Professional Documents

Culture Documents

Whether Derivatives Report

Uploaded by

BalajiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whether Derivatives Report

Uploaded by

BalajiCopyright:

Available Formats

Weather Derivatives

Weather derivatives are financial instruments that can be used by

organizations or individuals as part of a risk management strategy to reduce

risk associated with adverse or unexpected weather conditions. The

difference from other derivatives is that the underlying asset

(rain/temperature/snow) has no direct value to price the weather derivative.

The weather derivates market started in 1997 in the US as the first

transaction in this regard was recorded there but now this weather

derivatives market has spread to all major markets. According to US energy

market, US$ 1 trillion of the US economy is affected by the weather risk. By

the year 2000 about US$ 3.5 billion worth of weather derivates were traded

in the US.

There are 4 major players in the weather derivates market :

• MARKET MAKERS

• BROKERS

• INSURANCE AND REINSURANCE COMPANIES.

• END USERS such as Gas and power marketers and utilities etc.

Derivative is a contract or a security whose value or payoff derives from

the price of an underlying asset. Derivatives help an investor to control the

risks of changes in the prices of the underlying asset. For eg. An exporter

who receives his payments in foreign currency is exposed to currency risk ie

the risk of home currency appreciating with respect to the foreign currency.

When Rupee started appreciating against the US Dollar the textile exporters

and IT companies faces heavy losses if they had not hedged their positions.

Weather Measures

Weather measures are considered underlying assets of the weather

derivatives, as the price of a futures contract is an asset for an option on a

commodity. The two most common weather measures are – Heating Degree

Days (HDD) or Cooling Degree Days (CDD) – depending on the specifics of

the contract. It is estimated that 98-99% of the weather derivatives are now

using these temperature parameters. Other measures are based on

precipitation, which can be measured by the amount of rain over a given

time period or on Snowfall, measured by the amount of snow (or sleet) over

a given time period.

HDD and CDD

These weather measures are used to measure the demands that arise

due to the departure of the average daily temperatures from a base level.

An HDD (or CDD) is the number of degrees the day’s average temperature is

above (or below) a base temperature. They are calculated as follows:

Daily HDD = Max (0, base temperature – daily average temperature)

Daily CDD = Max (0, daily average temperature – base temperature)

Where,

Base temperature is defined as, the pre-defined base temperature, and,

Daily average temperature is measured as the average between the daily

high and the daily low.

Weather Derivatives in India

We have seen the how popular the weather derivatives have been

U.S.A. there the major customers for weather derivatives have been utility

companies but by Chicago mercantile exchange’s own admission the real

potential will be tapped when farming related activities start using the

weather derivatives. Weather derivatives have been launched in India as

well. Here the major customers will be the farming community. We don’t see

a huge potential for the derivatives by utility companies as India is a power

shortage nation and we don’t see the chances of excess power due to cooler

summers or warmer winters. The reasons why we think the weather

derivatives will be success in India are:

● Farmers

● Agriculture credit off-take in ninth plan – Rs. 2,31,798 crores

(grew @ 20% pa); Target for X plan – Rs. 7,36,570 crores

● 90% crop losses on account of weather related risks

● Rural Economy is highly weather dependent

● Commodity Traders

● Weather related supply bottlenecks make dry-land commodities

very volatile

● Intraday volatility of Guar, chilly touches 10-15% (daily trading at

national exchanges touches Rs.1000 crore daily)

● Vegetable and fruit Mandis highly dependent on temperature

(Delhi Mandi trade alone touches Rs.1000 crore annually)

● Trader income dependent on weather vagaries

● Industries like agro-input companies, food processing industry,

companies, plantations, FMCG, Banks, Power sector etc.

● Not uncommon to find Agri-Input companies, whose sale dips by over

30-40% due to fluctuation in rainfall

What needs to be done to establish a market for weather

derivatives in India:

First thing that needs to be done is to create the much needed

cash/spot market in India. Then we need to create an active futures/options

trading market in India

Deepening the Primary market

● Technology development

● Resolving the key constraints

Developing the secondary market in randem.

