Professional Documents

Culture Documents

Texas State Rep. Rob Orr 2010 Personal Financial Statement

Uploaded by

Texas Watchdog0 ratings0% found this document useful (0 votes)

9 views50 pagesOriginal Title

Texas state Rep. Rob Orr 2010 personal financial statement

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views50 pagesTexas State Rep. Rob Orr 2010 Personal Financial Statement

Uploaded by

Texas WatchdogCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 50

“Texas Ethics Commission P.0.Box 12070 ___Auetn, Texas 78711-2070 (121463.5800 1-300-325-8508

PERSONAL FINANCIAL STATEMENT FORM PFS

COVER SHEET

Filed in accordance with chapter 572 of the Government Code. J" page 1 of 50

For lings required in 2010, covering calendar year encing December 31,2009” oocaaere

Use FORM PFS - INSTRUCTION GUIDE when completing this form. 90054639

1 NAME Taner OFFICE USE ONLY.

Mn Robin D

eeenae "RECEIVE

op Or FEB 17 2010

2 ADDRESS

637 John Ct

Burleson, TX 76028

[a)_(check ir FLeR's HOME ADoREsS)

3. TELEPHONE TREACODE NBER: EXTENSON

Se (817) 447-2084

@ REASON

FOR FILING

STATEMENT 1 canoioate enoicaTe orice)

B ELECTED oFFiceR State Representative, District 58 (owpicaTe oF Fics)

C APPOINTED OFFICER (INDICATE AGENCY)

O exeounive Heap nica Ace

1 FORMER OR RETIRED JUDGE SITTING BY ASSIGNMENT

C1 stare party CHAIR cat Pa)

C other INDICATE POSITION)

5 Family members whose financial activity you are reporting filer must report information about the financial activity ofthe file's

‘spouse or dependent children ithe fier had actual control aver that activity):

cary Pamela G Orr

DEPENDENTcHLD 1, James C Orr

Inparis 1 through 18, you wil disclose your financial activity during the calendar year. In parts 1 through 14, you are

required to disclose not only your own financial activity, but also that of your spouse or a dependent child if you had actual control

‘over that person's financial activity,

p

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY 4/,/7999

“Texas Ethos Commission P.0.Box 12070 Austin, Texas 78711-2070

(512)469-5000 1-800.325-8506,

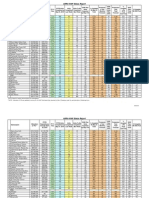

SOURCES OF OCCUPATIONAL INCOME

Dl NoT APPLICABLE

Part 1A

providing the number under which the child is listed on the Cover Sheet,

When reporting information about a dependent chil's activity, Indicate the child about whom you are reporting by

* INFORMATION RELATES TO

B rusr Cl spouse D7 DEPENDENT CHILD ___

? EMPLOYMENT

11 EMPLOYED BY ANOTHER | Or & Associates Real Estate

232 NW Tarrant

Burleson, TX 76028

‘Owner, Broker

Bl SELF-EMPLOYED

Real Estate Sales and Management

NAME AND ADDRESS OF EMPLOYER / POSITION HELD

1 (Check Fors Home Aderess)

NATURE OF OCCUPATION" ”

INFORMATION RELATES TO

Fer O spouse (1 DEPENDENT CHILD

EMPLOYMENT

Bi] EMPLOYED BY ANOTHER | Texas House of Representatives

PO Box 2910

Austin, TX 78768-2510

State Represontative, District 58

SELF-ENPLOYED

a State Legislature

NAME AND ADDRESS OF EMPLOYER / POSITION HELD

D1 (Check Fors Home Adéress)

NATURE OF OccUPATION

INFORMATION RELATES TO

O rier SPOUSE D7 DEPENDENT CHILD ___

EMPLOYMENT

C1 EWPLOYED BY ANOTHER | 77g Associates Real Estate

282 NW Tarcant

Burleson, TX 76028

‘Owner, Realtor

NATURE OF OCCUPATION

B] SELF-EMPLOYED

Real Estate Sales and Management

NAME AND ADDRESS OF EMPLOYER / POSITION HELD

Di (check i Fors Home Adress)

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box 12070 _Austin, Toxas 78711-2070 (s12)469-5800 1-000-326-6508

SOURCES OF OCCUPATIONAL INCOME PART 1A,

Cl Nor APPLICABLE

‘When reporting information about a dependent child's acivty, indicate the child about whom you are reporting by

providing the number under which the child is sted on the Cover Sheet.

1 INFORMATION RELATES TO

O Fier ‘SPOUSE 1 DEPENDENT CHILD

OVER POSTION VE

cMpLOVMENT NAME AND ADDRESS OF EMPLOYER iD

(check tees Home Adress

11 enpioveo sy anorver | or Property Management

232, NW Tarrant

Burleson, TX 76028

‘Owner, Property Manager

NATURE OF OCCUPATION

seLr-ewpLoven

a Residential and Commercial Property Management

‘COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethies Commission P.0.Box 12070 __ Austin, Texas 78711-2070

(51269-5800 1-800-325-8506

STOCK

1 NOT APPLICABLE

PART 2

INSTRUCTION GUIDE,

providing the number under which the child is listed on the Cover Sheet,

LUst each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

‘and indicate the category of the number of shares held or acquired, If some or all of the stock was sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM PFS—

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

1 BUSINESS ENTITY Houghton Royelty Trust

Tae

C1 s.00 70 8208

2 STOCK HELD OR ACQUIRED BY | Bl FIER Dasrouse CL DePENDENTCHLD ___

3 NUMBER OF SHARES Dues tran 100 EJ woot0499 ==] s00T099 © 1,000 70.4900

Ts.c0 T0968] 10000 0R MORE

4 iF SOLD (ner can

Einerioss | El LESS THANss.000 [] ss,000-s9.999 [] sio00-s24.909 [] $25,000-0R MORE

TAvE

BUSINESS ENTITY ooo

STOCK HELD OR ACQUIRED BY | Di] FLER Da srouse LI OEPENDENT CHD ___

NUMBER OF SHARES Dtess tan 100 E100 T0499 © son T0999 © 1.000 T0.4.900

i 10.000 oR MORE

Diner caw

Gnertoss

IF SOLD D1 Less tHan ss,000 [1] $6,000- $9,099

1 stac00-$24.999 C]s20,000-0R mone

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.80%12070 Austin, Texas 78711-2070 (512)463.5800 1-900.26-0506

BONDS, NOTES & OTHER COMMERCIAL PAPER Part 3

1 Nor APPLICABLE

List all bonds, notes and other commercial paper held or acquired by you, your spouse, or a dependent child during the

calendar year. If sold, indicate the category of the amount of the net gain or loss realized from the sale. For more

Information, see FORM PFS-INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

Providing the number under which the child is listed on the Cover Sheet

1 DESCRIPTION Mert Lynch, IRA

OF INSTRUMENT

2 HELD OR ACQUIRED BY

ruse Ci srouse (DEPENDENT CHD

3 IF SOLD

ner can Tess tHaw $5,000 [1] $5,000-8.903 [1] $10,000-$24,999 [1] $25,000-OF MORE

CO nertoss

DESCRIPTION Meri Lynch, IRA

OF INSTRUMENT

HELD OR ACQUIRED BY

Cruer BB srouse Di bePenvenr cut

IF SOLD

ner oan Li tess thaw $5000 [1] s5,000-85.999 [J s10.000-$24,999 [5] $25,000-0F MORE

OD nertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Toxas Ethics Commission P.0. Box 12079

Austin, Toxas 78711-2070

(12463-5800 1-800-325-8508

CO Nor apPLicaBLe

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS

PART 5

‘more information, see FORM PFS—INSTRUCTION GUIDE.

