Professional Documents

Culture Documents

Sample Financial Plan

Uploaded by

Sneha KhuranaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Financial Plan

Uploaded by

Sneha KhuranaCopyright:

Available Formats

Read more: http://www.bplans.com/personal_event_planning_business_plan/management_summary_fc.

cfm#ixzz11alvXBEk

Financial Plan

Service-based businesses require little funds to start-up, and as they grow and expand, less funds to maintain.

The charts and graphs that follow will show that investment up front allows Occasions to function debt-free with

little overhead. This gives Occasions a quicker break-even point and increased profit margins from the start. As

Occasions grows, the debt-free philosophy will be maintained until it is impossible to function during growth

periods without financial assistance.

7.1 Important Assumptions

Tax rates are noted for information. We carry no loan burden that would be effected by these rates. What hits

Occasions the hardest (but not nearly are bad as other service businesses), is the tax rate of 24%, which is

nearly one quarter of the total sales. As Occasions continues to grow, these numbers will be reference rather

than influence.

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 24.00% 24.00% 24.00%

Other 0 0 0

7.2 Key Financial Indicators

The break-even point for Occasions is based on the assumption that we will produce 22 events per month and

average approximately $521 per event. In the current situation, we average more than this assumption for our

public and private organization events. These currently make up 18 of the 22 average events hosted per month.

7.3 Break-even Analysis

The break-even point is based on the assumption that we will produce 22 events per month and average

approximately $521 per event. In the current situation, we average more than this assumption for our public and

private organization events. These currently make up 18 of the 22 average events hosted per month.

The break-even point will appear more rapidly for Occasions than for other types of home-based businesses.

Start-up costs are limited to minimal equipment, there is little or no staff to pay in the beginning, and contracted

companies will handle any additional equipment required for the planned events.

Break-even Analysis

Monthly Revenue Break-even $19,313

Assumptions:

Average Percent Variable Cost 12%

Estimated Monthly Fixed Cost $17,023

7.4 Projected Profit and Loss

Leading the industry in event planning requires the use of the resources available at the lowest cost. As noted in

the table, we spend less money on overhead than another event planners with an outside office or office space in

their own facility. This savings allows us to market in creative ways and spend funds on expansion into other

areas when the time is right.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $353,149 $494,670 $554,779

Direct Cost of Sales $41,872 $58,507 $64,299

Other Costs of Sales $196 $203 $221

Total Cost of Sales $42,068 $58,710 $64,520

Gross Margin $311,081 $435,960 $490,259

Gross Margin % 88.09% 88.13% 88.37%

Expenses

Payroll $56,044 $63,310 $66,560

Sales & Marketing & Other Expenses $146,013 $68,400 $73,400

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $516 $750 $800

Insurance $264 $750 $1,000

Rent $1,440 $1,800 $1,800

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $204,277 $135,010 $143,560

Profit Before Interest and Taxes $106,804 $300,950 $346,699

EBITDA $106,804 $300,950 $346,699

Interest Expense $406 $279 $362

Taxes Incurred $25,535 $72,161 $83,121

Net Profit $80,862 $228,510 $263,216

Net Profit/Sales 22.90% 46.19% 47.45%

7.5 Projected Cash Flow

Our cash situation is great. Although we begin with little extra cash, our increased growth allows us to make up

for lost time. Our cash balance is always above the mark with the cash flow not too far behind. We have no

negatives in our cash analysis.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $141,260 $197,868 $221,912

Cash from Receivables $178,271 $283,330 $327,145

Subtotal Cash from Operations $319,531 $481,198 $549,057

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $4,000 $1,080 $1,080

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $323,531 $482,278 $550,137

Expenditures Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $56,044 $63,310 $66,560

Bill Payments $199,964 $209,268 $223,979

Subtotal Spent on Operations $256,008 $272,578 $290,539

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $3,500 $500 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $259,508 $273,078 $290,539

Net Cash Flow $64,023 $209,200 $259,598

Cash Balance $66,323 $275,523 $535,121

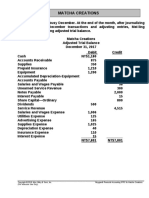

7.6 Projected Balance Sheet

Occasions is set up for success. According to the numbers, we start out fair and end up amazing. By FY2000, we

will be worth over $125,000 with a profit margin of over 30%. We are operating with little to zero debt, boosting

the net worth even higher. Our only weakness is the products to be released in FY2000 have not been accounted

for as an investment of funds. This will effect the cash flow in a moderate way, and is undetermined how it will

effect the profit ratio of the business.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $66,323 $275,523 $535,121

