(3), 422.510(c), 423.507(b)(3), and 423.509(c), CBC is

solely responsible for the identification, development, and implementation of its Corrective

Action Plan, and for demonstrating to CMS that the underlying deficiencies have been corrected

and are not likely to recur.

Opportunity to Respond to Notice

Pursuant to 42 C.F.R. 422.756(a)(2) and 423.756(a)(2), CBC has ten (10) calendar days from

the date of receipt of this notice to provide a written rebuttal, or by J une 9, 2014. Please note

that CMS considers receipt as the day after the notice is sent by fax, email, or overnight mail, or

Page 9 of 10

in this case, May 29, 2014. If you choose to submit a rebuttal, please send it to the attention of

Michael DiBella at the address noted below. Note that the sanctions imposed pursuant to this

letter are not stayed pending a rebuttal submission.

Right to Request a Hearing

CBC may also request a hearing before a CMS hearing officer in accordance with the procedures

outlined in 42 C.F.R. 422.660-684 and 423.650-662. Pursuant to 42 C.F.R.

422.756(b) and 423.756(b), a written request for a hearing must be received by CMS within

fifteen (15) calendar days of receipt of this notice, or by J une 13, 2014.

1

Please note, however, a

request for a hearing will not delay the date specified by CMS when the sanctions become

effective. Your hearing request will be considered officially filed on the date that it is mailed;

accordingly, we recommend using an overnight traceable mail carrier.

The request for a hearing must be sent to the CMS Hearing Office at the following address:

Benjamin Cohen

CMS Hearing Officer

Office of Hearings

ATTN: HEARING REQUEST

Centers for Medicare & Medicaid Services

2520 Lord Baltimore Drive

Suite L

Mail Stop: LB-01-22

Baltimore, MD 21244-2670

Phone: 410-786-3169

Email: Benjamin.Cohen@cms.hhs.gov

A copy of the hearing request should also be sent to CMS at the following address:

Michael DiBella

Director, Division of Compliance Enforcement

Centers for Medicare & Medicaid Services

7500 Security Boulevard

Baltimore, MD 21244

Mail Stop: C1-22-06

Email: Michael.Dibella@cms.hhs.gov

CMS will consider the date the Office of Hearings receives the email or the date it receives the

fax or traceable mail document, whichever is earlier, as the date of receipt of the request. The

request for a hearing must include the name, fax number, and e-mail address of the contact

within CBC (or an attorney who has a letter of authorization to represent the organization) with

whom CMS should communicate regarding the hearing request.

1

If the 15

th

day falls on a weekend or federal holiday, you have until the next regular business day to submit your

request.

Page 10 of 10

Please note that we are closely monitoring your organization and CBC may also be subject to

other applicable remedies available under law, including the imposition of additional sanctions,

penalties, or other enforcement actions as described in 42 C.F.R. Parts 422 and 423, Subparts K

and O. CMS will consider taking action to immediately terminate your contract if additional

issues that pose a serious threat to the health and safety of Medicare beneficiaries are identified

or left uncorrected.

If you have any questions about this notice, please call or email the enforcement contact

provided in your email notification.

Sincerely,

/s/

Gerard J . Mulcahy

Director

Medicare Parts C and D Oversight and Enforcement Group

Enclosure:

Attachment A Corrective Action Plan Template

cc: J ames McCaslin, CMS/CMHPO/Region III

J eremy Willard, CMS/CMHPO/Region III

J oyce Bryant, CMS/CMHPO/Region III

You might also like

- Quinn's Resignation LetterDocument2 pagesQuinn's Resignation LetterPennLiveNo ratings yet

- Senate Subpoena To Norfolk Southern CEODocument1 pageSenate Subpoena To Norfolk Southern CEOPennLiveNo ratings yet

- Letter Regarding PASS ProgramDocument3 pagesLetter Regarding PASS ProgramPennLive100% (1)

