Professional Documents

Culture Documents

Richard Blumenthal 2015 Tax Return

Uploaded by

Erin Laviola0 ratings0% found this document useful (0 votes)

21K views2 pagesRichard Blumenthal 2015 Tax Return

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRichard Blumenthal 2015 Tax Return

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21K views2 pagesRichard Blumenthal 2015 Tax Return

Uploaded by

Erin LaviolaRichard Blumenthal 2015 Tax Return

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

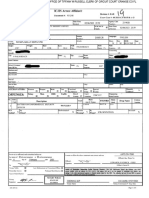

§ 1040 vrs tnciicut income tax Rotum” (2015)

ere er is ra coma atta

or Wena a a ita Nets une

RICHARD LUMENTHAL

iTajointreur, spouses Wet name and Tia) [Last ame Spar ml my nano

a RIES (Hane and SEB, Mou ave aT br, Sas HEGTONE. FACTO [4 tata nna sanon

hy oa ost oi cn and cay i 0S, dao SPO aS DEW ra

Foren enna Fain pocaRROORE aaonpeaaTn | atom o

_ ct | You_[_] spouse

7 Losi 7 eat of vseho (xh qualiving person). ihe qualifying

Filing Status > | sare ing ity (even fon on had income) personis cid but not your dependent ene ths c's

Check only 8 [3X] Nard ting separately. Emer spouse's SSN above name here. D>

onebon pyr mitigmian PCHNTETA BLUMENTHAL + nuthequsnian amore

‘2 LT Yours. 1 someone ean cam you a dpandat, do ot ehedk Doxéa Same

Exemptions "26 owe bee

€ Dependents: @Orpniets ots ‘peaars

Fata ete satya “—

Se.)

Ht more tan four

feats an ‘steed te

‘check here > [_] ‘ag rsnters

Craume domme Sina Eats

Jreome 7 Wages, stirs, s,s Antach Form(s) STMT LT 17a

: ta Toxable mores. tach Sched roqured te 2,269.

‘> Tax-xemptntrst. Be notin one 82 a 217343.

W2nere mos 92 Ordinary dvdends. tach Schedule B i equced a 18,388.

tach forme >On ents ny 17/871.

W26and 10° Taxablreunds, reds, ooo sate andioalincome tes seer Z—stwh | 1 o.

decorate, 11 Almony received 1

12 Busines income oF ss). tach Sched C o CZ a

tyoudisner 8 CHa gn or oss Ach Sead Direqute. otrequed,cecere > fs =I, 500.

wows. 14 Oter gins or Vosses. tach Form 4797 4

Seemstuctons. 164 IRA dstbvtons 158 2 Taxable amount “eh

162 Pansons an annus 16 1 Taxable amount 180 55,761.

17 nial el estat, yas, parterships, S corporations, ust, a. Atach Schedule E 7 =58.

18 Farm incom or (oss. tach Schl F 8

19 Unemployment compensation 19

20a Social seurty Deets 200 1 Taxable amount 28

21 Otharincoms. ist ype and mount 21

22 _Combin th amounts nto aight can Tor fos 7 Wrough27. Tas your tal ncome ble 248, 880.

73 Edo pons 2

Adjusted 24 SEELIGIy angie gg Aerie ees isis [oy

Gross 25 Heath savings account eduction. Atach Form 8889 25

Income —— 28 oving expenses. Atach For 3803 26

27 Deductible part of so-amplymant tax. Aah Schedule SE 2

2% Selremployed SEP, SIMPLE, and quali plans 28

29 Soltemployd beatnsurance deduction 20

‘30 Penayoneariywithdraual of savings 30

318 Alimony paid Recipient's SSW Be aa

22 IRA otztion 22

438 Studuntloan rest deduction =

‘6 _ Tutionand fees. Atach Fm 8917 ea

{5 Demet production atte deduction. ach Farm 8903 35

36 Addlines 23 trough 35 26

2 37 _Subiact ne 93 rom ine 2 Tis your suse ross income >» [x [208880

LWA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions. Fo TOAD ca)

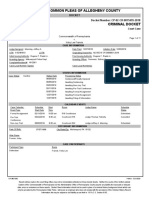

fom wooo) RICHARD BLUMENTHAL | ag 2

Tax and 8 Amount ron ine 37 (adhsod oss como) = 748,880.

