Professional Documents

Culture Documents

Taxes in India - SAP MM

Uploaded by

Anand PattedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxes in India - SAP MM

Uploaded by

Anand PattedCopyright:

Available Formats

Presented By

Mr P.K Das

Contd.

Three-Tier Federal Structure

The Union Government

The State Governments

The Urban/ Rural Local Bodies

The power to levy taxes and duties is distributed among the three tiers of Governments,

in accordance with the provisions of the Indian Constitution

1. Direct Taxes

Tax on Corporate Income

Wealth Tax

Personal Income Tax

Tax Incentives

Double Taxation Avoidance Treaty

2. Indirect Taxes

Taxes Levied by Central Government

Excise Duty

Customs Duty

Service Tax

Taxes Levied by State Government

Sales Tax

Stamp Duty

State Excise Duty

Land Revenue

Duty on Entertainment

Tax on Professions & Callings.

Taxes Levied by Local Bodies

Tax on properties

Octroi

Tax on Markets and Tax/User Charges for utilities like water supply, drainage, etc.

PERSONAL TAXATION

No additional exemption limit for Female Taxpayer

New category of Very senior citizen introduced eligible for higher exemption limits of Rs 5,00,000

Age criterion for senior citizens to be relaxed from 65 years to 60 years.

Basic exemption limit for senior citizens to be increased from Rs.2,40,000 to Rs.2,50,000

Income Slab Rates as per Budget

Upto Rs1,80,000 Exempt

Rs1,80,000 5,00,000 10 Percent

Rs5,00,000 8,00,000 20 percent

Rs Above 8,00,000 30 Percent

Deduction under Chapter VI

Deduction under Section 80C

The total limit under this section is Rs 1 lakh.

Qualifying Investments

Provident Fund (PF) & Voluntary Provident Fund (VPF)

Public Provident Fund (PPF)

Life Insurance Premiums

Equity Linked Savings Scheme (ELSS)

Home Loan Principal Repayment

Stamp Duty and Registration Charges for a home

National Savings Certificate (NSC)

Pension Funds

5-Yr bank fixed deposits (FDs)

5-Yr post office time deposit (POTD) scheme

Unit linked Insurance Plan

Deduction under Section 80D

Any Premium which is paid for medical insurance that has been taken on the health of

the assessee, his spouse, dependent parents or dependent children, is allowed as a

deduction, subject to a ceiling of Rs 15,000.

Where any premium is paid for medical insurance for a senior citizen, an enhanced

deduction of Rs 20,000 is allowed. The deduction is available only if the premium is paid

by cheque

Deduction under Section 80CCF

Deduction in respect of Infrastructure Bond is allowed subject to ceiling of Rs 20000

Deduction under Section 80E

The deduction under section 80E is available to an individual if following conditions are

satisfied:

1. Deduction available only to Individual not to HUF or other type of Assessee.

2.Deduction amount: The amount of interest paid is eligible for deduction and

moreover there is no cap on the amount to be deducted. You can deduct the entire

interest amount from your taxable income. However there is no benefit available on the

repayment of principal amount of the loan.

Deduction under Section 80DDB

An individual, resident in India spending any amount for the medical treatment of

specified diseases affecting him or his spouse, children, parents, brothers and sisters

and who are dependant on him, will be eligible for a deduction of the amount actually

spent or Rs 40,000, whichever is less

For any amount spent on the treatment of a dependent senior citizen an individual is

eligible for a deduction of the amount spent or Rs 60,000, whichever is less is available.

Deduction under Section 80U

It is deduction in the case of a person with a disability. An individual who is suffering from

a permanent disability or mental retardation as specified in the persons with disabilities

(Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 or the

National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation

and Multiple Disabilities Act, 1999, shall be allowed a deduction of Rs 50,000. In case of

severe disability it is Rs. 75,000

Deduction under Section 24

Whenever you take a housing loan to build or buy a new home, the interest payable

on this home loan is eligible for income tax deduction. Maximum deductible amount,

i.e under section 24 is Rs. 1,50,000.