- Correspondence From Conference To Institution Dated Nov 10 2023Document13 pagesCorrespondence From Conference To Institution Dated Nov 10 2023Ken Haddad100% (2)

- Calling For Rep. Zabel To ResignDocument2 pagesCalling For Rep. Zabel To ResignPennLiveNo ratings yet

- 23 PA Semifinalists-NatlMeritProgramDocument5 pages23 PA Semifinalists-NatlMeritProgramPennLiveNo ratings yet

- Wheeler's Letter To LeadersDocument2 pagesWheeler's Letter To LeadersPennLiveNo ratings yet

- Letter To Auditor General Timothy DeFoorDocument2 pagesLetter To Auditor General Timothy DeFoorPennLiveNo ratings yet

- Do Democrats Hold The Majority in The Pa. House of Representatives?Document12 pagesDo Democrats Hold The Majority in The Pa. House of Representatives?PennLiveNo ratings yet

- Letter To FettermanDocument1 pageLetter To FettermanPennLiveNo ratings yet

- Atlantic Seaboard Wine Association 2022 WinnersDocument11 pagesAtlantic Seaboard Wine Association 2022 WinnersPennLiveNo ratings yet

- Ishmail Thompson Death FindingsDocument1 pageIshmail Thompson Death FindingsPennLiveNo ratings yet

- Description of Extraordinary OccurrenceDocument1 pageDescription of Extraordinary OccurrencePennLiveNo ratings yet

- Regan Response To Cumberland County GOP ChairmanDocument1 pageRegan Response To Cumberland County GOP ChairmanPennLiveNo ratings yet

- Project Milton in Hershey, 2022Document2 pagesProject Milton in Hershey, 2022PennLiveNo ratings yet

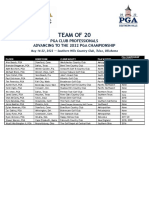

- 2022 Team of 20 GridDocument1 page2022 Team of 20 GridPennLiveNo ratings yet

- Letter To Senator ReganDocument2 pagesLetter To Senator ReganPennLiveNo ratings yet

- TWW PLCB LetterDocument1 pageTWW PLCB LetterPennLiveNo ratings yet

- Jake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoDocument5 pagesJake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoPennLiveNo ratings yet

- Letter Regarding PPE and UkraineDocument2 pagesLetter Regarding PPE and UkrainePennLiveNo ratings yet

- Redistricting ResolutionsDocument4 pagesRedistricting ResolutionsPennLiveNo ratings yet

- James Franklin Penn State Contract 2021Document3 pagesJames Franklin Penn State Contract 2021PennLiveNo ratings yet

- Pa. House Leaders' Letter Requesting Release of PSSA ResultsDocument3 pagesPa. House Leaders' Letter Requesting Release of PSSA ResultsPennLiveNo ratings yet

- Corman Letter Response, 2.25.22Document3 pagesCorman Letter Response, 2.25.22George StockburgerNo ratings yet

- Letter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyDocument1 pageLetter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyPennLiveNo ratings yet

- Envoy Sage ContractDocument36 pagesEnvoy Sage ContractPennLiveNo ratings yet

- Gov. Tom Wolf's LetterDocument1 pageGov. Tom Wolf's LetterPennLiveNo ratings yet

- Cumberland County Resolution Opposing I-83/South Bridge TollingDocument2 pagesCumberland County Resolution Opposing I-83/South Bridge TollingPennLiveNo ratings yet

- Greene-Criminal Complaint and AffidavitDocument6 pagesGreene-Criminal Complaint and AffidavitPennLiveNo ratings yet

- State System of Higher Education Funding RequestDocument10 pagesState System of Higher Education Funding RequestPennLiveNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Meaning and PrincipleDocument3 pagesMeaning and PrincipleSaravana KadirvelNo ratings yet

- Rop 2017Document365 pagesRop 2017SiddharthaSankarSarmah100% (1)

