Professional Documents

Culture Documents

Adam Steele, Brittany Montrois Et Al Versus United States of America

Uploaded by

Kelly Phillips ErbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adam Steele, Brittany Montrois Et Al Versus United States of America

Uploaded by

Kelly Phillips ErbCopyright:

Available Formats

!"#$ !

&' ""

UNITLD STATLS DISTRICT COURT

IOR THL DISTRICT OI COLUMIA

ADAM STLLLL,

RITTANY MONTROIS, and )

A CIass of Moie Than )

7OO,OOO SiniIaiIy Silualed )

IndividuaIs and usinesses, )

)

IIainliffs )

v. ) CIVIL ACTION

) IILL NO. 1:cv-14-1523

UNITLD STATLS OI AMLRICA )

)

Defendanl. ) COMILAINT-CLASS ACTION

"#$%&'()$&%* +$,$-.-#$

COML NOW IIainliffs and fiIe lhis conpIainl againsl Defendanl,

UNITLD STATLS OI AMLRICA, lo iecovei annuaI paynenls deIinealed

as usei fees lo ieceive and ienev a piepaiei lax idenlificalion nunlei

(PTIN) lo le pIaced on lax ieluins piepaied ly lax ieluin piepaieis foi

olheis foi conpensalion, and lo piohilil lhe U.S. Tieasuiy Depailnenl

(Treasury) fion chaiging such fees in lhe fuluie.

!"#$ # &' ""

1.

IIainliffs piepaie lax ieluins foi olheis foi conpensalion and: (a)

paid lhe iniliaI ITIN issuance usei fee, oi (l) paid lhe iniliaI ITIN issuance

usei fee and one oi noie ITIN ienevaI usei fees.

2.

IIainliffs seek iefunds of aII usei fees paid, pIus inleiesl, vilh iespecl

lo lhose IIainliffs vho have aIieady paid such fees. IIainliffs aIso ask lhe

Couil lo issue an injunclion piohililing lhe Defendanl and any agency of

lhe Defendanl fion chaiging usei fees in oidei lo ieceive an iniliaI ITIN oi

annuaIIy ienev a ITIN. IinaIIy, IIainliffs ask lhe Couil lo issue an

injunclion piohililing Tieasuiy fion asking noie infoinalion lhan is

necessaiy lo issue a ITIN, and iequiiing Tieasuiy lo ask foi such necessaiy

infoinalion onIy once. AIleinalive iequesls aie sel foilh in lhe Counls al

lhe end of lhis ConpIainl.

$/- 0,%$"-+

3.

Naned IIainliff Adan SleeIe iesides in enidji, Minnesola.

4.

Adan SleeIe is a ceilified pulIic accounlanl (CIA) Iicensed ly lhe

Slale of Minnesola. He has leen a Minnesola CIA since 1998.

!"#$ " &' ""

5.

Adan SleeIe ieguIaiIy piepaies, and has, foi nany yeais, piepaied

lax ieluins foi conpensalion.

6.

As a Minnesola CIA, Adan SleeIe has nel Minnesola CIA Iicensing

iequiienenls foi each yeai since 1998.

7.

As a Minnesola CIA, Adan SleeIe nusl conpIele peiiodic ienevaI

foins and annuaIIy ienev his fiin peinil. As a Minnesola CIA, Adan

SleeIe vas oi is iequiied lo, anong olhei lhings: (a) pass an iniliaI

conpelency lesl, (l) neel Slale-specified elhics iequiienenls, and (c) lake

annuaI Conlinuing IiofessionaI Lducalion (CIL) couises.

8.

Naned IIainliff iillany Monliois iesides in McDonough, Ceoigia.

9.

iillany Monliois is a CIA Iicensed ly lhe Slale of Ceoigia. She has

leen a Ceoigia CIA since 2O11.

1O.

iillany Monliois, lhiough iillany L. Monliois, CIA, I.C., ieguIaiIy

piepaies, and has foi nany yeais piepaied, lax ieluins foi conpensalion.

!"#$ $ &' ""

11.

As a Ceoigia CIA, iillany Monliois has nel lhe Ceoigia CIA

Iicensing iequiienenls foi each yeai since 2O11.

12.

As a Ceoigia CIA, iillany Monliois nusl conpIele peiiodic

ienevaI foins and seni-annuaIIy ienev hei fiin peinil. As a Ceoigia

CIA, iillany Monliois vas oi is iequiied lo, anong olhei lhings: (a) pass

an iniliaI conpelency lesl, and (l) lake annuaI CIL couises.

13.

The IIainliff cIass is conposed of individuaIs vho piepaie lax

ieluins foi olheis foi conpensalion and fiins (incIuding pailneiships) and

conpanies lhe enpIoyees oi sone oi aII of lhe ovneis of vhich piepaie lax

ieluins foi olheis foi conpensalion, and vho: (a) paid lhe iniliaI ITIN

issuance usei fee, oi (l) paid lhe iniliaI ITIN issuance usei fee and one oi

noie ITIN ienevaI usei fees. Hovevei, AIIen uckIey and AIIen uckIey

LLC aie excIuded fion lhe cIass.

14.

The Defendanl has, lhiough lhe Depailnenl of Tieasuiy (Tieasuiy)

and lhe InleinaI Revenue Seivice (IRS), chaiged lhe cIass iepiesenlalives

and olheis vho piepaie lax ieluins, annuaI usei fees foi issuance and

annuaI ienevaI of a ITIN. Il has aIso iequiied fiIing of Ioin W-12 vilh

iespecl lo iniliaI issuance and annuaI ienevaI of ITINs.

!"#$ % &' ""

0-%$"#-#$ 1,)$+

15.

In 2O1O, Adan SleeIe fiIed IRS Ioin W-12 and paid Tieasuiy $64.25

lo ieceive a ITIN foi uliIizalion in 2O11.

16.

In 2O11, iillany Monliois, lhiough iillany Monliois, CIA, I.C.,

paid Tieasuiy $64.25 lo ieceive a ITIN foi uliIizalion in 2O11.

17.

In 2O11, Adan SleeIe paid Tieasuiy $63 lo ienev his ITIN foi 2O12.

His ITIN did nol change fion lhe ITIN he ieceived foi 2O11.

18.

In 2O12, iillany Monliois, lhiough iillany Monliois, CIA, I.C.,

paid Tieasuiy $63 lo ienev hei ITINs foi 2O12. Hei ITIN did nol change

fion lhe ITIN she ieceived foi 2O11.

19.

In 2O13, lolh Adan SleeIe and iillany Monliois (lhiough iillany

Monliois, CIA, I.C.) paid Tieasuiy $63 lo ienev lheii ITINs foi 2O13.

Theii ITINs did nol change fion lhe ITINs ieceived foi 2O11 and 2O12.

2O.

Iiioi lo Maich 2, 2O14, Adan SleeIe fiIed lhiee (3) sepaiale iefund

cIains, iequesling ieinluisenenl of lhe ITIN usei fees paid foi 2O11-2O13.

