Professional Documents

Culture Documents

Carbon 2006 - Towards A Truly Global Market

Uploaded by

pointcarbonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carbon 2006 - Towards A Truly Global Market

Uploaded by

pointcarbonCopyright:

Available Formats

Carbon 2006

Towards a truly global market

28 February 2006

TO THE POINT

The world’s largest ever carbon market survey More than 800 participants in our web-survey and 67 in-depth

interviews, combined with Point Carbon’s proprietary databases and market intelligence services, makes

this the most comprehensive carbon market report to date.

Global carbon market transactions worth €9.4 billion in 2005. The EU ETS did an estimated 362 Mt CO2, at an

estimated financial value of €7.2 billion. 93% of the volumes in the project market came through CDM, at

397 Mt CO2e, €1.9 billion. JI did 28 Mt, €95 million.

China is largest CDM seller. More than 70% of CDM volumes came from a few large HFC-23 reduction

projects in China. There are also several projects in India and Brazil.

CDM buy side is dominated by private sector. Driven by high EU ETS prices together with an increasing

number of carbon funds.

Japan enters market in earnest. The European private sector activity will continue to dominate the market,

but Japanese public and private sector will add further to demand for project credits in 2006. Canada is

conspicuous by its absence from the market.

The EU ETS is a qualified success. The weekly turnover in EU ETS has been increasing steadily. The market

is reacting to fundamentals, although policy (non-)decisions also still constitute a price driver. 45% of

survey respondents found the EU ETS to be a success.

CDM/JI still has some way to go. Only 7% of survey respondents find the project market to be mature, and

only 22% find them to be a success.

The cost of carbon cannot fully explain the increase in power prices. Increasing fuel prices, increased

demand, as well as generators’ strategies have also contributed to power price increases. The impact of

carbon costs on power prices, and vice versa, has created new interplays between energy commodities

and strengthened energy market interactions.

Market is still best option for world to make transition to low-carbon economy. Unlike technology-based

alternatives, the carbon market places a cost on emissions and a value on reductions, and leads to large

scale reductions in the near term.

This report was published at Point Carbon’s 3rd annual conference, Carbon Market Insights 2006 in

Copenhagen 28 February - 2 March 2006. For more information, see www.pointcarbon.com

All rights reserved © 2006 Point Carbon

Carbon 2006

About Point Carbon:

Point Carbon is the leading provider of independent analysis, forecasting, market intelligence

and news for the power, gas and carbon emissions markets. Point Carbon has more than

14 000 subscribers in over 150 countries. Our reports are translated into Japanese, Chinese,

Portuguese, German, French, Spanish and Russian. Among our clients are BP, Dupont, Norsk

Hydro, RWE, Shell and Vattenfall. Point Carbon has offices in Oslo (HQ), London, Kiev, Brussels,

Hamburg and Tokyo.

The company has expanded rapidly in recent years and now has an international team of more

than 60 employees. The competencies of our staff include international and regional climate

policy; mathematical and economic modelling; forecasting methodologies; methods for expert

evaluation and energy industries analysis.

The in-depth knowledge of power, gas and CO2 emissions market dynamics positions Point

Carbon as the number-one supplier of analysis on price-driving fundamentals for European

energy and environmental markets.

About the report:

This report was written and edited by Henrik Hasselknippe and Kjetil Røine.

For citations, please refer to: Point Carbon (2006): ”Carbon 2006.” Hasselknippe, H. and K. Røine eds.

60 pages.

ii All rights reserved © 2006 Point Carbon

28 February 2006

Executive Summary

This report has been based on a number of different sources. First, Point Carbon’s proprietary databases

give an overview of the number of projects and their volumes. Our carbon project database contains at total

of 2,769 projects, and is to our knowledge the world’s largest. In addition, our web-based survey attracted

800 respondents, and we have further conducted in-depth interviews with 67 selected key market players.

Point Carbon estimates that the international carbon market in 2005 transacted a total of 799 Mt CO2-

equivalents worth approximately €9,400 million. In comparison, the market in 2004 saw an estimated 94 Mt

CO2e, worth €377 million.

The EU Emissions Trading Scheme saw the largest financial values in the previous year. In total, the brokered

and exchanged market did 262 Mt CO2, corresponding to €5.4 billion. Brokers did 79% of this volume,

whereas the ECX was by far the largest exchange, with 63.4% of the exchanged volume. Point Carbon

further estimates that the direct bilateral market (company-to-company, not through brokers or exchanges)

did 100 Mt, €1.8 billion in 2005. Annualised turnover increased to over 12% (OTC and exchange volumes

only).

The Clean Development Mechanism (CDM) remains the largest market segment in terms of volume. Point

Carbon estimates that emission reduction purchase agreements (ERPAs) corresponding to 397 Mt CO2e

were entered into in 2005. Assuming payment on delivery and a 7% discount rate, this is valued at €1.9

billion. The other project based mechanism, Joint Implementation (JI) did 28 Mt, €96 million. There is also

a small market for secondary CDM trading, this is expected to increase in the future, but is currently held

back by transaction log delays.

Other market remain insignificant in the larger picture, at 7.8 Mt, €52 million. The largest of these is the

NSW scheme in Australia, accounting for 93% of the financial value in this segment.

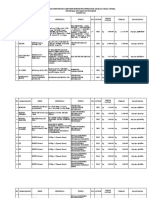

Table 1: Reported volumes and values 2004 and 2005

Reported and estimated volumes 2004 and 2005 , in million tonnes of carbon dioxide equivalents and €. Bilateral

ETS for 2005 estimated as 27% of total EU ETS volume at average EUA price through the year.

2004 2005

[Mt] [€ million] [Mt] [€ million]

EU ETS total 17 127 362 7,218

- OTC + exch. 9.7 n.a. 262 5,400

- Bilateral 7.3 n.a. 100 1,818

CDM 60 188 397 1,985

CDM 2nd 0 0 4 50

JI 9 27 28 96

Other 7.9 34 7.8 52

Sum 94 377 799 9,401

iii All rights reserved © 2006 Point Carbon

Carbon 2006

Executive Summary

But does the system work? We have seen very little evidence of actual fuel-switching or internal abatement

taking place. On the other hand, the market is working effectively, with reliable price discovery and increasing

volatility. Furthermore, the EU ETS is leading to substantial private sector investments in CDM, and to some

extent JI. In balance, we find that the EU ETS is a qualified success after its first year of operation. Survey

participants agree with us on this, at least to some extent. 45% of the respondents find that the EU ETS is

already a success. Only 22% think the same of the CDM/JI markets. However, only a handful of people find

the markets to be mature, 10% for EU ETS and 7% for CDM/JI.

One of the shortcomings of the EU ETS relates to the way the EC and Member States release information

to the market. With carbon now acting as hard currency, it would be wise to look to financial markets to

see how information is distributed. The European Commission has shown that it has a more important

role in emissions trading than other parts of EU’s environmental policy, and can be expected to meet this

challenge. Nevertheless, the market has shown that it can work even with asymmetric information

The introduction of carbon costs on power producers’ operation has also created new complexities with

other energy commodities, in particular power prices. The cross commodity impacts have also strengthened

interactions energy markets. We expect the debate on carbon’s impact on power prices to continue in 2006.

However, carbon costs cannot fully explain the increases in power prices. Increasing fuel prices, in particular

for gas, through 2005 have also contributed significantly. Also, increasing demand for power has an impact,

as well as generators’ trading strategies.

The survey respondents are bullish on prices. Only 20% expect the EUA price in one year to be lower than

it was in December 2005. More than 70% expect the price of an issued CER to increase over the same

time period. The market expects tighter allocations for EU ETS phase 2. Only 8% expect the allocation

for the next round to be looser than in the current phase. 25% expect it to be much tighter. Furthermore,

24% expect there to be more internal abatement in the next phase. It is also evident that carbon costs are

now taken into account for new investments. More than 40% see carbon costs as very important for new

investments in their industry.