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 SOURCE OF INCOME perenne

‘Tenant Occupied

432 NW Thomas,

Burleson, TX 76028

2 RECEIVED BY

Brier Bl spouse (7 DePENDENT cHiLD

3 AMOUNT

Ci ss00-s4.se3 [] $5,000-$9,909 f&] s10,000- $24,999) $25,000-0n MoRE

SOURCE OF INCOME eee

Tenant Occupied

353 Fild St

Burleson, Tx 76028

RECEIVED BY

FILER BI spouse 7 DEPENDENT CHILD

‘AMOUNT

i s500-s4.909 ([] $5,000- $9,909 [X] $10,000- s24,089 1) $25,000-0R MORE

‘SOURCE OF INCOME ee

Tenant Occupied

317 Suzanne

Burleson, ‘TX 76028

RECEIVED BY

DI rLer BI spouse (1 bePeNDENT CHILD

AMOUNT

1 s500- $4,900 1 s5.000-s,e09 [J $10,000-24,909 ] $25.000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission

P.0. 80% 12070 __Austin, Texas 78711-2070 (12463-5800 1-800-526-8508

CO NoT APPLICABLE

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS Part 5

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

1 SOURCE OF INCOME MAE NO NOOTESS,

‘Tenant Occupied

1535 Judith

Burleson, TX 76028

2 RECEIVED BY

Bi ruer BB spouse 1 DEPENDENT cHILD

3 AMOUNT

1 s500-s4,999

Di ss000-s9,98 fH] $10,000-$24,999 [1] $25,000-0R MORE

SOURCE OF INCOME, ated

Tenant Occupied

1017/1019 Mitchell

Burleson, TX 76028

RECEIVED BY

Drier SPOUSE (1 ePenbeNT cit

‘AMOUNT

D1 s500-4,009 1 s5.000-ss,999 [J s10,000-24,992 [] $25,000-OR MORE

SOURCE OF INCOME, econ ee

Tenant Occupied

4021/1023 Mitchell

Burleson, TX 78028

RECEIVED BY

Brier 1 spouse (7 vePeNDeNT cio

AMOUNT

Csso0-stsse }85,000-s9,999 [3] $10,000- 24,909] $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethes Commission P.0.Box 12070 __Austn, Texas 78711-2070 (512}463-5800 1.000.525.0506

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS PART 5

(1 NoT APPLICABLE

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

‘more information, see FORM PFS~INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

1 SOURCE OF INCOME ‘NAME AND ABDRESS

Tenant Occupied

721 Ash

Burleson, TX 76028,

2 RECEIVED BY

FILER Bl srouse [1 bePenoenr cHILD

3 AMOUNT

Ciss00-ses92 2] ssc00-s9.909 [J $10,000-824.989 1] $25,000-oR MoRE

SOURCE OF INCOME arene eee

Tenant Occupied

817 Crestviow

Burleson, TX 76028

RECEIVED BY

BH ruer [Bi srouse Cl bePeNpeNT cto

‘AMOUNT

Ciss00-sss02 1] s5,000-s9,909 [RJ $10,000-s24,s09 1] $25,000-0R MORE

‘SOURCE OF INCOME eel

‘Asbury, LP

675 Alsbury Blvd.

Burleson, TX 76028

RECEIVED BY

DQ ruer [i spouse 1 bepenvent cto

‘AMOUNT

Cisso0-ss.002 1} $5,000-se.e29 1] s10,000-s24,009 [X $25,000-0n MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0. Box 12070

‘Austin, Texas 78711-2070

(51263-5000 1-800.9258506

1 NoT APPLICABLE

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS

PART 5

List each source of income you, your spouse,

more information, see FORM PFS~-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity,

or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

Providing the number under which the child is listed on the Cover Sheet.

indicate the child about whom you are reporting by

1 SOURCE OF INCOME NAME AND ADDRESS

Burleson Business Center

200 Centre Drive

Burleson, TX 76028

2 RECEIVED BY

Ol rise spouse 1 DePenoenr cit

3 AMOUNT

C1 $500 - $4,909

i $s,000-$s,999 [] $10,000-$24,289 [] $25,000-OR MORE

SOURCE OF INCOME ee eee

Boone Business Park

300 Boone Rd.

Burleson, TX 76028

RECEIVED BY

DU Fier Bil spouse (0 DEPENDENT CHILD

AMOUNT

C1) ss00-s4,999 1] s5.000-s9,989 [J $10,000-824,999 [] $25,000-0R MORE

‘SOURCE OF INCOME a

Burleson Future Investments

PO Box 1088

Burleson, TX 76097

RECEIVED BY

FILER Di srouse (1 DEPENDENT CHILD

AMOUNT

LD 8500 - $4,899 17) s8.000-$9,909 [1] $10,000-$24.909 [XJ $25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission

P.0.80%12070 ___ Austin, Texas 78711-2070 (512!63.5000

1-200:325-0506

Nor APPLICABLE

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS

PART 5

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

‘more information, soe FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

1 SOURCE OF INCOME Neve Ano ACO

RPO Properties, LP

282 NW Tarrant

Burleson, TX 76028

2 RECEIVED BY

FILER Di spouse] bePenoenr cio

3 AMOUNT

ss00-s4009[]85,000-se,a98 |] stoco0-s24ou0 [] $28,000-oR MORE

‘SOURCE OF INCOME ee

Burleson Five Star

252 NW Tarrant

Burieson, TX 76028

RECEIVED BY

Da rir Lispouse 1 erenoenr ctu

‘AMOUNT

C)ss00-s4s00 1] 5000-0509] sio,000-s24.989 [3] $25,000-0R MORE

SOURCE OF INCOME NM 10 Ane,

{ICO Irrovocable Trust

PO Box 1088

Burleson, TX 76097

RECEIVED BY

Cispouse XJ DEPENDENT HD 4

‘AMOUNT

[issoo-s4o0 2) ss,000-80.900 [J s10.000-824009 [BJ $25,000-oR MoRE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commision P.0.B0% 12070 ___Austn, Texas 78711-2070 (S12 69-5800 1-800-225-8506

