Professional Documents

Culture Documents

City of Taylor, TIFA Lawsuit Against Wayne County

Uploaded by

David Komer0 ratings0% found this document useful (0 votes)

2K views132 pagesThis is a copy of the North Line Agreement Lawsuit from Taylor and its Tax Increment FInance Authority and Wayne County.

Original Title

City of Taylor, TIFA lawsuit against Wayne County

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is a copy of the North Line Agreement Lawsuit from Taylor and its Tax Increment FInance Authority and Wayne County.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views132 pagesCity of Taylor, TIFA Lawsuit Against Wayne County

Uploaded by

David KomerThis is a copy of the North Line Agreement Lawsuit from Taylor and its Tax Increment FInance Authority and Wayne County.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 132

STATE OF MICHIGAN

IN THE CIRCUIT COURT FOR THE COUNTY OF WAYNE

TAX INCREMENT FINANCE AUTHORITY

OF THE CITY OF TAYLOR,

a public body corporate, and

THE CITY OF TAYLOR,

a Michigan public body corporate

Plaintiffs, Case No. -CZ

Hon.

v.

THE COUNTY OF WAYNE,

a Michigan public body corporate

Defendant.

_____________________________________________________________________________/

Gustaf R. Andreasen (P40956) David F. Greco (P53523)

Michael F. Wais (P45482) Gasiorek Morgan Greco & McCauley PC

Howard & Howard Attorneys PLLC Attorney for Plaintiff:

Attorneys for Plaintiff: THE CITY OF TAYLOR

TAX INCREMENT FINANCE AUTHORITY 30500 Northwestern Hwy. Ste. 425

OF THE CITY OF TAYLOR Farmington Hills, MI 48334

450 West Fourth Street (248) 865-0001

Royal Oak, Michigan 48067

(248) 645-1483

_____________________________________________________________________________/

There is no other civil action arising out of the same transaction or

occurrence as alleged in this Complaint pending in this court nor has any such

action previously been filed and dismissed after having been assigned to a judge.

COMPLAINT

NOW COMES Plaintiffs, the TAX INCREMENT FINANCE AUTHORITY OF THE

CITY OF TAYLOR, and the CITY OF TAYLOR, all through their undersigned counsel, and for

their Complaint against Defendant, the COUNTY OF WAYNE, state as follows:

FILED IN MY OFFICE

WAYNE COUNTY CLERK

6/3/2014 3:54:57 PM

CATHY M. GARRETT

14-007181-CZ

DB

-2-

2582574v5

GENERAL OVERVIEW

In simple terms, The County of Wayne (the County) entered into an agreement with

the City of Taylor (the City) which, to date, took over Forty-One Million Dollars

($41,000,000) of funds belonging to the Tax Increment Finance Authority of the City of Taylor

(the Authority) and gave those funds to the County. The agreement through which the County

obtained the money is known as the Northline Road Agreement entered into between the City

and the County on July 21, 1988 (the Northline Road Agreement or the Agreement).

Despite the fact that the Authoritys money was being taken under the Northline Road

Agreement, the Authority was not a party to the Agreement and did not agree to the terms of the

Northline Road Agreement. Further, the Northline Agreement is not an effective Interlocal

Agreement under Michigans Urban Cooperation Act. Frankly, there is no legal or other basis to

permit the County or the City to take the Authoritys money.

The fact that the City signed the Northline Road Agreement does not provide the County

with a basis to keep the Authoritys money as Michigan law does not allow the City to enter into

agreements on behalf of the Authority. To the contrary, Michigan law provides that the

Authority is a separate and distinct public body that makes and enters into its own contracts on

its own behalf and in its own name. See e.g. MCL 125.1802 and 125.1807 and the Bylaws of

the Authority, Article IV, Section 1.

Moreover, the Countys taking of the Authoritys money which comes from an attempt

in the Northline Road Agreement to exclude the Countys millage from capture by the Authority

- is likewise not permissible because Michigan law does not allow the County to opt out of

capture by the Authority. See e.g. MCL 125.1801 et seq. The Countys taking of the money is

also contrary to Michigan law because the Authority is legally required under Michigan law to

-3-

2582574v5

expend its revenues only in accordance with its tax increment financing plan, which does not

authorize the County to take the Authoritys money. See e.g. MCL 125.1814. To the contrary,

the Authoritys funds must be used within its tax financing district (located within the City of

Taylor). See e.g. MCL 125.1814. However, with the Countys misappropriation of the

Authoritys funds, the over $41,000,000 that was legally required to be spent within the tax

financing district has been and continues to be spent by the County throughout Wayne County,

thereby taking funds belonging to the City of Taylor residents and using those funds throughout

the County instead of inside the City of Taylor as legally required.

Furthermore, Interlocal Agreements between public agencies (such as the Authority and

County) for sharing revenue derived from the levy of general ad valorem property taxes are

not effective unless these agreements meet the requirements set forth in the Michigan Urban

Cooperation Act (the UCA). See MCL 124.505a. The Northline Agreement does not meet

these requirements.

For instance, the UCA provides that a valid Interlocal Agreement must include a

provision stating that the agreement may be terminated or rescinded by a referendum of the

residents of a local governmental unit that is a party to the agreement not more than 45 days

after the approval of the agreement by the governing body of the local governmental unit. See

MCL 124.505a. The Northline Agreement does not contain such a provision. (See Exhibit A).

Next, the UCA provides that the legislative body of each local governmental unit

shall hold at least 1 public hearing before entering into an agreement under this section. See

MCL 125.505a. Upon information and belief, the parties never held a public hearing before

entering into the Northline Agreement.