CDM is set to be the project mechanism of choice, also in the future. Developing countries are indeed

taking their participation in the market seriously, and are years ahead of large JI sellers when it comes

to project approval frameworks. It also seems clear that the CDM will survive even without a successor

agreement to the Kyoto Protocol.

Technology based alternatives to the Kyoto Protocol are expected to be pushed forwards as viable options

for the future international climate cooperation. However, we do not find there to be much substance

in these plans. For an agreement to work it is essential that there is a price on carbon, and a value on

reductions, thus incentivising private sector investments in new technologies. Currently, the carbon

market remains the best option for enabling the transfer to a less carbon-intensive global economy.

iv All rights reserved © 2006 Point Carbon

28 February 2006

Foreword

In many ways, the year 2005 marks the birth of a and markets have become correlated in ways they

global carbon market. The unexpected high price have never been before – driven by the carbon

of allowances in Europe caught most players by market – requiring a broader spectre of factors to

surprise. During a period of a few months, carbon be taken into account when assessing trading and

trading suddenly came on the agenda in boardrooms investment strategies.

across Europe. This report attempts to document

how the sudden emergence of a global carbon Finally, evidence suggests that the carbon market

market has unfolded, and how it has affected leads to large-scale emission reductions. While

emitters of greenhouse gases – and their markets limited abatement appears to have taken place in

– in ways that few anticipated one year ago. Europe so far, there is no doubt that the unexpectedly

high European carbon price has been pivotal in

It has been a massive effort making this report. More terms of generating investments in projects under

than 800 readers responded to Point Carbon’s web- the Clean Development Mechanism.

poll carried out in November-December 2005. The

web-poll was complimented by in-depth interviews Until six months ago, we in Point Carbon were

with more than 60 key players: traders, industry pessimistic about the reductions that would be

representatives and service providers. Also, our daily generated by such projects. But the explosive

recording of carbon transactions has been invaluable growth lately has changed our minds. Credits

for documenting how the market has developed. from abatement projects under CDM and JI today

have the prospect of becoming a major avenue for

When analysing the results from the survey and ensuring compliance with the Kyoto Protocol.

the transaction data, three important conclusions

spring to light. Firstly, although the value of the Moreover, these projects often bring about

carbon market increased by 2500% from 2004 to economic, social and environmental benefits for the

€9.4bn in 2005, and now involves players in close local communities: e.g. close to half of the 2,769

to 150 countries, it is still early days. Traded volumes JI and CDM projects registered in Point Carbon’s

compared to the underlying volume are still far below database utilise renewable energy.

what we can observe in other markets.

You will find more about these trends – and a number

Moreover, among the participants there is a of others – in the present report, which we plan to

widespread feeling of the market being immature, provide as an annual publication.

e.g. only approximately 10 per cent of the respondents

agreed to our poll’s statement of the EU ETS being A considerable amount of work has gone into making

a mature market. Through the involvement of more it and we believe it represents the most thoroughly

players – and an increasing internationalisation of the researched overview of the global market. Hopefully,

market – volumes can be expected to grow rapidly it will provide you with a useful source of reference

also in the years to come. and we hope you will enjoy reading it as much as we

have enjoyed making it.

Secondly, strong links to the energy markets

are evident. The carbon market has significantly Kristian Tangen

increased power prices, and the development of the Director Research & Advisory

power markets strongly impact carbon prices. This Point Carbon

should come as no surprise as power production is

major source of greenhouse gases emissions.

But there is more to it than that. Most of the active

carbon traders have a background in power or fuel

trading, and they have brought with them this

knowledge and experience into the carbon market.

One consequence is that prices across commodities

v All rights reserved © 2006 Point Carbon

Carbon 2006

From the editors

This report had not been possible without the contribution of numerous people.

First and foremost, we would like to thank the 800 persons who participated

in our web-survey, as well as the 67 key market players who took the time to be

interviewed on the phone. As you will see, your inputs have been invaluable in

the making of this report.

Thanks also go to everyone at Point Carbon, for their tireless efforts in maintaining

our proprietary databases and models. It is only due to your combined efforts

that we have been able to put this report together. Our CDM and JI team have

contributed through the development of the Carbon Project Manager, which has

been used frequently throughout during the making of this report. Our EU ETS

team has contributed through the Carbon Market Trader. And the Power & Gas

team has contributed analysis and thinking on the chapter focusing on carbon-

power complexities.

Some of our colleagues deserve special thanks and attention for their contribution

to this report: Kristian Tangen for guidance and overall coordination. Anders

Skogen for setting up the web-survey. Miles Austin and Therese Karlseng for

calling around to more than one hundred people in the carbon market. Anne

Katrin Brevik for sparring and comments on the power/carbon debacle. Liza

Baeza for giving a helping hand with the layout and design. And finally, Kevin

Gould and Kjell Olav Kristiansen for providing valuable comments in the final

stages.

We hope that you find this report interesting and that it is useful for your

continued work in the carbon market. As this is the first annual report of this

kind, we encourage you to give us comments and feedback through the regular

channels (see Colophone). We look forward to meeting you all at our conference,

and look forward to producing another version of this report in 2007.

Henrik Hasselknippe and Kjetil Røine

Editors

vi All rights reserved © 2006 Point Carbon

28 February 2006

Table of contents

1 Introduction 1

2 What is the carbon market? 4

3 How does it work? 9

3.1 EU ETS 9

3.2 CDM & JI 11

4 Market activity in 2005 15

4.1 EU ETS 15

4.2 CDM and JI 22

4.3 Other markets 26

5 Does it really work? 28

6 Carbon Market Insight: The power of 33

carbon

6.1 Higher spot prices 33

6.2 Explaining increasing spot prices 34

6.3 New complexities arising 38

7 What does the future hold? 40

7.1 Globally - still political uncertainties 40

7.2 Where to now for EU ETS 41

6.1 CDM and JI - long term investments? 44

6.1 Towards a truly global market 45

Colophone 51

vii All rights reserved © 2006 Point Carbon

28 February 2006

1. Introduction We also provide a special feature on carbon and

power, discussing some of the impacts that carbon

The rumours of the Kyoto Protocol’s death were truly

trading has had on the European power market.

exaggerated. As the Protocol entered into force on 16

Finally, we look to the future and try to give some

February 2005, the international carbon market – the

indications on where the market will move in the

cornerstone of the Kyoto agreement – was already

years ahead.

showing healthy signs of increasing volumes. While

the market for greenhouse gas (GHG) allowances

Point Carbon regularly publishes in-depth analyses on

and reduction credits had been in operation for some

international climate policy and the carbon market in

years already, the market had only recently moved

our publication series Carbon Market Analyst (CMA)

beyond the embryonic stage. However, growth has

and Carbon Market Monitor (CMM). The analyses

since continued in all segments of the market, and

that have gone into the CMAs are to some extent

2005 has proved that the carbon market is indeed

reflected in this report, although the level of detailed

alive and well, although it has probably only reached

is lower here.

the toddler stage.

This report, Carbon 2006, provides a detailed

800 participants in our web-survey

overview of the global carbon market, with special

attention to volumes and price trends in 2005. We

In addition to our regular reports, the web- and phone

also include a brief introduction to the market for

surveys have provided new data and a different

those of you who might not be familiar with the

perspective. A total of 800 individuals responded

detailed – and often highly complex – structure of

to our web-survey. Furthermore, 67 people were

this new commodity market.

contacted by phone, giving detailed answers to

a range of questions not asked in the web-based

Particular attention is given to the EU Emissions

version. The in-depth interviews covered different

Trading Scheme (ETS) and the project based

sectors, and we got answers from 38 players from

Clean Development Mechanism (CDM) and Joint

the Power & Heat sector, 21 from industry, and 8

Implementation (JI). These market segments are by

from the financial sector.

far the most advanced of the Kyoto related market

mechanisms, although, as we shall see, they are at

very different stages of maturity. Figures 1.1-1.4 show the distribution of the

respondents to the web-survey. Half of the

Figure 1.1 Some big, many small

Respondents to the survey, broken down on their company’s annual emissions level.