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS PART 5

Cl _NOT APPLICABLE

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties and rents during the calendar year and indicate the category of the amount of the income. For

‘more information, see FORM PFS—INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 SOURCE OF INCOME ae ae

Tenant Occupied

720 Loma

Burleson, TX 76028

2 RECEIVED BY

rier Bl spouse (01 DePENpeNt cHiLD

3 AMOUNT

Ci ss00-s4,099, 1 ss000-s9,099 [9] $10.000-s24,992 J $25,000-OR MORE

SOURCE OF INCOME neo

Chesapeake Energy

PO Box 548806

‘Oklahoma, OK73154

RECEIVED BY

rier ‘SPOUSE 7 DePenvenr chit

‘AMOUNT

[i] ss00-s.299 7] $5,000-s9,999 ] $10,000-$24,908 7] $25.000-oR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxes Ethics Commission .0.B0x 12070___Austin, Texas 78711-2070 (1263-5800, 1-800.325-8508

PERSONAL NOTES AND LEASE AGREEMENTS PART 6

1 NOT APPLICABLE

Identify each guarantor of a loan and each person or nancial institution to whom you, your spouse, or

‘a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount of the liability. For more informa-

tion, see FORM PFS-INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

1 PERSON OR INSTITUTION First Financial Bank

HOLDING NOTE OR

LEASE AGREEMENT

2 LINBILITY OF

vo By rer BY seouse ——_ ePeNoeNT cut

3 GUARANTOR (Or, Rob

4 AMOUNT

Ci s1000-s«999 2) $5,000 $0,909] s10,000- 24,099 [X] $25,000-0n MORE

PERSON ORINSTITUTION | Community Bank

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Ty DJ Fer [spouse D1 DEPENDENT CHILD

GUARANTOR Or, Rob

oun Cis1,000-s4.989 [] $5,000- $9,999] s10,000- $24,999 [R] $25,000-0R MORE

PERSON ORINSTITUTION — | Magna Bank

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Drier ‘spouse (1 DePENDENT cHILD

GUARANTOR rr, Rob

‘AMOUNT

Ci s1.000-s«299 [] 85,000-s9,909 [X] $10,000- $24,009] $25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.0.Box 12070 __Austn, Texas 78711-2070 512}465-5800 1-800-325-8508

PERSONAL NOTES AND LEASE AGREEMENTS PART 6

C1 NOT APPLICABLE

Identy each guarantor ofa loan and each person or financial institution to whom you, your spouse, or

a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

agreement at any time during the calendar year and indicate the catogory of the amount ofthe liability. For more informa-

tion, see FORM PFS-INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is isted on the Cover Sheet.

1 PERSON OR INSTITUTION | Toyato Financial

HOLDING NOTE OR

LEASE AGREEMENT

2

Lo Omer SPOUSE (1 DEPENDENT CHILD

3 GUARANTOR Or, Pam

4 AMOUNT

Ci sio00-see92 1] 5.000-$9,999 [] st0.000-824.989 [3] $25,000-OR MORE

PERSON ORINSTITUTION | GMAC Auto

HOLDING NOTE OR

LEASE AGREEMENT

IABILITY OF

aa FILER spouse (7 DEPENDENT CHILD

GUARANTOR On, Rob

AMOUNT

C1s1,000-84.909 [1] $5.000-88,999 1] $10,000-$24,909 [X] $25,000-OR MORE

PERSON ORINSTITUTION — | Wells Fargo Home Mortgage

HOLDING NOTE OR

LEASE AGREEMENT

LIABIL

TY OF rer Dy spouse DEPENDENT CHILD

‘GUARANTOR Or, Rob

AMOUNT

(i s1.000-s4.990 [1] s5,000-s9,98 ] $10,000-$24,099 [X] $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.O. ox 12070 __Austin, Texas 78711-2070 (512)463-5800 1-300.325-8506

INTERESTS IN REAL PROPERTY PART 7A

Cl NOT APPLICABLE

Describe ail beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other speciic directions for completing this section, see FORM PFS

INSTRUCTION GUIDE.

When reporting information about @ dependent child's activity, Indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY ruse CD srouse D1 bepenpent cHito

2 STREET ADDRESS ‘STREET AGORESS NELUDNG GY, COUNTY AWD STATE

NOT AVAILABLE

Di check i riem's Howe anoREss

3 DESCRIPTION > TRONBER OF LOTS OR ACRES AND NAME GF COUNTY WHERE LOCATED

Qhors Tarrant

acres

4 NAMES OF PERSONS Weber, Pete

RETAINING AN INTEREST

D1 nor aPeutcase

(SEVERED MINERAL INTEREST)

Gireath, Dale

Harrison, Martin

Ogden, Jott

5 IF SOLD

Dnercan C1 ess tian ss.000 [] s5000-se,999 ] $10,000-$24,099 5] $25,000-0R MORE

Di nercoss

HELD OR ACQUIRED BY Orter Di spouse C1 bePeNpeNT cHiLo

STREET ADDRESS (ee peva) ‘REET ADDRESS, NCLUONG GT, COUNTY AO BTATE

nor avanasue

D1 check i er's Home apoRESS

DESCRIPTION 'NOWGER GF LOTS OR GRES AND ANE OF COLA WERE LOOATED

Quors

Dl acres

NAMES OF PERSONS ‘Orr, Rob

RETAINING AN INTEREST

Di nor aopuicasie

(SEVERED WNERAL INTEREST)

IF SOLD

Di nereaw D1Less THaw $5,000] $5,000-$9.999 ] s10.000-s24.998 ] $25,000-0R MORE

Di nertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TToxas Ethics Commission p.

0.Box 12070 __ Austin, Texas 78711-2070 (1263-5800

1-800-325-8506

INTERESTS IN REAL PROPERTY

CO Nor apPLicasLe

PaRT 7A

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calender year. If the interest was sold, also indicate the category of the amount ofthe net gain or loss realized from the sale

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

1 HELD OR ACQUIRED BY

2 STREET ADDRESS

Dror avanaste

Deneck res Hon

Brner (I spouse 1 vePeNpeNT cuit

432 Thomas

Burleson, Tx 76028

Johnson

3 DESCRIPTION

Dors

Dacres

Residential Duplex

4 NAMES OF PERSONS

RETAINING AN INTEREST

Di nor arpucasie

(SEVERED MINERAL INTEREST)

5 IF SOLD

Dncroan

Di nercoss

C1tess THaN's5;000 [1] $5,000-s0,999 [1] st0,000- $24,999] $25,000-oR MORE

HELD OR ACQUIRED BY

Drier [Wl spouse (O erenpenr cHito

STREET ADDRESS

Ci sor avanasse

317 Suzanne

Burleson, TX 76028

check riers Home anoness | “ORS”

DESCRIPTION ‘NOWSERGF LTS OR KOREN AND NOE OF GOLA WERE LOEATED

Alot

a Residential Single Family

ACRES

NAMES OF PERSONS

RETAINING AN INTEREST

Di xor arpuicase

(GEVERED MINERAL INTEREST)

IF SOLD

Oi ner can

Ci nertoss

Ci Less THanss.000 [1] $5000-s9,999 [] $10,000-$24.992 ] $25,000-OR MORE.

