Professional Documents

Culture Documents

What Is Leasing

Uploaded by

Rohit Rao0 ratings0% found this document useful (0 votes)

24 views3 pagesLeasing is a financial method that allows businesses to obtain equipment or assets with little upfront capital investment. There are different types of leasing agreements, including finance leasing where the customer keeps the asset after the contract expires, operational leasing where the asset is returned to the lessor, and leaseback transactions where a seller leases back an asset they sold to secure financing. Leasing offers advantages like conserving capital, flexible payment schedules aligned with when the asset generates returns, tax benefits, and potentially obtaining ownership of the leased asset at the end of the contract term. It provides a simpler way for businesses to acquire and maintain modern production assets compared to other financing options.

Original Description:

Original Title

What is Leasing

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLeasing is a financial method that allows businesses to obtain equipment or assets with little upfront capital investment. There are different types of leasing agreements, including finance leasing where the customer keeps the asset after the contract expires, operational leasing where the asset is returned to the lessor, and leaseback transactions where a seller leases back an asset they sold to secure financing. Leasing offers advantages like conserving capital, flexible payment schedules aligned with when the asset generates returns, tax benefits, and potentially obtaining ownership of the leased asset at the end of the contract term. It provides a simpler way for businesses to acquire and maintain modern production assets compared to other financing options.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views3 pagesWhat Is Leasing

Uploaded by

Rohit RaoLeasing is a financial method that allows businesses to obtain equipment or assets with little upfront capital investment. There are different types of leasing agreements, including finance leasing where the customer keeps the asset after the contract expires, operational leasing where the asset is returned to the lessor, and leaseback transactions where a seller leases back an asset they sold to secure financing. Leasing offers advantages like conserving capital, flexible payment schedules aligned with when the asset generates returns, tax benefits, and potentially obtaining ownership of the leased asset at the end of the contract term. It provides a simpler way for businesses to acquire and maintain modern production assets compared to other financing options.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

*What is leasing?

*

In brief, leasing is a financial method used by

businesses to obtain equipment or assets with

little capital investment. More often than not,

leasing is the preferred financing option in

industry. The concept has been widely used in

Russia for over 10 years now.

*FINANCE LEASING* - a leasing contract at the

expiry of which the asset is kept by the

customer (lessee).

*OPERATIONAL LEASING* - a leasing contract at

the expiry of which the customer returns the

asset to the lessor.

*LEASEBACK* - a transaction where an owner sells

an asset and leases it back as a way to secure

financing, meaning that the seller and the

lessee are one person.

*SUBLEASING* - a transaction that involves

leasing out equipment obtained under a leasing

contract. A customer who has leased equipment

becomes the lessor and leases out this equipment

to its own customers.

Merits of leasing

1. Leasing saves you the trouble of tying up

large amounts of capital to buy the required

asset.

2. Lease payments are distributed in the most

convenient way for the lessee, in sync with the

period when the company starts profiting from

the leased asset that is generating a return on

investment.

3. Leasing offers savings through tax

preferences (profit tax, VAT deduction, property

tax).

4. Leasing offers the only possibility to apply

accelerated amortization with a coefficient of

up to 3. As a result, the balance-sheet value of

property decreases at 3 times the normal rate,

resulting in lower property tax.

5. The repayment schedule (schedule of lease

payments) is highly flexible. The lessee makes

no payments until the leased asset is launched

into operation.

6. The leased asset may be reflected on the

balance sheet of either the lessee or the

lessor. In the latter case, the lessee has a

chance to improve the structure of the balance

sheet by reflecting the leased asset in off—

balance sheet accounts (this is impossible with

credit or direct purchase).

7. Also, if the leased asset is reflected on

the balance sheet of the leasing company, the

lessee has no need to reappraise the fixed

assets (in terms of the leased asset).

8. At the expiry of the lease contract, the

lessee has a chance to receive title to the

leased asset at zero cost.

9. As a rule, the lease contract is made for 3-

5 years, which roughly corresponds to the

payback period of the leased asset. If the

leased asset is equipment with a long payback

period, the lease contract may be prolonged to

5-6 years. Far from all lending institutions are

prepared to offer such terms.

