Professional Documents

Culture Documents

67133929

Uploaded by

chengadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

67133929

Uploaded by

chengadCopyright:

Available Formats

SPATIAL PRICE DISCRIMINATION IN AGRICULTURAL

PRODUCT PROCUREMENT MARKETS: A

COMPUTATIONAL ECONOMICS APPROACH

MARTEN GRAUBNER, ALFONS BALMANN, AND RICHARD J. SEXTON

Signicant transport costs and spatially distributed supply and processing create oligopsony power in

agricultural markets. Price discrimination expressed in the form of partial or complete absorption of

freight charges by processors is often observed in these environments, but we understand little about

how these pricing decisions are made. Analytical approaches are often intractable. As an alternative,

we propose a computational economics approach to analyze a general spatial competition model and

study rms choices of spatial pricing policy. Instead of the commonly presumed free-on-board pricing,

we nd that buyers choose price discrimination, either through uniform delivered pricing or through

partial freight absorption.

Key words: agent-based model, duopsony, genetic algorithm, price discrimination, spatial price theory.

JEL codes: C63, C72, L13, Q11.

The farmer is the only man in our economy

who buys everything at retail, sells everything at

wholesale, and pays the freight both ways.

John F. Kennedy

Agricultural production is typically dis-

tributed over geographical space, and often a

large number of producers sell to relatively

few processors who are also distributed within

the producing region due to the expense of

shipping the product long distances. Shipping

costs limit a producers choice among buy-

ers because farm products are typically bulky

and/or perishable, and transporting them to

processing facilities is costly relative to the

product value (Fackler and Goodwin 2001;

Rogers and Sexton 1994). As a result, pro-

cessors consider only neighboring rms as

direct competitors, which creates oligopsony

Marten Graubner is a postdoctoral research associate at the

Leibniz-Institute ofAgricultural Development inCentral andEast-

ern Europe (IAMO), Halle (Saale), Germany. Alfons Balmann is

director at IAMO and a professor at the Martin-Luther-University

Halle-Wittenberg. Richard J. Sexton is a professor in the Depart-

ment of Agricultural and Resource Economics, University of

CaliforniaDavis and a member of the Giannini Foundation of

Agricultural Economics.

The authors thank Jeff Dorfman, Pierre Mrel, Klaus Sal-

hofer, and two anonymous referees for valuable comments and

suggestions.

Financial support by the German Research Foundation (DFG,

Project Reference No. BA-1654/11-1 and BA-1654/12-1) is grate-

fully acknowledged.

conditions inagricultural product procurement

markets. Processors canexercisemarket power

over production located proximate to their

plants due to producers high costs of accessing

outside buyers.

While incorporating transport costs in agri-

cultural market models has a long history,

most literature has followed the approach

of spatial equilibrium modeling, where the

spatial dimension of markets is reduced to

discrete points of supply and demand sepa-

rated by geographic distance (Takayama and

Judge 1964a,b). Such models are not use-

ful for analyzing procurement markets with

spatially dispersed production and process-

ing locations. Among models that do account

explicitly for the spatial dispersion of produc-

ers and processors, many assume perfect com-

petition, which ignores the market power that

is endemic to such settings (Bressler and King

1970; Dahlgran and Blank 1992; Mwanaumo,

Masters, and Preckel 1997).

One important consequence of spatial mar-

ket power is that it facilitates spatial price

discrimination, which occurs when the differ-

ence in net price offered by a processor at

two locations does not equal the difference in

transport costs due to serving those locations

(Phlips 1983). Threepricingregimes areusually

considered in spatial price theory (Beckmann

1976): free-on-board (FOB), uniformdelivered

Amer. J. Agr. Econ. 93(4): 949967; doi: 10.1093/ajae/aar035

Received September 2010; accepted April 2011; published online July 17, 2011

The Author (2011). Published by Oxford University Press on behalf of the Agricultural and Applied Economics

Association. All rights reserved. For permissions, please e-mail: journals.permissions@oup.com

950 July 2011 Amer. J. Agr. Econ.

(UD), and optimal discriminatory (OD). In a

procurement context, FOBpricing, also known

as mill pricing, involves a constant offer price

at the processing plant gate, with farmers being

responsible for costs of transporting the prod-

uct to the processor. Local prices thus differ

exactly by the transport cost differences among

locations. Producers receive the same price

irrespective of their location relative to the

processor under UD pricing, with processors

bearing nominally the entire transportation

costs. UD pricing represents an extreme form

of price discrimination against nearby produc-

tion. OD pricing is characterized by processor

prot maximization at each market point and

usually involves partial freight cost absorption.

Despite the prevalence of spatial price dis-

crimination in the real world (Greenhut 1981),

classic and contemporary texts on agricul-

tural markets focus exclusively on FOB pric-

ing (Bressler and King 1970; Hudson 2007;

Tomek and Robinson 2003). UD pricing has

been studied for only a few cases, including

California processing of tomatoes (Durham,

Sexton, and Song 1996), Spanish (Alvarez et al.

2000) and German (Graubner et al. 2011) raw

milk markets, and corn-based ethanol produc-

tion (Gallagher,Wisner, and Brubacker 2005.)

1

Partial freight absorption, when local price dif-

ferences reect only a certain share of the

transport costs, might be presentfor example,

when a processor deducts a hauling charge or

provides a hauling allowance. However, such

policies have received almost no attention in

an agricultural market context.

2

Therefore, a central question that this article

seeks to answer is: What determines the spatial

price policy of purchasers of agricultural prod-

ucts?The question has been studied on the sell-

ing side mostly for the case of spatial monopoly,

but the oligopoly case and procurement mar-

kets (either monopsony or oligopsony) have

received little attention. The few investiga-

tions that address the question for oligopoly or

oligopsony focus primarily upon the two polar

cases of FOB and UD pricing, even though

we know that OD pricing in general yields

superior prots in the monopoly/monopsony

case (Beckmann 1976; Beckmann and Thisse

1986; Lfgren 1986). The key reason for the

1

Durham, Sexton, and Song (1996) offer further examples of

UD pricing in agricultural product markets.

2

Notable exceptions are Bailey, Brorsen, and Thomson (1995),

who used a statistical model to detect partial freight absorption for

feeder cattle in the United States, and Lfgren (1985), who studied

the Swedish pulpwood market.

limitedtreatment is that the more general cases

of price discrimination and freight absorption

have proven to be intractable analytically.

We set fortha general theoretical framework

to study spatial pricing in agricultural mar-

kets. To account for partial freight absorption

we introduce a linear pricedistance function,

enabling processors to absorb any fraction of

freight charges in the interval (0,1), as well

as to choose the boundary cases of FOB or

UD pricing. We surmount the problem of ana-

lytical intractability of this general framework

by obtaining results based on a computational

economics approach. An agent-based model is

used to simulate the price-policy game in the

framework of a static noncooperative duop-

sony market.

Consistent with most prior literature, we

study a linear market, with farmers distributed

uniformly in the market space and a proces-

sor located at either endpoint. The results show

that the price strategy of the processor depends

on the importance of transportation costs rel-

ative to the net value of the nished product.

This measure of relative transportation costs

in turn determines the spatial differentiation

between rms and the intensity of their com-

petition to procure the farm product. Under

price (Bertrand) competition when space does

not matter, the equilibrium involves perfect

competition, as is well known. However, with

increasing importance of space, competition

decreases as the processors become differenti-

ated fromthe perspective of producers, and for

sufciently high values of transportation costs,

processors desired market areas do not over-

lap and each can act as a spatial monopsonist.