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxas Ethics Commision P.O. 80x 12070 ___ Austin, Texas 78751-2070 (512)463-5800 1.300.526 -2506

INTERESTS IN REAL PROPERTY PART 7A

1 NoT APPLICABLE

Descrie all beneficial interests in real property held or acquired by you, your spouse, or a dependant child during the

Calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale,

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS.

INSTRUCTION GUIDE

‘When reporting information about a dependent chiles activity, indicate the child about whom you are reporting by

Providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY rue SPOUSE C1 DEPENDENT CHD

2 STREET ADDRESS a ‘REET ADDRESS NUON GT, COUNTY AND STATE

NOT AVARABLE Burleson, TX 76028

a siohnson

D cieck i ers Howe anoREss

a pecEStoe va "NUMBER OF LOTS GRAGRES AND NAME OF COUNTY WERE LOA

Bors Residential Duplex.

Dacass

4 NAMES OF PERSONS

RETAINING AN INTEREST

D1 nor appuicasie

(SEVERED MINERAL INTER

5 IF SOLD

Diner can C1 Less THAN ss,000 [1] ss,000- $9,999] $10,000-s24,98@ 1] $25,000-on MORE

Ci nertoss

HELD OR ACQUIRED BY rer Bi spouse C1 DEPENDENT cio

‘STREET ADDRESS) NELUDNG GY, COUNTY MRO BTATE

STREET ADDRESS poe

Cl wor avanaate Burleson, Tx 76028

sohnson

Cl crecoxir rims Howe aooress | 2°"

DESCRIPTION ‘NUNGER OF LOTS OR ACRES AND NAME GF COUNTY WHERE LOCATED

Ooots Single F

ingle Family Resid

Daces

NAMES OF PERSONS

RETAINING AN INTEREST

D1 nor appuicaate

(SEVERED MINERAL INTEREST)

IF SOLD

Over can Ci tess Than $5,000 [1] $5,000-s9,999 C] $10,000- $24,999] s25,000-oR MoRE

Di neross

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxas Ethics Commission P.0.Box 12070 Austin, Texas 78711-2070

(51263-5800,

4-800-325-8508

INTERESTS IN REAL PROPERTY

C1 NoT APPLICABLE

PART 7A

INSTRUCTION GUIDE.

providing the number under which the child is listed on the Cover Sheet.

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount ofthe net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

When reporting information about a dependent chilc's activity, indicate the child about whom you are reporting by

D oneok ir rxens HOME ADDRESS

1 HELD OR ACQUIRED BY er WI srouse J oerenoenr cnt

2 STREET ADDRESS “imiole ang, | SR ROSEN CoRR

Csr avavasts Baan, 708

ionneon

hors

q Residential Duplex

AORES

8 DESCRIPTION MINER OF [GTS OR AGRE NO WE

4 NAMES OF PERSONS

RETAINING AN INTEREST

(Ci nor aPpuicaste

(SEVERED MINERAL INTEREST)

1021/1023 Mitchell

Dl nor avanaate Burleson, TX 76028

Johnson’

Di eteck ries Home anoress

5 iF SOLD

Liner can Ti tess THan $5,000 [7] $5.000-89,999 1] s10.000-s24,909 [7] $25,000-0F MORE

Di nerioss

HELD OR ACQUIRED BY FILER Bi spouse D1 ePeNDENT cHiLD

STREET ADDRESS ‘STREET ADDRESS] NGLUDNS OT, GOIN AND STATE

ors Residential Duplex

Di acres

BESCHIETION 'NOMGER OF LOTS OR ACRES AND NAME OF COUNTY WHERE LOCATED

NAMES OF PERSONS

RETAINING AN INTEREST

D1 nor arpticaaue

(SEVERED WINERAL aTEREST)

IF SOLD

Dnertoss

Cncronn Ctess THaN 5.000 [] sso00-s9,959 [] s10,000-24,000

D7 s25,000-on mone

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.fox 12070 Austin, Texas 78711-2070 (51263-5000 1-800-925-8506

0 nor appuicasLe

INTERESTS IN REAL PROPERTY Part 7A

INSTRUCTION GUIDE.

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the chid is listed on the Cover Sheet,

1 HELD OR ACQUIRED BY

2 STREET ADDRESS

CD nor avanaste

D1 cxeck ir ruer's Home aporess

FILER BW spouse 7 DEPENDENT cHILD

200 Boone Rd.

Burleson, TX 76028,

Tarrant

3 DESCRIPTION

Quors

Dacees

‘Commercial Building

4 NAMES OF PERSONS

RETAINING AN INTEREST

C1 nor apeucaae

(SEVERED MINERAL werEREST)

DB] cuecx ir Fer's Home anoress

5 IF SOLD

Oner caw C1 tess THAN 85,000 [] $5,000-s9,929 [] $10,000-$24,99 [] $25,000~-0R MORE.

Onertoss

HELD OR ACQUIRED BY FILER ‘SPOUSE 1 bePeNDENT CHILD

STREET ADDRESS eaten “ "

Cl noravanasve Burleson, TX 76028

DESCRIPTION

Owrs

Dacees

Single Family Residence

NAMES OF PERSONS.

RETAINING AN INTEREST

Di nor arpucasis

(SEVERED MINERAL wreREST)

IF SOLD

ner oan

(ner oss

C1 tess Tan sso00 [1] $5,000-s,999 [] s10,000- 824,999] $25,000-oR MORE.

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.80x12070____ Austin, Texas 78711-2070 (51263-5800 ___ 1-900-325-8508,

INTERESTS IN REAL PROPERTY PaRT 7A

1 NOT APPLICABLE

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain of loss realized from the sel.