10. Securing funding via leasing is much

simpler, and collateral is required much less

frequently, because the leasing company will own

the asset until the expiry of the lease

contract.

11. Thanks to its simplicity, affordability and

effectiveness, leasing enables lessees to keep

their production assets up to speed with the

modern market requirements, giving them

considerable competitive edge.

You might also like

- The Ultimate Beginners Guide to Rental Real Estate Investing: Real Estate Investing, #7From EverandThe Ultimate Beginners Guide to Rental Real Estate Investing: Real Estate Investing, #7No ratings yet

- Financial Markets and Services (F) (5 Sem) : Unit-3 Leasing and Hire PurchaseDocument9 pagesFinancial Markets and Services (F) (5 Sem) : Unit-3 Leasing and Hire Purchasedominic wurdaNo ratings yet

- Basic Rules Governing Leasing Under Islamic LawDocument4 pagesBasic Rules Governing Leasing Under Islamic LawmobinnaimNo ratings yet

- Marketing of Financial Services Leasing 1 PPT FinalDocument17 pagesMarketing of Financial Services Leasing 1 PPT Finaljohn_muellorNo ratings yet

- LeasingDocument6 pagesLeasingShubham DhimaanNo ratings yet

- 1 Year MBADocument28 pages1 Year MBABijoy BijoyNo ratings yet

- Corporate Finance Ii2008 PDFDocument85 pagesCorporate Finance Ii2008 PDFTrymore KateeraNo ratings yet

- Unit 2.1Document3 pagesUnit 2.1hariNo ratings yet

- Accounting For Leases and Hire Purchase Contract Final - DocxmaryDocument41 pagesAccounting For Leases and Hire Purchase Contract Final - DocxmarySoledad Perez100% (1)

- Types of LeasingDocument26 pagesTypes of LeasingHimaja SridharNo ratings yet

- Lease - EssayDocument11 pagesLease - EssayhomerikoNo ratings yet

- What Is Lease Financing?: Parties To A LeaseDocument14 pagesWhat Is Lease Financing?: Parties To A LeasesumitruNo ratings yet

- Leasing TransactionsDocument11 pagesLeasing Transactionsshilpa_noorithayaNo ratings yet

- Lease Financing PDFDocument31 pagesLease Financing PDFreshma100% (5)

- Lease Financing: Learning OutcomesDocument31 pagesLease Financing: Learning Outcomesravi sharma100% (1)

- Unit III-Leasing and Hire PurchaseDocument50 pagesUnit III-Leasing and Hire PurchaseAkashik GgNo ratings yet

- YuvikaDocument8 pagesYuvikaYuvika DhimanNo ratings yet

- Ch13 LeasingDocument21 pagesCh13 LeasingJenny RanilloNo ratings yet

- Module 4 LeaseDocument34 pagesModule 4 LeaseJuhi JethaniNo ratings yet

- Leasing UnlockedDocument16 pagesLeasing UnlockedAashi VashistaNo ratings yet

- Intro To Leasing NoteDocument5 pagesIntro To Leasing NoteZain FaheemNo ratings yet

- Lease FinancingDocument16 pagesLease Financingparekhrahul9988% (8)

- Chapter 8 PDFDocument11 pagesChapter 8 PDFsabbir ahmedNo ratings yet

- Leasing, Hire Purchase & Consumer Credit: Unit-2Document60 pagesLeasing, Hire Purchase & Consumer Credit: Unit-2Feeroj PathanNo ratings yet

- LeaseDocument23 pagesLeaseRozminSamnaniNo ratings yet

- Leasing and HPDocument21 pagesLeasing and HPshivakumar NNo ratings yet

- LEASES Notes and Illustrations For The StudentsDocument4 pagesLEASES Notes and Illustrations For The StudentsEmmanuelNo ratings yet

- Module VDocument14 pagesModule VMidhun ManoharNo ratings yet

- ACCOUNTING FOR LEASES NotesDocument5 pagesACCOUNTING FOR LEASES NotesMutheu MuetiNo ratings yet