Accounts Receivable $33,618 $47,090 $52,812

Inventory $4,991 $6,975 $7,665

Other Current Assets $0 $0 $0

Total Current Assets $104,933 $329,588 $595,598

Long-term Assets

Long-term Assets $0 $0 $0

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $0

Total Assets $104,933 $329,588 $595,598

Liabilities and Capital Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $21,270 $16,836 $18,550

Current Borrowing $2,500 $3,080 $4,160

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $23,770 $19,916 $22,710

Long-term Liabilities $0 $0 $0

Total Liabilities $23,770 $19,916 $22,710

Paid-in Capital $3,665 $3,665 $3,665

Retained Earnings ($3,365) $77,497 $306,007

Earnings $80,862 $228,510 $263,216

Total Capital $81,162 $309,672 $572,888

Total Liabilities and Capital $104,933 $329,588 $595,598

Net Worth $81,162 $309,672 $572,888

7.7 Business Ratios

Data on our business ratios is shown in the table below. Industry Profile ratios are based on Standard Industry

Classification (SIC) Index code 7299.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 40.07% 12.15% 11.37%

Percent of Total Assets

Accounts Receivable 32.04% 14.29% 8.87% 10.40%

Inventory 4.76% 2.12% 1.29% 3.83%

Other Current Assets 0.00% 0.00% 0.00% 48.41%

Total Current Assets 100.00% 100.00% 100.00% 62.64%

Long-term Assets 0.00% 0.00% 0.00% 37.36%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 22.65% 6.04% 3.81% 23.10%

Long-term Liabilities 0.00% 0.00% 0.00% 24.97%

Total Liabilities 22.65% 6.04% 3.81% 48.07%

Net Worth 77.35% 93.96% 96.19% 51.93%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 88.09% 88.13% 88.37% 100.00%

Selling, General & Administrative Expenses 69.22% 35.37% 34.65% 65.24%

Advertising Expenses 0.51% 0.44% 0.47% 2.43%

Profit Before Interest and Taxes 30.24% 60.84% 62.49% 4.31%

Main Ratios

Current 4.41 16.55 26.23 1.83

Quick 4.20 16.20 25.89 1.31

Total Debt to Total Assets 22.65% 6.04% 3.81% 58.52%

Pre-tax Return on Net Worth 131.09% 97.09% 60.45% 7.33%

Pre-tax Return on Assets 101.40% 91.23% 58.15% 17.66%

Additional Ratios Year 1 Year 2 Year 3

Net Profit Margin 22.90% 46.19% 47.45% n.a

Return on Equity 99.63% 73.79% 45.95% n.a

Activity Ratios

Accounts Receivable Turnover 6.30 6.30 6.30 n.a

Collection Days 43 50 55 n.a

Inventory Turnover 10.91 9.78 8.78 n.a

Accounts Payable Turnover 10.40 12.17 12.17 n.a

Payment Days 27 34 29 n.a

Total Asset Turnover 3.37 1.50 0.93 n.a

Debt Ratios

Debt to Net Worth 0.29 0.06 0.04 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $81,162 $309,672 $572,888 n.a

Interest Coverage 262.90 1,078.67 957.73 n.a

Additional Ratios

Assets to Sales 0.30 0.67 1.07 n.a

Current Debt/Total Assets 23% 6% 4% n.a

Acid Test 2.79 13.83 23.56 n.a

Sales/Net Worth 4.35 1.60 0.97 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Read more: http://www.bplans.com/personal_event_planning_business_plan/financial_plan_fc.cfm#ixzz11amXaYqp

Forecast Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9

Month 10 Month 11 Month 12 Sales Private 0% $12,860 $10,966 $11,435 $12,889 $13,001

$15,777 $15,998 $24,960 $26,522 $20,009 $19,650 $22,103 Public 0% $3,852 $7,884

$7,200 $8,965 $8,566 $7,600 $9,705 $11,245 $11,780 $11,999 $12,300 $12,089 Other 0%

