Professional Documents

Culture Documents

Financial Statement Analysis: Changes From Eleventh Edition

Uploaded by

Dhiwakar SbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis: Changes From Eleventh Edition

Uploaded by

Dhiwakar SbCopyright:

Available Formats

CHAPTER 13

FINANCIAL STATEMENT ANALYSIS

Changes from Eleventh Edition

Updated from Eleventh Edition

Approach

Although it is not possible to do this precisely, the financial statement analysis discussion is more

coherent, we believe, if it is built around Illustration 13-1. The theme is that the financial statement proxy

for shareholder value is return on investment, and the ratios help explain why a given return was not

satisfactory (if it was not), or at least identify the areas that need investigation.

As with Chapter 8, the amount of attention given to this chapter depends on whether or not the students

are taking or will take a course in finance. In such a course, they will, of course, deal considerably more

with financial statement analysis than is contained in this introductory treatment. When a finance course

is given, we do not assign the chapter, but suggest only that students skim through it.

Students should not get the impression that there is one best list of ratios to be memorized. Although the

24 given in Illustration 13-3 could be expanded still further, in practice the analyst will select the ratios

most appropriate for a given industry setting.

Cases

Genmo Corporation is a backwards case in which students deduce the financial statements of General

Motors Corporation from the ratios.

Amerbran Company (B) is a case involving straightforward calculation of ratios.

Identify the Industries--1996 is a case showing companies in the different industries can have quite

disparate values of their ratios.

Supplement to Identify the Industries is a case showing companies in the different industries can have

quite disparate values of their ratios.

Springfield National Bank is a case in financial analysis as the basis for a lending decision. It involves

both the calculation of ratios and the exercise of judgment.

Quality Furniture Company is a case involving a credit decision.

Sears, Roebuck and Co. vs Wal-Mart Stores, Inc examines two companies with a similar return on equity

but very different business strategies.

Portor Lumber Company, Inc. involves preparation of proforma financial statements using financial

ratios. This case has been moved from Chapter 14 to Chapter 13 for the Twelfth Edition.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Problems

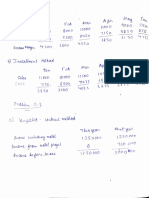

Problem 13-1

a. Profit Margins

M Net income

54

.05 (5 percent)

M Sales

1,080

N Net income

122

.10 (10 percent)

N Sales

1,215

N has the higher profit margin.

b. Investment Turnover

M Sales

1,080

6x

M Investment

180

N Sales

1,215

3x

N Investment

405

M has the higher investment turnover.

c. Return on Investment

M Net income

M-Sales

.05 x 6 .30 (30 percent)

M Sales

M-Investment

N Net income

N Sales

N Sales

N Investment

.10 x 3 .30 (30 percent)

Both firms have similar returns on investments. Based on this investment criterion, the investments

are equally attractive.

Problem 13-2

Since the division has no control over the financing of its assets employed in its operation, the most

appropriate measure of return on investment to use to judge its performance is

Net income excluding interest expense

Average total assets

$54,000 ($4,200 x .7)

($400,000 $525,000)/2

$56,940

$462,500

= .123 (12.3 percent).

Problem 13-3

2007 McGraw-Hill/Irwin

Chapter 13

Current Year

Days' cash

$5,479,296

($83,138,408 / 365)

$5,479,296

$227,776

= 24 days

Preceeding Year

Days' cash

$6,123,704

($99,748,943 / 365)

$6,123,704

$273,285

= 22.4 days

The new controller holds more cash relative to the companys cash expenses than did the old

controller. The higher level may be safer (i.e. less chance of not meeting payments when due), but

what is its cost? If the cash balance is excessive, the excess is a low-return use of cash compared to

investing it in higher return assets.

Problem 13-4

Current Year

Accounts receivable days

$1,392,790

($13,035,085 / 365)

$1,392,790

$35,713

= 39 days

Previous Year

Accounts receivable days

$1,207,393

($11,597,327 / 365)

$1,207,3930

$31,774

= 38 days

The new policy has not changed the payment practices of customers in any material way.