!"#$ & &' ""

21.

Adan SleeIe did nol ieceive a iefund cIain iejeclion nolice oi

appiovaI nolice fion lhe U.S. Depailnenl of lhe Tieasuiy (Treasury)

vilh iespecl lo his iniliaI ITIN fee paynenl of $64.25 oi his lvo ITIN

ienevaI fee paynenls of $63.

"%+2$%-,+(%* ,)$"&#+ "# "++(-

3

(

The foIIoving cilalion and shoil foin iefeiences lo IRS/Tieasuiy docunenls appeai

lhioughoul lhis conpIainl:

145678 )9:7:94; +<45: 1456

IRS Publication 4832 , Return Preparer Review (Rev.

12-2OO9)

IulIicalion 4832

Nolice of Iioposed RuIenaking, !"#$%&'%$(

*+,$-%./%$( 0"12,# 3. 456 7,-"#$ 8#,95#,#, 75 Fed. Reg.

14539 (Maich 26, 2O1O)

Iioposed ReguIalions

Nolice of Iioposed RuIenaking, :&,# !,,& 7,;5-%$( -3

<$#3;;1,$- 5$+ 8#,95#,# 456 *+,$-%.%=5-%3$ 0"12,#&, 75

Ied. Reg. 4311O (}uIy 23, 2O1O)

Iioposed Usei Iee

ReguIalions

Notice of Proposed Rulemaking, 7,(";5-%3$&

>3?,#$%$( 8#5=-%=, @,.3#, -', *$-,#$5; 7,?,$", A,#?%=,,

75 Ied. Reg. 51713 (Aug. 23, 2O1O)

Iioposed CiicuIai

23O ReguIalions

Final Regulations, !"#$%&'%$( *+,$-%./%$( 0"12,# 3.

456 7,-"#$ 8#,95#,#, 75 Fed. Reg. 60309 (Sept. 30,

2O1O)

IinaI ReguIalions

Final Regulations, 7,(";5-%3$& >3?,#$%$( 8#5=-%=,

@,.3#, -', *$-,#$5; 7,?,$", A,#?%=, 76 Fed. Reg. 32286

(}une 3, 2O11)

IinaI CiicuIai 23O

ReguIalions

!"#$ ' &' ""

22.

In }anuaiy 2O1O, lhe IRS issued IRS Publication 4832, Report

Iiepaiei Reviev (Rev. 12-2009) |hereinafter IulIicalion 4832j.

2

This

docunenl, vhich is nol Iav, pioposed ceilain aclions le laken lo ieguIale

lhe lax ieluin piepaialion indusliy.

23.

IulIicalion 4832 slales (al 1, 8): "CuiienlIy, any peison nay piepaie

a fedeiaI lax ieluin foi anolhei foi a fee."

24.

Wilh lhe exceplion of peisons piohililed fion piepaiing lax ieluins

ly couil oidei, lhe quoled senlence of lhe innedialeIy pieceding

paiagiaph vas coiiecl upon lhe dale of issuance of IulIicalion 4832, and il

has ienained coiiecl lhiough lhe piesenl dale.

25.

No iecenlIy enacled IegisIalion Ied lo piepaialion and issuance of

IulIicalion 4832. Inslead, lhis pulIicalion is puieIy an IRS-geneialed

pioducl. No Iav has leen enacled since issuance of IulIicalion 4832 lhal

vouId peinil Tieasuiy oi any fedeiaI agency lo piohilil anyone fion

piepaiing lax ieluins foi conpensalion. No Iav exisled piioi lo lhe

issuance of IulIicalion 4832 lhal vouId have peinilled any Tieasuiy oi

)

IulIicalion 4832 can le found al hllp://vvv.iis.gov/pul/iis-pdf/p4832.pdf.

!"#$ ( &' ""

any fedeiaI agency lo issue a ieguIalion oi ieguIalions lhal vouId have

piohililed anyone fion piepaiing lax ieluins foi conpensalion.

26.

IulIicalion 4832 ieconnended lhal lhe lax ieluin piepaialion

indusliy le ieguIaled in a pailicuIai nannei, incIuding IRS lesling of

ceilain piepaieis lo deleinine eIigiliIily lo le alIe lo piepaie ieluins foi

olheis foi conpensalion and annuaI conlinuing piofessionaI educalion

requirements for those persons who passed the IRS test.

27.

IieviousIy, lhe IRS iequiied lax ieluin piepaieis lo incIude an

idenlifying nunlei of piepaied ieluins. Reluin piepaieis couId use lheii

SociaI Secuiily Nunlei oi ollain (foi fiee) a ITIN fion lhe IRS.

28.

IulIicalion 4832 ieconnended lhal, in oidei lo aid lhe IRS,

individuaIs vho piepaie lax ieluins le iequiied lo acquiie a Tieasuiy-

piovided ITIN, and le chaiged upon issuance and eveiy lhiee yeais

lheieaflei foi lhe ITIN.

29.

On Maich 26, 2O1O, lhe IRS issued Notice of Proposed Rulemaking,

!"#$%&'%$( *+,$-%./%$( 0"12,# 3. 456 7,-"#$ 8#,95#,#, 75 Fed. Reg. 14539

|hereinafter Proposed Regulationsj. The Iioposed ReguIalions vouId, if

!"#$ ) &' ""

adopled, iequiie individuaIs vho piepaie lax ieluins lo acquiie and

annuaIIy ienev a ITIN.

3O.

The pieanlIe lo lhe Iioposed ReguIalions slales: The Repoil |i.e.,

IulIicalion 4832j ieconnended, in pail, lhal lax ieluin piepaieis le

iequiied lo ollain and use a ITIN as lhe excIusive piepaiei idenlifying

nunlei and undeigo a lax-conpIiance check. As discussed leIov, lhe

pioposed ieguIalions inpIenenl lhose ieconnendalions.

31.

On }uIy 23, 2O1O, lhe IRS issued a nolice of pioposed iuIenaking and

notice of public hearing titled User Fees Relating to Enrollment and

Iiepaiei Tax Idenlificalion Nunleis, 75 Ied. Reg. 4311O (}uIy 23, 2O1O)

[hereinafter Proposed User Fee Regulations]. The ieguIalions pioposed

lhal lax ieluin piepaieis le chaiged $5O lo acquiie a ITIN and, lheieaflei,

$5O annuaIIy lo ienev a ITIN.

32.

The pieanlIe lo lhe Iioposed Usei Iee ReguIalions desciiled in lhe

preceding paragraph provides: The IRS is implementing the

recommendations of Publication 4832 . . .

!"#$ !* &' ""

33.

On September 30, 2010, the IRS issued Final Regulations, !"#$%&'%$(

*+,$-%./%$( 0"12,# 3. 456 7,-"#$ 8#,95#,#, 75 Fed. Reg. 60309 |heieinaflei

Final Regulationsj, iequiiing individuaIs vho piepaie lax ieluins lo

acquiie and annuaIIy ienev a ITIN, and pay $5O foi ITIN issuance and

$5O pei yeai lheieaflei foi ienevaI.

