Professional Documents

Culture Documents

West Haven Arbitration Award-Pension

Uploaded by

mbrackenbury0 ratings0% found this document useful (0 votes)

229 views58 pagesCity OF WEST HAVEN and AFSCME, Council 15, Local 895. Police Pension Case No. 2009-MBA-308 AWARD OF THE ARBITRATION PANEL. Undersigned arbitrators were designated to hear and decide the dispute in accordance with Section 7-473c of the Connecticut General Statutes. Panel members met in several executive sessions to deliberate and decide each outstanding issue. The agreed-upon language submitted at the arbitration hearing is incorporated and made a part of this award.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCity OF WEST HAVEN and AFSCME, Council 15, Local 895. Police Pension Case No. 2009-MBA-308 AWARD OF THE ARBITRATION PANEL. Undersigned arbitrators were designated to hear and decide the dispute in accordance with Section 7-473c of the Connecticut General Statutes. Panel members met in several executive sessions to deliberate and decide each outstanding issue. The agreed-upon language submitted at the arbitration hearing is incorporated and made a part of this award.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

229 views58 pagesWest Haven Arbitration Award-Pension

Uploaded by

mbrackenburyCity OF WEST HAVEN and AFSCME, Council 15, Local 895. Police Pension Case No. 2009-MBA-308 AWARD OF THE ARBITRATION PANEL. Undersigned arbitrators were designated to hear and decide the dispute in accordance with Section 7-473c of the Connecticut General Statutes. Panel members met in several executive sessions to deliberate and decide each outstanding issue. The agreed-upon language submitted at the arbitration hearing is incorporated and made a part of this award.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 58

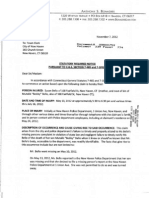

March 16, 2010 TRANSMITTAL MEMORANDUM

City of West Haven - and-

AFSCME Co. 15. Local 895. Police Pension

Case No. 2009-MBA-308

AWARD OF THE ARBITRATION PANEL

M. Jackson Webber, Esquire, Panel Chair John M. Romanow, Esquire, Management Member Paul Ariola, Labor Member

. . ... -------------

Representatives of the parties:

Christopher Hodgson, Esquire Certified return receipt requested

Richard Gudis, Esquire

Certified return receipt requested

cc: Town Clerk; City of West Haven Derrick Kennedy, CCM

John Olsen, President CT. AFL-CIO

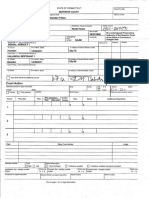

STATE OF CONNECTICUT

LABOR DEPARTMENT

*

*

*

*

ARBITRATION AWARD UNDER 7-473C

of the

GENERAL STATUTES, STATE OF CONNECTICUT

In the Matter of Arbitration Between:

CITY OF WEST HAVEN

March 16, 2010

-and-

AFSCME CO. 15 Local 895

Case No. 2009-MBA-308

The undersigned Arbitration Panel, having been duly appointed in accordance with the Rules of Procedure of the Connecticut State Board of Mediation and Arbitration, and pursuant to the provisions 7-473c of the General Statutes of the State of Connecticut, does respectfully make this Arbitration Award as required by said Statute.

REPRESENTATIVES OF THE PARTIES

Appearing for the City:

Christopher Hodgson, Esquire

Appearing for the Union:

Richard Gudis, Esquire

MEMBERS OF THE ARBITRATION PANEL

M. Jackson Webber, Chairman

John Romanow, Esquire Management Member

Paul Ariola Labor Member

INTRODUCTION

This dispute concerns bargaining between the City of West Haven and AFSCME, Council 15, Local 895 over the negotiation of a Successor Pension Agreement.

The undersigned arbitrators were designated to hear and decide the dispute in accordance with Section 7-473c of the Connecticut General Statutes. On May 7, July 23, August 13, September 8, September 10, September 16, and October 20, 2009, the parties appeared before the arbitration panel in West Haven,

Connecticut.

Both parties were represented and were accorded a

full opportunity to submit evidence, examine and cross-examine

witnesses and present arguments.

The parties' last best offers

on the issues in dispute were submitted to the panel on December 22, 2009. The panel members met in several executive sessions to deliberate and decide each outstanding issue.

The agreed-upon language submitted at the arbitration hearing is incorporated and made a part of this award.

1

STATUTORY FACTORS

"(2) In arriving at a decision, the arbitration panel shall give priority to the public interest and the financial capability of the municipal employer, including consideration of other demands on the financial capability of the municipal employer. The panel shall further consider the following factors in light

of such financial capability: parties prior to arbitration;

(A) The negotiations between the

(B)

the interests and

welfare of the employee group; ..... (C) changes in the cost of living; ..... (0) the existing conditions of employment of the employee group and those of similar groups; and ..... (E) the wages, salaries, fringe benefits, and other conditions of employment prevailing in the labor market, including developments in private sector wages and benefits."