Problem 13-5

Accounting: Text and Cases 12e Instructors Manual

Average inventory

Anthony/Hawkins/Merchant

($58,160 $62,880)

2

= $60,520

$60,520

($300,000 / 365)

Days' inventory

$60,520

$822

= 74 days

Inventory turnover

$300,000

$60,520

= 5 times

Ms. Whitneys utilization of her investment in inventory is lower than for similar companies.

Problem 13-6

Price/earnings ratio

$82

($20,000,000/2,000,000 shares)

$82

$10

= 8.2 times

Dividend yield

$5.74

82

= .07 (7 percent)

Dividend payout

($5.74 x 2,000,000 shares)

$20,000,000

$11,480,000

$20,000,000

= 57.4 percent

Problem 13-7

2007 McGraw-Hill/Irwin

Chapter 13

$1,750,000,000

$250,000,000

Working capital turnover

= 7 times

Capital intensity

$1,750,000,000

$525,000,000

= 3.33 times

Equity turnover

$1,750,000,000

$1,500,000,000

= 1.17 times

Cases

Case 13-1 Genmo Corporation

Note: Unchanged from the Eleventh Edition.

Approach

This case increases an understanding of ratios and of financial statement relationships by requiring the

student to work backwards from the straightforward description of ratios given in the text. It requires a

clear understanding and considerable deductive reasoning.

The numbers are those of General Motors Corporation for 1986 and 1987, divided by 10,000; that is, in

1986 General Motors had revenues of $97.8 billion. (GMAC is not consolidated; consolidation was

required beginning in 1988 (FASB 94), which made the ratios illustrated here less interpretable.) The case

therefore gives the student a picture of relationships in this huge corporation and is more interesting than

a mechanical calculation. In particular, reasons for a relatively low current ratio and high inventory

turnover (virtually no inventory of completed cars) can be discussed.

Discussion

In several instances, alternative ways of calculating a ratio were possible. In each, the correct alternative

can be found by checking the way the ratios actually were computed in 1986 (2001 in the case).

Financial statements and the method of calculating each item are given in Ex. A.

The 1987 (2002 in the case) return on shareholders equity was 9.60 percent. The 1986 and 1987 ROE

performance trend was obviously unsatisfactory from a longer-term perspective, and 9.60 percent was

unsatisfactory given AAA bond returns in 1987.

Exhibit A

*

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

9.

10.

11.

12.

13.

GENMO CORPORATION

Balance Sheet as of December 31, 2002

Assets

Cash and marketable securities..........................................................................................................................................

$ 416

Accounts receivable...........................................................................................................................................................

1,117

Subtotal: quick assets......................................................................................................................................................

1,533

Inventories.........................................................................................................................................................................

872

Prepaid expenses................................................................................................................................................................

273

Total current assets..........................................................................................................................................................

2,678

Noncurrent assets...............................................................................................................................................................

4,524

Total assets...................................................................................................................................................................

$7,202

Liabilities and Equity

Current liabilities...............................................................................................................................................................

$2,285

Noncurrent liabilities..........................................................................................................................................................

$1,885

Shareholders equity...........................................................................................................................................................

3,032

Total invested capital..........................................................................................................................................................

4,917

Total liabilities and shareholders equity......................................................................................................................

$7,202

14.

15.

16.

17.

18.

Income Statement, 2002

Revenues............................................................................................................................................................................

$10,281

Cost of sales.......................................................................................................................................................................

8,727

Gross margin......................................................................................................................................................................

1,554

Other expense....................................................................................................................................................................

1,263

Net Income.........................................................................................................................................................................

$ 291

Line

1.

2.

3.

4.

5.

6.

7.

8.

Notes

Line

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Line 3 - line 2

Revenue (10,281) * days receivables (39.66) / 365

Current liabilities (2,285) * quick ratio (0.671)

Cost of sales (line 15) inventory turnover (10.005)

Line 6 - (line 3 + line 4)

Current liabilities (2,285) * current ratio (1.172)

Line 8 - line 6

Same as line 13

Given

Let debt = X; then X (4,917 - X) = 0.6215 (debt/equity). Solving, X = 1,885. (The 4,917 comes

from line 12.)

11.

Line 12 - line 10

12.

Revenues (10,281) / invested capital turnover (2.091)

13.

Line 9 + line 12

14.

Given

15.

Line 14 - line 16

16.

Revenues (10,281) * gross margin percentage (0.1512)

17.

