Professional Documents

Culture Documents

In Hog Heaven With Hormel Foods

Uploaded by

sommer_ronald5741Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Hog Heaven With Hormel Foods

Uploaded by

sommer_ronald5741Copyright:

Available Formats

Measured Approach

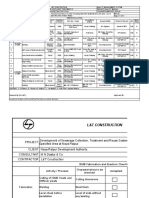

HORMEL FOODS CORPORATION (NEW YORK:HRL) Data as of: 01/22/2010

Industry:

Current Data

Current Price $38.62 PEG 1.8X

Market Cap ($M) $5,160. EPS TTM ($) $2.53

7

Shares Outstanding (M) 134.0 P/E TTM 15.3X

Institutional Holdings % 28.3% EPS Estimated 2010 ($) $2.67

Insider Holdings % 48.3% P/Estimated EPS 14.5X

Beta 0.39 MA Value ($) $56.29

Latest Quarter Reported 10/25/0 Dividend Yield % 2.2%

9

Hormel Foods Corporation, based in Austin, Minn., is a multinational

manufacturer and marketer of consumer-branded food and meat

products, many of which are among the best known and trusted in the

food industry. The company leverages its extensive expertise,

innovation and high competencies in pork and turkey processing and

marketing to bring quality, value-added brands to the global

marketplace. The company is a member of the Standard & Poor's 500

Index. Hormel Foods was named one of "The 400 Best Big Companies

in America" by Forbes magazine for the 10th consecutive year. The

company enjoys a strong reputation among consumers, retail grocers,

foodservice and industrial customers for products highly regarded for

quality, taste, nutrition, convenience and value. For more information,

visit http://www.hormelfoods.com.

Unilever announced that it has signed a definitive agreement with

Hormel Foods Corporation to sell its Shedd's Country Crock(R) branded

chilled side-dish business in the US. Under the terms of the transaction,

Hormel will market and sell Shedd's Country Crock chilled side-dish

products, such as homestyle mashed potatoes, under a license

agreement.

By the Numbers

Quarterly sales for the last four reported quarters are inconsistent. For

the quarter ending 01/09, sales stood at $1,689.1 million. Over the

next two quarters they declined to $1,574.4 million and then turned up

to $1,675.1 million for the quarter ending 10/09. Reuter’s reports

analyst estimates for the quarter ending 01/10 may be as high as

$1,729.5 million.

The decline in the sales (3.3%) may be attributable to a lack of pricing

power in today’s environment. Historically, sales grew at the rate of

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

4.4% over the past three years and 6.5% over the past five years. The

Company is adding new product through the acquisition of Shedd’s

Country Crock product line and through the introduction of Mexican

foods by its new joint venture MegaMex Foods. These additions should

boost sales.

On the other hand, quarterly earnings held up fairly well. The Company

reported EPS of $0.60 in the quarter ending 01/09 and declines to

$0.59 and $0.57 in the quarters ending 04/09 and 07/09 respectively

before jumping back to $0.77 for the quarter ending 10/09. Reuter’s

reports consensus estimates of $0.68 for the quarter ending 01/10.

Looking ahead, consensus estimates are $2.67 for FY 10 and $2.87 for

FY 11 on sales of $6,782.71 million and $7,111.07 million. The EPS

growth rate exploded for the TTM ending 10/09 to 21.9%. The three

year average EPS growth rate is 7.0% and the five year EPS growth

rate is 8.6%.

The gross margin for the trailing twelve months ending 10/09 (TTM) at

16.8% have held up well and reflect strength when compared with FY

08 and FY 07. Similarly, operating margins have grown from 7.8% in FY

07 to 7.6% in FY 08 to 8.2% in FY 09. Net margins reflect these trends,

as well. Net margin recovered to 5.2% in 10/09 from 4.2% in 10/08.

Both operating and net margins are consistently better than industry

medians. This reflects well on management’s ability to control costs.

Return on Equity at 16.6% and Return on Assets at 9.4% are higher

than in the prior three fiscal years and above industry medians.

Hormel has a strong balance sheet. The current ratio stands at 2.3X

(better than the industry median) and total liabilities to total assets

stand at 42.5%, below the industry median.

Long-term debt stands at $350 million. The times interest earned ratio

is better than 19X.

The Company pays an indicated dividend of $0.84 providing a current

yield of 2.2%.The dividend is well covered and represents a payout of

29.7%. Dividends have grown at an annual rate of 10.7% over the past

three years and 11.1% over the past five years.