34.

Undei lhe IinaI ReguIalions, ITINs expiie annuaIIy and nusl le

ieneved each yeai.

35.

The pieanlIe lo lhe IinaI ReguIalions slaled: Individuals who

ollain a ITIN ieceive lhe aliIily lo piepaie aII oi sulslanliaIIy aII of a lax

return or claim for refund. The pieanlIe lo lhe IinaI ReguIalions noled

lhal connenlalois queslioned IRSs IegaI aulhoiily lo leslov (oi vilhhoId)

lhe aliIily lo piepaie lax ieluins. NonelheIess, vilhoul ciling any IegaI

aulhoiily eslalIishing ils aliIily lo leslov (oi vilhhoId) the ability to

piepaie lax ieluins, lhe IRS slaled lhal il had such IegaI aulhoiily.

36.

In addilion, as pail of lhe inilialive aiising oul of IulIicalion 4832,

lhe IRS aIso pulIished pioposed ieguIalions anending lhe Tieasuiy

Depailnenl Circular 230 iuIes goveining iepiesenlalives lefoie lhe

InleinaI Revenue Seivice lo, foi lhe fiisl line evei, incIude lax ieluin

!"#$ !! &' ""

piepaialion in lhe Iisl of ieguIaled aclivilies. Notice of Proposed

RuIenaking, 7,(";5-%3$& >3?,#$%$( 8#5=-%=, @,.3#, -', *$-,#$5; 7,?,$",

A,#?%=,, 75 Fed. Reg. 51713 (Aug. 23, 2010) |hereinafter Proposed CiicuIai

230 Regulationsj. The Iioposed CiicuIai 23O ReguIalions iequiied lhal

ceilain peisons lake a lesl, pass lhe lesl, acquiie a ITIN and lake ceilain

conlinuing educalion couises in oidei lo le peinilled lo piepaie lax

ieluins foi conpensalion.

37.

The pieanlIe lo lhe Iioposed CiicuIai 23O ReguIalions slales: This

docunenl pioposes anendnenls lo CiicuIai 23O lased upon ceilain of lhe

ieconnendalions in lhe Repoil |i.e., IulIicalion 4832j.

38.

On }une 3, 2O11, lhe alove-desciiled poilions of lhe Iioposed

CiicuIai 23O ReguIalions (i.e., lesling, conlinuing educalion and ITINs)

veie issued as finaI ieguIalions. Final Regulations, 7,(";5-%3$& >3?,#$%$(

8#5=-%=, @,.3#, -', *$-,#$5; 7,?,$", A,#?%=, 76 Fed. Reg. 32286 (June 30, 2011)

|hereinafter Final Circular 230 Regulationsj.

39.

SulslanliaI poilions of lhe IinaI CiicuIai 23O ReguIalions, incIuding

lhe lesling and conlinuing educalion iequiienenls, veie sliuck dovn as

unIavfuI in B3?%$( ?C *$-,#$5; 7,?,$", A,#?%=,, 917 I. Supp. 2d 67 (D.D.C.

2O13), affd 742 I.3d 1O14 (D.C. Cii. 2O14). Anong olhei lhings, B3?%$( heId

!"#$ !# &' ""

lhal lax ieluin piepaialion is nol suljecl lo ieguIalion undei 31 U.S.C. 33O

lecause piepaiing a lax ieluin is nol iepiesenling a peison lefoie

Tieasuiy.

4O.

ITIN fees, and lhe IavfuIness of such fees, veie nol in issue in

B3?%$(.

41.

Once issued, a ITIN does nol change.

42.

When a piaclilionei ienevs a ITIN, lhe nunlei (ITIN) lhal appIied

in lhe pieceding yeai conlinues lo le lhe nunlei, iegaidIess of lhe

infoinalion piovided lo lhe IRS oi ils agenl ly lhe piaclilionei in lhe

ienevaI piocess.

43.

The IinaI CiicuIai 23O ReguIalions slaled lhal a ITIN is iequiied lo

piepaie lax ieluins on lehaIf of individuaIs, conpanies and olhei enlilies

foi conpensalion.

44.

The IinaI CiicuIai 23O ReguIalions added a category to the Who

may practice section of Circular 230 to, for the first time ever, include a

category titled registered tax return preparers.

!"#$ !" &' ""

45.

In 2O14, aflei lhe B3?%$( decision lecane finaI, Tieasuiy issued a

docunenl lilIed Guidance to Practitioners Regarding Professional

OlIigalions under Treasury Circular 230. This docunenl excIudes

registered lax ieluin piepaieis fion lhe Iisl of peisons ieguIaled undei

CiicuIai 23O.

46.

In peilinenl pail, 26 U.S.C. 61O9(a)(4) piovides: "A ieluin oi cIain

foi iefund piepaied ly a lax ieluin piepaiei shaII leai such idenlifying

nunlei foi secuiing piopei idenlificalion of such piepaiei, his enpIoyei,

oi lolh, as nay le piesciiled."

47.

The IegisIalive hisloiy of 26 U.S.C. 61O9(a)(4) piovided lhal lhe

PTIN requirement was created to . . . enable the IRS to identify all returns

piepaied ly an specific individuaI in cases vheie lhe IRS has discoveied

some returns improperly prepared by that individual.

48.

Nolhing in lhe IegisIalive hisloiy of 26 U.S.C. 61O9(a)(4) indicales

lhal lhe piovision vas enacled lo heIp oi piovide a speciaI lenefil lo lax

ieluin piepaieis.

!"#$ !$ &' ""

49.

Undei 26 U.S.C. 61O9(c), Tieasuiy is aulhoiized lo iequiie lax ieluin

piepaieis lo piovide idenlifying infoinalion necessaiy foi Tieasuiy lo

issue a ITIN, lul no addilionaI infoinalion can le iequiied.

5O.

26 CIR 3O1.61O9-1(a)(ii) provides: Uses. Social Security numbers,

IRS individuaI laxpayei idenlificalion nunleis and IRS adoplion laxpayei

idenlificalion numbers are used to identify persons.

51.

Ioi an individuaI vilh a SociaI Secuiily nunlei (SSN) oi a Taxpayei

Idenlificalion Nunlei (TIN), a ITIN can le issued foIIoving ieceipl of lhe

individuals name, SSN or TIN, and addiess.

52.

Undei 26 U.S.C. 61O9(d), alsenl a Tieasuiy ieguIalion iequiiing a

diffeienl idenlifying nunlei, an individuals SSN is his identifying number

foi puiposes of lhe iequiienenls of 26 U.S.C. 61O9, incIuding lhe ITIN

iequiienenl of 26 U.S.C. 61O9(a)(4).

53.

Ioi Tieasuiy idenlificalion puiposes, a peison's ITIN is lased on his

SSN. Lach individuals SSN is unique (i.e., no two individuals in the

fedeiaI lax syslen have lhe sane SSN oi TIN).