60 %

50 %

Share of respondents

40 %

30 %

20 %

10 %

0%

No 0-0.5 Mt/yr 0.5-1Mt/yr 1-5 Mt/yr 5-10 Mt/yr +10Mt/yr

emissions

Source: Point Carbon

1 All rights reserved © 2006 Point Carbon

Carbon 2006

Figure 1.2 Mostly outside trading sectors

Respondents to the survey, broken down on sectors.

35 %

30 %

Share of respondents

25 %

20 %

15 %

10 %

5%

0%

Service Other Power & Industry Gov.mnt Oil/gas

prov. Heat

Source: Point Carbon

respondents did not represent GHG emitting as 23% claimed that they would be engaging in

industries, while about 25% represented only small trading soon, but as many as 47% said they were

emission levels, i.e. below 0.5 Mt per year. 7.5% of not trading at all. Of the ones who were trading, 9%

the respondents represented major emitters, with were active in the EU ETS and 8% in both EUAs and

more than 10Mt per year. CDM/JI. 11% said they did CDM/JI trading only.

19% of respondents from Power &

Heat sector 28% trade one or more carbon

commodities

The share of non-emitters is also reflected in the

break-down of respondents on sectors, where This breakdown on respondents provides a backdrop

as many as 31% were said to represent service for the further analysis in this report. Where

providers, and 27% defined themselves as belonging appropriate, we will present answers based on

in the Other category. 19% of the respondents came limited responses. For instance, for certain answers

from the Power & Heat sector, 9% from industry we will not include the responses from non-emitting

and about 5% from oil/gas. players or companies which have not yet initiated

carbon trading internally. Where this is done it is

As many as 55% of the respondents were from clearly noted.

the EU, 36% from Northwestern Europe, 10% from

Central and Eastern Europe, and 9% from Southern Additional sources used in this report includes all of

Europe. In addition, 5% were from European Point Carbon’s proprietary databases. Our project

countries not in the EU. Of the remaining respondents database contains 2,256 CDM projects and 513 JI

20% were from industrialised countries, whereas projects, at all stages. We also maintain a transaction

another 20% were from developing countries, i.e. database, where we register all transactions that we

non-Annex I countries. learn of through our market intelligence services. In

addition, we draw extensively on our forecasting

55% from EU, 20% from developing services for the carbon, power and gas markets.

countries

28% of the respondents answered that they were

trading one or more carbon commodities. As many

2 All rights reserved © 2006 Point Carbon

28 February 2006

Figure 1.3 European responses

Respondents to the survey, broken down on geographic location. Annex 1 refers to industrialised

countries as defined under UNFCCC. CEE: Central and Eastern Europe

40 %

35 %

Share of respondents

30 %

25 %

20 %

15 %

10 %

5%

0%

EU: Other Non-Annex- EU: CEE EU: South Europe:

Northwest Annex-1 1 Non-EU

Source: Point Carbon

Figure 1.4 Only some trading actively

Respondents to the survey, broken down on trading activity.

50 %

40 %

Share of responses

30 %

20 %

10 %

0%

No Will be soon CDM/JI EUA Both EUA

and CDM/JI

Source: Point Carbon

3 All rights reserved © 2006 Point Carbon

Carbon 2006

2. What is the carbon market? had ratified the Protocol, corresponding to 61.6%

of total Annex I parties 1990 emissions. USA and

In brief,the carbon market can be explained as

Australia are noteworthy for being the only major

the market resulting from buying and selling of

industrialised countries not to ratify Kyoto.

emission allowances and reduction credits in order

to enable countries and companies meet their GHG

While the Kyoto Protocol does not impose

emission targets. Another way of looking at it is that

emission reduction commitments on developing

it introduces a price for carbon - placing a cost on

countries, they play a crucial role in the international

emissions and a value on reductions. This chapter

carbon market. Countries, and also companies, can

gives a brief introduction to the concepts underlying

invest in emission reduction projects in non-Annex

the carbon market, focusing on countries’ Kyoto

I countries and receive carbon credits in return for

targets and the structure of the market mechanisms

the resulting reductions. As we will show later in

that can help achieve them.

this report, developing countries are indeed already

participating in a meaningful way – contrary to what

When the Kyoto Protocol was agreed in 1997, a

has been argued by some opponents of the Kyoto

total of 39 industrialised countries (referred to in

Protocol.

treaty terminology as Annex B countries) were given

specific emission limitations for the 2008 to 2012

period. It did, however, take a number of years and How are countries meeting the

subsequent multilateral climate negotiations under Kyoto challenge?

the UN umbrella before all the technicalities of the

agreement were in place.

In an issue of CMA “Kyoto progress: Will countries

meet their targets?” (12 September 2005), we

Table 2.1 shows a selection of countries with

analysed how various countries were approaching

significant GHG emissions and their respective

their international climate commitment. The analysis

Kyoto targets. As of 14 February 2006, 161 states

was based on the latest available national reports

and regional economic integration organizations

on GHG emissions, reported figures for historic

Table 2.1 The Premier League

Selected countries’ commitments under the Kyoto Protocol for the period 2008-12. Targets for individual

Germany, UK, Italy and Spain under the EU 15’s burden sharing agreement.

Country GHG emissions in Kyoto target, in %

1990 as share of of 1990 emissions

Annex 1

Canada 3.3% -6%

Japan 8.5% -6%

EU 15 24.2% -8%

Germany 7.4% -21%

UK 4.3% -12.5%

France 2.7% 0%

Italy 3.1% -6,5%

Spain 1.9% +15%

EU 25 29.8% n.a

Poland 3.0% -6%

Russia 17% 0%

Ukraine not available 0%

USA 36.1% -7%

Australia 2.1% +8%

4 All rights reserved © 2006 Point Carbon

28 February 2006

emissions growth, and projections on countries’ lately, with a 15 Mt increase from the previous year

future emission growth. Using 2010 as the reference reported for 2003.

year for the Kyoto period we estimated what the

countries’ full five year shortfall would be without any Given these short positions, we might ask: How

new policies, domestic trading systems, or carbon can countries with such significant short positions

procurement funds, denoting this as the business- meet their targets? From the governmental point

as-usual (BAU) scenario. Figure 2.1 illustrates the of view, there are essentially three categories of

BAU short positions for the most significant buyer options: (1) Establish domestic emission trading

countries/regions aggregated for the whole Kyoto systems, (2) implement domestic non-market based

period (2008-12). policies, and (3) establish procurement programmes

for purchases of allowances or credits from other

In terms of BAU emissions, the EU15 bubble has countries. See also Table 2.2.

by far the largest gap to fill in terms of tonnage.

However, this should be viewed cautiously as it

is merely 12.5% above the EU15’s Kyoto target,

Emissions trading stimulates private

while Canada and Japan are projected to have BAU

sector reductions

emissions of 46% and 29% above their targets

respectively. Overall BAU gap leaves countries 5,540 The emission trading systems aims to stimulate the

Mt short in the first Kyoto period. private sector to reduce emissions through internal

abatement, external procurement, and trading. What

is common for the governmental and corporate

Countries BAU gap is 5,540 Mt for strategies is that they can both utilise credits from

five-year Kyoto period CDM and JI projects to meet their commitments.

To date, only EU has a comprehensive emission

Within the EU15 the Member States with the trading system, while Japan, Canada and New

biggest BAU gaps are Spain and Italy, at 660Mt and Zealand are all considering whether, and how, to put

620Mt, respectively. Spain has seen rapid economic up such systems. Obviously, all sectors contributing

growth coupled with rising emissions far beyond its to emissions of GHGs are not included in the

provision to expand under the EU15 burden sharing emission trading system, and consequently the

agreement. Italian emissions have also soared governments themselves need additional policies

Figure 2.1 Strong growth if unchecked

Business-as-usual emissions for world regions, i.e. no additional policies or measures

implemented, for the aggregate 5-year Kyoto period 2008-2012, in Mt CO2e. Source: Carbon Market

Analyst 12 September 2005.

