Professional Documents

Culture Documents

T.D.S./T.C.S. Deposits Module: (Please Use Separate File For Each Assessment Year)

Uploaded by

kartheekanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T.D.S./T.C.S. Deposits Module: (Please Use Separate File For Each Assessment Year)

Uploaded by

kartheekanCopyright:

Available Formats

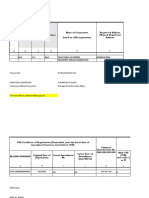

T.D.S./T.C.S. DEPOSITSNo.

MODULE

Characters

Deductor details: filled

TAN PTLA11515A 10

Name ABC LTD 7

Complete Address with City & State GGGGL LLLLLLLLL ;;;;;;;;;;;; 28

Telephone No. 222222222

PIN 110001

Assessment Year 2008-09 (Please use separate file for each assessment year)

To view codes for different sectons, click button scodes

Step1. Enter data in blank row

Step2. Go to challan sheet

Income Tax Surcharge Education Interest Penalty Total

Cess

SUMMARY OF DEPOSITS: 2,500 - 75 - - 2,575

Amount (in Rs. only) < Challan Identification Number(CIN) >

Record Deductee Section Income Tax Surcharge Education Interest Penalty Total Cheque No. Cheque Cheque drawn on bank and Payable by, BSR code Date of Serial Remarks

No. Code Code Cess dated branch Select 1 for (TDS/TCS of the deposit of number for

Payable by Taxpayer), Branch Challan challan

Select 2 for provided by

(TDS/TCS Regular bank

Assessment (Raised by

I.T.Dett.))

1 2 92B 2,500 75 2,575 200012 20-Jan-08 sbop,millerganj,delhi 1 5551001

- 1

- 1 ###

- 1 ###

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1

- 1 ###

- 1

- 1

- 1

- 1

-

-

-

-

*Important: Please see notes overleaf before

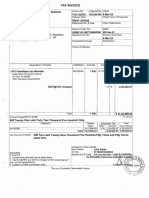

filling up the challan. T.D.S./T.C.S. TAX CHALLAN Single copy (to be sent to the ZAO)

Tax Applicable (Tick One)*

CHALLAN NO. / TAX DEDUCTED / COLLECTED AT SOURCE FROM Assessment

ITNS Year

281 (0020) COMPANY DEDUCTEES (0021) NON-COMPANY DEDUCTEES a

2 0 0 8 - 0 9

Tax Deduction Account No.(TAN)

P T L A 1 1 5 1 5 A

Full Name

A B C L T D

Complete Address with City & State

G G G G L L L L L L L L L L ; ; ; ; ; ; ; ; ; ; ; ;

Tel.No. 2 2 2 2 2 2 2 2 2 PIN 1 1 0 0 0 1

Type of Payment Code* 9 2 B

(Tick One) (Please see overleaf)

TDS/TCS Payable by Taxpayer (200) a FOR USE IN RECEIVING BANK

TDS/TCS Regular Assessment (Raised by I.T.Dett.) (400)

DETAILS OF PAYMENTS Debit to A/c / Cheque credited on

Amount (in Rs. Only)

Income Tax 2 5 0 0

Surcharge

Education Cess 7 5 D D M M Y Y

Interest SPACE FOR BANK SEAL

Penalty

Total 2 5 7 5

Total (in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Zero Zero Two Five Seven Five

Paid in Cash / Debit to A/c / Cheque No. 200012 Dated 20-Jan-08

Drawn on sbop,millerganj,delhi

(Name of the Bank and Branch)

Date: 30-Dec-99

Signature of person making payment Rs.

Tear off

Tax payers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

TAN P T L A 1 1 5 1 5 A

Received from ABC LTD

(Name)

Cash / Debit to A/c / Cheque No. 200012 For Rs. 2575

Rs. (in words) Two Thousand Five Hundred Seventy Five Only

drawn on sbop,millerganj,delhi

(Name of the Bank and Branch)

Company / Non Company Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at Source (TCS) from 92B (Fill up Code)

(Strike out whichever is not applicable)

for the Assessment Year 2 0 0 8 - 0 9

Rs.

