Professional Documents

Culture Documents

Housing Market Update

Uploaded by

M-NCPPCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Housing Market Update

Uploaded by

M-NCPPCCopyright:

Available Formats

Research & Technology Center

Montgomery County Planning Department

Housing Market Update

Montgomery County, Maryland

Sharon Suarez, AICP

Housing Coordinator

September 25, 2007

HOUSING MARKET UPDATE Montgomery County, Maryland September 25, 2007

Ove rview

The Research & Technology Center of the Montgomery County Planning Department monitors,

analyzes and publishes reports on a variety of housing market trends and statistics. This information

is used widely to:

develop forecasts of future jobs, population and housing growth;

shape County policies on affordable housing, growth, transportation and land use planning;

assess the health of the local housing and construction sectors and of the County’s economy

in general;

prepare County revenue estimates; and

respond to a wide range of data requests from County leaders, staff and the general public.

Recent instability in the nation’s housing market has intensified interest in the condition of

Montgomery County’s housing market. In response, the Research & Technology Center presents this

Housing Market Update report, giving decision-makers and residents timely access to key housing

market indicators, including:

Time on the Market

Median Home Sales Prices

Home Sales Volume

Household Income

Emerging Housing Market Trends

Additional housing market information is available in the following Research & Technology Center

reports and in our online data centers, available at www.mcfacts.org.

Economic Forces that Shape Montgomery County

Senior Housing Report

Montgomery County At-A-Glance

MD355/I-270 Technology Corridor Report

Research & Technology Center 1 Montgomery County Planning Department

HOUSING MARKET UPDATE Montgomery County, Maryland September 25, 2007

T ime on t he M arke t

Summer months typically provide the shortest times on the market.

The average number of days that homes are staying on the market continues to shorten from last

winter’s peak of 96 days to 68 days in July. This was just 9 days longer than the 59-day average in

July of 2006.

Time on the market averaged 25 days in July of 2004 and 2005, and 22 days in July of 2003.

M-NCPPC Research & Technology Center

Time-on-the-market

peaked in February 2007.

Montgomery County Fairfax County Loudoun County

Days on the market

150

140

130

120

110

100

90

80

70

60

50

40

30

20

10

0

January-03 July-03 January-04 July-04 January-05 July-05 January-06 July-06 January-07 July-07

Source: MRIS

Research & Technology Center 2 Montgomery County Planning Department

HOUSING MARKET UPDATE Montgomery County, Maryland September 25, 2007

M e dian S ale s Price s

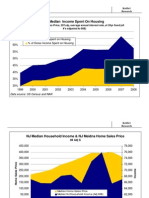

The median sales price of a new single-family detached home jumped sharply in the first quarter of

2007, topping $1.1 million for the first time. The median sales price for all types of housing in

Montgomery County’s increased 8 percent overall in July while home prices were flat for the rest of

the Washington, D.C. metro region. At $490,000, Montgomery County’s median sales price was the

region’s highest. (Washington Business Journal, August 10, 2007)

During the first quarter of 2007, prices for existing townhomes increased slightly. Over the same

period, prices for existing single-family detached homes and new townhomes decreased slightly from

their all-time highs in 2006, but remained well above historic levels.

Median Home Sales Price

Unit Type 2002 2003 2004 2005 2006 2007 (1Q)

Single-Family Detached (New) $475,700 $563,810 $666,540 $775,218 $881,600 $1,133,029

Single-Family Detached (Existing) $320,000 $376,000 $450,000 $530,000 $552,500 $540,000

Townhouse (New) $265,135 $358,553 $427,501 $499,375 $518,510 $505,462

Townhouse (Existing) $177,900 $223,000 $283,500 $340,000 $350,000 $364,000

Source: M-NCPPC, Research & Technology Center, STAR Report

M-NCPPC Research & Technology Center

Median price of a new single-family

detached home tops $1.1 million.

$1,250,000

$1,133,029

New Single-

$1,000,000

Family

$881,600

Detached

$775,218

$750,000 Existing

$666,540 Single-Family

Detached

$500,000 New

Townhouse

$250,000

Existing

Townhouse

$0

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

(1Q)

Source: STAR

Research & Technology Center 3 Montgomery County Planning Department

HOUSING MARKET UPDATE Montgomery County, Maryland September 25, 2007

S ale s Volume (F irst Quarter)

First quarter 2007 home sales volumes were below levels from the same period in previous years.