● Launching the Indices for key regions.

● Commodity funds, Agri-funds, Rainfall speculators, International

trading funds.

● Push for regulations on participation by Banks and MFIs.

● Presence in both the OTC and exchange traded market.

● Developing the Hybrid market.

BIBLIOGRAPHY:

http://en.wikipedia.org/wiki/Weather_derivatives

http://www.indianmba.com/Faculty_Column/FC1008/fc1008.html

http://financial-

dictionary.thefreedictionary.com/Weather+Derivative

http://www.livemint.com/2009/08/02222554/Ask-Mint--Weather-

derivatives.html

http://www.speedwellweather.com/

http://www.google.co.in/imgres?

imgurl=http://www.kwernerdesign.com/blog/images/thankU.jpg&im

grefurl=http://www.kwernerdesign.com/blog/general/&h=361&w=45

0&sz=42&tbnid=tqu-a

You might also like

- Whether DerivativesDocument11 pagesWhether DerivativesPreity YadavNo ratings yet

- Weather Risk Management in IndiaDocument39 pagesWeather Risk Management in IndiaMilliMehraNo ratings yet

- Weather Risk Management in IndiaDocument39 pagesWeather Risk Management in IndiaSonam VijNo ratings yet

- Microsoft Word DocumentDocument14 pagesMicrosoft Word Documentnileshgpatel88No ratings yet

- A Quick Guide To Weather DerivativesDocument3 pagesA Quick Guide To Weather DerivativesHummingbird11688No ratings yet

- Weather Derivatives - The ImpactDocument3 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- Weather DerivativesDocument19 pagesWeather DerivativesSneha Lee100% (1)

- Introduction to Weather Derivatives: A Risk Management Tool for Businesses Impacted by WeatherDocument6 pagesIntroduction to Weather Derivatives: A Risk Management Tool for Businesses Impacted by WeatherAbhay KamathNo ratings yet

- Introduction To International Business EnvironmentDocument10 pagesIntroduction To International Business EnvironmentSuresh ManiNo ratings yet

- DocxDocument7 pagesDocxRodrigo PerezNo ratings yet

- Thesis On Weather DerivativesDocument8 pagesThesis On Weather Derivativesamandawilliamscolumbia100% (1)

- Int Biz EnvDocument11 pagesInt Biz EnvHarsh AgarwalNo ratings yet

- Weather DerivativesDocument6 pagesWeather DerivativesRuchit DoshiNo ratings yet

- Risk Management: Credit, Weather, Energy, and Insurance Derivatives & Derivative MishapsDocument20 pagesRisk Management: Credit, Weather, Energy, and Insurance Derivatives & Derivative MishapsNishita SodagarNo ratings yet

- Economic ResourcesDocument28 pagesEconomic Resourcesayub_balticNo ratings yet

- Risk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranDocument2 pagesRisk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranTOSHAK SHARMANo ratings yet

- 23 Weather Energy DerivativesDocument9 pages23 Weather Energy DerivativestheanoflabeNo ratings yet

- IMT Covid19Document7 pagesIMT Covid19DEEKSHA DNo ratings yet

- IFM Guide to International Financial Management ConceptsDocument46 pagesIFM Guide to International Financial Management ConceptsSwati Milind RajputNo ratings yet

- Weather Derivatives - The ImpactDocument2 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- IBE: Analyzing International Business EnvironmentsDocument23 pagesIBE: Analyzing International Business EnvironmentsNidhuNo ratings yet

- Business Environment FactorsDocument7 pagesBusiness Environment FactorsRENUKA THOTENo ratings yet

- Thesis Weather DerivativesDocument5 pagesThesis Weather Derivativesjenniferontiveroskansascity100% (2)

- 1 Factors Affecting Business& Impact of COVID-19 On Various SectorsDocument34 pages1 Factors Affecting Business& Impact of COVID-19 On Various SectorsprettymandyNo ratings yet

- United Grain GrowersDocument4 pagesUnited Grain GrowersBoris SiraitNo ratings yet

