Professional Documents

Culture Documents

City of Lockport Cash Flow

Uploaded by

Time Warner Cable News0 ratings0% found this document useful (0 votes)

214 views19 pagesCity of Lockport Cash Flow

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCity of Lockport Cash Flow

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

214 views19 pagesCity of Lockport Cash Flow

Uploaded by

Time Warner Cable NewsCity of Lockport Cash Flow

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

DIVISION OF LOCAL GOVERNMENT

& SCHOOL ACCOUNTABILITY

OF F I C E O F T H E NE W Y O R K S T A T E CO M P T R O L L E R

Report of Examination

Period Covered:

January 1, 2014 May 30, 2014

2014M-195

City of Lockport

Cash Flow

Thomas P. DiNapoli

11

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Page

AUTHORITY LETTER 2

INTRODUCTION 3

Background 3

Objective 3

Scope and Methodology 3

Comments of Local Ofcials and Corrective Action 4

CASH FLOW 5

Cash Flow Analysis 6

Accounting Records 6

Recommendations 7

APPENDIX A Cash Flow Analysis 8

APPENDIX B Response From Local Ofcials 10

APPENDIX C OSC Comment on the Citys Response 14

APPENDIX D Audit Methodology and Standards 15

APPENDIX E How to Obtain Additional Copies of the Report 17

APPENDIX F Local Regional Ofce Listing 18

Table of Contents

2

OFFICE OF THE NEW YORK STATE COMPTROLLER

2

State of New York

Ofce of the State Comptroller

Division of Local Government

and School Accountability

August 2014

Dear City Ofcials:

A top priority of the Ofce of the State Comptroller is to help local government ofcials manage

government resources efciently and effectively and, by so doing, provide accountability for tax

dollars spent to support government operations. The Comptroller oversees the scal affairs of local

governments statewide, as well as compliance with relevant statutes and observance of good business

practices. This scal oversight is accomplished, in part, through our audits, which identify opportunities

for improving operations and Common Council governance. Audits also can identify strategies to

reduce costs and to strengthen controls intended to safeguard local government assets.

Following is a report of our audit of the City of Lockport, entitled Cash Flow. This audit was conducted

pursuant to Article V, Section 1 of the State Constitution and the State Comptrollers authority as set

forth in Article 3 of the General Municipal Law.

This audits results and recommendations are resources for local government ofcials to use in

effectively managing operations and in meeting the expectations of their constituents. If you have

questions about this report, please feel free to contact the local regional ofce for your county, as listed

at the end of this report.

Respectfully submitted,

Ofce of the State Comptroller

Division of Local Government

and School Accountability

State of New York

Ofce of the State Comptroller

33

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Background

Introduction

Objective

Scope and

Methodology

The City of Lockport (City) is located in Niagara County, encompasses

8.4 square miles and serves approximately 21,100 residents. The

elected Common Council (Council) is the legislative body responsible

for managing City operations, including establishing internal controls

over nancial operations and for maintaining sound nancial

condition. The Mayor is a member of the Council and serves as the

Citys chief executive ofcer. The elected City Treasurer (Treasurer),

as chief nancial ofcer, oversees accounting and nancial reporting

controls, supervises the preparation of accounting records, produces

nancial reports and ensures compliance with various State and

Federal laws.

As of J anuary 1, 2014, the City had 224 employees. The Citys

budgeted appropriations for the 2014 scal year are approximately

$33.4 million

1

and are funded primarily with real property taxes,

sales tax and State aid. The City provides services for its residents

including police and re protection, public works, recreation, water,

sewer, refuse collection and general government support.

The Council is responsible for adopting and monitoring the

Citys budget and nancial condition. The Treasurer is responsible

for providing the Council with accurate and up-to-date nancial

information so that the Council may carry out its nancial

responsibilities. The availability of adequate reports is especially

critical as the Ofce of the State Comptrollers Fiscal Stress

Monitoring System has determined that the City has been classied

as in moderate stress.

The objective of our audit was to assess the nancial condition of the

City. Our audit addressed the following related question:

Will the City be able to fund cash disbursements with cash

receipts generated from operations?

We examined the Citys accounting records and cash ow for the

period J anuary 1, 2014 through May 30, 2014.

We conducted our audit in accordance with generally accepted

government auditing standards (GAGAS). More information on such

standards and the methodology used in performing this audit are

included in Appendix D of this report.

1

$23.7 million in the general fund, $4 million in the water fund, $4.4 million the

sewer fund and $1.3 million in the refuse fund

4

OFFICE OF THE NEW YORK STATE COMPTROLLER

4

Comments of

Local Ofcials and

Corrective Action

The results of our audit and recommendations have been discussed

with City ofcials and their comments, which appear in Appendix B,

have been considered in preparing this report. City ofcials generally

agreed with our ndings and recommendations and planned to initiate

corrective action. Appendix C includes our comment on an issue

raised in the Citys response.

The Council has the responsibility to initiate corrective action. A

written corrective action plan (CAP) that addresses the ndings and

recommendations in this report should be prepared and forwarded

to our ofce within 90 days, pursuant to Section 35 of the General

Municipal Law. For more information on preparing and ling your

CAP, please refer to our brochure, Responding to an OSC Audit

Report, which you received with the draft audit report. We encourage

the City to make this plan available for public review in the City

Clerks ofce.