CORPORATE TAX

Tax Rate

Category Existing Rates New Rates

Income Tax 30 percent 30 percent

Surcharge 7.5 Percent 5 Percent

MAT Levied at 18 Percent of

Book Profit

Levied at 18.5 Percent of

Book Profit

Dividend Distribution Tax 15 percent

15 percent

CorparateTax on Foreign Companies are levied @ 40 Percent Plus Surcharge of 2

Percent

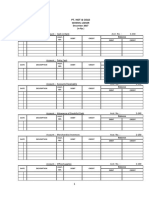

Section Nature of Payment Existing

Limit

Proposed

Limit

Rate

194B Winning from Lottery or Cross word puzzle 5,000 10,000 30

194BB Winning from Horse Race 2,500 5,000 30

194C Payment to Contractors [per Transaction] 20,000 30,000 2,1

194C Payment to Contractors [Annual Limit] 50,000 75,000 2,1

194D Insurance Commission 5,000 20,000 10

194H Commission or Brokerage 2,500 5,000 10

194I Rent 1,20,000 1,80,000 10

194J Fees for Professional and Technical Services 20,000 30,000 10

Tax Deduction At Source

Wealth Tax

Wealth tax is charged for every assessment year in respect of net wealth of corresponding

valuation date at the rate of one per cent of the amount by which net wealth exceeds Rs. 30 lakhs

The following assets are subjected to wealth tax:

Guesthouse, farm-house, commercial complex, shopping mall and residential complex are

subjected to the wealth tax.

Valuable items like jewelry and any items made up of precious metals like gold, silver, platinum or

any other precious metals.

Aircrafts, yachts, boats that is used for non-commercial purpose

Cash in hand that is more than 50,000, for individual and Hindu undivided families.

Any cash that is not recorded on the account log book is subjected to the wealth tax.

Motor car that is owned by an individual.

Any urban land situated in the jurisdiction where there is a total population of ten thousand as per

last census is subjected to the wealth tax.

Excise Duty

Manufacture of goods in India attracts Excise Duty under the Central Excise act 1944

and the Central Excise Tariff Act 1985. Herein, the term Manufacture means bringing into

existence a new article having a distinct name, character, use and marketability and

includes packing, labeling etc. Most of the products attract excise duties at the rate of

10%. Excise duty is levied on advalorem basis or based on the maximum retail price in

some cases

Small Scale Sector is exempted from payment of excise duty from annual production up

to Rs.1.5Crore

Impact Of The Recent Changes In Our Case

Sl Item Chapter

Heading

Existing

Duty

New Rate condition

1 Coal 27 Nil 5 With Cenvat credit

2 Coke 27 Nil 5 With Cenvat credit

3 Fly Ash 26 Nil 5 With Cenvat credit

Option to pay Excise duty @ 1percent is also available without utilization of Cenvat

Credit

Customs Duty

The levy and the rate of customs duty in India are governed by the Customs Act 1962

and the Customs Tariff Act 1975. Imported goods in India attract basic customs duty,

additional customs duty and education cess. The rates of basic customs duty are

specified under the Tariff Act. The peak rate of basic customs duty has been is 7.5% for

industrial goods. Additional customs duty is equivalent to the excise duty payable on

similar goods manufactured in India

The export duty on iron ore lumps and fines has been enhanced from 15% and 5%

respectively to a uniform rate of 20%.

Full exemption from export duty has been provided to iron ore pellets.

EXPORT DUTY

Service Tax

Service tax is levied at the rate of 10% (plus 3% education cess) on certain identified

taxable services provided in India by specified service providers. The Cenvat Credit

Rules allow a service provider to avail and utilize the credit of additional duty of

customs/excise duty for payment of service tax. Credit is also provided on payment of

service tax on input services for the discharge of output service Tax liability

Goods used for construction have been excluded from inputs while construction

services, work contract service, and other specified services in so far as they are used

for construction have been kept out of the purview of input services

Service Tax on Which Credit is Not Allowed

Services relating to , motor vehicles and personal use or consumption of employee will

not be eligible for Cenvat credit

Central Sales Tax

CST is 2% on manufactured goods against statutory declaration forms otherwise at the

rate prevailing under VAT

Value Added Tax

VAT is a multi-point destination based system of taxation, with tax being levied on value

addition at each stage of transaction in the production/ distribution chain. The term 'value

addition' implies the increase in value of goods and services at each stage of production

or transfer of goods and services. VAT is a tax on the final consumption of goods or

services and is ultimately borne by the consumer

There are four slabs of VAT

0% for essential commodities

1% on bullion and precious stones

4% on industrial inputs and capital goods and items of mass consumption

All other items 13.5%

Petroleum products, tobacco, liquor etc, attract higher VAT rates that vary from State to

