Professional Documents

Culture Documents

Bexar County Executive Summary 8july2014

Uploaded by

MarkAReagan0 ratings0% found this document useful (0 votes)

657 views22 pagesThis is an executive summary of the University of Texas at San Antonio Institute for Economic Development study of the Bexar County Economic Development Department that was presented by Robert McKinley, the associated vice president at the UTSA Institute for Economic Development, on July 8, 2014 at the Bexar County Commissioners Court meeting.

Original Title

Bexar County Executive Summary 8July2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is an executive summary of the University of Texas at San Antonio Institute for Economic Development study of the Bexar County Economic Development Department that was presented by Robert McKinley, the associated vice president at the UTSA Institute for Economic Development, on July 8, 2014 at the Bexar County Commissioners Court meeting.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

657 views22 pagesBexar County Executive Summary 8july2014

Uploaded by

MarkAReaganThis is an executive summary of the University of Texas at San Antonio Institute for Economic Development study of the Bexar County Economic Development Department that was presented by Robert McKinley, the associated vice president at the UTSA Institute for Economic Development, on July 8, 2014 at the Bexar County Commissioners Court meeting.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 22

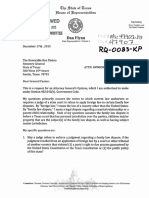

J uly 8, 2014

Economic Development Strategy Evaluation

for Bexar County

Executive Summary

The Commissioners Court has requested an evaluation of the effectiveness of the economic

development department and economic development strategy for the county. For the purposes of

continuous improvement they also sought recommendations in the areas of business retention

and recruitment.

The work scope outlined nine specific questions to be addressed. This executive summary will

address each question, summarize the findings, and list the recommendations. A full report with

background information, comparable research of other county economic development

approaches, feedback from interviews and surveys, and reference materials will be provided as

the basis for these recommendations.

1. Evaluate and make recommendations regarding the Bexar County economic

development department's program and its role in the community's economic development

effort.

Findings:

The EDD was created during fiscal year 2003-2004 and has continuously evolved its role and

functions. Its primary mission has been to represent the county in business development,

negotiate incentives, and collaborate with economic development allies to expand jobs and the

property tax base for the county.

A peer comparison of major Texas counties, and select out-of-state counties, was conducted by

Griffith, Moseley, J ohnson, and Associates. Findings indicate most peer Counties take the

2

minimalist approach for economic development, and rely on regional economic development

organizations to take the lead in business recruitment. Most counties are reactive with business

prospects brought to the negotiating table. They typically employ 1-3 staff, to evaluate projects

and propose property tax incentives from their county, getting approvals through their

commissioners court, and prepare incentive contracts with the county attorney's office. After

recruited companies establish operations, the same staff collect reports and monitor jobs and

investments performance versus goals. Any variances are reported to the county attorney and

Commissioners Court for corrective action. They typically also serve as representatives of their

county to collaborate and plan with the lead economic development organization in their

respective markets.

Some counties take on additional roles according to their local priorities. For example in Bexar

County, over time the department has assumed initiatives for small, women and minority

business supplier outreach, also tax increment financing districts, some housing finance

initiatives, Toyota supplier park development, locality development around the AT&T Center

and other county infrastructure investments, as well as advising smaller communities and

unincorporated areas within the county sharing their expertise on economic development matters.

In 2010, Bexar County formally joined the San Antonio Economic Development Foundation as a

major investor and partner at the level of $500,000 per year. The EDF is San Antonio's public

private partnership for economic development. Prior to this partnership, the county felt it was

often positioned as the last player at the table in negotiating incentives with recruited businesses.

This posture diluted negotiating power, and placed the county in a spoiler role if the incentive

requests were not accommodated.

Since joining EDF, the county now assumes a full participation and seat at the negotiating table

early in the process. The county also has a seat on the EDF executive board, to represent county

interests in governance, planning, coordination and accountability within the overall metro

economic development enterprise.

As an outgrowth of Toyota and their supplier park, the department has developed expertise in the

3

automotive sector supply chain. Research and promotion for a Texas Mexico Automotive Super

Cluster has been a result of these efforts. Continued positioning for additional future production

lines by Toyota, and potential automotive cluster business recruitment remains a priority for the

county and department staff.

More recently in November 2013 director David Marquez presented a recommendation for a

more robust department approach to commissioners court. The intent was to be more proactive

as a county by engaging in direct business recruitment above and beyond the EDF collaboration,

building a staff of Subject Matter Experts (SME) for each target industry, and aggressively

pursue international recruitment prospects, which had already begun via foreign recruitment

missions and country consultants hired for J apan, China and Germany.

This robust economic development approach was partially implemented, and more recently put

on hold due to questions about international activities, and affordability to staff up fully for this

expanded mission.

Recommendations:

A more moderate approach for the county's economic development mission and scope is

recommended. We do not recommend returning to the prior minimalist approach where the

county simply processed incentive requests, and monitored performance. The county deserves to

have a seat at the negotiating table with recruited companies, and also a seat at the table

representing their interests within the EDF public-private partnership for economic development.