Conclusion

We see modest but consistent growth potential for Hormel Foods.

Based on the consensus EPS estimate of $2.87 for FY 11 and our

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

evaluation of risk, we place an investment value of $56.29 on this

company. We think this is a buy.

Disclosure: Author has a long position in HRL.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Best in Coal SummaryDocument1 pageThe Best in Coal Summarysommer_ronald5741No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Starting Lineup For 2011Document3 pagesStarting Lineup For 2011sommer_ronald5741No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Global Telecom Opportunities SummaryDocument1 pageGlobal Telecom Opportunities Summarysommer_ronald5741No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Paper & Paper Products Industry SummaryDocument1 pagePaper & Paper Products Industry Summarysommer_ronald5741No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- DIY InvestingDocument2 pagesDIY Investingsommer_ronald5741No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 2010 Win Some Lose SomeDocument2 pages2010 Win Some Lose Somesommer_ronald5741No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Brinker International: Challenge For Casual DiningDocument2 pagesBrinker International: Challenge For Casual Diningsommer_ronald5741No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Inter Digital ProfileDocument2 pagesInter Digital Profilesommer_ronald5741No ratings yet

- A Small Cap Healthcare PickDocument1 pageA Small Cap Healthcare Picksommer_ronald5741No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Dialing For Dollars in ArgentinaDocument2 pagesDialing For Dollars in Argentinasommer_ronald5741No ratings yet

- The Long Term Case For HumanaDocument2 pagesThe Long Term Case For Humanasommer_ronald5741No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- GT SolarDocument2 pagesGT Solarsommer_ronald5741No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ComTech Telecom SummaryDocument3 pagesComTech Telecom Summarysommer_ronald5741No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- LubrizolDocument2 pagesLubrizolsommer_ronald5741No ratings yet

- Hawkins IncDocument2 pagesHawkins Incsommer_ronald5741No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Astrazeneca SummaryDocument1 pageAstrazeneca Summarysommer_ronald5741No ratings yet

- Endo Pharmaceuticals - Steady GrowthDocument3 pagesEndo Pharmaceuticals - Steady Growthsommer_ronald5741No ratings yet

- Tractor SupplyDocument2 pagesTractor Supplysommer_ronald5741No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Core Laboratories: An Oil Patch OpportunityDocument3 pagesCore Laboratories: An Oil Patch Opportunitysommer_ronald5741No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Game Is Not Over For GameStop Corp.Document4 pagesThe Game Is Not Over For GameStop Corp.sommer_ronald5741No ratings yet

- Navigate With GarminDocument2 pagesNavigate With Garminsommer_ronald5741No ratings yet

- DIY For Cars - Advance Auto Parts Inc.Document3 pagesDIY For Cars - Advance Auto Parts Inc.sommer_ronald5741No ratings yet

- Sorl Auto Parts Inc. - No Stopping HereDocument2 pagesSorl Auto Parts Inc. - No Stopping Heresommer_ronald5741No ratings yet

- Oracle Corporation: The Road To RecoveryDocument7 pagesOracle Corporation: The Road To Recoverysommer_ronald5741No ratings yet

- Fuqi International: Finding Gold in ChinaDocument3 pagesFuqi International: Finding Gold in Chinasommer_ronald5741No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Profit From Western DigitalDocument3 pagesProfit From Western Digitalsommer_ronald57410% (1)

- Stryker Corporation: Opportunity or Trap?Document6 pagesStryker Corporation: Opportunity or Trap?sommer_ronald5741100% (1)

- Duo Interpretation Class PresentationDocument31 pagesDuo Interpretation Class PresentationPlanetSparkNo ratings yet

- Omnitron CatalogDocument180 pagesOmnitron Catalogjamal AlawsuNo ratings yet

- Fortigate Firewall Version 4 OSDocument122 pagesFortigate Firewall Version 4 OSSam Mani Jacob DNo ratings yet

- Newsletter 1-2021 Nordic-Baltic RegionDocument30 pagesNewsletter 1-2021 Nordic-Baltic Regionapi-206643591100% (1)

- John Wren-Lewis - NDEDocument7 pagesJohn Wren-Lewis - NDEpointandspaceNo ratings yet

- Eapp Melc 12Document31 pagesEapp Melc 12Christian Joseph HerreraNo ratings yet

- MS Lync - Exchange - IntegrationDocument29 pagesMS Lync - Exchange - IntegrationCristhian HaroNo ratings yet

- The Comma Rules Conversion 15 SlidesDocument15 pagesThe Comma Rules Conversion 15 SlidesToh Choon HongNo ratings yet