2

ISSUES IN DISPUTE

3

In the Matter of Binding Interest Arbitration

CITY OF WEST HAVEN

CASE NO. 2009-MBA-308

-and-

Septer,nberI6,2009

AFSCME CO.15, LOCAL 895

POLICE CONTRACT

JOINT ISSUES IN DISPUTE - PENSION

Issue Paragraph Atticle/Section Party Description

# Number

1 0 City Change Effective and Ending Dates of Plan

2 9 1.08 City Effective Date

3 10 1.09 City Employee

4 13 1.12 City/Union Final Adjusted Salary

5 43 2.01 City Eligibili~ty to Participate

6 50a 3.03 City Employee Contribution 2010

7 SOb 3.03 City Employee Contribution 2011

8 SOc 3.03 City Employee Contribution 2012

9 SOd 3.03 City Employee Contribution 2013

10 50e 3.03 Union Years of Service/ Contribution

11 60 5.01 Union Calculation of Retirement Benefit

12 61 5.01 Union Calculation of Retirement Benefit

13 73 &74 5.06 City/Union Escalation Clause Adjustment for Retirement

Benefit

14 74a 5.07 Union Leave Sell-Back

15 74b 5.08 Union Military Service Buy-Back P:\GENERAL\mlk\917175\002\OOO75369.DOC

ISSUE 1 - Paragraph 0 -CITY

Change Effective and Ending Dates of Plan

The y is proposing that the Police Pension Plan would

commence January I, 2009, and run through December 31, 2016. The Union has proposed that the Police Pension Plan would terminate June 30, 2012.

The City stated "a 8-year term (2009-2016) is to have a workable period of time for the Plan so that the City does not have to negotiate it again so soon, but also to provide flexibility to the City in terms of determining what the economy will be in 2016. Mullin Testimony, Tr. 9/16/09, p.23. Also, the City had proposed a shorter period than the Union's proposal of 10 years because the City felt that 10 years was too long.

Further, the Union's current proposal of having the pension plan expire in 2~ years, on June 30, 2012, is untenable and impractical. The Union clearly wants to persuade the Panel to make the City come back to the Union with this proposal in 2012. The City submits that the union has submitted no evidence to support its argument that the defined contribution issue should be decided in 2012." (City Brief, page 7).

4

The Union believed that a shorter term pension plan with a modest employee contribution is the "wisest course of action". "Economists and politicians are all starting to suggest that it was a serious economic mistake to press for a hasty, major transformation of the U.s. economy on the heels of the worst

financial crisis in decades.

Frequently we are seeing that a

more effective approach would have been to concentrate first on fighting the recession and lay solid foundations for growth. Any plans to re-engineer the economy should be placed on the backburner, and kept them there until the economy emerges fully

from the recession and returns to robust growth." page 6).

It is not the norm that the pensions are negotiated for a

(Union Brief,

short period of time.

Thus the parties were unable to accept the

Union's proposal for a pension that would terminate June 30, 2012.

Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offers of the City for Issues 1 and 2 are accepted.

The City appointed Arbitrator agrees with the Neutral Arbitrator based upon the same Statutory Criteria, and the Union appointed Panel Member dissents on the selection of the Last Best Offer of the City based on the same Statutory Criteria.

5

ISSUE 3 -Paragraph 10 - Article/Section 1.09 - CITY Employee

ISSUE 5 -Paragraph 43 - Article/Section 2,01 - CITY Eligibility to Participate

The City is proposing that the word "employee" be defined as including members hired prior to November 1, 2009. "This ties in with the City's last best offer in Issue in Dispute #5, Section 2.01, that employees hired after November 1, 2009 shall not be eligible to participate in the Police Pension Plan but shall participate in the City of West Haven Pension Plan, which is a defined contribution 401(k) plan, with disability insurance. Hence, these two issues will be addressed together in this

section."

(City Brief, page 8).

"It is undisputed that the City borrowed $66 million in 2002 to fully fund the Plan. Not seven years later, the City is forecasted to be under funded again by at least $20 million in the January, 2010 reevaluation. As background, Steve Lemanski testified that the January, 2008 evaluation showed that the accrued liability of the plan was approximately $112.5 million against a market value of assets of $118 million, which devined the unfunded accrued liability. Tr. 9/16, pp. 36-37. At that time, the plan was over funded by $6.3 million, which he labeled

6

a 'negative unfunded liability.'

See Milliman Actuarial

Evaluation, January 1, 2008, City Exhibit 3 (City Vol. 11), Tab XI, p. 3.

Mr. Lemanski testified that while the Police Pension Plan was fully funded as of January, 2008, a primary source of the funds for the proceeds was from the 2002 pension obligation bond, which was approximately $66.3 million. Tr. 9/16, p. 48. As shown by Mr. Barron in his worksheet behind Tab XIV, City Exhibit 3 (City Vol. II), p. 2, as of 2002, the plan was 100% funded at $83,671,626, so the value of the pension was just over $17 million before the City bonded the balance of approximately $66 million to fully fund it. The liability to the City of the plan increased to just over $99 million in 2006, and then to just over $112 million for 2008, showing an annual growth rate of 6.4%. Id., pp. 52-53. This is also shown on Mr. Barron's worksheet, City Exhibit XIV, p. 21. Mr. Lemanski also explained that the terms of the pension obligation bond require that the pension be 100% funded. Tr. 9/16, pp. 49-50. Therefore, with a projected unfunded liability of close to $30 million as of August, 2009, the City is repaying just over $6 million in fiscal year 2011 if there was a $30 million annual shortfall. See Barron Worksheet,

p. 2.)