Line 16- line 18

18.

Revenue (10,281)* profit margin percentage (0.02831)

Case 13-2: Amerbran (B)*

*

This teaching note was prepared by James S. Reece. Copyright James S. Reece.

2007 McGraw-Hill/Irwin

Chapter 13

Note: This case is unchanged from the Eleventh Edition.

Approach

This is a straightforward exercise in calculating various ratios for two years of an actual companys

(American Brands) financial statements. Although the numbers have been revised, the magnitudes and

relationships have been preserved. (Most of the data appear in Exhibit 1 of Amerbran Company (A).) I

discuss question 1 after the gross margin percentage has been calculated, and question 2 after all of the

ratios have been presented. It is worthwhile to have students give the definition of each ratio and a brief

statement as to what it indicates before presenting their numbers for the ratio for space each year.

The required calculations are shown in the table below. The only tricky one is days cash. For 20x0, no

information is available in either the (A) or (B) case to estimate cash expenses. For 20xl, two approaches

are available. One is to use the quick and dirty estimate of total expenses less depreciation (given in

item 1 of the (A) case), which results in an estimate of $7,177,930; this is the approach taken for 20xl in

the table below. Of course, a better option would be to use a variation on the approach from preparing the

cash flow statement for the (A) case: Cash generated by operations was $574,128. Collections would have

been sales less the increase in accounts receivable: $7,622,677 - $68,827 = $7,553,850. Thus cash

expenses would have been $7,553,850 - $574,128 = 6,979,722. With this number the 20xl days cash

result would have been 1.51 days. For 20x0, the approach taken here was to take 20xl depreciation,

$115,974 and multiply it by the ratio of 20x0 to 20xl property, plant, and equipment (at cost), giving an

estimate of $101,198. Other approaches are also possible, but arent likely to change the result very much

since depreciation is such a small percentage of total expenses (1.6 percent in 20xl).

Question 1

Some years ago in looking at some oil company annual reports, I discovered (to my surprise) that there

was not uniform treatment of excise taxes on gasoline. Some companies included excise taxes in revenues

and then subtracted them below the gross margin line as a period cost (nonincome tax expense). Other

companies ignored excise taxes altogether in their statements, reflecting the view that the company was in

effect an involuntary tax collector and that the taxes collected were neither revenues nor expenses to the

firm. (I personally support this view.) The pretax income reported by the two approaches is identical, but

the absolute amount of revenues is inflated by the first approach, thus affecting the gross margin

percentage (and any other ratio that involves revenues in its calculation).

Amerbran Company collects excise taxes on tobacco products and uses the approach of including the

excise taxes in revenues and subtracting them as an expense but with the twist of treating the taxes as a

product cost (pregross margin) rather than as a period cost. This approach results in the same absolute

amount of gross margin as if the taxes were ignored altogether. However, it makes the companys sales

look greater by a significant amount: in 20x0, revenues excluding the taxes would have been $4,223,130,

or 36 percent lower than the amount reported. On the other hand, treating the taxes as a product cost

reduces the gross margin percentage. For example, with the taxes included in revenues but subtracted

below the gross margin line, in 20x0 the percentage would have been $4,004,130 / $6,577,480 = 60.9%;

and with the taxes ignored altogether the percentage would have been $1,649,780 / $4,223,130 = 39.1%.

As treated by Amerbran, the 20x0 gross margin percentage was 25.1%. Thus, one must speculate that the

company sees some advantage in trying to downplay (i.e., understate) its actual margin while at the same

time overstating its size (revenues).

Question 2

This question is intended to get students to think about the ratios, not just mindlessly calculate them. It

also suggests that ratio analysis raises questions, but it seldom automatically answers them, and that some

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

important questions are only indirectly related to the ratios. The overriding question is why net income

was down 13 percent from 20x0 to 20xl while revenues (including excise taxes) were up 16 percent: this

is directly reflected in the decreased net income percentage (return on sales) ratio. (I stress that though

this ratio is down only 1.45 percentage points, this is a decrease in the ratio of 25 percent.) This profit

margin question also at least indirectly relates to the downward trend in interest coverage, ROA, and

ROE. In fact, improved asset turnover (as well as equity turnover, which students werent asked to

calculate) helped offset part of the effect on ROA (and ROE) of the lower profit margin. Since the gross

margin percentage actually increased slightly in 20xl, the explanation of the narrowed profit margin must

lie in SG&A expenses, which were 14.8 percent of sales in 20x0 but 17.4 percent in 20xl. The decline in

the current and acid-test ratios may not be a concern, but rather may simply reflect better credit and

inventory management (notice that collection period days receivables is down and inventory turnover

is up). Financial leverage as measured by the debt/capitalization ratio has declined a bit, but even in 20x0

was at a relatively safe level for a firm of this basic stability.

