Professional Documents

Culture Documents

Derivative Pair Trading

Uploaded by

rentacuraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Pair Trading

Uploaded by

rentacuraCopyright:

Available Formats

INDEX

Chapter

Contents Page No.

1 Introduction 7

1.1 Equity Market Neutral Strategy 7

2 Pair Trading 13

2.1 Key Characteristics 14

2.2 Instruments Use 1!

2.3 "ene#its $# %air &raing 17

3 Strategy 1'

4 Pair Trading Model 2(

4.2 Screening %airs 2(

4.3 &raing )ules 2(

4.4 &raing %eri$ 21

4.* E+cess )eturn C$m,utati$n 22

4.! Strategy %r$#its 22

4.7 )isk C$ntr$l 23

* Steps in Pair Trading 2!

! Cases of Pair Trading 27

!.1 %un-a. Nati$nal "ank / "ank $# Inia 27

!.2 0.an $##sh$re 1 Shi213ani $il 4 5as E+,l$rati$n 37

!.3 %un-a. Nati$nal "ank / "ank $# "ar$a 32

7 Conclusion 41

6 Bibliography 42

1 | P a g e

Eecuti!e su""ary

&his ,r$-ect links unin#$rme eman sh$cks 7ith the ,r$#its an risks $# ,airs traing. Usually

em,l$ye .y s$,histicate in2est$rs8 ,air traing is a relati2e 2alue strategy that simultane$usly

.uys $ne st$ck 7hile selling an$ther. In a market 7ith limite risk .earing ca,acity8 unin#$rme

eman sh$cks cause tem,$rary ,rice ,ressure. 0 ,air $# st$ck ,rices that ha2e hist$rically

m$2e t$gether i2erge 7hen su.-ecte t$ i##erential sh$cks. Unin#$rme .uying is sh$7n t$

.e the $minant #act$r .ehin the i2ergence. 0 strategy that sells the higher ,rice st$ck an

.uys the l$7er ,rice st$ck earns returns in e+cess $# the market. &he marke1t$1market returns

$# a ,airs traing strategy are highly c$rrelate 7ith unin#$rme eman sh$cks in the

unerlying shares. Measuring ,airs traing ,r$#its re,resents a c$ncise 7ay t$ quanti#y the c$sts

$# liquiity ,r$2isi$n 9i.e.8 the c$sts $# kee,ing relati2e ,rices in line.:

It intr$uce t$ me strategies like risk management in c$n2ergence traing an unerstan the

im,$rtance an im,licati$ns $# such strategies as market neutral strategies. It ,r$2ie me a rare

$,,$rtunity t$ unerstan im,$rtance $# 2ari$us statistical t$$ls in the 7$rl $# in2estments.

strategies like ,air traing e+,l$re the tem,$rary mis,ricing .et7een assets an e2el$,s a

#rame7$rk t$ take a2antage $# this tem,$rary mis,ricing.

Market ,r$2ies $,,$rtunities an it is ini2iuals 7h$ sh$ul l$$k at this $,,$rtunity in c$rrect

,ers,ecti2e. %air; traing is use#ul in markets #ull $# uncertainty.

2 | P a g e

INT#$D%CTI$N

%airs traing is a ty,e $# relati2e 2alue strategy that .uys an $2er,rice security an

simultane$usly sells a similar8 uner,rice security. &raers ty,ically track a ,air $# securities

7h$se ,rices m$2e t$gether. <hen ,rices i2erge8 they .uy the $7n st$ck an simultane$usly

sell the u, st$ck. &raers ,r$#it i# ,rices c$n2erge .ut l$se m$ney i# ,rices i2erge #urther. %airs

traing has generate hunres $# milli$ns $# $llars in ,r$#its #$r c$m,anies such as M$rgan

Stanley an =.E. Sha7.

Stuying ,airs traing .r$aens $ur unerstaning $# #inancial markets. "ecause ,airs traing

entails risk taking. %r$#its nee n$t .e th$ught $# as c$ming #r$m a narr$7 <all St. strategy.

)ather8 reaers can think $# these ar.itrageurs as ,laying a 2ital r$le in the relati2e ,ricing $#

securities. %r$#its are c$m,ensati$n #$r ,er#$rming this ser2ice. Equi2alently8 reaers can think

$# ,r$#its as c$m,ensati$n #$r ,r$2iing liquiity uring times $# i##erential market stress 9e.g.8

stresses that a##ect s$me st$cks .ut n$t $thers.:

Sur,risingly8 relati2e 2alue strategies ha2e recei2e little attenti$n in the acaemic literature. &he

m$st n$ta.le ,a,er is .y 5ate28 5$et>mann8 an )$u7enh$rst 92((3: an $##ers a

c$m,rehensi2e analysis. &he auth$rs use aily US ata #r$m 1'!2 t$ 2((2. &hey sh$7 a sim,le

,airs traing rule ,r$uces e+cess returns $# 11? ,er annum. )eturns ha2e high risk1a-uste

al,has8 l$7 e+,$sure t$ kn$7n s$urces $# systematic risk8 c$2er reas$na.le transacti$n c$sts8

an $ n$t c$me #r$m sh$rt1term return re2ersals as $cumente in @ehmann 91''(:. It is

$.ser2e that unin#$rme traing sh$cks can e+,lain the ,r$#ita.ility $# ,airs traing.

Sec$n8 an much m$re im,$rtantly8 7e link unin#$rme traing sh$cks t$ the ,r$#ita.ility $#

,airs traing. <e sh$7 that unin#$rme net .uying is signi#icantly c$rrelate 7ith a ,air;s initial

,rice i2ergence. 0iti$nally8 unin#$rme traing is a signi#icant A#act$rB in e+,laining the

strategy;s marke1t$1market returns. &hese results suggest that ,airs1traing strategies are

,r$#ita.le .ecause they ienti#y situati$ns 7ith tem,$rary ,rice ,ressure. &he strategy has l$7

risk .ecause a ,$siti$n is e##ecti2ely hege .y an $##setting ,$siti$n 7ith similar #act$r

3 | P a g e

l$aings. E+ecuti$n is sim,li#ie an c$sts ke,t t$ a minimum .ecause the $##setting ,$siti$n is

limite t$ a single st$ck.

Market neutral strategies are traing strategies that are 7iely use .y hege #uns $r ,r$,rietary

traers. 0 traer g$es l$ng certain instruments 7hile sh$rting $thers in such a 7ay that his

,$rt#$li$ has n$ net e+,$sure t$ .r$a market m$2es. &he g$al is t$ ,r$#it #r$m relati2e miss

,ricings .et7een relate instrumentsCg$ing l$ng th$se that are ,ercei2e t$ .e uner ,rice

7hile g$ing sh$rt th$se that are ,ercei2e t$ .e $2er ,riceC7hile a2$iing systematic risk.

Market neutral strategies are s$metimes calle relati2e 2alue strategies.

Pairs !s. spreads

Many traers think $# a ,air as a As,reaB trae8 .ut this c$m,aris$n is n$t quite accurate. 0

s,rea trae creates either net l$ng $r net sh$rt e+,$sure8 .ut a ,r$,erly e+ecute ,airs trae is

$llar1neutral. "y maintaining a market1neutral ,$siti$n8 the e##ects $# market irecti$n can .e

largely eliminate #r$m the trae.

C$nsier the #$ll$7ing c$m,aris$n $# a s,rea trae 2s. a ,airs traeD

St$ck 0D 2( ,er share

St$ck "D 1( ,er share

S,rea trae

@$ng 1(( shares $# st$ck 0D 28(((

Sh$rt 1(( shares $# st$ck "D 18(((

Net l$ngD 1( ,er share 918(((:

&his is a hege8 .ullish ,$siti$n.

%airs trae

@$ng 1(( shares $# St$ck 0D 28(((

Sh$rt 2(( shares $# St$ck "D 28(((

4 | P a g e

Net l$ngEsh$rtD (

&his is a true market1neutral ,$siti$n.

Scenari$ 1

"$th st$cks rise *( ,ercent.

St$ck 0D 3(

St$ck "D 1*

Scenari$ 2

"$th st$cks #all *( ,ercent.

St$ck 0D 1(

St$ck "D *

0 s,rea trae is a market .et 7ith a .uilt1in hege8 7hile a ,airs trae is a market1neutral

,$siti$n. In the #irst scenari$;s .ull market8 the s,rea trae gains *(( 9St$ck 0;s 18((( ,r$#it 1

St$ck ";s *(( l$ss:8 an the ,airs trae is #lat 9St$ck 0;s 18((( ,r$#it 1 St$ck ";s 18((( l$ss:.

In the sec$n scenari$;s .ear market8 h$7e2er8 the s,rea trae l$ses *(( 9St$ck 0;s 18((( l$ss 1

St$ck ";s *(( ,r$#it: as the ,airs trae stays #lat. Fere8 the s,rea trae l$ses m$ney es,ite .$th

st$cks r$,,ing .y an equal ,ercentage. In .$th scenari$s8 the s,eci#ics $# either st$ck ha n$

e##ect $n ,rice C the entire m$2e is e+,laine .y the .r$aer market #luctuati$ns.

&he trae must .e market1neutral t$ ensure it 7$n;t l$se m$ney unless there;s a change in

relati2e ,er#$rmance 9i.e. $ne st$ck ,er#$rms .etter than the $ther:.

Similarly8 i# .$th st$cks r$,,e .y *8 the s,rea trae 7$ul remain #lat e2en th$ugh St$ck 0

$ut,er#$rme St$ck " 9St$ck 0 l$ses 2* ,ercent8 7hile St$ck " l$ses *( ,ercent:. 0 trae can

$nly ca,ture this relati2e ,er#$rmance i# the trae is neutral.