(City Brief, pages 9-10).

"The City updated the value of the pension plan as of December 7, 2009, showing that Morgan Stanley reports the value

7

as $103 mill

fore, Mr. Lemanski's estimate was not

r

off, and the City is still facing a $24 million shortfall, instead of a $27 million shortfall, using the December 7 number from Morgan Stanley.

Therefore, the Police defined benefit plan is strangling the City. The City not only had to borrow $66 million to fund it in 2002, but seven short years later now faces a shortfall of $24 million which it may have to repay over the next five years. The City cannot keep paying for the defined benefit plan for new hires." (City Brief, page 11).

"Milliman did a 25-year projection of the proposed pension plan change from the current defined benefit plan to a defined contribution plan where the City contributes 5% of the employee's salary. See City Exhibit 2 (City Vol. III), Tab V. Mr. Lemanski testified that they modeled the new defined contribution plan for the new hires over a 25-year period, using evaluation assumptions from the defined benefit plan in terms of the separations of existing members and being replaced by new hires. Tr. 9/16, p. 60. Looking at Milliman's chart, p. 2 behind Tab V, year one assumes that there will be 10 new hires and that would increase to 110 by year 25. Further, Milliman assumed that the new hires would each contribute 2% based on the City's existing 401(k) plan so that the City match would be 5%. Mr. Lemanski's assumption is

that 10 0

cers would retire in year one and that 10 officers

8

would

ace them.

Id., p. 61. In year one, the savings to the

City would be $21,554, representing the di rence in cost

between the employer contribution to the de contribution

plan, and the defined benefit City normal cost for the year (See Line 5 of the Projected Plan Change). By year 10, the savings in that one year would be approximately $122,000. By year 15, the annual savings would be close to $300,000. By year 20, the savings would be approximately $650,000. And for year 25, the

savings would be close to $1.5 million in that one year." Brief, pages 11-12).

The Union stated "The City testified that going to the 401(k) would not be a cost savings and at this time adding the 401(k) actually adds costs. (Tr id.) The Union strongly argues

(City

against making such a major change in a time of economic

turmoil."

(Union Brief, page 7).

From the evidence submitted, it is quite clear that the City is in a serious financial situation. The City has all other Unions, except the Police Union, in the Defined Contribution 401(k) Plan. This decision will give the City a chance to start to put its house in order.

Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offers of the City for Issues 3 and 5 are accepted.

The City appointed Arbitrator agrees with the Neutral Arbitrator

9

based upon the same Statutory Crite

, and the Union appointed

Panel Member dissents on the selection of the Last Best Offer of the City based on the same Statutory Criteria.

10

The current Pension Plan defines that pre-1999 hires who retire with twenty-five (25) or more years of service are entitled to the next higher rank as their "Final Adjusted Salary". "Mr. Lemanski calculated the savings to the City in eliminating this provision in his report dated December 2, 2009 (behind Tab V. City Exhibit 2, City Vol. III). He opined that the City's contribution would decrease by about $452,000 (5.91%

of payroll), assuming that the Plan's funded ratio remains below 10%. Tab. V, p. 2. He went through his worksheet (last page of Tab V) to show that by eliminating this job grade increase at retirement for pre-1999 hires, the liability for active members would be reduced from $43 million to approximately $41 million

(See, line 5), which reduces the Plan's liability by

approximately $1,85 million."

(City Brief, page 20).

The Union stated "The City has offered no economic data or operational rational to support it's demand to eviscerate the current pension plan while at the same time looking to eliminate the defined benefit pension for new hires. There is no

justification."

(Union Brief, page 8).

The Union further stated "The questioning goes on to explain

11

all s are assumptions and nothing more and the City made no

e to explain what the positive assumptions will be once the

economy improves."

(Union Brief, page 9).

The City was unable to sustain its burden of proof.

Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offer of the Union for Issue 4 is accepted. The Union appointed Arbitrator agrees with the Neutral Arbitrator based upon the same Statutory Criteria, and the City appointed Panel Member dissents on the selection of the Last Best Offer of the Union based upon the same Statutory Criteria.

12

ISSUE 6 -Paragraph SOa - Article/Section 3.03 - CITY Employee Contribution 2010

ISSUE 7 -Paragraph SOb - Article/Section 3.03 - CITY Employee Contribution 2011

ISSUE 8 -Paragraph SOc - Article/Section 3.03 - CITY Employee Contribution 2012

ISSUE 9 -Paragraph SOd - Article/Section 3.03 - CITY Employee Contribution 2013

The City is proposing a one-half (~%) percent increase in the employee contribution to the Police Pension Plan commencing July 1, 2010. The Union is proposing no increase to the current seven and one-half (7~%) percent.