55

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Cash Flow

Without cash ow nancing or drastic reductions in expenditures, the

City will run out of cash to nance operations in September 2014.

Further, the cash ow deciency will grow to nearly $4.6 million by

December 31, 2014.

2

The Citys cash ow problem is the result of

two factors. First, the City used fund balance as a nancing source for

operating expenditures until it was depleted. Second, the Treasurer

failed to maintain accurate accounting records or prepare an adequate

cash ow analysis, and the Citys audited nancial statements for the

scal year ending December 31, 2012 included account balances that

were materially misstated. Thus, reliable nancial records were not

available to disclose the depletion of fund balance to City ofcials

and alert them of the impending nancial crisis. Now, City ofcials

are faced with the likelihood that they will need to signicantly raise

real property taxes and user fees or cut costs and related services.

Cash shortfalls occur when bills must be paid before cash generated

from operations is received to pay them. Cash shortfalls also happen

when expenditures consistently exceed revenue in a scal year, and

ofcials use available fund balance to nance the difference. To avoid

cash shortfalls, the Council, the Mayor and the Treasurer should

monitor the Citys cash balances to ensure that they are sufcient to

liquidate current obligations, without relying on short-term borrowing

or one-shot funding mechanisms to address cash ow needs.

As indicated in our 2013 report, the City managed cash shortfalls

during the last two completed scal years

3

as follows:

In 2012, the City inappropriately loaned $2.3 million in bond

anticipation note proceeds from the capital projects fund to

the general fund. This loan was subsequently repaid in 2013.

In October 2013, the City issued a $2.7 million revenue

anticipation note (RAN) for cash ow purposes. In early

2014, the Treasurers Ofce appropriately set aside $2.7

million to repay the RAN when it matures in October 2014.

City ofcials cannot use the cash set aside to repay the RAN

to fund current operations. The cash set aside to repay the

RAN has signicantly increased the cash ow deciency

expected later in 2014.

2

See cash ow analysis in Appendix A.

3

See our audit report 2013M-330 entitled Fiscal Stress for further details.

Appendix D includes the Internet address of the report.

6

OFFICE OF THE NEW YORK STATE COMPTROLLER

6

An important tool to measure nancial condition is the cash ow

analysis. The cash ow analysis is a record of actual and projected

cash inows and outows within an accounting period. It is important

to consider the timing and amounts of cash receipts and disbursements

within a given period. As actual data becomes available, the cash ow

analysis should be updated and analyzed to rene future projections.

A cash ow analysis is a useful tool to identify cash decits in

advance. This advance warning may give the City more corrective

action options to help ease the cash decit.

The Treasurer does not routinely prepare cash ow analyses. We

found that the Treasurer was only maintaining a record of daily cash

ows of cash receipt and disbursement activity and was not analyzing

future cash ow for the scal year. Without cash ow projections,

the Council and City ofcials were unaware of the magnitude of the

Citys shortfall.

We prepared a cash ow analysis for 2014. Our analysis found that the

City will run out of cash in September 2014 and the cash deciency

will increase to nearly $4.6 million by the end of the scal year. A

detailed cash ow analysis with a description of our assumptions can

be found in Appendix A of this report.

The Treasurer is responsible for maintaining accurate and up-to-date

accounting records and for providing accurate nancial reports to the

Council so they can monitor and control City nances.

The Citys accounting records are in such poor condition that City

ofcials do not know the severity of their scal problems. The books

for the 2013 scal year were not closed as of J une 2014. The general

ledger cash balances were unreliable and were not reconciled to cash

in the bank. Further, City ofcials anticipate that the audited nancial

statements will not be available until October 2014. These delays

have put the Council and City ofcials at a disadvantage as they try

to resolve the current cash ow shortfall, begin the 2015 budgeting

process and develop a long-term plan that would address the Citys

scal problems.

Throughout the course of our eldwork, we met with City ofcials on

numerous occasions to discuss our cash ow assumptions, calculations

and projections, and disclose our ndings so City ofcials could start

developing immediate and long-term nancial plans to address the

Citys scal problems.

Subsequent to the completion of eldwork, the New York State

Legislature authorized the City to issue decit nancing to address

the accumulated decits from previous scal years. While this is a

Cash Flow Analysis

Accounting Records

77

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

step in addressing the Citys immediate scal problems, City ofcials

need to take further action to address the underlying causes of the

poor nancial condition and unreliable records of the City.

The Treasurer should:

1. Ensure that the Citys accounting records are complete, accurate

and maintained in a timely manner so that the Council and City

ofcials can properly assess the magnitude of the Citys scal

problems and subsequently monitor nancial activity.

2. Prepare adequate cash ow analyses and provide them to the

Council for review.

The Council should:

3. Develop a multiyear scal plan that builds a cash balance

sufcient to eliminate the need for signicant short-term cash

ow borrowing.

4. Adopt structurally balanced budgets that rely on recurring

revenues to fund recurring expenditures.

