Professional Documents

Culture Documents

NAACP CranleyOECAdvisory Opinion 07222008

Uploaded by

cch5020010 ratings0% found this document useful (0 votes)

12 views8 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views8 pagesNAACP CranleyOECAdvisory Opinion 07222008

Uploaded by

cch502001Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

Smitherman Daley Conway F 5137510244 pel

“ ‘O10 ETHICS COMMISSION

Ana Marie Traccy, Chair ry

Meron Braco oregon, Oka 425

ian ‘Telephone: (614) 466-7090

Shirley Mags Fas: (614) 466-8368

David , Fres!, rw sthies.ohio.pow

‘Executive Director

July 22, 2008

John Cranley

810 Matson Place, Suite 203

Cincinnati, Ohio 45204

Dear Mr. Cranley:

‘On April 24, 2008, the Ohio Ethics Commission received your request far an advisory

opinion. In your letter, you explained that you are a member of the Cincinnati City Council.

‘You are also a member of City Lights Development (City Lights), a limited liability company

(LLC) that is pursuing a property redevelopment project within Cincinnati. To facilitate this

project, City Lights plans to request the assistance of the Port of Greater Cincinnati Development

Authority (port authority).

‘You have explained that City Lights will ask the port authority to:

2) “Issue revenue bonds. to pay for public improvements in the City Lights

development;

(@) = Contract with city. Lights to construct the improvements; and

(3) ‘Repay the money borrowed from ‘the bondholders by obtaining the city’s

authorization to have the portion of real property taxes that are payable in the area

of the City Lights development be authorized to be service payments from a tax

increment financing (TTF) district...”

City Lights will also request that the Cincinnati Planning Commission rezone the property in the

development area. City council, which appoints some members ofthe port suthority, must

authorize the service payments from the TIP and will make the final decision regarding the

zoning request.

* Arthe Commission meeting on July 18, 2008, you stated that the amea that included the City Lights Development

‘was designated 8 TIF diswict is December 2005. You explained the, at the time the TIF legislation was passed,

there were no specific development projects planned for the area. You stated that you were a mnmber of council

‘whea the TDP legislation wae eoacted but you did not Vole ca the ordinance for reasous Unselaled mp the issues you

Ihave raised here,

‘Promoting Ethics in Public Service for Ohio since 1974

Smitherman Daley Conway F 5137510244 P-

John Cranley

July 22, 2008

Page 2

‘You stated that, pursuant to your understanding of the Ethics Laws, you have disclosed

your interest in City Lights and its development project to the city and the port authority and

have completely removed yourself from the LLC’s dealings with the city regarding the project.

‘You stated that you will also recuse yourself, as a council member, from any vote related to the

Project. You asked if the disclosure of your interest in the project and your abstention from

related matters is sufficient to comply with the prohibitions of the Ethics Law and related statutes

in order for you to continue your council service batil the end of your term in 2009.

Brief Answer

‘As set forth more fully below, disclosure and abstention are insufficient for you to

comply with the Ethics Laws if the LLC will seek or receive any financial benefit from the TIF.

If the LLC intends to seek service payments from the TIP, you umst either step down from your

Position on city council or ead your relationship with the LLC before any authorization is

Proposed to or made by the city.

Tf the LLC intends to forego TIF assistance, disclosure of your interest and abstention

from matters affecting the project may be sufficient for you to comply with public contract

sestrictions against your Conflict and related to revenue bonds and other port authority contracts,

‘and the prohibitions of the law related to the rezoning of the property. You will also be required

to demonstrate that you can meet an exception contained in the public contract law and that you

can comply with other restrictions in the Ethics Law and related statutes.

Purpose of an Advisory Opinion

At the ontset, it must be noted that the purpose of an Ethics Commission advisory opinion.

is to provide guidance upon which 2 public official or employee can rely before he engages in an

action that may be prohibited by the Ethics Law. The Commission has explained that its

function in rendering an advisory opinion is not a fact-finding process. Obio Ethics Commission

Advisory Opinion No. 94-002. The Commission can ‘rénder an advisoty opinion only in

response to a hypothetical question or a question that involves the prospective conduct af the

person who requests the opinion. Adv. Ops. No. 75-037, and 94.002. Therefore, this opinion

will address only prospective matters and will not reach conclusions ou any past actions.

C. 2921. = in a Public

A city council member is a public official subject to R.C, 2921.42(A)(3), which states

that no public official shall knowingly;

During the public official’s term of office or within one year thereafter, ‘occupy any

position of profit in the prosecution of a public contract authorized by the public

official or by a legislative body, commission, or board of which the public official

‘was a member at the time of authorization, unless the contract was let by

competitive bidding to the lowest and best bidder.

Smitherman Daley Conway F 5137510244

John Cranley

July 22, 2008

Page 3

R.C. 2921.01(A); Adv. Op. No. 89-008. A “public contract” is the purchase or acquisition, or a

contract for the purchase or acquisition, of property or services by or for a city.

