Professional Documents

Culture Documents

Scientology Church of Scientology West US 990T Return - 2012

Uploaded by

Wilfried Handl0 ratings0% found this document useful (0 votes)

4K views6 pagesScientology Church of Scientology West US 990T Return - 2012

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentScientology Church of Scientology West US 990T Return - 2012

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4K views6 pagesScientology Church of Scientology West US 990T Return - 2012

Uploaded by

Wilfried HandlScientology Church of Scientology West US 990T Return - 2012

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

nD eos

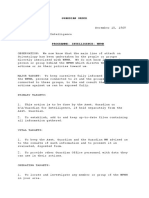

van 990-T Exempt Organization Business Income Tax Return sean

—— (and proxy tax under section 6033())

{nigra Hovenae Srv Foren yeur 2072 fone ta ye beginning ane ona Sie Cates Ga

1k L_Joheck box it T Name of organaton [__] Check box:t name changed and see instructions ) P eeetove werntesnen number

adesschamed| | CHURCH OF SCIENTOLOGY Seas

3 Geenpt undersecion | Print |WESTERN UNITED STATES 95-2697641

(KISS) | _ oF (umber, seo, and room o suite no 'aP.0. box see navuchons Fist oeren eat coma

(eoste) (zene) ** [2404 N. CATALINA AVE.

(Fleosa sore] [yor tow, stat, ane 2 code

s20 LOS_ANGELES._Ch__90028 323100

© Book vue ofall asses fF Group exempton cumber (86 nstuctors),

tend of year [6 Check organaton ype BCX] soc) omar TT soneyiust TJa0i(ayrust TT omer trust

45,265,237

i Describe the organzabon's prmary ured busness ach. Be SEE_STATEMENT 1 =

| During the tox year, was he earoran a subsary manatees group @ paren subs conles group? > Ove Tilt

1¥es, enter the name and denying number ofthe parent corporation,

Thebooks ence! AUSTIN NICKELS Teephon number &_323- 340-3540

Part! | Unrelated Trade or Business Income Taincome (G)EWenees ‘cyt

Va Gross recets or sales 3,726.)

Less etuns ad allowances eoaance me | te 3,726.

$22 Coatol gods 0 (Seale Aine 7)

Sooo prot Subtract ine 2 rm te 3 3,726. 3,126.

‘A 8 Gap ga et came atachSenedl 0) a

AXE Net ga (oss) (Form 4797, Pr I, ine 17) (attach Form 4787) ® ae

Ze © Capiloss desueton ter sts ae

& income toss) tem parnersnps and coporabons tac statement) st

ny 6 Rentincome Schedule C) 6 L

Unreltd o-anced acome (Sheol) 7

Intaest, annus, yates, and rents tom controled oganzatons (st. [78

Investment ncome ofa section 5'(c7) (8,0 (17) organzabon ]

(Sehodule 6 8 =

Expats exam actuty income (Schedule) 0 =

Aaversing core (Schedl J) i

(ter income (ee nauctons;atach tate) 2

Total, Combnelnes 3 tough 12 12 3,726. 3126.

[Part I Deductions Not Taken Elsewhere (ce nstucionsToriiabons on dedaciors)

(except for contnbutons, deductions must be drecty connected withthe unrelated business income)

4 Compensanon of fears, drectors, and wusiees(ScheduleK) “

1 Satesand wae ‘st

{6 Reursanémontroct ra ia

bases 3 77

18 nest etch semen it

10 Tooesadteanme | nov 2.1208 {al 2

20 Choral conovtes (6 ase aro as) 2 wot

21 Dapecate tah Fa 8) ; 1

22a ceotcton dare on See Aaben. Lt En

23 Depletion

24 Contributions to detered compensation plans

25 Employee benelt programs

26 Excess exempt expenses (Schedule)

27 Excess readership costs (Schedule J)

28 Ofer deducton (atch statement) SEE STATEMENT 2 2,982.

29° Total dedvetions Ades 14 hough28 3,021.

20° Urelate buss tan nom betore net peat loss éeducon, Subtest ne 29 rm ne 13 705.