Recommendations

8

OFFICE OF THE NEW YORK STATE COMPTROLLER

8

APPENDIX A

CASH FLOW ANALYSIS

We prepared a cash ow analysis for the 2014 scal year, using certain necessary assumptions,

calculations and projections. These assumptions and projections have been made in advance of actual

nancial transactions, and any unanticipated events in the near future will impact our estimates. For

example, the Council included a $1.05 million State grant as an estimated revenue in the 2014 general

fund budget. After reviewing the grant documents, we believe the grant cannot be used to fund general

City operations, but was meant for two specic capital projects. Therefore, we did not include this

revenue as a cash receipt on our cash ow analysis. The inability to use this revenue will impact the

Citys ability to nance 2014 general fund appropriations. Furthermore, based on current contractual

obligations and stafng levels, we are conservatively projecting that 2014 overtime costs will exceed

the budgeted appropriations by at least $200,000 or 15 percent. However, our estimate could be

impacted by an expected court ruling regarding re department minimum platoon stafng levels.

Finally, water and sewer rates have not been increased over the past six years. Our cash ow analysis

assumes that the Council will not increase water and sewer rates during 2014.

99

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

C

i

t

y

o

f

L

o

c

k

p

o

r

t

-

C

a

s

h

F

l

o

w

A

n

a

l

y

s

i

s

-

2

0

1

4

A

c

t

u

a

l

J

a

n

u

a

r

y

A

c

t

u

a

l

F

e

b

r

u

a

r

y

A

c

t

u

a

l

M

a

r

c

h

A

c

t

u

a

l

A

p

r

i

l

P

r

o

j

e

c

t

e

d

/

A

c

t

u

a

l

M

a

y

a

P

r

o

j

e

c

t

e

d

J

u

n

e

P

r

o

j

e

c

t

e

d

J

u

l

y

P

r

o

j

e

c

t

e

d

A

u

g

u

s

t

P

r

o

j

e

c

t

e

d

S

e

p

t

e

m

b

e

r

P

r

o

j

e

c

t

e

d

O

c

t

o

b

e

r

P

r

o

j

e

c

t

e

d

N

o

v

e

m

b

e

r

P

r

o

j

e

c

t

e

d

D

e

c

e

m

b

e

r

T

O

T

A

L

S

C

A

S

H

R

E

C

E

I

P

T

S

L

O

C

A

L

S

A

L

E

S

T

A

X

6

1

0

,

8

0

0

4

6

2

,

2

0

0

3

9

8

,

1

0

0

5

9

8

,

1

0

0

4

3

6

,

0

0

0

4

3

9

,

4

0

0

5

8

3

,

6

0

0

4

1

6

,

0

0

0

4

1

2

,

4

0

0

8

1

8

,

1

0

0

4

2

1

,

4

0

0

3

8

8

,

7

0

0

5

,

9

8

4

,

8

0

0

C

I

T

Y

C

O

U

R

T

1

6

,

6

0

0

2

0

,

2

0

0

1

9

,

0

0

0

1

4

,

9

0

0

2

7

,

4

0

0

2

7

,

5

0

0

2

7

,

4

0

0

2

7

,

4

0

0

2

7

,

4

0

0

2

7

,

4

0

0

2

7

,

4

0

0

2

7

,

4

0

0

2

9

0

,

0

0

0

U

T

I

L

I

T

Y

T

A

X

9

,

2

0

0

3

,

7

0

0

5

2

,

1

0

0

1

0

,

1

0

0

3

,

7

0

0

4

6

,

4

0

0

5

,

4

0

0

8

0

0

2

9

,

1

0

0

5

,

4

0

0

8

0

0

3

0

,

7

0

0

1

9

7

,

4

0

0

L

O

C

A

L

F

E

E

S

b

3

0

,

8

0

0

2

0

,

6

0

0

1

9

,

4

0

0

2

7

,

5

0

0

2

3

,

5

0

0

2

3

,

5

0

0

2

3

,

5

0

0

2

3

,

5

0

0

2

3

,

5

0

0

2

3

,

5

0

0

2

3

,

4

0

0

2

3

,

0

0

0

2

8

5

,

7

0

0

S

A

L

E

O

F

T

A

X

A

C

Q

U

I

R

E

D

P

R

O

P

E

R

T

Y

-

-

-

-

-

-

-

-

-

3

0

9

,

4

0

0

3

4

,