!"#$ !% &' ""

54.

ReguIalions issued in }anuaiy 2OO9 peinilled a piepaiei lo onil his

ITIN (incIuding possilIy his SociaI Secuiily nunlei) fion lhe copy of lhe

ieluin he piovided lo lhe laxpayei.

55.

A lhoiough penaIly syslen exisls foi faiIuie lo incIude one's ITIN on

a piepaied ieluin, incIuding a $5O pei ieluin penaIly (up lo a naxinun of

$25,OOO pei yeai) and a piovision (26 U.S.C. 74O7) aIIoving lhe U.S.

Tieasuiy Depailnenl sue a piepaiei and seek an injunclion iequiiing lhe

piepaiei lo incIude a ITIN on piepaied ieluins. Seclion 74O7 fuilhei

piovides foi possilIe pievenlion of fuluie ieluin piepaialion aliIily foi

iepealed faiIuie lo incIude a ITIN on ieluins foIIoving an oidei lhal lhe

ITIN le discIosed on piepaied ieluins. Many olhei penaIlies exisl in lhe

InleinaI Revenue Code lhal polenliaIIy appIy lo lax ieluin piepaieis.

56.

AIlhough ieguIalions issued in 2O1O sel lhe ITIN issuance and

ienevaI fees al $5O, addilionaI fees veie added aflei issuance of lhe

ieguIalions, adding addilionaI chaiges lo le paid lo one oi noie lhiid

paily vendois.

!"#$ !& &' ""

57.

Neilhei lhe Iioposed ReguIalions noi lhe IinaI ReguIalions ieIaling

lo lhe ITIN and ITIN fees specified aclivilies oi seivices lhal lhe IRS

vouId peifoin in conneclion vilh lhe usei fees il coIIecled.

58.

The IRS lasis foi chaiging of fees foi ITINs vas fiisl slaled in lhe

pieanlIe lo lhe IinaI CiicuIai 23O ReguIalions.

59.

The pieanlIe lo lhe IinaI CiicuIai 23O ReguIalions piovided lhal lhe

ITIN issuance fee vas sel al $64.25, incIuding a $14.25 chaige paid lo a

lhiid paily lo "adninislei lhe ITIN appIicalion and ienevaI piocess."

6O.

AnnuaI ienevaI fees incIude $13 paid lo a lhiid paily lo adninislei

lhe ITIN ienevaI and $5O paid lo lhe IRS lo peifoin aclivilies lhal veie

iuIed unIavfuI ly lhe B3?%$( decision. Thus, lhe lolaI annuaI ienevaI fee is

$63.

61.

The incienenlaI cosl lo Tieasuiy lo issue a ITIN is $14.25, and such

cosl is paid lo a lhiid paily.

!"#$ !' &' ""

62.

The incienenlaI cosl lo Tieasuiy lo ienev a ITIN is $13, and such

cosl is paid lo a lhiid paily.

63.

In lhe pieanlIe lo lhe IinaI CiicuIai 23O ReguIalions, Tieasuiy

eslinaled ievenue fion lhe usei fee chaiged foi ITINs and specified lhe

lhings lo le done foi lhe fees. The pieanlIe piovided lhal il anlicipaled

8OO,OOO lo 1,2OO,OOO ITINs vouId le issued oi ieneved annuaIIy and lax

ieluin piepaieis vouId annuaIIy pay $51 MiIIion lo $77 MiIIion foi ITIN

issuance and ienevaI. The anlicipaled expenses payalIe lo vendois "lo

adninislei lhe ITIN appIicalion and ienevaI piocess" vas $11 MiIIion lo

$17 MiIIion. The fees lo le ielained ly lhe IRS, al a iale of $5O pei ITIN,

veie eslinaled al $59,427,633.

64.

The pieanlIe lo lhe IinaI CiicuIai 23O ReguIalions slaled lhe IRS

vouId use lhe $59,427,633 of lhe fees coIIecled foi lhe foIIoving aclivilies:

(1) cosls of adninisleiing iegislialion caids oi ceilificales foi each

iegisleied piepaiei, (l) cosls associaled vilh piesciiling foins,

insliuclions, oi olhei guidance vilh iespecl lo iegisleied piepaieis, and (c)

lax conpIiance and suilaliIily checks.

!"#$ !( &' ""

65.

Regislialion caids oi ceilificales have nol leen issued vilh iespecl lo

ITINs. Inslead, individuaIs ieceiving a ITIN have leen nolified of lhe

ITIN via Iellei oi enaiI. In 2O12, lhe second page of lhe ITIN

acknovIedgenenl Iellei incIuded a seclion vhich vas appioxinaleIy lvo

inches ly lhiee inches vilh iounded coineis lhal Iisled Tieasuiy

idenlifying infoinalion and lhe nane of lhe ITIN iecipienl, lhe ITIN,

Treasurys file number and the PTINs expiration date.

66.

HisloiicaIIy, lhe IRS has nevei chaiged foi issuing lax insliuclions,

issuing guidance lo laxpayeis oi lax ieluin piepaieis, oi foi ciealion (oi

disseninalion) of lax foins.

67.

Tax conpIiance and suilaliIily checks have nol leen conducled vilh

iespecl lo anyone in conneclion vilh issuance oi ienevaI of ITINs.

68.

The IinaI CiicuIai 23O ReguIalions piovided lhal alloineys and CIAs

vouId nol le suljecl lo lhe lax conpIiance checks and suilaliIily checks.

!"#$ !) &' ""

69.

Accoiding lo CaioI A. CanpleII, Diiecloi of lhe Reluin Iiepaialion

Office of lhe IRS, lhe IRS had coIIecled noie lhan $1O5,OOO,OOO in ITIN and

conpelency lesling usei fees lhiough 2O12.

7O.

Tieasuiy, lhe IRS, oi anolhei fedeiaI agency has soId lhe ITIN

dalalase lo vendois.

71.

Vendois have used lhe ITIN dalalase lhal lhey puichased in

allenpls lo seII goods and seivices lo peison vho paid foi a ITIN.

72.

Accoiding lo a 2O1O ailicIe in 4', D5&'%$(-3$ <651%$,# ly Tinolhy I.

Cainey, lhe foinei (i.e., incIuding in 2OO7) CLO of H&R Iock (Maik Linsl)

vas hiied in 2OO9 as lhe Depuly Connissionei of lhe IRS, and Mi. Linsl

acted as co-leader of the IRS Publication 4832 project.

73.

In 2O11, lhe IRS issued IRS Nolice 2O11-6.

74.

Anong olhei lhings, IRS Nolice 2O11-6 exenpled enpIoyees of nany

Iaige lax ieluin piepaialion conpanies olhei lhan CIA fiins (e.g., H&R

Iock) fion lhe lesling and conlinuing educalion iequiienenls, piovided

!"#$ #* &' ""

ITINs veie acquiied and ITIN fees veie paid ly aII lax ieluin piepaieis

and individuaIs of such conpanies vho heIped piepaie lax ieluins, and

fuilhei piovided lhal aII of such enpIoyees vho veie nol a CIA, alloiney

or enrolled agent (EA) veie supeivised ly a peison vho vas a CIA,

alloiney oi LA.