For an explanation of ’benefical interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Gover Sheet

1 HELD OR ACQUIRED BY Dy rue SPOUSE [1 DePeNoENT cHiLD

2 ‘STREET ADDRESS NGMDONEGTY COV ND SATE

eu ate Lot 3 Bk 9 Alsbury Vilage

Ci nor avataste Burleson, TX 76028

Doneck ir rusestome aooress | Trent

3 DESCRIPTION TWONGERGF LOTS O8 ACRES NO NAHE GF COUNTY WHERE LOCATED

Quors Commercial Building

acres

4 NAMES OF PERSONS

RETAINING AN INTEREST

Di nor apeucaste

(SEVERED MINERAL INTEREST)

5 IF SOLD

C1tess THAN $5,000 [] $5,000-83,989 ] st000-$24,9e9 [] $25,000-OR MORE

HELD OR ACQUIRED BY Drier spouse 1 pepenoent cH

STREET ADDRESS one

CO nor avntane Burleson, 176028

Dloneccirruens nome aooness | Tarant

BESCHIETION TSE OF LOTS OR AGRES AND NEO COUNTY WERE LOGATED

g ors: Commercial Building

‘ACRES

NAMES OF PERSONS

RETAINING AN INTEREST

CD nor appucasie

(GEVERED MINERAL INTEREST)

IF SOLD

Dnercan (tess man 'ss.000 [] $5,000-$0.999 [] $10000-s24,900 — [] $25.000-oR MORE

Di nercoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Toxas Ebies Commission P.O. Box 12070 __ Austin, Texas 78711-2070 (612)469-5800

1-800-325-8506

1 NOT APPLICABLE

INTERESTS IN REAL PROPERTY

PaRT 7A

INSTRUCTION GUIDE.

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PES—

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

0 check iF FILER'S HOME ADDRESS

1 HELD OR ACQUIRED BY Dy rucr ‘SPOUSE 1 bepeNDenT CHILD

2 STREET ADDRESS ee {IREET ADDRESS, RGLUDNGTY COUNTY AND STATE

Dor avanasie Burleson, Tx 76028

3 DESCRIPTION

Qors

Dacacs

Single Family Residence

‘4 NAMES OF PERSONS

C1 nor aPpucasie

RETAINING AN INTEREST

(SEVERED MINERAL INTEREST)

5 iF SOLD

Cnercan

Cnervoss

(Less tHan $5,000 [] $5.000-sa.909 [] $10,000-s24,909 [] $25,000-OR MORE

HELD OR ACQUIRED BY

STREET ADDRESS

Nor avaltaBLe

Di creo riers Howe apres

FILER, 1 spouse D7 berenoent cHILD

‘STREET ADDRESE RELUBIG STV COUNTY MID TATE

817 Crestview

Burleson, TX 76028

Johnson

DESCRIPTION

Dore

Dacres:

Single Family Residence

NAMES OF PERSONS

D1 nor arpuicasie

RETAINING AN INTEREST

(SEVERED WINERAL INTEREST)

IF SOLD

Oi neronin

D nerLoss

[tess tHaNss,000 [] $5.000-s,999 [] $10,000-s24,om [J $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Toxas Ethics Commission .0. 8x 12070 __Austin, Texas 78711-2070 (12)163-5800, 1-900.926-8506

INTERESTS IN REAL PROPERTY Part 7A

1 Nor APPLICABLE

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

‘alondar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the childs isted on the Cover Sheet.

1 HELD OR ACQUIRED BY Di ruer SPOUSE D1 bePeNDeNT cro

2 ‘STREET ADDRESS GLIDING GUY, COUNTY ND STATE

STREET ADDRESS ee

Di not avanaace Burleson, TX 76028

dohnson

CD otecxir riers Hove aoress

3 DESCRIPTION TIMBER OF LOTS OR ACRES AND RANE OF GOONTY HERE LOOTED

Abt

Bors Building Lot

acres:

4 NAMES OF PERSONS

RETAINING AN INTEREST

Di nor apeucame

{SEVERED MINERAL INTEREST

5 iF SOLD

Dnerean [ess rian 85.000] $5,000-88.999 [] $10,000-s24,909 ] $28,000-0R MORE.

D nertoss

HELD OR ACQUIRED BY Bruer Dl spouse 1 bePenoeNT CHILD

‘STREET ADDRESS ee :

Di wor avanasus Burleson, TX 76028

Di onecrirruers Home anoress | “ohnson

BESCARTON TWO OF LTS OR ACRES AS WANE OF COUNTY WHERE LOCATED

40 acres

Duos Development Prop

i Acres

NAMES OF PERSONS

RETAINING AN INTEREST

Di nor areuicane

{SEVERED MINERAL INTEREST)

IF SOLD

Di neroaw Cl tess Tian ss.000 [7] s6.000- $9,909 [J s10.000-824,099 ] $25,900-0R MORE

Di nertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commision P.0.Box 12070 ___ Austin, Texas 78711-2070, (512)463-5800 1-800325-0506

(D_NOT APPLICABLE

INTERESTS IN REAL PROPERTY Part 7A,

INSTRUCTION GUIDE,

Describe all beneficial interests in real property held or acquited by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized irom the sale,

For an explanation of "beneficial interest’ and other specific directions for completing this section, see FORM PFS—

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

1 HELD OR ACQUIRED BY rier ‘SPOUSE Doe Penpent cHiLD

2 {STREET ADDRESS, NELUDRE ITY COUNTY AID STATE

STREET ADDRESS ns

(Nor avaivaate: Burleson, TX 76028

Terrant

D1 creck ir rues Home ADDRESS

3 DESCRIPTION a ‘NOWBER GF LOTS OR ACRES AND NE OF COONTY WHEE LOCATED

Lore. ‘Single Family Residence

Dacre

4 NAMES OF PERSONS

RETAINING AN INTEREST

Di nor arpucase

(SEVERED MINERAL TEREST)

5 IF SOLD

C1nerean

Dnertoss

Cites THAN ss,000 [1] $5,000-s9,099 [] $10.000-826,099 2] $25,000-OR MORE.

HELD OR ACQUIRED BY

Bruce Di srouse D1 DePENpeNT cHiLD

STREET ADDRESS

[Bl wor avanaate Burleson, TX 76028

Di creck irrners nome anoress | "ant

DESCRIPTION ; TNOWGER OF LOTS OR RES AND WANE GF COUNIY WHERE LOCATED

NAMES OF PERSONS

RETAINING AN INTEREST

Dxor areca

(SEVERED WINERAL INTEREST)

IF SOLD

Co nersan

Ti nerioss

[tess tHan ss,000 [] s59000-s3,900 1] s10,000- $24

88] $25,000-oR more

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box 12070 __Austin, Texas 78711-2070 (512)463-5800 1.800.526.0506,

INTERESTS IN BUSINESS ENTITIES Part 7B

1 NOT APPLICABLE

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of beneficial interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE

When reporting information about a dependent child's activity, Indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY Dirur

‘SPOUSE (7 DePeNDeNT cHiLD

2 DESCRIPTION Di eeeste race emesis

Orr & Associates Real Estate

282. NW Tarrant

Burleson, TX 76028

3 IF SOLD

OnNer cain C1 Less THAN $5,000 [[] $5,000-$9,998 [1] $10,000- $24,999) $25,000-0R MORE

ner toss

HELD OR ACQUIRED BY ruse Ti srouse —_ bePenvenr cuit

DESCRIPTION Di eect rane Home ates

Alsbury LP

675 Asbury Blvd

Burleson, TX 76028

IF SOLD

(ner aw Tess ia 85.000] $5:000-s9,95 [1 st0.000-824.999 [] s25.000-0R MORE

Liner toss

HELD OR ACQUIRED BY Da ruer Ti spouse Cy ePennenrcnuo

DESCRIPTION i teecrrtrs tome sion)

JACOLE LP

PO Box 1088

Burleson, TX 76028

IF SOLD

ner cain C1 tess THAN ss.000 [7] $5,000-88,999 [J s10,000- 24,909 1] $25,000-0R MORE

O nertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box 12070 ___Austin, Texas 78711-2070 (512}63-5800

1-900-525-8508

INTERESTS IN BUSINESS ENTITIES

CO Nor APPLICABLE

Part 7B

INSTRUCTION GUIDE

Providing the number under which the child is listed on the Cover Sheet.