-4-

2582574v5

The UCA provides that [p]rior to its effectiveness, an interlocal agreement shall be filed

with the county clerk of each county where a party to the agreement is located and with the

secretary of state. See MCL 124.510. The Northline Agreement was never filed with the

Wayne County Clerk, nor with the Secretary of State of Michigan.

Finally,

[i]f funds of this state are to be allocated to carry out an interlocal agreement,

prior to and as a condition precedent to its effectiveness, shall be submitted to the

governor who shall determine whether the agreement is in proper form and

compatible with the laws of this state.

See MCL 124.510. To the extent that any State Funds were used in the Northline Road

construction, the Northline Agreement would also be ineffective under the UCA as, upon

information and belief, the Governor of the State of Michigan did not approve the Northline

Road Agreement.

Obviously, agreements such as the Northline Road Agreement that purport to take

someones money without their permission are not enforceable. Likewise, contracts such as the

Northline Road Agreement that are founded upon acts that are prohibited by statute or public

policy are void. Accordingly, for these and other reasons set forth in this Complaint, Plaintiffs

request that this Court declare the Northline Road Agreement void and/or not enforceable.

Even if the Northline Road Agreement had, at one time, been legally enforceable and it

was not the County has nevertheless been unjustly enriched by taking over $41,000,000 from

the Authority.

In this regard, the Authority never had a contract with the County and never received

anything of benefit for the taking of more than $41,000,000 of its funds. Thus, at the very least,

the County must return the Authoritys money under an unjust enrichment claim.

-5-

2582574v5

Furthermore, although irrelevant to the Plaintiffs unjust enrichment claims, the County

was also unjustly enriched as compared to the City. The County took the Authoritys money

under the Northline Road Agreement to repay the County for the money the County spent to

widen two miles of Northline Road between Allen Road and Telegraph Road. However, the

County has long ago been repaid this money it spent to widen Northline Road indeed, the over

$41,000,000 taken from the Authority has repaid the County approximately 6 times more than it

spent to widen the road.

Finally, upon information and belief, the County did not take any funds from any other

municipality to widen Northline Road, despite the fact that the road was widened with County

funds in other municipalities at or about the same time as it was widened in the City of Taylor.

By treating the City of Taylor detrimentally differently than other similarly situated

municipalities likewise resulted in an unjust enrichment to the County.

Despite the foregoing, the County has refused to terminate the Northline Road

Agreement and, incredibly, seeks to continue to collect the Authoritys funds through 2030

(which is the current date under which the Authority will continue to operate)! If allowed to

continue, the County could take at least another $30,000,000 from the Authority, further unjustly

enriching the County and further harming the City, the Authority, and the residents of the City of

Taylor whose TIF funds will continue to be spent throughout the County instead of where they

are legally required to be spent inside of the tax financing district for the City of Taylor.

PARTIES, JURISDICTION, AND VENUE

1. The Authority was incorporated by the City on or about April 12, 1983 and is a

public body corporate which may sue and be sued in any court of this state.

-6-

2582574v5

2. The City is a Municipal Corporation created by the vote of the electors on the

8th day of November, A.D., 1966, to be known as the "City of Taylor" [and] shall be a body

corporate and politic and shall have perpetual succession.

3. The County is a body corporate [that] possesses home rule power enabling it to

provide for any matter of County concern and all powers conferred by constitution or law upon

charter counties or upon general law counties, their officers, or agencies.

4. This Court has jurisdiction pursuant to MCR 2.605(A)(2) because there is an

actual controversy within this Courts jurisdiction necessitating a declaration of legal rights

between the parties.

5. Further, the Court has jurisdiction pursuant to MCL 600.605 because the amount

in controversy exceeds twenty-five thousand dollars ($25,000.00), exclusive of interest and

costs.

6. Venue is proper with this Honorable Court pursuant to MCL 600.1615 because

the parties hereto exercise and may exercise governmental authority in the County of Wayne

and/or the principal office of each party lies within the Count of Wayne.

BACKGROUND

7. On or about April 12, 1983, and pursuant to Michigans Tax Increment Finance

Act (the Act), the City of Taylor (the City) incorporated the Tax Increment Finance

Authority

1

of the City of Taylor (the Authority).

8. The City established the Authority to perform economic development activities

within the City such as rehabilitation, restoration, or reconstruction of public facilities, existing

buildings, and multi-family homes (Economic Development). To fulfill its objectives, the

1

There were originally 6 contiguous TIFA Development Areas; however, these were consolidated into a single

TIFA Development Area in 2000.

-7-

2582574v5

Authority created a Development Plan and a Financing Plan (collectively the Plans) (See

Exhibit C). The Plans describe Development Areas (Development Areas). The Authority uses

tax increment financing (TIF) to finance Economic Development within the Development

Areas. TIF permits the Authority to capture tax revenues attributable to increases in the value of

real and personal property located within the Development Areas. For instance, assume a

property in the Development Area initially pays taxes of $10,000. The Authority subsequently

rehabilitates and restores the surrounding area. Property values increase. As a result of

increased property values, the property now pays $12,000 in taxes. Under TIF, the Authority is

entitled to the additional $2,000. The Authority uses the TIF revenue for continued Economic

Development.

9. The Act mandates that taxing jurisdictions which overlap the Development Areas,

such as the County of Wayne (the County), remit TIF revenues to the Authority. (See Exhibit

B). Taxing jurisdictions are not permitted to exclude their millage from capture by the

Authority. (See Exhibit B).

10. The County has recognized that the concept of tax increment financing

authorized by [the Act], is a valuable tool used by the City to provide public infrastructure

(See Exhibit A).

11. Nonetheless, the County determined, in direct contravention of the statute and of

public policy, that the concept of tax increment financing should be modified. (See Exhibit

A).