Most in demand in first quarter 2007 were used single-family detached units, followed by used

condominiums and used single-family attached units.

According to the Office of Federal Housing Enterprise Oversight (OFHEO), home price appreciation in

the Washington, D.C. region is ahead of the national average. Maryland posted the strongest gain in

the region. (Washington Business Journal, May 31, 2007)

First Quarter Sales Volume

Unit Type 2002 2003 2004 2005 2006 2007

Single-Family Detached (New) 408 195 225 182 195 98

Single-Family Detached (Existing) 1,909 1,563 2,121 1,967 1,562 1,553

Single-Family Attached (New) 301 300 176 132 113 53

Single-Family Attached (Existing) 1,332 1,142 1,491 1,527 1,016 834

Condominium (New) 92 44 916 156 38 200

Condominium (Existing) 1,005 1,034 2,250 1,872 987 911

Source: M-NCPPC, Research & Technology Center, STAR Report

Note: Median prices are based on market priced housing and exclude bulk transfers of property, transfers made among relatives,

and transfers made without transactions.

Research & Technology Center 4 Montgomery County Planning Department

HOUSING MARKET UPDATE Montgomery County, Maryland September 25, 2007

House hold Income

Census figures released last week show that, compared with other affluent major metropolitan areas,

the Washington metro area “ranks first in median income among blacks and non-Hispanic whites,

and the regions’ Hispanics and Asians rank second. (Washington Post, September 2, 2007)

A Tre nd To Wa tch Close ly :

Rapid depletion of affordable rental stock as investors snap up old & new multifamily properties.

The condo market is cooler now than it was a couple of years ago, and there is demand for

apartment buildings. Alexandria-based Delta Associates has reported that investors “spent $1.6

billion on Class A and B apartments in the metro area during the first half” of 2007, compared to

about $890 million a year ago. This uptick is significant and heralds a real investment demand for our

multifamily properties. (Washington Business Journal, July 16, 2007)

Apartment buildings are selling as fast as condo units were in 2005. According to Delta Associates, it

is now the “deep pocketed equity funds and investment banks that are lined up to buy them…(and

this has) prompted new and existing (multi-family) property owners to pound in ‘for sale’ signs as

they look to cash out and get top dollar for properties.” (Washington Business Journal, July 16,

2007)

Research & Technology Center 5 Montgomery County Planning Department

You might also like

- Issues of Housing Affordability in Montgomery County, MD: Slide 1Document87 pagesIssues of Housing Affordability in Montgomery County, MD: Slide 1M-NCPPCNo ratings yet

- Issues of Housing Affordability in Montgomery County, MDDocument120 pagesIssues of Housing Affordability in Montgomery County, MDM-NCPPCNo ratings yet

- NJ Home Sales DataDocument3 pagesNJ Home Sales Datakettle1No ratings yet

- NJ ReDocument2 pagesNJ Rekettle1No ratings yet

- Reiv June Quarter 23Document81 pagesReiv June Quarter 23Gloria ZhuNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Relocity Rental Price Trends February 2023 Report-SeattleDocument6 pagesRelocity Rental Price Trends February 2023 Report-SeattleSandeep KulkarniNo ratings yet

- Newhome 8-23-11Document1 pageNewhome 8-23-11Jessica Kister-LombardoNo ratings yet

- SanLeandro MarketDataDocument1 pageSanLeandro MarketDatacaudetNo ratings yet

- Median Sales Price (2006) : Montgomery County and Planning AreasDocument1 pageMedian Sales Price (2006) : Montgomery County and Planning AreasM-NCPPCNo ratings yet

- Contributions (Money Received)Document3 pagesContributions (Money Received)Zach EdwardsNo ratings yet

- 5-REO Schedule - XLT PDL - XLT 2019Document10 pages5-REO Schedule - XLT PDL - XLT 2019Reginald MettsNo ratings yet

- Summit-04-05-06-07-08-09 Full Year Dec.Document1 pageSummit-04-05-06-07-08-09 Full Year Dec.Breckenridge Grand Real EstateNo ratings yet