The simulations reveal that extreme price

discrimination in the form of UD pricing

emerges when the spatial dimension of the

market is less important and competition is

intense. Partial freight absorption (moderate

spatial price discrimination) emerges when

competition is less intense. In this case, the

degree of price discrimination decreases with

increasing relative transportation costs, con-

verging eventually to the OD pricing strat-

egy of a monopsony processor. Conversely,

despite its frequent use in agricultural mar-

ket models, FOB pricing does not emerge as

equilibrium behavior in the simulations. We

argue that these results are consistent with

what is observed in a wide range of agricultural

markets.

Subsequently, we briey present relevant

literature on spatial pricing and competition

before developing our theoretical framework

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 951

and deriving conditions regarding prot

maximization and market radii, which are

required to interpret the results obtained from

the simulations. The agent-based simulation

model is then illustrated through replicating

an analytical result for FOB pricing due to

Zhang and Sexton (2001). The model is then

extended to study pricing strategies based

upon the exible linear pricedistance func-

tion. Results for rms optimal spatial pricing

policies over the relevant range of transport

costs are presented, discussed, and related to

pricing policies observed in the real world.

Relevant Literature

Spatial pricing has been investigated most

often for the case of monopoly (Beckmann

1976; Beckmann and Thisse 1986; Greenhut,

Norman, and Hung 1987; Smithies 1941).

Smithies investigated the monopolists price

policy under a framework of linear price

distance functions. It is convenient to present

this formulation adapted to an input market

framework. We dene

(1) w(r) =mr

where the local (farm gate) price, w(r), is a lin-

ear function of the distance r to the processor,

a constant mill price m at r =0, and a uniform

portion [0, 1] of the freight costs .

3

We

denote the pair (m, ) as the processors spatial

price strategy. The degree of spatial price dis-

crimination is (1 ), which would represent

the hauling allowance per unit distance paid

by the buyer. Any <1 represents spatial price

discrimination because local price differences

do not fully reect the differences in transport

costs (Phlips 1983).

Depending on the shape of demand func-

tions, Smithies (1941) concluded that the spa-

tial monopolist would either use FOB pricing

( =1) or partially absorb freight costs but

never totheextent of UDpricing( =0). How-

ever, if FOBor UDpricing are the only options,

the rm is indifferent between them under

linear consumer demandandprefers FOBpric-

ing under concave demand and UD pricing

otherwise.

4

3

The case of >1, known as phantom freight charges, is not

considered because such charges can be eliminated by arbitrage

among producers.

4

Similar results regarding the equivalency of FOBand UDpric-

ing in terms of prots, output, and average price per customer

Only a few studies have investigated a

rms price-policy decision under competition.

Norman (1981) analyzed linear pricedistance

functions under two restrictive assumptions

regarding rms behavior under spatial com-

petition.

5

He showed that under certain con-

ditions, the degree of price discrimination

increases with increasing competition and can

yield UD pricing in the limit.

Most relevant for our study are papers by

Kats andThisse (1989; hereafter KT), Espinosa

(1992), and Zhang and Sexton (2001; here-

after ZS). In a noncooperative game and under

intense competition (i.e., when space is less

important), KT and Espinosa obtained a simi-

lar result to Norman (1981): high price discrim-

ination in the form of UD pricing emerges in

equilibrium. Espinosa also investigated linear

pricedistance functions and derived partial

freight absorption in equilibrium if competi-

tiveness of markets is intermediate.

6

However,

both KTand Espinosa (1992) assume perfectly

inelastic consumer demands subject to a reser-

vation price, and ZS show that their results

are biased in favor of UD pricing because this

strategy enables the rm to capture the entire

consumer surplus bysettingtheUDpriceequal

to the reservation price.

ZSs is the rst study of spatial price policy

under competitiontoconsider aninput market.

They investigate a two-stage, duopsony game

with FOB or UD pricing as the spatial price

option but assume linear farm supply func-

tions. Thus, in contrast to KT and Espinosa

(1992), agents located along the line are able

to alter their behavior in response to the local

price they pay or receive. In results that dif-

fer signicantly from prior studies, ZS nd that

FOB pricing is the dominant strategy if mar-

kets are highly competitive, mixed FOB-UD

pricing occurs for moderate competition, and

UDpricing is observedfor lowmarket compet-

itiveness. Fousekis (2011) adopts the ZS model

but makes one of the twoplayers a cooperative.

He nds that UD pricing emerges in equilib-

rium if markets are highly competitive, mixed

under linear demand functions and a xed market area have been

obtained by Beckmann (1976) and Beckmann and Thisse (1986),

as well as by Lfgren (1986) for the case of a spatial monopsony.

5

The competitionscenarios correspondtoparticular conjectural

variations regardingthereactionof onermtoapricechangebythe

other. Under one assumption, rms maximize their prots under

a given market radius, while under a second assumption, the local

price at the market boundary is assumed to be xed.

6

In Espinosas dynamic framework, competitiveness is mea-

sured in terms of the importance of space and the discount factor.

The most competitive market scenario is given if both values are

zero.

952 July 2011 Amer. J. Agr. Econ.

FOB-UD pricing emerges for intermediate

market structures (withco-ops using FOBpric-

ing), and FOB pricing results if the importance

of space in the market is sufciently high.

Thus, despite the pervasiveness of spatial

pricing in practice, there is much confusion in

the literature as to which policies emerge as

equilibrium strategies, with the extant litera-

ture limited in terms of the alternative strate-

gies it has considered and the ability of agents

to respond to price signals they receive. This

article extends the literature relative to ZS in

particular and other spatial competition mod-

els in general based upon our ability to handle

more complex and realistic market environ-

ments through use of the computational eco-

nomics framework. We reintroduce the linear

pricedistance function as a generalized spatial

price policy that nests FOB and UD pricing as

polar extreme cases. Accordingly, the proces-

sor simultaneously chooses two pricing instru-

ments: a constant mill price (m) and the degree

of spatial price discrimination (expressed in

terms of 0 1) to implement. We inves-

tigate this choice in a model of duopsony

competition and with elastic producer supply

response.

Spatial Price Theory

The basic structure of our model of a spatial

input market is standard (Alvarez et al. 2000;

Drivas and Giannakas 2008; Fousekis 2011;

Lfgren 1986; ZS) and represents adaptation

of the famous Hotelling (1929) duopoly model

to study input procurement. Two processors, A

andB, are locatedat the endpoints of a line with

length D. Producers of a homogeneous farm

product are distributed uniformly on the line

with unit density. A producers supply function

q(r) at distance r from a processors location is

assumed to be of the constant elasticity form:

q(r) =[w(r)]

e

, where e 0 is the price elasticity

of supply. The processors produce a nal good

g with technology g =min{q/v, f (Z)}, where

v =q/g denotes the xed conversion between

input and output, and Z is a vector of other

processing inputs. We set v =1 without loss

of generality and assume that other marginal

processing costs, c, are constant per unit of

output.

7

7

Under constant returns in the production technology of the

processors, xed costs provide a justication for limited entry

among processors and thus for spatial imperfect competition.

The processors receive a constant price for

the nished product, and the marginal value

product of the farm input is therefore =

c. This assumption of perfect competition

in the nal product market is also standard

(Lfgren 1986; Sexton 1990; ZS) and reects

that although farm product markets are local

or regional in geographic scope due to high

shipping costs, such costs for the nished prod-

uct are usually much lower, making the sales

market national or international in geographic

scope and, thus, subject to greater competition.

The importance of the spatial dimension of

a market and, hence, its competitiveness in the

Hotelling framework can be expressed as the

ratioof the unit transport rate times the market

length (D) to the marginal value product ( =

c) of the farminput: D/ (Hinloopen and

van Marrewijk 1999; Mrel and Sexton 2010;

ZS). Without loss of generality, we set D and

equal to one via normalizations. The normal-

ized transport rate t =/ thus measures the

real cost of transporting one unit of the input

per unit of distance, and the competitiveness

of the market is determined by t. For exam-

ple, low t implies that spatial differentiation

between rms is unimportant, and the procure-

ment market is highly competitive, while for

sufciently large values of t the rms desired

procurement markets do not overlap and they

operate as local monopsonies.