12. On July 21, 1988, based upon the Countys assertion that it is allowed to modify

Michigan law to better suit its own interests, the City and the County entered into an agreement

(the Northline Road Agreement) whereby the City agreed to exclude the Countys charter

-8-

2582574v5

millage of 6.07, its extra voted millage of 1.00 mils and any additional voted millage from any

present or any subsequently created tax increment financing district under P.A. 450 of 1980 or

P.A. 281 of 1986 in exchange for the County temporarily assuming jurisdiction of that portion

of Northline Road between Allen Road and Inkster Road within the City and funding the

widening of Northline Road between Allen Road and Telegraph Road a span of approximately

two miles. (See Exhibit A).

13. The Northline Road Agreement does not contain a provision stating that the

agreement may be terminated or rescinded by a referendum of the residents of a local

governmental unit that is a party to the agreement not more than 45 days after the approval of the

agreement by the governing body of the local governmental unit. See MCL 124.505a.

14. Upon information and belief, a public hearing was not held before the County and

City entered into the Northline Agreement. See MCL 124.505a.

15. The Northline Agreement was not filed with the county clerk of [Wayne County]

and with the secretary of state. See MCL 124.510.

16. Upon information and belief, the Northline Agreement was never submitted to

the governor [to] determine whether the agreement is in proper form and compatible with the

laws of this state. See MCL 124.510.

17. The funds to be excluded and taken by the County pursuant to the Northline

Road Agreement are TIF funds.

18. TIF funds are required to be given to the Authority and used only to fund projects

within the Development Areas.

19. The Authority is a separate legal entity from the City.

-9-

2582574v5

20. The Authority is legally required to enter into its own contracts on its own behalf

and in its own name.

21. The Authority did not sign or enter into the Agreement.

22. Upon information and belief, the Authority was not asked to sign or enter into the

Agreement.

23. Upon information and belief, the Authority did not authorize the City to enter into

the Agreement on behalf of the Authority.

24. The Authority did not agree to allow its funds to be given to the County.

25. But for the Agreement, the City would have paid the funds that have been taken

by the County to the Authority.

26. The Countys taking of the tax revenues under the Northline Road Agreement is

equivalent to the County opting out of tax increment financing districts.

27. Michigan law does not permit the County to opt out of the tax increment

financing districts.

28. The Authority is legally required to expend its revenues only in accordance with

the tax increment financing plan.

29. The Plan requires the Authoritys revenues to be expended within the

Development Areas.

30. The Authoritys tax increment financing plan does not authorize the County to use

TIF funds - and certainly does not authorize the County to use TIF funds outside of the

Development Areas.

-10-

2582574v5

31. The Countys taking of the funds under the Northline Road Agreement resulted in

the County taking money from the City of Taylor and the Authority to use throughout the County

as opposed to being used solely within the Development Areas for economic development.

32. The County used TIF funds outside of the TIF districts.

33. Upon information and belief, the Northline Road construction began in

approximately 1989 and was completed in approximately 1990.

34. Upon information and belief, the County expended approximately $7,000,000 to

widen Northline Road in the City of Taylor.

35. As a result of the Northline Road Agreement, the County has already excluded

$41,379,722.97 of its millage from capture by the Authority. (See Exhibit D).

36. If allowed to continue to capture funds under the Northline Agreement, the

County could receive another $30,000,000 or more between the date hereof and 2030 when the

Authority is presently set to terminate.

37. The Authority did not receive a benefit from the County in exchange for the

Countys taking of the TIF funds.

38. The County has more than been repaid under the Northline Road Agreement for

the funds it expended to widen Northline Road within the City of Taylor.

39. At or about the same time that the County widened Northline Road within the

City of Taylor, County funds were also used to widen Northline Road in Romulus and

Southgate.

40. Upon information and belief, the County did not collect funds from Romulus or

Southgate (or any other municipality or public entity) to pay for the widening of Northline Road

in Romulus and Southgate.

-11-

2582574v5

41. As a result, upon information and belief, the County treated the residents of the

City of Taylor detrimentally different than the residents of the Cities of Romulus and Southgate

as the County only took funds from the City of Taylor and/or the Authority and not from these

other municipalities for the same project.

42. To compound the foregoing detrimentally different treatment, the County took

TIF funds that were to be used in the Development Areas and used the funds throughout the

County.

43. Despite the fact that it has been repaid for the widening of Northline Road many

times over, and to add further insult to the injuries suffered by the Authority, the City, and the

residents of the City of Taylor, the County also required the City to, once again assume

the responsibility for the maintenance of Northline Road as herein described at

its sole cost and expense, including by way of illustration, but not of limitation,

grass maintenance, landscaping, gardening, sprinkler system maintenance,

lighting, and any other special median facilities construction and/or installed

therein: and the County shall be relieved of all responsibility therefor.

(See Exhibit A). Should major reconstruction of the median or curb be required at any time

after the completion of the [Northline Road widening], the costs thereof shall be the sole

responsibility of the City. (See Exhibit A).

44. Since the completion of construction on Northline Road in approximately 1990,

the County has continued to unlawfully exclude its millage from capture by the Authority. (See

Exhibit D).

45. To date the County has unlawfully excluded more than $41,000,000 from capture

by the Authority. (See Exhibit D).

-12-

2582574v5

46. Furthermore, under the illicit terms of the Northline Road Agreement, the County

expects to continue to exclude its millage from capture by the Authority and LDFA until the

[Development Areas are] dissolved. (See Exhibit A).

47. All told, the County, pursuant to an illegal contract, traded a one time construction

cost of approximately $7,000,000 for a perpetual benefit already in excess of $41,000,000 and

counting.