1

.

2

.

3

.

4

.

Definition

20x0

20xl

Return

[Net Income +

[$378,782 +

[$328,773 on Assets..........................................................................................................................................................................................................

Interest

$105,165

$102,791

*(1-Tax Rate)]

*(1-.4394)]

= 0.0987

*(1-.455l)]

= 00797

= 9.87%

= 7.97%

Total Assets

$4,433,448

$4,826,512

Return

Net Income

$378,782

$328,773

on Equity.........................................................................................................................................................................................................

= .1735

= 0.1417

=

=

Shareholders

$2,182,869

$2,320,620

17.35

14.17

Equity

%

%

Gross

Gross Margin

$1,649,780

$1,931,438

Margin

= 0.2508

= 0.2534

Percentage.......................................................................................................................................................................................................

=

=

Net Sales Revenue

$6,577,480

$7,622,677

25.08

25.34

%

%

Return

Net Income

$378,782

$328,773

on Sales...........................................................................................................................................................................................................

= 0.0576

= 0.0431

= 5.76%

= 4.31%

Net Sales Revenue

$6,577,480

$7,622,677

5

.

Asset

Sales Revenue

$6,577,480

$7,622,677

Turnover..........................................................................................................................................................................................................

= 1.48

= 1.58

Times

Times

Total Assets

$4,433,448

$4,826,512

6

.

Days

Cash

$23,952

$28,912

Cash.................................................................................................................................................................................................................

= 1.43

= 1.47

Days

Days

Cash Expenses /

($6,198,698 ($7,293,904 365

$101,198)/365

$115,974/365

7

.

Days

Accounts

$687,325

$756,152

Receivables.....................................................................................................................................................................................................

Receivable

= 38.1

= 36.2

Days

Days

Sales / 365

$6,577,480/365

$7,622,677/365

8

.

Days

Inventory

$1,225,402

$1,244,912

Inventories.......................................................................................................................................................................................................

= 173.8

= 162.1

Days

Days

Cost of sales / 365

$2,573,350/365

$2,803,623/365

2007 McGraw-Hill/Irwin

Chapter 13

9

.

Inventory

Cost of Sales

$2,573,350

$2,803,623

Turnover............................................................................................................................................................................................

= 2.10

= 2.25

Times

Times

Inventory

$1,225,402

$1,244,912

1

0

.

Current

Current Assets

$2,013,846

$2,106,116

Ratio..................................................................................................................................................................................................

= 1.53

= 1.30

Current Liabilities

1

1

.

$1,317,751

$1,625,218

Acid-Test

Monetary Current

$711,277

$785,064

Ratio..................................................................................................................................................................................................

Assets

= 0.54

= 0.48

Current Liabilities

$1,317,751

$1,625,218

1

2

.

Debt/

Noncurrent

$932,828

$880,674

Capitalizatio

Liabilities

= 0.2994

= 0.2751

n

=

=

Ratio..................................................................................................................................................................................................

29.94

27.51

(Noncurrent

$932,828 +

$880,674 +

%

%

Liabilities

$2,182,869

$2,320,620

+ Shareholders

Equity)

1

3

.

Times

Pretax Operating

Interest

Profit

$675,659 + $105,165

$603,331 +

Earned...............................................................................................................................................................................................

+ Interest

= 7.42

$102,791

= 6.87

times

Times

Interest

$105,165

$102,791

Case 13-5: Springfield Bank*

Note: Unchanged from the Eleventh Edition.

Approach

This case was used by Professor Ray G. Stephens in a study of the use of accounting information by bank

lending officers. For a full account of the study, see Ray G. Stephens, The Uses of Financial Information

in Structuring and Improving Decision Processes for Bank Lending Officers (an unpublished thesis,

Harvard Business School). The data for Dawson Stores, Inc., are the consolidated 1974 - 77 financial

statements for Dayton-Hudson Corporation, multiplied by 13 and / 1,000.