Describe all beneficial interests in business entiies held or acquired by you, your spouse, or a dependent child during the

Calendar yeer. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from tho sale.

For an explanation of "beneficial interest’ and other specific directions for completing this section, see FORM PFS

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

1 HELD OR ACQUIRED BY

Grier Bi spouse C1 DePENDENT CHILD

2 DESCRIPTION Di tereck tries ome Adsass)

DOOR Invastments, LLC

282, NW Tarrant

Burleson, TX 76028

Di tereck ters Home Aas)

(rr Investments, LLC

232 NW Tarrant

Burleson, TX 76028

3 IF SOLD

Dnercan C1 Less Tian $5,000 [] $5,000-ss,009 J $10.000- $24,999 $25,000-0R MORE

Dnertoss

HELD OR ACQUIRED BY FILER i spouse D7 berenpenr cuit

DESCRIPTION Sete

i ccreck ters Home Acres)

Burleson Five Star Properties

232 NW Tarrant

Burleson, TX 76028

IF SOLD

Cneroaw tess THaN $5,000] $5,000-89.999 [] s10,000-824,909 [] $25,000-oR MORE

Linertoss

HELD OR ACQUIRED BY Bruce Cisrouse ve PenneNT clin

DESCRIPTION Sarat a

IF SOLD

Cinertoss

Cerca C1 tess ran s6.000 1] $5000-$,959 [] s10.000-824.999. [1] s25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethles Commission P.0.Box 12070 ___ Austin, Texas 78711-2070 (512)63-5800 1-800-325-8508

INTERESTS IN BUSINESS ENTITIES PaRT 7B

1 NOT APPLICABLE

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Caver Sheet.

1 HELD OR ACQUIRED BY Bruce Clsrouse —] vePENveNTcHLD

2 DESCRIPTION Di teneceit Fer Home At

Burleson Future Investments

232 NW Tarrant

Burleson, TX 76028

3 IF SOLD

Diner cain Ties Tian ss00 2] $5.000-s9989 [] s10.000-824,99 [] $25,000-08 MORE

Linertoss

HELD OR ACQUIRED BY FILER Cisrouse 7] ePeNenr cH

Coon Di torecic it Fters Home address)

Burleson Premier Real Estate, LLP

232 NW Tarrant

Burleson, TX 76028

IF SOLD

Diner caw D1 Less THaN 5,000 [7] $5,000-$0,969 [1] st0,000-s24,999 [1] $25,000-oR MORE

Dnertoss

BETO ACoUInED Sy FILER sPousE 1 bePennent CHILD

DESCRIPTION ae

i (erect rs Heme Aras

RPO Properties, LP

232 NW Tarrant

Burleson, TX 76028

IF SOLD

ner can [tess tHan $5,000 [7] $6,000-s0,009 ] st0.000-s24.099 ] $25,000-0R MORE

Dnertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission P.0. Box 12070

‘Austin, Texas 78711-2070 (612/462-5600 1-800-325-8506

DI Nor APPLICABLE

INTERESTS IN BUSINESS ENTITIES

PaRT 7B

INSTRUCTION GUIDE

Describe all beneficial interests in business enlities held or acquired by you, your spouse, or a dependent child during the

Calendar year. Ifthe interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS—

When reporting information about a dependent chile’s activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

1 HELD OR ACQUIRED BY

FILER

LW spouse O bepenpenT cHiLD

}2 DESCRIPTION

(Orr Property Management

232 NW Tarrant

Burleson, TX 76028

Di tereck it Fer ome Ae

3 IF SOLD

Cnet ean Ctess tian ss.000 5.000.509] si,000-s24o99 [1] $25,000-OR MORE

Liner Loss

HELD OR ACQUIRED BY Di ruer Ciseouse DX] bepennenr cho

DESCRIPTION Ci teecct rors Home Aes

‘Abstract S58 MNGT LLC

2232 NW Tarrant

Burleson, TX 76028

IF SOLD

Liner can Ctess tian ss.000 [] $5,000-$909 [] $10.000-se4.960 1] $25,000-08 MORE

Cner toss

HELD OR ACQUIRED BY

FILER

D spouse D1 erenoenr crip

DESCRIPTION Di (erect Fars Home Aas)

Center Street investments

282 NW Tarrant

Burleson, 1% 76028

IF SOLD

CNet oan Ces THAN $5,000 [] $5,000-88,299 [] s10,000- 824,909 [1] $25,000-OR MORE

CQ netLoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“eras Ethics Commission P.0.Box 12070___ Austin, Texas 78711-2070 (512}169-5600, 1-800-928-8506

TRUST INCOME PART 9

1D NOT APPLICABLE

Identify each source of income received by you, your spouse, or a dependent ehild as beneficiary of a trust and indicate the

Category of the amount of income received. Also identify each asset ofthe trust from which the beneficiary received more

than $500 in income, if the identity of the asset is known. For more information, see FORM PFS-INSTRUCTION GUIDE.

‘When reporting information about a dependent chilt's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 SOURCE AE OF TRUST

ICO lnrevocable Trust 2007

? BENEFICIARY Orter CO spouse [i] DEPENDENT CHILD 4

3

ae Hts THAN'5,000 [1] $5,000-$9,999 [3] s10,000-s24,099 [1] $25,000-08 MORE

4 ASSETS FROM WHICH Mineral INoome

OVER $500 WAS RECEIVED

CD unknown:

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Tus EWis Commision P.O. Soc 12070 _Aust, Texas 171-2070 (exyesseon __avoas-s00

ASSETS OF BUSINESS ASSOCIATIONS PART 11A.

(NOT APPLICABLE

Describe all assets of each coporation, firm, partnership, limited partnership, limited liabiity partnership, professional

‘corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

Sent child held, acquired, or sold 60 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting Information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the cid is sted on the Cover Sheet.

