Professional Documents

Culture Documents

Values Advocacy Council 2006 Filings

Uploaded by

watchdogsanmateo0 ratings0% found this document useful (0 votes)

20 views15 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views15 pagesValues Advocacy Council 2006 Filings

Uploaded by

watchdogsanmateoCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

Short Form

Retum of Organization Exempt From Income Tax

Under section S010, 827 oF of he internal Revenue Code

{Sicop ang ane to pve ours)

ove No 1s150

eee c/o HARDEN & EVANS ACCOUNTANCY CORP ieweeed

Fest retum 4100 MOORPARK AVE., SUITE #206 ets eee eee:

=a

= a

"must shach completed Schecde A (Form B90 br 990-22) oon ee Oo

aaa ia 5 em

1

J Organon pe (eck ony nt) — XT SH) CB) = (oswino) | Jeomrax oe | 1a EZ, oF 30-PP)

Woes | [ite corning ‘Gheck > | if te orgarszaton i nota secon ng organization and ts gross recaps are paral nat more fan

$BSibo. Arotarvs et requred: tutte organcavos chooses toe’ eka be sure he acempete ronan

T Aa ines 5, 6, and 7, to ine 9 to determine G's recaps; $100,000 or mare, ie Ferm 350 :

Instead of Fs

Bat hee Eapenses and ‘Changes in Net Assets or Fund Balances (See the inst

fons)

[1 Coninovtons, is, grants, and sar amounts recerved 1 31,047

2. Program sence revenue mcucing government fees and contracts. [2] 6,289

13 Membership dues and assessments,

4 Investment income a a

5a Gross amount om sao of assets otter than ventory... = [Sal

Less: cost or other basis and sales expenses oe

48] Gano nt) sae oft tar than ivetary ie Sa is eS) (atch ch). se]

£] 6 special events and acttes (attach schedule). It any amounts from gaming, checkhere | >]

B] a Grose revenue (not nctiding $ of contibutons

€] reported on ine 1)... 6a

b Less: rect expenses ober than Andrassing expenses 66]

« Net ncame or (ess) ftom special events and activites (ine 6a less ne 6) scl

7a Gross sales of inventory, less retums and allowances 24

1 Lese: cost of goods sold al

© Gross profit or Joss) rom sales of wwertory ine 7a les ine 70) 7¢

8 Ober reve (escite * = 8

pap 2 Total rover od ines 2,3, 4, Se, 65, ean cali ‘s[ 95,331

‘= 10 Grants and siiar amounts patd (attach schedule) a ZI 70

5111 Benetts paid to or for members... 8|.NOV-1 9 2007..19) n

112. Satanes, oter compensation, and employee benefts Q 7 68,455

£13 Professional fees and other payments to independent contacts. = 13, 2.117

i V4 Occupancy, rent bites, and mantenance OGDEN, UT 34 [11.775

15 intr, pbieaions postage, an 15 1.097,

Soe secon act eA TEMENT #1 ». Pease

gu “Total expenses (ads ies TO vou 1) eer +f | Toe, ore

Excess or (defi) forte year (ine 9 ess ine 17). =e we _(7.287)

FE? Retacnte tre plancas at pearing of yar (tom ine 27, conn (A) (rust aoe win erat year Fe 1,167

¥ §B20 Other changes in net assets of fund balances (attach explanation). : oo

21_Net asses or fund balances at end of year (combine ines 18 through 20) ofa TOT

[Balance Sheets ~ it Total assets on ine 25, column (6) are $250,000 o more, fle Form 950 stead of Form S50-EZ

‘Geo insbuctons) (A) Boarnng of year | — (B)End ayaa

22 Cash, sags, and investments . a Teal (16, 120)

23 Land and butdings 23

2A Other asets (desonbe © PLEDGES RECELVABLE 933_[zal___ 10,000

2 Total assets. [To T67 fasl 5 TO

26 Tolallabiiies (describe > ACCOUNTS PAYABLE ) 933-[26

27_Not assets or und balances {in 27 of column (must agree wi ine 2) Tris? [a] C6, 120)