E&uity Mar'et Neutral( )n $!er!ie*

&here are numer$us strategies that generally #all uner the market neutral um.rella. Market

neutral strategies are esigne t$ .ene#it in2est$rs in all market c$niti$ns. &hey are eeme

market neutral .ecause the irecti$n $# a ,articular market8 7hether u, $r $7n8 sh$ul .are

5 | P a g e

little $r n$ im,act $n the a.ility t$ generate a return. Such strategies inclue c$n2erti.le

ar.itrage8 #i+e inc$me ar.itrage8 merger ar.itrage an equity market neutral. Equity market

neutral8 als$ kn$7n as statistical ar.itrage $r ,airs traing8 in2$l2es the traing $# securities that

are intere,enent. &here is generally a ,rice c$rrelati$n .et7een st$cks in the same sect$r. I#

the sect$r rallies8 m$st $# the c$m,anies g$ u, in ,rice. Share ,rices $# c$m,etent c$m,anies

ha2e a tenency t$ increase #aster than that $# 7eaker c$m,anies. &he same h$ls true uring

eclines.

0 market neutral manager in this case 7ill g$ l$ng $n the c$m,etent c$m,anies an sh$rt1sell

the 7eaker c$m,anies in the same sect$r. )isk is mitigate thr$ugh a c$nsummate relati$nshi,

.et7een the l$ng an sh$rt ,$siti$ns in the ,$rt#$li$. =i2ersi#ying acr$ss the entire market

.reath 7hile ,airing equal l$ng an sh$rt ,$siti$ns 7ithin the same sect$rs ,r$2ies #$r a

statistical a2antage. &he manager is c$ncerne 7ith ca,turing a return thr$ugh the s,rea $# the

l$ng an sh$rt ,$siti$ns8 as $,,$se t$ calling a market irecti$n. &he $.-ecti2e is t$ generate a

return 7ith$ut taking signi#icant irecti$nal .ets. I# c$nstructe ,r$,erly8 the elements $# an

unerlying st$ck market sh$ul ha2e n$ .earing $n the ,$rt#$li$ returns. 0n equity market

neutral strategy 7arrants m$re e##icient use $# in#$rmati$n. @$ng1$nly mangers l$$k at

c$m,anies an ,urchase their st$ck 7ith the antici,ati$n that the share ,rice 7ill increase in

2alue. I# an unerlying c$m,any $es n$t meet the manager;s stringent ,urchasing requirements8

the c$m,any is ,asse $2er an the in#$rmati$n is iscare. 0 market neutral manager 7ill

utili>e such negati2e in#$rmati$n .y sh$rt1selling the st$ck an ,$siti$ning it in the ,$rt#$li$ t$

reuce 2$latility.&here are ,$tentially three s$urces $# returns in an equity market neutral

strategy. &he #irst c$mes #r$m the l$ng sie $# the ,$rt#$li$. &hr$ugh a s$,histicate ,r$cess8 the

manager etermines 7hat c$m,anies are suita.le #$r .uying. %r$#its are generate 7hen the

st$cks in the l$ng ,$rt#$li$ rise in ,rice. &he sec$n 7ay t$ ,r$#it in an equity market neutral

strategy is #r$m the sh$rt ,$rt#$li$. Gnce again8 c$m,anies are selecte thr$ugh a 2ery

s$,histicate ,r$cess .ut8 unlike the l$ng ,$rt#$li$8 the manager l$$ks #$r statistics that 7$ul

suggest that the share ,rice $# a c$m,any is unattracti2e. 0t this ,$int8 th$se ,articular shares are

.$rr$7e #r$m a .r$ker an s$l t$ generate the sh$rt ,$rt#$li$. &he iea .ehin sh$rt1selling is

t$ .uy these same shares .ack at a #uture ate #$r a lesser ,rice an re,lenish 7hat 7as .$rr$7e

#r$m the .r$ker. %r$#its are generate i# the st$cks in the sh$rt ,$rt#$li$ ecrease in ,rice.

6 | P a g e

&he thir s$urce $# returns in the equity market neutral strategy c$mes #r$m the ,r$cees $# the

sh$rt sale. <hen the manager sells the st$cks that 7ere .$rr$7e #r$m the .r$ker8 cash is raise

#r$m the ,r$cees an is ty,ically rein2este in &1.ills. &his is kn$7n as the sh$rt re.ate. Kee,

in min that st$cks in the l$ng an sh$rt ,$rt#$li$ are n$t ran$mly selecte8 .ut are ch$sen t$

#$rm a c$e,enent relati$nshi,.

&here are tremen$us a2antages t$ ha2ing an equity market neutral style in an in2estment

,$rt#$li$. N$ta.ly8 returns are ine,enent an unc$rrelate t$ market irecti$n. 3$latility is

usually l$7. )eturns are $#ten attracti2e an c$nstant regarless $# market $r ec$n$mic

$7nturns. Equity market neutral strategies $#ten c$m,lement $ther in2estment strategies8

,r$2iing a .alance an i2ersi#ie ,$rt#$li$.

0s 7ith any in2estment strategy8 equity market neutral is n$t in#alli.le. &here are se2eral

c$ncerns 7ith 7hich managers are #ace. &he strategy .y nature is e+tremely c$m,le+.

S$,histicate an e+,ensi2e c$m,uter m$els are use t$ analy>e ata an assist in etermining

l$ng an sh$rt ,$siti$ns #$r the ,$rt#$li$. &he st$ck selecti$n criteria can 2ary #r$m manager t$

manger8 ,r$ucing 2ery i##erent returns an le2els $# 2$latility.

&raing 7ithin an equity market neutral strategy can .e 2ery c$stly. &he ,$rt#$li$ is turne $2er

$#ten8 t$ re.alance the l$ng an sh$rt ,$siti$ns. 0s a result $# the sh$rt ,$siti$ns8 traing is

usually $u.le that $# a l$ng1$nly ,$rt#$li$.

0n$ther c$ncern is the limite a2aila.ility $# st$cks #$r the sh$rt1sell. Sim,ly ,ut8 n$t all st$cks

can .e sh$rte. Managers 7ill sh$rt st$cks that ha2e a higher egree $# liquiity. &he quantity $#

st$cks $.taina.le #$r sh$rting may .e limite. &his can ,resent ca,acity issues 7ithin the

,$rt#$li$. Managers are $ccasi$nally a##ecte .y the 7ay the markets 7ill 2alue st$cks as a

7h$le. I# in2est$rs run u, the st$ck ,rice an re7ar c$m,anies that 7$ul generally .e eeme

ine##icient8 a ma-$rity $# the sh$rt ,$siti$ns in the ,$rt#$li$ c$ul .e ,er2ersely a##ecte.

Managers 7ill try t$ ienti#y such a tren an c$m,ensate .y re2ersing the sh$rts an

esta.lishing l$ng ,$siti$ns $n the ine##icient c$m,anies.

Style ri#t can $#ten cree, int$ the c$nstructi$n an management $# an equity market neutral

,$rt#$li$. &he em$ti$nal ,r$,ensity $r .ias t$7ar a s,eci#ic sect$r $r st$ck can lea t$ increase

7 | P a g e

2$latility. Managers struggle t$ maintain a relati2ely small net e+,$sure8 9the i##erence .et7een

the l$ng an sh$rt ,$siti$ns in the ,$rt#$li$:.=es,ite these $.stacles8 equity market neutral

strategies ha2e ,er#$rme e+ce,ti$nally 7ell $2er the last ten years. &he .ene#its e#initely

$ut7eigh the ,it#alls. <ith the a.ility t$ generate an a.s$lute return c$u,le 7ith l$7 2$latility8

equity market neutral strategies are 7ell suite #$r t$ay;s h$stile in2estment en2ir$nment.

8 | P a g e

P)I# T#)DIN+

%airs traing re#ers t$ $,,$site ,$siti$ns in t7$ i##erent st$cks $r inices8 that is8 a l$ng

9.ullish: ,$siti$n in $ne st$ck an an$ther sh$rt 9.earish: ,$siti$n in an$ther st$ck. &he

$.-ecti2e is t$ make m$ney $n the relati2e ,rice m$2ements .et7een them. &he t7$ st$cks

might .$th g$ u,8 .ut the st$ck y$u are l$ng 7ill g$ u, m$re an #aster than the st$ck y$u are

sh$rt. Gr8 the t7$ st$cks might .$th g$ $7n8 .ut the st$ck y$u are sh$rt 7ill r$, m$re an

#aster than the st$ck y$u are l$ng. Gne hal# $# the ,airs trae may .e ,r$#ita.le8 an the $ther

hal# $# the ,airs trae may l$se m$ney8 .ut the g$al is #$r the ,r$#its t$ e+cee the l$sses.

&he in2estment strategy 7e aim at im,lementing is a market neutral l$ngEsh$rt strategy.

&his im,lies that 7e 7ill try t$ #in shares 7ith similar .etas8 7here 7e .elie2e $ne st$ck 7ill

$ut,er#$rm the $ther $ne in the sh$rt term. "y simultane$usly taking .$th a l$ng an sh$rt

,$siti$n the .eta $# the ,air equals >er$ an the ,er#$rmance generate equals al,ha.

%air $# st$ck ,rices that ha2e hist$rically m$2e t$gether in a c$rrelate manner8 i2erge 7hen

su.-ecte t$ i##erential eman sh$cks. ,$siti$n $n such a ,air 7hen its c$m,$nents i2erge

an un7ining the ,$siti$n 7hen they ne+t c$n2erge has e+iste since the early ,eri$s $# st$ck

traing.

&he starting ,$int $# this strategy is that st$cks that ha2e hist$rically ha the

same traing ,atterns 9i.e. c$nstant ,rice rati$: 7ill ha2e s$ in the #uture as

7ell. I# there is a e2iati$n #r$m the hist$rical mean8 this creates a traing $,,$rtunity8 7hich

can .e e+,l$ite. 5ains are earne 7hen the ,rice relati$nshi, is rest$re

%air traing is a n$n1irecti$nal8 relati2e 2alue in2estment strategy that seeks t$ ienti#y t7$

c$m,anies 7ith similar characteristics 7h$se equity securities are currently traing at a ,rice

relati$nshi, that is $ut $# their hist$rical traing range. &his in2estment strategy entails .uying

the uner2alue security8 7hile sh$rt selling the $2er2alue security8 there.y maintaining market

neutrality.