Excerpts from interviews with three loan officers are given below to indicate the diversity of approaches

to the problem. (The loan officers reviewed the data before the multiplier effect used in this case.) In

addition, students can act as loan officers, presenting various arguments supported by ratio analysis.

Loan Officer B

Loan Officer B read the first two pages of the empirical study problem and turned to the financial

statements. In examining the financial statement, he noted: (1) accounts receivable were up, (2) company

*

This teaching note was prepared by Ray G. Stephens. Copyright Ray G. Stephens.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

had deferred taxes on installment sales which he inferred meant that they were selling fixed assets off. (3)

questioned the accounts receivable as he would think that the company would be primarily a cash

business, (4) wondered what the bad debt write-offs were, (5) wondered whether the company would be

better off factoring accounts receivable, (6) was curious about the purpose of the requested line of credit

because of the nonutilization of bank credit in the past, but felt that it would be a desirable account from

the deposit balances, and (7) wondered to whom the long-term debt was owed. At this point Loan Officer

B felt that he could not make a decision about the extension of credit without further clarification on four

issues: (1) What were the credit terms of Dawson stores, Inc.? (2) Had the company changed stores

recently? (3) Who was the lender on the long-term debt? and (4) What did the company feel was the

purpose of the request for funds and when would the funds be used and repaid?

Loan Officer D

Loan Officer D started with a comment about Mr. Dawson leaving the statements without an opportunity

for the lending officer to discuss his need for funds. In actual practice, he would expect more complete

statements of this type.

Loan Officer D then focused upon the current assets section of the statement of financial position as

communicating most about the companies need for the loan:

The need for cash or working capital (a better word) has to come from his current position, wherein

the inventory or the receivables reach such a point theyre not turning fast enough to support the cash

outlay; theyre not turning fast enough or theres some sort of . . . theyre out of kilter [There is

something out of kilter between the relationship of ] the three: receivables, inventory, and cash, so he

has to have satisfied me that the reason for this increase in receivables or inventory is legitimate.

After having satisfied himself as to the legitimacy of the increase, Loan Officer D then proceeded to

compute the following ratios: current, acid, debt/equity, sales/receivables, sales/merchandise

(inventory), profits/equity, and payables/purchases. He started out to compute only the first five and

computed the others also. The first five were felt to be basic to all companies while the latter were felt

to be relevant for this specific firm (from some later comments, we infer due probably to the retail

nature of the company). Loan Officer D was more interested in the trend of a specific ratio than in the

absolute value of the financial ratio.

Loan Officer Ds processing up to this point indicated that the company was a strong candidate as a loan

recipient. The only uncertainty was the amount of the loan, which would be granted. The detailed cash

flow statements previously requested would be utilized to determine the amount that the Loan Officer

would make a commitment of the bank to loan. Loan Officer D was not concerned with the 19-day

slowdown in accounts receivable collection, which the sales/merchandise ratio (computed in days)

indicated. Loan Officer D would, however, request the endorsement of the two Dawson brothers as

principals, even though they did not have controlling ownership of the company, due to his banks

standard policies.

Loan Officer E

Loan Officer E computed the following ratios: cost of sales/inventory, cost of sales/payables, cost of

revenues, operating expenses/revenues, earnings before income taxes/revenues, and net

earnings/revenues. While reviewing the cash flow statements, he placed a large question mark by

Mortgages assumed by purchasers of office properties and prepayment on long-term debt. Loan Officer

E then computed what the accounts payable would have been if they had remained at the same level as

the first year which was contained in the empirical study problem. His computation was undertaken in the

belief that the increase in accounts payable from $1,153,000 (33 days) to $2,272,000 (49 days) indicated

the amount of undercapitalization of the firm. This indicated that the firm was undercapitalized by

10

2007 McGraw-Hill/Irwin

Chapter 13

approximately $900,000 ($2,272,000 - $1,400,000).