State. This is normally up to 20%

Entry Tax

The levy and the rate of Entry Tax in Orissa are governed by the Orissa Entry Tax Act

1999. There shall be levied and collected a tax on entry of the scheduled goods into a

local area for consumption, use or sale therein at such rate of the purchase value of

such goods from such date as may be specified by the State Government and different

dates and different rates may be specified for different goods and local areas subject to

such conditions as may be prescribed. The tax leviable under this Act shall be paid by

every dealer in scheduled goods or any other person who brings or causes to be

brought into a local area such scheduled goods whether on his own account or on

account of his principal or customer or takes delivery or is entitled to take delivery of

such goods on such entry

Emerging New Tax Regime

Definition of Residential Status has been amended to cover only 2 category Resident

and Non Resident

Increase in medical reimbursement limit from ` 15,000 to 50,000

No additional exemption limit for Female Taxpayer

Income Slab Rates as per DTC

Upto Rs 2,00,000 Exempt

Rs 2,00,000 5,00,000 10 Percent

Rs 5,00,000-10,00,000 20 percent

Rs Above 10,00,000 30 Percent

Proposed Changes in DTC

Aggregate deductions for long term eligible savings along with tuition fees paid

proposed to be increased from Rs1lakh to Rs 3lakhs including interest on house loan

What Is GST

GST (Goods & Services Tax) is a domestic consumption tax applicable alike

on all goods and services. It will eliminate the differential treatment of the

manufacturing and service sector. It shall be a multi-stage tax where the

ultimate burden shall lie on the consumer.

The dealer shall charge GST on output and pay GST on inputs. Difference

of Output GST and input GST shall be payable as tax. Thus tax is payable

only on Value addition with no cascading effects.

There will be Dual GST Model

1. Central GST (CGST)

2. State GST(SGST)

State Level Taxes

VAT on sale of goods and deemed sales

Lotteries / Betting/ Gambling

Stamp Duty

Vehicle Tax / Road Tax / Passenger Tax / Toll Tax

Electricity Tax

Property Tax

Entry Tax / Purchase Tax, Octroi

Luxury Tax on services in Hotel and Restaurants.

Entertainment Tax

Cess and Surcharge

Various laws that get subsumed in GST

Central Taxes

Customs Duty on Imports

Central Excise Duty and Additional Excise Duty

Additional Customs Duty (CVD)

Service Tax on rendering of services

Central Sales Tax on Interstate sales

Cess and Surcharges

Various laws that get subsumed in GST

You might also like

- Direct and Indirect Tax: Submitted byDocument41 pagesDirect and Indirect Tax: Submitted bylakshyaNo ratings yet

- Taxation System in IndiaDocument5 pagesTaxation System in IndiaSiddharth NagarNo ratings yet

- Excise Duty: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityDocument16 pagesExcise Duty: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityNavendu ShuklaNo ratings yet

- Eco SeminarDocument17 pagesEco SeminarPavan GowdaNo ratings yet

- Direct & Indirect TaxesDocument33 pagesDirect & Indirect Taxesdinanikarim50% (2)

- Tax System in IndiaDocument53 pagesTax System in Indiadeepakldh998899No ratings yet

- Corporate Income Taxes and Tax RatesDocument38 pagesCorporate Income Taxes and Tax RatesShaheen ShahNo ratings yet

- Direct Tax CodeDocument4 pagesDirect Tax CodeHardip MatholiyaNo ratings yet

- Taxes: Tax StructureDocument14 pagesTaxes: Tax StructurePradeep NairNo ratings yet