4

0

0

-

3

4

3

,

8

0

0

S

T

A

T

E

A

I

D

-

-

-

-

-

-

-

-

2

8

0

,

1

0

0

-

-

2

,

3

7

0

,

4

0

0

2

,

6

5

0

,

5

0

0

M

O

R

T

G

A

G

E

T

A

X

-

-

-

-

-

6

5

,

9

0

0

-

-

-

-

-

8

3

,

8

0

0

1

4

9

,

7

0

0

A

M

B

U

L

A

N

C

E

C

H

A

R

G

E

S

5

3

,

1

0

0

5

3

,

0

0

0

6

3

,

2

0

0

5

3

,

9

0

0

7

0

,

0

0

0

7

0

,

0

0

0

5

0

,

0

0

0

3

0

,

0

0

0

5

0

,

0

0

0

5

0

,

0

0

0

3

0

,

0

0

0

3

0

,

0

0

0

6

0

3

,

2

0

0

N

Y

S

H

I

G

H

W

A

Y

A

I

D

-

-

-

-

4

6

,

2

0

0

-

-

4

6

,

3

0

0

-

-

-

-

9

2

,

5

0

0

C

I

T

Y

T

A

X

-

2

0

1

4

c

3

,

9

2

6

,

8

0

0

6

,

3

5

7

,

2

0

0

1

8

7

,

6

0

0

9

2

,

6

0

0

4

2

,

0

0

0

3

0

,

0

0

0

1

0

,

0

0

0

1

0

,

0

0

0

1

0

,

0

0

0

3

0

,

0

0

0

5

0

,

0

0

0

3

5

,

0

0

0

1

0

,

7

8

1

,

2

0

0

O

T

H

E

R

R

E

A

L

P

R

O

P

E

R

T

Y

T

A

X

I

T

E

M

S

d

1

4

2

,

6

0

0

9

9

,

5

0

0

1

7

5

,

4

0

0

1

6

1

,

5

0

0

1

2

2

,

2

0

0

4

7

,

1

0

0

4

7

,

2

0

0

4

7

,

2

0

0

4

7

,

2

0

0

4

7

,

2

0

0

4

7

,

2

0

0

4

7

,

3

0

0

1

,

0

3

1

,

6

0

0

M

I

S

C

G

E

N

E

R

A

L

F

U

N

D

C

A

S

H

R

E

C

E

I

P

T

S

7

4

,

0

0

0

1

5

3

,

4

0

0

1

2

8

,

1

0

0

1

3

2

,

3

0

0

4

4

,

5

0

0

4

4

,

4

0

0

4

4

,

5

0

0

4

4

,

5

0

0

4

4

,

4

0

0

4

4

,

5

0

0

4

4

,

5

0

0

4

4

,

5

0

0

8

4

3

,

6

0

0

W

A

T

E

R

C

H

A

R

G

E

S

3

2

3

,

8

0

0

1

5

5

,

2

0

0

2

8

3

,

8

0

0

3

2

2

,

6

0

0

2

6

6

,

6

0

0

2

6

6

,

6

0

0

2

6

6

,

6

0

0

2

6

6

,

6

0

0

2

6

6

,

6

0

0

2

6

6

,

7

0

0

2

6

6

,

7

0

0

2

6

6

,

7

0

0

3

,

2

1

8

,

5

0

0

S

E

W

E

R

C

H

A

R

G

E

S

4

3

8

,

9

0

0

1

6

3

,

0

0

0

2

6

1

,

9

0

0

4

3

7

,

1

0

0

2

6

7

,

0

0

0

2

5

8

,

6

0

0

4

1

8

,

0

0

0

2

5

8

,

6

0

0

2

5

8

,

6

0

0

4

1

8

,

0

0

0

2

5

8

,

6

0

0

2

5

8

,

6

0

0

3

,

6

9

6

,

9

0

0

R

E

F

U

S

E

C

H

A

R

G

E

S

1

8

,

0

0

0

2

4

2

,

2

0

0

8

3

,

3

0

0

8

5

,

3

0

0

8

4

,

4

0

0

8

4

,

5

0

0

8

4

,

5

0

0

8

4

,

5

0

0

8

4

,

4

0

0

8

4

,

5

0

0

8

4

,

5

0

0

8

4

,

4

0

0

1

,

1

0

4

,

5

0

0

T

O

T

A

L

C

A

S

H

R

E

C

E

I

P

T

S

5

,

6

4

4

,

6

0

0

7

,

7

3

0

,

2

0

0

1

,

6

7

1

,

9

0

0

1

,

9

3

5

,

9

0

0

1

,

4

3

3

,

5

0

0

1

,

4

0

3

,

9

0

0

1

,

5

6

0

,

7

0

0

1

,

2

5

5

,

4

0

0

1

,

5

3

3

,

7

0

0

2

,

1

2

4

,

7

0

0

1

,

2

8

8

,

9

0

0

3

,

6

9

0

,

5

0

0

3

1

,

2

7

3

,

9

0

0

C

A

S

H

D

I

S

B

U

R

S

E

M

E

N

T

S

P

A

Y

R

O

L

L

A

N

D

P

A

Y

R

O

L

L

R

E

L

A

T

E

D

e

1

,

6

2

6

,

1

0

0

1

,

2

3

0

,

6

0

0

1

,

1

1

9

,

9

0

0

1

,

0

5

1

,

9

0

0

1

,

6

3

4

,

6

0

0

1

,

1

0

1

,

4

0

0

1

,

1

5

7

,

0

0

0

1

,

1

0

3

,

1

0

0

1

,

0

8

1

,

9

0