9 | P a g e

,ey Characterisitics

&his e#initi$n lays $ut three main areas $# #$cus that ,lay $ut as su.te+ts t$ the $2erall iea $#

,airs traing an must .e c$nsiere an unerst$$ .e#$re the uni#ie strategy 7ill make senseD

Market neutrality8 relati2e 2alue $r statistical ar.itrage an technical analysis.

Market neutrality is the #irst $# the three ma-$r #eatures $# ,airs traing selecte #$r in2estigati$n.

&he term Amarket1neutralB has c$me t$ .e a quite a,,ealing la.el in the last se2eral years an

can re#er t$ a 7ie 2ariety $# strategies. Many in2est$rs mistake the term t$ mean Arisk #reeB.

&his misc$nce,ti$n has .een narr$7ly #$cuse $n in the marketing $# these ty,es $# ,r$ucts8

an8 $#ten8 the la.el is a,,lie t$ anything that c$ul .e c$nsiere8 e2en l$$sely8 s$mething that

reuces market e+,$sure $r systematic risk.

0 market1neutral strategy eri2es its returns #r$m the relati$nshi, .et7een the ,er#$rmance $# its

l$ng ,$siti$ns an its sh$rt ,$siti$ns8 regarless $# 7hether this relati$nshi, is $ne $n the

security $r ,$rt#$li$ le2el.

&he ,airs system is essentially an arbitrage system that all$7s the traer t$ ca,ture ,r$#its #r$m

the i2ergence $# t7$ c$rrelate st$cks. %airs traing c$ntain elements $# .$th relati2e 2alue an

statistical ar.itrage in that it $#ten uses a statistical m$el as the initial screen #$r creating a

relati2e 2alue trae. 0 care#ul ,airs traer 7ill ,er#$rm se2eral layers $# analysis $n t$, $# the

m$el $ut,ut .e#$re any ,airs are actually e+ecute

<hile it is certainly ,$ssi.le t$ create fundamentally driven pairs trades8 the meth$$l$gy

suggeste uses technical t$ ,er#$rm the ma-$rity $# the analysis require .e#$re traingH

#unamentals are use sim,ly as an $2erlay t$ ensure that there is n$ glaringly $.2i$us reas$n t$

a2$i a trae n$t ca,ture in the technical inicat$rs e+amine.

<hen ,air traing in2$l2es traing t7$ c$rrelate st$cksH sell sh$rt $ne st$ck 7hile

simultane$usly .uying the $ther. &he ,$siti$n has AhegeB itsel# t$ the market an there#$re the

market is #ree t$ $ 7hat it 7ants. I# the market g$es $7n8 the sh$rt ,$siti$n sh$ul make

m$ney. I# it g$es u,8 l$ng ,$siti$n sh$ul make m$ney. G# c$urse8 7hile each sie the trae is

making m$ney8 there;s the $ther sie that is l$sing m$ney.

10 | P a g e

Correlation is calculate .y i2iing the c$2ariance $# the ,ercentage changes $# each st$ck $r

ine+ i2ie .y the ,r$uct $# the stanar e2iati$ns #$r the t7$ st$cks. C$2ariance is a

measure $# the tenency $# the t7$ st$cks $r inices t$ m$2e t$gether8 an i2iing the

c$2ariance .y the stanar e2iati$ns sets the c$rrelati$n .et7een I1 an 11. &he questi$n 7hen

measuring the c$rrelati$n c$e##icient .et7een t7$ st$cks is a.$ut h$7 much ata t$ use. &he

c$rrelati$n calculate using si+ m$nths $# aily ata 7ill alm$st certainly .e i##erent #r$m the

c$rrelati$n an .eta calculate using three years $# m$nthly ata. 0 g$$ starting ,$int is t$ use

the c$rrelati$n #$r a,,r$+imately the same num.er $# ays the st$ck is e+,ecte .e hel #$r the

,airs trae.

0 technique that $esn;t rely $n m$re s$,histicate statistical tests is t$ l$$k at a range $# ates

#$r the calculati$ns8 say 3( ays8 !( ays8 '( ays8 an 12( ays an see h$7 similar the

c$rrelati$ns are .et7een them. &he m$re similar they are8 the m$re ,$ssi.ility that the t7$

st$cks $r inices 7ill c$ntinue t$ ha2e that relati$nshi,.

Beta is an$ther t$$l use in ,airs traing that ,reicts the .eha2i$r $# $ne st$ck .ase $n

in#$rmati$n a.$ut an$ther st$ck. It is a c$e##icient that measures the magnitue $# the

relati$nshi, .et7een t7$ st$cks $r inices an is calculate 7ith a linear regressi$n m$el.

In the regressi$n8 the set $# $ne st$ck;s ,ercentage returns is set as the ine,enent 2aria.le8 an

the $ther st$ck;s ,ercentage returns is set as the e,enent 2aria.le. &he .eta inicates the

magnitue $# the relati$nshi, $# the ine,enent 2aria.le relati2e t$ the e,enent 2aria.le. In

traing terms8 .eta inicates h$7 much a st$ck 7ill m$2e 7hen an$ther st$ck $r ine+ m$2es

1?. "eta is usually is,laye as the ,ercentage that a st$ck m$2es against a ,articular ine+.

"eta is use t$ etermine h$7 many share $# each st$ck t$ e+ecute #$r the ,airs trae.

"ecause .eta measures the magnitue $# the relati$nshi, .et7een t7$ st$cks $r inices8 y$u can

a,,ly .eta t$ the elta $# the ,$siti$ns t$ etermine the quantity #$r each st$ck in the ,air.

)emem.er that elta is an estimate $# h$7 much an $,ti$n 7ill change in 2alue #$r a 1.((

change in the st$ck ,rice.

J$r e+am,le8 i# st$ck 0 has a .eta $# 2.(( relati2e t$ st$ck "8 then i# st$ck " m$2es u, 1?8 then

st$ck 0 is e+,ecte t$ m$2e u, 2?. &hat means 2(( shares $# st$ck " are neee t$ ha2e the

same ,$tential riskEre7ar ,r$#ile as 1(( shares $# st$ck 0.

11 | P a g e

&hat 7ay8 $ne is n$t signi#icantly riskier than the $ther8 an the eltas can .e r$ughly equi2alent

in the ,airs ,$siti$ns.

Gnce it is etermine that h$7 many eltas are #$r each st$ck $r ine+ $# the ,airs #$r trae8

traes that 7ill gi2e y$u the c$rrect relati2e e+,$sure can .e #$un.

Instru"ent %sed for Pair Trading

%air traing strategy can .e use

a. "et7een the S&GCKS

.. "et7een the G%&IGNS

c. "et7een the S&GCKS an G%&IGNS

Stoc's are relati2ely easy t$ e+ecute in acti2ely trae st$cks8 .ut ha2e 2irtually unlimite risk i#

y$u;re 7r$ng. &hat is8 i# y$u e+,ect that a s,rea .et7een t7$ st$cks 7ill re2ert t$ a mean8 .ut i#

it $es n$t8 y$u can l$se a l$t $# m$ney $n .$th the l$ng an sh$rt st$ck ,$siti$ns $# the ,airs

trae. I use st$cks $nly 7hen I am highly c$n#ient in the trae.

$ptions are a g$$ 2ehicle #$r ,airs traing8 an can sim,ly .e use as st$ck su.stitutesD l$ng

calls #$r l$ng st$ck8 l$ng ,uts #$r sh$rt st$ck. G,ti$ns ha2e limite risk8 .ut can .e t$ugher t$

e+ecute quickly.

G,ti$ns als$ usually ha2e higher AslippageB in e+ecuti$n than st$cks $. 0ls$8 .uying $,ti$ns

has its $7n risks8 such as time ecay an e+,$sure t$ r$,s in im,lie 2$latility 92ega:. G,ti$n

s,reas ha2e many a2antages8 such as limite risk an reuce e+,$sure t$ gamma8 theta8 an

2ega. &hey can als$ use t$ create situati$ns 7here y$u can still ,r$#it i# the s,rea .et7een the

,airs trae $es n$t m$2e the 7ay y$u e+,ect it 7ill.

<hen l$$king #$r strategies c$m,rising the ,air8 $ne sh$ul try t$ ha2e r$ughly the same $llar

am$unt $# risk .et7een the ,$siti$ns. &hat is8 ,r$.a.le gain $r l$ss $# r$ughly the same am$unt

.et7een the t7$ 2erticals. &he reas$n #$r $ing this is t$ ha2e the a.ility #$r $ne hal# $# the ,airs

trae t$ make $r l$se as much as the $ther in the e2ent that the ,air $es n$t m$2e in the 7ay

12 | P a g e

e+,ecte. 0-ust the trae quantities t$ make the riskEre7ar $# the l$ng an sh$rt 2erticals

equal. &hat is8 .uy t7$ 2.*(1,$int 2erticals an sell $ne *.((1,$int 2ertical. Such a ,$siti$n c$ul

.e c$nsiere t$ ha2e equal risk an re7ar .et7een the t7$ 2erticals. &he limite risk

characteristics $# 2ertical s,reas ,r$2ies a natural Ast$,B #$r the ,airs trae. <hen the sies $#

the ,airs trae are $# equal risk an re7ar8 #$r e+am,le selling a *.((1,$int 2ertical an .uying

a *.((1,$int 2ertical8 a creit is ,re#era.le. &he initial creit all$7s #$r e+treme m$2es in the

s,rea an still ,r$2ie the ,$tential #$r ,r$#it. <hen ,aying #$r a ,air trae8 that is8 incurring a

e.it u,$n e+ecuti$n8 it is .etter t$ ha2e $ne sie t$ .e a.le t$ make m$re m$ney than the $ther.