- India Tax Structure 2011Document10 pagesIndia Tax Structure 2011wiesenerNo ratings yet

- U 5 TaxDocument23 pagesU 5 TaxfsafwfNo ratings yet

- Assignment: Taxation System in India'Document14 pagesAssignment: Taxation System in India'Devendra OjhaNo ratings yet

- 7th Term - Legal Frameworks of ConstructionDocument79 pages7th Term - Legal Frameworks of ConstructionShreedharNo ratings yet

- Bangladesh Income Tax Guide 2020 EYDocument60 pagesBangladesh Income Tax Guide 2020 EYAsif Assistant Manager100% (1)

- Comparison Between I.T. and DTCDocument23 pagesComparison Between I.T. and DTCsharma.shalinee1626No ratings yet

- Tax Changes in India and Morocco Taxation CiaDocument20 pagesTax Changes in India and Morocco Taxation CiaMEERA JOSHY 1927436No ratings yet

- Tax QuestionsDocument10 pagesTax QuestionsUdit VarshneyNo ratings yet

- India Tax System PDFDocument22 pagesIndia Tax System PDFIlma FatimaNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Tax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleDocument30 pagesTax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleSiddharth SharmaNo ratings yet

- Personal Exemptions: UK: Income Tax ExemptionsDocument4 pagesPersonal Exemptions: UK: Income Tax ExemptionsLuiza ŢîmbaliucNo ratings yet

- Tax LawsDocument4 pagesTax LawsGabby ChebetNo ratings yet

- Budget Highlights 2013Document12 pagesBudget Highlights 2013Souma MukherjeeNo ratings yet

- Direct Tax 2010Document2 pagesDirect Tax 2010Shivam TiwariNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- Tax Code of BangladeshDocument5 pagesTax Code of Bangladeshsouravsam100% (2)

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- DTC - FinalDocument18 pagesDTC - FinalvjranavjNo ratings yet

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- Direct Tax Code 2010Document3 pagesDirect Tax Code 2010Shuja MehdiNo ratings yet

- Direct Tax CodeDocument17 pagesDirect Tax CodeRashmi RathoreNo ratings yet

- 2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFDocument18 pages2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFtendaicrosby100% (1)

- Presenting: Direct Tax - Trends in IndiaDocument27 pagesPresenting: Direct Tax - Trends in IndiatusharNo ratings yet

- Tax Proposals in Financial Budget 2013-14: Ravi ChhatwaniDocument4 pagesTax Proposals in Financial Budget 2013-14: Ravi ChhatwanirockyrrNo ratings yet

- Taxes in IndiaDocument26 pagesTaxes in IndiaGyaneshwariNo ratings yet

- PWC Vietnam Pocket Tax Book 2013Document43 pagesPWC Vietnam Pocket Tax Book 2013Angie NguyenNo ratings yet

- Taxation System in IndiaDocument5 pagesTaxation System in IndiaTanvi SanghaviNo ratings yet

- Type Rate of Tax: Value-Added Tax (VAT) Donations Tax Unemployment Insurance ContributionsDocument2 pagesType Rate of Tax: Value-Added Tax (VAT) Donations Tax Unemployment Insurance Contributionsdiefenbaker13No ratings yet

- Unit1 GSTDocument26 pagesUnit1 GSTAryan SethiNo ratings yet

- Module 2 TRAIN Law RA10963Document26 pagesModule 2 TRAIN Law RA10963FlameNo ratings yet

- Input Tax CreditDocument16 pagesInput Tax CreditPreeti SapkalNo ratings yet

- Tax Assignment 1Document16 pagesTax Assignment 1Tunvir Islam Faisal100% (2)

- Income Tax AuthoritiesDocument12 pagesIncome Tax Authoritiesroni286No ratings yet

- Deloitte Tax Pocket Guide 2014Document20 pagesDeloitte Tax Pocket Guide 2014YHNo ratings yet