0

1

,

6

1

8

,

8

0

0

1

,

0

8

1

,

8

0

0

1

,

4

1

2

,

8

0

0

1

5

,

2

1

9

,

9

0

0

S

E

L

F

I

N

S

U

R

A

N

C

E

/

S

E

L

F

I

N

S

U

R

A

N

C

E

A

D

M

4

7

7

,

6

0

0

3

5

3

,

6

0

0

5

2

4

,

8

0

0

4

1

1

,

2

0

0

4

4

7

,

3

0

0

4

7

9

,

0

0

0

4

7

9

,

0

0

0

4

7

8

,

9

0

0

4

7

8

,

9

0

0

4

7

8

,

9

0

0

4

7

8

,

9

0

0

4

7

8

,

9

0

0

5

,

5

6

7

,

0

0

0

M

O

N

T

H

L

Y

B

I

L

L

S

2

8

1

,

2

0

0

5

9

6

,

0

0

0

6

5

4

,

8

0

0

4

8

9

,

5

0

0

3

9

7

,

5

0

0

3

2

5

,

9

0

0

3

2

5

,

8

0

0

3

2

5

,

8

0

0

3

2

5

,

9

0

0

3

2

5

,

8

0

0

3

2

5

,

8

0

0

3

2

5

,

9

0

0

4

,

6

9

9

,

9

0

0

D

E

B

T

P

A

Y

M

E

N

T

S

-

6

8

,

3

0

0

4

4

4

,

2

0

0

-

6

3

8

,

5

0

0

4

,

8

0

0

-

7

0

,

2

0

0

5

7

,

0

0

0

-

2

9

9

,

8

0

0

8

4

,

8

0

0

1

,

6

6

7

,

6

0

0

R

E

T

I

R

E

M

E

N

T

B

I

L

L

-

-

-

-

-

-

-

-

-

-

-

3

,

3

4

1

,

9

0

0

3

,

3

4

1

,

9

0

0

C

A

S

H

S

E

T

A

S

I

D

E

F

O

R

R

A

N

P

A

Y

M

E

N

T

-

-

2

,

7

0

0

,

0

0

0

-

-

-

-

-

-

2

2

6

,

8

0

0

-

-

2

,

9

2

6

,

8

0

0

P

A

Y

M

E

N

T

T

O

C

I

T

Y

S

C

H

O

O

L

D

I

S

T

R

I

C

T

-

6

0

9

,

3

0

0

-

-

-

-

-

-

-

-

-

-

6

0

9

,

3

0

0

R

E

F

U

S

E

1

8

,

0

0

0

2

4

2

,

2

0

0

8

3

,

3

0

0

8

5

,

3

0

0

9

0

,

3

0

0

8

1

,

8

0

0

8

1

,

9

0

0

8

1

,

9

0

0

8

1

,

8

0

0

8

1

,

9

0

0

8

1

,

9

0

0

8

1

,

8

0

0

1

,

0

9

2

,

1

0

0

W

O

R

K

E

R

S

C

O

M

P

A

N

D

U

N

E

M

P

L

O

Y

M

E

N

T

I

N

S

1

2

0

,

2

0

0

4

3

,

5

0

0

3

9

,

6

0

0

1

0

2

,

5

0

0

2

6

,

7

0

0

4

5

,

0

0

0

5

5

,

0

0

0

4

5

,

0

0

0

4

5

,

0

0

0

5

5

,

0

0

0

4

5

,

0

0

0

3

3

6

,

4

0

0

9

5

8

,

9

0

0

T

O

T

A

L

C

A

S

H

D

I

S

B

U

R

S

E

M

E

N

T

S

2

,

5

2

3

,

1

0

0

3

,

1

4

3

,

5

0

0

5

,

5

6

6

,

6

0

0

2

,

1

4

0

,

4

0

0

3

,

2

3

4

,

9

0

0

2

,

0

3

7

,

9

0

0

2

,

0

9

8

,

7

0

0

2

,

1

0

4

,

9

0

0

2

,

0

7

0

,

5

0

0

2

,

7

8

7

,

2

0

0

2

,

3

1

3

,

2

0

0

6

,

0

6

2

,

5

0

0

$

3

6

,

0

8

3

,

4

0

0

M

O

N

T

H

L

Y

C

A

S

H

S

U

R

P

L

U

S

/

(

D

E

F

I

C

I

T

)

3

,

1

2

1

,

5

0

0

4

,

5

8

6

,

7

0

0

(

3

,

8

9

4

,

7

0

0

)

(

2

0

4

,

5

0

0

)

(

1

,

8

0

1

,

4

0

0

)

(

6

3

4

,

0

0

0

)

(

5

3

8

,

0

0

0

)

(

8

4

9

,

5

0

0

)

(

5

3

6

,

8

0

0

)

(

6

6

2

,

5

0

0

)

(

1

,

0

2

4

,

3

0

0

)

(

2

,

3

7

2

,

0

0

0

)

C

A

S

H

-

B

E

G

I

N

N

I

N

G

B

A

L

A

N

C

E

2

3

3

,

2

0

0

P

R

O

J

E

C

T

E

D

C

A

S

H

S

U

R

P

L

U

S

/

(

D

E

F

I

C

I

T

)

3

,

3

5

4

,

7

0

0

7

,

9

4

1

,

4

0

0

4

,

0

4

6

,

7

0

0

3

,

8

4

2

,

2

0

0

2

,

0

4

0

,

8

0

0

1

,

4

0

6

,

8

0

0

8

6

8

,

8

0

0

1

9

,

3

0

0

(

5

1

7

,

5

0

0

)