- Hedging DerivativesDocument32 pagesHedging DerivativesSaurav KumarNo ratings yet

- Weather Derivatives and The Weather Derivatives MarketDocument10 pagesWeather Derivatives and The Weather Derivatives Marketmak112005gmailNo ratings yet

- Economics Defined: Production of GoodsDocument22 pagesEconomics Defined: Production of Goods'Sabur-akin AkinadeNo ratings yet

- Shahzar Ahmed - Covid 19 ProjectDocument5 pagesShahzar Ahmed - Covid 19 ProjectShahzar AhmedNo ratings yet

- Energy MidDocument3 pagesEnergy MidSamir MaharramovNo ratings yet

- Macroeconomics Revision Notes for Class 12 Chapter 1Document4 pagesMacroeconomics Revision Notes for Class 12 Chapter 1SheaNo ratings yet

- Uv0618 PDF EngDocument12 pagesUv0618 PDF EngVinukartik PillaiNo ratings yet

- Industry AnalysisDocument49 pagesIndustry Analysissaif khanNo ratings yet

- Risk Assesment of A Food CompanyDocument6 pagesRisk Assesment of A Food CompanyTowsif Noor JameeNo ratings yet

- Understanding the Key Concepts of International EconomicsDocument19 pagesUnderstanding the Key Concepts of International EconomicsUJJWAL SHARMANo ratings yet

- Business EnvironmentDocument3 pagesBusiness EnvironmentSimonNo ratings yet

- Types of Companies: Drivers: Product Mix, People, Production, Market Mix, Vision, Mission (Transition)Document34 pagesTypes of Companies: Drivers: Product Mix, People, Production, Market Mix, Vision, Mission (Transition)Rohan PatelNo ratings yet

- Pre Test JulyDocument4 pagesPre Test JulySai Min Thit KoNo ratings yet

- Assignment - 1 SolutionDocument5 pagesAssignment - 1 SolutionMuskan singh RajputNo ratings yet

- Section 5 - ProductionDocument14 pagesSection 5 - ProductionZhori DuberryNo ratings yet

- "Investment Opportunity in Petroleum Industry Focus On Security Analysis of Bharat Petroleum Corp. LTDDocument44 pages"Investment Opportunity in Petroleum Industry Focus On Security Analysis of Bharat Petroleum Corp. LTDRaj Singh GillNo ratings yet

- Chapter No. 01 Overview of BusinessDocument6 pagesChapter No. 01 Overview of BusinessMandar BhadangNo ratings yet

- Q1. Write A Note On Globalization. AnsDocument7 pagesQ1. Write A Note On Globalization. AnsBiplab KunduNo ratings yet

- International Financial MGT Unit 1Document10 pagesInternational Financial MGT Unit 1Davra NevilNo ratings yet

- Characters Tics of BEDocument6 pagesCharacters Tics of BESurbhi SofatNo ratings yet

- BHEL Is IndiaDocument5 pagesBHEL Is IndiamarkNo ratings yet

- Must Do Eco EnglishDocument31 pagesMust Do Eco EnglishDhruv ronNo ratings yet

- Introduction To Macro Economics Class 12 Notes CBSE Macro Economics Chapter 1 PDF 1Document4 pagesIntroduction To Macro Economics Class 12 Notes CBSE Macro Economics Chapter 1 PDF 1g26091993No ratings yet

- India's Massive Market OpportunityDocument34 pagesIndia's Massive Market OpportunityRavinder Singh Atwal100% (1)

- 5Document4 pages5shitalzeleNo ratings yet

- Running Head: Commodities Trading 0Document12 pagesRunning Head: Commodities Trading 0Ravi KumawatNo ratings yet

- MB0053Document7 pagesMB0053garima bhatngar100% (1)

- Reasons For Foreign Direct Investment by Alan S. GuttermanDocument6 pagesReasons For Foreign Direct Investment by Alan S. GuttermanSanchit AroraNo ratings yet