A processors prot per unit is the marginal

value product of the farm input net of its price

and transport costs. Multiplication by local

supply q(r) yields the prot at each location:

(2) =(1 w(r) tr)[w(r)]

e

.

A monopsonists prot-maximizing local price,

w

(r), can be determined by maximizing

equation (2) with respect to w(r) (Zhang 1997):

(3) w

(r) =

e(1 tr)

1 +e

.

Because w(r) =mtr and w(0) =m, the

optimal values for m and in the case of the

monopsony are:

(4) (m

) =

e

1 +e

,

e

1 +e

.

Because these costs do not inuence the models outcome, we do

not consider them further.

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 953

This OD pricing strategy involves freight

costs absorption by the processor because

=e/(e +1) <1. Moreover, the strategy is

independent of t and the size of the market

(Lfgren 1986). However, the market bound-

ary R, if not exogenously given(e.g., by aninter-

national border), is determined by at least one

of two conditions: (a) either the local price is

zero: mtR

1

=0 or (b) the processors local

prot per unit is zero: 1 m+tR

2

( 1) =0.

The effective border, R, is the lesser of these

two distances: R=min{R

1

, R

2

}, or stated more

formally:

(5) R=min

m

t

>0

,

1 m

(1 )t

0<1

.

The restrictions on in equation (5) apply

because =0 represents UD pricing, and then

there is no single location where local farm

price is zero, while =1 corresponds to FOB

pricing and then there is no single location

where local monopsony prot per unit is zero.

When given by equation (4), the processors

linear price strategy intersects the zero prot

line andthe zeroprice line at the same location.

Hence, the OD pricing strategy of equation

(4) maximizes R (Beckmann and Thisse 1986;

Lfgren 1986), and applying equation (4) to

equation (5) obtains R

=1/t. Using this rule,

we can calculate the upper limit of t that sepa-

rates spatial competition and (local) monop-

sony when processors desired market radii

do not overlap. This requires that R

=1/2.

Accordingly, processors A and B are local

monopsonists if t 2,

8

and therefore t [0, 2]

parameterizes theentirerangeof possiblecom-

petition outcomes, from perfect competition

(t =0) to pure monopsony (t 2).

Processors compete to procure supply for

all t <2, and results depend crucially on their

price strategies, which determine their market

areas and prots. A key analytical difculty

when considering possible asymmetric pricing

strategies between the rms, as well as strate-

gies involving freight absorption, is that a Nash

equilibriuminpurestrategies maynot exist due

to the potential for one rm to overbid its

rival and achieve a discontinuous expansion of

its market area and, hence, prots, withthe rival

facing a parallel discontinuous contraction.

8

Thus, given the normalizations, the market is a spatial monop-

sony if the distance separating processors multiplied by the unit

transportation costs is at least twice the net value of the nal

product.

The problem of nonexistence of

pure-strategy Nash equilibria created by

discontinuous payoff functions is explicated

for the general noncooperative-game case

by Dasgupta and Maskin (1986). It is well

known in the spatial literature for the case of

UD pricing (Beckmann 1973; KT; Schuler and

Hobbs 1982; ZS),

9

but the problem persists

also for a range of values of the linear price

schedule (m, ) and when rms can adopt

asymmetric pricing strategies. In essence, not

dissimilar to the UD pricing case (footnote 9)

the possibility exists to adjust (m, ) jointly

to overbid a rival over a discrete range of the

market space and thereby capture a discon-

tinuous increase in market share and prot,

making the payoff function discontinuous in

the strategic variables m and . Thus, extend-

ing processing rms choices of spatial pricing

policy to allow partial freight absorption and

selection of asymmetric pricing strategies,

although reective of choices rms can make

in the real world, presents intractable analyti-

cal difculties, making it impossible to obtain

a closed-form solution and motivating our

use of computational economics to simulate

noncooperative spatial competition under the

model framework described in this section.

Simulation

An appropriate simulation technique for spa-

tial competition must account for processor

and farmer heterogeneity based upon their

locations and possible differences in strate-

gic behavior. Processors interact strategically

as long as they are engaged in direct compe-

tition, i.e., t <2. Strategic interactions among

heterogeneous players can be studied with

agent-based modeling (ABM).

10

The purpose

of ABM is to investigate complex social sys-

tems through simulation (Axelrod 1997). In

our framework, an agent is either a proces-

sor or a farmer who is identied by a location

and a behavioral ruleprot maximization.

Farmers are assumed to act as price takers, but

processors exploit local market power.

9

The rm paying the higher price under UD pricing can acquire

product over the entire range of the market that it is willing to

serve at that price. Thus a small increase in price that enables a rm

to overbid its rival expands its market share and prot discontinu-

ously. An equilibrium exists in mixed strategies for the UD pricing

case (Beckmann 1973).

10

For an introduction and further information on ABM, see

Tesfatsion (2006).

954 July 2011 Amer. J. Agr. Econ.

A nite number of suppliers located uni-

formly along a linear market deliver product

to a processor (with one processor located at

each endpoint) who sets the higher price at

the producers location. Whena processor does

not offer service at the farmers location under

a pricing policy involving freight absorption,

farmers may deliver their product (at ship-

ping cost t) to the boundary of the processors

service area if it is protable to do so.

11

The objective of each processor is to max-

imize the sum of its local prots that are

denedfor eachlocationaccording toequation

(2). Whether a processor earns a prot at

location r depends on the local price w(r) =

max{w

A

(r), w

B

(1 r)} but also on the price

paid at other locations because of the possi-

bility of spatial arbitrage by producers (see

footnote 11). If the producer at location r has

offer w

A

(r), but no offer from rm B, the pro-

ducer may choose to deliver product to the

market boundary of processor B. Such arbi-

trage reduces the market area, supply, and

prot of rm A but has no effect on the prot

of rm B because its prot is zero for product

procured at its market boundary.

While the suppliers decisions are based

on the deterministic rule of price (prot)

maximization, processors have to identify

optimal strategies simultaneously. This prob-

lem exhibits nonconvexities, and conventional

Nash equilibrium search algorithms are likely

to miss the globally optimal strategy by fol-

lowing a local optimization path (Son and

Baldick 2004). Thus, we use a coevolutionary

genetic algorithm (GA), a method developed

to overcome this issue and identify the global

optima of the processors spatial decision-

making problem.

GAs represent a heuristic method for ran-

domsearchoptimization. Theyweredeveloped

by Holland (1975) and have been applied in

a broad range of disciplines (Foster 2001).

12

Important applications in economics include

the investigation of the repeated Prisoners

11

Any strategy involving freight absorption by the processor

must also involve setting a service-area boundary beyond which it

is not protable for the processor to procure product under that

strategye.g., see equation (5). We allow producers outside the

service area to ship product at their expense (shipping cost t) to

the boundary of the processors service area. Such producer arbi-

trage is discussed by ZS for UD pricing. The incentive also applies

under partial freight absorption when processors are unwilling to

serve the full market under their policy. The real-world analog to

such producer behavior is shipping product to receiving stations

operated by the buyer.

12

See Mitchell (1996), Goldberg (1989), and Dawid (1999) for

comprehensive discussions regarding the structure and function of

GAs with economic and general applications.

Dilemma by Axelrod (1984, 1997) and the

behavior of exchange rates by Arifovic (1996).