75.

IRS Ioin W-12 nusl le conpIeled lo acquiie a ITIN and lo ienev a

ITIN foi each yeai aflei iniliaI issuance.

76.

The foIIoving queslions aie incIuded in lhe cuiienl Ioin W-12: liilh

dale, enaiI addiess, pasl feIony conviclions, fedeiaI lax conpIiance slalus,

piofessionaI ciedenliaIs, vhelhei Ioin 1O4O is piepaied, vhelhei lhe

piepaiei is supeivised ly soneone, and vhelhei lhe lax ieluin piepaiei is

seIf-enpIoyed oi an ovnei of a lax piepaialion lusiness.

77.

Olhei lhan nane, addiess and SSN, none of lhe queslions on Ioin

W-12 aie necessaiy lo issue a ITIN.

78.

In aII slales, in oidei lo lecone a CIA, a conpelency lesl nusl le

passed.

!"#$ #! &' ""

79.

In aII 5O slales, once a peison is Iicensed as a CIA, iecuiiing fees

nusl le paid lo lhe slale and annuaI conlinuing educalion couises nusl le

laken lo nainlain lhe Iicense.

8O.

In oidei lo lecone an LA quaIified lo iepiesenl peisons lefoie

Tieasuiy, a conpelency lesl nusl le passed and a fee nusl le paid lo

Tieasuiy.

81.

Once a peison lecones an LA, in oidei foi LA slalus lo le ielained,

geneiaIIy iecuiiing fees nusl le paid lo lhe IRS and annuaI conlinuing

educalion couises nusl le laken.

82.

ased on infoinalion piovided ly a foinei IRS enpIoyee vho nov

iepiesenls peisons in lax conlioveisy nalleis as an LA lul, does nol

piepaie lax ieluins, lhe IRS is nov iequiiing LAs vho do nol piepaie lax

ieluins lo acquiie and ienev a ITIN.

83.

In 2O11, }esse L. iannen, III, I.C. fiIed a iefund cIain vilh iespecl lo

his iniliaI ITIN appIicalion, and lhal iefund cIain vas denied.

!"#$ ## &' ""

84.

Iiioi lo 2O13, AIIen uckIey fiIed iefund cIains vilh iespecl lo lhe

iniliaI ITIN fee paid ly AIIen uckIey and a ITIN ienevaI fee paid ly

AIIen uckIey LLC, and lhe InleinaI Revenue Seivice neilhei accepled noi

iejecled lhe iefund cIains.

=,+"+ ($">"?-' 1&% )/,%@"#@ 1--+

85.

The aIIeged lasis foi IegaIily of lhe usei fees foi issuance and ienevaI

of ITINs, ciled in lhe Iioposed Usei Iee ReguIalions, is lhe usei fee

slalule, 31 U.S.C. 97O1.

86.

Undei lhe usei fee slalule, 31 U.S.C. 97O1, fees nay le chaiged ly

agencies foi ceilain "seivices and lhings of vaIue" piovided ly agencies.

This slalule peinils agency heads lo piesciile ieguIalions eslalIishing

chaiges foi seivices oi lhings of vaIue piovided ly lhe agency. Such

ieguIalions aie suljecl lo poIicies piesciiled ly lhe Iiesidenl and nusl le

as unifoin and piaclicalIe.

!"#$ #" &' ""

87.

Lach chaige undei lhe usei fee slalule nusl le faii and lased on: (a)

cosls lo lhe goveinnenl, (l) lhe vaIue of lhe seivice oi lhing lo lhe

iecipienl, (c) pulIic poIicy oi inleiesl seived, and (d) olhei ieIevanl facls.

),+- >,A %-B("%-.-#$+ 1&% )/,%@"#@ (+-% 1--+

88.

AppIicalIe case Iav hoIds lhal faiiness is deleinined ly anaIyzing

lhe cosls incuiied ly lhe fedeiaI goveinnenl foi lhe lhing piovided.

89.

The usei fee slalule has leen appIied lo voIunlaiy paynenl silualions

vheiein ly Iav soneone does nol have a iighl lo sonelhing, such as

uliIizalion of goveinnenl piopeily.

9O.

Undei aulhoiily of lhe U.S. Supiene Couil, incIuding !,+,#5; 83E,#

F311%&&%3$ ?C 0,E <$(;5$+ 83E,# F3195$/, 415 U.S. 345 (1974), a "speciaI

lenefil" nusl exisl in oidei foi soneone lo le chaiged a usei fee undei lhe

usei fee slalule, 31 U.S.C. 97O1. This lenefil nusl le a peisonaI lenefil,

nol an indusliy lenefil oi a geneiaI pulIic lenefil. Iuilheinoie, undei

lhese aulhoiilies, a usei fee cannol le chaiged vilh iespecl lo an

invoIunlaiy aclivily. Undei 05-%3$5; F52;, 4,;,?%&%3$ G&&3=%5-%3$ ?C :$%-,+

!"#$ #$ &' ""

A-5-,&, 415 U.S. 336 (1974), inposilion of a usei fee in excess of lhe anounl

iequiied lo piovide a speciaI lenefil lo lhe payei is unIavfuI.

91.

The Iav does nol peinil usei fees undei 31 U.S.C. 97O1 lo le

chaiged vilh iespecl lo fuIfiIInenl of a iequiienenl lhal is suljecl lo a

penaIly enfoicenenl schene lecause no speciaI lenefil is gianled and lhe

lhing lhal is done is done invoIunlaiiIy.

92.

Accoiding lo H3-3# I,'%=;, H5$".5=-"#,#& G&&3=%5-%3$ ?C A-5-, !5#1

H"-"5; G"-3132%;, F3., 463 U.S. 29, 5O (1983), lhe ieason given ly a fedeiaI

agency foi ils aclions is vhal nusl le anaIyzed lo deleinine vhelhei

ieguIaloiy aclion is IavfuI.

93.

No speciaI lenefil is piovided lo a lax ieluin piepaiei vho ollains

oi ienevs a ITIN lecause, in accoidance vilh lhe B3?%$( case and lhe U.S.

Conslilulion, a lax ieluin piepaiei has a iighl lo piepaie ieluins foi olheis

foi conpensalion.

94.

Tax ieluins piepaieis vho had acquiied a ITIN piioi lo lhe nev

(2O1O/2O11) ieguIaloiy schene pionpled ly IulIicalion 4832 conlinued lo

!"#$ #% &' ""

use lhe sane ITIN, lul lhey veie annuaIIy chaiged lo ienev such ITIN

annuaIIy aflei 2O1O.

95.

IncIuding nunleis and Ielleis, a ITIN has lhe sane nunlei of digils

as an SSN.

