Professional Documents

Culture Documents

Question KPMT 3 - 2010

Uploaded by

Muadz AzmiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question KPMT 3 - 2010

Uploaded by

Muadz AzmiCopyright:

Available Formats

Additional Mathematics Project Work 3 2010

CURRICULUM DEVELOPMENT DIVISION

MINISTRY OF EDUCATION MALAYSIA

ADDITIONAL MATHEMATICS PROJECT WORK 3/2010

BACKGROUND

Every business requires some form of investment and a sufficient number of customers to

buy its products or services that give profits on a continuous basis. When pricing experts set

a selling price for a new product, their goal is to maximize profits. They begin by estimating

the demand for the product at various selling prices. Generally, the demand for a product will

increase as the selling price decreases.

PART 1

Table 1 shows the various selling prices and estimated demand for a particular computer

component manufactured by a company, Warisan RMN.

Selling Price Per Unit, s, Estimated Yearly Demand, d,

(RM) (units)

75 4500

125 3500

200 2000

250 1000

Table 1

(a) Determine the relationship between the demand, d, and the selling price, s, by plotting

a graph based on the values displayed in Table 1. Plotting of the graph can be done

manually, using computer software such as Microsoft Excel or graphing calculator.

Interpret the graph, discuss and write a brief explanation on the relationship between

the demand and the selling price of the computer components manufactured by the

company.

(b) Assuming that the production cost of the computer component is RM 50 per unit,

express the yearly profit, P, in terms of the selling price, s. Comment on your answer.

[Note: Total Profit = Total Sales – Total Cost]

(c) Use two or more methods to determine the maximum profit and the corresponding

selling price. Explain your answers.

(d) Further, determine the number of the computer components to be manufactured by the

company in order to gain maximum profit.

Curriculum Development Division, Ministry of Education Malaysia

1

Additional Mathematics Project Work 3 2010

PART 2

In year 2009, Warisan RMN made a profit of RM200 000. The company intends to increase

its production in year 2010, and therefore needs a substantial amount of money for capital

investment.

As manager of the company, you have to decide on the amount of loan and the period of the

loan to be taken for the purpose mentioned above.

Table 2 shows part of a monthly repayment schedule for a commercial loan from Bank A:

Loan Monthly Payment ( RM)

12 months 24 months 36 months 48 months 60 months

Amount

(RM)

10 000 1034.00 617.00 478.00 409.00 367.00

15 000 1550.00 925.00 717.00 613.00 550.00

20 000 2067.00 1234.00 956.00 817.00 734.00

25 000 2584.00 1542.00 1195.00 1021.00 917.00

30 000 3100.00 1850.00 1434.00 1225.00 1100.00

35 000 3617.00 2159.00 1673.00 1430.00 1284.00

40 000 4134.00 2467.00 1912.00 1634.00 1467.00

45 000 4650.00 2775.00 2150.00 1838.00 1650.00

50 000 5167.00 3084.00 2389.00 2042.00 1834.00

Table 2

(a) Based on Table 2, calculate the total amount of interest incurred for each choice of

repayment period and their corresponding amount of loan. Tabulate the values in

Table 3.

Total Loan Total Interest Incurred(RM)

RM 12 months 24 months 36 months 48 months 60 months

10 000

20 000

30 000

40 000

50 000

Table 3

(b) Based on your findings in (a) calculate the average interest rate per month. Tabulate

your results and comment on your findings.

(c) Further, tabulate the amount of yearly repayment for each choice of repayment period

up to 5 years for loan amounts from RM10 000 to RM100 000. By observing the total

annual payment for 12 months, show that the annual payment for loan amount of

RM10 000, RM15 000, RM20 000 and so on form a progression.

Curriculum Development Division, Ministry of Education Malaysia

2

Additional Mathematics Project Work 3 2010

(d) The company allocated only 20% of the profit made in the year 2009 on loan

repayment period per annum. Assume that the company continues to make an annual

profit of RM200 000 in the following years.

(i) Based on your table in (c), determine the maximum amount of loan, in multiples of

RM5000, for each choice of repayment period: 1 year, 2 years, 3 years, 4 years

and 5 years.

(ii) Hence, determine which loan option should the company take, and elaborate on

your reasons.

(e) The company has set aside a reserve fund of RM50 000 in a bank and earns monthly

interest beginning 1st January 2010.

Assuming that the bank gives an annual interest of 2.5%; determine the amount of the

reserve fund at the end of each month until 31st December 2010.

FURTHER EXPLORATION

Look into other commercial loans or other financial sources available in the market that may

be utilized by the company for its capital investment. (Example: Overdraft, Islamic Loan)

Discuss the advantages and disadvantages of the different types of loans available.

REFLECTION

While you were conducting the project, what have you learnt? What moral values did you

practise? Represent your opinions or feelings creatively through usage of symbols,

illustrations, drawings or even in a song.