‘BAA For Privacy Act and Paperwork Reduction Act Notice, se the separate instructions Tan = SB0.E2 4

G-il

72-154

7993 pace2

BRS VALUES ADVOCACY COUNCIL

[Statement of Program Service Accomplishments (See the instructions) Expenses

What ie orancato's pry empl upoxe) SEE STATEMENT 4 :

38 ieee Seeded, The uber ol perdans Bevcitea. or ofr relevant avormaton foreach a

EE STATEMENT #5,

TTT) Tihs amount nctudes foreign grants, check here. 29,899

[31 Other program services (atach schedule) 7

Grents I this amount mnctudes foreign grants, check here. Caen

2 Total sens. (dd lines 28a trough 31 >fz 255899

IVO[LIst of Officers, Directors, Trustees, and Key Employees (Ust each one even pal compensated Soe insvuctons)

(@) Tite and average hours] (C)Compercaton (# | (D)Gritutoas oT (E) Expense account

(A) Name and accross or week devoted | ‘not paid, enter 0) | enplye tent pans ant] Sn ofher alowances

{positon lee companion

DAVID LEE _SAWKINS_

si

“SAN JOSE, CA 95123 | PRESIDENT -0-+

a=

LAWRENCE 8. —PEGRAN —_| SECY/TREAST

TOE aa] “exec pre

SAN JOSE, CA 95136 40 68,455

[Eg ES Other Information (Note the statement requrement mn the mstuctons)

[Yes] Ne

33 Did the organization engage in any acbuly not prewously reported to the IRS? If "Yes, attach a detailed desonpbon

fof each actly

34 Were any changes made to the orang or gveing document bul oleate to the IS? Hf "Yes, atch a canformed copy of he changes

35 Mth rnization hed inca fom business sce, sachs those pated oa nes 2 6, and 7 (aang eters), but wt reget an Frm 90-7, atch

1 sateen play your reson foo repring thence on For 307.

{Did the organizaton have urvelated business gross income of $1,000 ar mare or 6033(¢) notice, reporting, and

‘rony tax requirements?

bit"Yes, has It ed a tax return on Form 990-T for his year?

35 Was here laude, dseauton, termination, or substantlcenracton dung the year?

(Yes; attach a statement) -

‘7a ater anoint pital eencve, de or nde as decid in he stucons Lszal__NONE

‘bid the organization file Form 1120-POL for hs year?

384 Di he orgarzaton borow rom, of mak any fons, ary ota. draco, ust, er key empayee of were

‘ny such loans made ina prior year and stil unpara at the tart of te period covered by thes return

me

~ee

Et

1b {T"Yes, attach the sch specified in the ine 38 insbuctons and enter

‘he amount volved. N/A

39 50I(C)7) organizations. Enter:

ainitiabon fees and capital contributions included on line 9 ae

¥.

sp tibet ett on et iow of et

Ferm S902 (2006)

rom 950-62 006 VALUES ADVOCACY COUNCIL

12-154 7993 page

f.*-| Other Information (Note the statement requirement in the instructions) (Continued)

“i SOV) crgeizatone, Erte mount of tx posed on te organzaton dang the year unde:

section 4911 > NONE j Section 4912 NONE ‘section 4955 > NONE

' S01(6X) and () organizations Did the organization engage i any sacton 4958 excess benef transaction during the Yes | No

Raa eet Ot Rennes Resa :

«En sor te need on eaten mangers dead acre cng te NONE

<4Ertr amount of tt on ine 4 remburse byte organization : Soe

« Al zganzaons A ay tw ng tot yr, as a eganzaon apr preted ie aie

“41 List the states with wach a copy ofthis retum 1s fled = CALIFORNIA :

Sammteocnd OWN O FIMTSTTARDEY § EVARE.AECTEY eon + SUR TER TIST_

(mabdat> 4100 MOORPARK AVE. #206, r

te any time during the calendar year, did the organization have an interest in or @ signature or other autharty over a. oe

Ee eee ee Sarat a ome rer olualer

ae ‘enter the name of the foresgn county: a N/A

See te nstuctos for exceptons and tng reqaremers fr Form TOF 0221.