We also do not recommend the aggressive scenario, with a robust scope of county business

recruitment initiatives on a domestic and global scale. Concerns about duplication of effort, and

affordability preclude this as a sustainable option.

Presented below is a table of economic development scenarios. This identifies a broad range of

roles and functions that may be found in economic development organizations. We recommend a

moderate scenario for Bexar County economic development which encompasses the basics, plus

additional roles particular to the priorities and capabilities of the county.

4

This matrix will help guide the Commissioners Court to redefine their economic development

mission, goals, operations, staffing structure, and role within the broader SA Metro development

infrastructure.

Economic Development Scenarios

Conservative Moderate Aggressive

Business Expansion & Retention Program X X X

Community Development X X X

Incentives X X X

Infrastructure Improvements X X X

Quality of Life X X X

Small, Minority & Women Owned Business Enterprise X X X

Workforce Collaboration X X X

Domestic Focus X X

Eagle Ford Shale X X

Economic Development Corporation X X

Locality Development X X

Outsourcing with strategic partner X X

Automotive Super Cluster X X

Trade Show Participation X X

Online Presence X X

Customer Relationship Management X X

International Focus X

Lead Generation X

Marketing and Outreach Campaign X

Prospecting X

Subject Matter Experts X

Sources: Derived from authors research; Development Counsellors International (2011); Leigh and

Blakely (2013); Nourick, S., Anderson, L., Ghosh, S., & Thorstensen, E. (2011; 2012); Reese (1994).

5

We also offer a set of principles to guide determination of the department's programs, and

relationships with stakeholders.

A) Promotional and recruiting activities should be coordinated on the Metro level through a

public private partnership such as EDF, not conducted independently.

B) Targeted business and industry sectors in which the San Antonio Metro can be

competitive and offer the highest potential economic growth should drive all recruitment

activity, both domestic and international. The County, SA2020, and EDF targeted sectors

generally align. Incentive policies should provide greater rewards for targeted industries,

higher skilled and compensated jobs, and priority locations for each jurisdiction.

C) The strategic plan for economic development presented by Deloitte Consulting in 2013

should be the general framework to prioritize goals and assignments among local

stakeholders, including Bexar County.

D) For international recruitment, any missions should be coordinated through EDF, and

determined by solid target companies first, and countries second. Foreign market

consultants should only be engaged for the highest priority prospects, such as Toyota.

Even then the costs and support services should be shared among local stakeholders.

E) Messaging which promotes the Metro area for business recruitment must be consistently

aligned and branded, not fragmented.

F) Recruitment prospects require one single point of contact for customer relationship

management. This avoids confusion and presents a united front as a community. The

predominance of prospects should be managed by EDF. In some cases, it makes sense for

one stakeholder to take the lead, for example CPS with TESLA, yet still in close

coordination with the team.

G) Coordinated deal negotiating and incentives packaging is essential. When suspects turn

into prospects, EDF effectively convenes all partners early to give the project parameters.

6

These negotiations also respect the distinct filters of each contributor to offer incentives,

including Bexar County, the City, CPS, SAWS, ISDs, Alamo Worksource, Texas

Enterprise Fund, etc.

H) Successes are shared and celebrated communitywide. Each deal has a different mix of

contributors, however everyone gains.

I) Elected officials must be engaged judiciously. Calls to companies get answered when a

Mayor or J udge take point. And internationally, government officials open doors to

access industry leaders at the top who are typically inaccessible to staff. Sufficient

preparatory work and coordination by EDF and City/County staff will determine highest

and best use of our top salespersons.

J ) Metrics, monitoring and evaluation are essential for continuous improvement and public

accountability. Outputs, outcomes, and return on investment should be transparently

reported at the partnership level of EDF, and also at the departmental level of the county,

city, and other stakeholders.

K) Limited local resources must be leveraged to support a collaborative approach to

economic development, in particular through a public-private partnership such as the

EDF.

L) Shared governance, policy and strategic direction for economic development should

occur at the Metro level through the EDF executive board. Bexar County should be

strongly represented along with other stakeholders to assert county interests in this

process.

2. Assess and make recommendations regarding the county's economic development

mission, programs and initiatives to ensure they are effective and properly focused.

When asked to express What is the mission for Bexar County economic development? the

most common general response of interviewees was "jobs and investment." When pressed for

7

more specific description of mission components, strategies and programs to generate jobs and

investments, there was little consensus or alignment as to how to accomplish these goals.

On the commissioners level, their role is mostly reactive when specific business recruitment

incentive proposals are presented to the court. If a project is in their precinct, they are engaged

earlier in the process of pitching to the prospect, and consulted to some degree by staff in

structuring incentives. Commissioner Kevin Wolff is the court liaison to the economic

development department. J udge Nelson Wolff is commonly involved reviewing active prospects

countywide, and engages proactively with the most solid prospects by making calls,

presentations, and receiving inbound delegations.

On the staff level, director Marquez and assistant director Decamps maintain a running log of

active projects, prospects, and events which drives most staff activity. Analyst Mauerer

maintains a database of active incentive contracts, and refers any job shortfall variances to

director Marquez for corrective actions. These cases are also added to the work log for

resolution.