- Direct Tax CodeDocument10 pagesDirect Tax Codejgaurav80No ratings yet

- Income Tax ReturnDocument57 pagesIncome Tax ReturnMalik WasimNo ratings yet

- TAX MGT PPT 1Document28 pagesTAX MGT PPT 1Rahul DesaiNo ratings yet

- Worldwide Tax Summaries 2013 2014Document18 pagesWorldwide Tax Summaries 2013 2014Malek AmaraNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- PWC DTC 2010 SnapshotDocument7 pagesPWC DTC 2010 SnapshotGs ShikshaNo ratings yet

- CustomsDocument28 pagesCustomsDamasceneNo ratings yet

- Workshop On Finance For Non-Finance Executives: Mining & BeneficiationDocument36 pagesWorkshop On Finance For Non-Finance Executives: Mining & BeneficiationSaikumar SelaNo ratings yet

- Union Budget: Prof. M K SahooDocument30 pagesUnion Budget: Prof. M K SahoosanujeeNo ratings yet

- 49 Tax Rates For A y 2011 12Document8 pages49 Tax Rates For A y 2011 12shitalNo ratings yet

- Unit 4Document112 pagesUnit 4Vetri Velan100% (1)

- Financial Budget 2013Document9 pagesFinancial Budget 2013Mitesh PanchalNo ratings yet

- Taxation System in IndiaDocument20 pagesTaxation System in IndiaChowdhary Mohinder SinghNo ratings yet

- Income Taxation: Basic Priciples: 1. As To Subject Matter or ObjectDocument8 pagesIncome Taxation: Basic Priciples: 1. As To Subject Matter or ObjectcesalyncorillaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Cloud ComputingDocument24 pagesCloud ComputingAnand PattedNo ratings yet

- Taxes in IndiaDocument31 pagesTaxes in IndiaAnand PattedNo ratings yet

- SFDC Working With CampaignsDocument10 pagesSFDC Working With CampaignsAnand PattedNo ratings yet

- 2008 StudyGuide CertifiedAdminDocument52 pages2008 StudyGuide CertifiedAdminJason MintNo ratings yet

- PM History CardDocument44 pagesPM History CardAnand PattedNo ratings yet

- Customer ServiceDocument21 pagesCustomer ServiceAnand Patted100% (1)

- SFDC ADM Course Certification ContentDocument4 pagesSFDC ADM Course Certification ContentAnand PattedNo ratings yet

- SAP MM - Release Procedure TGKL-PRDocument19 pagesSAP MM - Release Procedure TGKL-PRAnand PattedNo ratings yet

- Types of Tax in IndiaDocument2 pagesTypes of Tax in IndiaAnand PattedNo ratings yet

- Itil: The Basics: Valerie Arraj, Compliance Process Partners LLCDocument5 pagesItil: The Basics: Valerie Arraj, Compliance Process Partners LLCdmr1982No ratings yet

- Taxes in IndiaDocument31 pagesTaxes in IndiaAnand PattedNo ratings yet

- Make To Order & Make To StockDocument3 pagesMake To Order & Make To StockAnand PattedNo ratings yet

- Warranty FlowDocument1 pageWarranty FlowAnand PattedNo ratings yet

- Sap SD Pricing ConditionsDocument3 pagesSap SD Pricing ConditionsAnand PattedNo ratings yet

- Processing Blocked DocumentDocument13 pagesProcessing Blocked DocumentAnand PattedNo ratings yet

- Dangerous GoodsDocument13 pagesDangerous GoodsAnand PattedNo ratings yet

- Data Migration For Semifinished MaterialDocument7 pagesData Migration For Semifinished MaterialAnand PattedNo ratings yet

- Questions On Pricing Procedure in SAP SDDocument5 pagesQuestions On Pricing Procedure in SAP SDAnand PattedNo ratings yet

- Data Migration Service MasterDocument1 pageData Migration Service MasterAnand PattedNo ratings yet

- Credit or Risk ManagementDocument12 pagesCredit or Risk ManagementAnand PattedNo ratings yet

- LIC AAO Exam - 2007 (Solved)Document4 pagesLIC AAO Exam - 2007 (Solved)Anand PattedNo ratings yet

- Shipment Cost - SAP SDDocument13 pagesShipment Cost - SAP SDAnand Patted100% (3)

- Business BlueprintDocument10 pagesBusiness BlueprintAnand Patted0% (1)

