Professional Documents

Culture Documents

Crude Oil 31 October 2010

Uploaded by

AndysTechnicalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crude Oil 31 October 2010

Uploaded by

AndysTechnicalsCopyright:

Available Formats

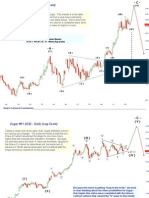

Crude Oil Monthly (Log Scale)

There are some well know Wave Technicians who refuse to do wave counts on commodities

like oil, grains, or softs. The reason is that wave theory should only apply to markets that are

“alive,” or ones that cannot “expire.” For instance, the S&P, Gold, and Euro are examples of

markets that do not expire--they have “cash” values that can be charted everyday. WTI

Crude, on the other hand, is a series of futures contracts that “expire.” For instance, the

front month crude contract is currently the Dec 2010 futures. When the Dec ’10 futures

expire and deliveries are made against the contract, the oil actually goes away--it is

consumed by a refinery and will never be seen again. The same can be said of the grain

commodities--the Dec ’10 Corn contract will either be eaten or it will spoil.

All of the above is the reason that applying wave counts to commodities can be

EXTREMELY difficult and can render wave counts that are difficult to model. For instance,

the price action in the dashed blue box is “uncountable.” It fits no known wave pattern.

With all that stated, we will attempt to lay some wave counts on this chart anyway….

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil Monthly (Log Scale)

The wave count begins with the December 1998 lows in Crude Oil at $10.35. This was the

point that the oil market and industry seemed completely “washed out.” This was a time of

hopelessness for the industry with the widespread belief that oil would never trade above

$20 bucks again. It was a period that triggered large scale consolidation/capitulation within <A>

the industry with ‘tech stocks” being “the place to be” for most investors. -V-

- III -

(V)

There are a few major “takeaways” from this chart from an Elliott Wave $147.27

perspective: The move from $10.35 to $147.27 was a “three wave”

move; and, the initial move down from $147.27 was so violent and short (B)

lived, it’s almost a certainty that it’s only the first wave of what will be a

longer enduring “correction.” (D)

Given those two major ideas, it leads to two basic wave counts. The first ( III )

is presented here and it predicts another 4 years of triangular congestion

which will be a Primary Wave -IV-, which when completed, will lead to a

( IV )

Primary Fifth Wave higher that will test the all-time highs.

(E)

-I- (I)

- IV -

(C) 2015

(A)

( II )

- II -

$10.35

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil Monthly (Log Scale)

The other, equally possible, wave count is that a cycle <A> wave concluded into the

2008 highs. This would means that we’re into a grueling <B> wave that will consume <A>

a decade or more of time and will likely conclude in the $20-$30/bbl range. If this -C-

seems like a really long time to remain in congestion, just remember what the Gold (V)

bulls had to endure between 1980 and 2000. In 1980, Gold fell 66% in just two years-- $147.27

woe be the “gold bug” who thought that Gold bottomed in 1982! It’s easy to envision a

similar outcome for oil, which jives with some of our longer term S&P forecasts of a

Cycle Wave <IV> that should last until 2020.

( III )

( IV )

-A- (I)

( II )

<B>

2018-2024

-B-

$10.35

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil Weekly (Log Scale)

<A>

-C- The manner in which the market has developed from the lows confirms that this is a “corrective” move

$147.27 higher--there is no possible way that this pattern higher can be interpreted as an impulse. The long-

enduring side-ways price congestion (blue dashed box) confirms this idea. An Intermediate (B) wave

following a corrective (A), SHOULD take back 60-80% of the previous move. Using the log-scale, which

seems appropriate in light of the enormous price range witnessed, a 60-80% retracement zone would be

$81.50-$109.55. Crude has already achieved the lower boundary of a minimum required retrace.

80% $109.55

(B)

60% $81.50

This move was a “complex”

correction that ended with a

triangle: abc-x-abcde There is no “predictable” limit on how long a (B) wave can last relative to an (A)

wave. In order for two waves to be “related,” a wave cannot be shorter than 25%

of time relative to the waves that precede it or come after it. Using that as a

guide, a (B) wave should not last much longer than 400% of an (A) wave. With

that as an “outter limit,” this (B) wave could last until the middle of 2011.

$33.55

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil Daily

The move up from the lows is a real mess--this is one of the more complicated wave counts I’ve ever seen. This represents my

“preferred” counting of the price action. The initial move up appears to be a “diametric” (a mutated “double”), which was followed

by an expanding triangle “x”-wave. The powerful e-wave of the expanding triangle explains why the market has been struggling

to retrace that wave--it’s difficult for markets to fully retrace e-waves of expanding triangles.

d

“w” b -b- -1-?

g

a -d-

-2-?

c

e $73.58

-e-

-a-

-c- b

a c

f e

“x”

a

d

For medium term traders, $73.58 looks like a key technical support

level under this wave model.

b

Notice how the apex of a

$33.55

triangle broken tends to

(A) conclude the “thrust.”