- 207 Morning Glory DR: Monroe Township, NJ 08831Document12 pages207 Morning Glory DR: Monroe Township, NJ 08831kohatian27796105No ratings yet

- 2020 May Buyer Preso RevisedDocument37 pages2020 May Buyer Preso RevisedKaty EatmonNo ratings yet

- Northstar Pr#4D1817Document8 pagesNorthstar Pr#4D1817karri410No ratings yet

- New Home Sales July 2011Document1 pageNew Home Sales July 2011Jessica Kister-LombardoNo ratings yet

- Prime BrokerageDocument28 pagesPrime BrokeragePrat Don100% (1)

- Quarterly Review: The Housing Boom: 2002-2005Document4 pagesQuarterly Review: The Housing Boom: 2002-2005Nicholas FrenchNo ratings yet

- Kelompok 2 ADDB - Assigment Week 1Document7 pagesKelompok 2 ADDB - Assigment Week 1Putri Ayuningtyas KusumawatiNo ratings yet

- US-Israel High Technology Forum: Anita M. AntenucciDocument10 pagesUS-Israel High Technology Forum: Anita M. AntenucciRahul SaikiaNo ratings yet

- McGraw HillInvestorFactBook - pg26 27 PDFDocument2 pagesMcGraw HillInvestorFactBook - pg26 27 PDFBabu Kr AnkitNo ratings yet

- Cost Breakdown Oct. 09 PDFDocument1 pageCost Breakdown Oct. 09 PDFBreckenridge Grand Real EstateNo ratings yet

- OM - Town Center Oaks - Kennesaw GA - c12804ff8589Document29 pagesOM - Town Center Oaks - Kennesaw GA - c12804ff8589Mazher Ahmed KhanNo ratings yet

- The Luxury Home Market A Quick Look September 2009 Single Family Detached Sales by Fletcher Wilcox V.P. Grand Canyon Title Agency, Inc. 602-648-1230Document9 pagesThe Luxury Home Market A Quick Look September 2009 Single Family Detached Sales by Fletcher Wilcox V.P. Grand Canyon Title Agency, Inc. 602-648-1230api-26125802No ratings yet

- TrendsDocument1 pageTrendsShmiddtyNo ratings yet

- Atlantic Bundle - Group3Document7 pagesAtlantic Bundle - Group3Bikasita TalukdarNo ratings yet

- Housing Equity: Its Impact On Household Net Worth in The US and Nashville Davidson Murfreesboro, TNDocument7 pagesHousing Equity: Its Impact On Household Net Worth in The US and Nashville Davidson Murfreesboro, TNapi-26011493No ratings yet

- Market MetricsDocument3 pagesMarket MetricsMichael KozlowskiNo ratings yet

- Laurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Document6 pagesLaurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Laurensius Adrian Wahyu SetiajiNo ratings yet

- Mobile Single-Family Real Estate: Mobile Market Still Holding Its OwnDocument2 pagesMobile Single-Family Real Estate: Mobile Market Still Holding Its Ownapi-27090225No ratings yet

- Listings Sold by Calendar QuarterDocument9 pagesListings Sold by Calendar Quarterapi-27643796No ratings yet

- Resort Real Estate Index First Quarter 2010Document4 pagesResort Real Estate Index First Quarter 2010Breckenridge Grand Real EstateNo ratings yet

- News Release: March Home Sales Surpass The 700 ThresholdDocument3 pagesNews Release: March Home Sales Surpass The 700 Thresholdapi-26128440No ratings yet

- Google PresentationDocument22 pagesGoogle Presentationcia100% (10)

- Median Sales Price (2005) : Montgomery County and Planning AreasDocument2 pagesMedian Sales Price (2005) : Montgomery County and Planning AreasM-NCPPCNo ratings yet

- Chairmans CornerDocument3 pagesChairmans Cornerjstamp02No ratings yet

- Redacted 2019 Financial ReportDocument7 pagesRedacted 2019 Financial ReportDepDepFinancial100% (3)

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- January 2010 Summit County Real Estate StatsDocument7 pagesJanuary 2010 Summit County Real Estate StatsBreckenridge Grand Real EstateNo ratings yet