1 BUSINESS NAME AND ADDRESS LD (Check Flers Home Adéress

BUSINESS |_| orr& Associates Real Estate

282 NW Tarrant

Burleson, TX 76028,

2 BUSINESS TYPE _ | Real Estate Soles

3 HELD, ACQUIRED, FUER spouse DEPENDENT CHAD

OR SOLD BY a a o

yee Sean T EGO

Listing Inventory

| ess ruaws5.000. [] $5:000-$9.99

1 C1 s10.000- $24,999

|

| uss sn sss

| Ciswen-oane Gl sne-onuon

'$25,000-OR MORE

Furniture and Fixtures

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission

P.0.Box 12070 __Austn, Texas 78711-2070

(12463-5800 1-800-325-8508

ASSETS OF BUSINESS ASSOCIATIONS

(Nor APPLICABLE

PART 11A

Describe all assets of each coporation, firm, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

held, acquired, or sold 60 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, see FORM PFS-INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

dent

providing the number under which the child is listed on the Cover Sheet.

| BUSINESS ANE AND ADDRESS —[] (Greek Flere Hane Alo)

ASSOCIATION | Alsbury LP

232 NW Tarrant

Burieson, TX 78028

2 BUSINESS TYPE Pe

3 HELD, ACQUIRED, Di rwer [I spouse (1 DePENDENT CHILD

OR SOLD BY

atRaeerS’ DESCRIPTION Coo

Commercial Building

Rental Income

Di tess man ss.000 [J $5,000- 89.08

1 si0.000- $24,089 [J $25,000-OR MORE.

T

1

|

I

ey

|

j Cites ran ss.000 [1] $5,000- $9.99

| Cl s10.000- $24,909 fx] $25,900-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission

P.0.8ox 12070 __Austin, Texas 78711-2070

(912463-5800____ 1-800-325-8506

Ol Nor APpLicasLe

ASSETS OF BUSINESS ASSOCIATIONS

ParT 11A

Describe all assots of each coporation, firm, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 60 percent or more of the outstanding ownership and indicate the calegory of the amount

of the assets. For more information, see FORM PFS~INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

1 BUSINESS [NAME AND ADDRESS [J (CheekitFie’s owe Adaress)

ASSOCIATION AACOLE LP

232 NW Tarrant

Burleson, TX 76028

2 gusiness Type [LP

8 HELD, ACQUIRED, FILER BW spouse (D1 berenpenr HL

OR SOLD BY

4 ASSETS DESCRIPTION T CATEGORY

Commercial Building

Rental Income

|

| Ditsss tian 5000 s5,00- 89.980

| C1 10,000- 24,90

Less THAN $5,000 [] $5,000- 89,909

|

‘$10,000- $24,998 [RJ $25,000-OR MORE

|

$$25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethie Commission P.0.Box 12070 ___Austn, Texas 78711-2070 (512}463-5800 1-800-325-0506

ASSETS OF BUSINESS ASSOCIATIONS PART 11A,

Ol NoT APPLICABLE

Describe all assets of each coporation, firm, partnership, limited partnership, limited liabilty partnership, professional

Corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

ent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, see FORM PFS~INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

7 BUSINESS NAME AND ADORESS —__[] (Ghocki Flare Home Adios)

ASSOCIATION DOOR INvestments

232 NW Tarrant

Burleson, TX 76028

2 Business Type [LLC

3 HELD, ACQUIRED, ret

. 5 ‘spouse DEPENDENT CHILD

OR SOLD BY 2 EI

@ ASSETS DESCRIPTION T CATEGORY

Commercial Building

| C1 Less THAN $5,000] $5,000- $9,090

| Cl 810.000 - $24,000 '$25,000~OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Toxas Ethie Commision P.0.B0% 12070 ___Austn, Texas 78711-2070 (sr2y63-s800___+-900.226-6508,

ASSETS OF BUSINESS ASSOCIATIONS ParT 11A

C1 Nor APPLICABLE

Deserve all assets ofeach coporaton, fim, partnership limited partnership, ited lablly parinrship, professional

corporation, professional association joint venture, or other business association in which you, your spouse, ora depen

dent child held, acquired, or sold 60 percent or more ofthe outstanding ownership and indicate the category ofthe amount

of the assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

7 BUSINESS NAME AN ADDRESS [] (eal Flor Fae As)

ASSOCIATION | OF Investments

232 NW Tarrant

Burleson, TX 76028,

2 pusiness type [LLC

3 HELD, ACQUIRED,

OR SOLD BY

a DESCRIPTION T CATEGORY

ae Investment Property

FILER BH spouse O ePenvenr cHiLD

| Cltess ras5on0 1] sso00- $3.98

| Ci sioo0 524099 1 s25.000-o wore

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0,Box 12070 __Avstin, Texas 78711-2070 (51263-5800 1-300.325-8506,

ASSETS OF BUSINESS ASSOCIATIONS PART 11A

1 Nor APPLICABLE

Describe all assets of each coporation, firm, parnership, imiled parinership ited lability parinership, professional

corporation, professional association joint venture, or other business association in which you, your spouse, ore open:

Gent chil held, acquired, or sold 50 percent or more of the outstanding ownorship and indicate the category ofthe encunt

of the assets. For more information, see FORM PFS-INSTRUCTION GUIDE.

\Whten reporting information about a dependent chit’ activity, indicate the chi about whom you are reporting by

Broviding the number under which the childs listed on the Covor Sheet

1 BUSINESS NAME ANO ADBRESS —L] (Sneek FFiers Hone Aas)

ASSOCIATION | Burleson Business Center

200 Centre Drive

Burleson, TX'76028

2 BusiINess Type | LL

3 HELD, ACQUIRED,

OR SOLD BY

é assets Commercial Building eee

FILER

SPOUSE (7 bePeNpeNT crit

CATEGORY

1 s10.000- 524,999 [R] $25,000-0R MORE

T

| [ess THaN $5,000] $5,000--$9.9¢0

I

'

Rental Income |

C1tess THaN $5,000 [] $5,000-$9,990

| [1 s10.000- 24,989] s25,000-on MoRE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.80x 12070 ___ Austin, Texas 78711-2070 (512)463-5800 800-325-8506

ASSETS OF BUSINESS ASSOCIATIONS Part 11A

C1 Nor APPLICABLE

Describe all assets of each coporation, firm, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 60 percent or more of the outstanding ownership and indicate the catagory of the amount

of the assets. For more information, see FORM PFS-INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

1 BUSINESS NAME AND ADDRESS (Check fFle’s Home Adsooe)

ASSOCIATION Burleson Five Star Propertios,

232 NW Tarrant

Burleson, TX 76028

2 BUSINESS TYPE —_| Partnership

'3 HELD, ACQUIRED,

OR SOLD BY

ASSETS vaaowe DESCRIPTION ‘CATEGORY

j Cites ria ss.000 [] s5000- sa.9e9

| Cs10.000- $24,989 DX] $25,000-08 MORE

FILER. Oi seouse (C1 ePeNDeNT CHILD

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box 12070 ___ Austin, Texas 78711-2070 1263-5200 +-800.926-6506

ASSETS OF BUSINESS ASSOCIATIONS Part 11A

1 NoT APPLICABLE

Describe all assets of each coporation, firm, partnership, limited partnership, limited liability partnership, professional