- Nutrition 2022 PIRDocument22 pagesNutrition 2022 PIRAlmira LacasaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEADocument21 pagesCRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEAcristian colceriu100% (2)

- Ismb ItpDocument3 pagesIsmb ItpKumar AbhishekNo ratings yet

- B. Inggris X - 7Document8 pagesB. Inggris X - 7KabardiantoNo ratings yet

- Seizure Control Status and Associated Factors Among Patients With Epilepsy. North-West Ethiopia'Document14 pagesSeizure Control Status and Associated Factors Among Patients With Epilepsy. North-West Ethiopia'Sulaman AbdelaNo ratings yet

- BÀI TẬP LESSON 7. CÂU BỊ ĐỘNG 1Document4 pagesBÀI TẬP LESSON 7. CÂU BỊ ĐỘNG 1Yến Vy TrầnNo ratings yet

- Directorate of Technical Education, Admission Committee For Professional Courses (ACPC), GujaratDocument2 pagesDirectorate of Technical Education, Admission Committee For Professional Courses (ACPC), GujaratgamailkabaaaapNo ratings yet

- A 138Document1 pageA 138pooja g pNo ratings yet

- Liquitex Soft Body BookletDocument12 pagesLiquitex Soft Body Booklethello belloNo ratings yet

- De Thi Chon Hoc Sinh Gioi Cap Tinh Mon Tieng Anh Lop 12 So GD DT Thanh Hoa Nam Hoc 2015 2016Document11 pagesDe Thi Chon Hoc Sinh Gioi Cap Tinh Mon Tieng Anh Lop 12 So GD DT Thanh Hoa Nam Hoc 2015 2016Thuy LinggNo ratings yet

- International Freight 01Document5 pagesInternational Freight 01mature.ones1043No ratings yet

- Microfinance Ass 1Document15 pagesMicrofinance Ass 1Willard MusengeyiNo ratings yet

- Lesson 1 Q3 Figure Life DrawingDocument10 pagesLesson 1 Q3 Figure Life DrawingCAHAPNo ratings yet

- Internship Format HRMI620Document4 pagesInternship Format HRMI620nimra tariqNo ratings yet

- Matrix PBX Product CatalogueDocument12 pagesMatrix PBX Product CatalogueharshruthiaNo ratings yet

- Beyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisDocument21 pagesBeyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisEra B. LargisNo ratings yet

- Guided-Discovery Learning Strategy and Senior School Students Performance in Mathematics in Ejigbo, NigeriaDocument9 pagesGuided-Discovery Learning Strategy and Senior School Students Performance in Mathematics in Ejigbo, NigeriaAlexander DeckerNo ratings yet

- 1 PBDocument7 pages1 PBIndah Purnama TaraNo ratings yet

- A Literary Nightmare, by Mark Twain (1876)Document5 pagesA Literary Nightmare, by Mark Twain (1876)skanzeniNo ratings yet

- Action ResearchDocument2 pagesAction ResearchGeli BaringNo ratings yet

- Java Complete Collection FrameworkDocument28 pagesJava Complete Collection FrameworkkhushivanshNo ratings yet

- Honda IzyDocument16 pagesHonda IzyTerry FordNo ratings yet

- The New York Times Presents Smarter by Sunday: 52 Weekends of Essential Knowledge for the Curious MindFrom EverandThe New York Times Presents Smarter by Sunday: 52 Weekends of Essential Knowledge for the Curious MindRating: 4.5 out of 5 stars4.5/5 (3)

- Emotional Intelligence: How to Improve Your IQ, Achieve Self-Awareness and Control Your EmotionsFrom EverandEmotional Intelligence: How to Improve Your IQ, Achieve Self-Awareness and Control Your EmotionsNo ratings yet

- 71 Ways to Practice English Writing: Tips for ESL/EFL LearnersFrom Everand71 Ways to Practice English Writing: Tips for ESL/EFL LearnersRating: 5 out of 5 stars5/5 (3)

- Purposeful Retirement: How to Bring Happiness and Meaning to Your Retirement (Retirement gift for men)From EverandPurposeful Retirement: How to Bring Happiness and Meaning to Your Retirement (Retirement gift for men)Rating: 4.5 out of 5 stars4.5/5 (4)

- The Food Almanac: Recipes and Stories for a Year at the TableFrom EverandThe Food Almanac: Recipes and Stories for a Year at the TableRating: 4 out of 5 stars4/5 (1)