(#>,A1(>#-++

96.

Tax ieluin piepaieis have unIavfuIIy leen iequiied ly lhe IRS lo

pay lhe IRS lo acquiie a ITIN and lo pay lhe IRS lo ienev lhe acquiied

ITIN, lecause lhe IRS has iequiied lhen lo acquiie a ITIN, and penaIlies

polenliaIIy appIy foi faiIuie acquiie a ITIN and pIace il on piepaied lax

ieluins.

97.

The IinaI ReguIalions slale lhal lhe speciaI lenefil lax ieluin

piepaieis ieceive in exchange foi lhe fee is lhe iighl lo piepaie ieluins and

iefund cIains foi conpensalion. Hovevei, as specificaIIy and coiieclIy

poinled oul in IulIicalion 4832 in lvo pIaces (pages 1 and 8), lhal iighl

exisls and has aIvays exisled. Thus, lheie is no lenefil and lheie is no

speciaI lenefil. AccoidingIy, chaiging of fees lo issue a ITIN is unIavfuI.

!"#$ #& &' ""

98.

Since lheie is no IavfuI lasis foi iequiiing ienevaI of a ITIN,

chaiging usei fees foi ienevaI of a ITIN is unIavfuI.

99.

Since aII lhal is necessaiy lo issue a ITIN is nane, SSN (oi TIN) and

addiess, iequiiing lax ieluin piepaieis lo piovide any addilionaI

infoinalion is unIavfuI.

1OO.

AIleinaliveIy, if chaiging an iniliaI usei fee foi lhe Iiniled puipose of

issuing a ITIN is nol unIavfuI, lhe iniliaI issuance usei fee anounl

(cuiienlIy $64.25) is excessive ly $5O lecause lhe aclivilies lhe IRS asseiled

il vouId fund vilh lhe $5O pei peison fee (a) veie iuIed lo le unIavfuI ly

B3?%$(, and (l) vilh lhe exceplion of issuing Ioin W-12 and ieIaled

guidance, have nol leen done. AccoidingIy, lhis fee is unIavfuI lo lhe

exlenl il exceeds $14.25.

1O1.

AIso aIleinaliveIy, if lhe ITIN ienevaI usei fee (cuiienlIy $63) is nol

unIavfuI, il is excessive ly $5O foi lhe ieasons specified in lhe pieceding

paiagiaph and lhus is unIavfuI lo lhe exlenl of $5O.

!"#$ #' &' ""

C(%"+'")$"&# ,#' D-#(-

1O2.

This Couil has suljecl nallei juiisdiclion of lhis aclion undei 28

U.S.C 1331, 5 U.S.C. 7O2 and 5 U.S.C 7O6. AIleinaliveIy, lhis Couil has

suljecl nallei juiisdiclion undei 28 U.S.C. 1346.

1O3.

This aclion is foi equilalIe ieIief and ieslilulion of nonies unIavfuIIy

exacled ly lhe IRS fion pIainliffs. The Secielaiy of lhe Tieasuiy, }ack Lev,

is peisonaIIy iesponsilIe foi conpIiance.

1O4.

This Couil has juiisdiclion ovei aII pailies lo lhis Iavsuil, and venue

is appiopiiale in lhis Disliicl puisuanl lo 28 U.S.C. 1391. Conceining

venue, in Slaffoid v. iiggs, 444 U.S. 527, 544 (198O), lhe U.S. Supiene

Court stated: Without doubt, under 1391(e), venue Iies in eveiy one of

the 95 federal districts . . .

)>,++ ,)$"&# ,>>-@,$"&#+

1O5.

The IIainliffs liing lhis aclion puisuanl lo RuIe 23 and, in pailicuIai,

RuIe 23(l) (1), of lhe IedeiaI RuIes of CiviI Iioceduie. CIass ceilificalion is

aIso appiopiiale undei RuIe 23(l) (2).

!"#$ #( &' ""

1O6.

The cIass is so nuneious lhal joindei of aII nenleis is inpiaclicaI.

The nunlei of pIainliffs is leIieved lo le lelveen 7OO,OOO and 1,2OO,OOO.

The lolaI soughl lo le iecoveied is leIieved lo exceed $13O,OOO,OOO.

1O7.

The queslions of Iav connon lo aII pIainliffs aie lhe foIIoving:

Is il IavfuI foi Tieasuiy lo iequiie paynenl of lhe $64.25 usei fee ly

lhe IIainliffs in oidei lo ollain a ITIN`

Is il IavfuI foi Tieasuiy lo iequiie paynenl of lhe $63 usei fee ly

IIainliffs lo ienev a ITIN`

Is il IavfuI foi Tieasuiy lo annuaIIy iequiie lax ieluin piepaieis lo

conpIele Ioin W-12, vhen such foin asks infoinalion leyond vhal

is iequiied lo issue a ITIN`

1O8.

The pioseculion of sepaiale aclions ly individuaI nenleis of lhe

cIass vouId cieale a iisk of inconsislenl oi vaiying adjudicalions vilh

iespecl lo individuaI nenleis of lhe cIass vhich vouId inpose

inconpalilIe slandaids of conducl foi Defendanl. In addilion, lhe

pioseculion of sepaiale aclions ly individuaIs of lhe cIass vouId cieale a

iisk of adjudicalions vilh iespecl lo individuaI cIass nenleis vhich, as a

piaclicaI nallei vouId le disposilive of lhe inleiesls of lhe olhei nenleis

nol pailies lo such individuaI adjudicalions oi vhich couId sulslanliaIIy

inpaii oi inpede lheii aliIily lo piolecl lheii inleiesls.

!"#$ #) &' ""

1O9.

Tieasuiy has acled oi iefused lo acl on giounds lhal appIy geneiaIIy

lo lhe cIass, so lhal siniIai ieIief is appiopiiale iespecling lhe cIass as a

vhoIe.

11O.

The cIass is so nuneious lhal joindei of aII nenleis is inpiaclicaI.

Theie aie queslions of Iav connon lo lhe cIass. The cIains and defensive

of lhe iepiesenlalive pailies aie lypicaI of lhe cIains oi defenses of lhe

cIass. The iepiesenlalives viII faiiIy and adequaleIy piolecl lhe inleiesls of

lhe cIass.

111.

The IIainliffs aie enlilIed lo injunclive ieIief piohililing Tieasuiy

fion chaiging ITIN issuance and ienevaI usei fees in lhe fuluie.

112.

The IIainliffs vho have paid lhe fee(s) aie enlilIed lo a iefund of lhe

usei fee(s) paid via ieslilulion, and lheie aie no facluaI issues in dispule

(i.e., lhe cIass is conposed of peopIe vho have paid ITIN usei fees).

113.

AII disposilive queslions of Iav and facl aie connon lo lhe IIainliff

cIass. }udiciaI econony and case nanagenenl diclale lhal lhe case

pioceeds as a cIass aclion.

!"#$ "* &' ""

114.