COUNT I

DECLARATORY RELIEF IN FAVOR OF THE CITY OF TAYLOR

48. Plaintiffs incorporates all prior allegations as if set forth herein in full.

49. The City of Taylor has repeatedly requested that the County terminate the

Northline Road Agreement as, inter alia, the contract is void, against public policy, and is

otherwise invalid for all of the reasons set forth above.

50. The County continues to refuse to terminate the Northline Road Agreement,

continues to insist upon receiving the TIF funds that belong to the Authority and apparently

claims that the Northline Road Agreement is valid and enforceable.

51. The Northline Road Agreement is void, against public policy and otherwise

invalid and unenforceable for the following reasons:

a. It takes money that belongs to the Authority without the Authoritys permission.

b. It takes money that belongs to the Authority that it is prohibited from taking under

Michigan law because the Act prohibits the County from exclude[ing] the Countys

Charter millage of 6.07, its extra voted millage of 1.00 mils and any additional voted

millage from any present or any subsequently created tax increment financing districts.

-13-

2582574v5

c. The County cannot contractually agree to a course of action that is not permitted

by statute.

d. The City did not, and does not, have the authority to contractually bind the

Authority.

e. Under the UCA, the Northline Agreement is not an effective Interlocal

Agreement.

f. Michigan law does not allow the County to opt out of the capture of TIF funds

by the Authority. See e.g. MCL 125.1801 et. seq.

g. The Countys taking of the Authoritys money is also contrary to Michigan law as

the Authority is legally required under Michigan law to expend its revenues only in

accordance with its Plan, which does not authorize the County to take the Authoritys

money. See e.g. MCL 125.1814. To the contrary, the Authoritys funds must be used

within the Development Areas (located within the City of Taylor). See e.g. MCL

125.1814.

h. The Countys misappropriation of the Authoritys funds that were legally

required to be spent within the Development Areas have been and continue to be spent by

the County throughout Wayne County, thereby taking funds belonging to the City of

Taylor residents and using those funds throughout the County instead of inside the City

of Taylor as legally required.

i. The County is not permitted to treat the City of Taylor, its residents, or the

Authority detrimentally different than the other municipalities and residents of the

County, but by taking the TIF funds without taking funds from any other municipality

where Northline Road was widened with the usage of County funds, the County is

-14-

2582574v5

treating the City of Taylor, its residents, and the Authority inequitably as compared to

other similarly situated municipalities and residents.

52. There is an actual controversy over whether or not the Northline Road Agreement

is valid and, as such, the City of Taylor requests that this Court declare the rights and other legal

relations of the parties with respect to the Northline Road Agreement.

WHEREFORE, the City of Taylor requests a declaratory judgment providing the

following judicial declarations:

a. The Northline Road Agreement is illegal, void, and/or otherwise unenforceable.

b. The City is not bound by the Northline Road Agreement.

c. The TIF Funds that had been taken by the County, or which would otherwise be

taken by the County, under the Northline Agreement are to be given to the Authority.

d. No further TIF Funds or other funds are to be taken by the County under the

Northline Road Agreement.

e. Enjoin the County from demanding, pursuing or receiving any further funds under

the Northline Road Agreement.

f. The County may not exclude its charter millage of 6.07, its extra voted millage of

1.00 mils and any additional voted millage from any present or any subsequently created

tax increment financing districts.

g. Grant all other appropriate and equitable relief that the Court deems proper.

COUNT II

DECLARATORY RELIEF IN FAVOR OF THE AUTHORITY

53. Plaintiffs incorporates all prior allegations as if set forth herein in full.

-15-

2582574v5

54. The Authority has requested that the County terminate the Northline Road

Agreement as, inter alia, the contract is void, against public policy, and is otherwise invalid for

all of the reasons set forth above.

55. The County continues to refuse to terminate the Northline Road Agreement,

continues to insist upon receiving the TIF funds that belong to the Authority, and apparently

claims that the Northline Road Agreement is valid and enforceable.

56. The Northline Road Agreement is void, against public policy and otherwise

invalid and unenforceable for each of the following reasons:

a. It takes the Authoritys money without the Authoritys permission.

b. It takes money that belongs to the Authority that it is prohibited from taking under

Michigan law because the Act does not permit the County to exclude the Countys

Charter millage of 6.07, its extra voted millage of 1.00 mils and any additional voted

millage from [the Authority nor] any present or any subsequently created tax increment

financing districts within the Citys boundaries.

c. The County cannot contractually agree to a course of action that is not permitted

by statute.

d. The City did not, and does not, have the authority to contractually bind the

Authority.

e. Under the UCA, the Northline Agreement is not an effective Interlocal

Agreement.

f. Michigan law does not allow the County to opt out of the capture of tax revenue

by the Authority. See e.g. MCL 125.1801 et. seq.

-16-

2582574v5

g. The Countys taking of the Authoritys money is also contrary to Michigan law

because the Authority is legally required under Michigan law to expend its revenues only

in accordance with the tax increment financing plan which does not authorize the money

to be taken by the County. See e.g. MCL 125.1814. To the contrary, the Authoritys

funds must be used within the Development Areas (located within the City of Taylor).

See e.g. MCL 125.1814.

h. The Countys misappropriation of the Authoritys funds that were legally required

to be spent within the Development Areas has been and is continuing to be spent by the

County throughout Wayne County, thereby taking funds belonging to the City of Taylor

residents and using those funds throughout the County instead of inside the City of

Taylor as legally required.

i. The County is not permitted to treat the City of Taylor, its residents or the

Authority detrimentally different than the other municipalities and residents of the

County, but by taking the TIF funds without taking funds from any other municipality

where Northline Road was widened with the usage of County funds, the County is

treating the City of Taylor, its residents and the Authority inequitably as compared to

other similarly situated municipalities and residents.