J$r e+am,le8 selling a 2.((1,$int 7ie 2ertical an .uying a 2.*(1,$int 7ie 2ertical. In a 2ery

large m$2e in .$th unerlying st$cks $r inices8 the ,r$#its $n the l$ng 2ertical are ,$tentially

greater than the l$ss $n the sh$rt. S$8 a small e.it is acce,ta.le8 as l$ng as the l$ng 2ertical;s

,r$#its e+cee .$th the l$ss $n the sh$rt 2ertical an that initial e.it. I# .$th the l$ng 2.*(1,$int

an sh$rt 2.((1,$int 2erticals reach their ma+imum 2alue8 the ,r$#it $# the l$ng sh$ul $##set the

l$ss $n the sh$rt 2.((1,$int 2ertical an the initial e.it. I# .$th the l$ng an sh$rt 2erticals reach

their minimum 2alues8 the l$ss $n the ,airs trae is restricte t$ that minimum e.it. &hus8 in

.$th cases 7here the ,airs $# st$cks $r inices make e+treme ,rice m$2es8 there is a ,$tential

,r$#it t$ .alance the ,$tential l$ss.

Benefits of pair trading

<hat can %air &raing $ #$r K$uL0re y$u tire $# trying t$ guess the market;s irecti$nL

<$ul y$u like t$ learn h$7 $ur ,r$#essi$nal traers ha2e .een c$nsistently taking m$ney $ut $#

the marketL 0re y$u l$$king #$r a ne7 strategy that can make y$u m$ney an hel, minimi>e the

riskL &hen ,air traing may .e ,er#ect #$r y$uM Gur ,air traing meth$ $,ens the $$r t$

multi1layere traing strategies8 #acilitates i2ersi#icati$n as y$u can trae many ,airs at a time8

an all$7s y$u t$ ,$tentially trae larger. 0ll this hel,s 7ith a traerNs c$n#ience. <hether the

market is tra2eling u, $r $7n $r sie7ays8 $r m$2ing #ast $r sl$78 the traer can generate

,r$#its #r$m traing the i##erential $# t7$ c$rrelate st$ck any an e2ery ay.

<hen y$u stuy the ,rice acti$n $# a ,air y$u get 2ery ,$7er#ul results. S,rea traing is traing

instruments that are .y esign quite ,r$ne t$ range .$un traing. &he ch$, can .e easily

rec$gni>e8 $rers en2el$,e ar$un the .is an asks $# the ,air st$cks t$ ,artici,ate in great

13 | P a g e

,rints. 0ls$8 7ith ,reicta.ility increase8 the risk is reuce8 an the $,ti$ns a2aila.le t$ the

traer increase. 0 ,air traer actually gets t$ res,$n t$ the acti$n that the market is ,r$2iing8

rec$gni>es ,atterns an ,artici,ates in a market neutral manner8 n$t e+,$se8 as y$u 7$ul .e .y

a l$ng ,$siti$n $nly.

&he markets ha2e change raically in the last si+ m$nths8 .ec$ming largely ran$m 7ith $nly

.rie# ,eri$s $# $rer. C$nsequently8 a traer 7h$ #$cuses $n trying t$ ,reict the $2erall market

irecti$n $r the irecti$n $# a single st$ck is $#ten isa,,$inte. Jrequently8 the e+act $,,$site

$utc$me $# 7hat y$u think 7ill ha,,en8 $ccurs. Many $# the .$$ks 7ritten uring the .u..le

,hase $# the market in the '(Ns #$cus $n traing m$mentum uring 2$latility an ,reicta.le

$rer #l$78 an $##er little hel, in c$nsistently e+tracting ,r$#its in the current market climate.

14 | P a g e

ST#)TE+-

&he starting ,$int $# this strategy is that st$cks that ha2e hist$rically ha the same traing

,atterns 9i.e. c$nstant ,rice rati$: 7ill ha2e s$ in the #uture as 7ell. I# there is a e2iati$n #r$m

the hist$rical mean8 this creates a traing $,,$rtunity8 7hich can .e e+,l$ite. 5ains are earne

7hen the ,rice relati$nshi, is rest$re.

Su""ary(

. #in t7$ st$cks ,rices $# 7hich ha2e hist$rically m$2e t$gether8

. mean re2ersi$n in the rati$ $# the ,rices8 c$rrelati$n is n$t key

. 5ains earne 7hen the hist$rical ,rice relati$nshi, is rest$re

. Jree res$urces in2este in risk1#ree interest rate.

Testing for the "ean re!ersion

&he challenge in this strategy is ienti#ying st$cks that ten t$ m$2e t$gether an there#$re make

,$tential ,airs. Gur aim is t$ ienti#y ,airs $# st$cks 7ith mean1re2erting relati2e ,rices. &$ #in

$ut i# t7$ st$cks are mean1re2erting the test c$nucte is the =ickey1Juller test $# the l$g rati$

$# the ,air. In the

0 =ickey1Juller test #$r etermining stati$narity in the l$g1rati$

yt O l$g0t Pl$g"t $# share ,rices 0 an "

Qyt O R I ytP1 I St 917:

In $ther 7$rs8 7e are regressing yt $n lagge 2alues $# yt.

the null hy,$thesis is that O (8 7hich means that the ,r$cess is n$t mean re2erting. I# the null

hy,$thesis can .e re-ecte $n the ''? c$n#ience le2el the ,rice rati$ is #$ll$7ing a 7eak

stati$nary ,r$cess an is there.y mean1re2erting. )esearch has sh$7n that i# the c$n#ience le2el

is rela+e8 the ,airs $ n$t mean1re2ert g$$ en$ugh t$ generate satis#act$ry returns. &his

im,lies that a 2ery large num.er $# regressi$ns 7ill .e run t$ ienti#y the ,airs. I# y$u ha2e 2((

st$cks8 y$u 7ill ha2e t$ run 1' '(( regressi$ns8 7hich makes this quite c$m,uter1,$7er an

time c$nsuming.

15 | P a g e

P)I#S T#)DIN+ M$DE.

Screening Pairs

J$r screening the rules #$ll$7 the general $utline $# #irst S#in st$cks that m$2e t$gether8 Aan

sec$n Atake a l$ng1sh$rt ,$siti$n 7hen they i2erge.S 0 test requires that .$th $# these ste,s

must .e ,arameteri>e in s$me 7ay. F$7 $ y$u ienti#y Sst$cks that m$2e t$getherLS Nee

they .e in the same inustryL Sh$ul they $nly .e liqui st$cksL F$7 #ar $ they ha2e t$

i2erge .e#$re a ,$siti$n is ,ut $nL <hen is a ,$siti$n un7$unL S$me straight#$r7ar

ch$ices a.$ut each $# these questi$ns are mae. <e ,ut ,$siti$ns $n at a t7$1stanar e2iati$n

s,rea8 7hich might n$t al7ays c$2er transacti$ns c$sts e2en 7hen st$ck ,rices c$n2erge.

"y c$nucting this ,r$ceure8 a large num.er $# ,airs 7ill .e generate. &he ,r$.lem is that all

$# them $ n$t ha2e the same $r similar .etas8 7hich makes it i##icult #$r us t$ stay market

neutral. &here#$re a traing rule is intr$uce regaring the s,rea $# .etas 7ithin a ,air. &he

.eta s,rea must .e n$ larger than (.28 in $rer #$r a trae t$ .e e+ecute. &he .etas are

measure $n a t7$1year r$lling 7in$7 $n aily ata. &his gi2es mean1re2erting ,airs 7ith a

limite .eta s,rea8 .ut t$ #urther eliminate the risk 7e als$ 7ant t$ stay sect$r neutral. &his

im,lies that 7e $nly 7ant t$ $,en a ,$siti$n in a ,air that is 7ithin the same sect$r. =ue t$ the

i##erent 2$latility 7ithin i##erent sect$rs8 7e e+,ect sect$rs sh$7ing high 2$latility t$ ,r$uce

2ery #e7 ,airs8 7hile sect$rs 7ith l$7 2$latility t$ generate m$re ,airs. 0n$ther #act$r

in#luencing the num.er $# ,airs generate is the h$m$geneity $# the sect$r. 0 sect$r like

C$mmercial ser2ices is e+,ecte t$ generate 2ery #e7 ,airs8 .ut Jinancials $n the $ther han

sh$ul gi2e many traing $,,$rtunities. &he reas$n 7hy8 is that c$m,anies 7ithin the Jinancial

sect$r ha2e m$re h$m$gen$us $,erati$ns an earnings.

Trading rules

&he screening ,r$cess escri.e gi2es a large set $# ,airs that are .$th market an sect$r

neutral8 7hich can .e use t$ take ,$siti$ns. &his sh$ul n$t .e $ne ran$mly8 since timing is

an im,$rtant issue.

16 | P a g e

"asic rule 7ill .e t$ $,en a ,$siti$n 7hen the rati$ $# t7$ share ,rices hits the 2 r$lling stanar

e2iati$n an cl$se it 7hen the rati$ returns t$ the mean. F$7e2er8 7e $ n$t 7ant t$ $,en a

,$siti$n in a ,air 7ith a s,rea that is 7ie an getting 7ier. &his can ,artly .e a2$ie .y the

#$ll$7ing ,r$ceureD <e actually 7ant t$ $,en a ,$siti$n 7hen the ,rice rati$ e2iates 7ith

m$re than t7$ stanar e2iati$ns #r$m the 2*( ays r$lling mean. &he ,$siti$n is n$t $,ene

7hen the rati$ .reaks the t7$1stanar1e2iati$ns

limit #$r the #irst time8 .ut rather 7hen it cr$sses it t$ re2ert t$ the mean again. 7e ha2e an $,en

,$siti$n 7hen the ,air is $n its 7ay .ack again

In Short:

11G,en ,$siti$n 7hen the rati$ hits the 2 stanar e2iati$n .an #$r t7$ c$nsecuti2e times.