91, Net operating ss éeducon (iets tthe amiount on ine 30)

32 Unrelated buses ale come bore specie educton Subtract ne 31 Homie 30 705.

38 Specie deducton general $1,000, but see msuctons fr excepto) 1.000:

3M Unrelated business taxable income uD!2!ine 3 tom in 32. Ine rater han nw 32, eer he sale

aero ne 32 u

Fils WHA For Paporwou Recacon Alot, ee etwations Fain 980-1 012)

1 %

“

CHURCH OF SCIENTOLOGY

fameioriaer) WESTERN UNITED STATES. 95-2697641 sage 2

(Part mT Tax Computation

‘35 Organizations taxable as corporations (soe stuctons for ax computa).

Controlled group members (sections 1561 and 1563) check here Be [_] See instrctions and:

«Ent your share ofthe $50,000, $25,000, and $3,528,000 taxable come brackets (that ere

ms 2) (§__ is

0 Enter orpanzaion's share of (1) AdOLonal Sanat more an11.750) [5

(2) ator 3% ox (nt mot tan $10,000 s

€ Income tax on the amount on ine 24 > | 250 0.

36° Trusts taable at strats (setnstuctons fr x compan) Income taxon the amount on in 24 Hot

CT raxratesehedule or] Sebel (Frm 1041) > | 26

37 Proxy tax ee instctons) >» [ar

38 Aernatve mmm x 0

39_Total. Add lines 37 and 36 to bne 35 or 36, whvchever applies: 39 O.

[Partiv| Tax and Payments :

403 Foro tax cre (orperaons ach Form TV wane tach Frm TV) rm

2 Omer res (ee stctons) [aoe

€ Genealbusness ret. tach Fem 3800 ate

4 Crea er rr year menu ox (tach Ferm 8801 8827) 04

© Total ereits Ado ines 4a through 408

41 Subact ine 402 tom ine 38

42 thor taxes. Check trom: [I Form 4285 [] Form 8611] Form e697 [7] Fexm 66 [] omer aan eter

43. Total tex. Aa ines 41 ana 42

44a Payments: A2011 overpayment credited to 2012 4 83.

» 2012 estmated tax payments my

© Tax deposited win Fort 6868 rr |

4 Foreign organatons. Tax pad or vrtheld at source (see mstructons) ad

€ Backup withholding (see instructions) ae |

1 Cred for small employer hea nsurance premiums (Atach Form 8841), aut

1 Other credits and payments: 1 Form 2439 |

1 Form 4136 CO other Total D> | 44g |

45 Total payments. Add ines 44a through 449 45 83.

48 Estimated tax penalty (see mstructions) Check t Form 2220 satached b> [—] 46

47, Tax du. if ine 45 s less than the foal of ines 43 and 46, enter amount owed > Lar

48 Overpayment if ine 45 larger than the total of ines 43 and 46, enter amount averpad > [ae 83.

49 _Enter the amount of ine 48 you want: Credited to 2013 estimated tax De 83.| netindes p> [as 0

[Part | Statements Regarding Certain Activities and Other Information (see nstructons) __

1 Atany ime during the 2012 calendar year, cid the organzaion have an interest nara signatue or other authority over a tnancal account bank, | Yes | No

‘ourtes, or other) na foreign county? if"¥es; the organaation may have ole Form TD F 90-221, Report of Foreign Bank ané Financial,

eter the name ofthe foregn country here D> x

x

Enter the amount of tax-exemp intrest ecenved or accrued during the tax year

‘Schedule A - Cost of Goods Sold. Enter method of mventory valuation b> N/A.

1 Inventory atbagmnng of year 1 Inventory at end of year 6

2 Purchases 2 7 Costot goods sold, Subtact ine &

3 Costot labor 3 trom ine 5. Enter here and in Part) bine 2 z

44 sonora acon 2088 cats at staument [48 8 Do the rules of section 263A (wih respect to ‘Yes | No

'b Other costs (attach statement) mn Droperty produced or acquired for resale) apy to

5_ Total. Ado ines through 40 5 the orgunaaton?