RC. 2921.01()(1Xa). The Ethics Commission has held, and comrts have agreed, that a political

subdivision’s purchase or acquisition of commmmity and economic development services, or urban

revitalization services, through the use of loans, grants, tex exemptions, land rentilization

rograms, revenue bands, or other similar programs or incentives, constitntes a “public contract”

regardless of whether services are funded through local or federal money. Adv. Ops. No. 84-011,

85-002, 89-008. See State v. Lardi, 140 Ohio App.3d 561, 569 (2000), discretionary appeal not

allowed, 91 Ohio St3d 1523, 91 Ohio St3d 1526, 91 Ohio St3d 1536, motion _for

92 Ohio St34 1422 (2001)

‘Tax increment financing works by exempting the value of real property improvements

from taxes. R.C. 5709.40. The nmnicipality authorizes a TIF by enacting legislation. Id. A

taxpayer whose operations are located within a TIF continues to make payments to the

in an amount equal to the real property tax Usbility that otherwise would have been

due had the property not been exempted. R.C. 5709.40 and R.C. 5709.42. These paymeats in

lieu of taxes, called service payments, are then used to finance the improvements designated in

the ordinance. Id.

The city’s designation of a development as a TIF, which provides an incentive for

commercial and residential developers to construct projects that will provide economic growth to

the city, is a public contact. See City of Cincinnati TIF Policy and Cincinnati Manicipal Code

Section 740-3 (“city assistance” means providing a developer with tax increment financing).

‘See also R.C. 5709.40 and Adv. Op. No. 89-008 (a tax abatement which is granted by a city in

‘or urban renewal services by the city).

‘A public official occupies a position of profit in a public contract when he will realize a

financial advantage, gain, or benefit, which is a definite and direct result of the public contract.

See Adv. Ops. No. 92-013 and 92-017. A person with an ownership intesest ia a business

Occupies a position of profit in the contracts of the business. See Adv. Ops. No. 90-003 and

O30? ‘See also Adv. Ops. No. 76-012 and 2006-02 (2 “membership interest” in an LLC is a

meuiberx’s share of the profits and losses of the LLC and the right to receive distribution). As a

member of City Lights, a ee

corporation, ~~.

‘A public contract is “authorized” by a public official or board if the contract could not have

been awarded without the approval of the official, the position that he holds, or the board on which

he serves. See Adv. Ops. No. 87-004 and 92-008. The legislative authority of a municipal

comporation has the sole authority to enact TU? approving legislation and to authorize the

allocation of revenve collected under a TIF to a specific development project. RC. 5709.40.

° if peroons interest in a company is limind to awning a frectional amount of sick (ender aoc peceat, the

pearon is not considered to occupy a position of praft inthe onexpany.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Cincinnati NAACP Actions and Results Highlights 2007 To 2012Document2 pagesCincinnati NAACP Actions and Results Highlights 2007 To 2012cch502001No ratings yet

- City Cinti SBEContract Award Report 2010 First QTRDocument1 pageCity Cinti SBEContract Award Report 2010 First QTRcch502001No ratings yet

- NAACP City of Cinti Contract Award Reports 2007 Thru 2009Document3 pagesNAACP City of Cinti Contract Award Reports 2007 Thru 2009cch502001No ratings yet

- NAACPcaricatureCPS01152010 NAACPDocument1 pageNAACPcaricatureCPS01152010 NAACPcch502001No ratings yet

- 2010.04.19. Public Records Request For CPS and 2010.04.23 CPS Response MergedDocument2 pages2010.04.19. Public Records Request For CPS and 2010.04.23 CPS Response Mergedcch502001No ratings yet

- NAACP Cincinnati 2009 Candidates Questionnaire Part 1Document42 pagesNAACP Cincinnati 2009 Candidates Questionnaire Part 1cch502001No ratings yet

- NAACP CranleyOECAdvisory Opinion 07222008Document8 pagesNAACP CranleyOECAdvisory Opinion 07222008cch502001No ratings yet

- NAACP City of Cinti Contract Award Reports 2007 Thru 2009Document3 pagesNAACP City of Cinti Contract Award Reports 2007 Thru 2009cch502001No ratings yet

- NAACP Cincinnati 2009 Candidates Questionnaire Part 2Document39 pagesNAACP Cincinnati 2009 Candidates Questionnaire Part 2cch502001No ratings yet

- Cincinnati NAACP 2009 Cincinnati City Council Legislative Report CardDocument1 pageCincinnati NAACP 2009 Cincinnati City Council Legislative Report Cardcch502001No ratings yet

- 2009 Ohio Conference Advance RegistrationDocument11 pages2009 Ohio Conference Advance Registrationcch502001No ratings yet

- City of Cincinnati 2009 SBE Spending Report January Thru AugustDocument16 pagesCity of Cincinnati 2009 SBE Spending Report January Thru Augustcch502001No ratings yet

- NAACPCinti Exec Comm 2009 PDFDocument1 pageNAACPCinti Exec Comm 2009 PDFcch502001100% (2)

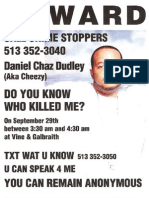

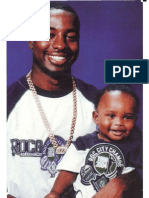

- Daniel Chaz DudleyDocument1 pageDaniel Chaz Dudleycch502001No ratings yet

- John HarrisDocument1 pageJohn Harriscch502001No ratings yet

- The Buffet Dinner (PR Vs 9X)Document7 pagesThe Buffet Dinner (PR Vs 9X)cch502001No ratings yet