*NOTES

1. Please note that quoting false TAN may attract a penalty of Rs.10,000/- as per section 272BB of I.T.Act.1961.

2 Use a Separate Challan for each Nature(Type) of Payment. The relevant Codes are:

Section Nature of payment Code

192 Payment to Govt.Employees other than Union Government Employees 9 2 A

192 Payment to Employees other than Govt.Employees 9 2 B

193 Interest on Securities 1 9 3

194 Dividend 1 9 4

194A Interest other than interest on securities 9 4 A

194B Winnings from lotteries and crossword puzzles 9 4 B

194BB Winnings from horse race 4 B B

194C Payment of contractors and sub-contractors 9 4 C

194D Insurance Commission 9 4 D

194E Payments to non-resident Sportsmen/Sports Associations 9 4 E

194EE Payments in respect of Deposits under National Savings Schemes 4 E E

194F Payments on account of Re-purchase of Units by Mutual Funds or UTI 9 4 F

194G Commission, prize etc. on sale of Lottery tickets 9 4 G

194H Commission or Brokerage 9 4 H

194I Rent 9 4 I

194J Fees For Professional Or Technical Services 9 4 J

194K Income payable to a Resident Assessee in respect of Units of a specified Mutual Funds or of the Units of the UTI 9 4 K

194LA Payment of Compensation on acquisition of certain immovable property 9 4 L

195 Other sums payable to a non-resident 1 9 5

196A Income in respect of units of Non-Residents 9 6 A

196B Payments in respect of Units to an Offshore Fund 9 6 B

196C Income from Foreign Currency Bonds or shares of Indian Company payable to Non-Resident 9 6 C

196D Income of Foreign institutional investors from securities 9 6 D

206C Collection at Source from Alcoholic Liquor for Human Consumption 6 C A

206C Collection at Source from Timber obtained under Forest lease 6 C B

206C Collection at Source from Timber obtained by any Mode other than a Forest Lease 6 C C

206C Collection at Source from any other Forest Produce (not being Tendu Leaves) 6 C D

206C Collection at Source from Scrap 6 C E

206C Collection at Source from contractors or licensee or lease relating to Parking lots 6 C F

206C Collection at Source from contractors or licensee or lease relating to toll plaza 6 C G

206C Collection at Source from contractors or licensee or lease relating to mine or quarry 6 C H

206C Collection at Source from tendu leaves 6 C I

PLEASE TICK THE RELEVANT BOX AT THE TOP OF THE CHALLAN. SEPARATE CHALLANS SHOULD BE USED FOR

DEPOSITING TAX DEDUCTED AT SOURCE FROM COMPANY DEDUCTEES AND FROM NON-COMPANY DEDUCTEES.

KINDLY ENSURE THAT THE BANK'S ACKNOWLEDGEMENT CONTAINS THE FOLLOWING:-

1. 7 DIGIT BSR CODE OF THE BRANCH

2. DATE OF DEPOSIT OF CHALLAN (DD MM YY)

3. CHALLAN SERIAL NUMBER

THESE WILL HAVE TO BE QUOTED IN YOUR RETURN OF INCOME.

You might also like

- Challan Salary 192 PDFDocument1 pageChallan Salary 192 PDFVipin Kumar ChandelNo ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- Tax Certificate of Noh Sung Hwan - 20240310 - 0001Document2 pagesTax Certificate of Noh Sung Hwan - 20240310 - 0001Md RasalNo ratings yet

- Annexture Report 2015-16 To 2018-19Document6 pagesAnnexture Report 2015-16 To 2018-19Hemant ChaudhariNo ratings yet

- Form 281 Candeur Constructions - 92bDocument1 pageForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNo ratings yet

- TANGEDCO - Pachiyamman LathDocument2 pagesTANGEDCO - Pachiyamman LathprabhakaranNo ratings yet

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenNo ratings yet

- Customer ID.: Consumer No.:: South Regional OfficeDocument1 pageCustomer ID.: Consumer No.:: South Regional OfficeVinod KumarNo ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Service DetailsDocument1 pageService DetailssabeerNo ratings yet

- Aset SahamDocument69 pagesAset SahamAlif SyarifudinNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- YzRoRWYySmhVc2JIYStqTlZxVGFRQT09 Seller Tax InvoiceDocument1 pageYzRoRWYySmhVc2JIYStqTlZxVGFRQT09 Seller Tax Invoiceamit silNo ratings yet

- R5Cacao BED FormsDocument3 pagesR5Cacao BED FormsChristian PorlucasNo ratings yet

- Technical Questionnaire - MMIM19 ActDocument1 pageTechnical Questionnaire - MMIM19 Actyeini rocio cardenas lozanoNo ratings yet

- Accounting Grade 8 MemorandumDocument5 pagesAccounting Grade 8 MemorandumGodfreyNo ratings yet

- Final Copy of 2021 Pamosaingan Wfp-NewDocument4 pagesFinal Copy of 2021 Pamosaingan Wfp-NewMadelyn LabeNo ratings yet