Further, the City is proposing that the employee contribution be increased to eight and one-half (8~%) percent as of July 1, 2012. In addition, the City is proposing an increase to nine (9%) percent contribution by the employees as of July 1, 2014, and as of July 1, 2016, the employee contribution would go to nine and one-half (9~%) percent.

In Issue 9, the Union has proposed an increase of the employees' contribution to nine (9%) percent on June 30, 2012.

13

The C Y stated "Mr. Lemans 1% of salary to the Defined Bene

testified that an increase of Plan would result in an

offset to the City's contribution of about $78,000 per year,

based on fact that the police payroll is approximately $7.8

million. Id. P. 89.

Currently, the City has proposed a one half percent increase in contribution, going from 7.5% of pay to 8% of pay effective July 1, 2010. The City would thus recoup an approximate amount of $35-$40 thousand in increased employee contributions. With the liability of the Plan increasing by 6.4% every year, this is a reasonable request from the City and helps the City defray the

increased costs that

faces every year in funding this plan."

(City Brief, pages 21-22).

The Union argued "The City last best offer in the contract arbitration proposed general wage increases of 0% for the time the contract expired until July 1, 2010 where it offered a 1.5%. The general wage increase July 1, 2011 is 2%. The City argues that the "City's budget will be as tight in 2011 as it is today." The City has no way of predicting it will remain in such a dire financial state unless the Mayor plans on continuing to run the City of West Haven into the ground. A 3% general wage increase over the course of the contract will cost the City approximately $210,000.00; based on the police payroll budget of $7,000,000.00. If the panel were to award the City the increases in employee

14

contributions it would have the effect of saving the city $78,000.00 a year (TR 9/16/09 P 89) Essentially in the years the City is proposing an increase in the employee contribution and a 0% general wage increase the average officers salary is decreasing by approximately $650.00 a year. That number is based on $78,000 divided by 120 police 0 cers which is what the chief said the department averaged. Awarding any of these issues to the city in light of their last best offers in the contract is excessive and out of line with other municipalities and not justified by the evidence. There is no doubt the City will argue in it's pension brief as it did in its contract brief that the "City is desperately trying to dig out from it's current deficit." It should be noted that in their contract brief the City states to the panel that there was a cash crisis that compelled withdrawing FY 10 pension contributions to meet expenses ... (City Contract Brief p 18) However, that action was ultimately undone less than a week later which calls into

question how real the cash crisis was. pages 12-13).

The Union is proposing to increase the employee contribution

(EX D)."

(Union Brief,

to nine (9%) percent on June 30, 2012. The City is proposing that employee contribution as of June 30, 2012 would be eight and one-half percent. This Panel has already decided that the duration of this pension shall be to December 31, 2016.

15

Therefore, to have a gradual increase of the employee contribution seems appropriate.

Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offers of the City for Issues 6, 7, 8 and 9 are accepted. The City appointed Arbitrator agrees with the Neutral Arbitrator based upon the same Statutory Criteria, and the Union appointed Panel Member dissents on the selection of the Last Best Of r of the City based on the same Statutory Criteria.

16

This issue was withdrawn by the Union.

17

ISSUE 11 -Paragraph 60 - Article/Section 5.01 - UNION Calculation of Retirement Benefit

ISSUE 12 -Paragraph 61 - Article/Section 5.01 - UNION Calculation of Retirement Benefit

The Last Best Offers of both parties are the same. Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offers of the Union for Issues 11 and 12 are accepted.

18

ISSUE 13 -Paragraphs 73 & 74 - Article/Section 5.06 - CITY/UNION Escalation Clause Adjustment for Retirement Benefit

The City is proposing to delete Section 5.06(b) and (c) and replace it with language that.would grant the Board of Police Commissioners periodic review to determine the cost of living. "The City is proposing to delete those provision of the current Section 5.06(b) and (c) providing for an escalation provision based on the amount of the general wage increase to active employees. As to employees hired prior to July 1, 1993, the escalation provision is that the retirement benefit should be increased by an amount equal to 50% of the actual dollar amount that the active employees receive. Subsection (b). As to employees hired after July 1, 1993, their retirement benefit shall be increased by one half of a percent of the general wage

increase. Subsection (c)."

(City Brief, page 23).

The Union argued "The uniform incorporates its argument at issue 4 regarding escalation in so far as the city has offered no rational for this change. There was no testimony or economic or financial data to support this proposal. Removing the escalation clause does not change the city's net pension obligation in the end." (Union Brief, page 18).

The City was unable to submit convincing evidence to sustain

19

its position. Therefore, after reviewing all of the information received by the arbitration panel, in light of the Statutory Criteria, the Last Best Offer of the Union for Issue 13 is accepted. The Union appointed Arbitrator agrees with the Neutral Arbitrator based upon the same Statutory Criteria, and the City appointed Panel Member dissents on the selection of the Last Best Offer of the Union based upon the same Statutory Crite a.

20

ISSUE 14 -Paragraphs 74a - Article/Section 5.07 - UNION Leave Sell-Back

This issue has been withdrawn by the Union.