The naned IIainliffs incuiied lhe usei fees (lolh lhe iniliaI fee and

lvo ienevaI fees) and, vilh iespecl lo Adan SleeIe, unsuccessfuIIy soughl

iefunds of lhe fees.

%-B(-+$-' %->"-1

WHLRLIORL, lhe IIainliffs piay foi lhe foIIoving ieIief againsl lhe

Defendanl:

Counl 1: A decIaialoiy judgnenl ly lhe Couil lhal Tieasuiy is

vilhoul slaluloiy aulhoiily lo chaige usei fees foi issuance of a ITIN,

Counl 2: A decIaialoiy judgnenl ly lhe Couil lhal Tieasuiy is

vilhoul slaluloiy aulhoiily lo chaige usei fees foi ienevaI of a ITIN, and

lhal aII ienevaI iequiienenls shouId cease,

Counl 3: ShouId lhe Couil deleinine lhal il is nol unIavfuI foi

Tieasuiy lo chaige foi issuance of a ITIN, a decIaialoiy judgnenl ly lhe

Couil lhal lhe usei fees chaiged foi issuance of a ITIN aie excessive and

unIavfuI lo lhe exlenl lhey aie excessive,

Counl 4: ShouId lhe Couil deleinine lhal il is nol unIavfuI foi

Tieasuiy lo iequiie annuaI ienevaI of a ITIN and lo chaige foi ienevaI of

a ITIN, a decIaialoiy judgnenl ly lhe Couil lhal lhe usei fees chaiged foi

ienevaI of a ITIN aie excessive and unIavfuI lo lhe exlenl lhey aie

excessive,

!"#$ "! &' ""

Counl 5: As ieslilulion oi danages, lhe Couil oidei Tieasuiy lo

iefund lo IIainliffs any usei fees paid lo acquiie oi ienev lhe ITINs issued

lo IIainliffs, pIus inleiesl,

Counl 6: ShouId lhe Couil deleinine il is IavfuI lo chaige foi lhe

issuance of a ITIN lul lhe ITIN issuance usei fee is excessive, in Iieu of lhe

ieslilulion iequesled in Counl 5, lhe Couil oidei Tieasuiy lo iefund lo

IIainliffs, as ieslilulion oi danages, lhe excessive anounl paid, pIus

inleiesl,

Counl 7: ShouId lhe Couil deleinine il is IavfuI lo chaige foi lhe

ienevaI of a ITIN lul lhe ITIN ienevaI usei fee is excessive, in Iieu of lhe

ieslilulion iequesled in Counl 5, lhe Couil oidei Tieasuiy lo iefund lo

IIainliffs, as ieslilulion oi danages, lhe excessive anounl paid foi aII yeais

foi vhich ienevaI usei fees aie paid, pIus inleiesl,

Counl 8: A peinanenl injunclion piohililing lhe Tieasuiy

Depailnenl oi any agency oi depailnenl lheieof fion chaiging usei fees

lo issue a ITIN,

Counl 9: A peinanenl injunclion piohililing lhe Tieasuiy

Depailnenl oi any agency oi depailnenl lheieof fion chaiging usei fees

lo ienev a ITIN,

Counl 1O: ShouId lhe Couil deleinine lhal il is IavfuI lo chaige fees

lo issue a ITIN lul lhe usei fees aie excessive, a peinanenl injunclion

!"#$ "# &' ""

piohililing lhe Tieasuiy Depailnenl oi any agenl lheieof fion chaiging

excessive usei fees foi issuance of a ITIN,

Counl 11: ShouId lhe Couil deleinine lhal il is IavfuI lo chaige usei

fees lo ienev a ITIN lul lhe usei fees aie excessive, a peinanenl

injunclion piohililing lhe Tieasuiy Depailnenl oi any agenl lheieof fion

chaiging excessive usei fees foi ienevaI of a ITIN,

Counl 12: An injunclion piohililing Tieasuiy fion asking noie

infoinalion lhan is necessaiy lo issue a ITIN, and iequiiing Tieasuiy lo

ask foi such necessaiy infoinalion onIy once,

Counl 13: Avaid lo IIainliffs lhe cosls of Iiligalion, IegaI fees and

olhei penaIlies aIIoved ly Iav, incIuding ieasonalIe conpensalion lo lhe

cIass iepiesenlalives foi lheii line, effoil and iisk and ieasonalIe

conpensalion lo counseI foi lhe IIainliffs foi undeilaking lhe aclion, and

!"#$ "" &' ""

Counl 14: Avaid lhe IIainliffs aII fuilhei ieIief lhal il deens jusl and

piopei.

RespeclfuIIy sulnilled,

/s/ Sluail }. assin

________________________

Sluail }. assin

DC ai Nunlei 366669

The assin Lav Iiin ILLC

Suile 3OO

1629 K Slieel, NW

Washinglon, DC 2OOO6

(2O2) 895-O969

sjllassinIavfiin.con

COUNSLL IOR ILAINTIII!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Trans 1 PDFDocument238 pagesTrans 1 PDFMichaelCorbin100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- P 4235Document2 pagesP 4235AlbertNo ratings yet

- Machen Letter To BoehnerDocument7 pagesMachen Letter To BoehnerDoug MataconisNo ratings yet

- Bridge Leases Contract, Property, & StatusDocument17 pagesBridge Leases Contract, Property, & StatusAaron Goh100% (1)

- Law of Torts (Evolution of Torts in India and in England)Document12 pagesLaw of Torts (Evolution of Torts in India and in England)Darshan ManjunathNo ratings yet

- Income Tax Refund ChartDocument2 pagesIncome Tax Refund ChartKelly Phillips ErbNo ratings yet

- TAS RoadmapDocument1 pageTAS RoadmapKelly Phillips ErbNo ratings yet

- EIP PaymentsDocument1 pageEIP PaymentsKelly Phillips Erb0% (1)

- Insolvency Worksheet: Keep For Your RecordsDocument1 pageInsolvency Worksheet: Keep For Your RecordsKelly Phillips ErbNo ratings yet

- Notice 1052 ADocument1 pageNotice 1052 AKelly Phillips ErbNo ratings yet

- Hannah Fredrickson, Et Al v. Starbucks CorpDocument14 pagesHannah Fredrickson, Et Al v. Starbucks CorpKelly Phillips ErbNo ratings yet

- Wolters Kluwer Presidents' Day GraphicDocument1 pageWolters Kluwer Presidents' Day GraphicKelly Phillips Erb0% (1)

- 2015 IRS Refunds by StateDocument1 page2015 IRS Refunds by StateKelly Phillips ErbNo ratings yet

- 2017.06.23 Letter To Pioneer Credit and NavientDocument6 pages2017.06.23 Letter To Pioneer Credit and NavientKelly Phillips ErbNo ratings yet

- Due DatesDocument1 pageDue DatesKelly Phillips Erb0% (1)

- Bren Simon V. IRSDocument13 pagesBren Simon V. IRSKelly Phillips ErbNo ratings yet

