Professional Documents

Culture Documents

Basco V Pagcor

Uploaded by

Leomar Despi Ladonga0 ratings0% found this document useful (0 votes)

20 views1 pageK

Original Title

Basco v Pagcor

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentK

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageBasco V Pagcor

Uploaded by

Leomar Despi LadongaK

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

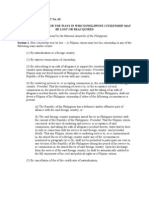

Basco v Pagcor

Municipal Corporation Local Autonomy imperium in imperio

On July 11, 1983, PAGCOR was created under PD 1869 to enable the Government to regulate and centralize all games of chance

authorized by existing franchise or permitted by law. Basco and four others (all lawyers) assailed the validity of the law creating

PAGCOR on constitutional grounds among others particularly citing that the PAGCORs charter is against the constitutional

provision on local autonomy.

Basco et al contend that P.D. 1869 constitutes a waiver of the right of the City of Manila to impose taxes and legal fees; that Section

13 par. (2) of P.D. 1869 which exempts PAGCOR, as the franchise holder from paying any tax of any kind or form, income or

otherwise, as well as fees, charges or levies of whatever nature, whether National or Local is violative of the local autonomy

principle.

ISSUE: Whether or not PAGCORs charter is violative of the principle of local autonomy.

HELD: NO. Section 5, Article 10 of the 1987 Constitution provides:

Each local government unit shall have the power to create its own source of revenue and to levy taxes, fees, and other

charges subject to such guidelines and limitation as the congress may provide, consistent with the basic policy on local autonomy.

Such taxes, fees and charges shall accrue exclusively to the local government.

A close reading of the above provision does not violate local autonomy (particularly on taxing powers) as it was clearly stated that

the taxing power of LGUs are subject to such guidelines and limitation as Congress may provide.

Further, the City of Manila, being a mere Municipal corporation has no inherent right to impose taxes. The Charter of the City of

Manila is subject to control by Congress. It should be stressed that municipal corporations are mere creatures of Congress which

has the power to create and abolish municipal corporations due to its general legislative powers. Congress, therefore, has the

power of control over Local governments. And if Congress can grant the City of Manila the power to tax certain matters, it can also

provide for exemptions or even take back the power.

Further still, local governments have no power to tax instrumentalities of the National Government. PAGCOR is a government

owned or controlled corporation with an original charter, PD 1869. All of its shares of stocks are owned by the National Government.

Otherwise, its operation might be burdened, impeded or subjected to control by a mere Local government.

This doctrine emanates from the supremacy of the National Government over local governments.

Equal Protection Gambling

PAGCOR was originally created by virtue of PD 1067-A dated Jan 1, 1977 and was granted a franchise under PD 1067-B also

dated Jan 1, 1977 to establish, operate and maintain gambling casinos on land or water within the territorial jurisdiction of the

Philippines. Its operation was originally conducted in the well known floating casino Philippine Tourist. The operation was

considered a success for it proved to be a potential source of revenue to fund infrastructure and socioeconomic projects, thus, PD

1399 was passed on June 2, 1978 for PAGCOR to fully attain this objective. Subsequently, on July 11, 1983, PAGCORs charter

was created under PD 1869 to enable the Government to regulate and centralize all games of chance authorized by existing

franchise or permitted by law, under the following declared policy:

Section 1. Declaration of Policy. It is hereby declared to be the policy of the State to centralize and integrate all games of

chance not heretofore authorized by existing franchises or permitted by law.

Basco and other lawyers assailed the validity of PAGCOR averring among others that it violates the equal protection clause of the

constitution in that it legalizes PAGCOR conducted gambling, while most other forms of gambling are outlawed, together with

prostitution, drug trafficking and other vices.

ISSUE: Whether or not the creation of PAGCOR violates the equal protection clause.

HELD: The SC found Bascos petition to be devoid of merit. Just how PD 1869 in legalizing gambling conducted by PAGCOR is

violative of the equal protection is not clearly explained in their petition. The mere fact that some gambling activities like cockfighting

(PD 449) horse racing (RA 306 as amended by RA 983), sweepstakes, lotteries and races (RA 1169 as amended by BP 42) are

legalized under certain conditions, while others are prohibited, does not render the applicable laws, PD. 1869 for one,

unconstitutional.