‘corporation, professional association, joint venture, or other business association In which you, your spouse, or a depen

dent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Gover Sheet,

7 BUSINESS NAME AND ASORESS —[] (Gheck Fer Home ns)

ASSOCIATION | Burleson Future Investments

232 NW Terrant

Burleson, TX 76028

2 pusiness TYPE | UP

3 HELD, ACQUIRED, FILER ‘SPOUSE DEPENDENT CHILD

OR SOLD BY a Qo Qo —

We va ESCRPTION REGO

j CLLess tian sson0 C] s5,000- 89.900

| C1 s10.000-sze,cee fH $25,000-oR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0. 80% 12070 ___Austin, Texas 78711-2070,

(51263-5800 1-900-325-8506

ASSETS OF BUSINESS ASSOCIATIONS

C1 Nor APPLICABLE

PART 11A

providing the number under which the child is listed on the Cover Sheet,

Describe all assets of each coporation, fim, partnership, limited partnership, limited liability partnership, professional

‘corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen

dent child held, acquired, or sold 60 percent or more of the outstanding awnership and indicate the category of the amount

of the assets. For more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

7 BUSINESS NAME AND ADDRESS [] (oreo Pera oe Rar)

ASSOCIATION __| Burleson Promior Real Estate

232.NW Tarrant

Burleson, TX 76028

2 susiness Type [ULC

3 HELD, ACQUIRED, FILER SPOUSE DEPENDENT CHILD.

OR SOLD BY a a a

i DESSRPTON T CATECORY

eae 41 Acres |

j Ll tess man sso00 1] 86:000.-3,900

| C1 st0.000-s24.999 [J $25,000-oR woRE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box 12070 Austin, Texas 78711-2070 (51263.5800 4-900-225-0506,

ASSETS OF BUSINESS ASSOCIATIONS Part 11A

1 Nor APPLICABLE

Describe all assets of each coporation, fim, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, see FORM PFS~INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet

1 BUSINESS NAME AND AGDRESS —_—_L] (Cech Flere ane Res)

ASSOCIATION (Orr Property Management

232. NW Tarrant

Burleson, TX 76028

2 BUSINESS TYPE _| Residential and Commercial Property Management

3 HELD, ACQUIRED,

OR SOLD BY

o DESCRIPTION T CATEGORY

eer Client Inventory

ruse TB spouse C1 oePenvent creo

| cueeenitsne Css.

| Cl st0.000-s24.e09 fj $26,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.80% 12070 Austin, Texas 78711-2070, (12469-5800 __ 1-800-326-8506

ASSETS OF BUSINESS ASSOCIATIONS ParT 11A

1 NoT APPLICABLE

Describe all assets of each coporation, fim, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

ont child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

cf the assets. For more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

te "NAME AND ADDRESS [_] (Ghockif Fiera Rome Adeross)

BUSINESS || tac eb NGT LLC

232 NW Tarrant

Burleson, TX 76028

2 Business TPE [LLC

3 HELD, ACQUIRED, FILER ‘spouse DEPENDENT CHILD.

OR SOLD BY a o o

1 ASSETS DESCRIPTION T ‘GRTEGORY

Raw Land i

j Cltsss THawss000 C] 85000-89908

| Cl s10.000-s24,989 [59 $25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission P.O. Box 12070 ___Austin, Texas 78711-2070 (512 }469-5800___ 1-800-325-8506

ASSETS OF BUSINESS ASSOCIATIONS Part 11A

1 Nor APPLICABLE

Describe all assets of each coporation, fim, partnership, limited partnership, limited liability partnership, professional

‘corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

You might also like

- Kentucky Senate Bill 88Document5 pagesKentucky Senate Bill 88Texas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2009)Document12 pagesKentucky Resources Council 990 (2009)Texas WatchdogNo ratings yet

- Senate Bill 13Document6 pagesSenate Bill 13Texas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2010)Document27 pagesKentucky Resources Council 990 (2010)Texas WatchdogNo ratings yet

- Senate Bill 14Document24 pagesSenate Bill 14Texas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2008)Document12 pagesKentucky Resources Council 990 (2008)Texas WatchdogNo ratings yet

- Drop Settlement AnnouncmentDocument2 pagesDrop Settlement AnnouncmentTexas WatchdogNo ratings yet

- Texans For Public Justice Lawsuit ReleaseDocument2 pagesTexans For Public Justice Lawsuit ReleaseTexas WatchdogNo ratings yet

- Economic Analysis of Critical Habitat Designation For Four Central Texas SalamandersDocument138 pagesEconomic Analysis of Critical Habitat Designation For Four Central Texas SalamandersTexas WatchdogNo ratings yet

- Texas Revenue EstimateDocument100 pagesTexas Revenue EstimateTexas WatchdogNo ratings yet

- Project Connect/ Urban Rail ReportDocument22 pagesProject Connect/ Urban Rail ReportTexas WatchdogNo ratings yet

- The Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasDocument4 pagesThe Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasTexas WatchdogNo ratings yet

- Road Map To RenewalDocument72 pagesRoad Map To RenewalTexas WatchdogNo ratings yet

- Hog Catcher Liberty County TexasDocument1 pageHog Catcher Liberty County TexasTexas WatchdogNo ratings yet

- School Finance 101 01142011Document50 pagesSchool Finance 101 01142011Texas WatchdogNo ratings yet

- Preview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Document4 pagesPreview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Texas WatchdogNo ratings yet

- Coburn Safety at Any PriceDocument55 pagesCoburn Safety at Any PriceAaron NobelNo ratings yet

- Your Money and Pension ObligationsDocument24 pagesYour Money and Pension ObligationsTexas Comptroller of Public AccountsNo ratings yet

- Travis County BallotDocument2 pagesTravis County BallotTexas WatchdogNo ratings yet

- OIG Report On Homeland Security Spending by State of TexasDocument53 pagesOIG Report On Homeland Security Spending by State of TexasTexas WatchdogNo ratings yet

- Weekly Weatherization ReportsDocument89 pagesWeekly Weatherization ReportsTexas WatchdogNo ratings yet

- Alamo ReportDocument38 pagesAlamo ReportTexas WatchdogNo ratings yet

- Inspection ReportsDocument63 pagesInspection ReportsTexas Watchdog100% (1)

- Homeland Security BudgetDocument183 pagesHomeland Security BudgetTexas Watchdog100% (1)

- Nov 2012 Sample BallotDocument6 pagesNov 2012 Sample BallotMike MorrisNo ratings yet

- Stateemployees PercentDocument1 pageStateemployees PercentTexas WatchdogNo ratings yet

- Cityreferenda DownballotDocument2 pagesCityreferenda DownballotTexas WatchdogNo ratings yet

- Travisco DownballotDocument3 pagesTravisco DownballotTexas WatchdogNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)