Price (1997) used a GA to model standard

games from industrial organization, including

monopoly as well as Cournot and Bertrand

competition, to demonstrate its relevance as

an analytical tool in such settings. Valle and

Ba sar (1999) andAlemdar and Sirakaya (2003)

modeled leaderfollower competition, while

BalmannandHappe(2001) exploredoligopoly

behavior in spatial agricultural land markets.

13

Ina simpliedway, the GAmimics biological

evolutionandis basedonsurvival-of-the-ttest

behavioral strategies (Dawid 1999). A GA

stochastically explores the solution space

for optimal (or close to optimal) strategies.

Depending on the application, the design of

GAs can vary greatly.

14

However, a GA basi-

cally consists of three components: a pool of

candidate solutions (a population), the objec-

tive (tness) function, and the genetic opera-

tors (selection, crossover, and mutation). We

rst describe briey the major features of the

GA and then illustrate its use in a particular

example.

The rst step of a GA simulation involves

random choice of z candidate solutions to a

problem. Usually, these candidate solutions are

not the decision variables themselves, i.e., the

phenotype. Instead, strategies are coded into,

for instance, binary strings of 0 and 1, i.e.,

the genotype. The genotype representation of

a candidate solution is known as a chromo-

some. Accordingly, suppose that x

A,i,k

(x

B,j,k

)

represents an encoded strategy of processor

A (B) with i, j ={1, 2, . . . , z} and k is a gen-

eration, which consists of tness evaluation

and the application of the genetic opera-

tors. Because of strategic interactions in our

model where the payoff (tness) of a strategy

depends on the strategy chosen by the com-

petitor, we use a coevolutionary GA (Price

1997; Son and Baldick 2004). The main char-

acteristic is that we initialize two populations

X

k

, one each for processors A and B such

that X

A,k

={x

A,1,k

, x

A,2,k

, . . . , x

A,z,k

} and X

B,k

=

{x

B,1,k

, x

B,2,k

, . . . , x

B,z,k

}.

Each of processor As strategies is then

played repeatedly against one of processor Bs

strategies selected randomly from X

B,k

and

13

The study by Zhang and Brorsen (2010) is a recent example of

anagent-basedapplicationto(nonspatial) oligopsony price compe-

tition in cattle procurement markets, where an alternative (particle

swarm optimization) algorithm is used to search for equilibrium

solutions.

14

See Graubner (2011) for a more detailed documentation of

the simulation model in this article.

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 955

vice versa. As a result, an average tness of

strategy x

A,i,k

can be determined subject to the

random vector x

B,k

of strategies drawn from

the competitors population (x

B,k

X

B,k

).

15

Based upon their tness values, good strate-

gies are selected for the next generation k +1.

We use a selection scheme where a predened

number z ( z z) of thettest chromosomes are

selected. To ensure the desired population size

z in each generation k, we ll up a new popula-

tion X

k+1

with z z random copies of already

selected strategies. These copies are selected in

proportion to the average tnessthe higher

the tness of a strategy, the more likely it will

be duplicated.

Because selection reduces the variety of

strategies and strategies that are even close to

the optimum are unlikely to be initialized in

a population, we need operators to increase

the variety within the population in order to

nd new and potentially superior strategies.

This is done by mutation and crossover. Muta-

tion is a random manipulation of a strategy

(e.g., switching 0 to 1 in the binary represen-

tation of a strategy to create a new strategy),

while crossover recombines the information of

two parent chromosomes, which yields (with

high probability) two newcandidate strategies.

Over a (high) number of generations, i.e., the

succession of tness evaluations and the appli-

cation of genetic operators, the GA solution

converges toward a Nash equilibrium solution

(Riechmann 2001; Son and Baldick 2004).

We illustrate the procedure by attempting

to replicate the analytical FOB-pricing equi-

librium derived by ZS. For all simulations

presented in the article, we used a GA with

z =25 candidate solutions (chromosomes) in

each processors population, selected z =20

strategies from each population in k for k +1,

and ran the GAover k

max

=2, 500 generations.

To determine an average tness value of each

strategy, we tested it with ve random strate-

gies (20%) of the competitors population. The

mutation rate, or the probability of a random

changeof somepart of achromosome, was 0.04.

The crossover rate, or the probability of ran-

dom recombination of two chromosomes, was

0.10. Crossover and mutation rates are con-

stant over generations and we used one-point

crossover where a chromosome is parted into

two segments at most.

15

Hence, the tness evaluation consists of a tournament of

strategies between both players.

Optimal FOB Prices in Duopsony

If both processors choose FOB pricing, ZS

show that a pure-strategy Nash equilibrium

in prices exists. The theoretical framework is

unchanged except that we set =1 in equation

(1) to coincide with FOB pricing and e =1

local supply is linear in the local price, that is,

q(r) =w(r), the assumption invoked by ZS.

16

Accordingly, a producer is indifferent between

delivering to processor A or processor B if

m

A

tR=m

B

t(1 R), which yields:

(6) R

A

=

m

A

m

B

+t

2t

, R

B

=(1 R

A

).

Under FOB pricing, a producers net price and

hence supply depends on his location, r, but a

processors local prot per unit is constant over

her market area:

(7) (m

A

, 1, R

A

) =(1 m

A

)

R

A

0

(m

A

tr)dr.

Using equation (6) to substitute for R

A

in

equation (7) and maximizing this function with

respect to choice of m

A

obtains processor As

price reaction function m

A

=m

A

(m

B

, t). Like-

wise, the reaction function of processor B is

m

B

=m

B

(m

A

, t). The intersection of reaction

functions represents a unique and symmetric

Nash equilibrium with m

A

=m

B

=m

f

:

17

(8) m

f

=

1

4

2 3t +

4 +t(13t 4)

.

The equilibrium FOB price is a rather com-

plicated, nonmonotonic function of t; it is

decreasing for t t

, where t

=2(1 +3

3)/13,

and increasing for t >t

up to the monopsony

price m

f

=2/3, which applies for t 4/3.

18

ZS explain the nonmonotonicity of m

f

(t)

as the result of two offsetting factors, a

competition effect and an elasticity effect.

Spatial competition between processors

16

This specication lacks generality, but, as ZS note, relative

to the inelastic demand assumption invoked commonly in mod-

els of spatial oligopoly, it is a parsimonious way to introduce the

key feature of making local supply responsive to the local price

paid.

17

We use the subscripts f , u, and o to refer to FOB, UD, and OD

pricing.

18

Under the FOB pricing framework the limit for t separating

spatial competition and (local) monopsony is lower compared with

the general linear pricing framework discussed previously because

the market radius under OD pricing, 1/t, is larger than under FOB

pricing, 2/3t.

956 July 2011 Amer. J. Agr. Econ.

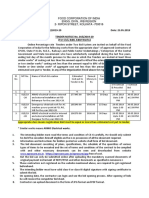

Figure 1. Composition of processor As set of strategies at initialization and after the rst

generation

decreases with t, which enables them to pay

lower mill pricesthe competition effect.

However, a monopsony processor operating

with a xed market radius pays an optimal mill

price that is an increasing function of t.

19

This

strategy limits the reduction in local supply

from increasing t (and decreasing local prices)

by partial absorption of this increase by the

processor (Mrel and Sexton 2010) and rep-

resents the elasticity effect. The competition

(elasticity) effect dominates if t t

(t >t

),

yielding the price schedule in equation (8).

In applying the GA to the FOB pricing

problem, we randomly select z =25 mill prices,

m

A,i,0

and m

B,j,0

, for processor A and processor

B, respectively, in the economically reason-

able range of m [0, 1]. We then x a level of

transportation cost, say t =0.5. According to

equation (8), the symmetric Nash equilibrium

mill price is m

f

(0.5) 0.698, and substitution

into equation (7) yields

A

(m

A

, m

B

, 0.5)

0.087. We can evaluate processor As prot

(tness) for each m

A,i,0

for a randomly selected

strategy m

B,j,0

. For instance, one such element

in the initial randomization for processor A is

m

A,i,0

=0.71, and

av

A,i,0

(0.71, m

B,j,0

, 0.5) repre-

sents the average prot of m

A,i,0

=0.71 found

by repeated evaluation of it against a ran-

dom vector of processor Bs strategies, m

B,k

.

To determine the tness of all strategies, we

19

Holding R exogenous and solving the rst-order condition of

equation (8), we get m

f

=(2 +Rt)/4 and m

f

/t >0.

undertake repeated testing of strategies in a

tournament, where, for instance, all of proces-

sor As strategies (chromosomes) are tested

at least ve times and in different combina-

tions with strategies randomly selected from

processor Bs population.

The next step is to select the best strategies

from the set of potential solutions for proces-

sor A and processor B according to

av

i

().

Hence, we select the z =20 ttest strategies

from the original set and copy them into a new

set. We add z z =5 copies of already selected

strategies, where the probability that a strat-

egy is duplicated is directly proportional to its

tness. As a result, we obtain a new composi-

tion (population) of strategies for each player;

that is, we expect to nd a different distribu-

tion of strategies in the new set of prices. For

instance, several copies of a price strategy with

a relatively high tness may be included in the

population. Figure 1 illustrates this point by

comparing processor As initial set of strategies

with the set of the next generation of the GA.

Note that some of the strategies are con-

tained more frequently than others because of

selection, but there are also new strategies due

to mutation and crossover applied after selec-

tion.

20

Both operators are required because

20

While mutation manipulates a chromosome at one single loca-

tion, e.g., switching 0 to 1 in the binary representation of a strategy,

crossover exchanges sequences of 0s and 1s between two parent

chromosomes (two potential FOB prices) to yield two offspring

(twonewFOBprices). Wecanalsoillustratecrossover withthegen-

eral linear price strategy dened in equation (1). Suppose (m

i

,

i

)

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 957

Figure 2. The analytical Nash equilibrium and the results of the simulation

repeated selection of good strategies eventu-

ally results in a set of identical strategies for

eachplayerthe price withthe highest average

prot of the initial set of strategies of proces-

sor A and processor B. Of course, most likely

this strategy is not even close to the optimal

solution. Hence, the selection of good strate-

gies allows us tograduallyclimbtheobjective

function such that the average tness of the

population approaches the value of the best

strategy. This value can be, but does not have

to be, close to a maximum. Hence, the random

change of strategies ensures that the algorithm

not only is able to get closer to any optima but

also does not get stuck at a local optimum.

In gure 2, the analytical Nash equilibrium

outcome, equation (8), is compared with the

results of the GA simulation over the relevant

range of t. For each t ={0, 0.05, 0.10, . . . , 1.30},

30 simulations were conducted. The points

depicted in the gure represent averages

over the last 5% of 2,500 GA genera-

tions for each of the 30 runs and for both

players. Hence, we have 7,500 observations

(2500 0.05 30 2) for each value of t.

Even though the Nash equilibrium prices vary

considerably and are nonmonotonic in t, the

GA simulation is able to closely approximate

the analytical solution. The correlation coef-

cient is R

2

0.999.

and (m

j

,

j

) are two strategies in the processors population. One

possible outcome of crossover is the exchange of the decision

variables, i.e., (m

i

,

j

) and (m

j

,

i

).

Of course, we do not need the GA when

we can obtain an analytical solution. How-

ever, the replicationof known, albeit nontrivial,

results illustrates application of the GA and

provides a certainvalidationof its performance

and precision. Unfortunately we cannot pro-

vide this type of evaluation for the cases when

the GA is needed, namely when no analytical

solution is available.

Simulation Results: The Processors Spatial

Price Strategies

We now present simulation results from relax-

ing the FOB pricing assumption ( =1) and

allow m and to each range in the inter-

val [0, 1]. We carried out simulations for

t ={0, 0.02, . . . , 2}, i.e., the entire competition

range for t in increments of 0.02. The base

value of local supply elasticity chosen for the

simulations is e =1 (unit elastic) to enable a

direct comparison with the analytical results

contained in ZS for the polar cases of UD

and FOB pricing. However, we also report

results for two cases of inelastic farm supply,

e =0.25 and e =0.75, given the importance of

the inelastic-supply case in many agricultural

markets.

21

21

For example, Gardner (1992, p. 63) cites inelastic supply of

agricultural products as one of four essential elements of agri-

cultural product markets that jointly cause the so-called farm

problem of low and unstable farm incomes.

958 July 2011 Amer. J. Agr. Econ.

Figure 3. The processors equilibrium price strategy parameters m and

Figure 4. Frequency (F in thousands) of the strategy variables (m, ) for selected values of t

Results for both price strategy parameters

m and for the base case are presented in

gures 3 and4. Figure 3 depicts the average val-

ues of the decision variables for both players

over the last 5% of 2,500 GA generations.

Figure 4 shows their distribution for selected

values of t. First, notice that the expected

results are obtained for the limit cases of per-

fect competition and spatial monopsony. In the

rst case t =0, and m= =1 represents the

zero prot Bertrand outcome. Price discrimi-

nation (1 ) in this case is the mean of a uni-

form distribution due to the simulations ran-

dominitialization because does not inuence

the local price if t =0 andthuschoiceof has

no role in the optimization. The other extreme

is local monopsony when t >2, in which case

both processors use OD pricing, which from

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 959

equation(4) is characterizedfor theunit-elastic

supply case by 50% absorption of freight costs,

(m

) =(0.5, 0.5).

The distributions of m and provided in

gure 4 are unimodal, indicating that the simu-

lation results do not support the existence of

asymmetric equilibria; that is, rms optimal

strategies are symmetric. This observation is

consistent with the analytical result of Mrel

and Sexton (2010) for consumer markets and

spatial duopoly, which shows that elastic con-

sumer demands (equivalent to the elastic farm

supplies in our case) yield a unique symmetric

equilibrium under FOB pricing, whereas equi-

libria with asymmetric strategies exist in the

traditional inelastic-demand case.

Two general types of spatial price policies

can be identied from the results. When space

is not too important, as in the cases of t =0.4

and t =0.8 in gure 4 or more generally for

0 <t 1.07 in gure 3, strategies correspond

to UDpricing because the values for are near

zero. However, if t is sufciently high, such as

the cases of t =1.2 and t =1.6 in gure 4, we

observe only partial absorption of freight costs

(instead of full absorption under UD pricing),

withtherateof absorptiondecreasingas afunc-

tion of t. From below, and m both approach

the OD amount of freight absorption and mill

price of 0.5. Importantly, we do not observe

FOB pricing in the simulation for any t. These

results are thus considerably different from

prior work in general and ZS in particular.

Results for m in the interval t (0, 1.07)

are consistent with expected price behavior

in that the mill price decreases as differ-

entiation between the rms increases. How-

ever, this relationship is reversed for t (

1.07, 2.0). Similar results (e.g., gure 2) have

been observed for the case of FOB pricing

(Capozza andVan Order 1978; Mrel and Sex-

ton 2010; Salop 1979; ZS) and are sometimes

called perverse price effects (Gronberg and

Meyer 1981). Our results establish that the pat-

tern persists as it pertains to munder the linear

pricedistance function studied here.