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil - 180 minute Chart

The move down from $84.43 smacks of a corrective move (triangular congestion) and it’s now approaching a critical juncture. If

this count is correct, we’re almost certainly looking at an “extended” wave -1- because of the longer enduring nature of the wave-

2. At this point, the Wave-2- seems to have run it’s course; so, crude needs to begin launching higher immediately. Short term

bulls might use $80.29 and $79.01 has first and second level support. Bears should probably use the [b]-[d] line as a “stop” for

new shorts. Above there, $83.25 seems like resistance.

-1- [b]

(x) [b]

$83.25

[d]

[e]

[c] [c]

[a]

(w) (y)

-2-?

[a]

Andy’s Technical Commentary__________________________________________________________________________________________________

Crude Oil Daily - Channel Congestion

One of the most basic “charting” concepts is that when in a channel congestion eventually gets broken, either to the upside or

downside, it will extend higher or lower by the size of the channel it broke out from. With that in mind, there is a lot at stake

depending on which way this market decides to “resolve itself.” For instance, a “breakout” above $84.00-$87.09 zone targets

numbers between $100-$110. A “breakdown” below the $69.50-$64.24 zone targets $55 to $41.

$87.09

$84.00

$69.50

$64.24

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Sugar Jan 1 2010Document9 pagesSugar Jan 1 2010AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- SP500 Update 30 Jan 11Document9 pagesSP500 Update 30 Jan 11AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- SP500 Update 24 Oct 09Document7 pagesSP500 Update 24 Oct 09AndysTechnicalsNo ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- Morning View 24 Feb 10Document4 pagesMorning View 24 Feb 10AndysTechnicalsNo ratings yet

- Copper Report 31 Jan 2010Document8 pagesCopper Report 31 Jan 2010AndysTechnicalsNo ratings yet

- Gold Report 16 May 2010Document11 pagesGold Report 16 May 2010AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Sugar Dec 11 2009Document6 pagesSugar Dec 11 2009AndysTechnicalsNo ratings yet

- NAVODAYA VIDYALAYA SAMITI HALF YEARLY EXAM MARKING SCHEMEDocument4 pagesNAVODAYA VIDYALAYA SAMITI HALF YEARLY EXAM MARKING SCHEMEAdil MasudNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Baidu (BIDU) Daily Linear ScaleDocument6 pagesBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Futures Junctures: PerspectiveDocument8 pagesFutures Junctures: PerspectiveBudi MulyonoNo ratings yet

- Engineering & Managerial Economics EHU 501Document3 pagesEngineering & Managerial Economics EHU 501sakshamNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Sharp Impulse Following - Counter-Trend Rally: (DJIA Hourly)Document6 pagesSharp Impulse Following - Counter-Trend Rally: (DJIA Hourly)Budi MulyonoNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- CSS Economics Last 10 Years Past Papers by BaltiDocument24 pagesCSS Economics Last 10 Years Past Papers by BaltiBalti100% (1)

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Aits 2223 PT II Jeea TD Paper 1 SolDocument17 pagesAits 2223 PT II Jeea TD Paper 1 SolTanman RajNo ratings yet

- Xii - Accountancy - Doc (M)Document4 pagesXii - Accountancy - Doc (M)Manav Ji Manav100% (1)

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- Submission Date: 26 May 2017: Figure Q1 (A) Shows The Operation of A Cruise Control System of A VehicleDocument3 pagesSubmission Date: 26 May 2017: Figure Q1 (A) Shows The Operation of A Cruise Control System of A VehicleDK White LionNo ratings yet

- Time Series Problem SetDocument3 pagesTime Series Problem Setibrahim b s kamaraNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Econ 2017 Spec Paper 1Document12 pagesEcon 2017 Spec Paper 1Ronaldo Taylor67% (3)

- Practice Questions and SolutionsDocument7 pagesPractice Questions and SolutionsLiy TehNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- 856 EconomicsDocument9 pages856 EconomicsAstle JudeNo ratings yet

- Lecture Notes - ECON 22358G - Chapter 10 - Part II - No AnswersDocument47 pagesLecture Notes - ECON 22358G - Chapter 10 - Part II - No AnswersnimugiritshaNo ratings yet

- Sunday Evening Views 21 March 10Document6 pagesSunday Evening Views 21 March 10AndysTechnicalsNo ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- BBA 3rd Semester Macroeconomics Exam Paper C-VDocument3 pagesBBA 3rd Semester Macroeconomics Exam Paper C-VDOARIENNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Maximum Marks: 80 Time Allowed: Three Hours: EconomicsDocument8 pagesMaximum Marks: 80 Time Allowed: Three Hours: EconomicsStephine BochuNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- B3 IefDocument2 pagesB3 IefadnanNo ratings yet