Bascos posture ignores the well-accepted meaning of the clause equal protection of the laws. The clause does not preclude

classification of individuals who may be accorded different treatment under the law as long as the classification is not unreasonable

or arbitrary. A law does not have to operate in equal force on all persons or things to be conformable to Article III, Sec 1 of the

Constitution. The equal protection clause does not prohibit the Legislature from establishing classes of individuals or objects upon

which different rules shall operate. The Constitution does not require situations which are different in fact or opinion to be treated in

law as though they were the same.

You might also like

- Commonwealth Act No. 63Document4 pagesCommonwealth Act No. 63Sherill Padua GapasinNo ratings yet

- Aznar Vs GarciaDocument1 pageAznar Vs GarciaLeomar Despi LadongaNo ratings yet

- Art. 333 - 346 - Crimes Against ChastityDocument6 pagesArt. 333 - 346 - Crimes Against ChastityLeomar Despi LadongaNo ratings yet

- Phil Bank Vs EchiverriDocument1 pagePhil Bank Vs EchiverriLeomar Despi LadongaNo ratings yet

- Art. 171 - 184Document8 pagesArt. 171 - 184Leomar Despi LadongaNo ratings yet

- Phil Bank Vs EchiverriDocument1 pagePhil Bank Vs EchiverriLeomar Despi LadongaNo ratings yet

- Conflict CasesDocument28 pagesConflict CasesLeomar Despi LadongaNo ratings yet

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaNo ratings yet

- Mercantile Law 2013 October Bar ExamsDocument17 pagesMercantile Law 2013 October Bar ExamsNeil RiveraNo ratings yet

- CRIMES AGAINST CIVIL STATUSDocument4 pagesCRIMES AGAINST CIVIL STATUSLeomar Despi LadongaNo ratings yet

- Aznar Vs GarciaDocument1 pageAznar Vs GarciaLeomar Despi LadongaNo ratings yet

- Full CasesDocument70 pagesFull CasesLeomar Despi LadongaNo ratings yet

- Art. 353 - 364 - Crimes Against HonorDocument13 pagesArt. 353 - 364 - Crimes Against HonorLeomar Despi Ladonga88% (8)

- Crimes Against State LawsDocument4 pagesCrimes Against State LawsLeomar Despi LadongaNo ratings yet

- NEGLIGENT ACTS UNDER PHILIPPINE LAWDocument3 pagesNEGLIGENT ACTS UNDER PHILIPPINE LAWLeomar Despi Ladonga100% (3)

- Spouses Yap vs. International Exchange BankDocument1 pageSpouses Yap vs. International Exchange BankLeomar Despi LadongaNo ratings yet

- ObligationDocument2 pagesObligationLeomar Despi LadongaNo ratings yet

- Book VDocument19 pagesBook VLeomar Despi LadongaNo ratings yet

- Simple Tenses and Perfect Tenses ExplainedDocument3 pagesSimple Tenses and Perfect Tenses ExplainedLeomar Despi LadongaNo ratings yet

- Bar Exams QuestionsDocument43 pagesBar Exams QuestionsLeomar Despi LadongaNo ratings yet

- January 11-20 2013 Civil CasesDocument1 pageJanuary 11-20 2013 Civil CasesLeomar Despi LadongaNo ratings yet

- Bildner V IlusorioDocument8 pagesBildner V IlusorioLeomar Despi LadongaNo ratings yet

- Monte de Piedad Earthquake Relief Funds DisputeDocument11 pagesMonte de Piedad Earthquake Relief Funds DisputeLeomar Despi LadongaNo ratings yet

- Complaint: X IncorporatedDocument6 pagesComplaint: X IncorporatedLeomar Despi LadongaNo ratings yet

- MANPOWER SUPPLY AGREEMENTDocument3 pagesMANPOWER SUPPLY AGREEMENTLeomar Despi LadongaNo ratings yet

- FActsDocument2 pagesFActsLeomar Despi LadongaNo ratings yet

- Chan Robles Virtual Law LibraryDocument7 pagesChan Robles Virtual Law LibraryLeomar Despi LadongaNo ratings yet

- RTC Hilongos Leyte People Philippines vs AB arson informationDocument1 pageRTC Hilongos Leyte People Philippines vs AB arson informationLeomar Despi LadongaNo ratings yet

- Basco V PagcorDocument1 pageBasco V PagcorLeomar Despi LadongaNo ratings yet

- BDO Bank Account Authorization CertificateDocument3 pagesBDO Bank Account Authorization CertificateLeomar Despi LadongaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)