- Warranty FlowDocument1 pageWarranty FlowAnand PattedNo ratings yet

- ER1 Report ExplainationDocument2 pagesER1 Report ExplainationAnand PattedNo ratings yet

- Vistex - SAP SD With VistexDocument25 pagesVistex - SAP SD With VistexAnand Patted100% (2)

- ER1 Report FormatDocument1 pageER1 Report FormatAnand PattedNo ratings yet

- Business and Management SL P1msDocument9 pagesBusiness and Management SL P1msniranjanusms100% (1)

- Salas Vs CADocument4 pagesSalas Vs CAHiroshi Carlos100% (1)

- Introduction of Aditya Birla GroupDocument4 pagesIntroduction of Aditya Birla GroupdeshmonsterNo ratings yet

- Ar 2019 # Samindo-4 PDFDocument271 pagesAr 2019 # Samindo-4 PDFpradityo88100% (1)

- University College Lahore: School of LawDocument6 pagesUniversity College Lahore: School of LawNoor Ul Hassan GilaniNo ratings yet

- 08 InvestmentquestfinalDocument13 pages08 InvestmentquestfinalAnonymous l13WpzNo ratings yet

- Payslip Nov 18Document1 pagePayslip Nov 18gowda RaghuNo ratings yet

- John Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentDocument19 pagesJohn Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentThe Straw BuyerNo ratings yet

- PitchBook PME Benchmarking MethodologyDocument10 pagesPitchBook PME Benchmarking Methodologykartikkhanna1990No ratings yet

- NCDDP AF Sub-Manual - Program Finance, Aug2021Document73 pagesNCDDP AF Sub-Manual - Program Finance, Aug2021Michelle ValledorNo ratings yet

- Company Profile - 6A GROUP 5Document26 pagesCompany Profile - 6A GROUP 5PUTERI SIDROTUL NABIHAH SAARANINo ratings yet

- Final Exam (Essay) EconomicsDocument2 pagesFinal Exam (Essay) EconomicsFraulein G. Foronda36% (11)

- Stanley Black DeckerDocument9 pagesStanley Black Deckerarnabkp14_7995349110% (1)

- Attn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDDocument1 pageAttn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDNg Kit YinNo ratings yet

- Law On Business and Regulations-PrintDocument2 pagesLaw On Business and Regulations-PrintSittie Sarah BangonNo ratings yet

- Personal Trading BehaviourDocument5 pagesPersonal Trading Behaviourapi-3739065No ratings yet

- FRBM ActDocument3 pagesFRBM ActDHWANI DEDHIANo ratings yet

- CheatsheetDocument2 pagesCheatsheetSafi NurulNo ratings yet

- Investment Project (Mock Trading)Document9 pagesInvestment Project (Mock Trading)sanaNo ratings yet

- Lembar - JWB - Soal - B - Sesi 2Document11 pagesLembar - JWB - Soal - B - Sesi 2Sandi RiswandiNo ratings yet

- Consultants DirectoryDocument36 pagesConsultants DirectoryPeter WahlburgNo ratings yet

- Briefer For CREBA Meeting CI JGDocument3 pagesBriefer For CREBA Meeting CI JGVic CajuraoNo ratings yet

- Petition For Issuance of Letter of AdministrationDocument4 pagesPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaNo ratings yet

- LCCI Level 3 - Advanced Business Calculations (Exam Kit)Document332 pagesLCCI Level 3 - Advanced Business Calculations (Exam Kit)BethanyNo ratings yet

- Company Profile at CMC LimitedDocument20 pagesCompany Profile at CMC LimitedAnkur DubeyNo ratings yet

- Marginal Costing and Cost Volume Profit AnalysisDocument5 pagesMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet

- Final Exam Review 2 - LSM 1003 - HCT - ..Document12 pagesFinal Exam Review 2 - LSM 1003 - HCT - ..Roqaia AlwanNo ratings yet

- Ho Chi Minh City Q4 2012 ReportDocument27 pagesHo Chi Minh City Q4 2012 ReportQuin Nguyen PhuocNo ratings yet

- CSD PlanDocument12 pagesCSD PlanNargis FatimaNo ratings yet