If the company had its payables at the end of 03 down to approximately the 30-day level which they

were at three years ago, although I dont know it was probably satisfactory, their payables would

have been down to whatever the satisfactory level is, which we assume [is] maybe 30 days, and the

bank would have found itself with a $900,000 unsecured loan at the time of the year when a retailer

should be most liquid and out of debt. Clearly, hes telling me that this year he needs $1,000,000 more

than he needed last year, or one could say that last year he needed $900,000, so maybe he needs a

little bit more money than he needed last year.

Loan Officer E was also concerned about Dawson Stores, Inc., paying out so much in dividends. Over the

last four years, dividends amounted to approximately $600,000, which represented a large portion of the

amount that Loan Officer E felt that the company was undercapitalized. Combined with the lack of

breakdown in operating expenses, Loan Officer E was unable to tell how much money the officers were

taking out of the firm.

Further, Loan Officer E was concerned about the real estate operation of the firm. He felt that managing

real estate was not their business. Combining this with the information about the sale of office properties,

he further confirmed his antipathy toward granting a seasonal $1,000,000 loan commitment.

Summarizing, Loan Officer E said:

Well, theres sufficient information here to indicate that the company is undercapitalized and that

basically [through] the analysis I did with accounts payable, most of it has come to light. The

company is undercapitalized. I dont want to capitalize it with unsecured debt; . . . if this was

something [a loan request] coming in from the outside, I would probably just reject it without asking

for additional information. Given that it is a long-term customer of the bank, I would seek out

additional information to see if it would [become a loan situation].

Loan Officer E would express apprehensions to the loan requester in several areas: dividends, carrying

retail accounts receivable, real estate operations, and owning their own real estate. Loan Officer E felt that

his comments would be applicable to companies 10 times or 100 times as large.

11

You might also like

- Accounting Text and Cases 12 Ed - Chapter 1Document16 pagesAccounting Text and Cases 12 Ed - Chapter 1sanjay28382100% (2)

- Sources of Capital: Debt: Changes From Eleventh EditionDocument19 pagesSources of Capital: Debt: Changes From Eleventh EditionDhiwakar Sb100% (1)

- Chapter 27 Management AccountingDocument19 pagesChapter 27 Management AccountingLiz Espinosa100% (1)

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocument19 pagesBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument22 pagesRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Anthony Im 26Document18 pagesAnthony Im 26Aswin PratamaNo ratings yet

- anthonyIM 09Document17 pagesanthonyIM 09Ki Umbara100% (1)

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- anthonyIM 24Document18 pagesanthonyIM 24ceojiNo ratings yet

- Other Items That Affect Net Income and Owner'S Equity: Changes From Eleventh EditionDocument14 pagesOther Items That Affect Net Income and Owner'S Equity: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- anthonyIM 06Document18 pagesanthonyIM 06Jigar ShahNo ratings yet

- Control: The Management Control Environment: Changes From The Eleventh EditionDocument22 pagesControl: The Management Control Environment: Changes From The Eleventh EditionRobin Shephard Hogue100% (1)

- Additional Aspects of Product Costing Systems: Changes From Eleventh EditionDocument21 pagesAdditional Aspects of Product Costing Systems: Changes From Eleventh EditionceojiNo ratings yet

- anthonyIM 24Document18 pagesanthonyIM 24Victor LimNo ratings yet

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument21 pagesRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KNo ratings yet

- Case1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9Document20 pagesCase1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9amyth_dude_9090100% (2)

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- Chap 026Document17 pagesChap 026Neetu Rajaraman100% (2)

- Chapter 15&16 Problems and AnswersDocument22 pagesChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Control: The Management Control Process: Changes From Eleventh EditionDocument25 pagesControl: The Management Control Process: Changes From Eleventh EditionAlka Narayan100% (1)

- anthonyIM 23Document25 pagesanthonyIM 23ceojiNo ratings yet

- CH 21Document7 pagesCH 21Rand Al-akamNo ratings yet

- Cash Flow CH 11Document2 pagesCash Flow CH 11ayush sharma75% (4)

- Bonus ch15 PDFDocument45 pagesBonus ch15 PDFFlorence Louise DollenoNo ratings yet

- AHM Chapter 3 Exercises CKvxWXG1tmDocument2 pagesAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNo ratings yet

- Chapter 8 PDFDocument36 pagesChapter 8 PDFRoan CalimdorNo ratings yet

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- AHM Chapter 4 - SolutionsDocument24 pagesAHM Chapter 4 - SolutionsNitin KhareNo ratings yet