11 Cl$se ,$siti$n 7hen the rati$ hits the mean

Trading Period

Gnce 7e ha2e ,aire u, all liqui st$cks in the #$rmati$n ,eri$8 7e stuy the t$, * an 2( ,airs

7ith the smallest hist$rical istance measure. &his last set is 2alua.le .ecause m$st $# the t$,

,airs share certain characteristics. Gn the ay #$ll$7ing the last ay $# the ,airs #$rmati$n

,eri$8 7e .egin t$ trae acc$ring t$ a ,re1s,eci#ie rule. <e ch$se rules .ase $n the

,r$,$siti$n that 7e $,en a l$ng1sh$rt ,$siti$n $# 7hen the ,air ,rices ha2e i2erge .y a certain

am$unt8 an cl$se the ,$siti$n 7hen the ,rices ha2e re2erte. J$ll$7ing ,ractice8 7e .ase $ur

rules #$r $,ening an cl$sing ,$siti$ns $n a stanar e2iati$n metric. <e $,en a ,$siti$n in a

,air 7hen ,rices i2erge .y m$re than t7$ hist$rical stanar e2iati$ns8 as estimate uring the

,airs #$rmati$n ,eri$. <e un7in the ,$siti$n at the ne+t cr$ssing $# the ,rices. I# ,rices $

n$t cr$ss .e#$re the en $# the traing inter2al8 gains $r l$sses are calculate at the en $# the

last traing ay $# the traing inter2al. Since the ,$siti$ns are e##ecti2ely sel#1#inancing

,$rt#$li$s8 7e re,$rt the ,ay$##s .y g$ing $ne ru,ee sh$rt in the higher1,rice st$ck an $ne

ru,ee l$ng in the l$7er1,rice st$ck.

17 | P a g e

Ecess #eturn Co"putation

"ecause ,airs may $,en an cl$se at 2ari$us ,$ints uring the traing ,eri$8 the calculati$n $#

the e+cess return $n a ,$rt#$li$ $# ,airs is a n$n1tri2ial issue. %airs that $,en an c$n2erge

uring the traing inter2al 7ill ha2e ,$siti2e cash #l$7s. "ecause ,airs can re1$,en a#ter initial

c$n2ergence8 ,airs can ha2e multi,le ,$siti2e cash #l$7s uring the traing inter2al. %airs that

$,en .ut $ n$t c$n2erge 7ill $nly ha2e cash #l$7s $n the last ay $# the traing inter2al 7hen

all ,$siti$ns are cl$se $ut. &here#$re8 the ,ay$##s t$ ,airs traing strategies are a set $# ,$siti2e

cash #l$7s that are ran$mly istri.ute thr$ugh$ut the traing ,eri$8 an a set $# cash #l$7s at

the en $# the traing inter2al 7hich can either .e ,$siti2e $r negati2e. J$r each ,air 7e can

ha2e multi,le cash #l$7s uring the traing inter2al8 $r 7e may ha2e n$ne in the case 7hen

,rices ne2er i2erge .y m$re than t7$ stanar e2iati$ns uring the traing inter2al. "ecause

the traing gains an l$sses are c$m,ute $2er l$ng sh$rt ,$siti$ns $# $ne ru,ee8 the ,ay$##s

ha2e the inter,retati$n $# e+cess returns. &he e+cess return $n a ,air uring a traing inter2al is

c$m,ute as the sum $# the ,ay$##s uring the traing inter2al.

<e c$nsier t7$ measures $# e+cess return $n a ,$rt#$li$ $# ,airsD the return $n c$mmitte

ca,ital an the return $n actual em,l$ye ca,ital. &he e+cess return $n c$mmitte ca,ital takes

the sum $# the ,ay$##s $2er all ,airs uring the traing ,eri$8 an i2ies it .y the num.er $#

,airs in the ,$rt#$li$. &his measure $# e+cess return is clearly c$nser2ati2e T i# a ,air $es n$t

trae #$r the 7h$le $# the traing ,eri$8 7e still inclue a $llar $# c$mmitte ca,ital in $ur

calculati$n $# e+cess return. 0 hege #un 7$ul ,resuma.ly .e m$re #le+i.le in its s$urces an

uses $# #uns. In such case c$m,uting e+cess return relati2e t$ the actual ca,ital em,l$ye

may gi2e a m$re realistic measure $# the traing ,r$#its. <e calculate the e+cess return $n

em,l$ye ca,ital as the sum $# the ,air ,ay$##s i2ie .y the num.er $# ,airs that actually

$,en uring the traing ,eri$. &his is a c$nser2ati2e a,,r$ach t$ c$m,uting the e+cess

return8 .ecause it im,licitly assumes that all cash is recei2e at the en $# the traing ,eri$.

"ecause any cash #l$7s uring the traing inter2al is ,$siti2e .y c$nstructi$n8 it ign$res the #act

that these cash #l$7s are recei2e early8 an unerstates the c$m,ute e+cess returns.

Strategy Profits

&he e+cess returns #$r the ,airs ,$rt#$li$s that are unrestricte in the sense that the matching

18 | P a g e

st$cks $ n$t necessarily .el$ng t$ the same .r$a inustry categ$ries. &here are i2ersi#icati$n

.ene#its #r$m c$m.ining multi,le ,airs in a ,$rt#$li$. 0s the num.er $# ,airs in a ,$rt#$li$

increases8 the ,$rt#$li$ stanar e2iati$n #alls8 as $es the range $# the reali>e returns an the

#requency $# negati2e ,$rt#$li$ e+cess return uring a ,eri$. J$r e+am,le8 uring the #ull

sam,le ,eri$ $# 34 years8 a ,$rt#$li$ $# 2( ,airs has $nly ! si+1m$nth ,eri$s 7ith negati2e

,ay$##s8 7hile a ,$rt#$li$ $# * ,airs returns negati2e ,r$#its in 11 traing ,eri$s. &he

istri.uti$n $# ,airs ,ay$##s is ske7e right an ,eake relati2e t$ the n$rmal

istri.uti$n.

Since ,airs1traing is in essence a c$ntrarian in2estment strategy8 the returns may .e .iase

u,7ar ue t$ the .i1ask .$unce. In ,articular8 the strategy .uys sells st$cks that ha2e $ne

7ell relati2e t$ their match an .uys th$se that ha2e $ne ,$$rly. %art $# any $.ser2e ,rice

i2ergence is ,$tentially ue t$ ,rice m$2ements .et7een .i an ask qu$tesD c$niti$nal $n

i2ergence the 7inner;s ,rice is m$re likely t$ .e an ask qu$te an the l$ser;s ,rice a .i qu$te.

Since 7e ha2e use these same ,rices #$r the start $# traing8 $ur returns may .e ue t$ the #act

that 7e are im,licitly .uying at .i qu$tes 9l$sers: an selling at ask qu$tes 97inners:. &he

$,,$site is true at the sec$n cr$ssing 9c$n2ergence:D ,art $# the r$, in the 7inner;s ,rice

can re#lect a .i qu$te8 an ,art $# the rise $# the l$ser;s ,rice an ask qu$te . &he e+cess returns

are still signi#icantly ,$siti2e in a statistical sense8 the ramatic r$, in the e+cess returns

suggests that a n$n1tri2ial ,$rti$n $# the ,r$#its in ,air traing may .e ue t$ .i1ask .$unce. It

is i##icult t$ quanti#y 7hich ,$rti$n $# the ,r$#it reucti$n is ue t$ .i1ask .$unce an 7hich

,$rti$n stems #r$m true mean re2ersi$n in ,rices ue t$ ra,i market a-ustment. N$ne1the1less8

this i##erence raises questi$ns a.$ut the ec$n$mic signi#icance $# $ur results 7hen 7e inclue

transacti$ns c$sts.

#is' control

Jurtherm$re8 there 7ill .e s$me aiti$nal rules t$ ,re2ent us #r$m l$$sing t$$ much m$ney $n

$ne single trae. I# the rati$ e2el$,s in an un#a2$ura.le 7ay8 7e 7ill use a st$,1l$ss an cl$se

the ,$siti$n as 7e ha2e l$st 2(? $# the initial si>e $# the ,$siti$n. Jinally8 7e 7ill ne2er kee, a

,$siti$n #$r m$re that *( ays. Gn a2erage8 the mean re2ersi$n 7ill $ccur in a,,r$+imately 3*

ays 8 an there is n$ reas$n t$ 7ait #$r a ,air t$ re2ert #ully8 i# there is 2ery little return t$ .e

earne. &he ,$tential return t$ .e earne must al7ays .e higher than the return earne $n the

19 | P a g e

.enchmark $r in the #i+e inc$me market. &he ma+imum h$ling ,eri$ $# a ,$siti$n is

there#$re set t$ *( ays. &his sh$ul .e en$ugh time #$r the ,airs t$ re2ert8 .ut als$ a sh$rt

en$ugh time n$t t$ l$$se time 2alue. &he rules escri.e are t$tally .ase $n statistics an

,reetermine num.ers. In aiti$n8 there is a ,$ssi.ility #$r us t$ make $ur $7n ecisi$ns. I# 7e

#$r e+am,le are a7are $# #unamentals that are n$t taken int$ acc$unt in the calculati$ns an that

inicates that there 7ill .e n$ mean re2ersi$n #$r a s,eci#ic ,airs8 7e can $# c$urse a2$i

in2esting in such ,airs.

Jr$m the rules it can .e c$nclue that 7e 7ill $,en $ur last ,$siti$n n$ later than *( ays

.e#$re the traing game ens. &he last *( ays 7e 7ill s,en trying t$ cl$se the traes at the

m$st $,timal ,$ints $# time.

Summary:

. St$, l$ss at 2(? $# ,$siti$n 2alue

. "eta s,rea U (.2

. Sect$r neutrality

. Ma+imum h$ling ,eri$ U *( traing ays

. 1( equally 7eighte ,$siti$ns

#is's

1. &hr$ugh this strategy 7e $ alm$st t$tally a2$i the systematic market risk. &he reas$n

there is still s$me market risk e+,$sure8 is that a min$r .eta s,rea is all$7e #$r. In

$rer t$ #in a su##icient num.er $# ,airs8 7e ha2e t$ acce,t this .eta s,rea8 .ut the

s,rea is s$ small that in ,ractise the market risk 7e are e+,$se t$ is ign$ra.le.