- Financial Model Template: Company X 31-Mar NZ$Document6 pagesFinancial Model Template: Company X 31-Mar NZ$Bobby ChristiantoNo ratings yet

- IC Marketing KPI Dashboard 11183Document6 pagesIC Marketing KPI Dashboard 11183Ahmad FuadNo ratings yet

- The Real Estate Report Winter 2011Document4 pagesThe Real Estate Report Winter 2011Chad LariscyNo ratings yet

- Montgomery County's Median Sales Price For Single and Multifamily, New and Used Homes, Was $355,000 in October, The Same Level As 2004Document1 pageMontgomery County's Median Sales Price For Single and Multifamily, New and Used Homes, Was $355,000 in October, The Same Level As 2004M-NCPPCNo ratings yet

- Full Solution Manual For Essentials of Business Statistics 2Nd by Jaggia PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Essentials of Business Statistics 2Nd by Jaggia PDF Docx Full Chapter Chapterbethgreennixk57100% (13)

- The North American Free Trade AgreementDocument21 pagesThe North American Free Trade AgreementajinnkNo ratings yet

- UntitledDocument4 pagesUntitledRima WahyuNo ratings yet

- Repair QuoteDocument1 pageRepair Quoteapi-26702852No ratings yet

- Housing Equity: Its Impact On Household Net Worth in The US and Anaheim Santa Ana, CADocument7 pagesHousing Equity: Its Impact On Household Net Worth in The US and Anaheim Santa Ana, CAdbeisnerNo ratings yet

- Cheyenne Wyoming: This Is Confidential Information and Cannot Be Used by Outside PartiesDocument21 pagesCheyenne Wyoming: This Is Confidential Information and Cannot Be Used by Outside Partieskkopp9853No ratings yet

- Fraser Valley Nov 08Document13 pagesFraser Valley Nov 08HudsonHomeTeamNo ratings yet

- Report 5e0631ed0Document1 pageReport 5e0631ed0Teresa Dallman KeenanNo ratings yet

- Kansas Farm Family Living ReportDocument3 pagesKansas Farm Family Living ReportKeri StrahlerNo ratings yet

- Series UniformesDocument5 pagesSeries UniformesPAULA ANDREA OCAMPO ARENASNo ratings yet

- Monterey Market ReportDocument6 pagesMonterey Market ReportNicole TruszkowskiNo ratings yet

- 22 Year Residential AVG Summit CombinedDocument2 pages22 Year Residential AVG Summit CombinedBreckenridge Grand Real EstateNo ratings yet

- Obama Tax Plan: NevadaDocument2 pagesObama Tax Plan: NevadaThe Heritage FoundationNo ratings yet

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- Ceramic Wall & Floor Tiles World Summary: Market Values & Financials by CountryFrom EverandCeramic Wall & Floor Tiles World Summary: Market Values & Financials by CountryNo ratings yet

- Obama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsFrom EverandObama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsNo ratings yet

- HPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumDocument2 pagesHPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumM-NCPPCNo ratings yet

- HPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumDocument2 pagesHPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumM-NCPPCNo ratings yet

- Label - Name Type Ftype - Name From - TO - Mplan RW MP - ClassDocument2 pagesLabel - Name Type Ftype - Name From - TO - Mplan RW MP - ClassM-NCPPCNo ratings yet

- HPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumDocument2 pagesHPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumM-NCPPCNo ratings yet

- HPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumDocument4 pagesHPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumM-NCPPCNo ratings yet

- Development Review Committee Monday, October 3, 2016 9:30 A.MDocument1 pageDevelopment Review Committee Monday, October 3, 2016 9:30 A.MM-NCPPCNo ratings yet

- UntitledDocument62 pagesUntitledM-NCPPCNo ratings yet

- T I A C P & GDocument28 pagesT I A C P & GM-NCPPCNo ratings yet

- About ZTA 16-03: BACKGROUND: Planning Board RecommendationDocument1 pageAbout ZTA 16-03: BACKGROUND: Planning Board RecommendationM-NCPPCNo ratings yet

- UntitledDocument15 pagesUntitledM-NCPPCNo ratings yet

- Orange: YellowDocument10 pagesOrange: YellowM-NCPPCNo ratings yet

- Planning Board Draft September 14, 2016Document36 pagesPlanning Board Draft September 14, 2016M-NCPPCNo ratings yet