EU 15

Japan

Canada

Other

0 500 1 000 1 500 2 000 2 500

Source: Point Carbon Mt CO2e

5 All rights reserved © 2006 Point Carbon

Carbon 2006

Table 2.2 Governmental and corporate strategies for meeting Kyoto targets

Governmental Establishing emission Procurement Non-market policies

strategies trading systems (ie EU programmes (tech. dev, CO2-tax)

ETS) (CDM/JI/AAU)

Corporate strategies Internal trading (ie External Internal abatement

within EU ETS) procurement and strategies

trading (ie CER/

ERU)

for being in compliance with the Kyoto targets. For policies for domestic abatement – constitute the

instance, approximately 44 % of GHG emissions political framing conditions that are decisive for how

within the EU are covered by the EU ETS. the market mechanisms actually work.

To what extent have countries employed these

Several countries with operational strategies? And to what extent are they actually

procurement programs reducing emissions? Our analysis from 12

September 2005 looked at the full range of policies

Thus, it will be essential for countries to also and mechanisms employed by all countries expected

engage policies in other sectors. Non-market to be short in the Kyoto period. All governmental

policies are typical domestic measures that will procurement programs were examined closely,

primarily impact sectors not subject to trading considering actual and planned budgets in light of

system and requirements, e.g. different renewable prices in the carbon market. We further investigated

energy policies, environmental taxes and subsidies, whether non-market policies already in place actually

and various voluntary programs. For instance in had any impacts, and estimated how much existing

Japan, the Kyoto Protocol Target Achievement Plan climate policy plans would contribute to the required

contains a raft of new schemes and measures, reductions. Finally, we looked at allocations under

nearly all of which are voluntary. Mandatory existing or planned emissions trading systems

measures are limited to reporting emissions and and estimated how much these schemes would

efficiency rates, not actually reducing them. In reduce.

1997 the Japanese business federation, the Nippon

Keidanren implemented its voluntary action plan on Figure 2.3 shows the final results, and that several

the environment. The plan currently covers 82% of countries still have a long way to go before they

industrial emissions embracing 34 industries. will meet their Kyoto targets. It should be noted

that some countries, Japan in particular, have

The third pillar of the governmental climate strategy, announced governmental procurement plans since

the procurement programmes, primarily aim at the analysis was undertaken, and that the analysis

purchasing Certified Emission Reductions (CERs, simply applied the caps in the EU ETS phase 1 to

from CDM projects) and Emission Reduction phase 2. The recent guidance from the European

Units (ERUs, from JI projects), as well as Assigned Commission has made it clear that several countries

Amount Units (AAUs, the “country allocation” under will have to reduce their caps for the second phase.

Kyoto). There are several countries with operational

procurement programs, e.g. the Netherlands and Spain, Italy and Canada at bottom of

Denmark, as well as a number of countries that league

have invested in funds for procurement, e.g. the

different World Bank funds. Figure 2.2 further shows

how these different strategies all add up to form the Nevertheless, the figure gives a good indication on

carbon market. In this respect, national policies - which countries that look set to meet their targets

such as the allocation of allowances to companies comfortably and which that will have to make some

under EU ETS or implementation of non-market sacrifices.

6 All rights reserved © 2006 Point Carbon

28 February 2006

Figure 2.2 How it works, at least in theory

The interplay of flexible mechanisms, purchasing programmes and trading schemes. Non-market

policies and overall allocations set the frame.

Political framing decisions

Gov. AAU sales JPN/CAN/NZ

CDM/JI

Gov. Purchase EU ETS

programmes Governments Private sector Internal trading,

abatement

= Supply Forwarding

compliance

= Demand

Political framing decisions

Figure 2.3 Winners and sinners

Relative distance to the Kyoto target for countries covered in the study after all policies and programs have been

accounted for. Assumes that current allocation in EU ETS continues in phase 2.

Sweden

Switzerland

UK

Netherlands

France

Germany

Denmark

Belgium

Greece

Finland

New Zealand

Austria

Ireland

Portugal

Norway

Japan

Canada

Italy

Spain

-10 % -5 % 0% 5% 10 % 15 % 20 % 25 %

Source: Point Carbon

7 All rights reserved © 2006 Point Carbon

Carbon 2006

Bottom of the league are Spain, Italy, Canada and leaving them with substantial emission allowance

Japan who all, it seems, will miss their targets by 20 (AAUs) to sell. These countries, located in Central

per cent or more unless drastic action is taken. Still, and Eastern Europe, are also prime candidates for

there is little reason for other countries to be smug, JI projects, as it is less costly to reduce emissions

almost all of the countries covered in the study have here than in Western Europe, Canada or Japan.

yet to develop credible policies and measures that Finally, there are about 100 non-Annex I countries

will help them meet their Kyoto targets. which can qualify as hosts for CDM projects, and

which could produce substantial reduction volumes

Overall, our analysis finds that these measures that could be sold to emission-craving industrialised

might potentially reduce the Kyoto gap with some countries.

50 % from the shortfall presented in figure 1.

Still, major buyer countries experience a 2,740 Mt Without going into too much detail on the analysis, it

shortfall for the five-year period, or 548 Mt per year is clear that the potential supply in the carbon market

in the Kyoto period even when taking measures into is considerably larger than the aggregated demand.

account, leaving them 9.5% above their collective Figure 2.4 shows the net supply and demand in the

Kyoto target. 5-year Kyoto period, as estimated by Point Carbon.

In particular, Russia has the potential to export

An updated analysis on countries’ Kyoto progress significant amounts of allowances, although it is far

will be presented in a forthcoming issue of Carbon from certain that they will do so. Our forecast for the

Market Analyst, set for publication in early April 2006. CDM market also shows that developing countries

Moreover, the carbon policies in non-EU countries will contribute substantial amounts, which could

will be further analysed in the CMA “Carbon around grow even higher than what we indicate here. Point

the world”, scheduled for March 2006 Carbon monitors the situation in the major seller

countries on a continuous basis and will publish

The above analysis clearly shows that the demand several in-depth analyses on how their behaviour will

for allowances or credits is real. What then about impact on volumes and prices in the global carbon

supply? Several of the countries with Kyoto targets market.

experienced economic downturn in the 1990s,

Figure 2.4 Potential supply more than enough

Net short and long positions for countries and regions, i.e. when all policies and procurement plans have been

accounted for. Aggregated for the 5-year Kyoto period

EU 15

Japan

Canada

Other

Ukraine

Eastern Europe

Russia

-5 -4 -3 -2 -1 0 1 2

Gt CO2e

Source: Point Carbon

8 All rights reserved © 2006 Point Carbon

28 February 2006

3. How does it work? outlining the upper level of allowances to be issued

(the caps) and how these are allocated to sectors

While the previous chapter presented a general

and individual installations within in each Member

overview of how countries fare in respect to

State (MS). The EU Commission (EC) has approved

their Kyoto target, this chapter will focus on the

in total 6.3 billion allowances to be issued for the

mechanisms that are being employed to meet

period 05-07, excluding allowances set aside to new

targets. We will give a brief introduction to the EU

installations, resulting in an average of 2.1 billion

ETS, what it is and how it works, as well as a quick

allowances to be distributed each year. However,

overview of CDM and JI. While the operation of these

MS’ initial applications were for even more.

mechanisms is much more complex than what can

be conveyed within these pages, this gives at least a

general introduction. For more detailed analyses we EC cut 300 Mt, 4% from initial

refer to our regular report series. volumes

3.1 EU ETS The EC ended up cutting almost 300 Mt of

The European Union Emissions Trading Scheme (EU allowances, or more than 4 % of the total volume,

ETS) works, simply put, by placing GHG emission from the initial volumes of allowances as submitted

limitations on a number of installations within specific in the draft NAPs. Comparing this to 2003

sectors, and allowing the emission targets to be met emissions, we find that the EU ETS covers 44 % of

through trading of EU emission allowances (EUAs). all greenhouse gas (GHG) emissions in the EU.