Curriculum Development Division, Ministry of Education Malaysia

3

You might also like

- Adds Math Project 2010 (Tugasan 3)Document5 pagesAdds Math Project 2010 (Tugasan 3)Aaron Lai Chin ChenNo ratings yet

- FAB Assignment 2020-2021 - UpdatedDocument7 pagesFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminNo ratings yet

- MCS-035-Accountancy and Financial ManagementDocument5 pagesMCS-035-Accountancy and Financial ManagementShainoj KunhimonNo ratings yet

- UBS Capital BudgetingDocument19 pagesUBS Capital BudgetingRajas MahajanNo ratings yet

- Ukam3043 Management Accounting IiiDocument9 pagesUkam3043 Management Accounting IiiBay Jing TingNo ratings yet

- FM Paper Solution (2012)Document6 pagesFM Paper Solution (2012)Prreeti ShroffNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- 401 Epm QP NDDocument2 pages401 Epm QP NDvipul rathodNo ratings yet

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeeNo ratings yet

- Accounting Devoir Part BDocument2 pagesAccounting Devoir Part BAbdul HadiNo ratings yet

- Take Home Final Exam1Document4 pagesTake Home Final Exam1Sindura RamakrishnanNo ratings yet

- Advanced Financial Management Elective PaperDocument3 pagesAdvanced Financial Management Elective PaperRamakrishna NagarajaNo ratings yet

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- 10JUNE23 Quiz Question FinanceDocument2 pages10JUNE23 Quiz Question FinanceShaleeena Aihara0% (1)

- Cw3 - Excel - 30Document4 pagesCw3 - Excel - 30VineeNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Final Exam 2017Document10 pagesFinal Exam 2017Ahtisham KhawajaNo ratings yet

- PDFDocument56 pagesPDFOmar AjNo ratings yet

- Exercise On Capital Budgeting-BSLDocument19 pagesExercise On Capital Budgeting-BSLShafiul AzamNo ratings yet

- MQP - MBA - Sem2 - Financial Management (DMBA202) PDFDocument4 pagesMQP - MBA - Sem2 - Financial Management (DMBA202) PDFsanjeev misraNo ratings yet

- SCMPEDocument8 pagesSCMPEkalyanNo ratings yet

- UntitledDocument1 pageUntitledSaraswathy ArunachalamNo ratings yet

- Verdadero Cjezerei Borrowing CostsDocument11 pagesVerdadero Cjezerei Borrowing CostsPeter PiperNo ratings yet

- Business Management Paper 2 SLDocument7 pagesBusiness Management Paper 2 SLSaket GudimellaNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- P1 Question December 2019Document7 pagesP1 Question December 2019S.M.A AwalNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Final Practrice (Unit 4 and 5)Document9 pagesFinal Practrice (Unit 4 and 5)mjlNo ratings yet

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamNo ratings yet

- Additional Mathematics Project Work 3Document22 pagesAdditional Mathematics Project Work 3Atiqah Pinka100% (1)

- Assignment-Project ManagementDocument2 pagesAssignment-Project ManagementAnu KrishnaNo ratings yet

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentNoumanNo ratings yet

- MBA I Semeste Model Question Papers W.E.F (2011-13) StudentsDocument8 pagesMBA I Semeste Model Question Papers W.E.F (2011-13) Studentsvikramvsu100% (2)

- II SEMESTER ENDTERM EXAMINATION MARCH 2016Document2 pagesII SEMESTER ENDTERM EXAMINATION MARCH 2016Nithyananda PatelNo ratings yet

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Business Management Standard Level Paper 2: Instructions To CandidatesDocument7 pagesBusiness Management Standard Level Paper 2: Instructions To CandidatesjinLNo ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarNo ratings yet

- Entrepreneurship & IP: Financial AnalysisDocument9 pagesEntrepreneurship & IP: Financial Analysiswihanga100% (2)

- Sri Sairam Institute of Management Studies Chennai - 44Document4 pagesSri Sairam Institute of Management Studies Chennai - 44Anbarasu KrishnanNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Accounting For Managerial DecisionsDocument3 pagesAccounting For Managerial DecisionsKevin JoyNo ratings yet

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationZeeshan MahmoodNo ratings yet

- Final Exam A142 AnswerDocument10 pagesFinal Exam A142 AnswerNadirah Mohamad SarifNo ratings yet

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyNo ratings yet

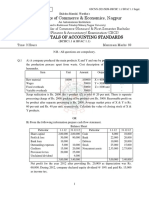

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- sFikv8tLO3DuTOB3I8bY--4762Document2 pagessFikv8tLO3DuTOB3I8bY--4762dipusharma4200No ratings yet

- Jimma University Construction Economics (CEGN 6108)Document7 pagesJimma University Construction Economics (CEGN 6108)TesfuNo ratings yet

- Projec Addmath 2010Document21 pagesProjec Addmath 2010Ini Qama0% (1)

- P2 - AO1 Revision Exercises - 2023 For 16 August 2023 Class (1) - 3Document7 pagesP2 - AO1 Revision Exercises - 2023 For 16 August 2023 Class (1) - 3Lameck ZuluNo ratings yet