Staff below the director and assistant director in general are unaware of the department's specific

goals, metrics, annual work plans to achieve them, or the specific expectations for their positions.

Work assignments are largely reactive, constantly shifting to cover weekly urgencies. Position

descriptions have not been updated to define current staff roles and responsibilities. Individual

annual performance appraisals have not been conducted. Administrative workflow for office and

budget management is also more reactive than planned.

The only departmental metrics are after-the-sale monitoring of company performance on booked

incentive contracts. Company jobs reported versus goals, and financial forecasts for the property

tax effects through the abatement periods, and resultant increases to the county's property tax

base are monitored between the department and the budget office.

Although county staff participate in visits to the county's largest employers through the Business

Retention and Expansion program of the EDF, they have little to no influence on after-the-sale

company performance. Yet this is the main metric for their evaluation.

8

Most departmental activities are described as working to bring in new jobs and investment.

Effectiveness bringing in new business is not measured for the department. No specific goals are

set for either business recruitment efforts, or results. No annual reports either internal or external

are routinely produced for accountability. This is a lost opportunity, since clearly many business

recruitments have been accomplished with important county contributions and economic

impacts.

The main presentation of economic development programs and initiatives is contained in the

annual budget submission process. This is a summary document for general budget request

justification. It is not apparently used as an annual work plan.

In November 2013, director Marquez presented an expanded vision for the department to

Commissioners Court. This advocated a more robust county capability to directly market and

recruit business prospects across targeted industries. Shifting and adding staff assigned to each

target industry would create Subject Matter Experts. These positions would act similarly to the

recruitment VPs at the EDF. They would be assigned to research their target industry sectors,

identify leads, and conduct direct recruitment outreach activities. It was intended for them to be

assigned goals and evaluated on new businesses, jobs and investment successfully recruited. And

expansion of international business recruitment was also advocated, through consultant

representatives in J apan, China and Germany. This expanded capability was never fully

implemented, with some staff assignments shuffled to cover target industries. Two additional

proposed positions remain unfilled. And public questions regarding international recruitment

efficacy have largely curtailed those activities.

On the community stakeholder level, the department is recognized as an important partner and

contributor to collaboratively promote the Metro area to business prospects. The county's main

tool to help attract business is property tax abatement. All stakeholders indicate the county's

participation early in the process of negotiating and structuring deals has been very positive.

Also the engagement of director Marquez, J udge Wolff and commissioners to receive inbound

delegations and sell San Antonio as part of the team effort has been very effective.

9

When economic development partner agencies are asked about the mission, programs and

initiatives of Bexar County economic development, they most often cite representation of the

county's interest within EDF governance, collaborating on presentations to recruitment

prospects, involving the judge and commissioners for top prospects, effectively negotiating and

structuring incentives from the county's perspective, also strategic planning as part of the

Deloitte implementation team. Smaller communities within the county specifically cite the

support and expertise provided by the department to help with locality development projects.

Community stakeholder agencies also expressed confusion about the county's independent

international outreach and prospecting. Most were unaware of departmental goals and staff

assignments. None of the partner agencies were aware of the expanded vision and scope

presented in November.

It is obvious that communication and alignment of the department's role is not sufficiently

focused and can be improved. This applies on the policy level with Commissioner's Court, also

on the operational level with staff and interdepartmental relations at the county. And it applies at

the community level for the county to contribute their important economic development role on a

collaborative basis.

Recommendations:

A. Basic management functions of the department need reinforcement. A clearer vision,

mission, focused work plans, goals, metrics, position descriptions, reports of

accomplishments versus goals, and performance evaluations for individuals and the

department as a whole all need attention.

B. To strengthen basic departmental management it is recommended that director Marquez

report administratively to County Manager Smith, as do all other departments of Bexar

County. Administrative routine oversight will ensure basic management functions are

maintained. Commissioners do not have sufficient bandwidth to supervise day-to-day

operations, which is not the highest and best use of their time as policy leadership.

The economic development director position was originally structured as a direct report

to the Court, to make clear this position is the principal negotiator of incentive deals

10

without another layer of appeal. To maintain a direct line for this aspect of the job, we

recommend a specific delegation of authority to negotiate and recommend incentive

packages directly to the Court for their final review and approvals. Routine coordination

meetings on business prospects directly with liaison Kevin Wolff, J udge Wolff and David

Smith should continue. Routine supervisory review and approvals on expenditures,

travel, human resources, interdepartmental matters, etc. will be more efficiently managed

through the County Manager.

C. Also consider assignment of a department staff member to focus on internal management.

This would complement the director's primary role as an external representative and

promoter with business prospects.

D. The next generation of departmental management plans should reflect a moderate

scenario for the Bexar County economic development scope, as outlined above in

Question 1. Specific functions and program elements, staff and budget to carry them out,

can be tailored per the priorities of the county, affordability, and adherence to the

principles of collaborative economic development on the Metro level.

