Professional Documents

Culture Documents

Global Briefing October 2010

Uploaded by

Absolute ReturnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Briefing October 2010

Uploaded by

Absolute ReturnCopyright:

Available Formats

GlobalBriefing

HedgeFund

Intelligence

Volume 3 Issue 12 October 2010 A HedgeFund Intelligence publication

HEDGE FUND INDUSTRY GLOBAL NEWS ROUND-UP • RESEARCH • ABSOLUTE UCITS • DATA

September ushers in a reversal of fortunes

GLOBAL SUMMARY

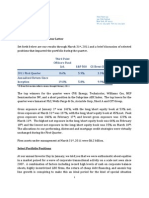

GLOBAL INDICES (EST)

Medians Means September saw a reversal of August’s bearish sentiment, when

Strategy Sep-10 YTD Sep-10 YTD a constant flow of poor macroeconomic data had dominated the

Equity 3.28% 2.31% 3.87% 3.59%

news, escalating investors’ fears of a double-dip recession and

Macro 1.64% 4.56% 2.72% 4.65%

Managed Futures 2.20% 3.83% 3.41% 5.95%

causing an over-zealous sell-off.

Event Driven 2.41% 5.25% 3.92% 6.32% Despite September’s generally subdued economic data, it

Emerging Market Debt 1.79% 8.16% 1.96% 10.32% was far from indicating a return to recession like the previous

Emerging Market Equity 4.89% 3.61% 5.65% 5.53% month, as US data stabilised, calming recent fears. Markets were

HFI Global Composite 2.20% 4.11% 3.11% 4.93%

supported further by comments from the Federal Reserve and the

Bank of England, which signalled a willingness to provide further

stimulus, if needed, with a second round of quantitative easing.

GLOBAL COMPOSITE MEDIAN INDICES The economic outlook also improved for emerging markets,

% 350 particularly China, which saw an increase in imports and a rise in

its industrial production that surpassed expectations, indicating

300

that it was over the recent slowdown and reaccelerating.

250

Hedge fund managers had one of their best months in recent

200 years with the HedgeFund Intelligence Global Index – Composite

150 up 2.20% and HedgeFund Intelligence Global Index – Equity

100 up 3.28%. Unlike August, when markets fell, September saw

managers underperform the surge in local bourses, with the S&P

50

500 gaining almost 9%, and the FTSE (up 6.19%), DAX (up 5.13%),

0

Nikkei (up 6.18%), Hang Seng (up 8.87%) and MSCI The World

-50 Index – Net (up over 9%) all gaining.

98

99

00

1

02

03

04

05

06

07

08

09

10

-0

p-

Currencies became a hot topic again last month as growing

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

emerging economies saw inflows strengthening their currencies,

Japan move defensively to suppress the yen and an increase in

MSCI World Index - Net rhetoric from the US over the value of the Chinese renminbi.

HedgeFund Intelligence Global Index - Macro

HedgeFund Intelligence Global Index - Managed Futures CONTENTS

1 Global summary

HedgeFund Intelligence Global Index - Event Driven

3 The Americas summary Equities boast best September since 1939

HedgeFund Intelligence Global Index - Equity

4 Europe summary Hope returns as double-dip concerns fade

HedgeFund Intelligence Global Index - Emerging Market Equity 5 Asia-Pacific summary Asian markets rebound with positive returns

HedgeFund Intelligence Global Index - Emerging Market Debt 6 Funds of funds summary Commodities and equities perform the best

8 Absolute UCITS Latest UCITS III developments

HedgeFund Intelligence Global Index - Composite

9 Research Global hedge fund assets edge up to $1.87 trillion

11 Data Absolute UCITS continues to attract funds

For more information please contact: Damian Alexander

email: dalexander@hedgefundintelligence.com tel: +44 (0)20 7779 7361 12 Latest weekly news

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx

www.absolutereturnsymposium.com

November 2 & 3, 2010, The New York Athletic Club, New York

The AR Symposium is a major hedge fund event which attracts the industry’s elite from

around the globe. Offering incisive and topical content, the Symposium will address the

overall outlook for the hedge fund industry and the financial markets, as well as the

challenges and risks across a range of specific strategies.

Why you should attend the AR Symposium?

• Reputation for being the leading event in the U.S. with unrivaled speakers

• Up-to-date program put together by our knowledgeable editorial staff

• Informed debate with the most senior level hedge fund managers and investors

• Fantastic networking opportunity

• Over 350 delegates expected

Register NOW and save 10%

Register before October 1 and receive 10% off the standard rates.

Don’t miss out, book your ticket now:

Ticket hotline: +44 (0) 20 7779 8999 www.absolutereturnsymposium.com

For sponsorship and exhibition

opportunities contact:

Sumehr Sondhi, T: +1 212 224 3275

E: ssondhi@absolutereturn.net

AR Symposium ad.indd 1 20/09/2010 09:47

Covering the single manager hedge

fund industry in the Americas

Equities boast best September since 1939

ABSOLUTE RETURN INDICES (EST) MARKET EVENTS

Medians Means

Strategy Sep-10 YTD Sep-10 YTD • Bank of Canada raises interest rates for third time this year

Mixed Arbitrage Index 0.89% 4.38% 0.67% 4.78%

Commodities Index 2.82% 1.00% 3.94% 3.52%

• Unemployment rate remains at 9.6%

Convertible & Equity Arbitrage Index

Credit Index

1.09%

1.70%

6.56%

8.61%

1.68%

2.13%

7.85%

10.96%

• Government passes Obama’s Small-Business Bill

Distressed Index 1.60% 8.06% 1.44% 8.29% • Dollar falls as Fed admits possibility of further quantitative easing

Event Driven Index 3.56% 8.07% 4.55% 7.37%

Fixed Income Index 0.93% 7.68% 1.22% 8.09% • Senate delays vote on extending Bush tax cuts until after mid-terms