- Blank 3e ISM Ch02Document40 pagesBlank 3e ISM Ch02Sarmad KayaniNo ratings yet

- Screenshot 2023-08-27 at 11.56.55 AMDocument34 pagesScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNo ratings yet

- AssignmentsDocument7 pagesAssignmentspratikshakurhade04No ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- The Act of ShirkDocument12 pagesThe Act of ShirkMuadz AzmiNo ratings yet

- Question KPMT 4 - 2010Document4 pagesQuestion KPMT 4 - 2010Muadz AzmiNo ratings yet

- Question KPMT 2 - 2010Document4 pagesQuestion KPMT 2 - 2010Muadz AzmiNo ratings yet

- Question KPMT 1 2010Document4 pagesQuestion KPMT 1 2010matsepuNo ratings yet

- Loan Function of BanksDocument2 pagesLoan Function of BanksKarlo OfracioNo ratings yet

- p2014 FSI 01final ReportDocument350 pagesp2014 FSI 01final Reportalt.xq-2twvdr2No ratings yet

- Delaware No. 41-0449260 420 Montgomery Street, San Francisco, California 94104Document21 pagesDelaware No. 41-0449260 420 Montgomery Street, San Francisco, California 94104PetrNo ratings yet

- RRLDocument10 pagesRRLKristin Zoe Newtonxii PaezNo ratings yet

- D2023191SMTDocument13 pagesD2023191SMTParth VijayNo ratings yet

- W-8BEN-E: Certificate of Status of Beneficial Owner For United States Tax Withholding and Reporting (Entities)Document8 pagesW-8BEN-E: Certificate of Status of Beneficial Owner For United States Tax Withholding and Reporting (Entities)betanviNo ratings yet

- Summative Test (Bank Recon) : 1. Email AddressDocument12 pagesSummative Test (Bank Recon) : 1. Email AddressDennis Feliciano VirayNo ratings yet

- International Finance Ass.Document4 pagesInternational Finance Ass.SahelNo ratings yet

- Kerala State Right To Service ActDocument3 pagesKerala State Right To Service ActJayashree GopalakrishnanNo ratings yet

- PPBL Savings Account Statement for 28 March 2022 to 27 June 2022Document43 pagesPPBL Savings Account Statement for 28 March 2022 to 27 June 2022Maha RajaNo ratings yet

- QuestionnaireDocument6 pagesQuestionnaireSaikumarNo ratings yet

- A Summer Internship Project Report On: Submitted ToDocument64 pagesA Summer Internship Project Report On: Submitted ToApoorva PattnaikNo ratings yet

- 2018 SCC OnLine NCDRC 703Document13 pages2018 SCC OnLine NCDRC 703Ayushi PanditNo ratings yet

- IBSAT Exam Guide: Management Career Opportunities and Test DetailsDocument17 pagesIBSAT Exam Guide: Management Career Opportunities and Test DetailsSubodh ChoudharyNo ratings yet

- Rbi & Its RoleDocument26 pagesRbi & Its RolePraveen Rai100% (1)

- Seafarer's Certification SystemDocument3 pagesSeafarer's Certification SystemJames AmirNo ratings yet

- Profel1 AC Activity Assets Part1Document2 pagesProfel1 AC Activity Assets Part1Dizon Ropalito P.No ratings yet

- Public Finances Management) Act 1995 (Consolidated To No 57Document49 pagesPublic Finances Management) Act 1995 (Consolidated To No 57desmond100% (1)

- Critical Analysis of PNB Scam: Impact and LoopholesDocument11 pagesCritical Analysis of PNB Scam: Impact and LoopholesSaahiel SharrmaNo ratings yet

- Do Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramDocument14 pagesDo Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramShivani NaiduNo ratings yet

- Principles of Commercial BankingDocument3 pagesPrinciples of Commercial BankingdhitalkhushiNo ratings yet

- Job Application Letter Format For BankDocument4 pagesJob Application Letter Format For Bankafjwsbgkjdhkwz100% (2)

- External Market Assessment and Internal Analysis GuidelineDocument62 pagesExternal Market Assessment and Internal Analysis GuidelineAbenetNo ratings yet

- Special Proceedings 3dDocument16 pagesSpecial Proceedings 3dEmilio PahinaNo ratings yet

- HDFC - Financial Rights FormDocument3 pagesHDFC - Financial Rights FormRAGHAVA NAIDU .KNo ratings yet

- View your account statement onlineDocument3 pagesView your account statement onlinespahujNo ratings yet

- From Developmentalism To Neoliberalism TDocument19 pagesFrom Developmentalism To Neoliberalism TSumeyye KocamanNo ratings yet

- Birla Sun Life Tax Relief 96 Fund Application FormDocument3 pagesBirla Sun Life Tax Relief 96 Fund Application FormDrashti Investments100% (2)

- Mary Wong The Sole Shareholder and Manager of Kitchenware Inc PDFDocument1 pageMary Wong The Sole Shareholder and Manager of Kitchenware Inc PDFTaimour HassanNo ratings yet

- Prasad New Era MoneyDocument6 pagesPrasad New Era MoneyBryce JobsNo ratings yet