- Lesson 3 Accounting For LeasesDocument11 pagesLesson 3 Accounting For LeasesKurrent Toy100% (1)

- Lease Contract - Intermediat 2 Project11Document13 pagesLease Contract - Intermediat 2 Project11Mahammad AlkhalilyNo ratings yet

- Lease FinanceDocument62 pagesLease Financepriyankakataria143100% (1)

- Basics of LeasingDocument10 pagesBasics of LeasingNeeraj PariharNo ratings yet

- Leasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiDocument7 pagesLeasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiGaluh DewandaruNo ratings yet

- 202004021945300501vasudha Kumar Finance Management 1Document7 pages202004021945300501vasudha Kumar Finance Management 1StarboyNo ratings yet

- Financial Management LeasingDocument38 pagesFinancial Management LeasingKimberly MurrayNo ratings yet

- Leasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustDocument6 pagesLeasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustmanyasinghNo ratings yet

- LeasingDocument1 pageLeasingppratap90No ratings yet

- Financial Lease Vs Operating LeaseDocument7 pagesFinancial Lease Vs Operating LeasePhuongwater Le Thanh PhuongNo ratings yet

- 14 Different Types of Lease You Need To KnowDocument3 pages14 Different Types of Lease You Need To KnowLaylaNo ratings yet

- Term Loans and Leases: Payment $5,000 Pvifa $5,000 3.0373 $1,646.20Document6 pagesTerm Loans and Leases: Payment $5,000 Pvifa $5,000 3.0373 $1,646.20NeerajNo ratings yet

- MFS 5Document44 pagesMFS 5rahul raoNo ratings yet

- LeasingDocument2 pagesLeasingtanjimalomturjo1No ratings yet

- Project Hire Purchase and LeasingDocument29 pagesProject Hire Purchase and Leasingsawantrohan214No ratings yet

- Lease TheoryDocument10 pagesLease TheorySyeda AtikNo ratings yet

- Leasing & Hire Purchase-2Document30 pagesLeasing & Hire Purchase-2sarveshNo ratings yet

- STDocument13 pagesSTmastermahmedNo ratings yet

- Group2 Lease FinancingDocument24 pagesGroup2 Lease FinancingMohit Motwani100% (1)

- Lea Se Fin Anc IngDocument22 pagesLea Se Fin Anc IngrachealllNo ratings yet

- By Otmar, B.A: Leasing PreparedDocument53 pagesBy Otmar, B.A: Leasing PreparedAnna Mwita100% (1)

- Introduction To LeasingDocument8 pagesIntroduction To LeasingvmktptNo ratings yet

- Leasing 1Document41 pagesLeasing 1Aaryan SinghNo ratings yet

- What Is A LeaseDocument9 pagesWhat Is A LeaseAshutosh PandeyNo ratings yet

- Hybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument165 pagesHybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesJewel Mae MercadoNo ratings yet

- Lease & Hire Financing - IIDocument16 pagesLease & Hire Financing - IIKartik MuppirisettyNo ratings yet

- Lease FinancingDocument36 pagesLease Financingssahni15No ratings yet

- Leasing NotesDocument3 pagesLeasing Notesfazalwahab89100% (1)

- The Rental Property Investment Bible: Budget Limited but Ambition Unlimited: The Reference Book for Investing Intelligently, Generating Passive Income and Achieving Financial IndependenceFrom EverandThe Rental Property Investment Bible: Budget Limited but Ambition Unlimited: The Reference Book for Investing Intelligently, Generating Passive Income and Achieving Financial IndependenceNo ratings yet

- MEPCO ONLINE BILL BankDocument1 pageMEPCO ONLINE BILL Bankahmadjutt19823No ratings yet

- Chapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankDocument8 pagesChapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankJulie Mae Caling MalitNo ratings yet

- Pool Management For Islamic BanksDocument27 pagesPool Management For Islamic Bankssjawaidiqbal83% (6)

- Beams Aa13e PPT 16Document48 pagesBeams Aa13e PPT 16Brianna GilharryNo ratings yet

- CIR vs. Sekisui Jushi Philippines, IncDocument2 pagesCIR vs. Sekisui Jushi Philippines, IncCombat GunneyNo ratings yet

- Tirstrup BioMechanics (Denmark)Document2 pagesTirstrup BioMechanics (Denmark)Ioana PunctNo ratings yet

- Vertical Balance Sheet Particulars RsDocument2 pagesVertical Balance Sheet Particulars Rsamit2201No ratings yet

- Balance-Sheet - PWC& Deloitte-Summary & AnalysisDocument7 pagesBalance-Sheet - PWC& Deloitte-Summary & AnalysisAjit AgarwalNo ratings yet

- Contribution Midterm Answers and SolutionsDocument10 pagesContribution Midterm Answers and SolutionsKimNo ratings yet

- FAQ - Payment Tracking ServiceDocument2 pagesFAQ - Payment Tracking ServiceViwat JulkittiphanNo ratings yet

- Modern Banking Services - A Key Tool For Banking Sector: Mobile No: 90038 12289Document6 pagesModern Banking Services - A Key Tool For Banking Sector: Mobile No: 90038 12289MD Hafizul Islam HafizNo ratings yet

- Debt Recovery Agency in IndiaDocument22 pagesDebt Recovery Agency in Indiarecreatecredit CollectionsNo ratings yet

- Financial Management Assignment On Financial Analysis of Infosys Technologies LTDDocument5 pagesFinancial Management Assignment On Financial Analysis of Infosys Technologies LTDDigesh ShahNo ratings yet

- Check Returned To Synchrony Financial May-19-2016Document19 pagesCheck Returned To Synchrony Financial May-19-2016Neil GillespieNo ratings yet

- Capital StructureDocument38 pagesCapital StructureShil ShambharkarNo ratings yet

- Selections From The Numismatist. Modern Foreign Currency / by American Numismatic AssociationDocument325 pagesSelections From The Numismatist. Modern Foreign Currency / by American Numismatic AssociationDigital Library Numis (DLN)100% (1)

- Hedge Fund Investment StrategiesDocument386 pagesHedge Fund Investment Strategiesjk kumar100% (1)

- Annual Report 2007-2008 (ENG) - 20100603063436Document89 pagesAnnual Report 2007-2008 (ENG) - 20100603063436Rakshya ShresthaNo ratings yet

- Chap 019Document11 pagesChap 019dbjnNo ratings yet

- Lesson 3 - Credit ProcessDocument6 pagesLesson 3 - Credit ProcessRachel Ann RazonableNo ratings yet

- Account Statement As of 29-11-2020 19:58:57 GMT +0530Document5 pagesAccount Statement As of 29-11-2020 19:58:57 GMT +0530Dwitikrushna RoutNo ratings yet

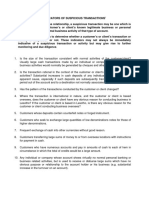

- Indicators of Suspicious TransactionsDocument3 pagesIndicators of Suspicious TransactionsArtūras CimbalistasNo ratings yet

- Book Building: Presented By: Rajni Sharma MBA, Final YearDocument23 pagesBook Building: Presented By: Rajni Sharma MBA, Final YearRixim86% (7)

- Letter of Credit ProcedureDocument4 pagesLetter of Credit ProcedureKarthickDevanNo ratings yet

- Financial FreedomDocument3 pagesFinancial FreedomErika AhumadaNo ratings yet

- Banks in Tanzania 2010Document3 pagesBanks in Tanzania 2010Mussa MlawaNo ratings yet

- Lop PPT - Post OfficeDocument21 pagesLop PPT - Post Office201BM110 Daicy nallammal.JNo ratings yet

- A Project Report On Custmer Satisfaction Regarding HDFC BANKDocument66 pagesA Project Report On Custmer Satisfaction Regarding HDFC BANKvarun_bawa25191585% (94)

- Credit Cards WorksheetDocument36 pagesCredit Cards Worksheetapi-3723081070% (2)

- Multiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsDocument13 pagesMultiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsJEP WalwalNo ratings yet