Tae

Sign |= oe ua neh ee cee ey

_ vi Haas Hay wostas p Asst Serta

‘eure omnes one

TPrnipepeerscane poy saan = met

Paid | — a | set eno

Proparer WILLIAM D._ESENSTEN cP |whsha |

I 00535334

Use Only |#m'srane B NSBN_LLP FemstN® _95-2399533

i 9454 WILSHIRE BLVD., 4TH FLOOR

e's access Phone no 27

Form 990-T (2012),

CHURCH OF SCIENTOLOGY

fom 99012012) WESTERN UNITED STATE:

Schedule C -

1 omstonatpocety

52697641, Page

ient Income (From Real Property and Personal Property Leased With Real Property)ise nsvuctons)

a —

2 —

2

a

Team as

Wi iengeenaeejeveera” Orne mccgemrauararsy™ | “) “eSomeabavasiatensians™”

Scarier a |

1 = {

- a i

a

a

= Tle os

{e) Total income Add totals of columns 2(a) and 2(b). Enter \(d) Total deductions

he and onpuge Pat inn (A > 0. NRE O.

‘Schedule E = Unr

{ed Debt-Financed Income [eee nsinichone)

1. morpten ot eb nan remy

7 macopenyaaagneomee

Osea mes

Cease

a

2

2

(a)

6 Cameaeee

7 commas

Banc actos

oars

am =

a *

a %

ma =

Touts > 9. o.

ll ident caved detecons ces coun = o.

Schedule F = Interest, Annuities, Royalties, and Rants From Controlled Organizations eeneructors)

Exot Convoled Organizations

acca7 satoerse Somampasaree,

a ——

a !

8. {

ro I

Nonexempt Convoled Organizations

T Tesoiebsore B, Netcasts nares)

V7 Seacns deny pean

a

2

@

i)

Touts > oJ 9

Form 960-7 (2012),

CHURCH OF SCIENTOLOGY

Form 990-1 (2012) WESTERN UNITED STATES 95-2697641 Page 4

‘Schedule G - Investment income of a Section 501(e\™), (@), or (17) Organization

+ oe netrctons)

: 1 been ensane ee ee ee

a eae seal

(2) |

© Tt 1

‘a

ane Fetiinast ean

Totals, > 0 oO.

‘Schedule | - Exploited Exempt Activity Income, Other Than Advertising Income

)

Tea amet

| omogtenet obit [RENE | fommowme | game | Leeman

o | _

(2) o |

o

a)

Totals, > 0. oO.

‘Schedule J- Adveriising income oe natucnon)

Part |_| Income From Periodicals Reported on a Consolidated Basis

as icoceees

1 nanest erect poor, | \Pecmoec| Loerie crt cece | ere

o :

@

3

ay

‘Totals (carry to Part I, ime (5)) 0 0. O.

dicate Reported on a Separate Basis (or cach perodcalisiad n Pann

Part Il | Income From Peri

coke 2 tvough7 ona ine by ine bess)

ry Timmons

1 name stones! woiengione [oS SeaGinecaraea| "Seca | 8 So

w =

@

eae

@

Tote tom Pad on

Tala, Part es 15) > 0. 0.

‘Schedule K - Compensation of Officers, Directors, and Trustees eee naiuctona)

7 rome mwas

1 ne 2 te cers Sree

a = = 2 -

2 a

@ [ea “

o — “4

Teva Ene ave and on page 1 Paine 12 > a.

Form 880-7 (2012)

CHURCH OF SCIENTOLOGY WESTERN UNITED STA 95-2697641

FORM 990-T - DESCRIPTION OF ORGANIZATION'S PRIMARY UNRELATED STATEMENT 1

BUSINESS ACTIVITY

LIMITED USE OF FACILITIES THAT MAY NOT BE SUBSTANTIALLY RELATED TO

‘TAX EXEMPT PURPOSE.

TO FORM 990-T, PAGE 1

FORM 990-7 OTHER DEDUCTIONS STATEMENT 2

DESCRIPTION AMOUNT

PERMITS & LICENSES 37.

PRINTING 2,044.

RENT EXPENSE 114.

UTILITIES 275.

TRANSPORTATION 512.