21

Military Service Buy-Back

This issues has been withdrawn by the Union.

22

In the Matter of Arbitration Between:

CITY OF WEST HAVEN

-and-

AFSCME, CO. 15, Local 3583

Case No. 2009-MBA-308

Romanow, Esquire anagement Member

Paul AJiOla

crrv OF \XIEST HAVEN'S LAST BEST OFFER - PENSION CASE NO. 2009-MBA-308

In the Matter of Binding Interest Arbitration

CITY OF WEST HAVEN

CASE NO. 2009-MBA-308

-and-

DECEMBER 22,2009

AFSCME CO. 15, LOCAL 895

POLICE CONTRACT (PENSION)

LAST BEST OFFER - PENSION

CITY OF \VEST HAVEN'S LAST BEST OFFER PENSION CJ\SE NO. 2009-MBA-308

ISSUE IN DISPUTE #1

COVER PAGE

January 1,2009 - December 31, 2016

CITY OF \V'EST HA YEN'S LAST BEST OFFER - PENSION CASE NO. 2009-MBA-308

ISSUE IN DISPUTE #2

ARTICU~ 1.08

DEFINITIONS

EFFEC11VE DATE

Section 1.08 Effective Date. January 1,2009 December 31,2016

CrIY OF \X'EST HAVEN'S LAST BEST Or'FI-':R - PENSION CASE NO. 2009-MBA-308

ISSUE IN DISPU7E #3

AR71CLE 1

DEF1NI710NS

SEcnON 1.09

Employee. Any regular, full-time, permanent, investigatory and uniformed member of the City of West Haven Police Department who is duly sworn and vested with police powers hired before November 1, 2009.

CITY OF WEST I1£'\ YEN'S LAST BEST OFFER - PENSION CASE NO. 2009-MBA-308

ISSUE IN DISPUTE #4

ARTICU~ 1

DEFINITIONS

SECTION 1.12

Delete section 1.12

CrIY OF ·WEST HAVEN'S L'\ST BEST OFFER PENSION CASE NO. 2009-l'vIBA-308

ISSUE IN DISPUl1~ #5

ARTICLE 2

EUGIBIUTY

SECTION 2.01

Eligibility to Participate. Each Employee who was a Participant in the Prior Plan shall continue as a Participant. Any other Employee shall become a Participant on the date that the Employee commences employment. Regular, full-time, permanent, investigatory and uniformed members hired after November 1, 2009 shall not be eligible to participate in the City of West Haven Police Department Pension Plan and shall participate in the City of West Haven Pension Plan (defined contribution 401 (k) plan).

{Employees hired after November 1, 2009 will be eligible for disability retirement, under a City Policy at 45% of final salary up to the age of 65.}

CITY OF \'VEST 1M. YEN'S LAST BEST OFFER - PENSION Cr\SE NO. 2009-MBA-308

ISSUE IN DISPUTE #6

ARTICLE 3

FUNDING POVCY AND CONTRIBUTIONS

SECTION 3.03

Employee Contributions.

(c) Effective July 1, 2010, each Participant shall contribute to the Plan the annual amount of eight percent (8%) of Compensation for the Plan Year.

CITY OF WEST IIAVEN'S U\ST BEST OFFER PENSION CASE NO. 2009-MBA-308

ISSUE IN DISPUTE #7

ARnCLE 3

['UN DING POLICY AND CONTRIBUnONS

SEcnON 3.03

Employee Contributions.

(d) Effective July 1, 2012, each Participant shall contribute to the Plan the annual amount of eight and one-half percent (8.5%) of Compensation for the Plan Year.

CITY OF WEST HA VEN'S LAST BEST OFFER - PENSION CASE NO. 2009-l'vffiA-308

ISSUE IN DIJPUTE #8

ARTICLE 3

FUNDING POUCY AND CONTRIBUTIONS

SECTION 3.03

Employee Contributions.

(e) Effective July 1, 2014, each Participant shall contribute to the Plan the annual amount of nine percent (9%) of Compensation for the Plan Year.

CITY OF WEST IIAVEN'S LAST BEST OFFER - PENSION CASE NO. 2009-tvffiA-308

ISSUE IN DISPUTE #9

ARTICLE 3

FUNDING POLICY AND CONTRIBUTIONS

SECTION 3.03

Employee Contributions.

(f) Effective July 1, 2016, each Participant shall contribute to the Plan the annual amount of nine and one-half percent (9.5%) of Compensation for the Plan Year.

CITY OF WEST HA YEN'S Lf\ST BEST OFFER - PENSION CASE NO. 2009-l'vIBJf\-308

ISSUE IN DISPUTE #10

ARTICLE 3

FUNDING POIJCY AND CONTRIBUTIONS

SECTION 3.03 - NEW SECnON E

No new section e.