- Chapter 7 (Case) : Joan HoltzDocument2 pagesChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- Pressco Case QuestionsDocument1 pagePressco Case QuestionsAashna MehtaNo ratings yet

- Solution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocument51 pagesSolution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerSEHA ÖZTÜRK0% (1)

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- Report On Sinclair CompanyDocument5 pagesReport On Sinclair CompanyVictor LimNo ratings yet

- Chap 023Document23 pagesChap 023Neetu RajaramanNo ratings yet

- Chap 018Document25 pagesChap 018Neetu RajaramanNo ratings yet

- Inventories BemDocument62 pagesInventories BemRosedel Rosas100% (2)

- Chap 006Document62 pagesChap 006MubasherAkram33% (3)

- Bonus Ch15Document45 pagesBonus Ch15agctdna5017No ratings yet

- Solution-Manual-Of-Chapter-4-Managerial - Accounting-15thDocument51 pagesSolution-Manual-Of-Chapter-4-Managerial - Accounting-15thMehedi Hasan ShatilNo ratings yet

- Pressco Case MemoDocument7 pagesPressco Case Memotodenheim0% (3)

- Chap 021Document19 pagesChap 021Neetu Rajaraman100% (1)

- Case Study On Giberson Glass StudioDocument16 pagesCase Study On Giberson Glass StudioChandan Pahelwani0% (2)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Case 2 Corporate FinanceDocument5 pagesCase 2 Corporate FinancePaula GarciaNo ratings yet

- Delaney Motors CaseDocument15 pagesDelaney Motors CaseVan DyNo ratings yet

- Chap 003Document19 pagesChap 003jujuNo ratings yet

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDocument26 pagesAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Chap 006Document15 pagesChap 006Neetu RajaramanNo ratings yet

- Solution Manual For Managerial Accounting 6th Edition Jiambalvo 1Document21 pagesSolution Manual For Managerial Accounting 6th Edition Jiambalvo 1nicholas kibet100% (4)

- EetgbfvDocument38 pagesEetgbfvchialunNo ratings yet

- 29614Document7 pages29614Jigyasa Gautam0% (3)

- Cases Chap013Document12 pagesCases Chap013Henry PanNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- SPJ2021 SolsDocument13 pagesSPJ2021 Solsmohamad nassrallahNo ratings yet

- 5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467Document152 pages5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467sukriti2812No ratings yet

- Evaluation of Financial Performance: Answers To QuestionsDocument16 pagesEvaluation of Financial Performance: Answers To QuestionsTINAIDANo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet

- Acounts Case Study Wid SolutionsDocument20 pagesAcounts Case Study Wid SolutionsRoopali SinghNo ratings yet

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarNo ratings yet

- Basel III - An Easy To Understand SummaryDocument18 pagesBasel III - An Easy To Understand SummaryDhiwakar Sb100% (2)

- Reliance Broadcast Network Limited: This Document Is Important and Requires Your Immediate AttentionDocument12 pagesReliance Broadcast Network Limited: This Document Is Important and Requires Your Immediate AttentionDhiwakar SbNo ratings yet

- Regn T-VIDocument1 pageRegn T-VIDhiwakar SbNo ratings yet

- HCL-ROW - Pre-Sales and SolutionsDocument2 pagesHCL-ROW - Pre-Sales and SolutionsDhiwakar SbNo ratings yet

- IIML Casebook 2014-15Document213 pagesIIML Casebook 2014-15Dhiwakar Sb100% (1)

- A Case Study On Supply Chain Management With Special Reference To Mumbai DabbawalaDocument7 pagesA Case Study On Supply Chain Management With Special Reference To Mumbai DabbawalaAbhinav RamariaNo ratings yet

- Wedding InvitationDocument3 pagesWedding InvitationDhiwakar SbNo ratings yet

- TMP 1784767780Document13 pagesTMP 1784767780Didi MuftiNo ratings yet

- Dec'14 Preview: Cross Currency Pangs Add To The Seasonal WeaknessDocument9 pagesDec'14 Preview: Cross Currency Pangs Add To The Seasonal WeaknessDhiwakar SbNo ratings yet