Global Equity Index 2.34% 2.17% 3.25% 2.90%

Latin American Debt Index 1.66% 5.84% 1.61% 5.82%

Latin American Equity Index 2.93% 7.00% 3.47% 8.67%

HEDGE FUND STRATEGIES

Macro Index 2.77% 5.92% 3.79% 6.31%

Equities Despite September’s mixed macro-economic data, investors

Managed Futures Index 2.21% 4.06% 3.48% 6.36%

Mortgage Backed Securities Index 2.20% 9.14% 2.10% 11.14% grew more confident as fears of a double-dip recession receded and

Multi-Strategy Index 1.36% 4.51% 2.56% 4.54% there was raised expectation of a further round of quantitative easing by

Technology Index 3.44% 4.55% -3.88% -0.01% the Federal Reserve. Gains were made in corporate bonds and dividend

U.S. Equity Index 4.07% 2.40% 4.57% 5.18% paying equities, while funds with conservatively positioned portfolios

Absolute Return Composite Index 2.50% 5.27% 3.44% 6.14%

were unable to take advantage of the rally in equities, as stock prices

soared and the S&P 500 Index returned its best September in 71 years,

ABSOLUTE RETURN MEDIAN INDICES VS ending up 8.76%. US and Global Equity funds returned an estimated

MSCI WORLD INDEX AND S&P 500 4.07% and 2.34% respectively, while Tech funds returned an estimated

3.44%. Managers expect the November elections to influence the markets,

% 300

and are conservatively hedging portfolios to prepare for higher volatility.

250

Convertible and Equity Arbitrage Convertible funds were up 1.09%

200 bringing the year to date to 6.56%. Funds that performed well found the

surge in the equity markets led to outrights being better buyers, while

150 investors anticipated new issuance. Year-to-date performance is down

compared to the same time last year, when funds were up 41%, according

100 to the Absolute Return Convertible & Equity Arbitrage Index; managers

thus remain cautious on convertibles, but are adding opportunistically.

50

Credit Funds within the Credit space returned an estimated 1.70%

0

for the month, gains being made through long positions in bonds and

CDS. Short positions in Brazilian indices and Chinese banks contributed

-50

to losses. Managers are targeting bonds with refinancing potential and

98

99

00

01

02

03

04

05

06

Se 7

08

09

10

0

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

see an opportunity in high-quality loans and refinance candidates.

S&P 500

Commodities/CTAs Commodity-based funds and CTAs returned

MSCI World 2.82% and 2.21% for the month respectively. Following the Japanese

Absolute Return Composite Index Government’s intervention in the yen, many portfolios saw a reduction

in their long yen exposure to the US dollar to combat the increase in

Absolute Return Global Equity

currency volatility. In the commodities market, gains were made from

Absolute Return U.S. Equity long positions in gold and silver as the continued weakness of the US

dollar led investors to seek a safe haven in the precious metals market.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 3

Covering the single manager

hedge fund industry in Europe

Hope returns as double-dip concerns fade

EUROHEDGE INDICES (EST) MARKET EVENTS

Medians Means • National Bank of Greece plans to raise €2.8bn in new capital

Strategy Sep-10 YTD Sep-10 YTD

European Equity USD 2.26% 1.19% 2.55% 1.77%

• Ireland’s cost of borrowing hits new highs in September

European Equity GBP 3.19% 2.37% 3.91% 3.52% • Anglo Irish Bank sees bailout of €34bn

European Equity EUR 2.48% 2.48% 2.26% 2.97%

Macro USD 0.59% 3.81% 1.29% 4.07%

• Spain’s credit rating cut from AAA to Aa1 by Moody

Fixed Income USD 0.45% 5.71% 0.86% 6.88% • Unions strike across Europe

Global Equity USD 2.85% 0.27% 3.78% 0.88%

Managed Futures USD 2.13% 5.87% 3.18% 6.10%

Credit USD 0.96% 7.47% 1.38% 7.49%

HEDGE FUND STRATEGIES

Currency 1.74% 3.78% 2.54% 6.41% Equities Equities had a strong month during July, with lessening fears

Event Driven USD 1.08% 2.05% 3.43% 4.48% of a double-dip recession and improved economic data being released.

Mixed Arbitrage & Multi Strategy USD 1.42% 3.84% 2.36% 6.77%

The EuroHedge Global Equity index saw an estimated gain of 2.85% for

Equity Market Neutral &

Quantitative Strategies USD 0.32% 2.73% 0.47% 2.01% September – one of its best months for a year, while emerging-market

Convertible & Equity Arbitrage USD 1.69% 7.35% 1.49% 8.12% equity was also up, gaining 4.89% for the month, with a 5.35% return for

Emerging Market Debt USD 1.69% 7.49% 2.10% 7.18% the year after oil and metal prices rose. Despite concerns over Ireland’s

Emerging Market Equity USD 4.89% 5.35% 5.13% 4.55%

banking issue, European equities still had a strong month, with the MSCI

EuroHedge Composite 1.83% 3.03% 2.47% 3.60%

Europe, DAX and FTSE up 5.31%, 5.13% and 6.19% respectively. The

French CAC also had a strong month, though was still down for the year

at -5.62% even after a boost of 6.43% for September. European hedge

EUROHEDGE MEDIAN INDICES VS

funds benefited from their long positions in equities, yet underperformed

MSCI EUROPE their benchmarks with a gain of 2.48% for the month and up the same

for the year so far, as short books affected their gains. Gains from long

% 200

positions in cyclical and growth stocks added to performance, while on a

sector basis, funds benefited from gains in energy, resources and utilities.

150

Managed Futures The EuroHedge Managed Futures Index continued

its positive performance from August with another gain of 2.13% for

100

September, pushing the return for the year’s first three quarters to 5.87%.

The month’s main contributor to performance was commodities, which

50

saw prices rise as the Fed hinted of more quantitative-easing techniques,

pushing the USD lower. Losses from long positions in fixed income such

0 as Euribor and European government bonds were offset with gains from

long positions in cotton and crops – which saw weather conditions push

prices higher. As the EuroZone forecasted better-than-expected results

-50

for 2011, the euro rose, causing a small loss for short positions. Further

00

02

03

04

05

06

07

08

09

10

-0

p-

p-

p-

p-

p-

p-

p-

p-

p-

p-

gains came from energy as prices increased during the month.