CI1Y OF \'x/EST HA YEN'S LAST BEST OFFER - PENSION CASE NO. 2009-J'yffii\-308

ISSUE IN DISPUTE #11

ARTICLE 5

CALCULATION OF RETIREMENT BENEFIT

SEcnON 5.01

(a) two and one-quarter percent (2.25%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service, provided the Participant has at least ten (10) Years of Service, plus

CITY OF WEST HAVEN'S LAST BEST OFFER PENSION CASE NO. 2009-MBA308

ISSUE IN DISPUTE # 12

AR77CLE 5

CALCUL/1110N OF REI1REMENT BENEr'lT

SECTION 5.01

(b) three percent (3.0%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service in excess of twenty (20),provided that in no event shall the Accrued Benefit be less than $2,000/year, nor more than seventy five percent (75%) of a Participant's Final Salary, or Final Adjusted Salary if applicable.

CITY OF WEST HA YEN'S LAST BEST OFFER PENSION CASE NO. 2009-MBA-308

ISSUE IN DIJPUTE # 13

ARTICLE 5

CALCULATION OF RETIREMENT BENEHT

SECTION 5.06

(a) The provIsIons of this Section shall not apply to the Retirement Benefit of a Terminated Vested Participant.

The Board of Police Commissioners shall periodically review the plan to determine whether to provide a cost of living increase to the retirement benefit.

Delete paragraphs band c.

CITY OF WEST I-V\ YEN'S LAST BEST OFFER - PENSION CASE NO. 2009-.MBA-308

ISSUE IN DIJPUTE #14

ARTICLE 5

CALCUJ..../1TION OF RETIREMENT BENE vrt

SECTION 5.07 (NEW)

No new section a.

CITY OF WEST HA YEN'S Li\ST BEST OFFER - PENSION CASE NO. 2009-NffiA.-308

ISSUE IN DISPUIE #15

ARTICLE 5

CALCULATION OF RETIREMENT BENEFIT

SE010N 5.08

No new section b.

l' \ C EN ERA] .\mlk \ 917175 \002\00075654.DOC

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE # 1

COVER PAGE

ISSUE IN DISPUTE #1

COVER PAGE

CURRENT PLAN LANGUAGE:

(Effective January 1, 1999)

UNIONS PROPOSAL:

Date of Award - June 30. 2012

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE # 2

ARTICLE 1.08

DEFINITIONS

EFFECTIVE DATE

Section 1.08 Effective date. Date of Award - June 3D, 2012

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE # 3

ARTICLE 1.

DEFINITIONS

Section 1.09

CURRENT PLAN LANGUAGE:

Employee:

Any regular, full time employee, permanent, investigatory and uniformed

member of the City Of West Haven Police Department who is duly sworn and vested with police powers.

UNIONS PROPOSAL

Employee: Any regular, full time employee, permanent, investigatory and uniformed

member of the City Of West Haven Police Department who is duly sworn and vested with police powers.

West Haven Police Local 895 Last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE # 4

ARTICLE 1.

DEFINITIONS

Section 1.12

CURRENT PLAN LANGUAGE

Section 1.12 - Final Adjusted Salary. For a participant employed prior to January 1, 1999, who has completed twenty-five (25) years or more Years of Service, the participant's Final Adjusted Salary shall be the annual Compensation of an Employee holding the next higher rank to that held by the Participant prior to retirement. A Participant holding the rank of Chief prior to retirement shall not be entitled to a Final Adjusted Salary regardless of the Participant's Years of Service. For any Participant who commences employment on or after January 1, 1999, there shall be no Final Adjusted Salary and the Participant's benefits shall be determined by reference to Final Salary only.

UNIONS LAST BEST OFFER

Section 1.12 - Final Adjusted Salary. For a participant employed prior to January 1,1999, who has completed twenty-five (25) years or more Years of Service, the participant's Final Adjusted Salary shall be the annual Compensation of an Employee holding the next higher rank to that held by the Participant prior to retirement. A Participant holding the rank of Chief prior to retirement shall not be entitled to a Final Adjusted Salary regardless of the Participant's Years of Service. For any Participant who commences employment on or after January 1, 1999, there shall be no Final Adjusted Salary and the Participant's benefits shall be determined by reference to Final Salary only.

West Haven Police Local 895 Last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUIE #5

ARTIa..E2

EUGIBIUTY

SECITON 2.01

CURRENT PLAN LANGUAGE:

Eligibility to Participate. Each Employee who was a Participant in the Prior Plan shall continue as a Participant. Any other Employee shall become a Participant on the date that the Employee commences employment.

UNIONS LAST BEST OFFER

Eligibility to Participate. Each Employee who was a Participant in the Prior Plan shall continue as a Participant. Any other Employee shall become a Participant on the date that the Employee commences employment.

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE #6

ARTICLE 3

FUNDING POUCY .AND CONTRIBUTIONS

SECllON3.03

CURRENT PLAN LANGUAGE:

Employee Contributions.

(a) Prior to January 1, 1999, each Participant shall contribute to the Plan the annual amount

of seven percent (7%) of Compensation for the Plan Year.

(b) On and after January 1, 1999, each Participant shall contribute to the Plan the annual amount

of seven and one-half percent (7.5%) of Compensation for the Plan Year.