57. There is an actual controversy over whether or not the Northline Road Agreement

is valid and, as such, the Authority requests that this Court declare the rights and other legal

relations of the parties with respect to the Northline Road Agreement.

WHEREFORE, the Authority requests a declaratory judgment providing the following

judicial declarations:

a. The Northline Road Agreement is illegal, void, and/or otherwise unenforceable.

-17-

2582574v5

b. The Authority is not bound by the Northline Road Agreement.

c. The TIF Funds that had been taken by the County, or which would otherwise be

taken by the County, under the Northline Agreement are to be given to the Authority.

d. No further TIF Funds or other funds are to be taken by the County under the

Northline Road Agreement.

e. Enjoin the County from demanding, pursuing or receiving any further funds under

the Northline Road Agreement.

f. The County may not exclude its charter millage of 6.07, its extra voted millage of

1.00 mils and any additional voted millage from any present or any subsequently created

tax increment financing districts.

g. Grant all other appropriate and equitable relief that the Court deems proper.

COUNT III

UNJUST ENRICHMENT IN FAVOR OF THE AUTHORITY

58. Plaintiffs incorporates all prior allegations as if set forth herein in full.

59. The Authority did not receive a benefit from the Countys taking of its funds.

60. The County unjustly received a benefit of $41,379,722.97 to the detriment of the

Authority.

61. The County would continue to be unjustly enriched if it continued to receive

additional funds pursuant to the Northline Road Agreement.

62. It would be inequitable for the County to retain these benefits.

WHEREFORE, the Authority respectfully requests that this Court order the

County to pay the Authority all funds the County received under the Northline Road Agreement

(plus statutory interest), order that no further funds are to be paid to the County under the

-18-

2582574v5

Northline Road Agreement and granting the Authority such further and other relief as it may

request and this Court may deem appropriate.

COUNT IV

UNJUST ENRICHMENT IN FAVOR OF THE CITY

63. Plaintiffs incorporates all prior allegations as if set forth herein in full.

64. The City did not receive an equivalent benefit from the Countys taking of the

Authoritys funds.

65. The County unjustly received a substantial benefit to the detriment of the City.

66. The County would continue to be unjustly enriched if it continued to receive

additional funds pursuant to the Northline Road Agreement.

67. It would be inequitable for the County to retain these benefits.

WHEREFORE, the City respectfully requests that this Court order the County to pay the

City all funds the County received under the Northline Road Agreement (plus statutory interest),

order that no further funds are to be paid to the County under the Northline Road Agreement and

granting the City such further and other relief as it may request and this Court may deem

appropriate.

Respectfully submitted,

HOWARD & HOWARD ATTORNEYS PLLC

/s/ Gustaf R. Andreasen

Gustaf R. Andreasen (P40956)

Michael F. Wais (P45482)

Attorneys for Plaintiff:

TAX INCREMENT FINANCE AUTHORITY

OF THE CITY OF TAYLOR

450 West Fourth Street

Royal Oak, Michigan 48067

(248) 645-1483

-19-

2582574v5

GASIOREK MORGAN GRECCO & MCCAULEY PC

/s/ David F. Greco, with consent

David F. Greco (P53523)

Attorneys for Plaintiff:

THE CITY OF TAYLOR

30500 Northwestern Hwy. Ste. 425

Farmington Hills, MI 48334

(248) 865-0001

Dated: June 3, 2014

Exhibit A

Exhibit B

Exhibit C

Exhibit D

You might also like

- Viviero Vs CA G.R. No. 138938 October 24, 2000Document10 pagesViviero Vs CA G.R. No. 138938 October 24, 2000herbs22225847No ratings yet

- Kindred Torts Digests (Set 6)Document15 pagesKindred Torts Digests (Set 6)jetzon2022No ratings yet

- University of the East Held Liable for Damages Despite Negligence of ProfessorsDocument8 pagesUniversity of the East Held Liable for Damages Despite Negligence of ProfessorsMasterboleroNo ratings yet

- CIR Vs ReyesDocument16 pagesCIR Vs Reyes123456789No ratings yet

- Contex Corporation vs. CIR Persons LiableDocument16 pagesContex Corporation vs. CIR Persons LiableEvan NervezaNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Document9 pagesCommissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Mariel ManingasNo ratings yet

- Expropriation in EuropeDocument31 pagesExpropriation in EuropeCentar za ustavne i upravne studije100% (1)

- Evidence Rules DigestDocument6 pagesEvidence Rules DigestKylie Kaur Manalon DadoNo ratings yet

- Annex B - Data Requirements in Excel FormDocument87 pagesAnnex B - Data Requirements in Excel Formruss8diko100% (1)

- Bustos vs. Millians Shoe, Inc.Document12 pagesBustos vs. Millians Shoe, Inc.Krystal Grace D. PaduraNo ratings yet

- Alamayri vs. PabaleDocument25 pagesAlamayri vs. Pabaleanon_614984256No ratings yet

- Full Text Evidence. Module 1 CasesDocument102 pagesFull Text Evidence. Module 1 CasesCarla CariagaNo ratings yet

- Capitol Medical Center, Inc. vs. Trajano, 462 SCRA 457, June 30, 2005Document9 pagesCapitol Medical Center, Inc. vs. Trajano, 462 SCRA 457, June 30, 2005Mark ReyesNo ratings yet

- Supreme Transliner, Inc. vs. BPI Family Savings Bank, Inc.Document17 pagesSupreme Transliner, Inc. vs. BPI Family Savings Bank, Inc.Xtine CampuPotNo ratings yet

