Professional Documents

Culture Documents

Investing in Range-Bound Markets by Vitaliy N. Katsenelson (Published in NAPFA Magazine)

Uploaded by

VitaliyKatsenelson0 ratings0% found this document useful (0 votes)

2K views3 pagesInvesting in Range-Bound Markets by Vitaliy Katsenelson

Original Title

Investing in Range-Bound Markets by Vitaliy N. Katsenelson (published in NAPFA Magazine)

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvesting in Range-Bound Markets by Vitaliy Katsenelson

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views3 pagesInvesting in Range-Bound Markets by Vitaliy N. Katsenelson (Published in NAPFA Magazine)

Uploaded by

VitaliyKatsenelsonInvesting in Range-Bound Markets by Vitaliy Katsenelson

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

I

By vitaliy Katsenelson

Investing

Investing in range -Bound Markets

O

ver the last decade, the stock This doesn’t happen because stock doesn’t have to be spectacular, just more

market has earned the title of Lost market gods want to play a practical or less average), brings terrific returns to

Decade. The next decade will joke on gullible humans, but because, as jubilant investors. Range-bound markets

not be much different from the last: The the daily noise subsides, stock prices in follow bull markets. As clean-up guys,

U.S. stock market will set record highs the long run are driven by two factors: they rid us of the high P/Es caused by bull

and multi-year lows, but index investors earnings growth (or decline) and price- markets, reverting them down towards and

and buy-and-hold stock collectors will to-earnings expansion (or contraction). actually below the mean. P/E compression

find themselves not far from where they Though economic fluctuations have (a staple of range-bound markets) works

started in 2000. We are in a Cowardly been responsible for short-term market against any earnings growth that occurs,

Lion market, whose occasional bursts of volatility, long-term market cycles were resulting in zero or near-zero price

bravery are ultimately overrun by fear that either bull or range-bound if the economy appreciation plus dividends. These results

leads to a subsequent descent. was growing close to the average rate (see come with plenty of cyclical volatility

Every long-lasting bull market, except Graph 1). along the way.

one, over last two centuries (including This distinction between bear and The 1982-2000 bull market ended at

the supersized one from 1982 to 2000) range-bound markets is seldom made, the highest P/Es ever. Thus, it will take

was followed by a range-bound market but it’s extremely important. One should longer than usual for earnings growth to

that lasted about 15 years. The Great invest very differently in each market— deflate them. Though continued economic

Depression was the only exception. more on this later. growth appears to be a wildly optimistic

Despite common perception, secular Prolonged bull markets started assumption, given what is taking place

markets spent a lot more time in bull or with below-average P/Es and ended in the economy, it is not particularly

range-bound phases, roughly half in each. with above-average P/Es. This vibrant unrealistic to assume that we will see

They only visited a bear cage on very rare combination of P/E expansion and nominal economic growth over the next

occasions. earnings growth (the latter of which decade. The Fed and our government are

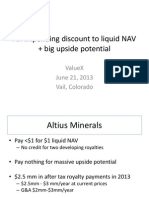

Graph 1 working very hard to achieve that, at any

cost.

Bear markets are range-bound

markets’ cousins; they share half of their

DNA in high starting valuations. However,

where in range-bound markets economic

growth helps to soften the blow caused

by P/E compression, during secular bear

markets the economy is not helping

either. Economic blues result in declining

earnings, which throw water on an already

dying fire (the compression of high

starting P/Es), and this combination brings

devastating results to investors.

A true, long-lasting bear market

has not really taken place in the U.S.,

but it did occur in Japan, where stocks

declined gradually, and not so gradually,

at times. Japanese stocks have fallen

over 80 percent from the late 1980s until

today. If the U.S. economy fails to stage

a comeback with at least some nominal

earnings growth over the next decade,

Continued on page 24

22 Napfa advIsor aprIl 2010

I

Investing

Continued from page 22

what started as a range-bound market in

2000 will turn into a bear market, given

Finally, if earnings were to be as

projected, we’d be following the last

stocks to above-average valuations,

causing P/Es to expand beyond their

the high valuations that are in place. recession’s recovery path, which is unlikely. long-term average. P/Es can shoot for

Let’s try to figure out the earnings The last recession was corporate, while the stars, but they don’t get there—at the

power of the S&P 500. The current 2010 the current one is riddled with debt-laden late stages of the secular bull market,

estimates of its operating earnings are consumers. Deleveraging the excesses of P/Es stop expanding. As earnings growth

$75. I am skeptical of this number for the housing bubble, in the face of higher becomes the sole source of returns,

several reasons. future taxation and likely higher interest disappointed investors start diversifying

First, it is nearly double the reported rates (both byproducts of large deficits), away from stocks into other asset classes,

2010 earnings estimates of $45. The will be a lengthy process. The recovery will and a range-bound market ensues. As the

percentage difference between reported be slower, and real earnings growth will be range-bound market marches on, unmet

and operating numbers is the second- lower than in previous recessions. expectations reinforce disappointment in

highest since 1988 (2008 holds the It is hard to know the exact earnings stocks, and P/Es are compressed to the

record). During the 2001-2003 recession, power of the S&P 500, but it likely lies other extreme. Keeping this in mind, note

the difference was about 50 percent. “One- somewhere in between operating and that stocks are still not cheap, and thus

time” write-offs are responsible for the reported earnings estimates, and thus range-bound markets still lie ahead of us.

Interest rates and inflation are

secondary to psychological drivers, but

they’re still important. They don’t cause

the cycles, but they do help to shape their

duration and the valuation extremes that

stocks achieve. For instance, if, at the end

of the 1966-1982 range-bound market,

interest rates and inflation had not been

in the mid-teens, the range-bound market

would have ended sooner, at higher P/Es.

On the other hand, if, in the late-1990s,

interest rates and inflation had not been

scraping low single-digits, the bull market

would have ended sooner and at lower

P/Es. The higher inflation and interest rates

that are around the corner will take their toll

on the duration and final P/E of this market

as well.

What Investors Should Do

In range-bound markets, as P/Es

compress, they turn against investors. In

this difficult environment, investment

difference. It is very likely that these “one- closer to $60. This would put the P/E of strategy needs to be adjusted for the new

time” charges are not really “one-time”; the S&P 500 today at about 19. investment reality. Here are things that

thus, operating estimates overstate the true Since 1900, stocks have spent very investors can do:

earnings power of the market. little time at what is known as a “fairly • Become an active value investor.

Second, 2010 estimates are only valued” P/E of 15. In fact, they have spent Traditional buy-and-forget-to-sell (hold)

slightly below the all-time high earnings less than 27 percent of the time between P/ strategy is not dead, but it’s in a coma,

the S&P achieved in 2007, when our Es of 13 and 17. They only saw a P/E of waiting for the next secular bull market

economy was under the influence of 15 when they went from one extreme to to return, and it’s still far, far away. Sell

several bubbles which severely inflated another. Most importantly, they’ve never is not just another four-letter word; sell

corporate profit margins to unprecedented stopped at the average and gone the other discipline needs to be kicked into higher

levels. Also, the bulk of excesses in direction; they’ve continued their journey gear.

margins in 2007 came from the financial, to the other extreme. • Increase your margin of safety.

materials, energy, and industrial sectors— During secular bull markets, Typically, value investors seek protection

the ones that are struggling today and will investor optimism, bundled with constant from overestimating the “E,” earnings. In

continue to do so for a long time. reinforcement from rising prices, takes this environment, protection needs to be

24 Napfa Advisor April 2010

Mean Reversion

I Investing

beefed up to accommodate the impact of

constantly declining P/Es.

• Don’t fall into the relative-

valuation trap. Many stocks will appear

cheap based on past valuations, but

past secular bull market valuations

will not be in vogue for a long time.

Thus, absolute-valuation tools such as

discounted cash-flow analysis should

carry more weight.

• Though timing the market is

alluring, don’t try it. Market timing is

very difficult to do consistently. Value

individual stocks instead. Buy them

when they are undervalued, and sell

them when they become fairly valued.

• Increased margin of safety and

stricter selling discipline will lead

investors to have a higher cash position

at times. Don’t invest for the sake of

being invested, because this will force

you to own stocks of marginal quality or

stocks that don’t meet your heightened

required margin of safety. Secular

bull markets taught investors not to

hold cash, as the opportunity cost of

doing so was very high. However, the

opportunity cost of cash is a lot lower

during a range-bound market.

And what if a range-bound market

isn’t in the cards? If a bull market develops,

active value investing should do at least as

well as buy-and-hold investing or passive

indexing. In the case of a bear market, your

portfolio should decline a lot less.

Vitaliy Katsenelson is a director of

research/portfolio manager at Investment

Management Associates, Inc., a value

investment firm based in Denver. He is

the author of Active Value Investing:

Making Money in Range-Bound Markets,

published by Wiley & Sons. His insights

on value investing, as well as on investing

in China, Russia, and Japan, are regularly

featured in major business and investor

publications. For more information, go to

contrarianedge.com.

APril 2010 Napfa Advisor 25

You might also like

- How To Stay Rational in An Irrational World - Vitaliy KatsenelsonDocument37 pagesHow To Stay Rational in An Irrational World - Vitaliy KatsenelsonVitaliyKatsenelson100% (23)

- VALUEx Vail 2014 - Visa PresentationDocument19 pagesVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- VALUEx Vail 2014 - Visa PresentationDocument19 pagesVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- How To Stay Rational in An Irrational World - Vitaliy KatsenelsonDocument37 pagesHow To Stay Rational in An Irrational World - Vitaliy KatsenelsonVitaliyKatsenelson100% (23)

- Closed End Funds A Unique OpportunityDocument13 pagesClosed End Funds A Unique OpportunityValueWalkNo ratings yet

- Investment Case For Blucora - Motiwala CapitalDocument19 pagesInvestment Case For Blucora - Motiwala CapitalCanadianValueNo ratings yet

- HealthSouth Presentation Laughing Water CapitalDocument29 pagesHealthSouth Presentation Laughing Water CapitalCanadianValueNo ratings yet

- ValueXVail 2013 - Dan FerrisDocument14 pagesValueXVail 2013 - Dan FerrisVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Ethan BergDocument35 pagesValueXVail 2013 - Ethan BergVitaliyKatsenelsonNo ratings yet

- Greg Porter Lancashire Holdings Limited - ValueX 2014 Presentation FinalDocument25 pagesGreg Porter Lancashire Holdings Limited - ValueX 2014 Presentation FinalValueWalkNo ratings yet

- ValueXVail 2012 - Barry PasikovDocument13 pagesValueXVail 2012 - Barry PasikovVitaliyKatsenelsonNo ratings yet

- QR Energy Qre Valuex Vail 2014Document3 pagesQR Energy Qre Valuex Vail 2014ValueWalkNo ratings yet

- Active Value Investing Process by Vitaliy Katsenelson, CFADocument16 pagesActive Value Investing Process by Vitaliy Katsenelson, CFAVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Brian BosseDocument51 pagesValueXVail 2013 - Brian BosseVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Chris KarlinDocument26 pagesValueXVail 2013 - Chris KarlinVitaliyKatsenelsonNo ratings yet

- Hiding in Plain Site: Diving Deeply Into SEC FilingsDocument8 pagesHiding in Plain Site: Diving Deeply Into SEC FilingsfootnotedNo ratings yet

- Vail ValueX Presentation PublicDocument35 pagesVail ValueX Presentation Publicmarketfolly.comNo ratings yet

- Value Investor Congress Las Vegas 2013 - I Like Big Dividends and I Cannot Lie - Vitaliy KatsenelsonDocument47 pagesValue Investor Congress Las Vegas 2013 - I Like Big Dividends and I Cannot Lie - Vitaliy KatsenelsonVitaliyKatsenelsonNo ratings yet

- Active Value Investing Process by Vitaliy Katsenelson, CFADocument16 pagesActive Value Investing Process by Vitaliy Katsenelson, CFAVitaliyKatsenelsonNo ratings yet

- ValueXVail 2012 - Jon MarkmanDocument39 pagesValueXVail 2012 - Jon MarkmanVitaliyKatsenelsonNo ratings yet

- ValueXVail 2012 - Joe CornellDocument13 pagesValueXVail 2012 - Joe CornellVitaliyKatsenelsonNo ratings yet

- ValueXVail 2012 - Kai ShihDocument30 pagesValueXVail 2012 - Kai ShihVitaliyKatsenelsonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1 Basic Consid & Formation FinalDocument50 pagesChapter 1 Basic Consid & Formation FinalTheresa Timonan86% (14)

- Cost of Environmental Degradation Training ManualDocument483 pagesCost of Environmental Degradation Training ManualNath RoussetNo ratings yet

- JP Morgan Chase - DeckDocument9 pagesJP Morgan Chase - DeckRahul Girish KumarNo ratings yet

- Aurora Textile Company (SPREADSHEET) F-1536X - FCVDocument15 pagesAurora Textile Company (SPREADSHEET) F-1536X - FCVPaco ColínNo ratings yet

- Financial Statement Analysis NotesDocument9 pagesFinancial Statement Analysis Notesshe lacks wordsNo ratings yet

- ACCA F3 Exam Kit 2013 Emile Woolf PDFDocument181 pagesACCA F3 Exam Kit 2013 Emile Woolf PDFTinh Linh90% (20)

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- Set 1 PM - ADocument36 pagesSet 1 PM - AMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- Advanced Accounting ExamDocument10 pagesAdvanced Accounting ExamMendoza Ron NixonNo ratings yet

- Chapter Five: Tax Avoidance and EvasionDocument14 pagesChapter Five: Tax Avoidance and Evasionembiale ayaluNo ratings yet

- 11 16 18 10 06 705Document2 pages11 16 18 10 06 705Finance - SnackerStreetNo ratings yet

- MRSUQ2C04Document2 pagesMRSUQ2C04Chinna ThambiNo ratings yet

- Finnish TaxationDocument217 pagesFinnish TaxationTobi MemoryNo ratings yet

- Sporting Business Value and Price - DamodaranDocument20 pagesSporting Business Value and Price - DamodaranFrancisco AlemanNo ratings yet

- Front Office TerminologyDocument7 pagesFront Office TerminologyKiran Mayi67% (3)

- AnupamDocument61 pagesAnupamviralNo ratings yet

- Logistics CostingDocument21 pagesLogistics CostingRuchita RajaniNo ratings yet

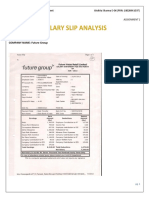

- Sector: Retail COMPANY NAME: Future GroupDocument3 pagesSector: Retail COMPANY NAME: Future GroupAkshita SharmaNo ratings yet

- Role of Board of DirectorsDocument3 pagesRole of Board of DirectorsFarhan JawedNo ratings yet

- Skripsi Rifa'atul Mahmudah "Analisis Usaha Jamur Tiram"Document89 pagesSkripsi Rifa'atul Mahmudah "Analisis Usaha Jamur Tiram"Rifa'atul Mahmudah Al Masir100% (1)

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- Act 624 Finance No.2 Act 2002Document23 pagesAct 624 Finance No.2 Act 2002Adam Haida & CoNo ratings yet

- Khuram Cement TuanaDocument115 pagesKhuram Cement TuanaZeeshan ChaudhryNo ratings yet

- FI515 Homework1Document5 pagesFI515 Homework1andiemaeNo ratings yet

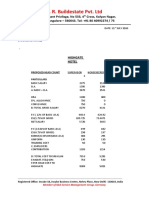

- Cost SheetDocument4 pagesCost SheetQuestionscastle FriendNo ratings yet

- Housekeeping ProposalDocument2 pagesHousekeeping Proposalprabhav_rrcNo ratings yet

- Auditing Project Sem 3Document33 pagesAuditing Project Sem 3Vivek Tiwari50% (2)

- FAR - Learning Assessment 2 - For PostingDocument6 pagesFAR - Learning Assessment 2 - For PostingDarlene JacaNo ratings yet

- ISE 2040 Excel HWDocument20 pagesISE 2040 Excel HWPatch HavanasNo ratings yet