Credits s9a check { [XX] Youwers born before January 2, 1951, [_] Blind. | Total boxes

Pesan] te [A spouse was bor before Janvary2, 1961, [—] Bind. J checked 300 | _ 1

'b It your spouse itemizes on a separate return or you were @ dua-status alien, check here > sob TXT

40 temized deductions (rom Sched A) er your standard deduction (se et margin) “0 87,507.

[At Subiactin 4 tom ino 38 a 61,373.

42 Exemptions. ine 38 is $154,960 or lass, multiply $4,000 by the number on ine 64. Otherwise, see inst. 2 0.

48 TavabloInsme, Subiact e 2 om ne 41. Iino 428 moe tan te 1, nt -0- @ T 373.

‘M4 Tax Check ifany from: al] Forms) 8814 b{_] Form 4972 el] “ 37,801.

45 Alternative minimum tax, Atach Form 6251 6 20,932.

leazonen | 46, Excess advance premium xcre opment Ath Fors 6952 ae}

pies tes | 47 Addis 4,45, 46 >t 58,733.

[5300 | 48. Foreign tx credit. attach Form 1116 traquved a 1,317.

Hexesme | 49 Creditor chid and dopendent cae expenses. tach Form 2433 @

[tthe | 50. Education cred rm Form €86, ne 19 0

[Seco | 81. Retirement savings contributions credit. Attach Form 8880 St

leict | 82 hl taxeredt. Atach Sehadule 812, required 2

[S253 | 52 esidental enray reds. tach Form 5695 53

4 Oter cre romFom: aL] 3600 »(—] 8801 e[ 3

58. Adaline 4 tough 58 Tes are your ttl rds 5 1,317.

56_Subract ine 5 rom Ine 4. ne 55 is ror than ine 47. enir-0- > [5 BT, 416.

57 Satremployment tox ach Schedule SE 7

Other 58 Uaroprad soci security and Medicare tax rom Form: aC] a7” bE] ta 58

Taxes 58. Additonal taxon Is, ther qualia retroment pln, e. Aah Form 5328 reaued 30

(608 Household payments rom Schedule 0a

1 Fttms homebuyer credtepayment tach Frm S405 required [ooa}

‘61° Heath car: Individual responsibilty (see instructions) __Fulhyear coverage [1] Gl

62 Taxes rom: a[X] Form a959 6[X] Form 8960 ¢ [—] inst; enter codes) STATEMENT 9 ee 570.

{8_Adlines 56 trough 62. hiss your wa tx > [es 37,986.

Payments 6+ Federal come tx witha rom Forms W-2 and 1000 cH 44/390.| STATEMENT 8

(65. 2015 estimated tax payments and amount aplied trom 2014 return 65 45,071.

Taeyer® sa Eamed income credit Ec) co

Sretacn [— b Noninable combat pa ecton rs

Seat] 67 pagional hid wx ret Attach Schedule 812 7

{8 American opportunity eet rom Focm 886, ine 8 8

68 Natprmum tx cred tach Form 2952 o

70 Amount ald wt request fr edonson tole 70

71 cess sci security and ter 1 ARTA taxwtheld 7m

72. Gre or federal tc on fuels tach Form 4136 7

73 Credits rom Form: a[__}2439 bL_Tneamee | leaes &[ 73

74_ Addins 64, 65,652, 2nd 67 trough 73. These ae your tll payments Bln 89,461.

Refund 75 Itline 74 is more than line 63, subtract line 63 from line 74. This is the amount you overpaid. 75 31,475.