- KOL50001546122Document2 pagesKOL50001546122Sonali Chopra AdvocateNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .CA Sree Harsha BVNo ratings yet

- Service Bill StatusDocument2 pagesService Bill StatusKR RamanNo ratings yet

- For Goats CertificateDocument6 pagesFor Goats CertificateBeximco Denim LabNo ratings yet

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document15 pagesEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Tarikul IslamNo ratings yet

- LBP - MDS Operating Unit 2022Document92 pagesLBP - MDS Operating Unit 2022Ann marie trinidad FabilaNo ratings yet

- S-PRC ReportDocument1 pageS-PRC Reporttalhashaukat11No ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- Amman Arts 5Document1 pageAmman Arts 5sugunec2013No ratings yet

- July 2021 STRFDocument11 pagesJuly 2021 STRFYae'kult VIpincepe QuilabNo ratings yet

- Service DetailsDocument1 pageService DetailssabeerNo ratings yet

- IFMIS TelanganaDocument11 pagesIFMIS TelanganaAskani KurumaiahNo ratings yet

- Salaryouter 41663221 18517Document1 pageSalaryouter 41663221 18517addtoowinNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Marks Question No. 1 (A) RS.: Strategic Management Accounting - Semester-6Document7 pagesMarks Question No. 1 (A) RS.: Strategic Management Accounting - Semester-6Abdul BasitNo ratings yet

- Rebate: Due DateDocument2 pagesRebate: Due DateRakesh Dey sarkarNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- Adobe Scan Nov 24, 2021Document2 pagesAdobe Scan Nov 24, 2021Sohan LalNo ratings yet

- E FilingDocument4 pagesE FilingAvigyan BasuNo ratings yet

- Oct 2021 To Oct 2022Document1 pageOct 2021 To Oct 2022akshay20saNo ratings yet

- Itr-V Aaifp5094r 2007-08 2554600241007Document1 pageItr-V Aaifp5094r 2007-08 2554600241007dharmendraganatra2No ratings yet

- Unnumbered 2022 174 Submission of ELECTION BIR FORM NO. 2316Document4 pagesUnnumbered 2022 174 Submission of ELECTION BIR FORM NO. 2316Albino GalgoNo ratings yet

- TANGEDCO - Pachiyamman Company2Document2 pagesTANGEDCO - Pachiyamman Company2prabhakaranNo ratings yet

- School's MOOE Chart of AccountsDocument17 pagesSchool's MOOE Chart of AccountsWean IlinonNo ratings yet

- Hoppe AbudeeniDocument2 pagesHoppe AbudeeniPreetam LP GhoshNo ratings yet

- THE Rala V LU DDE: K A DTADocument2 pagesTHE Rala V LU DDE: K A DTAKesavapillai GanesanNo ratings yet

- MRD 2017 - F101 - DBM - For DOF Posting Up To Dec2017Document27 pagesMRD 2017 - F101 - DBM - For DOF Posting Up To Dec2017RHUNo ratings yet

- Financial Ledger (Nse/Bse/Fo)Document5 pagesFinancial Ledger (Nse/Bse/Fo)pooja sharmaNo ratings yet

- Payment Assessment FormDocument1 pagePayment Assessment FormHanabishi RekkaNo ratings yet

- Class 1Document1 pageClass 1hendraNo ratings yet

- Npo 000065 Egi Ele Ten Reg z01 000004 DrawingDocument4 pagesNpo 000065 Egi Ele Ten Reg z01 000004 Drawingscarlett3232No ratings yet

- Mani PCR Test 2Document2 pagesMani PCR Test 2ManilaalNo ratings yet

- Cash Disbursement Jan 2020Document60 pagesCash Disbursement Jan 2020Jomar DomingoNo ratings yet

- Three Business SampleBillDocument2 pagesThree Business SampleBillIbrahim AbdullahNo ratings yet

- Annex A Timta 2022Document8 pagesAnnex A Timta 2022Nestly MendezNo ratings yet

- Appendix 37 CBRegDocument1 pageAppendix 37 CBRegGar RylNo ratings yet

- NG CD 1454509-1 A1-1238314Document2 pagesNG CD 1454509-1 A1-1238314Christian ChavezNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- DT NotesDocument95 pagesDT NotesDharshini AravamudhanNo ratings yet

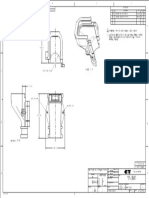

- Backshell X1 DanfossDocument1 pageBackshell X1 DanfossTom Van BenedenNo ratings yet