(

1

,

1

8

0

,

0

0

0

)

(

2

,

2

0

4

,

3

0

0

)

(

4

,

5

7

6

,

3

0

0

)

a

A

c

t

u

a

l

d

a

t

a

f

o

r

p

a

y

r

o

l

l

a

n

d

M

a

y

2

0

1

4

A

c

c

o

u

n

t

s

P

a

y

a

b

l

e

R

e

g

i

s

t

e

r

c

a

s

h

d

i

s

b

u

r

s

e

m

e

n

t

s

b

I

n

c

l

u

d

i

n

g

c

l

e

r

k

f

e

e

s

,

p

a

r

k

i

n

g

t

i

c

k

e

t

s

a

n

d

l

i

c

e

n

s

e

s

a

n

d

i

n

s

p

e

c

t

i

o

n

s

c

I

n

c

l

u

d

i

n

g

r

e

l

e

v

i

e

s

d

I

n

c

l

u

d

i

n

g

P

I

L

O

T

s

,

t

a

x

a

g

r

e

e

m

e

n

t

s

a

n

d

d

e

l

i

n

q

u

e

n

t

t

a

x

p

a

y

m

e

n

t

s

e

I

n

c

l

u

d

i

n

g

o

v

e

r

t

i

m

e

10

OFFICE OF THE NEW YORK STATE COMPTROLLER

10

APPENDIX B

RESPONSE FROM LOCAL OFFICIALS

The local ofcials response to this audit can be found on the following pages.

11 11

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

12

OFFICE OF THE NEW YORK STATE COMPTROLLER

12

13 13

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

See

Note 1

Page 14

14

OFFICE OF THE NEW YORK STATE COMPTROLLER

14

APPENDIX C

OSC COMMENT ON THE CITYS RESPONSE

Note 1

Since we completed our eldwork, City ofcials informed us that they repaid a $450,000 loan from

the capital projects fund, paid the Lockport City School District $438,300 in school taxes and reduced

debt service costs by $466,500. The net effect of these transactions reduces the Citys operating cash

by $421,800. As a result, the City may run out of cash for operations sooner than we projected in our

cash ow analysis. These issues should be reected in the cash ow analysis recently prepared by the

Treasurer.

15 15

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

APPENDIX D

AUDIT METHODOLOGY AND STANDARDS

The Ofce of the State Comptrollers Fiscal Stress Monitoring System evaluates local governments

based on both nancial and environmental indicators. These indicators are calculated using the local

governments annual update document (AUD)

4

and information from the United States Census

Bureau, the New York State Department of Labor and the New York State Education Department,

among other sources. The City demonstrated signs of scal stress in several areas. Due in part to these

scal stress indicators, we conducted an audit of the City in 2013. The results of that audit can be

found at http://www.osc.state.ny.us/localgov/audits/cities/2013/lockport.pdf.

We continued to monitor the Citys nancial condition and determined that an additional audit was

warranted. Our overall goal with this audit was to assess the Citys 2014 cash ow. To accomplish our

audit objective and obtain relevant audit evidence, our procedures included the following:

We interviewed City ofcials responsible for nancial oversight and maintaining accounting

records and reviewed Council minutes and the City Charter to obtain an understanding of the

Citys policies and procedures and job descriptions.

We examined the December 2013 bank reconciliations and 2013 and 2014 general ledger

reports to obtain an accurate beginning cash balance.

We reviewed the Treasurers ofce actual cash ow data for accuracy and completeness by

comparing the activity to the J anuary through April 2014 bank statements and daily deposit

reports. All differences were discussed with the Treasurers ofce and reconciled as needed.

We evaluated each material revenue and expenditure to determine the most accurate method

for projecting cash ow through the 2014 scal year. In some instances, more than one method

was used. Projections were based on the following:

2013 operating results,

Two to six year average of prior scal year activity provided by AUD reports or actual

billing data,

2014 budgeted appropriations or estimated revenues,

Average of J anuary through April 2014 actual activity and

Third-party billing information.

We reviewed our projections with City ofcials on several occasions to ensure that we were

using the most accurate assumptions available.

We conducted this performance audit in accordance with GAGAS. Those standards require that we

plan and perform the audit to obtain sufcient, appropriate evidence to provide a reasonable basis

4

Required to be submitted annually by the City to the Ofce of the State Comptroller

16

OFFICE OF THE NEW YORK STATE COMPTROLLER

16

for our ndings and conclusions based on our audit objective. We believe that the evidence obtained

provides a reasonable basis for our ndings and conclusions based on our audit objective.