UD pricing, the outcome under relatively

intense spatial competition (t [0, 1.07]),

represents too much price discrimination rel-

ative to what maximizes buyer prots because

the optimal level of freight absorption is

o

=

1/2 for our base case of linear supply func-

tions. Due to decreasing competition as t

increases in the range (1.07, 2.0), the proces-

sors are able to increase prots by simultane-

ously increasing the mill price and decreasing

the amount of freight absorption, converging

to the monopsony OD pricing optimum, as

gure3illustrates. Thus, althoughthemill-price

portion of the linear pricing strategy (m, )

behaves in a qualitatively similar fashion as

a function of t to the FOB price function

(compare gures 2 and 3), the economic expla-

nations for the respective pricing behaviors are

somewhat different. Whereas the FOB price

pattern is determined by the relative strength

of the competition and elasticity effects, as

describedpreviously(ZS), thepathfor munder

the linear pricing schedule is also inuenced

by processors opportunity to converge upon

OD pricing as competitive pressures wane for

sufciently large t.

Comparative statics of local prices, w(r),

for a change in t differ across locations

within a processors market area; produc-

ers are thus impacted differentially from an

increase/decrease in differentiation between

rms and, hence, the intensity of their compe-

tition. Figure 5 illustrates net prices received at

the median location, w(R/2), and the market

border, w(R), and also the quantity-weighted

average price w, where

w=

1

2

0

(mtr)

2

dr

1

2

0

(mtr)dr

=

1

3

2mt +

4m

2

4mt

.

22

(9)

These net prices decrease in t for t (0, 1.07)

in a relationship determined fully by the pat-

tern for m(t) illustrated in gure 3. Because

processors utilize UD pricing in this range,

producers do not directly bear any of the

increase int. However, because the mill price m

increases in t for 1.07 <t 2, while the degree

of freight absorption decreases, increases in

t in this interval affect producers differently

based upon their location. Indeed, producers

located sufciently close to the processor ben-

et on net from higher transport costs because

the increase in m dominates the increase in

their shipping costs caused by higher t and

higher .

23

For more distant producers, net

farm price continues to decrease in t in the

interval 1.07 <t 2, but at a decreasing rate.

22

Because both processors use the same price policy in equilib-

rium, R=1/2.

23

A clear example is producers located immediately proximate

to a processing plant, for whom the local price is w(0) =m in

gure 3.

960 July 2011 Amer. J. Agr. Econ.

Figure 5. The average market price w, the local price of the median farmer w(R/2), and the

price at the market border w(R)

Figure 6. The processors equilibrium price strategy parameters mand for inelastic producer

supply

Notably, althoughthere are signicant distribu-

tional effects from a change in t in this interval

based upon producer location, the weighted

average price is nearly constant in t in this

interval.

Inelastic Farm Supply

Figure 6 summarizes the simulation results for

m and for two cases of inelastic farm supply:

e ={0.25, 0.75}. These results demonstrate the

relative robustness of results for the base case.

As in the base case, we observe the theoretical

expected outcomes of perfect competition and

OD pricing in the two limit cases of t =0 and

t 2. Note however per equation (4) that both

m

o

and

o

decline in the OD price strategy as

farm supply becomes more inelastic.

We also observe, consistent with the base

case, a high level of price discrimination (very

low values for ) that closely resembles UD

pricing occurring over a signicant range of t.

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 961

Also similar to the base case, as competition

wanes with sufciently large t, rms decrease

the rate of freight absorption, and the strategy

converges upon OD pricing. However, in an

interesting contrast tothe base case, the thresh-

old value for t when the rate of freight absorp-

tionbegins todiminishis larger thaninthe base

case. As discussed in detail below, rms deviate

fromODpricing because the benet frommar-

ket share gained from deviating toward UD

pricing more than compensates for the reduc-

tion in local prots from deviating from OD

pricing. However, when individual farm sup-

ply is more inelastic than the base case, farm

price is less under all pricing strategies for all

t >0. Thus, capturing additional market share

throughhighrates of freight absorptionconfers

a greater benet in terms of prot margin the

more inelastic is producer supply, thus delaying

the advent of the inevitable convergence of the

pricing strategy to OD pricing.

Discussion

Tointerpret theresults of thesimulations, recall

that OD pricing as expressed in equation (4) is

prot maximizing at each location. Any change

of price strategy by a processor involves two

effects, which we call market-share and price-

optimization effects. Any deviation from local

OD prices diminishes local prots. The sum

of local prot differences between OD pric-

ing and any alternative strategy within a given

market area constitutes the price-optimization

effect, and it is always negative. However, a

positive market-share effect exists if the devi-

ation yields additional prots from a higher

market share gained at the expense of the

competitor, that is, from capturing producer

locations by overbidding the competitor in

the region of the market border. We show

that a processor has incentive to deviate from

OD pricing in the direction of higher price

discrimination.

If both processor A and processor B use OD

pricing (m

o

,

o

) =(0.5, 0.5) in the base case,

and they share the market equally, R=1/2.

Each processors prot is:

(m, , R) =(0.5, 0.5, 0.5)

=

0.5

0

(0.5 0.5tr)

2

dr

=(1/96)[12 +t(t 6)]. (10)

Suppose processor B uses OD pricing and

0 <t 1/2. Processor A can then earn posi-

tive prots at processor Bs location (and all

other locations served by processor B) because

(1 t >1/2 =m

o

). Processor A can capture

the whole market by, for example, adopt-

ing UD pricing and setting m

u

=1/2 . This

strategy is protable because (0.5, 0, 1) >

(0.5, 0.5, 0.5), where

(m, , R) =(0.5, 0, 1)

=0.5

1

0

(0.5 tr)dr

=(1/4)(1 t). (11)

If 1/2 <t 1, processor A cannot capture the

whole market against an OD-pricing rival

because processor As zero prot line and

the competitors OD price function intersect

in the markets interior, setting 1 tR

A

=

0.5 0.5(1 R

A

)t, and solving for R

A

yields

a maximum market area for processor A of

R

A

=(1 +t)/3t <1. To capture this area, pro-

cessor A can set, for instance, a UD price

m

u,o

=(2 t)/3 that matches the competitors

OD price at R

A

.

24

This strategy yields prot

(12) ( m

u,o

, 0, R

A

) =

2 +3t t

3

54t

and it is easy to show that [(2 t)/3, 0, (1 +

t)/3t] >(0.5, 0.5, 0.5).

Figure 7 illustrates the deviation from OD

to UD pricing for t =3/4. The light-gray

shaded area (1/2 r R

A

) illustrates the posi-

tive market-share effect, while the dark-shaded

areas in0 r <r

1

andr

1

<r 1/2 illustrate the

negative price-optimization effect. For r <r

1

,

the UD price is too low and results in a subop-

timal quantity supplied from farmers located

in that range. For r

1

<r <0.5, the UD price is

too high relative to the OD optimum.

Although the areas in gure 7 illustrate the

changes in processor As prot from deviat-

ing unilaterally from OD pricing, they do not

depict the actual changes in prot because

quantities produced at each location are not

depicted on the graph. However, comparisons

of equations (10), (11) and (12) establish that

the positive market-share effect for a deviation

24

The subscripts of m

u,o

refer to a UD price set in response to

a competitors OD price. We later discuss a UD price m

u,f

set in

response to a competitors FOB price.

962 July 2011 Amer. J. Agr. Econ.

Figure 7. The market-share and price-optimization effects when processor A unilaterally

deviates from OD to UD pricing (t =3/4)

Note: The dark-shaded areas represent the negative price-optimization effect on processor As prots caused by processor A deviating from OD pricing to UD

pricing, and the light-shaded area represents the positive market-share effect on processor As prots caused by its deviation from OD to UD pricing.

from OD to UD pricing exceeds the nega-

tive price-optimization effect. OD pricing thus

is not an equilibrium strategy under moder-

ate to intense spatial competition dened by

t [0, 1] because it is vulnerable to an over-

bidding strategy involving more extreme price

discrimination.