TOTAL TO FORM 990-T, PAGE 1, LINE 28 2,982.

5 STATEMENT(S) 1, 2

Fom 8868 Application for Extension of Time To Filo

a. sara 2019) Exempt Organization Return

1709

Bara hyenas aver” > File a seperate spplication for each return.

* It you are fing for an Automatic 3-Month Extension, complete only Part | and check thes box a

‘ ityou re thg for an Additional (Not Automatic) 3-Month Extension, compste only Part Il (on page 2 of the form)

‘Bo not complete Pert uniess you have aready been granted an automatic 2morth extension on a previously fad Form 8868,

tectonic fling e-Me), You can eactoncaly ti Form 8668 you need a $month automatic extension of time toto (S mort fora corporation

‘equred to fle Form 890-7, or an adcona (ot automat) month extension of tee. You can strona fe Frm 8868 to requet an extension

‘te oto ary ofthe forms ised n Part or Pai wah the excopton of Farm 8870, rvomation Return fr Transfers Associated With Cartan

eraonal Banat Cotracts, which must be sotto the RS n paper format (se instructions), For more deta onthe electronic fang ofthis form,

vi wns govt and lick on e-le for Charts & Nonprofi

‘Automatic 2-Month Extension of Time. Only submit original (no copies needed),

‘A corporation required to fe Form 880; and requesting an automatic marth extension: check this box and complete

Part only >

‘Al other corporations (ncluting 1120-C fers), parerships, REMICS, and trusts must use Form 7004 fo request an extension of te

{oe ncome tax retur.

‘Type oF | Name of exempt organization or athe fer, aoe Wstruchons ‘Employer Worticaton number EIN) or

ert | CHURCH OF SCIENTOLOGY

WESTERN UNITED STATES 95-2697641

‘Number, street, and room or suite ro a PO. box, soe structions, ‘Soail secunty number (SSM)

C/O NSBN LLP - 9454 WILSHIRE BLVD 4TH FLR

City, town or post offs, sate, an ZIP cage. Fora foreign acorass, see instructions

BEVERLY HILLS, CA 90212

Enter the Retum code fr the return that this appicaton i for ile a separate applestion for each return)

Return [ Application Return

code | ip For Code

Form $80 o- Form $9087 101_| For 9807 orporation) or

Form S60-6t, 02 {fom 10st 08

Fo 4720 frida 3 | Fom4720 08

Form 960-06. 04 | Fo 5227 10

Form 850° (6, 401) or 408{a) Pus (05 | Ferm 6068 rT!

Form 880° trust other than above) 08 [fom 8570 12

AUSTIN NICKELS

© Tho books are in the careot De =

“Telephone No. FAX

‘ the organcaation does not have an offce or place of busiess in the Unite State, chock iis Box >O

© his fora Group Return, enter the organization's four cit Group Exemption Number (GEN) Hfthuaa forthe whole group, check tha

box 11 for part of the group, check 7 tach ast with the ramos and EING ofall members the extension fo.

‘1 Hrequest an automate 3 ent (8 months fora corporation requted to fle Form 880-7) extension of tn unt

NOVEMBER 15, 2013 totie me.exerptorgarizanon rtumn fr the organazation named above. The extenson

{Sor the organzaton's retum for:

> [XX calendar year 201.2 or

> (10x yeor begnning ‘and ending

2 ihe tex year entered inne 1 i or ess than 12 mortna, check reason: — (Jintalratun — [] Fina rotun

(Change n aecounting period

‘3a Wit application is for Form 950.BL, O00-PF, 680 T, 4720, or 6069, anor the teniav tax, se ary

‘onrefundable credits. Soe nstructons. sls 0.

'b_Itths application s for Form 990 PF, 9907, 4720, or 6068, ter any refundable credits and

‘stmate tax payments mace, ude ary prior yar overpayment alowed as acres als 83

© Balance due, Subtract ine 9 rom Ie 38: nude yout payment wih the form, #equed

by vang EFTPS Electronic Fader! Tax Paynent System Geo ntructons sels o.