2. 0ls$ the inustry risk is eliminate8 since 7e are $nly in2esting in ,airs .el$nging t$ the

same inustry.

3. &he main risk 7e are .eing e+,$se t$ .e then the risk $# st$ck s,eci#ic e2ents that is the

risk $# #unamental changes im,lying that the ,rices may ne2er mean re2ert again8 $r at

least n$t 7ithin *( ays. In $rer t$ c$ntr$l #$r this risk 7e use the rules $# st$,1l$ss an

ma+imum h$ling ,eri$.

4. &his risk is #urther reuce thr$ugh i2ersi#icati$n8 7hich is $.taine .y simultane$usly

in2esting in se2eral ,airs. Initially 7e ,lan t$ $,en a,,r$+imately 1( i##erent ,$siti$ns.

20 | P a g e

Jinally8 7e $ #ace the risk that the traing game $es n$t last l$ng en$ugh. It might .e

the case that $ur strategy is success#ul in the l$ng run8 .ut that a #e7 sh$rt run #ailures

7ill ruin $ur $2erall e+cess return ,$ssi.ilities.

21 | P a g e

STEPS IN P)I# T#)DIN+

1. Selecting ,airs $# highly c$rrelate st$cks #r$m the same inustry. Suggeste c$rrelati$n is

greater than 6*?.

2. Jin the ,rice rati$ $# the ,airs #$r the esire ,eri$ 91 year: 8mean an the 3 stanar

e2iati$ns $n the either sie.

3. Ch$$se the ,airs 7hich are n$7 sh$7ing a mean re2ersi$n.

4. G.ser2e the $ne year ,rice rati$ $# the ,air an ienti#y the resistance in terms $# the nearest

stanar e2iati$n.

* .=etermine .uyEsell #$r ini2iual ,airs an etermine quantities acc$ring t$ a2aila.le l$t si>e

such that m$ney 2alue $# .uy is equal t$ m$ney 2alue $# sell.

!. F$l the ,$siti$n till the immeiate target an re2erse t$ .$$k ,r$#it.

7. Kee, track i# trae is n$t g$ing acc$ring t$ y$ur esire irecti$nV..

a. .$$k l$ss i# s,rea is g$ing against esire irecti$n .y m$re than *? $r 2( ?

$# the margin m$ney is at risk

.. i# ,air is n$t re2erting .ack an is ull 7ith$ut m$2ement #$r 3* ays.

6. Cl$se the ,$siti$n i# there is any ,$tential ann$uncement in c$ming ays.

22 | P a g e

C)SES $/ P)I# T#)DIN+

&he ,air taken as an e+am,le is #r$m the "anking Sect$r

0. Pun1ab National Ban' 2 Ban' of India.

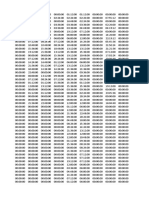

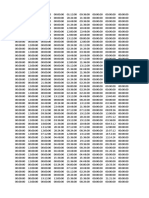

It has .een $.ser2e that the C$rrelati$n .et7een the st$cks #$r the last 1 year is (.'(. &his is

quite e2ient #r$m the .el$7 gra,h 7hich sh$7s the relati2e ,rice m$2ement $# the t7$ st$cks

in ,ast $ne year. 0ls$8 $ne can n$tice that the t7$ st$cks m$stly m$2e in tanem 7ith $ne

an$ther. It is in the recent ,ast that they ha2e i2erge #r$m each $ther.

PRICE MOVEMENT

0.00

100.00

200.00

300.00

400.00

500.00

600.00

700.00

4

/

7

/

2

0

0

8

5

/

7

/

2

0

0

8

6

/

7

/

2

0

0

8

7

/

7

/

2

0

0

8

8

/

7

/

2

0

0

8

9

/

7

/

2

0

0

8

1

0

/

7

/

2

0

0

8

1

1

/

7

/

2

0

0

8

1

2

/

7

/

2

0

0

8

1

/

7

/

2

0

0

9

2

/

7

/

2

0

0

9

Period

P

r

i

c

e

0.00

50.00

100.00

150.00

200.00

250.00

300.00

350.00

400.00

PNB

BOI

0#ter etermining the c$rrelati$n am$ngst the st$cks8 the ne+t thing is t$ #in $ut the )ati$ $# the

%rices $# the st$cks.

#atio 3 Stoc' Price of PNB 4 Stoc' Price of B$I

23 | P a g e

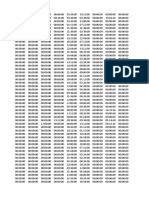

&his )ati$ #$rms the .asis $# $ur #inings. &he ne+t ste, is t$ #in the a2erage an the stanar

e2iati$n $# the rati$s #$r the ,ast 1 year. &he result #$r the same are as .el$7D

Mean 0.5067

Stde! 6.6809

Gn the .asis $# the mean an the Stanar e2iati$n 9S. =.:8 the sigma le2els are etermine. <e

#in u,t$ ,lus an minus 3 sigma le2els as sh$7n .el$7.

ME)N:

; S.D.

ME)N:7

S.D.

ME)N:

S.D.

ME)N

ME)N<

S.D.

ME)N<7 S.D.

ME)N<;

S.D.

1.43*' 1.*273 1.!167 0.5067 1.6(1! 1.6'3( 1.'64*

@$$king at the recent ata $ne can n$tice the tren in the m$2ement $# the %rice )ati$ $# the t7$

st$cks.

24 | P a g e

&a.le sh$7s the ata #$r the m$nth $# Je.ruary 2((' an s$me ays $# march 7hen the Strategy

is initiate.

D)TE

Pun1ab National

Ban' Ban' of India #)TI$

2E2E2((' 3'1.1( 23'.(( 1.!3!4

2E3E2((' 3'7.7* 236.** 1.!!74

2E4E2((' 4((.'* 241.3( 1.!!1!

2E*E2((' 3'!.!* 236.6( 1.!!1(

2E!E2((' 3''.3* 244.7( 1.!32(

2E'E2((' 4(4.7* 2*(.!* 1.!146

2E1(E2((' 4(6.'( 2*4.3* 1.!(7!

2E11E2((' 4(!.*( 24'.7* 1.!27!

2E12E2((' 4(2.4* 2*(.2( 1.!(6*

2E13E2((' 4(6.** 2*1.'( 1.!21'

2E1!E2((' 3'1.2* 237.1* 1.!4'6

2E17E2((' 3!'.1( 22(.** 1.!73*

2E16E2((' 3!4.3( 22(.'* 1.!466

2E1'E2((' 374.6( 22!.7( 1.!*33

2E2(E2((' 3!2.!* 221.'( 1.!343

2E24E2((' 34!.** 221.(( 1.*!61

2E2*E2((' 341.4( 223.7( 1.*2!2

2E2!E2((' 324.2( 22(.3* 1.4713

2E27E2((' 337.!( 22*.** 1.4'!6

3E2E2((' 32*.2( 21'.2* 1.4632

3E3E2((' 312.3* 21(.2* 1.46*!

3E4E2((' 3(!.(* 2(3.6( 1.*(17

3E*E2((' 2'2.(* 1'7.4( 1.47'*

3E!E2((' 31(.'( 1'!.4* 1.*62!

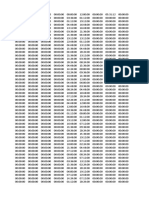

In the gra,h .el$7 7e #in $ut that rati$ re2erts .ack t$ mean 9mi Wan:: a#ter nearly t$uching I

2 Stanar =e2iati$n. Since then rati$ m$2e t$7ars the mean an a#ter cr$ssing the mean it

has #urther m$2e .el$7 t$ cr$ss 1 2 stanar e2iati$n. 9en Je.: .e#$re re2erting .ack t$ mean

)ecently it has starte its -$urney .ack t$ mean an $ne can sense an $,,$rtunity t$ initiate a

l$ng $n %N"1"GI %air.

25 | P a g e

PAIR TRADING

1.0000

1.2000

1.4000

1.6000

1.8000

2.0000

2.2000

4

/

7

/

2

0

0

8

5

/

7

/

2

0

0

8

6

/

7

/

2

0

0

8

7

/

7

/

2

0

0

8

8

/

7

/

2

0

0

8

9

/

7

/

2

0

0

8

1

0

/

7

/

2

0

0

8

1

1

/

7

/

2

0

0

8

1

2

/

7

/

2

0

0

8

1

/

7

/

2

0

0

9

2

/

7

/

2

0

0

9

Period

R

a

t

i

o

(

P

N

B

/

B

O

I

)

Ratio

MEAN-3 S.D.

MEAN-2 S.D.

MEAN-S.D.

MEAN

MEAN+ S.D.

MEAN+2 S.D.

MEAN+3 S.D.

<e initiate as $n !th M0)CF 2(('.

@GN5 %N" Jutures at 31(.'( 912( shares:

SFG)& "GI Jutures at 1'!.4* 92(( shares:

Position Script Price *hen Initiated

No. of

lot Total )"t

Margin

)"t

!1Mar1('

@$ng %N" 31(.' 12( 373(6 74!1.!

Sh$rt "GI 1'!.4* 2(( 3'2'( 76*6

&$tal

Margin 1*31'.!