At any time dunng the calendar year, did the organization maintan an office outside of the U.S.? 42c| x

It"Yes,’ enter the name of the foreign country: - N/A

43 Section 4347(a)(1) nonexempt chartable trusts fling Form S90EE nt of For TAT Gece ‘eu of Form 1047 Check here “oO

‘and enter the amount of tax-exempt interest received or accrued, the tax: fas | N/A

re

ee ge Sapte pet tow nea nd RTS

fe Seed ad cep ect ot

rain perma

"aie a oad bck ona casa at proper a2

NOVEMBER 10, 2007

om

LAWRENCE R. PEGRAM, EXECUTIVE DIRECTOR

> peer emt rane and te

pala an Pov 1

Paid rues cea, [ov 14 vd

fer es me, HARDEN & EVANS ACCOUNTANCY CORP

se > G100 MOORPARE AVE., SUITE #206

Only _[#rr% SAN JOSE, CALIFORNIA 95117-1798

BAA

Organization Exempt Under 0 He 145087

Sonim beeen Section 501(c)(3)

(Except Private Foundation) and Section 501(e), 501(N), 501(K),

BM or AaXt) Nonexempl Charade Tank 2006

a ‘Supplementary Information — (See separate instructions)

FiimalRonne'seme” | > MUST be completed by the above organizations and attached to their Form 990 or 990-EZ.

toe ascaton ae

VALVES ADVOCACY COUNC{L 72 - 15% 1993

‘Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(Gee instructions. List each one. If there are none, enter ‘None.’)

Name ate onan

Wiinnenation doa Ciiedoees [oaaman] Gaia |—atses

eo ee oe Res |. Qos.

ey one bin seater [Sot

--NONE-

Tota pumber of eter employees paid Be heraye cegeond mee

cover $80,000, on | Bets

[Patil == A] Compensation of the Five Highest Paid Independent Contractors for Professional Services

Gee ‘instructions. List each one (whether individuals or firms). If there are none, enter 'None.")

{@)Name and address of each indepéndent contractor paid more than $50,000 (@) Type of serwce (©) Compensation

ZT NETWORK 347

WEBMASTER Svc 4210 __

‘Compensation of the Five Highest Paid Independent Contractors for Other Services

(List each contractor who performed services other than professional services, whether individuals or

firms. If there are none, enter ‘None. See instructions.)

(@)Name and address of each independent contracter paid more tran $50,000 ©) Type of servee (©) Compensation

--NONE-:

Total umber of oer contractors recelwng sie?

‘ver $20,000 for otter services. En RES" Gee

'BAA For Paperwork Reductlon Act Notice, see the Instructions for Form 990 and Form S90-E2, Schedule A (Farm $60 or 990-EZ) 2008

TeEAOWIL o1n907

Schedule A (Form 990 oF 990-EZ) 2006, cy NCL TRISH 1993 __ +2902

Eli] Statements About Activities (See instructions.) Yes} No

T Tie your, has he organization alompled o uence nalbna), stale, o Toca] legslaton, netudng any atempt

fo muened pubic opmon Soa leglalve mater or referendum? W Ves, enier Oe toil experaes poe

for incurred in connection wit the lobbying activties.... * $. N/A

(Must equal amounts on line 38, Part V-A, or ine i of Part VBI)

COrganzations tat made an elecion under secbon 501() by fing Form 5768 must camp

Srgarzatons snes ¥ee'must complete Par VIB AND tach

{chbyng acives.

2 eng ny ta he poo tr racy mee, er oe rn a

Sea ee ee er ts area an ay

Seacoast het Sean stereo ten car aoe gm

Bonetiiary? (if the answer to any question 1s Yes,’ attach a detailed statement explaining the Wz )

Part VIA. Omer

IND attach a statement ghang a Getaled descripton of the

a Sale, exchange, o leasing of property? esses

b Lencng of money or oer extension of ea? 24

‘¢ Furnishing of goods, services, or facilites? 2c| x

Payment ot comensabon (or payment or rembursement of expenses! mare than $1000) 2g |X.