$800 $955 $900 $1,190 $2,450 $2,133 $2,100 $4,656 $4,500 $4,622 $4,800 $4,688 Total

Sales $17,512 $19,805 $19,535 $23,044 $24,017 $25,510 $27,803 $40,861 $42,802

$36,630 $36,750 $38,880 Direct Cost of Sales Month 1 Month 2 Month 3 Month 4 Month 5

Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Private $1,800 $1,535

$1,601 $1,804 $1,820 $2,209 $2,240 $3,494 $3,713 $2,801 $2,751 $3,094 Public $385

$788 $720 $897 $857 $760 $971 $1,125 $1,178 $1,200 $1,230 $1,209 Other $40 $48 $45

$60 $123 $107 $105 $233 $225 $231 $240 $234 Subtotal Direct Cost of Sales $2,226

$2,371 $2,366 $2,760 $2,799 $3,075 $3,315 $4,852 $5,116 $4,232 $4,221 $4,538

Read more: http://www.bplans.com/personal_event_planning_business_plan/appendix_fc.cfm#ixzz11ampIKhe

Read more: http://www.bplans.com/personal_event_planning_business_plan/market_analysis_summary_fc.cfm#ixzz11ak48abC

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Event Specialist 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Site Manager 0% $735 $907 $735 $735 $735 $735 $1,245 $1,400 $1,245 $875 $875 $875

Other 0% $586 $800 $586 $586 $586 $586 $844 $895 $844 $844 $895 $895

Total People 0 0 0 0 0 0 0 0 0 0 0 0

Total Payroll $4,321 $4,707 $4,321 $4,321 $4,321 $4,321 $5,089 $5,295 $5,089 $4,719 $4,770 $4,770

Pro Forma Profit and Loss

Month

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11

12

Sales $17,512 $19,805 $19,535 $23,044 $24,017 $25,510 $27,803 $40,861 $42,802 $36,630 $36,750 $38,880

Direct Cost of Sales $2,226 $2,371 $2,366 $2,760 $2,799 $3,075 $3,315 $4,852 $5,116 $4,232 $4,221 $4,538

Other Costs of Sales $15 $13 $15 $16 $16 $16 $19 $22 $22 $13 $15 $14

Total Cost of Sales $2,241 $2,384 $2,381 $2,776 $2,815 $3,091 $3,334 $4,874 $5,138 $4,245 $4,236 $4,552

Gross Margin $15,271 $17,421 $17,154 $20,268 $21,202 $22,419 $24,469 $35,987 $37,664 $32,385 $32,514 $34,328

Gross Margin % 87.21% 87.96% 87.81% 87.95% 88.28% 87.88% 88.01% 88.07% 88.00% 88.41% 88.47% 88.29%

Expenses

Payroll $4,321 $4,707 $4,321 $4,321 $4,321 $4,321 $5,089 $5,295 $5,089 $4,719 $4,770 $4,770

Sales & Marketing &

$9,015 $10,748 $9,982 $10,260 $10,315 $10,415 $12,418 $18,015 $16,615 $13,290 $11,975 $12,965

Other Expenses

Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities $43 $43 $43 $43 $43 $43 $43 $43 $43 $43 $43 $43

Insurance $22 $22 $22 $22 $22 $22 $22 $22 $22 $22 $22 $22

Rent $120 $120 $120 $120 $120 $120 $120 $120 $120 $120 $120 $120

Payroll Taxes 12% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses $13,521 $15,640 $14,488 $14,766 $14,821 $14,921 $17,692 $23,495 $21,889 $18,194 $16,930 $17,920

Profit Before Interest and

$1,750 $1,781 $2,666 $5,502 $6,381 $7,498 $6,777 $12,492 $15,775 $14,191 $15,584 $16,408

Taxes

EBITDA $1,750 $1,781 $2,666 $5,502 $6,381 $7,498 $6,777 $12,492 $15,775 $14,191 $15,584 $16,408

Interest Expense $17 $50 $47 $44 $41 $38 $35 $33 $30 $27 $24 $21

Taxes Incurred $416 $415 $629 $1,310 $1,521 $1,790 $1,618 $2,990 $3,779 $3,399 $3,734 $3,933

Net Profit $1,318 $1,315 $1,990 $4,148 $4,818 $5,669 $5,123 $9,469 $11,966 $10,765 $11,826 $12,454