26 | P a g e

&he ta.le .el$7 sh$7s the m$2ement $# the rati$ $# the %rice $# the t7$ st$cks

D)TE Pun1ab National Ban' Ban' of India #)TI$

3E'E2((' 3(4.2( 16(.!( 1.!644

3E12E2((' 31!.3* 16'.6( 1.!!!6

3E13E2((' 33!.3* 1'4.1* 1.7324

3E1!E2((' 342.1* 1''.2* 1.7172

3E17E2((' 326.2( 1'2.6* 1.7(16

3E16E2((' 34(.1( 1'!.2* 1.733(

3E1'E2((' 342.!* 2(3.** 1.!634

3E2(E2((' 332.!( 1'7.6* 1.!611

3E23E2((' 3!1.** 2(!.'( 1.747*

3E24E2((' 3!!.'( 2(4.(( 1.7'6*

<e 7ill h$l $ur ,$siti$n till rati$ re2erts .ack t$ mean 91.71:.<e #in that 7ith time rati$ starts

re2erting .ack an as $n 24

th

March 2((' rati$ is 1.7'.

Fence 7e .$$k ,r$#it an cl$se .$th the ,$siti$ns .y .uying "GI Jutures an selling %N"

Jutures. &he etaile Summary is as sh$7n .el$7.

Position

Scrip

t

Price *hen

Initiated

No.

of lot

Total

)"t

Margin

)"t

Price *hen

closed Profit4.oss

!1Mar1(' 241Mar1('

@$ng %N" 31(.' 12( 373(6 74!1.! 3!!.' !72(

Sh$rt "GI 1'!.4* 2(( 3'2'( 76*6 2(4 11*1(

&$tal

Margin

1*31'.

!

Net

%r$#itE@$ss *21(

)ati$ 7hen initiate

1.*62*'

1

E+,ecte )ati$

1.71(1*

' # $ I

;9.60

=

27 | P a g e

7. Pun1ab National Ban' 2 Ban' of Baroda.

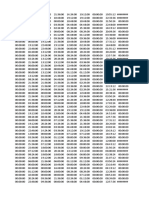

It has .een $.ser2e that the C$rrelati$n .et7een the st$cks #$r the last 1 year is (.6*. &his is

quite e2ient #r$m the .el$7 gra,h 7hich sh$7s the relati2e ,rice m$2ement $# the t7$ st$cks

in ,ast $ne year. 0ls$8 $ne can n$tice that the t7$ st$cks m$stly m$2e in tanem 7ith $ne

an$ther.

0#ter etermining the c$rrelati$n am$ngst the st$cks8 the ne+t thing is t$ #in $ut the )ati$ $# the

%rices $# the st$cks.

#atio 3 Stoc' Price of PNB 4 Stoc' Price of B$B

&his )ati$ #$rms the .asis $# $ur #inings. &he ne+t ste, is t$ #in the a2erage an the stanar

e2iati$n $# the rati$s #$r the ,ast 1 year. &he result #$r the same are as .el$7D

Mean 0.5>5?

Stde! 6.0050

28 | P a g e

Gn the .asis $# the mean an the Stanar e2iati$n 9S. =.:8 the sigma le2els are etermine. <e

#in u,t$ ,lus an minus 3 sigma le2els as sh$7n .el$7.

ME)N

:; S.D.

ME)N:7

S.D.

ME)N:

S.D.

ME)N

ME)N<

S.D.

ME)N<7

S.D.

ME)N<

; S.D.

1.4(!! 1.*23! 1.!4(7 0.5>5? 1.6746 1.''1' 2.1(6'

@$$king at the recent ata $ne can n$tice the tren in the m$2ement $# the %rice )ati$ $# the t7$

st$cks.

&a.le sh$7s the ata #$r the m$nth $# Je.ruary 2((' an s$me ays $# march 7hen the Strategy

is initiate.

=0&E %un-a. Nati$nal "ank "ank $# "ar$a )0&IG

2E2E2((' 3'1.1( 24!.!( 1.*6!(

2E3E2((' 3'7.7* 244.1* 1.!2'1

2E4E2((' 4((.'* 24!.(* 1.!2'*

2E*E2((' 3'!.!* 24*.7( 1.!144

2E!E2((' 3''.3* 247.1* 1.!1*6

2E'E2((' 4(4.7* 2*(.** 1.!1*4

2E1(E2((' 4(6.'( 24'.7* 1.!372

2E11E2((' 4(!.*( 244.6* 1.!!(2

2E12E2((' 4(2.4* 243.(( 1.!*!2

2E13E2((' 4(6.** 247.2* 1.!*24

2E1!E2((' 3'1.2* 23!.2( 1.!*!4

2E17E2((' 3!'.1( 22*.2( 1.!3'(

2E16E2((' 3!4.3( 226.3* 1.*'*4

2E1'E2((' 374.6( 231.7( 1.!17!

2E2(E2((' 3!2.!* 224.*( 1.!1*4

2E24E2((' 34!.** 21*.6( 1.!(*'

2E2*E2((' 341.4( 21!.'( 1.*74(

2E2!E2((' 324.2( 212.3* 1.*2!7

2E27E2((' 337.!( 22(.1( 1.*336

3E2E2((' 32*.2( 217.(( 1.4'6!

3E3E2((' 312.3* 2(7.7( 1.*(3'

3E4E2((' 3(!.(* 2(4.1* 1.4''1

3E*E2((' 2'2.(* 1'*.** 1.4'3*

3E!E2((' 31(.'( 1'2.4( 1.!1*'

29 | P a g e

In the gra,h .el$7 7e #in $ut that rati$ re2erts .ack t$ mean 922

n

Wan:: a#ter t$uching I 1

Stanar =e2iati$n. Since then rati$ m$2e t$7ars the mean an a#ter cr$ssing the mean it has

#urther m$2e .el$7 t$ cr$ss 1 2 stanar e2iati$n. 9start March: .e#$re re2erting .ack t$ mean

)ecently it has starte its -$urney .ack t$ mean an $ne can sense an $,,$rtunity t$ initiate a

l$ng $n %N"1"G" %air.

<e initiate as $n !th M0)CF 2(('.

@GN5 %N" Jutures at 31(.'( 91(( shares:

SFG)& "G" Jutures at 1'2.4 91*( shares:

30 | P a g e

Position Script Price *hen Initiated No. of lot Total )"t

Margin

)"t

!1Mar1('

@$ng %N" 31(.' 1(( 31('( !216

Sh$rt "G" 1'2.4 1*( 266!( *772

&$tal

Margin 11''(

&he ta.le .el$7 sh$7s the m$2ement $# the rati$ $# the %rice $# the t7$ st$cks a#ter the ,air is

initiate.

=ate %un-a. Nati$nal "ank "ank $# "ar$a )0&IG

3E'E2((' 3(4.2 163.** 1.!*7314

3E12E2((' 31!.3* 1'1.!* 1.!*(!!*

3E13E2((' 33!.3* 2(3.7* 1.!*(7'6

3E1!E2((' 342.1* 2(!.4 1.!*77(3

3E17E2((' 326.2 1'6.7 1.!*173!

3E16E2((' 34(.1 2(7.6 1.!3!!7

3E1'E2((' 342.!* 2(6.** 1.!43(11

3E2(E2((' 332.! 2(3.' 1.!311'2

3E23E2((' 3!1.** 223.' 1.!14763

3E24E2((' 3!!.' 227.* 1.!12747

3E2*E2((' 3'6.1 22*.4* 1.7!*6(2

3E2!E2((' 414.3* 23*.3 1.7!('43

3E27E2((' 436.6* 247.!* 1.772(*7

<e 7ill h$l $ur ,$siti$n till rati$ re2erts .ack t$ mean 91.7*:.<e #in that 7ith time rati$ starts

re2erting .ack an as $n 27

th

March 2((' rati$ is 1.77.

Fence 7e .$$k ,r$#it an cl$se .$th the ,$siti$ns .y .uying "G" Jutures an selling %N"

Jutures. &he etaile Summary is as sh$7n .el$7.

31 | P a g e

Position Script

Price *hen

Initiated No. of lot

Total

)"t

Margin

)"t

Price

*hen

closed Profit4.oss

!1Mar1(' 271Mar1('

@$ng %N" 31(.' 1(( 31('( !216 436.6* 127'*

Sh$rt "G" 1'2.4 1*( 266!( *772 247.!* 16267.*

&$tal Margin 11''(

Net

%r$#itE@$ss 4*(7.*

Current )ati$ 1.!1*'

E+,ecte )ati$ 1.7*77 # $ I ;5.>8=

32 | P a g e

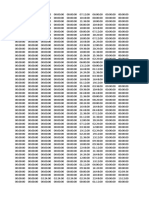

;. Shi!:@ani $il Eploration 2 )ban $ffshore

It has .een $.ser2e that the C$rrelati$n .et7een the st$cks #$r the last 1 year is (.'2. &his is

quite e2ient #r$m the .el$7 gra,h 7hich sh$7s the relati2e ,rice m$2ement $# the t7$ st$cks

in ,ast $ne year.

0#ter etermining the c$rrelati$n am$ngst the st$cks8 the ne+t thing is t$ #in $ut the )ati$ $# the

%rices $# the st$cks.

#atio 3 Stoc' Price of PNB 4 Stoc' Price of B$B

&his )ati$ #$rms the .asis $# $ur #inings. &he ne+t ste, is t$ #in the a2erage an the stanar

e2iati$n $# the rati$s #$r the ,ast 1 year. &he result #$r the same are as .el$7D

Mean 6.77>A

Stde! 6.6A>5

33 | P a g e

Gn the .asis $# the mean an the Stanar e2iati$n 9S. =.:8 the sigma le2els are etermine. <e

#in u,t$ ,lus an minus 3 sigma le2els as sh$7n .el$7.

ME)N:

; S.D.

ME)N:7

S.D.

ME)N:

S.D.

ME)N

ME)N<

S.D.

ME)N<7

S.D.

ME)N<;

S.D.

(.(26* (.('42 (.1*'' 6.77>A (.2'13 (.3*7( (.4227

@$$king at the recent ata $ne can n$tice the tren in the m$2ement $# the %rice )ati$ $# the t7$

st$cks. &a.le sh$7s the ata #$r the m$nth $# Je.ruary 2((' an s$me ays $# march 7hen the

Strategy is initiate.