UNIONS LAST BEST OFFER

Retain current language with no increase into employee contribution

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE #7

ARTI0E3

FUNDING POLICYAND CONTRIBUIIONS

SECTION 3.03

CURRENT PLAN LANGUAGE:

Employee Contributions.

(a) Prior to January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven percent (1%) of Compensation for the Plan Year. On and after January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven and one-half percent (1.5%) of Compensation for the Plan Year

UNIONS LAST BEST OFFER

Retain current language with no increase into employee contribution

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUIE #8

ARTIaE3

FUNDING POUCY AND CONTRIBUTIONS

SECTION 3.03

CURRENT PLAN LANGUAGE:

Employee Contributions.

(a) Prior to January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven percent (7%) of Compensation for the Plan Year .On and after January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven and one-half percent (7.5%) of Compensation for the Plan Year.

UNIONS LAST BEST OFFER

Retain current language with no increase into employee contribution

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE #9

ARTIClE}

FUNDING POVCY AND CONTRIBUTIONS

SECI10N 3.03

CURRENT PLAN LANGUAGE:

Employee Contributions.

(a) Prior to January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven percent (1%) of Compensation for the Plan Year. On and after January 1, 1999, each Participant sllall contribute to the Plan the annual amount of seven and one-half percent (1.5%) of Compensation for the Plan Year.

UNIONS LAST BEST OFFER

(a) On and after June 30, 2012, each Participant shall contribute to the Plan the annual amount of nine percent (9%) of Compensation for the Plan Year.

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUrn #10

ARTIaE3

FUNDING POUCY AND CONTRIBUTIONS

SECDON 3.03 - NEW SECDON E

CURRENT PLAN LANGUAGE:

Employee Contributions.

(a)

Prior to January 1, 1999, each Participant shall contribute to the Plan the annual of seven percent (7%) of Compensation for the Plan Year.

amount

(b) On and after January 1, 1999, each Participant shall contribute to the Plan the annual amount of seven and one-half percent (7.5%) of Compensation for the Plan Year.

UNIONS LAST BEST OFFER

Union Withdraws Issue

Wes~ Haven Police Local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUIE #11

ARTICLES

CALCULATION OF RETIREMENT BENEFIT

SECTION 5.01

CURRENT PLAN LANGUAGE:

(a) two and one-quarter percent (2.25%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service, provided the Participant has at least ten (10) Years of Service, plus

UNIONS LAST BEST OFFER

(a) two and one-quarter percent (2.25%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service, provided the Participant has at least ten (10) Years of Service, plus

West Haven Police Local 895 Last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE #12

ARTICLES

CALCULATION OF RETIREMENT BENEFIT

SECTION 5.01

CURRENT PLAN LANGUAGE:

(b) three percent (3.0%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service in excess of twenty (20),provided that in no event shall the Accrued Benefit be less than $2,000/year, nor more than seventy five percent (75%) of a Participant's Final Salary, or Final Adjusted Salary if applicable.

UNIONS PROPOSAL:

(b) three percent (3.0%) of such Participant's Final Salary, or Final Adjusted Salary, if applicable, multiplied by Years of Service in excess of twenty (20),provided that in no event shall the Accrued Benefit be less than $2,OOO/year, nor more than seventy five percent (75%) of a Participant's Final Salary, or Final Adjusted Salary if applicable.

West Haven Police Local 895 Last Best Offers Pension Case No 2009-MBA-308

IJSUE IN DISPUTE #13

ARTICLE 5

C4.LCUG1TION OF RETIREMENT BENEFIT

SECTION 5.06

CURRENT PLAN LANGUAGE:

Escalltllnn Clause Adjustment fnr Retirement Benefit.

(a) The provisions of this Section shall not apply to the Retirement Benefit of a Terminated Vested Paeticipanr.

(1)) For Employees who were hired prior to July 1,1993, the following escalation provision shall apply. In the event that: the annual salary paid to active Employees holding a rank equivalent to the rank held by the Retired Participant is increased, the Retirement Benefit payable to said retired Participant shall be increased in an amount equal [0 fifty percent (50%) of the actual dollar amount of the increase that the active Employee receives. Said increased Retirement Benefit shall be payable over the same period of rime that said active Employee receives the increased annual wage.

(c) For employees who are hired on or after July 1, 1993, and who retire thereafter, the following escalation provision shall apply. In the event that the annual salaries paid to active Employees are increased by a general wage increase through collective bargaining, the Retirement Benefic payable to retired Participants shall be increased by one-half of the percentage general wage increase. For example, if there is a general wage increase of four pcltcent (4%), Retirement Benefits shall increase by two percent (2%).

UNIONS PROPOSAL

Escalation Clause Adjustment for Retirement Benefit.

(a) The provisions of this Section shall not apply to the Retirement Benefit of a Terminated Vested Participant.

(b) For Employees who were: hired prior to July 1, 1993. the following escalation provision shall apply. In the event that the annual salary paid [0 active Employees holding a rank equivalent to the rank held by the Retired Participant is increased, the Retirement Benefit payable to said retired

West Haven Police Local 895 Last Best Offers Pension Case No 2009-MBA-308

Participant shall be increased in an amount equal to fifty percent (SOO/I)) of the actual dollar amount of the increase chat the active Employee receives. Said increased Retirement Benefit shall be payable over the same period of rime that said active Employee receives the increased annual wage.