- Engtek v. CIR PDFDocument16 pagesEngtek v. CIR PDFArnold Rosario ManzanoNo ratings yet

- Torres and de Jesus vs. Sicat Vda. de MoralesDocument6 pagesTorres and de Jesus vs. Sicat Vda. de MoralesRoizki Edward MarquezNo ratings yet

- Income Tax Syllabus. Rev. Jan. 2021Document13 pagesIncome Tax Syllabus. Rev. Jan. 2021Macapado HamidahNo ratings yet

- DigestDocument8 pagesDigestDewm DewmNo ratings yet

- SPOUSES RENATO S DigDocument5 pagesSPOUSES RENATO S DigCharlie PeinNo ratings yet

- Diona vs. Balangue, 688 SCRA 22, January 07, 2013Document18 pagesDiona vs. Balangue, 688 SCRA 22, January 07, 2013TNVTRLNo ratings yet

- Sample Judicial AffidavitDocument3 pagesSample Judicial AffidavitRoland Bon IntudNo ratings yet

- Aniceto G. Saludo, JR., Petitioner, vs. American Express International, Inc., and - or Ian T. Fish and Dominic Mascrinas, Respondents.Document3 pagesAniceto G. Saludo, JR., Petitioner, vs. American Express International, Inc., and - or Ian T. Fish and Dominic Mascrinas, Respondents.Shailah Leilene Arce BrionesNo ratings yet

- Final Scrimp Rob Lock A Pen A Clemente ADocument5 pagesFinal Scrimp Rob Lock A Pen A Clemente Aemen penaNo ratings yet

- Gulam vs. SantosDocument14 pagesGulam vs. SantosBLNNo ratings yet

- Specpro Rule 109 - Case DigestsDocument6 pagesSpecpro Rule 109 - Case DigestsAlbert BantanNo ratings yet

- Ong - Eagleridge DigestDocument7 pagesOng - Eagleridge DigestJesimiel CarlosNo ratings yet

- Philippines murder evidenceDocument3 pagesPhilippines murder evidenceNika RojasNo ratings yet

- CIR vs. BenipayoDocument5 pagesCIR vs. BenipayoHannah BarrantesNo ratings yet

- Petitioner Vs Vs Respondents Jose Y. Torres G. D. Demaisip C. A. DabalusDocument4 pagesPetitioner Vs Vs Respondents Jose Y. Torres G. D. Demaisip C. A. DabalusKier Christian Montuerto InventoNo ratings yet

- Ong Vs People G.R. NO. 190475 April 10, 2013Document1 pageOng Vs People G.R. NO. 190475 April 10, 2013Emrico CabahugNo ratings yet

- GR 120935 - Adamson Vs CIRDocument11 pagesGR 120935 - Adamson Vs CIRJane MarianNo ratings yet

- Bautsita V BarriosDocument3 pagesBautsita V Barriosnia_artemis3414No ratings yet

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocument11 pages35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNo ratings yet

- US vs. MercadoDocument4 pagesUS vs. MercadoCarmelito Dante ClabisellasNo ratings yet

- 242-Castro v. CIR G.R. No. L-12174 April 26, 1962Document11 pages242-Castro v. CIR G.R. No. L-12174 April 26, 1962Jopan SJNo ratings yet

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinNo ratings yet

- GUAGUA NATIONAL COLLEGE V CA RULINGDocument2 pagesGUAGUA NATIONAL COLLEGE V CA RULINGRhodz Coyoca EmbalsadoNo ratings yet

- Vidal de Roces V PosadasDocument1 pageVidal de Roces V PosadasKat Dela PazNo ratings yet

- Set2 Cases SpeproDocument58 pagesSet2 Cases SpeproLynetth LclNo ratings yet

- People of The Philippines v. TundagDocument1 pagePeople of The Philippines v. TundagBenBulacNo ratings yet

- G.R. No. 106231hawaiianDocument5 pagesG.R. No. 106231hawaiianAmicus CuriaeNo ratings yet

- Union Bank v. Santibañez PDFDocument3 pagesUnion Bank v. Santibañez PDFAnne Dela CruzNo ratings yet

- Sabay v. PeopleDocument3 pagesSabay v. PeopleMitch BarandonNo ratings yet

- Medical Malpractice and Damages ComplaintDocument8 pagesMedical Malpractice and Damages ComplaintResci Angelli Rizada-NolascoNo ratings yet

- Federal Trade Commission Vs ActavisDocument43 pagesFederal Trade Commission Vs ActavisJames LindonNo ratings yet

- A.L. ANG NETWORK, INC., Petitioner, EMMA MONDEJAR, Accompanied by Her Husband, EFREN MONDEJAR, Respondent. G.R. No. 200804, January 22, 2014 DoctrineDocument2 pagesA.L. ANG NETWORK, INC., Petitioner, EMMA MONDEJAR, Accompanied by Her Husband, EFREN MONDEJAR, Respondent. G.R. No. 200804, January 22, 2014 Doctrinekate joan madridNo ratings yet

- 16 Manila Electric v. RemonquilloDocument6 pages16 Manila Electric v. RemonquilloPaolo Enrino PascualNo ratings yet

- Spec Pro Digest 2Document7 pagesSpec Pro Digest 2Jon BandomaNo ratings yet

- Widow Appeals Deficiency Tax Assessments Due to Lack of Accounting RecordsDocument2 pagesWidow Appeals Deficiency Tax Assessments Due to Lack of Accounting RecordsLDNo ratings yet

- 304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Document9 pages304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Jopan SJ100% (1)