Net Profit/Sales 7.52% 6.64% 10.19% 18.00% 20.06% 22.22% 18.43% 23.17% 27.96% 29.39% 32.18% 32.03%

Pro Forma Cash Flow

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Cash Received

Cash from Operations

Cash Sales $7,005 $7,922 $7,814 $9,218 $9,607 $10,204 $11,121 $16,344 $17,121 $14,652 $14,700 $15,552

Cash from Receivables $0 $5,604 $11,241 $11,797 $12,844 $14,138 $14,888 $16,040 $20,860 $25,138 $23,706 $22,016

Subtotal Cash from Operations $7,005 $13,526 $19,055 $21,014 $22,451 $24,342 $26,009 $32,384 $37,981 $39,790 $38,406 $37,568

Additional Cash Received

Sales Tax, VAT, HST/GST

0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Received

New Current Borrowing $0 $4,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

free)

New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received $7,005 $17,526 $19,055 $21,014 $22,451 $24,342 $26,009 $32,384 $37,981 $39,790 $38,406 $37,568

Expenditures Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Expenditures from Operations

Cash Spending $4,321 $4,707 $4,321 $4,321 $4,321 $4,321 $5,089 $5,295 $5,089 $4,719 $4,770 $4,770

Bill Payments $477 $14,309 $13,919 $13,277 $15,006 $14,951 $15,891 $18,185 $27,728 $25,842 $20,173 $20,204

Subtotal Spent on Operations $4,798 $19,016 $18,240 $17,598 $19,327 $19,272 $20,980 $23,480 $32,817 $30,561 $24,943 $24,974

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Out

Principal Repayment of Current

$0 $0 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350

Borrowing

Other Liabilities Principal

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Repayment

Long-term Liabilities Principal

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Repayment

Purchase Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Dividends $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Spent $4,798 $19,016 $18,590 $17,948 $19,677 $19,622 $21,330 $23,830 $33,167 $30,911 $25,293 $25,324

Net Cash Flow $2,206 ($1,490) $465 $3,066 $2,773 $4,720 $4,679 $8,554 $4,814 $8,879 $13,113 $12,245

Cash Balance $4,506 $3,016 $3,481 $6,547 $9,321 $14,041 $18,719 $27,273 $32,087 $40,966 $54,079 $66,323

Pro Forma Balance Sheet

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Starting

Assets

Balances

Current Assets

Cash $2,300 $4,506 $3,016 $3,481 $6,547 $9,321 $14,041 $18,719 $27,273 $32,087 $40,966 $54,079 $66,323

Accounts Receivable $0 $10,507 $16,786 $17,266 $19,296 $20,863 $22,031 $23,825 $32,301 $37,122 $33,963 $32,306 $33,618

Inventory $0 $2,448 $2,609 $2,602 $3,037 $3,079 $3,383 $3,647 $5,337 $5,628 $4,655 $4,643 $4,991

Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Current Assets $2,300 $17,462 $22,411 $23,350 $28,880 $33,262 $39,454 $46,191 $64,911 $74,837 $79,584 $91,028 $104,933

Long-term Assets

Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Accumulated Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Assets $2,300 $17,462 $22,411 $23,350 $28,880 $33,262 $39,454 $46,191 $64,911 $74,837 $79,584 $91,028 $104,933

Liabilities and Capital Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Current Liabilities

Accounts Payable $0 $13,844 $13,478 $12,777 $14,509 $14,423 $15,296 $17,259 $26,860 $25,169 $19,502 $19,470 $21,270

Current Borrowing $2,000 $2,000 $6,000 $5,650 $5,300 $4,950 $4,600 $4,250 $3,900 $3,550 $3,200 $2,850 $2,500

Other Current Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Current Liabilities $2,000 $15,844 $19,478 $18,427 $19,809 $19,373 $19,896 $21,509 $30,760 $28,719 $22,702 $22,320 $23,770

Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Liabilities $2,000 $15,844 $19,478 $18,427 $19,809 $19,373 $19,896 $21,509 $30,760 $28,719 $22,702 $22,320 $23,770

Paid-in Capital $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665 $3,665

Retained Earnings ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365) ($3,365)

Earnings $0 $1,318 $2,633 $4,623 $8,771 $13,589 $19,258 $24,381 $33,851 $45,817 $56,582 $68,408 $80,862

Total Capital $300 $1,618 $2,933 $4,923 $9,071 $13,889 $19,558 $24,681 $34,151 $46,117 $56,882 $68,708 $81,162

Total Liabilities and Capital $2,300 $17,462 $22,411 $23,350 $28,880 $33,262 $39,454 $46,191 $64,911 $74,837 $79,584 $91,028 $104,933

Net Worth $300 $1,618 $2,933 $4,923 $9,071 $13,889 $19,558 $24,681 $34,151 $46,117 $56,882 $68,708 $81,162

Read more: http://www.bplans.com/personal_event_planning_business_plan/appendix_fc.cfm#ixzz11anBRt2O

You might also like

- Financial Planning Business Plan: 7.1 Important AssumptionsDocument32 pagesFinancial Planning Business Plan: 7.1 Important AssumptionstemesgenNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- PEANUT FINANCIALSDocument4 pagesPEANUT FINANCIALSTertius Du ToitNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Financial PlanDocument28 pagesFinancial PlannabeelaraoNo ratings yet

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaNo ratings yet

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgeNo ratings yet

- Services & Offers and Financial ProjectionDocument13 pagesServices & Offers and Financial ProjectionMark Leonil FunaNo ratings yet

- Assignement 5Document4 pagesAssignement 5Valentin Florin Drezaliu100% (1)

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Financial PlanDocument2 pagesFinancial PlanUssa BugguNo ratings yet

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- Financial Plan: Company NameDocument5 pagesFinancial Plan: Company NameJasmine Esguerra IgnacioNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Business DescriptionDocument8 pagesBusiness DescriptionPreacher Of IslamNo ratings yet

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.No ratings yet

- Fabricycle FinancialsDocument3 pagesFabricycle FinancialsRahul AchaяyaNo ratings yet

- Harvard Case Study - Flash Inc - AllDocument40 pagesHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Financial Analysis of COKEDocument9 pagesFinancial Analysis of COKEUsmanNo ratings yet

- RV Park Business Plan ExampleDocument27 pagesRV Park Business Plan Examplejackson jimNo ratings yet

- Rutland - Performance ReportDocument1 pageRutland - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265No ratings yet

- FINC 721 Project 2Document2 pagesFINC 721 Project 2Sameer BhattaraiNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzNo ratings yet

- Maddelein - Performance ReportDocument1 pageMaddelein - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Projections of BusinessDocument4 pagesProjections of BusinessJawwad JabbarNo ratings yet

- What Is Leveraged Buyout Model Aka LBO Model?Document5 pagesWhat Is Leveraged Buyout Model Aka LBO Model?bhumiklalka999No ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Homework Chapter 13 Case From Text BookDocument23 pagesHomework Chapter 13 Case From Text Bookjhanzab0% (1)

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Anthem IncDocument28 pagesAnthem IncHans WeirlNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- 6100 Greenview - Performance ReportDocument1 page6100 Greenview - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7242 Montrose - Performance ReportDocument1 page7242 Montrose - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- Forecast Zeiber's 2013 Financial StatementsDocument4 pagesForecast Zeiber's 2013 Financial Statementsseth litchfieldNo ratings yet

- Chapter 09. Solution For CH 09-10 Build A Model: AssetsDocument4 pagesChapter 09. Solution For CH 09-10 Build A Model: AssetsDiana SorianoNo ratings yet

- 2104040066 Nguyễn Thị Tuyết MaiDocument3 pages2104040066 Nguyễn Thị Tuyết MaiHoàng HuếNo ratings yet

- Financial Statement Ratio Analysis: Your Company, IncDocument4 pagesFinancial Statement Ratio Analysis: Your Company, IncPeninahNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Calculate your DSCR with this free worksheetDocument1 pageCalculate your DSCR with this free worksheetArun Shakthi GaneshNo ratings yet

- 5790 Guilford - Performance ReportDocument1 page5790 Guilford - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Amazon Financial Statements 2005-2019 - AMZNDocument2 pagesAmazon Financial Statements 2005-2019 - AMZNVinita AgrawalNo ratings yet

- 6693 Baldwin - Performance ReportDocument1 page6693 Baldwin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Final PPT DoCoMoDocument23 pagesFinal PPT DoCoMoNirmal100% (2)

- A Study of Eu and India ReportDocument38 pagesA Study of Eu and India ReportSneha KhuranaNo ratings yet

- Sample Business Plan: Executive SummaryDocument24 pagesSample Business Plan: Executive SummarySneha KhuranaNo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Packaging IndustryDocument10 pagesPackaging IndustrySaurabh GuptaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- YNAPDocument123 pagesYNAPShan Paul Ho100% (1)

- Tax Differentiated From Other TermsDocument2 pagesTax Differentiated From Other TermsMiguel Satuito100% (1)

- Newsletter Jan 2016Document5 pagesNewsletter Jan 2016rk_rkaushikNo ratings yet

- 2.03 Sharing With Uncle SamDocument3 pages2.03 Sharing With Uncle SamJakeFromStateFarmNo ratings yet

- Balance Sheet: KMC Speciality Hospitals (India) LimitedDocument16 pagesBalance Sheet: KMC Speciality Hospitals (India) Limitedparika khannaNo ratings yet

- Revenue Recognition: When to Recognize RevenueDocument6 pagesRevenue Recognition: When to Recognize RevenueFantayNo ratings yet

- Financial Statement AnalysisDocument36 pagesFinancial Statement Analysisvini2710No ratings yet

- Review construction contract gross profit calculationsDocument3 pagesReview construction contract gross profit calculationsAvishchal ChandNo ratings yet

- CTT Answer Season 1Document4 pagesCTT Answer Season 1ucc second yearNo ratings yet

- Paper 2 - NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 2 - UnlockedDocument19 pagesPaper 2 - NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 2 - UnlockedHirak Jyoti DasNo ratings yet

- Cash Basis vs. Accrual Basis-1Document44 pagesCash Basis vs. Accrual Basis-1moNo ratings yet

- OCS Salary 22Document6 pagesOCS Salary 22Mangal SinghNo ratings yet

- Generally Accepted Accounting PrinciplesDocument6 pagesGenerally Accepted Accounting PrinciplesMuhammad RizwanNo ratings yet

- Chapter 8 263-270Document8 pagesChapter 8 263-270Anthon AqNo ratings yet

- CM Brac BankDocument31 pagesCM Brac BankSuny ChowdhuryNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument7 pagesChapter 3 - Financial Statement AnalysisLorraine Millama PurayNo ratings yet

- 2018 Annual Report PDFDocument162 pages2018 Annual Report PDFTousif GalibNo ratings yet

- Contoh Membuat Payslip & Slip GajiDocument3 pagesContoh Membuat Payslip & Slip GajiMD Razlan72% (53)

- Problem Set 2: FIN 401: Financial Management Syed Waqar AhmedDocument3 pagesProblem Set 2: FIN 401: Financial Management Syed Waqar AhmedJiteshNo ratings yet

- Financial Statement Analysis On APEX and Bata Shoe CompanyDocument12 pagesFinancial Statement Analysis On APEX and Bata Shoe CompanyLabiba Farah 190042118No ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- Investment Banking Seo Intern Hard Skills Training356Document64 pagesInvestment Banking Seo Intern Hard Skills Training356GranttNo ratings yet

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- JSCL Quarterly Report Sep 30 2023Document55 pagesJSCL Quarterly Report Sep 30 2023marketcapcoin66No ratings yet

- Year 9 Mathematics The Curry Problem: DetailsDocument4 pagesYear 9 Mathematics The Curry Problem: DetailsJames BuchanNo ratings yet

- Tire City Case SolutionDocument6 pagesTire City Case SolutionShivam Bhasin60% (10)

- West Lake Home Furnishings Should Accept Wholesaler's Proposal to Increase Sales and ProfitsDocument7 pagesWest Lake Home Furnishings Should Accept Wholesaler's Proposal to Increase Sales and ProfitsRohan KumarNo ratings yet

- Project Report of Financial Analysis of Blue Star and HitachiDocument16 pagesProject Report of Financial Analysis of Blue Star and HitachiAman VermaNo ratings yet

- Fernandez Hermanos Inc. vs. CIR GR No. L 21551Document8 pagesFernandez Hermanos Inc. vs. CIR GR No. L 21551ZeusKimNo ratings yet

- Formation of Case Problems.Document27 pagesFormation of Case Problems.CHARAK RAYNo ratings yet