- 12 Eco Material EngDocument161 pages12 Eco Material EngYASHU SINGHNo ratings yet

- Management of Business Chapter 4 Review QuestionsDocument3 pagesManagement of Business Chapter 4 Review QuestionsRebecca BhagganNo ratings yet

- Lecture 9, 2023Document54 pagesLecture 9, 2023Juliana AzizNo ratings yet

- Renewable energy finance: Sovereign guaranteesFrom EverandRenewable energy finance: Sovereign guaranteesNo ratings yet

- Project On Kotak Mahindra BankDocument88 pagesProject On Kotak Mahindra BankBalaji100% (6)

- Project On HDFC BankDocument104 pagesProject On HDFC BankBalaji100% (2)

- Project On Clay Tile IndustryDocument72 pagesProject On Clay Tile IndustryBalaji100% (6)

- Contemprory BankingDocument89 pagesContemprory BankingBalajiNo ratings yet

- Management Buyouts - MergersDocument26 pagesManagement Buyouts - MergersBalaji100% (3)

- NeuromarketingDocument28 pagesNeuromarketingBalajiNo ratings yet

- Whether DerivativesDocument11 pagesWhether DerivativesBalajiNo ratings yet

- Security Analysis and Portfolio MGMNTDocument50 pagesSecurity Analysis and Portfolio MGMNTBalajiNo ratings yet

- ForecastingDocument42 pagesForecastingBalaji88% (8)

- Classification N TabulationDocument39 pagesClassification N TabulationBalaji88% (16)

- PerquisitesDocument6 pagesPerquisitesBalajiNo ratings yet

- Meaning & Significance of DiagramsDocument49 pagesMeaning & Significance of DiagramsBalaji100% (2)

- Methods of CostingDocument12 pagesMethods of CostingBalajiNo ratings yet

- Mergers and Acquisitions-470Document54 pagesMergers and Acquisitions-470wilson_nadarNo ratings yet

- Perfect Competition - Managerial EconomicsDocument11 pagesPerfect Competition - Managerial EconomicsBalajiNo ratings yet

- Demand Analysis - MANAGERIAL ECONOMICS MBA I YEARDocument12 pagesDemand Analysis - MANAGERIAL ECONOMICS MBA I YEARABHI100% (6)

- Stock MarketDocument26 pagesStock MarketBalajiNo ratings yet

- Anti Takeover Amendments - MergersDocument7 pagesAnti Takeover Amendments - MergersBalajiNo ratings yet

- Supply Analysis - Managerial EconomicsDocument20 pagesSupply Analysis - Managerial EconomicsBalaji67% (3)

- Cost Reduction and Control ProcessDocument4 pagesCost Reduction and Control ProcessBalajiNo ratings yet

- Defference Between Cost Control and Cost ReductionDocument6 pagesDefference Between Cost Control and Cost ReductionBalajiNo ratings yet

- Cost Reduction TechniquesDocument7 pagesCost Reduction TechniquesBalaji0% (1)

- Cost Reduction ProgrammeDocument6 pagesCost Reduction ProgrammeBalajiNo ratings yet

- Production Analysis - Managerial EconomicsDocument27 pagesProduction Analysis - Managerial EconomicsBalaji80% (10)

- Cost Reduction - IntroductionDocument7 pagesCost Reduction - IntroductionBalaji0% (1)

- Project - MRPLDocument60 pagesProject - MRPLBalaji100% (1)

- Cost Reduction and Control TechniqueDocument9 pagesCost Reduction and Control TechniqueBalaji67% (3)

- BehaviourDocument45 pagesBehaviourBalajiNo ratings yet

- Learning - Organisation BehaviourDocument40 pagesLearning - Organisation BehaviourBalaji100% (2)

- Currency Derivatives ExplainedDocument57 pagesCurrency Derivatives ExplainedNagireddy KalluriNo ratings yet

- BENNETT VS JAKUBOWSKI Et Al.Document43 pagesBENNETT VS JAKUBOWSKI Et Al.Andrew LiebichNo ratings yet