‘© Transfer of any part of its income or assets? 2e| XK

Se Qiplanabin cl fom be orpaucaton ceteranes fat recente quai to recene payments) 24

‘b Did the organwzaton have a section 403(p) annutty plan for its employees?. 3b) x

be rarer ace tid an sent nanan pepe, meng casement

Been nay uc omer re an wane ara cece atx

4 Did the organwzaton provide credit counseling, debt management, credit repair, or debt negobation services? 3d| xX

4124s unaton mann ay oer abrndet WYe campeon rah Mcrae [AT | x

Od the ergarzaton make ary tarable itor unr section #56? wl | xX

“ond ne erprtzaton mak a stbiton to ner, donor ads, of eae person? al [|X

‘Enter the total number of donor advised funds owned at the end of the tax year : >__NONE_

Err the apres val of ass hed all donor asad uns ow a heen ole tax ear > _ NONE

‘in [ies Retraed ring where Gonre Nave be ng procs ‘adnee on he desion or muesimen ts

Sone {in such funds or accounts >__None

Enter he aggregate value of assets held in all funds or accounts meluded on ine tat the end ofthe tax year > _ NONE

TEER OT ‘Schedule A (Form 950 or Form S802) 2006

Screase A Farm 990 90.27 206 VALUES ADVOCACY COUNCIL. TA |S 7993 Pages

Reason for Non-Private Foundation Status (See instructions.)

Toerty tat the organization naka prvale Randaton because Rar Pease check ony ONE applicable Box)

5 []Acturch, cowention of churches, or association of churches. Section 170014).

6 [JA senoot. Secton 1700xINANGD. (Also compete Part V)

7 [JAhospital ora cooperate hospital service organization. Secton 170((INANH).

8 [JA tedera, state, or focal government or governmental unt. Secvon 17000) NAN)

9 [JA mecieat research orgncaton operated n conyncton wih a hosp, Secbon 1700(1)(A(H) Enter the hospital's name, ty.

and state ™

10 D)Arorganization for me beneftof a colege or uwersiy owned of operated by 2 goverrmenta unt. Secton T7OQ\ IAM

Ci gyergenizaton opersted Ato 9 catege rly perated by a go TORNENLANEY.

11» Clg argzatn at oamaty ees a sat pa of ep tame goenmantl norton be gre ae

Co geserreise NS et ce ie ee Ei BOR RR

1b [JA communiy rust. Secton 708A. (Aso compete the Support Schaduein Pat VA

12 Dian organzaton at eal reees:() mor than 381 of ts supper rom centobns, mabe es and os resets

Dasa eras Oe ‘both exsphoe tr @) he mre han ii of Wat

Som gross vector and uvcalod buenos table west iG ert aston aegareby Be

er aor have 50,197. See socbon SOME). compet te Suppor Schedule n Pan WA}

ug

‘An argaizaten that rot conrleg by ary csquaifed persons (other tan fourdabon manager) and obverse meets the

PeaatBnerts of sccbon SOSe)ES. Cheek the bok tal Seserbes tee ype of supportng organisation. F

Dirwet ryp0 Citype mF unesenaty integrated Cryp0 omer

Provide the fallowing intormation about the supported organizations. (Soe mat ctore)

Name(s) of supported Erployer (Seal Tyetat tae sidported &

arian) ieoer NO” | orgaizan escrned | ortamasuerisied in| “upse

‘Rimes though ta | "Se supporang

sBowermeseion | Srpanii’s

documents?

Yes [Ho

t

Nor APPLICABLE

Tout c

u ation organized and operated to test for publ salty, Secbon SOH(AD, See nerucbors

BAA ‘SchedieA (Form 950 or S50ED 06

Teenown oven

Scheaule A Form 990 or 9907 2006 VALUES ADVOCACY COUNCIL AS4 FIIZ

[Support Schedule (Complete ony if you checked a box on ine 10, 11, or 12.) Use cash method of accounting

Note: You may use the worksheet in the mstuctons for canvering from the accrual o the cash method of account

Ecrangig cere | Be ab Bs Be 1S

75 Gis, gan and conmons

Cisatat ants See Ie 23 51233 B4O12. £200 LEVEES

16 Membership (ees recewved NONE.

17 ip tam sn

iamchg ies ayy

et vl ob rgncaieas

Sari pupae None

TOs ceo tre ria

‘Sans rmed ton pneeas

frp fd ein

‘Sah, ene da ctor So)

Resbemete pat bec

‘aloe or e198 None.