17 17

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

APPENDIX E

HOW TO OBTAIN ADDITIONAL COPIES OF THE REPORT

Ofce of the State Comptroller

Public Information Ofce

110 State Street, 15th Floor

Albany, New York 12236

(518) 474-4015

http://www.osc.state.ny.us/localgov/

To obtain copies of this report, write or visit our web page:

18

OFFICE OF THE NEW YORK STATE COMPTROLLER

18

APPENDIX F

OFFICE OF THE STATE COMPTROLLER

DIVISION OF LOCAL GOVERNMENT

AND SCHOOL ACCOUNTABILITY

Andrew A. SanFilippo, Executive Deputy Comptroller

Gabriel F. Deyo, Deputy Comptroller

Nathaalie N. Carey, Assistant Comptroller

LOCAL REGIONAL OFFICE LISTING

BINGHAMTON REGIONAL OFFICE

H. Todd Eames, Chief Examiner

Ofce of the State Comptroller

State Ofce Building - Suite 1702

44 Hawley Street

Binghamton, New York 13901-4417

(607) 721-8306 Fax (607) 721-8313

Email: Muni-Binghamton@osc.state.ny.us

Serving: Broome, Chenango, Cortland, Delaware,

Otsego, Schoharie, Sullivan, Tioga, Tompkins Counties

BUFFALO REGIONAL OFFICE

J effrey D. Mazula, Chief Examiner

Ofce of the State Comptroller

295 Main Street, Suite 1032

Buffalo, New York 14203-2510

(716) 847-3647 Fax (716) 847-3643

Email: Muni-Buffalo@osc.state.ny.us

Serving: Allegany, Cattaraugus, Chautauqua, Erie,

Genesee, Niagara, Orleans, Wyoming Counties

GLENS FALLS REGIONAL OFFICE

J effrey P. Leonard, Chief Examiner

Ofce of the State Comptroller

One Broad Street Plaza

Glens Falls, New York 12801-4396

(518) 793-0057 Fax (518) 793-5797

Email: Muni-GlensFalls@osc.state.ny.us

Serving: Albany, Clinton, Essex, Franklin,

Fulton, Hamilton, Montgomery, Rensselaer,

Saratoga, Schenectady, Warren, Washington Counties

HAUPPAUGE REGIONAL OFFICE

Ira McCracken, Chief Examiner

Ofce of the State Comptroller

NYS Ofce Building, Room 3A10

250 Veterans Memorial Highway

Hauppauge, New York 11788-5533

(631) 952-6534 Fax (631) 952-6530

Email: Muni-Hauppauge@osc.state.ny.us

Serving: Nassau and Suffolk Counties

NEWBURGH REGIONAL OFFICE

Tenneh Blamah, Chief Examiner

Ofce of the State Comptroller

33 Airport Center Drive, Suite 103

New Windsor, New York 12553-4725

(845) 567-0858 Fax (845) 567-0080

Email: Muni-Newburgh@osc.state.ny.us

Serving: Columbia, Dutchess, Greene, Orange,

Putnam, Rockland, Ulster, Westchester Counties

ROCHESTER REGIONAL OFFICE

Edward V. Grant, J r., Chief Examiner

Ofce of the State Comptroller

The Powers Building

16 West Main Street Suite 522

Rochester, New York 14614-1608

(585) 454-2460 Fax (585) 454-3545

Email: Muni-Rochester@osc.state.ny.us

Serving: Cayuga, Chemung, Livingston, Monroe,

Ontario, Schuyler, Seneca, Steuben, Wayne, Yates Counties

SYRACUSE REGIONAL OFFICE

Rebecca Wilcox, Chief Examiner

Ofce of the State Comptroller

State Ofce Building, Room 409

333 E. Washington Street

Syracuse, New York 13202-1428

(315) 428-4192 Fax (315) 426-2119

Email: Muni-Syracuse@osc.state.ny.us

Serving: Herkimer, J efferson, Lewis, Madison,

Oneida, Onondaga, Oswego, St. Lawrence Counties

STATEWIDE AUDITS

Ann C. Singer, Chief Examiner

State Ofce Building - Suite 1702

44 Hawley Street

Binghamton, New York 13901-4417

(607) 721-8306 Fax (607) 721-8313

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- US V Sheldon Silver ComplaintDocument35 pagesUS V Sheldon Silver ComplaintNick ReismanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Eric Frein: What He Had in The HangarDocument14 pagesEric Frein: What He Had in The HangarAnonymous arnc2g2NNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Public Health Review of High Volume Hydraulic Fracturing For Shale Gas DevelopmentDocument184 pagesA Public Health Review of High Volume Hydraulic Fracturing For Shale Gas DevelopmentMatthew LeonardNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Judge's Ruling Dismissing Murder Charge Against Oral "Nick" HillaryDocument7 pagesJudge's Ruling Dismissing Murder Charge Against Oral "Nick" HillaryTime Warner Cable NewsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Market .Impact of A Proposed Tyre, New York Casino On Turning Stone - Final.10.27.2014Document100 pagesMarket .Impact of A Proposed Tyre, New York Casino On Turning Stone - Final.10.27.2014glenncoin100% (1)

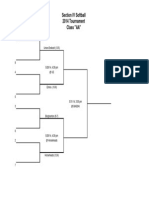

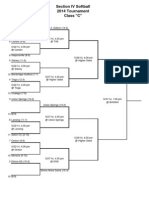

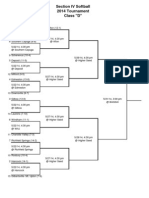

- Section IV Softball 2014 TournamentDocument5 pagesSection IV Softball 2014 TournamentTime Warner Cable NewsNo ratings yet