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

MSCI Europe - Net

Credit The EuroHedge Credit Index is fast becoming the best strategy

EuroHedge Composite Index

for the year, up 7.47% through to the end of September after another

EuroHedge European Long/Short Equity EUR Index estimated gain of 0.96% for the month. As interest rates remain low,

EuroHedge Managed Futures USD Index issuance in Europe and the US has continued to pick up through 2010,

EuroHedge Fixed Income USD Index as seen by BP’s raising of $3.5bn bonds during September, as interest on

EuroHedge Macro USD Index debt remains cheap. While Europe saw a surge in ABS deals, confidence

EuroHedge Global Equity USD Index was boosted not only by the rally in equities but central banks’

admitting that quantitative easing may be used to revive the economy.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 4

Covering the single manager hedge

fund industry in the Asia-Pacific

Asian markets rebound with positive returns

ASIAHEDGE INDICES (EST) MARKET EVENTS

Medians Means

Strategy Sep-10 YTD Sep-10 YTD • BoJ intervenes in the currency market for first time since 2004

Asia including Japan USD 4.46% 2.92% 6.23% 4.20% • China’s PMI improves for second month, indicating reaccelerating growth

Asia excluding Japan USD 7.38% 5.55% 7.33% 7.11%

• Malaysia announces an Economic Transformation Programme of

Chinese Equity 4.87% 0.11% 5.66% 1.17% $444 billion over 10 years

Indian Equity

Japanese Equity USD

7.25%

0.99%

12.35%

0.52%

7.27%

0.93%

14.74%

-0.80%

• Hong Kong dollar and RMB appreciates substantially

Japanese Equity JPY 1.96% 1.16% 2.41% -0.32% • Weak US dollar pushes up commodities

Australian Equity AUD 4.21% 0.31% 6.61% 4.57%

AsiaHedge Composite 3.02% 3.51% 4.05% 4.16%

HEDGE FUND STRATEGIES

Single Country August was a tough month and most AsiaHedge indices

EQUITY BENCHMARKS were down for the month and also for the year to date. However, the

Benchmark index Sep-10 YTD

markets rebounded and all indices gained in September, bringing all

MSCI Pacific Free Net 7.62% 4.78%

MSCI Pacific ex Japan 12.96% 7.96%

year-to-date figures back into a positive stance. Indian and Chinese equity

MSCI China 9.05% 3.90% were the only gainers in August and both remained strong in September,

China Shanghai Composite Index -1.07% -20.34% up an estimated 7.25% and 4.87%, respectively. The MSCI China was up

Sensex 11.67% 14.91% 9.05% in September, as money continued to flow into Hong Kong and

TOPIX 3.91% -6.92%

China. Technology firms in Taiwan gained from global market strengths.

Nikkei 225 6.18% -11.16%

Australian All Ordinaries 4.46% -5.03%

Hang Seng 8.87% 2.22% Asia excluding Japan Equity Asian equity was strong in September,

in line with equities across the globe – the recovery was led by better

macro economic data, which suggested that the US would not have

ASIAHEDGE MEDIAN INDICES VS a double-dip into recession this year. ASEAN markets such as the

MSCI PACIFIC FREE Philippines and Indonesia led the region and the MSCI Pacific ex-Japan

% 150

was up a staggering 12.96% for the month. Funds investing into Asia

excluding Japan equities did not come close to the MSCI benchmark;

120

however, they were still the best-performing strategy (up 7.38%).

90

Australian Long/Short Equity Sentiment towards equity markets

60 improved, as better US housing and manufacturing data and stabilising

signs in China contributed to a positive outlook. Domestically, the

30 federal election was finalised and economic data remained strong. The

Australian All Ordinaries was up 4.46% in September and Australian

0 equity funds were closely in line with the market (up 4.21%).

Outperforming sectors included materials and industrials, but

-30 defensive sectors including REITS and healthcare underperformed.

-60

Japanese Long/Short Equity September followed a similar trend to

00

01

02

03

04

05

06

07

08

09

10

p-

p-

August, as the market changed direction several times. Prime Minister

p-

p-

p-

p-

p-

p-

p-

p-

p-

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Se

Naoto Kan won the Democratic Party of Japan presidential election,

MSCI Pacific Free Net

which briefly sent the yen to a 15-year high. However, the Japanese

AsiaHedge Composite Index

AsiaHedge Japanese Equity Index USD

monetary authorities finally intervened in the international currency

AsiaHedge Asia including Japan Index USD markets and exporters were the major gainers. The Japanese market

AsiaHedge Asia excluding Japan Index USD ended the month up 3.91% (TOPIX) and 6.18% (Nikkei), with Japanese

equity funds (USD-denominated) gaining 0.99%.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 5

Covering the global

fund of funds industry

Commodities and equities perform the best

INVESTHEDGE INDICES HEDGE FUND STRATEGIES

Medians Means

Commodities

Strategy Sep-10 YTD Sep-10 YTD The InvestHedge Commodities index is, at present, one of the top-

Arbitrage USD Index 1.38% 2.75% 1.38% 2.06% performing strategies, up 3.48% last month, despite reporting an

Asian Pacific Fund of Funds Index 2.47% -0.03% 2.90% 0.07% estimated year-to-date loss of 1.02% and underperforming the MCSI

Asset Based Lending Index 0.28% 2.22% 0.28% 1.67%

World Index quite considerably (up 9.32%). With funds continuing to

Commodities Index 3.48% -1.02% 3.98% -0.45%

report, this is subject to change in the coming weeks. Several weather

Distressed Index 1.55% 3.97% 1.76% 3.81%

events and supply shortages pushed a number of markets sharply higher,

Emerging Managers Index 2.01% 1.25% 2.02% 0.79%

such as cotton, due to the flooding in Pakistan; wheat, due to the drought

Emerging Markets Hedge USD Index 3.68% 4.67% 3.19% 3.14%

in Russia; sugar, due to the dry weather in Brazil; and corn, due to the

European Equity EUR Index 1.81% -0.22% 2.32% -0.06%

European Multi Strategy EUR Index 2.00% 1.28% 2.29% 0.95% dry weather in China. The price of gold was also significantly higher.

Fixed Income USD Index 2.01% 6.31% 2.08% 6.06%

Global Equity USD Index 3.11% 1.75% 2.62% 1.28% Equities

Global Macro Currency USD Index 2.45% 2.69% 2.34% 3.15% The InvestHedge Global Equity index is among the best-performing

Global Multi Strategy EUR Index 1.15% 0.48% 1.68% 0.74% strategies at the moment, with the mean up 3.11% and the median up

Global Multi Strategy USD Index 2.13% 2.02% 2.10% 2.02% a further 2.62%, reporting a year-to-date gain of 1.75% and 1.28%

Leveraged Global Multi-Strategy USD Index 3.09% 4.20% 3.00% 4.87% respectively. Equity markets rallied as economic data improved, leading

US Equity Index 2.78% 1.85% 2.66% 2.50%

to a greater investor risk appetite. The US equity markets rose due to

InvestHedge Composite Index 2.23% 1.94% 2.33% 1.84%

optimistic manufacturing, jobs and housing figures while the European

equity markets were mixed, as Spain’s credit rating was downgraded

INVESTHEDGE MEDIAN INDICES VS MSCI WORLD followed by Ireland’s banking system failing, but consumer confidence

% 120 grew as retail sales in the UK hit a high and German inflation slowed.

100 New funds

Signet Capital Management has launched its first UCITS-compliant

80

multi-strategy fund of funds following growing demand from their

institutional and private bank clients. The Signet Multi-Strategy fund

60

offers weekly liquidity and will allocate globally to approximately 15

hedge funds that follow the limits set in the UCITS III regulations. The

40

fund domiciled in Dublin is intended for investors in the UK, Europe

20 and Asia. The fund aims to produce consistent, low-volatility returns

largely uncorrelated with traditional markets, and will be flexible in

0 terms of strategy, always keeping the UCITS guidelines in mind.

-20 Mandates

Funds of funds and single-manager hedge-fund mandates seem to be

-40

on par with one another this month as the size of individual FoHF

02

03

04

05

06

07

08

09

10

mandates are smaller and single-manager fund allocations are growing,

p-

p-

p-

p-

p-

p-

p-

p-

p-

Se

Se

Se

Se

Se

Se

Se

Se

Se

according to the InvestHedge monthly mandate tables. A number of

MSCI The World Index – Net

InvestHedge Leveraged Global Multi-Strategy USD searches for single-manager hedge funds are still underway in a variety

InvestHedge Global Multi-Strategy USD of strategies at US state pensions. CalPERS put another $105 million to

InvestHedge Global Equity USD work in single HF fund allocations as New Jersey prepares to put in

InvestHedge European Multi-Strategy EUR

more than $7 billion in hedge funds to meet a larger asset allocation.

InvestHedge European Equity EUR

InvestHedge Composite Pensions in Norway and Korea added to both single manager and FOHF

mandates, while the state of Vermont made its foray via FoHFs.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 6

www.hedgefundintelligence.com

New service – just launched

Absolute

UCITS

Everything you need to know

about UCITS hedge funds

A one-stop shop for news, data and analysis, this online service will offer:

• Comprehensive database of global UCITS hedge funds

• Industry news and analysis

• New fund launches

• Distributor profiles

• Regulatory updates

• UCITS index

Take a free trial to the service

Contact us today for a free no-obligation trial of the new service.

We will be happy to show you the product. Contact:

Ian Sanderson: isanderson@hedgefundintelligence.com / +44 (0)20 7779 7339

James Barfield: jbarfield@hedgefundintelligence.com / +44 (0)20 7779 7336

Are your UCITS funds in our database?

Include your UCITS funds in our database now. Send details to Amy Kirbyshire on data@absoluteucits.com

Absolute UCITS ad_Just Launched.indd 19 10/09/2010 14:22

Absolute

UCITS

Latest UCITS III developments

Single-manager UCITS III news

SEPTEMBER UCITS PERFORMANCE INDICES • Merchant Capital has lined up the third fund launch for its UCITS III

Medians Means

Strategy Sep-10 YTD Sep-10 YTD hedge fund platform. The Merchant Global Resources UCITS Fund is due

Absolute UCITS European Equity Index 0.68% 0.31% 1.43% 2.14% to launch later this month and will be run by experienced resources

EuroHedge European Equity EUR Index 2.48% 2.48% 2.26% 2.97% investment manager Tal Lomnitzer.

Absolute UCITS Single Manager Composite Index 1.02% 1.50% 2.26% 1.70%

HedgeFund Intelligence Global Index – Composite 2.20% 4.11% 3.11% 4.93% • HSBC Global Asset Management has rolled out a leveraged version of

its flagship macro absolute return portfolio, the HSBC GIF Global Macro

EQUITY BENCHMARKS Fund. The fund is co-managed by Guillaume Rabault and Jim Dunsford,

Benchmark index Sep-10 YTD and will invest across liquid markets in cash, equities, bonds and

MSCI Europe – Net 5.31% 1.77% currencies worldwide.

FTSE 100 (London) 6.19% 2.51%

DAX (Frankfurt) 5.13% 4.56% • Martin Currie, the Edinburgh-based ‘big boutique’ manager overseeing

$1.2 billion, is launching a UCITS III-compliant product based on the

firm’s ARF-Japan Fund, a long/short equity strategy launched in 2000.

UCITS INDICES VS EUROHEDGE EUROPEAN Luxembourg-domiciled Japan Absolute Alpha will be managed by

EQUITY AND MSCI EUROPE John-Paul Temperley and Keith Donaldson.

% • GLG Partners plan to reopen one of its UCITS-compliant offerings to

30 new investment after receiving strong demand from investors. The firm

is creating an additional $250 million of capacity and will close the fund

20 again once this has been filled.

• Swiss alternatives manager Salus Alpha is planning an Asia-focused

multi-strategy UCITS III fund to meet investor demand for a highly

10

liquid product centred on the fast-growing region. Salus Alpha is

partnering with an Asian fund manager to launch an existing multi-

0

strategy product on its UCITS III platform.

• Quant Asset Management is planning to launch a UCITS III fund that

-10 will follow the investment strategy of its offshore global equities fund.

The UCITS version of the British Virgin Islands-based Quant Global

-20 Equities Fund is expected to launch in January 2011.

Multi-manager UCITS III news

-30

• Alternative asset manager Man has launched a UCITS III long/short

equity fund of funds domiciled in Luxembourg. The portfolio has

-40 between eight and 12 managers including Marshall Wace, RWC Partners

and TT International.

-50

Industry news

07

09

10

-0

p-

p-

p-

p

Se

• Assets under management for UCITS that use hedge fund strategies

Se

Se

Se

have almost reached the $50 billion milestone. There are a total of 296

EuroHedge UCITS European Equity Index (Median)

EuroHedge European Equity EUR Index (Median) funds that have $49.2 billion AUM, according the latest research by the

HedgeFund Intelligence Global Index – UCITS HedgeFund Intelligence data team. They consist of 254 single-manager

HedgeFund Intelligence Global Index - Composite

hedge funds with combined assets of $46.1 billion, plus 42 funds of

MSCI Europe - Net

funds with $3.1 billion assets.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 8

Research

Global hedge fund assets edge up to $1.87tr

After a rebound of some 10% buoyed by

strong performance during the second half The $1.87 trillion industry: where the assets are managed

of 2009, assets in the global hedge fund

industry edged up at a much slower pace 1,500 Asia-Pacific funds managed in the US $30bn

$1,342bn European funds managed by US firms $21bn

during the first half of 2010. According to

Other hedge funds managed in the US $1,291bn

our latest research, global assets were up a 1,200 European funds managed in Europe $349bn

modest 2% during the first half of this year Asia-Pacific funds managed in Europe $12bn

to reach a total of $1.866 trillion by the Asia-Pacific funds managed in Asia-Pacific $96bn

Assets $bn

900 Rest of world – Latin America $40bn

beginning of July.

Rest of world – Canada $20bn

The latest numbers on global assets came Rest of world – Africa $7bn

following a period of relatively flat 600 Total $1,866bn

performance during the first half across the $382bn

hedge fund industry – which implies that 300

any new inflows of assets must have been $138bn

$67bn

more or less evenly matched by the pace of

0

investor redemptions. US Europe Asia Rest of the world

Industry assets remain a long way below Source: HedgeFund Intelligence Note: The figures shown here are for single-manager hedge funds only. They do not include or double-count money allocated to hedge funds

their historic high of over $2.65 trillion set via funds of funds. Assets in funds of hedge funds are tracked separately by InvestHedge.

during 2007 before the global financial

crisis took hold. Absolute Return Billion Dollar Club alone more, representing a combined total of

As in previous years, the lion’s share of accounting for combined assets of over $1.2 $1.535 trillion – a slightly higher propor-

global assets are managed in the United trillion. Globally, there are now 302 firms tion than at the beginning of the year, and

States, with the 217 members of the that run hedge fund assets of $1 billion or continuing a trend whereby assets have

become ever more heavily concentrated

The global billion dollar club: July 2010 among the bigger firms. The top 10 firms

AUM $bn Number of % of total % of total alone now control 15% of the global total.

Location firms assets funds New York remains the biggest single

NY, USA 706.44 124 46.03% 39.49%

London, UK 238.82 52 15.56% 16.56% centre of the industry, followed by London

CT, USA 168.1 25 10.95% 7.96% which is still in second place. Assets in

CA, USA 70.03 16 4.56% 5.10%

MA, USA 89.48 12 5.83% 3.82% standard European hedge funds did not rise

Hong Kong 13.47 10 0.88% 3.18% at all in the first half, though there was an

TX, USA 25.59 8 1.67% 2.55% increase in onshore UCITS III-compliant

NJ, USA 25.32 5 1.65% 1.59%

Sydney, Australia 19.67 5 1.28% 1.59% hedge funds to reach nearly $35 billion in

MN, USA 16.53 5 1.08% 1.59% Europe (and nearly $50 billion in all)

Singapore 6.15 5 0.40% 1.59%

IL, USA 22.05 4 1.44% 1.27% – which are not included in the totals here.

Paris, France 15.39 4 1.00% 1.27% The rising centres include places in Asia

Hamilton, Bermuda 11.22 4 0.73% 1.27%

such as Hong Kong, where the number of

Stockholm, Sweden 14.34 3 0.93% 0.96%

WI, USA 9.85 3 0.64% 0.96% firms in the Billion Dollar Club jumped

Rio de Janiero, Brazil 5.13 3 0.33% 0.96% from 6 to 10 in the first half of the year;

Toronto, Canada 4.14 3 0.27% 0.96%

Tokyo, Japan 3.92 3 0.26% 0.96% and in Latin America, where there are now

GA, USA 11.84 2 0.77% 0.64% five firms with $1 billion or more in either

PA, USA 11.79 2 0.77% 0.64%

Sao Paulo or Rio de Janeiro.

São Paulo, Brazil 10.31 2 0.67% 0.64%

Other 35.28 14 2.30% 4.46%

Total 1,534.86 302* 100% 100% Taken from a HedgeFund Intelligence

Source: HedgeFund Intelligence *De-duplicated to account for groups with more than one official location

press release, London

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 9

The world’s leading

hedge fund database

bigger HedgeFund Intelligence provides the most

comprehensive hedge fund, fund of funds, and UCITS

database available. Linked with our extensive news

and research, subscribers can benefit from a unique

combination of quantitative and qualitative analysis.

faster Bigger

With over 13,000 funds listed in the database, HedgeFund Intelligence provides

the most complete source of hedge funds, and funds of funds than any data

provider*. With three specialist regional products (Asia-Pacific, Europe and the

Americas) a global fund of hedge funds and a new UCITS Absolute Return

database, the HedgeFund Intelligence database will meet your needs.

clearer

Faster

Updated weekly with (practically) all data available within four weeks of month

end, the extensive research and editorial team ensure rapid inclusion of new

funds and updates on key data points.

Clearer

The database provides dedicated, clear and detailed information on hedge funds,

trusted

UCITS Absolute Return funds and funds of funds (without unnecessary multiple share

classes). Links to news and analysis provide additional information on funds and over

70 non-investable indices are available to benchmark performance.

Trusted

With an experienced and dedicated specialist team gathering and verifying the data

to ensure accuracy, this database is used by many of the industry’s leading firms.

simple

Simple

A user-friendly interface allows effortless sorting by multiple criteria including

fund name, management company, performance, strategy, asset size and date of

inception. Compatible with Pertrac and fully downloadable into Microsoft Excel,

Access and other various third-party platforms.

*Comparative information taken from public sources.

To find out how we can tailor this powerful research tool to fit your requirements or

for a demonstration, please email sales@hedgefundintelligence.com or contact:

James Barfield +44 20 7779 7336 / jbarfield@hedgefundintelligence.com

Ian Sanderson +44 20 7779 7339 / isanderson@hedgefundintelligence.com

Absolute

UCITS

HFI Global Database Ad Full HFI_UCITS.indd 19 01/07/2010 14:44

Data

Absolute UCITS continues to attract funds

NUMBER OF NEW FUNDS ADDED TO THE HFI DATABASE DURING SEPTEMBER

The Hedgefund Intelligence data and research team EuroHedge InvestHedge

added 173 UCITS funds to the database during AsiaHedge Absolute Return Absolute UCITS

September, as we saw the launch of Absolute UCITS 250

Number of funds added to

– our online news offering dedicated to UCITS funds.

200

In total, the team added 208 funds to the database

during the month, with EuroHedge adding an 150

HFI database

additional 15, Absolute Return + Alpha adding 10 100

and AsiaHedge and InvestHedge adding 8 and 2

50

respectively. The majority of funds added were

either based in the US, London or Singapore. 0

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10

NUMBER OF FUNDS LIQUIDATED DURING SEPTEMBER*

In total, 55 funds were liquidated in the database EuroHedge InvestHedge

AsiaHedge Absolute Return Absolute UCITS

during September. Absolute Return saw the greatest

80

Number of funds liquidated

number of funds close, with 19, followed closely by 70

EuroHedge at 18. InvestHedge and AsiaHedge saw 60

10 and 8 respectively. Our Absolute UCITS database 50

also saw a liquidation last month, with one fund 40

noted as closed. On the single-manager side, over 30

half of the funds noted as liquidated in the 20

10

database during September closed within 2010. No

0

specific strategy dominated but a number of equity Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10

* de-duped to exclude multiple share classes

strategies saw liquidations throughout September.

DISTRIBUTION OF PERFORMANCE

%

Hedge funds had one of their strongest months during Positive Negative

100

September posting an estimated gain of 2.20% for the

month, the strongest gain since May 2009. While 83% 80

of single-manager hedge funds, which have reported to 60

our database so far are posting positive performance 40

during September – with a handful of funds posting 20

strong double-digit gains, they still managed to

0

underperform their equity benchmarks – with the

9

09

09

10

-10

-10

-10

10

10

10

t-0

r-1

l-1

g-

n-

n-

p-

MSCI the World Index up 6.95% as small losses from

v-

c-

ar

ay

b

Ju

Ap

Au

Ja

Ju

Fe

Se

Oc

De

No

short positions detracted from gains in their long books.

GlobalBriefing: Data

If you have a fund which you wish to be included please contact the following:

Europe Americas Asia-Pacific Fund of Hedge Funds UCITS

Samantha Munday Amal Robleh Wing-Yung Lok Meera Mehta Amy Kirbyshire

data@eurohedge.com data@hedgefundintelligence.com data@asiahedge.com data@investhedge.com data@absoluteucits.com

For more information on the database and subscriptions please contact Ian Sanderson on + 44 (0) 207 779 7339 or James Barfield on + 44 (0) 207 779 7336

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 11

Latest WEEKLY news

AR Symposium workshops to Lombard Odier taps Bataillon Hong Kong’s DragonBack Plan sponsors monitor

feature Utah pension exec to run l/s European equity morphs into fund platform funding status, Mercer says

The full schedule for workshop Lombard Odier Investment Hong Kong-based DragonBack Current markets present

sessions at the forthcoming AR Managers, the institutional Capital is transitioning to a challenges to trustees, but

Symposium, to be held at the New asset management arm of the platform provider for hedge it seems most are focused

York Athletic Club on November 200-year-old Swiss private bank fund managers in Asia and on funding issues and

2-3, has now been finalized — Lombard Odier Darier Hentsch overseas following the recent ‘de-risking’ of their portfolio,

adding a range of important & Cie, has made a significant closure of its two strategies according to a recent survey

topics and speakers from many addition to its hedge fund and the departure of its released by Mercer.

more major firms to the program. operation with the hire of investment team, led by

experienced long/short equity co-founder Matthew Barnett. ABN Amro teams up with

Everest Capital partners with manager Marc Bataillon and his Lyxor for hedge funds

RiceHadley Group team from Selectium Europe. LaCrosse buys BoAML’s global ABN Amro Private Banking

Everest Capital, a $2 billion global fund admin business and Lyxor Asset Management

macro hedge fund in Miami, has GLG starts UCITS version of LaCrosse Global Fund Services have entered into a partner-

formed a strategic partnership Atlas Macro fund has finalised its acquisition of ship for hedge fund solutions,

with the RiceHadley Group, the GLG Partners is launching a Bank of America Merrill enabling ABN Amro’s private

consulting firm founded by UCITS-compliant version of its Lynch’s $6 billion global fund bank to offer its clients access

former U.S. Secretary of State high-performing GLG Atlas administration business – the to a wide selection of Lyxor’s

Condoleezza Rice and former U.S. Macro Fund, managed by latest spin-off deal of its kind managed account-based

National Security Advisor portfolio manager Driss Ben- from a multibillion-dollar hedge fund products.

Stephen Hadley, according to a Brahim and chief investment financial institution.

letter the firm sent to investors. strategist, Jamil Baz. Albourne grows team

Marble Bar rethinks Asia exponentially

September rally pushes all Polar recruits AXA strategy post closure of fund Albourne Partners, whose

strategies into the black Framlington global EM team London-based Marble Bar clients have now placed more

With almost a quarter of Polar Capital has announced Asset Management, the than $200 billion among 1,500

September’s performance in so far, the formation of a global EM long/short-focused firm, hedge funds, has dramatically

it appears that hedge funds in the franchise with the hiring of is said to be examining grown its team and anticipates

U.S. are posting positive returns, an experienced three-strong the way forward for its another 10 hires before year end

with the AR Composite Index up team from AXA Framlington Singapore office after the in line with its commitment to

an estimated 3.33%, compared to comprising William Calvert, closure in June of its MBAM track client growth with the

August’s gain of 0.42%. Ming Kemp and Neil Denman. Pan-Asian Fund. firm’s colleague growth.

Compiled by head of research & data Group publisher John Willis Customer Services

GlobalBriefing Damian Alexander

dalexander@hedgefundintelligence.com

Managing director John Orchard

Subscription sales

+44 (0) 20 7779 8610

customerservices@euromoneyplc.com

Database and directory sales

Research and data team US Matt Colbeck

Email info@hedgefundintelligence.com US/Europe Ian Sanderson

Americas: Amal Robleh mcolbeck@hedgefundintelligence.com

Telephone +44 (0) 20 7779 7330 isanderson@hedgefundintelligence.com

Europe: Samantha Munday +1 212 224 3568

Fax +44 (0) 20 7779 7331 +44 (0) 20 7779 7339

Asia-Pacific: Wing Yung Lok Europe Jamie Austin

Published by HedgeFund Intelligence, Nestor House, US/Europe James Barfield

Funds of Funds: Meera Mehta jaustin@hedgefundintelligence.com

Playhouse Yard, London EC4V 5EX jbarfield@hedgefundintelligence.com

UCITS: Jack Young +44 (0) 20 7779 8041 +44 (0) 20 7779 7336

To receive your free subscription to Global Briefing, Managing editor Neil Wilson Asia Robert Ball Asia Robert Ball

please sign up at: nwilson@hedgefundintelligence.com rball@hedgefundintelligence.com rball@hedgefundintelligence.com

www.hedgefundintelligence.com/globalbriefing.aspx

Production Michael Hunt/Loveday Cuming +852 2842 6996 +852 2842 6996 1473-3153

Disclaimer: This publication is for information purposes only. It is not investment advice and any mention of a fund is in no way an offer to sell or a solicitation to buy the fund. Any information in this publication should not be the basis for an investment decision. EuroHedge does not guar-

antee and takes no responsibility for the accuracy of the information or the statistics contained in this document. Subscribers should not circulate this publication to members of the public, as sales of the products mentioned may not be eligible or suitable for general sale in some countries.

Copyright in this document is owned by HedgeFund Intelligence Limited and any unauthorised copying, distribution, selling or lending of this document is prohibited.

GlobalBriefing is a free monthly publication To subscribe please go to www.hedgefundintelligence.com/globalbriefing.aspx October 2010 12

You might also like

- Lake Hill Capital Management - Aug 2013 - Investor LetterDocument0 pagesLake Hill Capital Management - Aug 2013 - Investor LetterAbsolute ReturnNo ratings yet

- Sac Sec OrderDocument17 pagesSac Sec Orderadam2938No ratings yet

- Time Series Momentum - Journal of Financial Economics 2012Document23 pagesTime Series Momentum - Journal of Financial Economics 2012Absolute ReturnNo ratings yet

- Balter Capital Management Hedge Fund Regional Performance StudyDocument18 pagesBalter Capital Management Hedge Fund Regional Performance StudyAbsolute ReturnNo ratings yet

- Lake Hill Capital Management - Mar 2013 - Investor Letter - ARDocument8 pagesLake Hill Capital Management - Mar 2013 - Investor Letter - ARAbsolute ReturnNo ratings yet

- Absolute Return - April 2003 - Inaugural IssueDocument43 pagesAbsolute Return - April 2003 - Inaugural IssueAbsolute ReturnNo ratings yet

- It's The Market - The Broad-Based Rise in The Return To Top TalentDocument22 pagesIt's The Market - The Broad-Based Rise in The Return To Top TalentAbsolute ReturnNo ratings yet

- EuroHedge Summit Brochure - April 2011Document12 pagesEuroHedge Summit Brochure - April 2011Absolute ReturnNo ratings yet

- AR Hedge Fund Billion Dollar Club October 2011Document2 pagesAR Hedge Fund Billion Dollar Club October 2011Absolute ReturnNo ratings yet

- EuroHedge Summit 2012 BrochureDocument8 pagesEuroHedge Summit 2012 BrochureAbsolute ReturnNo ratings yet

- Absolute Return Symposium 2012Document7 pagesAbsolute Return Symposium 2012Absolute ReturnNo ratings yet

- Top 25 Hedge Fund Managers Earned $22 Billion Combined in 2010Document2 pagesTop 25 Hedge Fund Managers Earned $22 Billion Combined in 2010Absolute Return100% (1)

- AlphaClone's 2011 Year-End CommentaryDocument4 pagesAlphaClone's 2011 Year-End CommentaryAbsolute ReturnNo ratings yet

- EuroHedge Summit Brochure - March 2012Document12 pagesEuroHedge Summit Brochure - March 2012Absolute ReturnNo ratings yet

- Hayman Capital Management Letter To Investors (Dec 2011)Document5 pagesHayman Capital Management Letter To Investors (Dec 2011)Absolute Return100% (1)

- Third Point Investor Letter 4.8.2011Document6 pagesThird Point Investor Letter 4.8.2011Absolute Return100% (1)

- Hayman Capital Management Letter To Investors (Nov 2011)Document12 pagesHayman Capital Management Letter To Investors (Nov 2011)Absolute Return100% (1)

- MFA Board Press Release 2012Document2 pagesMFA Board Press Release 2012Absolute ReturnNo ratings yet

- Kyle Bass - Hayman Investor Letter - February 2011 - Fed Governors AttachmentDocument6 pagesKyle Bass - Hayman Investor Letter - February 2011 - Fed Governors AttachmentAbsolute Return100% (1)

- Texas ERS - Tactical Plan Hedge Funds - 2011.08.23Document5 pagesTexas ERS - Tactical Plan Hedge Funds - 2011.08.23Absolute ReturnNo ratings yet

- Texas ERS - Hedge Funds Policies and Procedures - 2011.08.23Document22 pagesTexas ERS - Hedge Funds Policies and Procedures - 2011.08.23Absolute ReturnNo ratings yet

- Neuberger Berman - FOF - 2011 Strategy OutlookDocument57 pagesNeuberger Berman - FOF - 2011 Strategy OutlookAbsolute ReturnNo ratings yet

- Global Hedge Fund Assets Up and Above $2 TrillionDocument3 pagesGlobal Hedge Fund Assets Up and Above $2 TrillionAbsolute ReturnNo ratings yet

- GAO Report On Prop Trading, July 2011Document62 pagesGAO Report On Prop Trading, July 2011Absolute ReturnNo ratings yet

- PSI Wall Street Crisis 041311Document646 pagesPSI Wall Street Crisis 041311feckish2000No ratings yet

- The Future of Long-Term InvestingDocument91 pagesThe Future of Long-Term InvestingAbsolute ReturnNo ratings yet

- Meeting Between Federal Reserve Board Staff and Representatives of The Managed Funds Association - February 17, 2011Document94 pagesMeeting Between Federal Reserve Board Staff and Representatives of The Managed Funds Association - February 17, 2011Absolute ReturnNo ratings yet

- Barai and Longueuil Arrest PRDocument5 pagesBarai and Longueuil Arrest PRAbsolute ReturnNo ratings yet

- Kyle Bass - Hayman Investor Letter - February 2011Document17 pagesKyle Bass - Hayman Investor Letter - February 2011Absolute Return100% (1)

- HFI Global Briefing - February 2011Document8 pagesHFI Global Briefing - February 2011Absolute Return100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Adjective: the girl is beautifulDocument15 pagesAdjective: the girl is beautifulIn'am TraboulsiNo ratings yet

- Physics Force and BuoyancyDocument28 pagesPhysics Force and BuoyancySohan PattanayakNo ratings yet

- 2018 JC2 H2 Maths SA2 River Valley High SchoolDocument50 pages2018 JC2 H2 Maths SA2 River Valley High SchoolZtolenstarNo ratings yet

- Active Sound Gateway - Installation - EngDocument9 pagesActive Sound Gateway - Installation - EngDanut TrifNo ratings yet

- Epri ManualDocument62 pagesEpri Manualdrjonesg19585102No ratings yet

- Essentials of Report Writing - Application in BusinessDocument28 pagesEssentials of Report Writing - Application in BusinessMahmudur Rahman75% (4)

- CONTACT DETAILS HC JUDGES LIBRARIESDocument4 pagesCONTACT DETAILS HC JUDGES LIBRARIESSHIVAM BHATTACHARYANo ratings yet

- Reg OPSDocument26 pagesReg OPSAlexandru RusuNo ratings yet

- Applied SciencesDocument25 pagesApplied SciencesMario BarbarossaNo ratings yet

- Alice in ChainsDocument18 pagesAlice in ChainsmexicolaNo ratings yet

- Construction Internship ReportDocument8 pagesConstruction Internship ReportDreaminnNo ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- Singular and Plural NounsDocument3 pagesSingular and Plural NounsJosé BulquesNo ratings yet

- jk2 JAVADocument57 pagesjk2 JAVAAndi FadhillahNo ratings yet

- Counter Circuit Types, Components and ApplicationsDocument22 pagesCounter Circuit Types, Components and Applicationsnavin_barnwalNo ratings yet

- European Heart Journal Supplements Pathophysiology ArticleDocument8 pagesEuropean Heart Journal Supplements Pathophysiology Articleal jaynNo ratings yet

- How To Retract BPS Data Back To R3 When There Is No Standard RetractorDocument3 pagesHow To Retract BPS Data Back To R3 When There Is No Standard Retractorraphavega2010No ratings yet

- S 20A Specification Forms PDFDocument15 pagesS 20A Specification Forms PDFAlfredo R Larez0% (1)

- DMGT403 Accounting For Managers PDFDocument305 pagesDMGT403 Accounting For Managers PDFpooja100% (1)

- M and S Code of ConductDocument43 pagesM and S Code of ConductpeachdramaNo ratings yet

- Ballari City Corporation: Government of KarnatakaDocument37 pagesBallari City Corporation: Government of KarnatakaManish HbNo ratings yet

- Youtube SrsDocument23 pagesYoutube Srsabhinandan PandeyNo ratings yet

- Fundamental of Computer MCQ: 1. A. 2. A. 3. A. 4. A. 5. A. 6. ADocument17 pagesFundamental of Computer MCQ: 1. A. 2. A. 3. A. 4. A. 5. A. 6. AacercNo ratings yet

- Sonochemical Synthesis of NanomaterialsDocument13 pagesSonochemical Synthesis of NanomaterialsMarcos LoredoNo ratings yet

- 01 Lab ManualDocument5 pages01 Lab ManualM Waqar ZahidNo ratings yet

- 4mb1 02r Que 20220608Document32 pages4mb1 02r Que 20220608M.A. HassanNo ratings yet

- Mid Term Business Economy - Ayustina GiustiDocument9 pagesMid Term Business Economy - Ayustina GiustiAyustina Giusti100% (1)

- Facebook TemplateDocument2 pagesFacebook Templateapi-352106462No ratings yet

- XLVI ESAN INTERNATIONAL WEEK (MBA Only - July 2023)Document38 pagesXLVI ESAN INTERNATIONAL WEEK (MBA Only - July 2023)Juan Diego Fernández CastilloNo ratings yet

- On-Chip ESD Protection Design For IcsDocument14 pagesOn-Chip ESD Protection Design For IcsMK BricksNo ratings yet