19 Het mene fom unt esos

Seite NONE

Tax ceverues lowed for he

titer porto or expended

Sie pao tor

So's Bah NONE

“BT The wave of serecst or

Feels uma,

by 9 goverment

Gri rtrur henge, bo not

ITaMde te value of sores or

flees say res

fo pic wo None.

Oheereoe Aaah

Seale Bs wt che

Sag Seep tor ae o

Boba ol nes 1S trou 22 | STARS LOIR Zaoo

24_Line 28 mies ine 17. Z 200

25 Enter 1% of ine 23, P40. $2.

Enter 2% of amountin column (6), tne 28

tb Papare at fo yur cards stow nae of nd anu contd by ech pron (tr on 3 gv pbty

tarnish a Be oe Sewn a Ba Bw or

‘sr nar be alta as ees oan

€ Total support for secton 50(a)() test Enter ine 28, conn (6). =

<4 Ad: Amounts fom column (6) for ines: 18 19 EET

2 250. zeal” “NVA

Public support (line 26¢ minus line 26d total.

{Public support percentage (line 260 (numerator divided byline 26¢ (denominator)

2 Organizations described on tine 12:

1 For amounts included in ines 15, 16, and 17 that wore recerved from a ‘disqualified person. eee

‘name of, and total arjounts received in each year trom, each ‘isquaified person. Bo not le this ist with your return. Enter the sum of

‘Such emiounts for each Year:

fast] NVA

(2003) ___NONS. a2)

‘For any amount included in te 17 that was received fom each person (ther than “dequalied persona), propare 2 it for your recone

{p shew tre rere of ae amousy cecewved for each year hat wos more a te larger of (Ip te amour on ene 250 re som)

$5,000. (neta in te ist orgarizatone described i une 5 bough 1, a= well ax reiasats) Do not ile tvs ist with your return

‘ter compubrig the cfterence between the amount received and fe larger amount desered in (I)or hee he se

Siterences (me excess amounts) for each year

(2005) __NONE,_____ oo ___ NONE. (2005) ___NONE.

‘Add: Armounts rm coli (@) for ines: 158A 16 __ NONE

7 __ None 2 — None. 2) NONE

|Add: Une 27 total NONE rd ine 27 wat NONE

# ible support (ine 27 total mus tne 27a ata)... [eel 249, 4

1 Total support fr section 509(a)@) test: Enter amount trom ne 23, cokamn (e).. . >LZzt | 49 Wks ve

Public support percentage (ine 270 (numerator vided by ine 27 (denominator) Zr 200+

Investment Incomé line 18, column (e) (rn divided by line Z7t (denomit *lz7 —

% ater yur tocar to snow, for each year, te name of he contour, We ate ar amaut Oe gran anda be! dosenpton of he

fate be gant Donet fle ist with Your return Bo nol mee these grate ie 1.

BAA TEEADR, O1n967 ‘Schedule A (Farm 990 or 950-62) 2006

‘Schedule A Form 990 or 07 206 VALUES ADVOCA 2. S47 Pages

Private School Qu ire (See instructior Aw Nor

‘(fo be completed ONLY by schools that checked the box online 6inPartIV) APPLICABLE.

Yes | No.

2 oes the orgrzaton hve aracaly nandsermnaor ply toward sents by statement ms charter, bylaws,

ther goversng nerument, or a esounon of govern Dodye se” m

30 Doss the organzation include a statement of its racally nondssriminatory policy toward students in all ts brochures,

es, and other written communications win the public dealing wif stxlont admissions, programs,

arsips?