788 Amount ins 75 you wat relunded oyu, IForm 8888s tached heck Toa

Fah aA] | Pa Po

‘rmactens_1_ Amount oie Fe youwant applied to your 2016 eefimatetax [77]

‘Amount 78 Amovetyou owe. Subact ne 74 rom nw 6. Fr deals on how to py, 8 asrucons 18

You Owe _79 Estimated tox penaly (see instructions) js]

‘Third Party Do you vantio alow anoter person to assuss is return with te IRS (ee insracions)?” LAK Ves. Complete below: T Tito

Designee fk" bSIINO, MICHAEL F. h212-503-8800 __rantarpag "|

= Se oe

igi ‘ret anes Olan ve CO Fas ae aaeTeN a Dato eas DeSean ay OS

Here ‘ursonaue a rece

S._SENATOR

ins Sey an ey

Preston

rs Fenawoarare as om 7m

Paid satay

Preparer STINO, MICHAEL F. 00536611

Use Only “Frvsnse MARKS PANETH LLP Rasen *F=** FEET

685 THIRD AVENUE Phoneme. 212-503-8800

Bic semeasouse NEW YORK, NY 10017

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ashley Biles SentencingDocument5 pagesAshley Biles SentencingErin LaviolaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Press Release 210417Document1 pagePress Release 210417Erin LaviolaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- USA V PhelpsDocument7 pagesUSA V PhelpsJ RohrlichNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ashley Biles IndictmentDocument4 pagesAshley Biles IndictmentErin LaviolaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ian Baunach Probable Cause AffidavitDocument12 pagesIan Baunach Probable Cause AffidavitErin Laviola100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Niviane Phelps Detention OrderDocument1 pageNiviane Phelps Detention OrderErin LaviolaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Dominic Glass AffidavitDocument6 pagesDominic Glass AffidavitErin LaviolaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Landon Perry Grier - Statement of FactsDocument6 pagesLandon Perry Grier - Statement of FactsLaw&CrimeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grier Conditions of ReleaseDocument3 pagesGrier Conditions of ReleaseErin LaviolaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Kelly McKin Arrest AffidavitDocument4 pagesKelly McKin Arrest AffidavitErin LaviolaNo ratings yet

- Ernest Mcknight Arrest ReportDocument5 pagesErnest Mcknight Arrest ReportErin LaviolaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Michael Haak ComplaintDocument1 pageMichael Haak ComplaintErin LaviolaNo ratings yet

- Chance Seneca ComplaintDocument8 pagesChance Seneca ComplaintErin Laviola100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Claire Miller AffidavitDocument4 pagesClaire Miller AffidavitErin Laviola75% (4)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Landon Grier BondDocument2 pagesLandon Grier BondErin LaviolaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Koby Francis 2018 Arrest Court DocketDocument11 pagesKoby Francis 2018 Arrest Court DocketErin LaviolaNo ratings yet

- Matthew Leatham ComplaintDocument2 pagesMatthew Leatham ComplaintErin LaviolaNo ratings yet

- Claire Miller DocketDocument2 pagesClaire Miller DocketErin Laviola50% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- OC Communicator - Oct 2 07Document6 pagesOC Communicator - Oct 2 07Erin LaviolaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Lil Wayne AttorneyDocument1 pageLil Wayne AttorneyErin LaviolaNo ratings yet

- Koby Francis 2017 Arrest Court DocketDocument7 pagesKoby Francis 2017 Arrest Court DocketErin LaviolaNo ratings yet

- Davis and Williams AffidavitDocument4 pagesDavis and Williams AffidavitErin LaviolaNo ratings yet

- OCSO Statement DO ChargesDocument1 pageOCSO Statement DO ChargesErin LaviolaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Alec Denney ArrestDocument2 pagesAlec Denney ArrestErin LaviolaNo ratings yet

- Lil Wayne Charge DocumentDocument5 pagesLil Wayne Charge DocumentErin LaviolaNo ratings yet

- 10-9-2020 Barker Park Media ReleaseDocument1 page10-9-2020 Barker Park Media ReleaseErin LaviolaNo ratings yet

- Hendershott Miles and Butler AffidavitDocument15 pagesHendershott Miles and Butler AffidavitErin LaviolaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Initial Suicide Report - RedactedDocument2 pagesInitial Suicide Report - RedactedErin LaviolaNo ratings yet

- Case Synopsis, ME20-2404, Baker, NevanDocument1 pageCase Synopsis, ME20-2404, Baker, NevanErin LaviolaNo ratings yet

- #8 Firing Email From Headmaster 9-5-2020Document3 pages#8 Firing Email From Headmaster 9-5-2020Erin LaviolaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)