- Answer To MTP - Intermediate - Syl2016 - June2018 - Set 2: Paper 8-Cost AccountingDocument18 pagesAnswer To MTP - Intermediate - Syl2016 - June2018 - Set 2: Paper 8-Cost Accountingmurthy gNo ratings yet

- Revenu and Expenditure (In Million Rupees) of Four Companies P, Q, R and Sin 2015 Revenue ExpenditureDocument24 pagesRevenu and Expenditure (In Million Rupees) of Four Companies P, Q, R and Sin 2015 Revenue ExpenditureGingka HaganeNo ratings yet

- Dr. Ruchi GoyalDocument1 pageDr. Ruchi GoyalYashasvi SehgalNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Courses: English For Business Supporting Lecturer: Ivo Selvia Critical Journal ReviewDocument11 pagesCourses: English For Business Supporting Lecturer: Ivo Selvia Critical Journal ReviewAgnesdonasariNo ratings yet

- Checklist For Audit of CooperativeDocument6 pagesChecklist For Audit of CooperativeSachin Dwa100% (2)

- Aerfin LTD Quotation: To: Ship ToDocument1 pageAerfin LTD Quotation: To: Ship To9 MediaNo ratings yet

- FM PPT3Document73 pagesFM PPT3abdellaNo ratings yet

- E Banking of Sonali BankDocument37 pagesE Banking of Sonali Bankmd shadab zaman RahatNo ratings yet

- TB Chapter03 Analysis of Financial StatementsDocument68 pagesTB Chapter03 Analysis of Financial StatementsReymark BaldoNo ratings yet

- ST Paul Co Does Business in The United States andDocument1 pageST Paul Co Does Business in The United States andAmit PandeyNo ratings yet

- Maaden MSHEM Safety Documents 8Document143 pagesMaaden MSHEM Safety Documents 8ShadifNo ratings yet

- Tessitura Monti India-R-28032018Document7 pagesTessitura Monti India-R-28032018Pradeep AhireNo ratings yet

- Water Desalination 2018-12-04 Desalination Plants 48 Desalination Plants AccountDocument46 pagesWater Desalination 2018-12-04 Desalination Plants 48 Desalination Plants AccountYusop MDNo ratings yet

- PED Notified Body List 2020 (Casas Certificadoras)Document230 pagesPED Notified Body List 2020 (Casas Certificadoras)Judith PonceNo ratings yet

- Assignment #1 Submission ChecklistDocument4 pagesAssignment #1 Submission Checklistdeepak bansalNo ratings yet

- Bookmyshow 2Document11 pagesBookmyshow 2Monisha UrsNo ratings yet

- Evaluate Business Performance with Data and KPIsDocument2 pagesEvaluate Business Performance with Data and KPIsBer Mie33% (3)

- Measuring Consumer Preferences for Sales Promotion SchemesDocument13 pagesMeasuring Consumer Preferences for Sales Promotion Schemesthinckollam67% (3)

- Cost Volume ProfitDocument24 pagesCost Volume ProfitRomuell BanaresNo ratings yet

- Economics of Sea Transport and International TradeDocument256 pagesEconomics of Sea Transport and International TradeAntMNo ratings yet

- 90-Day Content CalendarDocument29 pages90-Day Content CalendarOsita TamNo ratings yet

- IBF Certification ProgramDocument3 pagesIBF Certification ProgramEmani RaghavendraNo ratings yet

- Key Result Areas in Food and Beverage OperationsDocument17 pagesKey Result Areas in Food and Beverage OperationsgeoffmaneNo ratings yet

- John Wood Swot AnalysisDocument1 pageJohn Wood Swot Analysisapi-541742485No ratings yet

- BFCI FINAL ENGAGEMENT PROPOSAL Silver FernDocument2 pagesBFCI FINAL ENGAGEMENT PROPOSAL Silver FernGeram ConcepcionNo ratings yet

- 2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDocument12 pages2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDoris Acheng0% (1)

- Invoice AndresDocument1 pageInvoice Andresapi-251514739No ratings yet

- Unit Test 4 Volkova DariaDocument3 pagesUnit Test 4 Volkova DariaVolkova DariaNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Tender DocumentsDocument83 pagesTender DocumentsSwati Rohan JadhavNo ratings yet

- VNT - Step 4 - 212032 - 34Document17 pagesVNT - Step 4 - 212032 - 34Erik Johan Victoria BenjumeaNo ratings yet

- Iwokazpy Fo - QR Forj.K Fuxe Fyfevsm: Purvanchal Vidyut Vitaran Nigam LTDDocument2 pagesIwokazpy Fo - QR Forj.K Fuxe Fyfevsm: Purvanchal Vidyut Vitaran Nigam LTDAvinash palNo ratings yet

- Ijrpr2769 Rural Customer Perception Towards Banking ServiceDocument6 pagesIjrpr2769 Rural Customer Perception Towards Banking ServiceraisehellNo ratings yet