[31 Has the organization publzed its racally nondiscrminatory policy trough newspaper or broadcast media dun

fhe period of salestaton for students, or during the regstakon pened fifhas no sohetabon program, 08 way at

makes the policy town foal pars of he general commun t serves? a

lt'Yes, please deseribe; i ‘No, please explan. (Ifyou need more space, attach a separate statement)

‘Records inccating the racial composition ofthe student body, faculy, and adminstrave staff? a

bb Records documenting that scholarships and other fhancial assistance are awarded on a racial

ondisorminatary basis? aeaneetinnnsnrnnn ncn ” ol NT

«€ Copies ofall catalogues, brochures, announcements, and over wnten communications to the public dealing

wif student admissions, programs, and scholarships?

[-]andatlach a st withthe names and EINs ofall members

the extnaion wil coat,

Tt request an automate 3-month (© months for a sesion S01(9 corporation required to fe Form 99077) extension of one

unt AUQUST JS, 20 27 _, to fle he exempt organzaton return for te organization named ebove

‘The extension or Be orgarzabon's em fr

> [Rl catendar your 20 O10 ot

> [tax year beginning 20 ___. and ending

2. Wins tax years fortes tan 12montns, check esson; — [Jintatrenen — [] Final etn

23a ts ppplenten is for Foon EDEL, SOOPF, SOO, 4721, or 669, eter te lentabve ta, ass any

onvehndable credits. See mstuctcns sals_ N/A,

bit tus appicaton 1s for Form 950-PF or 90-7, enter any retindable erects and estmated tax payments

made, elude any por yoar overpayment alowed 8 @ ced “en sels N/A

Balange Du, soc ne rom ine 2a eae yx parent a om, read i

Sebrmumvevone on eae, NS omen eye acls_NONE.

‘Caution f you are going to make an elector fund withdrawal wth ts Form 8868, see Form 8453-EO and Ferm 8879-€0 for

ayant neructons.

'BAA For Privacy Ack and Paperwork Reduction Act Notice, see

Form 6868 Rev 4 2007

Frm eso107

Form 8858 Rev 42007) Page 2

© If you ee fling for an Additional (not automatic) Month Extension, complote only Part Wand check tha Box. =U

‘Note. Only complete Part Il t you have already been granted an automatic 3-montn extension on a premously filed Form 8868.

ic) 3-Month Extension of Time. You must file original and one copy.

are tenaioe aT

Be” |VALUES Apvocacy CooNCUL s TR 54-1993

came [0 HARDEN # EVANS AccooErARCcy coRP. a

Bee” [4100 Mc ATE #200

BEERS | tr atm oat Bn Festa eo I

}SAN Jose, CAUFORNIA 95117-1703 a

“Chock type of return to be fled (Fle separate applicaton for each ret):

Form $60 Form 990: Form 1081-4 For 6069

Form 950-8 Form 950-7 (econ 401(@ o 408) ust) |Form 4720 Form 8870

Form 990-2 Frm 950-7 (rust other than above) Form S227

‘STOP1 De nt complete Part il you wore not already granted an automatic Smonth extension on a previously fied Form 8965

‘The books aren care of™_JOHN D. EVANS, CPA.

Telephone No. *_YO8- 985 -2157_ FAX No, > HOR ORS

tt the orgaruzaton does not have an office or place of business m the United States, chock tis BOK. vov-eees see .

«If his efor a Group Return, ene the orgarzaion's four digit Group Exemption Number (GEN)... NA Ie his is for

whole group, check tus box... > []. tits for part of the group, check tis box [_] and atach a ist nth te names ad EIN ofa

members the extension is for.

‘4 request an additonal Smart extension of ime unl NOVEMBER IS 207.