- Case Digest - Damages - PARCEDocument7 pagesCase Digest - Damages - PARCESkylee SoNo ratings yet

- San Roque Vs CirDocument2 pagesSan Roque Vs Cirj guevarraNo ratings yet

- 1 - G R - No - 180677Document2 pages1 - G R - No - 180677Denise DianeNo ratings yet

- Kepco Philippines Corporation Vs. CIR VAT Refund CaseDocument4 pagesKepco Philippines Corporation Vs. CIR VAT Refund CaseWhere Did Macky GallegoNo ratings yet

- PLDT Vs CADocument2 pagesPLDT Vs CAAissa VelayoNo ratings yet

- CIR Vs Far East BankDocument1 pageCIR Vs Far East BankRodney SantiagoNo ratings yet

- HHFBHJDocument14 pagesHHFBHJvincent anthonyNo ratings yet

- Ajero v. CA-Lim (D2017)Document2 pagesAjero v. CA-Lim (D2017)Kyle David IrasustaNo ratings yet

- Systems Plus Computer College Vs Caloocan CityDocument4 pagesSystems Plus Computer College Vs Caloocan CityRachelle DomingoNo ratings yet

- Williams v. Hagood, 98 U.S. 72 (1878)Document4 pagesWilliams v. Hagood, 98 U.S. 72 (1878)Scribd Government DocsNo ratings yet

- Popeyes Gratiot Complaint 7-24-18-SignedDocument8 pagesPopeyes Gratiot Complaint 7-24-18-SignedAnonymous RPwles6No ratings yet

- DPD Event Report 1 Cornell DeathDocument1 pageDPD Event Report 1 Cornell DeathDavid KomerNo ratings yet

- Taylor Mayor Rick Sollars IndictmentDocument37 pagesTaylor Mayor Rick Sollars IndictmentDavid KomerNo ratings yet

- SCSPD Press Release July 18 2019Document31 pagesSCSPD Press Release July 18 2019Anonymous qoi5xbNo ratings yet

- Detroit Police Interview 1 Chris Cornell DeathDocument1 pageDetroit Police Interview 1 Chris Cornell DeathDavid KomerNo ratings yet

- Rizzo Plea Hearing ScheduledDocument1 pageRizzo Plea Hearing ScheduledDavid KomerNo ratings yet

- WSU Jack Lessenberry Investigation Final Report 7.17.18 Title IXDocument15 pagesWSU Jack Lessenberry Investigation Final Report 7.17.18 Title IXDavid KomerNo ratings yet

- Ex-Clinton Twp. Trustee Dean Reynolds Lied About Cancer To Get Out of JailDocument12 pagesEx-Clinton Twp. Trustee Dean Reynolds Lied About Cancer To Get Out of JailDavid KomerNo ratings yet

- Michigan Supreme Court Ruling On Ex-Sen. Virgil Smith CaseDocument73 pagesMichigan Supreme Court Ruling On Ex-Sen. Virgil Smith CaseDavid KomerNo ratings yet

- Autopsy Report - Teen Who Died in ATV ChaseDocument18 pagesAutopsy Report - Teen Who Died in ATV ChaseDavid KomerNo ratings yet

- Chuck Rizzo Sentencing Memo For Macomb Co. Corruption ScandalDocument40 pagesChuck Rizzo Sentencing Memo For Macomb Co. Corruption ScandalDavid KomerNo ratings yet

- Detroit Police Interview 2 Chris Cornell DeathDocument1 pageDetroit Police Interview 2 Chris Cornell DeathDavid Komer100% (1)

- Ex-Fiat Chrysler Director Michael Brown Plea AgreementDocument27 pagesEx-Fiat Chrysler Director Michael Brown Plea AgreementDavid KomerNo ratings yet

- MSU Dr. William Strampel Arrest AffidavitDocument11 pagesMSU Dr. William Strampel Arrest AffidavitDavid KomerNo ratings yet

- Immigration Court OrderDocument35 pagesImmigration Court OrderClickon DetroitNo ratings yet

- Kwame Kilpatrick Claims in New Filing He Tried To Beat Up His AttorneyDocument38 pagesKwame Kilpatrick Claims in New Filing He Tried To Beat Up His AttorneyDavid KomerNo ratings yet

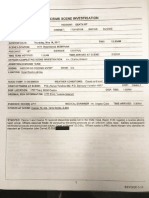

- Crime Scene Investigation 2 Cornell DeathDocument1 pageCrime Scene Investigation 2 Cornell DeathDavid KomerNo ratings yet

- DPD Event Report 2 Cornell DeathDocument1 pageDPD Event Report 2 Cornell DeathDavid KomerNo ratings yet

- Crime Scene Investigation 1 Cornell DeathDocument1 pageCrime Scene Investigation 1 Cornell DeathDavid KomerNo ratings yet

- Chris Cornell Investigation Report 2Document1 pageChris Cornell Investigation Report 2David KomerNo ratings yet

- Detroit Police Interview 3 Chris Cornell DeathDocument1 pageDetroit Police Interview 3 Chris Cornell DeathDavid Komer100% (1)

- Chris Cornell Investigation Report 1Document1 pageChris Cornell Investigation Report 1David Komer0% (1)

- Crime Scene Investigation 3 Cornell DeathDocument1 pageCrime Scene Investigation 3 Cornell DeathDavid KomerNo ratings yet

- DPD Inter-Office Memorandum Cornell DeathDocument1 pageDPD Inter-Office Memorandum Cornell DeathDavid KomerNo ratings yet

- Feds Accuse Doctor of Running Narcotics OperationDocument22 pagesFeds Accuse Doctor of Running Narcotics OperationDavid KomerNo ratings yet