- anthonyIM 09Document17 pagesanthonyIM 09Ki Umbara100% (1)

- Other Items That Affect Net Income and Owner'S Equity: Changes From Eleventh EditionDocument14 pagesOther Items That Affect Net Income and Owner'S Equity: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Accounting Texts and Cases Ch. 12 SolutionDocument9 pagesAccounting Texts and Cases Ch. 12 SolutionFeby Rahmawati100% (2)

- anthonyIM 06Document18 pagesanthonyIM 06Jigar ShahNo ratings yet

- Long-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh EditionDocument11 pagesLong-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh Editioner4sallNo ratings yet

- anthonyIM 01Document15 pagesanthonyIM 01Julz JuliaNo ratings yet

- Covered Call Option Strategy Reverse Covered Call Protective Put Reverse of A Protective PutDocument2 pagesCovered Call Option Strategy Reverse Covered Call Protective Put Reverse of A Protective PutMayara CabralNo ratings yet

- TOA - InvestmentsDocument8 pagesTOA - InvestmentsPrincessDiana Doloricon EscrupoloNo ratings yet

- OTCEIDocument17 pagesOTCEIMani Sankar100% (1)

- 1daily DerivativesDocument3 pages1daily DerivativesGauriGanNo ratings yet

- MERGER AND ACQUISITIONS (Chapter 7)Document62 pagesMERGER AND ACQUISITIONS (Chapter 7)Shara Kaye SerdanNo ratings yet

- 37 Wyckoff TimeDocument4 pages37 Wyckoff TimeACasey101100% (1)

- Chapter 12Document7 pagesChapter 12RBNo ratings yet

- 10 Myths About Financial DerivativesDocument6 pages10 Myths About Financial DerivativesArshad FahoumNo ratings yet

- Faculty of Management: Syllabus For Master of Business AdministrationDocument19 pagesFaculty of Management: Syllabus For Master of Business AdministrationSri NandhuNo ratings yet

- Credit Administration Manager: Our ClientDocument5 pagesCredit Administration Manager: Our ClientAde KarimaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument5 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- Xiv: Velocityshares Daily Inverse Vix Short-Term Etn: Note Information Issuer InformationDocument2 pagesXiv: Velocityshares Daily Inverse Vix Short-Term Etn: Note Information Issuer InformationglassguyNo ratings yet

- Super Trader Tactics For TRIPLE-DIGIT RETURNSDocument22 pagesSuper Trader Tactics For TRIPLE-DIGIT RETURNSjdalvaran85% (20)

- 001 Financial Analysis - Liquigaz Philippines CorporationDocument8 pages001 Financial Analysis - Liquigaz Philippines CorporationJeff RecañaNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Pulau Carey KenangaDocument17 pagesPulau Carey KenangaAzim FauziNo ratings yet

- CostDocument6 pagesCostAditya KumarNo ratings yet

- Q7Document4 pagesQ7Sundaramani Saran100% (2)

- BOI - Promoting Investments Through ServicingDocument15 pagesBOI - Promoting Investments Through ServicingAnonymous yKUdPvwjNo ratings yet

- Alternative InvestmentsDocument63 pagesAlternative InvestmentsAspanwz SpanwzNo ratings yet

- TestReviewer Docx LDocument27 pagesTestReviewer Docx LCes100% (1)

- Holding The LineDocument16 pagesHolding The Lineeric_stNo ratings yet

- 2014 AMAA Winter Conference Member DirectoryDocument86 pages2014 AMAA Winter Conference Member DirectoryMike NallNo ratings yet

- Multiple Bank Accounts Registration FormDocument2 pagesMultiple Bank Accounts Registration FormMamina DubeNo ratings yet

- BA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceDocument5 pagesBA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceJoy PeleteNo ratings yet

- FSM MAPS ModAggressive Growth 3Document3 pagesFSM MAPS ModAggressive Growth 3Meng AunNo ratings yet

- Payout SlidesDocument39 pagesPayout SlidesMohamed MedNo ratings yet

- Market Risk Premium PDFDocument3 pagesMarket Risk Premium PDFmelinaguimaraesNo ratings yet

- IPSASB 2016 Handbook Editorials 2016Document9 pagesIPSASB 2016 Handbook Editorials 2016Tareq ChowdhuryNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)