- Court Documents Filed by Gary Thibodeau's AttorneysDocument192 pagesCourt Documents Filed by Gary Thibodeau's AttorneysTime Warner Cable News100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Section IV Softball 2014 Tournament Class "AA"Document1 pageSection IV Softball 2014 Tournament Class "AA"Time Warner Cable NewsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Section IV Softball 2014 Tournament Class "C"Document1 pageSection IV Softball 2014 Tournament Class "C"Time Warner Cable NewsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Section IV Softball Brackets: DDocument1 pageSection IV Softball Brackets: DTime Warner Cable NewsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Section IV Playoff Bracket: Softball ADocument1 pageSection IV Playoff Bracket: Softball ATime Warner Cable NewsNo ratings yet

- Girls Lacrosse 2014 BracketsDocument3 pagesGirls Lacrosse 2014 BracketsTime Warner Cable NewsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Baseball Brackets 2014Document6 pagesBaseball Brackets 2014Time Warner Cable NewsNo ratings yet

- WRAP HandbookDocument63 pagesWRAP Handbookzoomerfins220% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Exam Questions AZ-304: Microsoft Azure Architect Design (Beta)Document9 pagesExam Questions AZ-304: Microsoft Azure Architect Design (Beta)Deepa R NairNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Sauna Studies As An Academic Field: A New Agenda For International ResearchDocument42 pagesSauna Studies As An Academic Field: A New Agenda For International ResearchsedgehammerNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sona Koyo Steering Systems Limited (SKSSL) Vendor ManagementDocument21 pagesSona Koyo Steering Systems Limited (SKSSL) Vendor ManagementSiddharth UpadhyayNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Evolution Epidemiology and Etiology of Temporomandibular Joint DisordersDocument6 pagesEvolution Epidemiology and Etiology of Temporomandibular Joint DisordersCM Panda CedeesNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Company Profile RadioDocument8 pagesCompany Profile RadioselviNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- G.R. No. 186450Document6 pagesG.R. No. 186450Jose Gonzalo SaldajenoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- NURS FPX 6021 Assessment 1 Concept MapDocument7 pagesNURS FPX 6021 Assessment 1 Concept MapCarolyn HarkerNo ratings yet

- DLL Week 7 MathDocument7 pagesDLL Week 7 MathMitchz TrinosNo ratings yet

- Anglicisms in TranslationDocument63 pagesAnglicisms in TranslationZhuka GumbaridzeNo ratings yet

- The Structure of The Nazi Economy - Maxine Yaple SweezyDocument273 pagesThe Structure of The Nazi Economy - Maxine Yaple Sweezygrljadus100% (2)

- Thick Teak PVT LTD Aoa and MoaDocument17 pagesThick Teak PVT LTD Aoa and MoaVj EnthiranNo ratings yet

- Project Report Devki Nandan Sharma AmulDocument79 pagesProject Report Devki Nandan Sharma AmulAvaneesh KaushikNo ratings yet

- Odisha Block Summary - NUAGAONDocument8 pagesOdisha Block Summary - NUAGAONRohith B.NNo ratings yet

- EEN 203 Slide Notes Year 2018: PART I - Numbers and CodesDocument78 pagesEEN 203 Slide Notes Year 2018: PART I - Numbers and CodesSHIVAM CHOPRANo ratings yet

- 5.4 Marketing Arithmetic For Business AnalysisDocument12 pages5.4 Marketing Arithmetic For Business AnalysisashNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- RPS Manajemen Keuangan IIDocument2 pagesRPS Manajemen Keuangan IIaulia endiniNo ratings yet

- Techniques of Demand ForecastingDocument6 pagesTechniques of Demand Forecastingrealguy789No ratings yet

- dm00226326 Using The Hardware Realtime Clock RTC and The Tamper Management Unit Tamp With stm32 MicrocontrollersDocument82 pagesdm00226326 Using The Hardware Realtime Clock RTC and The Tamper Management Unit Tamp With stm32 MicrocontrollersMoutaz KhaterNo ratings yet

- Judicial Review of Legislative ActionDocument14 pagesJudicial Review of Legislative ActionAnushka SinghNo ratings yet

- T2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFDocument1 pageT2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFGrissellNo ratings yet

- Question 1 (1 Point) : SavedDocument31 pagesQuestion 1 (1 Point) : SavedCates TorresNo ratings yet

- Surefire Hellfighter Power Cord QuestionDocument3 pagesSurefire Hellfighter Power Cord QuestionPedro VianaNo ratings yet

- Narrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"Document1 pageNarrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"AdrianNo ratings yet

- Horgolás Minta - PulcsiDocument5 pagesHorgolás Minta - PulcsiCagey Ice-RoyNo ratings yet

- Divorced Women RightsDocument41 pagesDivorced Women RightsAnindita HajraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2-Emotional Abuse, Bullying and Forgiveness Among AdolescentsDocument17 pages2-Emotional Abuse, Bullying and Forgiveness Among AdolescentsClinical and Counselling Psychology ReviewNo ratings yet

- 7 кмжDocument6 pages7 кмжGulzhaina KhabibovnaNo ratings yet

- SBP Notes-1 PDFDocument7 pagesSBP Notes-1 PDFzeeshanNo ratings yet

- Astm C1898 20Document3 pagesAstm C1898 20Shaik HussainNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet