Professional Documents

Culture Documents

S&P 500 Update 25 Apr 10

Uploaded by

AndysTechnicalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S&P 500 Update 25 Apr 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

S&P 500 Daily and Weekly Candlesticks

The potential “doji” star top on the Weekly was clearly negated with the market sporting another bullish continuation stick. The S&P

finished on the highs for the day and week. There is nothing remotely bearish about these candles….

Daily Weekly

Andy’s Technical Commentary__________________________________________________________________________________________________

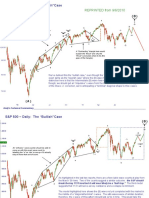

S&P 500 Weekly with the 8,13 and 55 week EMA

I’m going to keep highlighting various interesting Moving averages because I

know that these get followed by a large number of participants. I think the

weekly 8 (red), 13 (green) and 55 (blue) exponential moving averages highlight

the usefulness of MA analysis. Bulls don’t seem to have anything to worry as

long as the 8 week EMA stays above the 13. Check out the way the 55 week

EMA held PERFECTLY twice.

It’s actually quite RARE for countertrend

waves to hit and reverse at exact Fibonacci

levels*, but you have to believe there are a

ton of sell orders positioned at 1229, the

61.8% retracement of the entire decline. This 55 Week EMA holds twice

area will provide resistance on the “first go.”

8/13

bullish

cross

*It’s much more common for waves flowing in the same

direction to adhere to Fibonacci relationships.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 June e-Minis ~ (240 min.)

Reprinted from 4/18/10

a?

If there is a way for a wave to take longer to c?

complete, then assume that it will….

f

d

b

g b?

“w” e “x”

c

-5-

c

a

-3-

a

“x” -1-

b -4-

d -2-

The “orthodox” crowd won’t like this count, but this is another good

b alternative. The prolonged congestion higher in the middle of the pattern

could have been one of those “diametrics” (seven-legged corrections). This

a wave count suggests more sideways or higher price action before we

conclude the wave up from early February. A break of 1175 would damage

e this idea.

“y”

c (X)

Andy’s Technical Commentary__________________________________________________________________________________________________

c

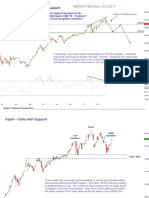

S&P 500 June e-Minis ~ (300 min.)

a

If there is a way for a wave to take longer to

complete, then assume that it will….

b

f

d

b

This sure looks like a triangle

g with a “thrust” that is just

“w” “x” beginning….

c e

-5-

c This overlapping price action in the middle of

the progression highly suggests the

a presence of a corrective “x” wave

-3-

a

-1-

-4-

-2-

The market held key support last week and now seems to have completed a

triangle b-wave. The “thrust” is just now underway, so it looks like the first few

b days of next week will have an upward bias.

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

“y”

c

S&P 500 June e-Minis ~ (60 min.)

a

-c- -b-

-d-

-a-

The triangle might

have concluded here.

-e-

b

f

-b- -c-

-a-

One good target for this setup would be 1237 for a = c. The “thrust” should achieve

75-125% of the widest part of the triangle. This would give a range between 1220 and

g 1236. The midpoint (100%) would give us 1228. If a triangle did conclude at either

“x” 1197.50 or 1201.50, then those levels should be solid support for the short

term/daytraders looking to ride this “thrust.”

Andy’s Technical Commentary__________________________________________________________________________________________________

Sugar #11 - Daily (Non-Log)

Sugar, once the “hottest” commodity on the board, has now fallen 50%.

However, there are some signs that this current washout is coming to a

“2” conclusion. The markets seems to be breaking down out of a triangle

-2- formation, which suggest that the next leg down might be the conclusion of

this move. The entire wave resembles an “impulsive” five wave structure. If

the final Wave “5” looks like “1”, then we should get a bottom near 14c/lb in

the next several days.

-4-

“1” -1-

-3-

2

The light blue line would be the

Elliott Wave Channel for the

proposed “impulse” lower. -5-

1 4

a

-b-

3 c

“4”

5 e

“3”

-a-

d

-c-

b

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- S&P 500 Update 18 Apr 10Document10 pagesS&P 500 Update 18 Apr 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Market Update 27 June 10Document9 pagesMarket Update 27 June 10AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Dollar Index 15 Feb 2010Document4 pagesDollar Index 15 Feb 2010AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- DXY Report 11 April 2010Document8 pagesDXY Report 11 April 2010AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- MATH 153-Test2-Review For Fall 2019Document12 pagesMATH 153-Test2-Review For Fall 2019Bryan LeonardNo ratings yet

- Live Worksheets AnswersDocument1 pageLive Worksheets AnswersVeselin PavlovNo ratings yet

- Progress - Test Intermediate Level - IELTSDocument8 pagesProgress - Test Intermediate Level - IELTSRatih MaulidiniNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- Preliminary Survey on Γ-semiringsDocument15 pagesPreliminary Survey on Γ-semiringssreenus1729No ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- COMP20007 Design of Algorithms: Graphs and Graph ConceptsDocument17 pagesCOMP20007 Design of Algorithms: Graphs and Graph Concepts李宇皓No ratings yet

- Baidu (BIDU) Daily Linear ScaleDocument6 pagesBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- Space eSewingTemplateDocument2 pagesSpace eSewingTemplateVioleta StanojevicNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- How to Ace an English Proficiency TestDocument4 pagesHow to Ace an English Proficiency TestClaraNo ratings yet

- SNAP 2005 Answer KeyDocument7 pagesSNAP 2005 Answer KeyHarsh JainNo ratings yet

- Answer Key-Snap 2005: Symbiosis National Aptitute Test (SNAP) 2005 1Document7 pagesAnswer Key-Snap 2005: Symbiosis National Aptitute Test (SNAP) 2005 1Yogesh KumarNo ratings yet

- Qdoc - Tips - Remedial Test in Eapp HumssDocument3 pagesQdoc - Tips - Remedial Test in Eapp HumssAirahNo ratings yet

- Mathematics Paper 3 Discrete Mathematics HLDocument4 pagesMathematics Paper 3 Discrete Mathematics HLNeelamNo ratings yet

- I I I I: Music RudimentsDocument5 pagesI I I I: Music RudimentsNathaniel MooreNo ratings yet

- Graphalgorithms-Bfs and DfsDocument14 pagesGraphalgorithms-Bfs and Dfsjayit sahaNo ratings yet

- Future TestDocument3 pagesFuture TestDA MANo ratings yet

- BofA To Keep Foreclosures Despite New Utah Law - The Salt Lake TribuneDocument6 pagesBofA To Keep Foreclosures Despite New Utah Law - The Salt Lake TribunejrosswilsonNo ratings yet

- IMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music NotationDocument1 pageIMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music Notationmichel kowalevskyNo ratings yet

- Machine Learning Course - Matrix FactorizationDocument7 pagesMachine Learning Course - Matrix FactorizationnagybalyNo ratings yet

- RPV Unit 2Document2 pagesRPV Unit 2Rodrigo Miranda NascimentoNo ratings yet

- Vocabulary: Common ObjectsDocument2 pagesVocabulary: Common ObjectsEdith ChambillaNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- ColoursDocument2 pagesColoursDelfina PiñeyroNo ratings yet

- LI L2 Vocabulary ExtensionDocument8 pagesLI L2 Vocabulary ExtensionGiselleNo ratings yet

- Duke John of Polland His Galiard: Tenor ViolDocument1 pageDuke John of Polland His Galiard: Tenor ViolLeandro MarquesNo ratings yet

- Landlocked BuccaneerDocument1 pageLandlocked BuccaneerIan LardoNo ratings yet

- FTL PaperDocument63 pagesFTL Paperthatg1rlNo ratings yet

- IELTS - Review Module 2 (Mar 10)Document16 pagesIELTS - Review Module 2 (Mar 10)nguyenthianhtam.cosmosNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Nation of Islam Timeline and Fact Sheet (Brief)Document6 pagesNation of Islam Timeline and Fact Sheet (Brief)salaamwestnNo ratings yet

- General Math Second Quarter Exam ReviewDocument5 pagesGeneral Math Second Quarter Exam ReviewAgnes Ramo100% (1)

- PW Show Daily at Frankfurt Day 1Document68 pagesPW Show Daily at Frankfurt Day 1Publishers WeeklyNo ratings yet

- SAMPLE Information On RapeDocument2 pagesSAMPLE Information On RapeMay May100% (2)

- 420jjpb2wmtfx0 PDFDocument19 pages420jjpb2wmtfx0 PDFDaudSutrisnoNo ratings yet

- Sunat PerempuanDocument8 pagesSunat PerempuanJamaluddin MohammadNo ratings yet

- 6 Certification DefaultDocument2 pages6 Certification DefaultBhakta PrakashNo ratings yet

- Recruitment On The InternetDocument8 pagesRecruitment On The InternetbgbhattacharyaNo ratings yet

- TheoriesDocument87 pagesTheoriesCzari MuñozNo ratings yet

- KPK Progress in PTI's Government (Badar Chaudhry)Document16 pagesKPK Progress in PTI's Government (Badar Chaudhry)badarNo ratings yet

- Amazon InvoiceDocument1 pageAmazon InvoiceChandra BhushanNo ratings yet

- Appendix F - Property ValueDocument11 pagesAppendix F - Property ValueTown of Colonie LandfillNo ratings yet

- The First Charm of MakingDocument8 pagesThe First Charm of Makingapi-26210871100% (1)

- Barredo Vs Garcia and AlmarioDocument10 pagesBarredo Vs Garcia and AlmarioRson RTacastacasNo ratings yet

- Power Plant Cooling IBDocument11 pagesPower Plant Cooling IBSujeet GhorpadeNo ratings yet

- Uttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsDocument140 pagesUttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsAchyut SinghNo ratings yet

- Rizal Back in MadridDocument3 pagesRizal Back in MadridElle Dela CruzNo ratings yet

- AIDA Model in AdvertisingDocument3 pagesAIDA Model in AdvertisingHằng PhạmNo ratings yet

- Clearlake City Council PacketDocument57 pagesClearlake City Council PacketLakeCoNewsNo ratings yet

- Tiket Kemahasiswaan Makasar1Document4 pagesTiket Kemahasiswaan Makasar1BLU UnramNo ratings yet

- TA Employee Referral ProgamDocument3 pagesTA Employee Referral ProgamagalaboNo ratings yet

- Unit 1 Personality, Vision and Work of Aurobindo: 1.0 ObjectivesDocument10 pagesUnit 1 Personality, Vision and Work of Aurobindo: 1.0 ObjectivesAnkita RijhsinghaniNo ratings yet

- Sarva Shiksha Abhiyan, GOI, 2013-14: HighlightsDocument10 pagesSarva Shiksha Abhiyan, GOI, 2013-14: Highlightsprakash messiNo ratings yet

- Marketing MetricsDocument29 pagesMarketing Metricscameron.king1202No ratings yet

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDocument5 pagesGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloNo ratings yet

- Blades of Illusion - Crown Service, Book 2 First Five ChaptersDocument44 pagesBlades of Illusion - Crown Service, Book 2 First Five ChaptersTerah Edun50% (2)

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- Early Registration FormDocument2 pagesEarly Registration FormMylene PilongoNo ratings yet

- RGPV Enrollment FormDocument2 pagesRGPV Enrollment Formg mokalpurNo ratings yet

- BT - Cat35fr005 - Field Report LaafDocument21 pagesBT - Cat35fr005 - Field Report LaafFabianoBorg100% (2)