E. To strengthen planning, oversight, and accountability we recommend Bexar County

establish an economic development advisory body. This group should be representative

of County economic development stakeholders, include experts in the field and key

partner organizations. It should not duplicate Metro level coordination which occurs at

the EDF executive board, but rather help to focus Bexar County economic development

by advising the director and the court, who retain final decision-making authority

3. Determine if the department is adding sufficient and proper value to the larger, overall

economic development effort and make recommendations for improvement, if applicable.

Findings:

From the commissioners' perspective most concur that Bexar County has a vested interest in

economic development, and should play an active role in the overall metro economic

11

development efforts. Some question the balance of investing in economic growth with pressing

community development needs. Especially in unincorporated areas of the County where

infrastructure deficiencies exist and the growth only adds stress to roads, schools, utilities,

abatements are sought which then limit revenues to service the increased demands. Consensus

generally exists for a collaborative approach through a public private partnership such as the

EDF. The county's high dependence on property tax revenues to fund its overall mission, with

ever increasing demands for services, requires stimulation of business and job growth.

Staff and stakeholder interviews echo this important role for the county also. The primary added

value is collaboration by the county in promoting and recruiting business prospects, and

contributing its property tax incentives where the return on investment with economic impacts

makes sense.

Recommendations:

Bexar County should continue in a proactive role in economic development, revised within the

moderate scenario, to avoid duplication and maintain affordability.

Specific departmental goals for outputs, outcomes, and ROI should be established. Reporting

mechanisms to evaluate performance versus these goals on a long-term basis should become

routine. These basic management tools will guide continuous improvements for the counties

economic development efforts.

4. Examine Bexar County's role in international recruitment activities. Determine if

international recruitment efforts are appropriate for Bexar County. If so, provide

recommendations regarding oversight measures needed in the area of international

recruitment, and examine whether these activities should be outsourced to another

organization, such as the San Antonio Free-Trade Alliance.

Findings:

Feedback from commissioners, staff and community stakeholders question the role of Bexar

County acting independently to promote and recruit international business investments.

12

Sensitivity to such trips led to a new policy requiring specific court approval of any international

outreach missions. This new policy was invoked quickly and has been well received as a

standard check and balance protocol.

At the same time, there is broad support for community-wide efforts for international outreach

and business recruitment. Toyotas manufacturing plant with 2,000 assembly jobs plus over

2,000 supplier jobs, positioning for a future potential production line expansion, and

opportunities to build the automotive cluster with additional recruitments, are valid and priority

targets.

In the economic development field, the proportion of domestic versus international prospects is

shifting. The Brookings Institution's Global Cities Initiative recently selected San Antonio as a

pilot to promote foreign direct investments. International outreach is not new for San Antonio,

ever since HemisFair, then with NAFTA, Toyota and even Eagle Ford Shale with significant

foreign investments. It is clearly an appropriate role for the San Antonio Metro area to recruit

international businesses and investment. However this should be done on a coordinated basis

with other economic development allies, not solely by Bexar County.

An analysis by Brookings Metropolitan Policy Program indicates that 83% of global economic

growth is occurring outside of the U.S. As a result, current economic development approaches

that focus on U.S. targets are outdated. In order to compete effectively, metropolitan areas will

need to shift economic growth policy by becoming more globally focused.

Brookings points toward growing global recruitment, but does not prescribe how. In recent years

San Antonio organizations promoting internationally have been in flux. The San Antonio Free

Trade Alliance suffered poor staff leadership for a long time, then a transition period to reassess

their mission and roles, and recently staff leadership was re-established by hiring the former

Executive Director. Other organizations such as the Greater, Hispanic, Asian Chambers, City

International Affairs, and County Economic Development began to experiment and act

independently on outreach initiatives, with trips, engaging foreign representatives, and hosting

events such as Sister Cities International Conference.

13

To fill the void for coordination City Councilwoman Elisa Chan began a China Advisory

Committee, which then morphed into the Global Advisory Committee (GAC) in 2012. The GAC

grew to 50-60 representatives across the community, as a forum to plan and coordinate

international outreach. Due to leadership changes and the GACs assignment to the Free Trade

Alliance, this lost momentum and was recently disbanded.

Free Trade Alliance operates under a new City contract as of 2014 to continue its historical roles

of advocating free trade policies, promoting trade for area businesses, and convening trade

stakeholder groups locally. A new element added to the FTASA work scope is to assist EDF

with international business recruitment, which is currently a work-in-progress. EDF contracts

call for 34 marketing trips annually overall, with a goal of only 2 of the 34 being international.

Given the importance of international recruitment, time is ripe to convene a stakeholder

conversation on how to best mobilize a collective effort and resources internationally. The

Brookings foreign direct investment initiative is a good place to start.

Recommendations:

International recruitment should be consolidated and coordinated by a single entity, presumably

with EDF and FTASA assistance. All international business recruitment travel with Bexar

County representatives should be coordinated with this lead entity, after review and approval by

the Court.

For international recruitment, any missions should be coordinated through EDF, and determined

by solid target companies first, and countries second. Target industries defined by the Deloitte

plan, Bexar County, SA2020 and EDF provide clear guidance on recruitment priorities.

J udicious use of elected leadership to assist foreign recruitment is important. Government

officials can open doors to access industry leaders at the top who are typically inaccessible to

staff. Most of their involvement will be receiving inbound delegations, however selective

outbound missions with prime targets merit their involvement too. Sufficient preparatory work

and coordination by EDF and City/County staff will determine highest and best use of our top

salespersons.

14

Existing foreign representation contracts with J apan, China and Germany should either be

terminated or consolidated under the restructured international recruitment effort with EDF.

Foreign market consultants should only be engaged for the highest priority prospects, such as

Toyota. Even then the costs and support services should be shared among local stakeholders.

A consensus plan for the Metro areas international recruitment strategy does not currently exist,

and should be articulated and agreed upon by all key economic development stakeholders, in

order to focus resources on a short list of targeted foreign industries and countries.

5. Provide recommendations for performance measures that will clearly establish and

communicate desired outcomes in the area of economic development.

Inputs:

Success implementing strategic plan (i.e., how many goals were actually met)

New investment attracted /total capital provided

Incentives awarded / availability of different types of start-up capital for local business

(number and/or value)

Marketing campaigns

Amount of financing provided

Public-private partnerships, joint ventures, collaboration (number, size, and type)

Relationships established with other organizations, customers and stakeholders

Attendance of conferences, conventions and trade shows

Greater involvement and collaboration with strategic partners

Outputs:

Businesses attracted and created in the region (number , distribution across targeted

industries)

Number of jobs attracted and created (full time, part time, contract, seasonal)

Number of businesses and jobs expanded

Number of businesses and jobs retained

Wages / salaries of jobs attracted (average)

15

Number of business leads that choose to locate in the community

Foreign direct investment attracted to the county

6. Conduct a review of the department's staffing, to include an analysis of the skill sets and

talents needed to implement desired economic development strategy.

Findings: The county staff descriptions are out of date. Furthermore, staff have been shifted to

other duties and roles. This review was conducted using staff rsums and information given

during interviews.

Executive Director: This position is responsible for the overall operation of the EDD. These

duties include planning, developing, and directing efforts pertaining to economic development.

Part of the responsibilities are to attract new businesses and economic development projects,

whether locally or globally, to the county. This is done by overseeing the process from

prospecting and recruiting to the execution and compliance of agreements. The role also involves

contract negotiations, and developing and supervising compliance of tax phase-in contracts.

Duties include making recommendations, goal setting, and overseeing funding and expenditure

data as well as the development of budget submissions. The executive director reports key issues,

trends and progress to the Commissioners Court. In addition to being the department

representative to the Court, the position also serves as a liaison to the business community,

intergovernmental partners and community based organizations on economic development

activities.

Deputy Director: This position reports to the executive director and acts on their behalf as

needed. Duties include facilitating annual work plans and overseeing the roles of SMEs.

Contingent plans would have the deputy director serve as the aerospace SME. Primary

responsibilities are prospecting and coordinating with various personnel and organizations on

economic development projects. Other duties include managing operational budget and

expenditures, and develops and facilitates regional partnerships.

ED Manager: The primary function had previously been tax abatement work. Prior to the

department reorganization, this position acted more as a sales representative for the county and

16

worked to bring jobs and investments to communities. The ED manager also handled the

department budget, which has now been turned over to the deputy director and the office

supervisor. The current duties focus on workforce analysis and works specifically on the Toyota

project.

Senior Policy Advisor: This position clearly shows the mismatch of job titles and actual

responsibilities. The original hiring title was CIED Data Program Manager. Currently, duties

include serving as a data analyst and contingent plans will assign this role as the corporate SME.

Future work plans include working with the executive director, and deputy director in developing

a strategic plan designed to increase the rate of job growth in the county. This year duties will

include developing the departments budget and supervising abatement compliance and

monitoring with the analyst position.

Analyst: The primary functions of this role includes serving as a liaison between the department

and other county departments, working directly with the incentives process, from qualifying and

analyzing applications to drafting and monitoring agreements. An additional duty is conducting

site compliance visits and maintaining the departments compliance database.

Senior Analyst: Prior to the new role, this position served as the Strategic Initiatives Coordinator

for TMASC. Current duties include maintaining a focus on the automotive cluster and a focus on

the Eagle Ford Shale industry. This role oversees social media, and serves as the program

manager for the internship program. Additionally, duties are providing background research and

marketing materials for the department. This role involves coordination of various agendas and

meeting set ups between the department and various delegations as well as collaborating and

reporting to the Deputy Director.

Office Supervisor: This role reports directly to the executive director. Duties included

maintaining the executive directors and staff meetings. The primary functions are to supervise,

train and evaluate office clerical and administrative personnel. Responsibilities are

administrative and clerical support such as developing office administration procedures,

monitoring employees time and attendance, maintaining in-house budget expenditures, creating

17

reports, and assisting with budget preparation. Other duties include managing the daily office

functions such as ordering supplies, and creating and reviewing requisitions and purchase orders,

and verifying and authorizing vendor payments.

7. Determine if the department has sufficient resources available to successfully achieve the

recommended economic development strategy.

Findings:

The aggressive approach to economic development is likely unsustainable and commissioners

agree that this strategy should be re-evaluated.