- Ideas20 Ashish KilaDocument81 pagesIdeas20 Ashish Kilaabhishekkumar00No ratings yet

- Project Feasibility & Finance PrinciplesDocument27 pagesProject Feasibility & Finance PrinciplesHimanshu DuttaNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- Petition For Judicial ReviewDocument10 pagesPetition For Judicial ReviewBINGE TV EXCLUSIVENo ratings yet

- Time Value of Money ProblemsDocument24 pagesTime Value of Money ProblemsMahidhara Davangere100% (1)

- Behavioral Finance at Jpmorgan - ReportDocument2 pagesBehavioral Finance at Jpmorgan - Reportapi-2521386310% (1)

- Balanced Funds Guide - Risk-Return Profiles and Fund TypesDocument19 pagesBalanced Funds Guide - Risk-Return Profiles and Fund TypesInvest EasyNo ratings yet

- Arrow Et. Al. - 2004Document34 pagesArrow Et. Al. - 2004Ayush KumarNo ratings yet

- 11 Chapter 11 Investment PropertyDocument6 pages11 Chapter 11 Investment PropertyJhon Eljun Yuto EnopiaNo ratings yet

- Credit Suisse Analyst Valuation Book PDFDocument144 pagesCredit Suisse Analyst Valuation Book PDFP Win80% (5)

- Market ProFile Trading Methods - Dmitry SapeginDocument7 pagesMarket ProFile Trading Methods - Dmitry SapeginWirya TanjungNo ratings yet

- Banking Industry - Security Bank Specialized Industry Audit TopicDocument14 pagesBanking Industry - Security Bank Specialized Industry Audit TopicJohn Paul Licayan MirafuentesNo ratings yet

- 2020 Registered Insurance Intermediaries As at 19th October 2020-MergedDocument202 pages2020 Registered Insurance Intermediaries As at 19th October 2020-MergedericmNo ratings yet

- CH 13 5Document2 pagesCH 13 5Meghna CmNo ratings yet

- Market Cap, Large-Cap, Mid-Cap, Small-Cap DefinedDocument1 pageMarket Cap, Large-Cap, Mid-Cap, Small-Cap DefinedShitanshu YadavNo ratings yet

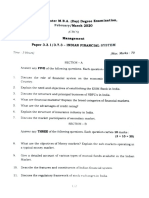

- CBCS 3.3.1 Indian Financial System 2020Document2 pagesCBCS 3.3.1 Indian Financial System 2020Bharath MNo ratings yet

- Homework Assignment Chapter 18 - 1Document4 pagesHomework Assignment Chapter 18 - 1adlkfjNo ratings yet

- Comparison of Habib Metro ModarabaDocument8 pagesComparison of Habib Metro ModarabaihtashamNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

- CME Individual Fees and Commission Rates for Futures and FX TradingDocument3 pagesCME Individual Fees and Commission Rates for Futures and FX TradingxdjeNo ratings yet

- Financial Management Chapter - Bond and Stock ValuationDocument6 pagesFinancial Management Chapter - Bond and Stock ValuationNahidul Islam IUNo ratings yet

- Financial InstrumentsDocument8 pagesFinancial InstrumentsMezbah Uddin AhmedNo ratings yet

- c914 - 2016 Updates On DOSRI Rule PDFDocument19 pagesc914 - 2016 Updates On DOSRI Rule PDFJoey SulteNo ratings yet

- Cost Sharing Framework For SWMDocument76 pagesCost Sharing Framework For SWMALFREDO ELACIONNo ratings yet

- Finance Loop Cards: Opening Balance in JuneDocument1 pageFinance Loop Cards: Opening Balance in JunedollyNo ratings yet

- PT PP Persero TBK Des17 Final PDFDocument145 pagesPT PP Persero TBK Des17 Final PDFaprillia ikaNo ratings yet

- AccountingDocument10 pagesAccountingCacjungoyNo ratings yet

- Productivity: What Is It?Document8 pagesProductivity: What Is It?Fabiano BurgoNo ratings yet