Thus, if the price of carbon is higher than the internal

abatement cost, companies will – at least in theory The annual average cap is distributed among the MSs

– reduce internally and sell any unused allowances as shown in Figures 3.1 and 3.2. Germany is by far

in the market. For installations that miss their target the MS with highest number of allowances (488 Mt/

the penalty is €40/t CO2 on the shortfall in the 2005- year), followed by Italy, Poland and the UK pending

2007 period, in addition to having to purchase the around 250 Mt each for the first trading period, and

deficit on the market. France and Spain around 150 Mt. Together, these six

countries constitute 71 % of the total allowances in

The National Allocation Plans (NAPs), developed the market.

by each member state and approved by the

Commission, set the overall structure of EU ETS by

Fig 3.1. The big emitters…

EU member states with more than 100 Mt in aggregated allocations for the 2005-2007 period. Emissions in

ETS sectors in 1990, 2003 and allocated in 2005, in Mt CO2.

600

500

400

Mt

300

200

100

0

DEU GBR POL ITA ESP FRA CZE NLD GRC BEL FIN PRT DNK

Source: Point Carbon 1990 2003 CAP

9 All rights reserved © 2006 Point Carbon

Carbon 2006

Fig 3.2. ..and the smaller ones

Total allocations to some of the smaller EU member states, aggregated for period 05-07. Emissions in ETS sectors

in 1990, 2003 and allocated in 2005, in Mt CO2.

45

40

35

30

25

Mt

20

15

10

0

AUT HUN SVK SWE IRL EST LTU SVN CYP LVA LUX MAL

Source: Point Carbon 1990 2003 CAP

Fig 3.3 Power & heat in driver’s seat

Total EU ETS allocations on sector level, aggregate for 2005-2007 period, in Mt CO2.

4 000

3 500

3 000

2 500

Mt

2 000

1 500

1 000

500

0

Power & Metals Cement, Oil & gas Pulp and Others

heat Lime & paper

Glass

Source: Point Carbon

Figures 3.1-2 also show calculated CO2- emissions Within each MS the allowances are allocated to

for the years 1990 and 2003 in the sectors now existing installations in five main sectors. Figure 3.3

covered by the EU ETS. The majority of the countries illustrates the distribution of allowances between

have had to reduce their emissions compared to these. The power & heat sector is by far the largest

their 2003 level. sector, accounting for 55 % of all allowances in the

system, making the EU ETS primarily dependant on

activities and changes within this sector.

10 All rights reserved © 2006 Point Carbon

28 February 2006

Fig 3.4 When size matters

Distribution of allowances and number of installations according to size categories for installations; less than 1 Mt, between

1 and 10 Mt, and larger than 10 Mt.

100

80

60

%

40

20

0

< 1 Mt 1 Mt < x < 10 Mt > 10 Mt

Source: Point Carbon Allowances Installations

Close to 10,000 installations now have of view, it does not make any difference whether

commitments within the EU ETS. Figure 8 illustrates NERs are made available through new installations

the distribution of allowances and installations or through auctions; they represent net supply to

categorised relative to the size of the installations. the market in any case.

According to the currently available installation lists,

there are 92 large installations with an allocation 3.2 CDM and JI

of more than 10 Mt CO2e in the 3-year period 05- While the EU ETS is a consequence of countries

07. Together these account for only 0.9 % of the taking on their Kyoto commitments, the two project

total number of installations but for a whopping based mechanisms are actually specified in the

34% of the total allowances. At the other end of the Kyoto Protocol itself.

scale, we find that there are close to 9,000 small

installations emitting less than 1 Mt CO2e, totalling CDM is the only mechanism under the Kyoto Protocol

only 19% of the allowances but more than 90% of involving countries that are not subject to binding

all installations. However, it is the medium sized greenhouse gas emission caps by the protocol – so-

emitters, between 1 and 10 Mt, which have the called non-Annex I countries, primarily consisting

largest amounts of allowances, accounting for 47% of developing nations. Under the CDM, investors

of the total amount. from Annex I states, i.e. industrialised countries,

receive Certified Emissions Reduction units (CERs)

Medium-sized emitters account for for the actual amount of greenhouse gas emissions

47% of total allocation reduction achieved through an emission reduction

project, subject to host country agreement. CERs

can be produced from projects initiated after

In addition to allocating allowances to existing 2000, and although most current projects are only

installations, the MSs have in their NAPs set aside contracted until 2012, there is no specific end date

some allowances for new installations, the so called for the mechanism itself.

New Entrant Reserves (NER). Based on the current

version of MS NAPs, the total potential supply of

allowances from NERs for the 05-07 period is Additionality is key component of

between 120 – 180 Mt. Unused NERs might be CDM

made available to the market later in the first trading

period. There are basically two options for how the A key component of the CDM is the requirement of

NER surplus is dealt with, either by sale or auction, additionality. CER units generated under the CDM

or cancellation. From a demand and supply point will only be recognised when the reductions of

11 All rights reserved © 2006 Point Carbon

Carbon 2006

1) Both participants are parties of the Kyoto Protocol.

Fig 3.5 Step-by-step 2) Both participants have a national system for

The different stages for a CDM project and some of the risk identification of GHG emissions from sources and

factors that might arise at the different stages, storage using sinks. 3) Both participants have a

computerised national registry compliant with

international requirements. 4) Both participants

Stages Risk factors

have submitted a report for determining their initial

assigned amounts. 5) Both participants annually

Project submit a current inventory protocol fully compliant

Initial stage

development failure with Kyoto requirements.

Design docs. Methodology Hence, the track 1 system leaves much more up

methodology rejected to the host nation than does track 2 and the CDM.

Track 1 JI projects are still, however, required to

Approval, substantiate additionality.

Non-approval

Executive Board

While the above describes the project market in very

Failure broad terms, it is in fact a highly complicated market,

Implementation Delay with several steps and bureaucratic processes to go

through before credits are issued and can be used

for compliance purposes. Figure 3.5 shows a very

Certification Uncertified

simplified picture of the different steps needed for

a CDM project to produce credits, and some of the

CER risks involved at different stages. In this context, the

process for JI track 2 can be assumed to be fairly

similar, although there will be different institutions

involved.

greenhouse gas emissions are additional to any that

would occur in the absence of the certified project

activity.

Increased regulatory certainty lead

to jump in CDM/JI activity

JI is the sister mechanism of CDM, allowing for GHG

emission reduction projects to be carried out jointly As expected, the increased regulatory certainty

between two or more developed Annex I countries, following Kyoto ratification by Russia, and

where one will act as investor/buyer and the other subsequent entry into force of the Protocol, as well

as host/seller. These projects will result in so-called as the registration of the first CDM project on 18

Emission Reduction Units (ERUs), which can then November 2004 has lead to a jump in CDM activity.

be used for compliance by countries or companies. In addition to this come the improvements to the

Although a test programme for JI has existed since processes of the CDM Executive Board and the

1999, the actual transfer of allowances will not begin Methodology Panel.

until 2008.

This can be seen clearly from the number of

Two broad categories under JI - Track proposed CDM projects registered in Point Carbon’s

1 is very simplified database, which more than doubled throughout the

year, from 980 to 1965 projects. Currently, there are

2,256 CDM projects in the database. A significant

There are two broad categories under the JI, called share of the increased number of projects has come

track 1 and track 2. Whereas track 2 is essentially in a few select countries. Figure 3.6 shows the

the same as the CDM (see above) with strong number of projects in the Point Carbon database for

additionality requirements, track 1 is a very simplified selected countries at the end of 2004 compared to

procedure. The issuance of ERUs from a track 1 mid-December 2005.

initiative can be done provided the following criteria

are fulfilled by both buyer and seller:

12 All rights reserved © 2006 Point Carbon

28 February 2006

Fig 3.6 Project growth

The number of projects registered in Point Carbon’s project database, at the end of 2004 and in December 2005.

350

300

250

Number of Projects

200

150

100

50

0

Chile

Philippines

Mexico

India

China

Brazil

Panama

Vietnam

Argentina

Indonesia

Source: Point Carbon To year end 2004 To Dec 2005

Table 3.1 CDM and JI host country rating

Point Carbon’s assessment of major project hosts.

CDM Dec 05 Dec 04 JI Dec 05 Nov 04

1. India A- (1, BBB) 1. Bulgaria BBB+ (1, BBB)

2. China BBB (5, B) 2. Romania BBB (4, BB)

3. Chile BBB (2, BBB) 3. Poland BBB- (5, BB)

4. Mexico BB+ (7, B) 4. Hungary BB (6, BB)

5. Brazil BB+ (3, BB) 5. Estonia BB (7, BB)

6. Korea B+ (4, BB) 6. New Zealand BB- (n.a.)

7. Peru B+ (6, B) 7. Chzech. Rep B+ (2, BBB)

8. Morocco B (5, B) 8. Slovakia B (3, BBB)

9. South Africa B (10, CCC) 9. Russia B (9, CCC)

10. Argentina B (n.a.) 10 Ukraine B- (8, B)

11. Malaysia B (n.a.)

12. Vietnam CCC+ (8, CCC)

13. Egypt CCC (n.a.)

14. Indonesia CCC (11, CCC)

15. Thailand CCC (9, CCC)

13 All rights reserved © 2006 Point Carbon

Carbon 2006

We see that growth was significant throughout

the year, testifying to the increase of activity in the

carbon project market. India and China are particularly

noteworthy, having more than doubled the number

of projects through the year. Still, this is somewhat

misleading as the graph shows projects at all stages

of development. India and Brazil are the countries

with most projects at Project Design Document

(PDD) level or higher, 186 and 101 respectively,

while China currently has a modest 35 projects at

the same stages.

However, although counting the numbers of projects

in the different countries tells us something about

where the activity levels might be the greatest, it

does not tell us where the reduction potential will

be the highest.

Of the 10 host countries in our database with the

largest estimated volume by 2012, China, India

and Brazil are responsible for about 63% of the

total volume for all projects at PDD stage shown in

table 3.1. It must, however, be stressed that these

have not been adjusted for the possibility that the

various projects might not be implemented after all,

that they might be implemented later than stated in

the PDD, or that they will deliver fewer reductions

than aimed for. The risk factor is an essential part of

the CDM/JI market, and as we will see later in this

report it is an important parameter for the price paid

for different projects.

China, India and Brazil dominate the

sell side

Point Carbon monitors developments in all major

CDM and JI host countries, and rates them according

to their attractiveness as project hosts. Based on

an assessment of the country’s CDM- or JI-related

organisations and institutions, its investment climate

and its CDM/JI project status, Point Carbon evaluates

whether the country in question is attractive for

CDM or JI investments. Table 3.1 shows the ratings

for the major host countries and how they ranked at

the end of 2005 in comparison to their standing at

the beginning of the year.

The following chapter will go into detail on the type of

projects that were contracted in different countries

in 2005. Later chapters will discuss whether the

CDM/JI mechanisms are functioning as intended,

and how they might develop in the future.

14 All rights reserved © 2006 Point Carbon

28 February 2006

4. Market activity in 2005 not in terms of physical volumes. In total, 262

million EU allowances (EUAs), worth €5.4 billion

The volumes and values for the carbon market last

were transacted through brokers and exchanges

year are based on registrations in our proprietary

in 2005, 79% of this through brokers. In addition,

databases, interviews with market participants, and

we estimate that the bilateral market (company-to-

our assessment of policy developments and their

company, not brokered or exchanged) did 100 Mt,

potential market impacts. The analysis of the size

€1.8 billion.

of the CDM and JI market in 2005 is furthermore

based on interviews with around 60 of the major

CDM is by far the dominant of the two project-based

players in the market, together with registrations

mechanisms, and we find that contracts for 397 Mt,

in Point Carbon’s transaction database, and Point

€1.9 billion were entered into in 2005. JI saw 28 Mt,

Carbon’s project database. See Box 4.1 for a further

€95 million contracted in Central and Eastern Europe

description of the methodology and Box 4.2 for a

(CEE). Other carbon markets remain insignificant

description of what is included in this analysis, and

in the larger picture, and did 7.8 Mt, €52 million in

what is not. Table 4.1 presents the market activity in

2005. The New South Wales trading system remains

2004 and 2005.

the largest of these, at an estimated 93% of the

financial value.

Carbon market did 799 Mt, €9.4

billion in 2005

4.1 EU ETS

We find that the global carbon market saw transactions The past year saw significant growth in the

toalling 799 Mt CO2e in 2005, corresponding to a European emissions trading market. In total, the

financial value of €9.40 billion. See Figure 4.1 for an market transacted 262 Mt CO2 through brokers and

overview of historic volumes in the carbon market. exchanges, corresponding to a financial volume of

In comparison, the market saw an estimated 94 Mt, €5.4 billion. In addition to this comes an unreported

€377 million in 2004. The growth and speed in the direct bilateral market, which Point Carbon estimates

carbon market has been quite extraordinary, with an to be 100 Mt, €1.8 billion. In comparison, the EU

eight-fold increase in volume from 2004, and about ETS did an estimated 17 Mt, €127 million in all

25 times larger financial values in 2005 compared to segments in 2004. Although growth slowed down

the previous year. towards the end of the year, see Figure 4.2, each

quarter saw record volumes and value. This growth

The EU Emissions Trading Scheme (ETS) was the has continued also in 2006, with the market trading

largest market segment in financial value, although 91 Mt, €2.3 billion year-to-date (10 February).

Table 4.1: Reported volumes and values 2004 and 2005

Reported and estimated volumes 2004 and 2005 , in million tonnes of carbon dioxide equivalents and €. Bilateral

ETS for 2005 estimated as 27% of total EU ETS volume at average EUA price through the year.

2004 2005

[Mt] [€ million] [Mt] [€ million]

EU ETS total 17 127 362 7,218

- OTC + exch. 9.7 n.a. 262 5,400

- Bilateral 7.3 n.a. 100 1,818

CDM 60 188 397 1,985

CDM 2nd 0 0 4 50

JI 9 27 28 96

Other 7.9 34 7.8 52

Sum 94 377 799 9,401

15 All rights reserved © 2006 Point Carbon

Carbon 2006

New Values of Netherlands also did some volumes,

Figure 4.1 Stepstones assumed to be some hundred thousand tonnes, but

Contracted volumes 2003-2005, Mt CO2e. that final figures were not available at the time of

writing.

1 000 ECX and Nord Pool both offer clearing of OTC

900 contracts, which added significantly to the activity

800 on the exchanges. We have not included this in the

700 reported volume as it is already accounted for in

Mt CO2e

600 the brokered market. In total, ECX did 59.0 Mt efp

500 (exchange-for-physical) and Nord Pool cleared 14.7

400

Mt.

300

200

100 European Climate Exchange is by far

0 the largest of the lot

2003 2004 2005

Source: Point Carbon CDM JI EU ETS Other

The direct bilateral market of EU allowances

– company to company, no brokers or exchange

involved - is notoriously hard to estimate. In 2004

The majority of trading took place in the brokered we estimated that the bilateral market was about

(OTC) market, which did 207 Mt in total, a 79% the same size as the brokered market. However, as

share of the total OTC and exchange market. The 2005 has also brought the option of trading through

different exchanges launched at various times exchanges one could imagine that several companies

throughout the year, and they also saw steady will have opted to do more directly through that

growth. The exchanges’ relative shares of the total channel. Nevertheless, all accounts indicate that

daily volume were highest during the summer and there still is a substantial bilateral market.

at the end of the year, see Figure 4.3. The European

Climate Exchange is by far the largest of the lot, As part of our web-based Carbon Market Survey we

with 63% of the exchange market. Nord Pool in asked respondents to indicate their best guess of

second place did 24% of the reported exchanged the share of the bilateral market. Figure 4.5 shows

volumes. Powernext of France became stronger the distribution of answers from all respondents with

towards the end of the year, overtaking Nord Pool an existing Point Carbon subscription - in total 286

in monthly volumes in December 2005. See Figure respondents at all levels of subscription (Standard,

4.4 for a breakdown of monthly volumes on the Plus, Premium and Project Manager). Although the

different carbon exchanges. It should be noted that

Box 4.1 What is counted, what is it worth?

What? Point Carbon’s methodology for estimating and forecasting the carbon market has been in use since our

first publications in 2001. The methodology differs from that seen in other market assessments, e.g. by the

World Bank. One reason for this difference is that our proprietary transaction database registers only broker

transactions/contracts and signed Emission Reduction Purchase Agreements (ERPAs) that are reported to us.

This will produce a different, and in our view more accurate, result than also including volumes in term sheets.

We also differentiate between reported contracts/transactions and an estimated “hidden” market; notably

bilateral deals in EU ETS and undisclosed contracts in CDM and JI.

How much? The time value of money makes the value of a contract different from signing to delivery. This is

especially evident for forward streams such as CDM/JI projects with long lifetimes and distant deliveries. For

the purpose of illustration, we discount all contract values to the year they were signed using a 7% discount

rate, based on their proposed deliveries. For simplicity, we assume all payment to be done on delivery, although

some contracts have partial up-front payments.

16 All rights reserved © 2006 Point Carbon

28 February 2006

Box 4.2 What is included, what is not?

The carbon market has historically been fragmented, and although the vast majority of trading activity now

takes place in the EU ETS, CDM and JI segments, there are still some deals involving greenhouse gas credits

that we do not include in our analysis and forecast. This might be the case if no actual contract has been signed

or transaction has taken place, or if there is no standardised tradable unit involved in a transaction.

Included

Kyoto markets: CDM, JI, AAU

Mandatory emissions trading: EU ETS, UK ETS, New South Wales (Australia)

Voluntary emissions trading: CCX (USA)

For the EU ETS we report transactions in the brokered (OTC) market and the volumes on exchanges. However,

we do not include clearing (e.g. exchange for physical) of OTC contracts through exchanges. In addition, we

estimate the size of the pure bilateral market (outside brokers and exchanges).

For CDM and JI we include only emission reductions purchase agreements (ERPAs) signed by both Seller(s)

and Buyer(s). We furthermore only report contracts based on future delivery, as there will be no liquid spot

market until the International Transaction Log (ITL) is up and running in April 2007, at the earliest. We also

include forward sales of issued/approved and non-issued/approved CERs/ERUs in the secondary market. In

addition, we include auctions of CERs through the New Values platform, and transactions of Carbon Credit

Notes through the Johannesburg Stock Exchange.

Not included

Domestic project tenders: Programs where companies can apply to their government in order to receive

emission credits or allowances based on specific projects, e.g. in the past this has applied to New Zealand’s

PRE Tender. Although these programs might result in the allocation of actual credits or allowances that can

be traded on the market, the initial allocation of the credits from the government to the company or project

developer is not counted as a transaction. If the project volumes are sold on to a buyer we count the volumes

once that contract is registered.

There are also US states with caps on emissions and plans for trading, but as long as there is no activity in

these potential markets they will not be included.

Various voluntary programs: Several voluntary programs exist where companies or organisations engage in

deals that include transfers of carbon credits, e.g the Oregon Climate Trust, which uses its funds to acquire

emission reductions from a number of sources. These credits are normally not transferable to operational

trading systems. There is also a growing retail sector, selling various carbon credits to companies, organisations

and individuals. Typical retail initiatives include e.g. programs for offsetting emissions from air travel.

Various stand-alone deals: Some companies have undertaken carbon credits deals that are so far not related

to any program or system. Many of these are done for company internal emission requirements, or used for

Corporate Social Responsibility reporting purposes. If these credits are sold to any operational system they are

reported under that market segment.

17 All rights reserved © 2006 Point Carbon

Carbon 2006

Figure 4.2. So good we had to show it twice

Quarterly volumes and values in the EU ETS in 2005, Mt and € million.

120 2 500

7%

100 14%

137% 2 000

80 94%

1 500

Mt CO2

€ mill

60

46% 1 000

40 185

20 500

0 0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Source: Point Carbon

responses are spread somewhat evenly, there are exactly how much is traded bilaterally, this provides

some indications that the majority see the bilateral at least some transparency on what the company-

market as being somewhere between 10% and to-company market might look like.

50%.

Based on this response we estimate that the 4.1.1 What drives the EUA price?

bilateral market in 2005 was 100 Mt, or 27.6% of Prices increased significantly in the first half of

the total volume. Although bilateral trading will have 2005, going from about €7/t in February to almost

occurred at different times throughout the year, €30/t in July, before ranging from €20/t to €24/t for

by applying the average price through the year we the second half. Figure 4.6 shows the daily prices

find that the bilateral market in 2005 corresponds as reported by Point Carbon together with daily

to €1.8 billion. While we will certainly never know volumes in the OTC and exchanged markets.

Price changes based on fuel prices

Figure 4.3 More or less and weather

The relative shares of daily volumes for the brokered and

exchanged market in the EU ETS in 2005. Pure bilateral

What were the main drivers for the price development

trades not included.

over the year? As in any market, the price is set by

100 % supply and demand. The supply is here determined

first by the caps set under the different NAPs,

80 % together with the amount of reserve allowances

and CDM credits coming into the market. Demand

60 %

is set by the amount of emissions through the year

40 % in relation to the overall allocation. Briefly put, the

allowance demand can be measured by estimating

20 % the emissions from the different sectors under the

EU ETS and subtracting the caps. This produces

0%

what Point Carbon terms the emissions-to-cap (E-t-

C), our allowance demand indicator.

3- v

c

3- l

g

p

3- r

n

3- b

ay

n

ar

ct

Ju

Ap

No

De

Ja

Ju

Au

Se

Fe

M

O

M

3-

3-

3-

3-

3-

3-

3-

3-

Source: Point Carbon OTC Exchanges The E-t-C will change on a continuous basis due to

a number of factors, but in particular: weather, as

18 All rights reserved © 2006 Point Carbon

28 February 2006

Figure 4.4: Exchanges grow too

Monthly volumes of EUA trades in 2005 at the different carbon exchanges, in Mt CO2.

10

Volum e s thro u g h 2 0 0 5

ECX: 63.4%

Nord Pool: 24.0%

8 Powernext: 7.9%

EEX: 4.3%

EXAA: 0.3%

6

Mt CO2

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Source: Point Carbon ECX NordPool Powernext EEX EXAA

temperature determines power/heat demand and Have we seen evidence of the market reacting to

precipitation the potential for hydropower production; these fundamentals? In fact, the first year of the EU

and fuel prices, as the relative price for coal and gas ETS has shown that the market is indeed responding

will determine which of the fuels will be used for to changes in fuel prices and weather. Nevertheless,

power production. In other words, if the winter is policy decisions still have the potential to shift prices.

cold and the gas-to-coal price differential widens, See Point Carbon’s Carbon Market Analyst “After the

emissions will increase as more power is consumed NAPs” from 3 November 2005 for a full discussion

and coal, which emits more GHGs per unit of output on which policy events we anticipate to impact on

than gas, is the preferred fuel source. Thus, carbon price development in the future.

prices will also increase. A different situation would

occur in a mild and wet summer, where there is Market is responding to

less demand for power and the rainfall increases the fundamentals and policy events

potential for hydropower production.