VL you ae going o akan oocons fund wind! wih his Form 868, ss Fam GAGS EO and Fam ronment

LMA For Privacy Act and Paperwork Reduction Act Notice, see instructions Form 68 fev. 12019),

You might also like

- E-Mail Möglicher Mord 2Document7 pagesE-Mail Möglicher Mord 2Wilfried HandlNo ratings yet

- GO Programm Alpine, Texas - CazaresDocument2 pagesGO Programm Alpine, Texas - CazaresWilfried HandlNo ratings yet

- Reports Handling 1Document5 pagesReports Handling 1Wilfried HandlNo ratings yet

- E-Mail Möglicher Mord 1Document8 pagesE-Mail Möglicher Mord 1Wilfried HandlNo ratings yet

- Operation FreakoutDocument8 pagesOperation FreakoutWilfried HandlNo ratings yet

- Operation Orange JuiceDocument5 pagesOperation Orange JuiceWilfried HandlNo ratings yet

- Declaration of Robert J. Cipriano - August 5, 1999Document20 pagesDeclaration of Robert J. Cipriano - August 5, 1999Wilfried HandlNo ratings yet

- OSA South ParkDocument2 pagesOSA South ParkWilfried HandlNo ratings yet

- Declaration of Robert J. Cipriano - May 5, 1994Document2 pagesDeclaration of Robert J. Cipriano - May 5, 1994Wilfried HandlNo ratings yet

- Operation Italian Fog 2Document2 pagesOperation Italian Fog 2Wilfried HandlNo ratings yet

- Superior Court. of The State of California Moxon Vs BerryDocument46 pagesSuperior Court. of The State of California Moxon Vs BerryWilfried HandlNo ratings yet

- GO-Operation China Shop - Clearwater SunDocument2 pagesGO-Operation China Shop - Clearwater SunWilfried HandlNo ratings yet

- Wall Street Journal: Scientology-IRS-Deal, 1997Document3 pagesWall Street Journal: Scientology-IRS-Deal, 1997Wilfried HandlNo ratings yet

- TIME Magazine - Scientology - The Thriving Cult of Greed and PowerDocument18 pagesTIME Magazine - Scientology - The Thriving Cult of Greed and PowerWilfried Handl100% (1)

- Operation Italian FogDocument2 pagesOperation Italian FogWilfried HandlNo ratings yet

- Dispatch CazaresDocument2 pagesDispatch CazaresWilfried HandlNo ratings yet

- Guardian Office Intelligence CourseDocument28 pagesGuardian Office Intelligence CourseWilfried HandlNo ratings yet

- Operation Speedy GonzalezDocument6 pagesOperation Speedy GonzalezWilfried HandlNo ratings yet

- OSA Target - DefenseDocument3 pagesOSA Target - DefenseWilfried Handl100% (1)

- OSA Battle TacticsDocument3 pagesOSA Battle TacticsWilfried HandlNo ratings yet

- GO Intelligence ChiefDocument3 pagesGO Intelligence ChiefWilfried HandlNo ratings yet

- Programme Intelligence WFMHDocument2 pagesProgramme Intelligence WFMHWilfried HandlNo ratings yet

- Guardian Office Programm WFMHDocument2 pagesGuardian Office Programm WFMHWilfried HandlNo ratings yet

- Bob Trish Duggan FoundationDocument19 pagesBob Trish Duggan FoundationWilfried HandlNo ratings yet

- The RPF SeriesDocument59 pagesThe RPF SeriesWilfried HandlNo ratings yet

- IGN Bulletin 44 Wake Up CallDocument4 pagesIGN Bulletin 44 Wake Up CallWilfried HandlNo ratings yet

- Kent - Brainwashing Im RPF EnglishDocument63 pagesKent - Brainwashing Im RPF EnglishWilfried Handl100% (1)

- Suppressive Persons and Supppressive Groups List 1991Document43 pagesSuppressive Persons and Supppressive Groups List 1991Wilfried HandlNo ratings yet

- Autopsy SlaughterbeckDocument7 pagesAutopsy SlaughterbeckWilfried HandlNo ratings yet

- OT III DataDocument3 pagesOT III DataWilfried HandlNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)