The use of SMEs (Subject Matter Experts) has the potential to add permanent fixed costs to EDD

operations, exceed resources available in the general fund (and thus relying on a diminishing

CIED fund) and at the same time, underutilize costly resource experts. SMEs should be sourced

on an as-needed basis and not be part of full-time EDD staff. If the CIED fund is used to support

fixed costs, then long term funding will be unsustainable.

Existing consulting contracts with China, and Germany should either be terminated or

consolidated under the restructured international recruitment entity. A formal international

strategy does not currently exist and should be articulated and agreed upon by all Bexar County

economic development stakeholders in order to focus resources on a short list of targeted

countries.

8. Provide recommendations regarding financial controls and management oversight for

economic development activities.

Findings:

Commissioners generally agree that a single point of contact with county staff will establish

necessary financial controls and management oversight for economic development activities.

To strengthen basic departmental management it is recommended that director Marquez report

administratively to County Manager Smith, as do all other departments of Bexar County.

Administrative routine oversight will ensure basic management functions are maintained.

18

Commissioners do not have sufficient bandwidth to supervise day-to-day operations, which is

not the highest and best use of their time as policy leadership.

The economic development director position was originally structured as a direct report to the

Court, to make clear this position is the principal negotiator of incentive deals without another

layer of appeal. To maintain a direct line for this aspect of the job, we recommend a specific

delegation of authority to negotiate and recommend incentive packages directly to the Court for

their final review and approvals. Routine coordination meetings on business prospects directly

with liaison Kevin Wolff, J udge Wolff and David Smith should continue. Routine supervisory

review and approvals on expenditures, travel, human resources, interdepartmental matters, etc.

will be more efficiently managed through the County Manager.

Current Organizational Chart

19

Recommended Organizational Chart

---For tax abatements and incentives, Executive Director can directly report to the Commissioners Court

9. Review of the county's agreement with the San Antonio Economic Development

Foundation and determine whether the county should be investing in this activity and if so,

at what level.

Findings:

From the commissioners perspectives, most agree the EDF agreement is an appropriate means

to participate in collaborative business recruitment for the region. Inclusion in the prospect

presentations, negotiations and deal structuring process at the front-end is an improvement over

their prior experience of being the last player at the table in negotiating incentives. Some

concerns are voiced about the representation of one seat on the EDF Board for the Countys

20

$500,000 contribution, and inattention to issues of community development when EDF brings

industry into parts of the County lacking infrastructure.

From the staff perspective, the operational collaboration with EDF when serious prospects are

qualified is very close and effective. Through the stages of promotion and site location proposals,

to packaging incentives across the City, County, ISDs, utilities, job training, Governors Office

Enterprise Fund, to approval of incentive contracts, and sharing successes there is reportedly

good coordination. Staff also actively participates in EDF governance via the Executive Board,

strategic planning and implementation with the Deloitte process. Staff negotiates the annual

agreement with EDF, in coordination with the City, however emphasizing the Countys

particular priorities and goals. The Countys original 3-year agreement with EDF lapsed last Fall,

and in the interim the collaboration was business as usual, and an extension was approved in

J une.

From the stakeholders perspective, Bexar Countys participation as an EDF partner is integral.

The City, the Chambers, the utilities and private sector members value and expect Bexar County

to be at the table and contribute to the recruiting process with talents, efforts, leadership

involvement and resources on a team basis. Many cited room for improvement, and issues to

address in future agreements, however are committed to proceeding with economic development

as a team activity through EDF.

From a best-practices perspective, Griffith, Moseley, J ohnson and Associates surveyed

comparable county economic development organizations and found the norm is to participate in

regional business recruitment organizations, as public-private partnerships. No counties in the

survey attempted aggressive business recruiting on their own.

From a contractual perspective, it is important to recognize the general performance of EDF has

consistently met or exceeded the goals and specifications reflected in both the County and City

contracts. The public sector buy-in occurred in 2010 after a task force recommended that the

County and City take formal roles in setting business recruitment policy and EDF governance,

influence the quality of businesses and jobs recruited and incentivized, maintain consistency in

marketing messages, establish a new Business Retention and Expansion program (partially in

21

response to AT&Ts HQ departure), and conduct Metro-level economic development strategic

planning. Resources were redirected from City Economic Development by reducing non-core

functions and staffing from 47 to 27. The County has also maintained a limited staff of 7 for the

Economic Development Department, to enable the EDF investment.

From 2010 to 2014 represents the first generation of the public buy-in to EDF, the County with a

3-year contract plus the recent extension, and the City with a 5-year contract. Now is an

opportune time to learn from this first cycle, and address any course-corrections of concern by

the partners. Serious concerns were voiced by some key County & City stakeholders, and are

summarized below:

With the additional $1 million/year public buy-in to EDF, business recruitments and

expansions continue a similar trend averaging 25-30 companies and 3,000 4,000 new

jobs per year. Even though contractual goals are met, should the results be showing a

commensurate increase with funding to EDF?

With the City and County investing $500,000 each, is one Board slot representative for

this level of investment? In addition to the City & County executives, should broader

community interests be included?

Private enterprise membership and dues for EDFs mission should increase also

commensurate with the publics investments.