- OSHA NRTL'sDocument29 pagesOSHA NRTL'sDM2No ratings yet

- Asean Cdo Report Minute Report FinalDocument55 pagesAsean Cdo Report Minute Report FinalDao - Ngoc LamNo ratings yet

- List of Veterinary CollegesDocument6 pagesList of Veterinary CollegesSriram SKNo ratings yet

- ResumeDocument3 pagesResumeapi-301267735No ratings yet

- 50 Nurses & 300 Careworkers - Japan 2Document3 pages50 Nurses & 300 Careworkers - Japan 2Joswe BaguioNo ratings yet

- DIASS Reviewer Social WorkDocument6 pagesDIASS Reviewer Social WorkFlang ChangNo ratings yet

- ECM GD-07-A-VGP General Compliance RequirementsDocument9 pagesECM GD-07-A-VGP General Compliance RequirementsNikos MastrogiannisNo ratings yet

- 1 Part 2 Final: Cloud-Based GIS Maps Displaying Aggregate Data On Medical MalpracticeDocument11 pages1 Part 2 Final: Cloud-Based GIS Maps Displaying Aggregate Data On Medical Malpracticeapi-253598260No ratings yet

- LEED Social Impact Checklist - 4 2 18Document4 pagesLEED Social Impact Checklist - 4 2 18M Alim Ur RahmanNo ratings yet

- RR - Executive Order 417Document7 pagesRR - Executive Order 417Chito Zoleta Jr.No ratings yet

- Kashmir Report Lawyers and Activists Final CompressedDocument162 pagesKashmir Report Lawyers and Activists Final CompressedAltaf Hussain Wani100% (1)

- Documentary Requirements and Format of Simplified CSHPDocument1 pageDocumentary Requirements and Format of Simplified CSHPRhalf AbneNo ratings yet

- Approved CPD DTP Dated 16 March 2022Document1,356 pagesApproved CPD DTP Dated 16 March 2022Rizalyn Landiza100% (1)

- Disaster Management, Electrical Safety Procedures and Accident PreventionDocument261 pagesDisaster Management, Electrical Safety Procedures and Accident PreventionGunadevan ChandrasekaranNo ratings yet

- The Public and Private Sector in HealthcareDocument2 pagesThe Public and Private Sector in HealthcarePatricia OrtegaNo ratings yet

- ABC of Development PolicyDocument52 pagesABC of Development PolicysudumanikamanjuNo ratings yet

- Prezentare Standarde Si Norme Tehnice in Sectorul de Apa Si Canalizare in RomaniaDocument26 pagesPrezentare Standarde Si Norme Tehnice in Sectorul de Apa Si Canalizare in RomaniacrinugeorgeNo ratings yet

- Key Features of The Proposed Draft AgreementDocument3 pagesKey Features of The Proposed Draft AgreementThe Wire100% (6)

- 01 Gen Prov With GPP OverviewOct2019Document110 pages01 Gen Prov With GPP OverviewOct2019Jay TeeNo ratings yet

- Production Sharing ContractDocument23 pagesProduction Sharing Contracthetalpatel1112000No ratings yet

- Kansas RFP Evt0001028Document171 pagesKansas RFP Evt0001028infochghealthNo ratings yet

- LA3002 October B2 LLB BSC Degrees With LawDocument3 pagesLA3002 October B2 LLB BSC Degrees With LawFahmida M RahmanNo ratings yet

- TW Manuals Essential Standard 4 TelehandlersDocument4 pagesTW Manuals Essential Standard 4 TelehandlersdomagojNo ratings yet

- Social Infrrastructure (Andhrapradesh)Document23 pagesSocial Infrrastructure (Andhrapradesh)ramachanderbNo ratings yet

- Hindustan TimesMumbai18!04!202069678Document12 pagesHindustan TimesMumbai18!04!202069678Kristic AngelNo ratings yet

- Legally Authorized Representatives in Clinical TrialsDocument5 pagesLegally Authorized Representatives in Clinical Trialsmohanjaga793No ratings yet