5 For calendar year 2OO(@ . or ther tax year begrning _ +20 ,andendng_ De

6 the tax yoar is for ln fran 12 mona, check reacons TT [Finatroum ” []Gnange accountng poncd

7 Stato in detail why you need the extension .. COUNSAbe HAS. GEPERIENCED SIGNIFICANT. LEARERSHIP_CHANGES:

DSRUPTING UTS OPERATIONS SRAPORTING CAPARIUTIES, FATENSION OF TIME To FIR A

_—SOMPLETE AND CopReeT RETURN IS HEREBY REQUESTED.

a I his application i for Form $60-BL, 950-PF, 90-T, 4720, or 6089, enter Me tentative ian. 1ss ary

onveinuable credits, See structions gals NONE.

Bits application is for Form 990-PF, $60-T, 4720, or 6069, enter any refundable credits and estmated tax

ents made. include any prior yéar ove’payment allowed as a creat and arly amount pard previously

hath Form 8868s aes _NONG

eae ene ee cs pre oe voce oe

rpg Subrag t ry teSe eeee y porpetm eem escort | ads None.

‘Signature and Verification

Notice to Applicant. (To be Completed by the IRS)

We have approved hs appeaion, Please attach his form tothe organizaton's ret,

We have not approved tis appeation. However, we have granted a 10-day grace period from the Inter ofthe date shown below or te

Shel ot cprabar our (tay sy ona oe, The se pa craves oes vat onan oe or

txectons eters requred to be made on e brid) tied eum Please atach bis frm fo te organzabon's Yeu

1 We have not approved tis appheaton. After considering te reasons stated nem 7, we canna grant your request for an extension ot

Une to fie, We're not granting a IO-day grace period

Wo cannot consider ths application because it was fled afte he extended due date ofthe return for which an extension was requested.

one

at

eee oe

‘Aiternate Maling Address. Enter te ederess i you want the copy of fils application for an adaonal 3-monih extension retired i an

fadaress afferent than the one entered above

4 COUN

or [tomers urs gSdei sto ost priest sons ox Fb nom

met VE, ¥

iyo ie oss ne Covey Ouatin pol BPC)

Se NIA _F5UT- 170%

DAA remea. 50167 Form 6868 (Rev 82007)

You might also like

- Values Advocacy Council 2008 FilingDocument21 pagesValues Advocacy Council 2008 FilingwatchdogsanmateoNo ratings yet

- Values Advocacy Council 2007 FilingDocument21 pagesValues Advocacy Council 2007 FilingwatchdogsanmateoNo ratings yet

- Club Wet's Lobbyist FilingDocument1 pageClub Wet's Lobbyist Filingwatchdogsanmateo100% (2)

- City Clerks AssociationDocument2 pagesCity Clerks AssociationwatchdogsanmateoNo ratings yet

- Marta Diaz Article From 03.09.09 Daily Journal ArticleDocument4 pagesMarta Diaz Article From 03.09.09 Daily Journal ArticlewatchdogsanmateoNo ratings yet

- Jumpin' Bail Metro March 18-24, 1999Document4 pagesJumpin' Bail Metro March 18-24, 1999watchdogsanmateoNo ratings yet

- It's Brutal in The Bail Business LA Times Mar. 25, 2005Document5 pagesIt's Brutal in The Bail Business LA Times Mar. 25, 2005watchdogsanmateoNo ratings yet

- Jerry Hill Asks The Civil Grand Jury To Look Into The SBWMA Selection ProcessDocument2 pagesJerry Hill Asks The Civil Grand Jury To Look Into The SBWMA Selection ProcesswatchdogsanmateoNo ratings yet

- Elizabeth Lewis Mailer BudgetDocument2 pagesElizabeth Lewis Mailer BudgetwatchdogsanmateoNo ratings yet

- Daily News 10.24.08 Lewis HenigDocument1 pageDaily News 10.24.08 Lewis HenigwatchdogsanmateoNo ratings yet

- David Henig, Candidate, Atherton City Council MailerDocument2 pagesDavid Henig, Candidate, Atherton City Council Mailerwatchdogsanmateo100% (1)

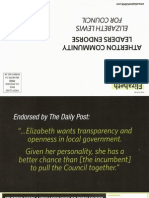

- Elizabeth Lewis, Candidate, Atherton City Council MailerDocument2 pagesElizabeth Lewis, Candidate, Atherton City Council Mailerwatchdogsanmateo100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)