- Reporting Officer Narrative Cornell Death 1Document1 pageReporting Officer Narrative Cornell Death 1David KomerNo ratings yet

- Novi Heroin Raid by DEADocument6 pagesNovi Heroin Raid by DEADavid KomerNo ratings yet

- Hamama Order 06-26-17Document7 pagesHamama Order 06-26-17WXYZ-TV Channel 7 DetroitNo ratings yet

- Court Stay ExtendedDocument3 pagesCourt Stay ExtendedClickon DetroitNo ratings yet

- Judge Issues Stay On Deportation Order For Iraqi Citizens in U.S.Document6 pagesJudge Issues Stay On Deportation Order For Iraqi Citizens in U.S.WXYZ-TV Channel 7 DetroitNo ratings yet

- Land Value Capture Finance For Transport Accessibility A Review 2012 Journal of Transport GeographyDocument8 pagesLand Value Capture Finance For Transport Accessibility A Review 2012 Journal of Transport GeographyZen ZeeNo ratings yet

- Good Jobs First Study On CPS AbatementsDocument17 pagesGood Jobs First Study On CPS AbatementsMadeline MitchellNo ratings yet

- Coordinating Economic Growth and Preservation in Chicago's Fulton Market Innovation DistrictDocument35 pagesCoordinating Economic Growth and Preservation in Chicago's Fulton Market Innovation DistrictTed LedNo ratings yet

- 2019 Suburban TIF SummaryDocument26 pages2019 Suburban TIF SummaryCrainsChicagoBusinessNo ratings yet

- Oregon Urban Renewal HistoryDocument70 pagesOregon Urban Renewal Historyনূরুন্নাহার চাঁদনীNo ratings yet

- Grocery Store PDFDocument36 pagesGrocery Store PDFARJUN HALDARNo ratings yet

- Case Study Real Estate and Land Value CaptureDocument54 pagesCase Study Real Estate and Land Value CaptureCombo DosmilseiscientosNo ratings yet

- Financing Economic Development - Lecture NotesDocument10 pagesFinancing Economic Development - Lecture NotesCoursePinNo ratings yet

- Mount Dora - Redevelopment Plan (Final)Document51 pagesMount Dora - Redevelopment Plan (Final)Andres GarzónNo ratings yet

- 1401 Elm ProposalDocument22 pages1401 Elm ProposalRobert WilonskyNo ratings yet

- Waguespack and Flores Introduce Sunshine Ordinance To Improve Transparency and Accessibility of TIF Redevelopment AgreementsDocument5 pagesWaguespack and Flores Introduce Sunshine Ordinance To Improve Transparency and Accessibility of TIF Redevelopment AgreementsjkalvenNo ratings yet

- HUD Letter of Findings of Non-ComplianceDocument29 pagesHUD Letter of Findings of Non-ComplianceTexas HousersNo ratings yet

- Downtown Revitalization/Public Goods PowerPoint PresentationDocument23 pagesDowntown Revitalization/Public Goods PowerPoint PresentationmattbuchananNo ratings yet

- Implementing Real TOD: DR Chris Hale Department of Infrastructure Engineering The University of MelbourneDocument35 pagesImplementing Real TOD: DR Chris Hale Department of Infrastructure Engineering The University of MelbourneAnonymous zqPnHPANo ratings yet

- SO2019-2583: Lincoln Yards Redevelopment AgreementDocument127 pagesSO2019-2583: Lincoln Yards Redevelopment AgreementjrNo ratings yet

- Mentor Tax Increment Financing LegislationDocument8 pagesMentor Tax Increment Financing LegislationThe News-HeraldNo ratings yet

- Austin Et Al. IndictmentDocument19 pagesAustin Et Al. IndictmentCrainsChicagoBusinessNo ratings yet

- SH0418Document16 pagesSH0418Anonymous 9eadjPSJNgNo ratings yet

- Agenda Packet For Caddo Commission Meeting Dec. 9, 2021Document224 pagesAgenda Packet For Caddo Commission Meeting Dec. 9, 2021Curtis HeyenNo ratings yet

- SH0620Document16 pagesSH0620Anonymous 9eadjPSJNgNo ratings yet

- Urban Planning TerminologyDocument8 pagesUrban Planning Terminologytanu kukrejaNo ratings yet

- Cui IndictmentDocument10 pagesCui IndictmentSteve WarmbirNo ratings yet

- Ministry of Economy Ukraine research institute reference Dr Maryna KlymchukDocument3 pagesMinistry of Economy Ukraine research institute reference Dr Maryna KlymchukDND IIMENo ratings yet

- IrvingCC Packet 2010-05-13Document396 pagesIrvingCC Packet 2010-05-13Irving BlogNo ratings yet

- 2021 Recommendations PDFDocument601 pages2021 Recommendations PDFWGN Web DeskNo ratings yet

- Courier: A Thousand WordsDocument20 pagesCourier: A Thousand WordsAnonymous 9eadjPSJNgNo ratings yet

- Vincent Schoemehl Deposition TranscriptDocument113 pagesVincent Schoemehl Deposition TranscriptAnonymous 0rAwqwyjVNo ratings yet

- OgdenPulaskiFINALPlan - Exhibits8 3 07Document265 pagesOgdenPulaskiFINALPlan - Exhibits8 3 07Valerie F. LeonardNo ratings yet

- Property Tax Billing and Collection RFPDocument33 pagesProperty Tax Billing and Collection RFPBikash Ranjan SatapathyNo ratings yet

- VFP Candidate Questionnaire - Mary May LarryDocument5 pagesVFP Candidate Questionnaire - Mary May LarryMichaelRomainNo ratings yet