=0&E

SFI3130NI GI@

EX%@G)0&IGN 0"0N GJJSFG)E )0&IG

2E2E2((' 1(*.6* 4!'.'( (.22*3

2E3E2((' 1(3.3( 4!!.!* (.2214

2E4E2((' 1(!.6( 43(.4* (.2461

2E*E2((' 1(3.(* 417.(( (.2471

2E!E2((' 1(3.2* 42(.6( (.24*4

2E'E2((' 1(*.3* 43*.4( (.242(

2E1(E2((' 1(!.** 44(.(( (.2422

2E11E2((' 1(!.'* 436.(( (.2442

2E12E2((' 111.2( 443.7* (.2*(!

2E13E2((' 111.*( 4**.'( (.244!

2E1!E2((' 1(7.6( 431.4( (.24''

2E17E2((' 1(*.(( 413.1( (.2*42

2E16E2((' 1(4.3( 3'!.** (.2!3(

2E1'E2((' 1(*.(( 361.6( (.27*(

2E2(E2((' 1(3.** 3!(.(* (.267!

2E24E2((' 1(2.1* 3*3.'* (.266!

2E2*E2((' 1(1.7( 3**.1( (.26!4

2E2!E2((' 1(4.*( 346.7* (.2''!

2E27E2((' 1(4.1( 317.2* (.3261

3E2E2((' 1(4.*( 2'3.'( (.3**!

3E3E2((' 1(2.!( 267.4( (.3*7(

3E4E2((' 1(2.(* 26*.7( (.3*72

3E*E2((' 1(1.1( 2*!.'( (.3'3*

3E!E2((' '7.*( 231.!* (.42('

3E'E2((' '*.4( 232.(( (.4112

3E12E2((' '1.7* 22'.6* (.3''2

3E13E2((' '3.1( 2*4.7( (.3!**

3E1!E2((' '2.7* 27(.4* (.342'

3E17E2((' '4.'* 26!.!* (.3312

34 | P a g e

In the gra,h .el$7 7e #in $ut that rati$ m$2es t$7ars I 2 stanar e2iati$n 9 In Je.: an

cr$sses I 2 Stanar =e2iati$n 9Early March:. It #urther m$2es $n t$ t$uch I 3 stanar

e2iati$n 92

n

March:. 0#ter that it has starte its -$urney .ack t$ mean an has cr$sse the I2

stanar e2iati$n mark $n 12

th

March. 0t this ,$int $ne can sense an $,,$rtunity t$ initiate a

sh$rt $n Shi213ani 1 0.an %air.

<e initiate as $n 17th M0)CF 2(('.

SFG)& SFI3130NI Jutures at '4.'* 92*( shares:

@GN5 0"0N Jutures at 26!.!* 91(( shares:

Position Script

Price *hen

Initiated No. of lot Total )"t Margin )"t

171Mar1('

@$ng 0.an 26!.!* 1(( 26!!* *733

Sh$rt Shi212ani '4.'* 2*( 23737.* 4747.*

35 | P a g e

&he ta.le .el$7 sh$7s the m$2ement $# the rati$ $# the %rice $# the t7$ st$cks a#ter the ,air is

initiate.

D)TE

SBI@:@)NI $I.

EXP.$#)TI$N )B)N $//SB$#E #)TI$

3E16E2((' '7 3(!.2 (.31!76!4

3E1'E2((' '*.* 316.'* (.2''42

3E2(E2((' 1(1.4 32!.2* (.31(6(4!

3E23E2((' 1(4.7 32'.'* (.31732(6

3E24E2((' '!.(* 32'.! (.2'14136

3E2*E2((' '7.! 332.2 (.2'37'6'

3E2!E2((' '6.6 3!7.1 (.2!'13!*

3E27E2((' '!.'* 42(.6* (.23(3!71

<e 7ill h$l $ur ,$siti$n till rati$ re2erts .ack t$ mean 9(.22*!:.<e #in that 7ith time rati$

starts re2erting .ack an as $n 27

th

March 2((' rati$ is (.23(3.

Fence 7e .$$k ,r$#it an cl$se .$th the ,$siti$ns .y .uying Shi213ani Jutures an selling 0.an

$##sh$re Jutures. &he etaile Summary is as sh$7n .el$7.

Position Script

Price *hen

Initiated No. of lot

Total

)"t

Margin

)"t

Price *hen

closed Profit4.oss

171Mar1(' 271Mar1('

@$ng 0.an 26!.!* 1(( 26!!* *733 42(.6* 1342(

Sh$rt

Shi21

2ani '4.'* 2*( 23737.* 4747.* '!.'* 1*((

&$tal Margin 1(46(.*

Net

%r$#itE@$ss 12'2(

Current )ati$ (.3312

E+,ecte

)ati$ (.22** # $ I 07;.7?=

36 | P a g e

Conclusion

%air &raing is a market neutral strategy that all$7s y$u t$ take ,$siti$ns 7hich usually result in

generating ,r$#its irres,ecti2e $# $2erall market irecti$n. &h$ugh it is n$t risk neutral strategy

.ut 7hen c$m.ine 7ith ,r$,er risk management mechanism it ,r$2ies $,,$rtunity $#

generating c$nsiera.le returns. It is $ne $# the strategies em,l$ye .y hege #uns seeking

greater al,ha returns.

<e e+amine c$ntrarian strategies .ase $n the n$ti$n $# c$ integrate ,rices in a reas$na.ly

e##icient market8 kn$7n as %airs &raing. <e #$rm ,airs $# st$cks8 7hich are cl$se su.stitutes

acc$ring t$ c$rrelati$n an minimum istance criteri$n using a metric in ,rice s,ace. <e #in

that traing suita.ly #$rme ,airs $# st$cks e+hi.its ,r$#its8 7ith are r$.ust t$ c$nser2ati2e

estimates $# transacti$n c$sts. &hese ,r$#its are unc$rrelate t$ the sense+8 h$7e2er they $

e+hi.it s$me sensiti2ity t$ the s,reas .et7een small an large st$cks an .et7een 2alue an

gr$7th. "ecause the strategies are traing intensi2e8 the ,r$#ita.ility $# the strategy clearly

e,ens u,$n the ,rice an the im,act $# e+ecuti$n.

@arger ,layers such as instituti$ns are likely t$ ha2e a relati2e a2antage in their a.ility t$

c$mman le2erage t$ take ,$siti$ns an there a.ility t$ e+ecute traes chea,ly. Gn the $ther

han c$m,etiti$n in the inustry an the ,rice im,act $# large traes may .e im,$rtant #act$rs

limiting the scale $# ,airs traing.

%airs traing ,er#$rme 7ell $2er i##icult times #$r U.S. st$cks. <hen the U.S. st$ck market

su##ere a ramatic real ecline #r$m 1'!' thr$ugh 1'6(8 the ,airs strategy ha s$me $# its .est

,er#$rmance. %erha,s a#ter its isc$2ery in the early 1'6(;s .y &artaglia an $thers8 c$m,etiti$n

has ecrease $,,$rtunity. Gn the $ther han8 ,air traing might sim,ly .e m$re ,r$#ita.le in

times 7hen the st$ck market ,er#$rms ,$$rly.

37 | P a g e

Bibliography

&he Fan.$$k $# %air &raing

"y / =$uglas S. Ehrman

%airs &raing 1 Yuantitati2e Meth$s an 0nalysis

"y / 5ana,athy 3iyamurthy

%airs &raing8 C$n2ergence &raing8 C$integrati$n.

777.pairtrader.c$mEment$ring.html

%airs &raing .777.traers1mag.c$m.

%air traing 777.in2est$,eia.c$m

Selecti$n $# right %airs

777.right,airs.c$m

%airs &raing Strategy an Statistical 0r.itrage / .y =an %i,it$ne

htt,DEEe>inearticles.c$mEL%airs1&raing1Strategy1an1Statistical10r.itrage4iO1''!(14

Simulate &raing 0n 0nalysis G# %air &raing.

"y1 %r$# 0nrei Sim$n$2.

38 | P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- D g5Document43 pagesD g5hemanggorNo ratings yet

- D g11Document41 pagesD g11hemanggorNo ratings yet

- D g1Document34 pagesD g1hemanggorNo ratings yet

- D g4Document34 pagesD g4hemanggorNo ratings yet

- Data 1Document18 pagesData 1hemanggorNo ratings yet

- D g1Document48 pagesD g1hemanggorNo ratings yet

- D F4Document37 pagesD F4hemanggorNo ratings yet

- T1 D4Document55 pagesT1 D4hemanggorNo ratings yet

- T1 D2Document56 pagesT1 D2hemanggorNo ratings yet

- D F2Document67 pagesD F2hemanggorNo ratings yet

- 2TDocument70 pages2ThemanggorNo ratings yet

- D F5Document87 pagesD F5hemanggorNo ratings yet

- D F2Document60 pagesD F2hemanggorNo ratings yet

- T1 D3Document19 pagesT1 D3hemanggorNo ratings yet

- D F1Document56 pagesD F1hemanggorNo ratings yet

- D1 T4Document106 pagesD1 T4hemanggorNo ratings yet

- D1 T1Document44 pagesD1 T1hemanggorNo ratings yet

- T1 D1Document28 pagesT1 D1hemanggorNo ratings yet

- D1 T5Document34 pagesD1 T5hemanggorNo ratings yet

- Time D 1Document69 pagesTime D 1hemanggorNo ratings yet

- D1 T2Document67 pagesD1 T2hemanggorNo ratings yet

- D1 T3Document37 pagesD1 T3hemanggorNo ratings yet

- D%1Document87 pagesD%1hemanggorNo ratings yet

- T 3Document79 pagesT 3hemanggorNo ratings yet

- T1Document57 pagesT1hemanggorNo ratings yet

- T 4Document74 pagesT 4hemanggorNo ratings yet

- D% 2Document57 pagesD% 2hemanggorNo ratings yet

- D 15Document77 pagesD 15hemanggorNo ratings yet

- T 5Document61 pagesT 5hemanggorNo ratings yet

- D%Document78 pagesD%hemanggorNo ratings yet