Concerns about industry targets and prospecting methods by EDF, with a mix of

recruited companies still perceived to be old-school vs. growth and innovation industries,

approaches relying too much on site-selection consultants.

Insufficient use of political leadership by EDF in recruiting, and often poor coordination

when they are used. From phone calls, to receiving key inbound prospects, making

pitches or trips, use of the communitys top spokespersons can be improved.

22

EDF leadership to implement the SA2020 economic growth component and Deloitte

Strategic Plan can be improved, to mobilize and align institutional efforts around that

common mission.

A more holistic approach and emphasis linking economic development to community

development is needed, although EDF tends to focus primarily on the business

recruitment and BRE parts of development.

Recommendation:

While voicing these concerns, at the same time a commitment to continue a team approach and

public-private partnership for economic development with EDF was also voiced. The

recommended governing body to address these concerns is the EDF Executive Board, and should

have this dialogue with participation of top County and City leadership in addition to staff. The

set of guiding principles outlined in Question 1 above provides a useful framework to determine

the next generation agreements among the County, City, EDF and other stakeholders. A meeting

of the minds to clarify the direction, roles and responsibilities of the San Antonio and Bexar

County economic development enterprise is needed.

It is recommended the County continue with extension of the EDF agreement to perform on the

established goals with the established budget, and make the necessary adjustments for the next

generation contract phase.

Summation

Timing for Bexar County is opportune to consider and implement these recommendations. The

2015 budget planning cycle is in progress for internal Economic Development adjustments, and

the next EDF agreement cycle is ready to proceed with negotiations.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 9006 - LTCC SolutionsDocument9 pages9006 - LTCC SolutionsFrancis Vonn Tapang100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Falcon Corporation Limited - Stop Work Authority PolicyDocument9 pagesFalcon Corporation Limited - Stop Work Authority Policyramkumardotg_5807772No ratings yet

- LoneStar AlternativesDocument11 pagesLoneStar AlternativesMarkAReaganNo ratings yet

- South Africa's Famous Crimes 1903-1987Document115 pagesSouth Africa's Famous Crimes 1903-1987Liam MerwedeNo ratings yet

- stc76307 PDFDocument2 pagesstc76307 PDFjohn faredNo ratings yet

- Public CommentDocument4 pagesPublic CommentMarkAReaganNo ratings yet

- NCAA Non-Discrimination QuestionnaireDocument7 pagesNCAA Non-Discrimination QuestionnaireDeadspinNo ratings yet

- Texas GOP Caucus Letter Gender ID 1Document1 pageTexas GOP Caucus Letter Gender ID 1MarkAReaganNo ratings yet

- James Myart ComplaintDocument17 pagesJames Myart ComplaintMarkAReaganNo ratings yet

- Shirley Gonzales Gender Equity CCRDocument2 pagesShirley Gonzales Gender Equity CCRMarkAReaganNo ratings yet

- District Court ComplaintDocument32 pagesDistrict Court ComplaintJulie Wolfe100% (1)

- Kesha AppealDocument5 pagesKesha AppealMarkAReaganNo ratings yet

- 210 Area Code Petition ChangeDocument40 pages210 Area Code Petition ChangeMarkAReaganNo ratings yet

- CCR - Councilmember Trevino - Spanish Language Intrepreter at Certain Meetings and Public HearingsDocument2 pagesCCR - Councilmember Trevino - Spanish Language Intrepreter at Certain Meetings and Public HearingsMarkAReaganNo ratings yet

- Mayor Ivy Taylor's 2016 State of The City AddressDocument21 pagesMayor Ivy Taylor's 2016 State of The City AddressMarkAReaganNo ratings yet

- Evenwel v. Abbott OpinionDocument53 pagesEvenwel v. Abbott OpinionDoug MataconisNo ratings yet

- 2015.12.22 PFR (Signed)Document3 pages2015.12.22 PFR (Signed)MarkAReaganNo ratings yet

- Mayor Ivy Taylor's 2016 State of The City AddressDocument21 pagesMayor Ivy Taylor's 2016 State of The City AddressMarkAReaganNo ratings yet

- Greg Abbott - Restoring The Rule of LawDocument92 pagesGreg Abbott - Restoring The Rule of LawBob Price100% (3)

- COSA Live Music and Entertainment Division CCRDocument2 pagesCOSA Live Music and Entertainment Division CCRMarkAReaganNo ratings yet

- NVRA Complaint W.D. Tex. Case No. 16 CV 00257Document19 pagesNVRA Complaint W.D. Tex. Case No. 16 CV 00257MarkAReaganNo ratings yet

- Lucky - ECF Doc. 8 - SA Zoo Motion To DismissDocument31 pagesLucky - ECF Doc. 8 - SA Zoo Motion To DismissMarkAReaganNo ratings yet

- Texas AG Grievance LetterDocument24 pagesTexas AG Grievance LetterCBS 11 News100% (1)

- Suit Filed by Freedom From Religion FoundationDocument16 pagesSuit Filed by Freedom From Religion FoundationAnonymous ovJgHANo ratings yet