(c) For employees who are hired on or after July 1, 1993, and who retire thereafter, the following escalation. provision shall apply. In the event that the annual salaries paid to active Employees are increased by a general wage increase through collective bargaining, the Retirement Benefit payable to retired Participants shall be increased by one-half of the percentage general wage increase. For example, if there is a general wage increase of four percent (4%), Retirement Benefits shall increase by two percent (2%).

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUTE #14

ARTICLE 5

CALCULATION OF RETIREMENT BENEFIT

SECllON 5.07 (NEW)

CURRENT PLAN LANGUAGE:

None

UNION WITHDRAWS

West Haven Police local 895 last Best Offers Pension Case No 2009-MBA-308

ISSUE IN DISPUIE #15

ARTIaE5

CALCULATION OF RETIREMENT BENEFIT

SECflON5.08

CURRENT PLAN LANGUAGE:

None

UNION WITHDRAWS

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Bello - Intent To SueDocument3 pagesBello - Intent To SuembrackenburyNo ratings yet

- Town-By-Town Voter TurnoutDocument5 pagesTown-By-Town Voter TurnoutmbrackenburyNo ratings yet

- ZULLO Jason Govt Memo Opp Bond Mod 021412Document7 pagesZULLO Jason Govt Memo Opp Bond Mod 021412mbrackenburyNo ratings yet

- Sunshine HouseDocument9 pagesSunshine HousembrackenburyNo ratings yet

- Berg LawsuitDocument12 pagesBerg LawsuitmbrackenburyNo ratings yet

- Certified Connecticut Election Results.Document7 pagesCertified Connecticut Election Results.mbrackenburyNo ratings yet

- P.J. Case - Settlement AgreementDocument13 pagesP.J. Case - Settlement AgreementmbrackenburyNo ratings yet

- Fe Andmaybeteiminatedbyemployeeormutua@Rt'Esorupon: Haven ofDocument4 pagesFe Andmaybeteiminatedbyemployeeormutua@Rt'Esorupon: Haven ofmbrackenburyNo ratings yet

- CCJEF V Rell, 2nd Amended ComplaintDocument64 pagesCCJEF V Rell, 2nd Amended ComplaintmbrackenburyNo ratings yet

- Adverse EventsDocument80 pagesAdverse EventsmbrackenburyNo ratings yet

- Dixwell Avenue Congregational Church, UCCDocument1 pageDixwell Avenue Congregational Church, UCCmbrackenburyNo ratings yet

- MILLER, Et Al Protective OrderDocument6 pagesMILLER, Et Al Protective OrdermbrackenburyNo ratings yet

- Feb. 9, 2012 - Pattis Motion To DismissDocument25 pagesFeb. 9, 2012 - Pattis Motion To DismissmbrackenburyNo ratings yet

- 2012 Connecticut Midwinter Waterfowl Survey ResultsDocument1 page2012 Connecticut Midwinter Waterfowl Survey ResultsmbrackenburyNo ratings yet

- FitzGerald Distinguished Flying Cross CitationDocument2 pagesFitzGerald Distinguished Flying Cross CitationmbrackenburyNo ratings yet

- Statement of Mayor Maturo Re - Gallo 01-30-12Document1 pageStatement of Mayor Maturo Re - Gallo 01-30-12mbrackenburyNo ratings yet

- West Haven Letter To Mayor 12-12-11Document2 pagesWest Haven Letter To Mayor 12-12-11mbrackenburyNo ratings yet

- All Ing Town Fire District TerminationDocument5 pagesAll Ing Town Fire District TerminationmbrackenburyNo ratings yet

- VEMS ReportDocument3 pagesVEMS ReportmbrackenburyNo ratings yet

- DECD Email of December 14Document1 pageDECD Email of December 14mbrackenburyNo ratings yet

- Postal Service MemoDocument1 pagePostal Service MemombrackenburyNo ratings yet

- Joseph Fitzgerald StatementDocument2 pagesJoseph Fitzgerald StatementmbrackenburyNo ratings yet

- Powell WarrantDocument10 pagesPowell WarrantmbrackenburyNo ratings yet

- Tabor Test ReportDocument19 pagesTabor Test ReportmbrackenburyNo ratings yet

- AT&T vs. West HavenDocument46 pagesAT&T vs. West HavenmbrackenburyNo ratings yet

- West Haven Drug Arrest WarrantDocument2 pagesWest Haven Drug Arrest WarrantmbrackenburyNo ratings yet

- Dauria Arrest ReportDocument13 pagesDauria Arrest ReportmbrackenburyNo ratings yet

- SEEC - Derby AgreementDocument5 pagesSEEC - Derby AgreementThe Valley IndyNo ratings yet

- Sears Closings ListDocument2 pagesSears Closings ListmbrackenburyNo ratings yet

- State of The Sound ReportDocument52 pagesState of The Sound ReportmbrackenburyNo ratings yet