Consider now why FOB pricing is not an

equilibrium strategy. Suppose t is low, so that

processor A and processor B are relatively

undifferentiated, competition is intense, and

both processors use FOB pricing. The equi-

librium price m

f

is given by equation (8), and

the market border is R=1/2. Processor A can

deviate from FOB to UD pricing and set the

UD price at m

u,f

=(2m

f

t)/2 so as to hold

constant the local price at the market bor-

der, w(R) =m

f

tR, in which case the location

of the border R=1/2 remains constant, and

there is no market-share effect. Figure 8 com-

pares the local price differences for UD and

FOB pricing with the optimal (OD) prices.

The dark-gray shaded area represents the local

price differences between UDand ODpricing,

and the light-gray shaded area is the differ-

ence between FOB and OD pricing. The area

between the OD and UD price lines for r

1

r 1/2 is not shaded because it is part of the

reduction in prot relative to OD pricing for

both UD and FOB pricing. Comparison of the

respective prots demonstrates formally that

such a deviation is protable for moderate t:

(13) ( m

u,f

, 0, 0.5) (m

f

, 1, 0.5)t 2/3.

However, m

u,f

is not the optimal reply to the

FOB-pricing processor. Instead, the reaction

functionof theUDpricingprocessor as derived

by ZS calls for setting a UD price that is higher

than m

u,f

. This optimal reply yields a lower

price-optimization effect than m

u,f

but has a

positive market-share effect that more than

compensates for it. In the framework of ZS,

the best reply of the FOB-pricing competitor

processor B to processor As UD price is to

raise the FOB price instead of deviating to

UD pricing as well. This, in turn, makes the

UD pricing policy of processor A less prof-

itable and ensures either symmetric FOB or

mixed UD-FOB pricing equilibria under mod-

erate to intense competition when processors

are limited to only those pricing options.

As gure 8 illustrates, the negative price-

optimization effect of FOB pricing is large

absolutely. The price-optimization effect is

even worse for processor B if it raises its FOB

price in response to UD pricing by proces-

sor A (as in the case of ZSs mixed pricing

equilibrium). A high FOB price is, nonethe-

less, an optimal reply to (re)gain market share

in response to a competitors deviation to UD

pricing if there is no alternative pricing strat-

egyavailable. Ingeneral, however, FOBpricing

features the lowest market-share effect rela-

tive to other linear price strategies because it

forces distant producers to bear full transport

costs andthus is a relatively ineffective strategy

to capture market share. In our model, there-

fore, FOB pricing is never the best reply to any

strategy.

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 963

Figure 8. The price-optimization effects of FOB and UD pricing (t =1/2)

Note: The light-shaded area represents the negative price-optimization effect on processor As prots from adopting the optimal FOB pricing strategy,

m

f

, instead of OD pricing, and the dark-shaded area represents the negative price-optimization effect on processor As prots from adopting the UD price,

m

u,f

, instead of utilizing OD pricing. Analytical comparison of the respective areas conrms that deviation from FOB pricing to UD pricing is protable

against processor Bs use of the FOB price m

f

.

To amplify upon this point, consider the

market border R between processor A and

processor B under a linear price policy. The

intersection of the rms pricedistance func-

tions m

A

A

tR=m

B

B

t(1 R) yields

R=(m

A

m

B

+

B

t)/t(

A

+

B

). The market

share for processor A decreases in

A

:

(14)

R

A

=

m

A

m

B

+

B

t

(

A

+

B

)

2

t

0

whenever m

A

m

B

B

t, which must hold

because m

B

B

t is processor Bs price at

the location of processor A. Conversely,

R/m

A

=1/t(

A

+

B

) >0; that is, market

share is increasing in the mill price. Because

is xed at 1 under FOB pricing, increasing

the mill price is the only tool available to

processor B to counter processor As UD

price strategy in our example (apart from

also deviating to UD pricing). Introducing an

intermediate degree of price discrimination by

reducing would allow processor B to achieve

both a higher market-share effect and a better

price-optimization effect, making such a strat-

egy protable compared with raising the FOB

mill price. But this possibility is not present

in ZS. Hence, FOB pricing emerges in equi-

librium due to the lack of alternative pricing

strategies.

Spatial Pricing in Practice

The simulation results revealed spatial price

discrimination as an optimal strategy when

spatially separated processors compete to

procure farm products. UD pricing is equi-

librium behavior under relatively mild differ-

entiation between rms, and hence intense

spatial competition (0 <t 1.07) and par-

tial but high freight absorption emerges under

less intense competition, (1.07 <t <2). Con-

versely FOB pricing does not emerge in equi-

librium. Rather, the emergence of FOB pric-

ing in agricultural product procurement mar-

kets would appear to depend crucially on

the condition that more than one buyer is

present at each location, in which case a price-

discriminating rm can be overbid for produc-

tion near the joint location by an FOB-pricing

rival. Indeed such a characterization of compe-

tition is implicit in the classic point-space trad-

ing model (e.g., Takayama and Judge 1964a)

that presumes its use. Examples include the

shipment of fresh produce to traditional ter-

minal markets (e.g., Sexton, Kling, and Car-

man 1991) or to one of several packing houses

located in close proximity to intensive growing

regions (e.g., Cho 2004).

Conversely, for farm products that go to

processing where efciency considerations dic-

tate spatially dispersed processing facilities

located throughout a growing region, we

believe observed pricing practices are broadly

consistent with the predictions of this model.

Dairy processing and meatpacking represent

prominent examples for most countries, as

do fruit and vegetable processing, with spe-

cic products differing across countries and

regions based upon growing conditions. Clear

cases of UD pricing are readily observed in

964 July 2011 Amer. J. Agr. Econ.

these settings, as noted at the beginning of

this paper (Alvarez et al. 2000; Durham, Sex-

ton, and Song 1996; Graubner et al. 2011)

and are broadly consistent with intense spatial

competitionnal products that are valuable

relative to shipping costs (i.e., have low t).

Milder forms of spatial price discrimina-

tion, which are predicted in our model to

emerge under less intense spatial competition,

are often less transparent. Although the mag-

nitude of hauling allowances for transportation

costs borne by producers can be observed, as

by Locke andTurner (1995) for U.S. sugarbeets

and by McCarter (2011) for U.S. potatoes,

25

the actual transportation costs are typically

unavailable to the market analyst. However, in

most cases shipment is arranged by the buyer,

making it a rather simple matter to impose a

hauling charge upon the seller but to set that

charge at less than the actual cost, that is, to

partially absorb the freight cost. Further, under

buyer-provided shipping and negotiated pric-

ing at each farm location, a price policy that

nominally appears to be UD can in reality

represent only partial (instead of full) freight

absorption if the buyer offers a lower mill price

for product involving longer-distance hauls.

Lfgren (1985) related spatial pricing to the

case of renewable natural resources and pro-

vided evidence of partial freight absorption

in the Swedish pulpwood market. The pricing

of sugarbeets in Germany is also illustrative.

Processors typically use UD pricing to pur-

chase sugarbeets up to the quantity limits set

by the EUquota system(formally the so called

A- and B-quotas). Sugar gained from exceed-

ing supply must be sold on the world market

at a lower price. In this case, the processor

charges a portion (e.g., 50%) of the transport

costs to the producer. Because both types of

sugarbeet have the same transport costs but

the quota sugar has a higher product value, the

market is more competitive (t is lower) rela-

tive to sugar sold at the world market price.

Our results are consistent with the observation

of UD pricing in the rst instance and partial

freight absorption in the latter.