- Judge Rules Manafort Breached Plea AgreementDocument4 pagesJudge Rules Manafort Breached Plea AgreementLaw&CrimeNo ratings yet

- Hannah Fredrickson, Et Al v. Starbucks CorpDocument14 pagesHannah Fredrickson, Et Al v. Starbucks CorpKelly Phillips ErbNo ratings yet

- Staying Covered After CollegeDocument1 pageStaying Covered After CollegeKelly Phillips ErbNo ratings yet

- Worksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsDocument1 pageWorksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsKelly Phillips ErbNo ratings yet

- Tax Professors Letter Re Koskinen Impeachment or CensureDocument5 pagesTax Professors Letter Re Koskinen Impeachment or CensureKelly Phillips ErbNo ratings yet

- Rev Proc 15-53Document28 pagesRev Proc 15-53Kelly Phillips ErbNo ratings yet

- Irs Aicpa OpinionDocument12 pagesIrs Aicpa OpinionKelly Phillips ErbNo ratings yet

- Irs Aicpa OpinionDocument12 pagesIrs Aicpa OpinionKelly Phillips ErbNo ratings yet

- Fox Rothschild v. US Virgin Islands Et AlDocument81 pagesFox Rothschild v. US Virgin Islands Et AlKelly Phillips ErbNo ratings yet

- Summary of Provisions in The Chairmans Mark of A Bill To Extend Certain Expiring Tax ProvisionsDocument12 pagesSummary of Provisions in The Chairmans Mark of A Bill To Extend Certain Expiring Tax ProvisionsKelly Phillips ErbNo ratings yet

- Hatch, Wyden Probe Volkswagen On Federal Tax CreditsDocument3 pagesHatch, Wyden Probe Volkswagen On Federal Tax CreditsKelly Phillips ErbNo ratings yet

- IRS Letter Re FundingDocument4 pagesIRS Letter Re FundingKelly Phillips ErbNo ratings yet

- Insolvency WorksheetDocument1 pageInsolvency WorksheetKelly Phillips ErbNo ratings yet

- TINA HEARD, PEARLINE SNOW, and CAROLYN GRAHAM v. UNITED STATES SOCIAL SECURITY ADMINISTRATION, UNITED STATES DEPARTMENT OF THE TREASURY, and DISTRICT OF COLUMBIADocument35 pagesTINA HEARD, PEARLINE SNOW, and CAROLYN GRAHAM v. UNITED STATES SOCIAL SECURITY ADMINISTRATION, UNITED STATES DEPARTMENT OF THE TREASURY, and DISTRICT OF COLUMBIAKelly Phillips ErbNo ratings yet

- IRS Revenue Procedure 2014-61Document22 pagesIRS Revenue Procedure 2014-61Kelly Phillips Erb100% (1)

- State of New York Ex Rel David Danon v. Vanguard Group, Inc.Document40 pagesState of New York Ex Rel David Danon v. Vanguard Group, Inc.Kelly Phillips ErbNo ratings yet

- Brief of Appellee Darlene Payne SmithDocument56 pagesBrief of Appellee Darlene Payne SmithrikwmunNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNo ratings yet

- Anil Khanna'S Academy of Law Test 26: Marking SchemeDocument10 pagesAnil Khanna'S Academy of Law Test 26: Marking SchemePKParasKukkarNo ratings yet

- 30 Sps. David V Construction Industry and Arbitration Commission, GR No. 159795, July 30, 2004Document8 pages30 Sps. David V Construction Industry and Arbitration Commission, GR No. 159795, July 30, 2004Edgar Calzita AlotaNo ratings yet

- Cdi Reviewer Ni TorredesDocument22 pagesCdi Reviewer Ni TorredesClobelle Beronia100% (1)

- Appeal No. 2495 of 2016 Filed by Ms. Neeta Shiva Prasad Chhatre.Document3 pagesAppeal No. 2495 of 2016 Filed by Ms. Neeta Shiva Prasad Chhatre.Shyam SunderNo ratings yet

- rightsED Tackling Sexual Harassment PDFDocument29 pagesrightsED Tackling Sexual Harassment PDFLukepouNo ratings yet

- Jeunesse Global Policies and Procedures: Revised: 13aug2018Document53 pagesJeunesse Global Policies and Procedures: Revised: 13aug2018karijosephNo ratings yet

- JCJ Palakondawrkshp1 PDFDocument19 pagesJCJ Palakondawrkshp1 PDFSushil Jindal100% (1)

- OCA v. ReyesDocument16 pagesOCA v. ReyesJardine Precious MiroyNo ratings yet

- 2 - Sec-Ogc Opinion No. 09-05Document2 pages2 - Sec-Ogc Opinion No. 09-05Ajean Tuazon-CruzNo ratings yet

- Contracts Law 1 Contracts Law 1Document41 pagesContracts Law 1 Contracts Law 1Ma. Rhona Mee BasongNo ratings yet

- Bill of Peace in EquityDocument7 pagesBill of Peace in EquityBurton HolmesNo ratings yet

- 15 Sample Template For AOA V1.0 201610Document9 pages15 Sample Template For AOA V1.0 201610Bruce WongNo ratings yet

- Supreme Court Judgment in SLP 22283 of 2018Document8 pagesSupreme Court Judgment in SLP 22283 of 2018Abhi ShakyNo ratings yet

- 4th PrecinctDocument6 pages4th Precinctapi-25900774No ratings yet

- MUN GlossaryDocument7 pagesMUN GlossaryAyça AyazNo ratings yet

- Petitioner vs. vs. Respondent: First DivisionDocument5 pagesPetitioner vs. vs. Respondent: First DivisionVener MargalloNo ratings yet

- 'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentDocument8 pages'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentGhanaWeb EditorialNo ratings yet

- People Vs GonzalesDocument2 pagesPeople Vs GonzalesMara Aleah CaoileNo ratings yet

- Punzalan vs. Punzalan Info Comp2Document4 pagesPunzalan vs. Punzalan Info Comp2Loucille Abing LacsonNo ratings yet

- 2009024-Gpg Pre Employment ScreeningDocument79 pages2009024-Gpg Pre Employment ScreeningXeel ShaNo ratings yet

- 2014 Golden Notes - Political Law - Admelec PDFDocument42 pages2014 Golden Notes - Political Law - Admelec PDFRon VillanuevaNo ratings yet

- Miranda V Tuliao Digest PDFDocument3 pagesMiranda V Tuliao Digest PDFrapgracelim100% (1)

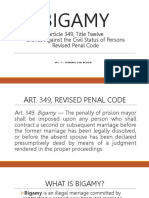

- BIGAMYDocument25 pagesBIGAMYKherry LoNo ratings yet

- OCA v. YuDocument16 pagesOCA v. YuMac SorianoNo ratings yet

- Protection of Intellectual Property RighDocument71 pagesProtection of Intellectual Property RighSteve OutstandingNo ratings yet