Fig 4.7 shows the development of the EUA price

Figure 4.5 What the readers think throughout 2005 in relation to the impact from

Our subscribers’ best guess of the relative size of the fuel and weather to the overall short position, i.e.

bilateral market. the impact on Point Carbon’s allowance demand

Carbon Market Survey 2006 indicator E-t-C from relative coal/gas prices and

90

Q: What is your best guess of temperature/precipitation. It is evident from the

80 the bilateral market as graph that the market is to a large extent trading on

Number of respondents

70 percentage of total volume in changes in the fundamentals. The correlation (R2)

60 EU ETS? between the EUA price and the combined effect

50 from fuel and weather was 0.92 over the year as a

40 whole. The individual correlations to fuel prices and

weather were 0.89 and 0.48, respectively. This is

30

yet another signal of the market working effectively,

20 as participants and observers clearly see that the

10 market price is not arbitrary.

0

0-10% 10-25% 25-50% 50-75% 75-90% 90-100% However, some would still argue that the current

Source: Point Carbon price neglects fundamentals, in the sense that

19 All rights reserved © 2006 Point Carbon

Carbon 2006

Figure 4.6 Volumes and prices

Daily closing prices and traded volumes in EU ETS in 2005

3500 30

28

3000 26

2500 24

22

2000 20

ktCO2

18

€/t

1500 16

14

1000 12

500 10

8

0 6

24-Nov-05

23-Dec-05

3-Jan-05

4-Apr-05

3-May-05

29-Jul-05

29-Aug-05

1-Feb-05

26-Oct-05

2-Mar-05

1-Jun-05

30-Jun-05

27-Sep-05

Source: Point Carbon's Carbon Market Trader Volume Price

Figure 4.7 Driven by fuel prices

EUA prices from 8 Feb to end Nov 2005, left axis in €/t, compared to the changes to Point Carbon’s allowance demand

indicator E-t-C from fuel prices and weather, accumulated throughout 2005, right axis in Mt CO2.

35 140

R2 = 0,92

30 120

100

25

80

20

Mt CO2

€/t

60

15

40

10

20

5 0

0 -20

8-Aug

8-Sep

8-Feb

8-Mar

8-Apr

8-May

8-Jun

8-Jul

8-Oct

8-Nov

8-Dec

Source: Point Carbon EUA 2006 Fuel + weather (accumulated)

20 All rights reserved © 2006 Point Carbon

28 February 2006

“switching prices” in the UK are well above the What do market participants see as the most

EUA prices. Hence, one would need higher EUA important factors for carbon price development?

prices and/or lower gas prices to trigger substantial Fig 4.8 shows the response from our survey, where

switching from coal to gas. it is evident that fuel prices are seen as the most

important price determinant. Appoximately 45 % of

Majority of trading due to power the respondents considered fuel prices as the most

generators’ activities important factor, while more than 20 % considered

it to be the second most important factor. It is also

interesting to note that political factors are seen to

Not only does the price relation to fundamentals tell be the second most important factor in the short

us that the market has found reliable price indicators, term. Many of the political factors should already

it also shows to some extent which sectors that are have been cleared at this stage, but it is evident that

active in the market. The Power & Heat sector, which this politically created market still looks to policy for

is where the overall shortage has been placed, is announcements on supply, and to some extent also

used to trading on a daily basis, and importantly, demand.

is used to trading based on weather and fuel price

changes. Although there are some (larger) industrial It would clearly be a positive development if the

companies with their own trading departments, the importance of politics was reduced and replaced by

majority of trading activity - and price development a more predictable fundamental both as a risk and a

- in 2005 was due to power generators trading price driver. This will probably happen as the EU ETS

strategies. matures and confidence in its continuation accrues

and the outcome of legal and regulatory tussles

This dominance by the power sector has been used between the commission and MSs becomes more

by many to criticise the system, in particular in light predictable.

of the impact carbon costs have had on power

prices. As we will touch upon later in this report, Fuel prices most important in short-

the increased spot prices in the German and Nordic term perspective

power markets can to a large extent be explained by

the introduction of emissions trading. There are, however, political developments that

cannot be expected to be solved in the immediate

Figure 4.8 Short-term price drivers in the EU ETS

Based on responses from our web-survey

Fuel/other commodity prices

Political factors

Weather

CDM/JI supply

Long-term prices

Other factors

0% 20 % 40 % 60 % 80 %

Share of responses

Most important factor

Source: Point Carbon Second most important factor

21 All rights reserved © 2006 Point Carbon

Carbon 2006

Figure 4.9 Long-term price drivers in the EU ETS

Based on responses from our web-survey

Political factors

Fuel/other commodity prices

CDM/JI supply

Weather

Long-term prices

Other factors

0% 20 % 40 % 60 % 80 %

Share of responses

Most important factor

Source: Point Carbon Second most important factor

future. In particular, this relates to the developments 4.2 CDM and JI

towards an international climate agreement to Volumes in the project markets also increased

follow the Kyoto Protocol. Fig 4.9 shows what the considerably in 2005. The lion’s share of transactions

respondents to our web-survey saw as the most still takes place in developing countries, where

important price drivers in the long-term. Political CDM contracts (ERPAs) worth 397 Mt CO2e were

decisions are seen as by far the most important registered by Point Carbon, corresponding to an

factor, while it should also be mentioned that CDM/ estimated financial value of €1.9 billon (7% discount

JI supply is seen as more important in the long- rate). Thus, CDM accounted for 93% of the physical

term than the short-term. This shows that market volumes transacted in the project market and 95%

participants are looking to international policy for of the total financial value. The JI market is still

certainty on the future of the market, while at considerably smaller than CDM, but nevertheless

the same time they expect developing countries almost tripled in volume in 2005, growing to 28 Mt

to participate in an active manner through CDM CO2e, €95 million, worth of reported transactions.

investments. As we will show in the following Table 4.2 shows CDM and JI volumes in 2005 as

section, there is already evidence that this is taking registered by Point Carbon, together with estimates

place. on the financial value.

CDM saw 397 Mt, €1.9 billion. JI did

Table 4.2 CDM still dominates the project market 28 Mt, €95 million

CDM and JI volumes registered by Point Carbon in

2005. For simplicity, all payment is assumed to be

In 2005, a total of 397 million certified emission

done on delivery, and a 7% discount rate is applied.

reductions (CERs), at volume weighted average

price of 6.7 €/CER, were contracted for future

Volume Financial value delivery. As for JI, the volume of emission reduction

(Mt) (€ million) units (ERUs) contracted more than doubled, to 28

Mt, while the average price increased slightly to 5.1

CDM 397 1,985

€/t As Figure 4.10 shows, the volume has increased

CDM 2nd 4 50 throughout with Q4 as by far the most hectic

JI 28 96 contracting period in terms of volume signed. To

22 All rights reserved © 2006 Point Carbon

28 February 2006

have shown increased support for the project base

Figure 4.10 Most towards the end mechanisms, in particular China and Brazil. Also,

Quarterly volumes in the CDM and JI markets in 2005, in Mt large-scale projects are contributing significantly,

CO2e- with four HFC-23 decomposition projects signed in

2005.

350 Some of the bottlenecks at the institutional level,

300 both in host countries and at the CDM Executive

250 Board, have been overcome, or are in the process of

being removed. The CDM EB’s improved efficiency

200 in approving methodologies and projects, and the

150 positive signs in terms of establishment of the JI

100 Supervisory Committee have both added to the

increasing investment trend.

50

0 Bottlenecks are being removed

Q1 Q2 Q3 Q4

Source: Point Carbon CDM JI

China, India and Brazil are the main seller countries

when it comes to numbers of CDM ERPAs. The

some extent this might reflect when Point Carbon large volumes in China are primarily due to a few