Summary and Conclusions

Many markets for agricultural products t

the basic spatial markets paradigm of many

25

McCarter discusses a lawsuit challenging whether a hauling

allowance was part of the producers cropproceeds andthus subject

to the security interests of a lender (Washington Farm Service, Inc.,

v. Olsen, 90 P.3d 1053 (Wash. 2004)).

producers and few processors distributed

within a region, along with high transportation

costs relative to the marginal value product

of the farm product. These features facilitate

the exercise of local market power and price

discrimination as part of processors spatial

price strategy. Nonetheless economic models

of these markets usually assume nondiscrimi-

nating FOB pricing. Spatial price discrimina-

tion, if considered, is generally the extreme

form of UD pricing. Despite its comparative

ease of implementation, partial freight absorp-

tion is neglected, likely due to the analytical

intractability of studying it.

The goal of this article has been to derive

insights into spatial pricing in agricultural mar-

kets by analyzing the determinants of the spa-

tial price-policy decision with a exible linear

spatial pricing schedule. Although reective

of choices rms have in the real world,

this pricing policy causes the correspond-

ing noncooperative competition model to

become intractable analytically. We offered an

alternative approach based on computational

economics methods.

UDpricing emerges as the equilibriumstrat-

egy under intense to moderate spatial compe-

tition. When competition is less intense, partial

freight absorption emerges as an equilibrium

strategy, with the degree of freight absorp-

tion decreasing with the increasing impor-

tance of space and converging ultimately to

OD pricing as the market converges to local

monopsonies. Finding spatial price discrimina-

tion in all market settings where transporta-

tion costs matter constitutes a major differ-

ence between our results and those of pre-

vious studies. More extreme forms of price

discrimination than OD pricing reduce prof-

its relative to OD pricing through a negative

price-optimization effect but enable a buyer to

captureagreater market shareandhigher prof-

its by offering high prices in the region of the

market border.

We believe that the results presented here

help to explain pricing practices for raw agri-

cultural products used for processing when

processing facilities are dispersed through-

out the growing region. Although agricultural

economists often presume the use of FOBpric-

ing in these settings, this analysis has shown

that discriminatory pricing strategies emerge

as equilibrium behavior. Although we have

cited some limited empirical evidence of use of

full (UDpricing) and partial freight absorption

in these cases, empirical studies are needed to

document the prevalence of alternative spatial

pricing arrangements.

Graubner, Balmann, and Sexton Spatial Price Discrimination in Agricultural Markets 965

References

Alemdar, N., and S. Sirakaya. 2003. On-line

Computation of Stackelberg Equilibria

with Synchronous Parallel Genetic Algo-

rithms. Journal of Economic Dynamics and

Control 27: 15031515.

Alvarez, A. M., E. G. Fidalgo, R. J. Sexton,

and M. Zhang. 2000. Oligopsony Power

with Uniform Spatial Pricing: Theory and

Application to Milk Processing in Spain.

European Review of Agricultural Eco-

nomics 27: 347364.

Arifovic, J. 1996. The Behavior of Exchange

Rate in the Genetic Algorithm and Exper-

imental Economies. Journal of Political

Economy 104: 510541.

Axelrod, R. 1984. The Evolution of Coopera-

tion. NewYork: HarperCollins.

. 1997. The Complexity of Cooperation.

Princeton, NJ: University Press.

Bailey, D., B. W. Brorsen, and M. R. Thomson.

1995. Identifying Buyer Market Areas and

the Impact of Buyer Concentration in

Feeder Cattle Markets Using Mapping

and Spatial Statistics. American Journal of

Agricultural Economics 77: 309318.

Balmann, A., and K. Happe. 2001. Applying

Parallel Genetic Algorithms to Economic

Problems: The Case of Agricultural Land

Markets. In Microbehavior and Macrore-

sults: Proceedings of IIFET 2000, ed. R.

Johnston and A. Shriver. Corvallis: Inter-

national Institute of Fisheries Economics

and Trade.

Beckmann, M. J. 1973. Spatial Oligopoly as a

Noncooperative Game. International Jour-

nal of Game Theory 2: 263268.

. 1976. Spatial Price Policies Revisited.

Bell Journal of Economics 7: 619630.

Beckmann, M. J., and J. F. Thisse. 1986.

The Location of Production Activities. In

Handbook of Regional and Urban Eco-

nomics, ed. P. Nijkamp, vol. 1, 2195. Ams-

terdam: Elsevier Science.

Bressler, R. G., and R. A. King. 1970. Markets,

Prices and Interregional Trade. New York:

John Wiley & Sons.

Capozza, D. R., andR. VanOrder. 1978. AGen-

eralized Model of Spatial Competition.

American Economic Review 68: 896908.

Cho, S.-Y. 2004. An Economic Analysis of the

Washington Apple Industry. Ph.D. disser-

tation, Washington State University.

Dahlgran, R. A., and S. C. Blank. 1992.

Evaluating the Integration of Contigu-

ous Discontinuous Markets. American

Journal of Agricultural Economics 74:

469479.

Dasgupta, P., and E. Maskin. 1986. The Exis-

tence of Equilibrium in Discontinuous

Games, II: Applications. Review of Eco-

nomic Studies 53: 2741.

Dawid, H. 1999. Adaptive Learning by Genetic

Algorithms, 2nd ed. Berlin: Springer.

Drivas, K., and K. Giannakas. 2008. Process

Innovation Activity in a Mixed Oligop-

sony: The Role of Marketing Coopera-

tives. Journal of Rural Cooperation 36:

131156.

Durham, C. A., R. J. Sexton, and J. H. Song.

1996. Spatial Competition, Uniform Pric-

ing and Transportation Efciency in the

California Processing Tomato Industry.

American Journal of Agricultural Eco-

nomics 78: 115125.

Espinosa, M. P. 1992. Delivered Pricing, FOB

Pricing, and Collusion in Spatial Mar-

kets. Rand Journal of Economics 23:

6485.

Fackler, P. L., and B. K. Goodwin. 2001. Spatial

Price Analysis. In Handbook of Agricul-

tural Economics, ed. B. L. Gardner and G.

C. Rausser, vol. 1B, 9711024. Amsterdam:

Elsevier Science.

Foster, J. A. 2001. Evolutionary Computation.

Nature: Reviews Genetics 2: 428436.

Fousekis, P. 2011. Free-on-Board and Uniform

Delivery Pricing Strategies in a Mixed

Duopsony. European Review of Agricul-

tural Economics 38: 119139.

Gallagher, P., R. Wisner, and H. Brubacker.

2005. Price Relationships in Processors

Input Market Areas: Testing Theories for

Corn Prices Near Ethanol Plants. Cana-

dian Journal of Agricultural Economics 53:

117139.

Gardner, B. 1992. Changing Economic Per-

spectives on the Farm Problem. Journal of

Economic Literature 30: 62101.

Goldberg, D. E. 1989. Genetic Algorithm in

Search, Optimization and Machine Learn-

ing. Reading, MA: Addison-Wesley.

Graubner, M. 2011. The Spatial Agent-

Based Competition Model (SpAbCoM).

IAMO Discussion Paper No. 135, Leibniz-

Institute of Agricultural Development in

Central and Eastern Europe (IAMO),

Halle (Saale).

Graubner, M., I. Koller, K. Salhofer, and A.

Balmann. 2011. Cooperative Versus Non-

cooperative Spatial Competition for Milk.

European Review of Agricultural Eco-

nomics 38: 99118.

966 July 2011 Amer. J. Agr. Econ.

Greenhut, M. L. 1981. Spatial Pricing in the

United States, West Germany and Japan.

Economica 48: 7986.

Greenhut, M. L., G. Norman, and C. S. Hung.

1987. The Economics of Imperfect Compe-

tition, 2nd ed. Cambridge, UK: University

Press.

Gronberg, T., and J. Meyer. 1981. Competitive

Equilibria in Uniform Delivered Pricing

Models. American Economic Review 71:

758763.