- How To Handle A DWI Stop by PoliceDocument1 pageHow To Handle A DWI Stop by PoliceMarkAReaganNo ratings yet

- 159246Document104 pages159246MarkAReaganNo ratings yet

- RQ0083KPDocument4 pagesRQ0083KPMarkAReaganNo ratings yet

- Tbri Insp Rep 1-28-16Document2 pagesTbri Insp Rep 1-28-16MarkAReaganNo ratings yet

- MALDEF Complaint - Jan. 2016Document16 pagesMALDEF Complaint - Jan. 2016MarkAReaganNo ratings yet

- Admin Rule ProposalsDocument21 pagesAdmin Rule ProposalsMarkAReaganNo ratings yet

- CouchDocument1 pageCouchMarkAReaganNo ratings yet

- TerroristRefugeeInfiltrationPrevention ActDocument7 pagesTerroristRefugeeInfiltrationPrevention ActMarkAReaganNo ratings yet

- San Antonio Texas 2015Document1 pageSan Antonio Texas 2015MarkAReaganNo ratings yet

- Campus Carry Preliminary RecommendationsDocument9 pagesCampus Carry Preliminary RecommendationsMarkAReaganNo ratings yet

- Mutual Non-Disclosure and Non-Circumvention Agreement BetweenDocument9 pagesMutual Non-Disclosure and Non-Circumvention Agreement BetweenAdetokunbo AdemolaNo ratings yet

- Intro To MarriageDocument6 pagesIntro To MarriageClarkNo ratings yet

- MONTANEZvCipriano (2012) (181089) (FT) (CD)Document5 pagesMONTANEZvCipriano (2012) (181089) (FT) (CD)PierreNo ratings yet

- BCI Membership FormDocument13 pagesBCI Membership FormSoyeb Hassan100% (1)

- CitiBike - Original Contract Appendix and Exhibits - April 2012Document50 pagesCitiBike - Original Contract Appendix and Exhibits - April 2012Peter DrierNo ratings yet

- Plaintiff-Appellee Vs Vs Defendant-Appellant Bishop & O'Brien, Attorney-General WilfleyDocument3 pagesPlaintiff-Appellee Vs Vs Defendant-Appellant Bishop & O'Brien, Attorney-General WilfleyAnne MadambaNo ratings yet

- 5 6316439597127565363Document13 pages5 6316439597127565363KhayceePadillaNo ratings yet

- Case NotesDocument50 pagesCase NotesAbhinav ChaharNo ratings yet

- AA30203 - Kuliah 8 (Dasar Malaysia) 1Document27 pagesAA30203 - Kuliah 8 (Dasar Malaysia) 1Anna ZilahNo ratings yet

- Formation of Contracts Legal Env-1Document96 pagesFormation of Contracts Legal Env-1Alowe EsselNo ratings yet

- US vs. BasaDocument2 pagesUS vs. BasanomercykillingNo ratings yet

- Notes On Prelims LaborDocument15 pagesNotes On Prelims LaborCarol JacintoNo ratings yet

- Cases in Transportation LawDocument191 pagesCases in Transportation LawAn JoNo ratings yet

- PU 4 YEARS BBA V Semester SyllabusDocument12 pagesPU 4 YEARS BBA V Semester Syllabushimalayaban50% (2)

- Indian Contract Act 1872Document66 pagesIndian Contract Act 1872Abhishek Narang100% (2)

- Fusibles Térmicos TycoDocument2 pagesFusibles Térmicos TycoFabián Roberto NoyaNo ratings yet

- Guzman vs. CADocument2 pagesGuzman vs. CAIris DinahNo ratings yet

- 012-Pioneer Insurance vs. CA 175 Scra 668 (1989)Document11 pages012-Pioneer Insurance vs. CA 175 Scra 668 (1989)wewNo ratings yet

- SPS. VALENZUELA v. KALAYAANDocument3 pagesSPS. VALENZUELA v. KALAYAANAlfonso Miguel DimlaNo ratings yet

- Cheat CodeDocument6 pagesCheat CodeJustin TayabanNo ratings yet

- Concept - Leases and Licences PDFDocument24 pagesConcept - Leases and Licences PDFShaniah Williams100% (1)

- Thirdy - Sales Week 4Document4 pagesThirdy - Sales Week 4Thirdy DemonteverdeNo ratings yet

- Law of Contract: Alizah Ali Uitm JohorDocument31 pagesLaw of Contract: Alizah Ali Uitm Johorjustin_styles_7No ratings yet

- Quitoriano v. JebsenDocument2 pagesQuitoriano v. JebsenMa Charisse E. Gaud - BautistaNo ratings yet

- Blockchain-Risk-Considerations-for-Professionals WHPBRC WHP Eng 0421Document18 pagesBlockchain-Risk-Considerations-for-Professionals WHPBRC WHP Eng 0421Anis QasemNo ratings yet

- Drugs Testing Laboratory Punjab Bahawalpur: Laboratory Chemicals For Financial Year 2019-20Document40 pagesDrugs Testing Laboratory Punjab Bahawalpur: Laboratory Chemicals For Financial Year 2019-20rehanNo ratings yet