- UntitledDocument36 pagesUntitledM-NCPPCNo ratings yet

- UntitledDocument32 pagesUntitledM-NCPPCNo ratings yet

- Agenda: White Flint Sector Plan Implementation Advisory CommitteeDocument1 pageAgenda: White Flint Sector Plan Implementation Advisory CommitteeM-NCPPCNo ratings yet

- UntitledDocument9 pagesUntitledM-NCPPCNo ratings yet

- Revised 11/23/2009 Montgomery County Historic Preservation Commission 301-563-3400 Wednesday DecemberDocument1 pageRevised 11/23/2009 Montgomery County Historic Preservation Commission 301-563-3400 Wednesday DecemberM-NCPPCNo ratings yet

- HPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumDocument4 pagesHPC WORKSESSION - 7:00 P.M. in Third Floor Conference Room HPC MEETING - 7:30 P.M. in MRO AuditoriumM-NCPPCNo ratings yet

- Transportation: Appendix EDocument63 pagesTransportation: Appendix EM-NCPPCNo ratings yet

- Distinct Topics:: 1 - Preliminary Program of Requirements - NotesDocument6 pagesDistinct Topics:: 1 - Preliminary Program of Requirements - NotesM-NCPPCNo ratings yet

- Orange: YellowDocument10 pagesOrange: YellowM-NCPPCNo ratings yet

- 2016 Subdivision Staging Policy: Planning Board Recommendation SummaryDocument33 pages2016 Subdivision Staging Policy: Planning Board Recommendation SummaryM-NCPPCNo ratings yet

- UntitledDocument2 pagesUntitledM-NCPPCNo ratings yet

- Environment: Appendix FDocument41 pagesEnvironment: Appendix FM-NCPPCNo ratings yet

- UntitledDocument5 pagesUntitledM-NCPPCNo ratings yet

- Bethesda: Downtown PlanDocument65 pagesBethesda: Downtown PlanM-NCPPCNo ratings yet

- UntitledDocument78 pagesUntitledM-NCPPCNo ratings yet

- Retail Planning Study: Appendix DDocument241 pagesRetail Planning Study: Appendix DM-NCPPCNo ratings yet

- Appendix G:: ParksDocument15 pagesAppendix G:: ParksM-NCPPCNo ratings yet

- UntitledDocument28 pagesUntitledM-NCPPCNo ratings yet

- Activity No. 2 Credit Analysis LiquidityDocument2 pagesActivity No. 2 Credit Analysis LiquidityStephanie Gaile Bermudez0% (1)

- Cameo Sports Agencies Pvt. LTDDocument4 pagesCameo Sports Agencies Pvt. LTDBhupender TakshakNo ratings yet

- Annual Barangay Youth Investment Program Monitoring FormDocument3 pagesAnnual Barangay Youth Investment Program Monitoring FormJaimeh AnnabelleNo ratings yet

- AE12 Module 1 Economic Development A Global PerspectiveDocument3 pagesAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangNo ratings yet

- Accounting TermsDocument5 pagesAccounting TermsShanti GunaNo ratings yet

- Income Tax Payment Challan: PSID #: 139758233Document1 pageIncome Tax Payment Challan: PSID #: 139758233umaar99No ratings yet

- Noise Flair BillDocument2 pagesNoise Flair BillShrinivethika BalasubramanianNo ratings yet

- Comparative Study of Investment Vs RISK SYNDocument12 pagesComparative Study of Investment Vs RISK SYNAnonymous F6fyRYGOqGNo ratings yet

- Question 1 of 15Document8 pagesQuestion 1 of 15mohamed goudaNo ratings yet

- 2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A RecessionDocument1 page2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A Recessionpan0No ratings yet

- Quizzer 1 - Pas 8 and Cash/accrual, Single EntryDocument10 pagesQuizzer 1 - Pas 8 and Cash/accrual, Single Entryjaleummein100% (1)

- Department of Labor: NJAC12 55 1 2 2 4Document6 pagesDepartment of Labor: NJAC12 55 1 2 2 4USA_DepartmentOfLaborNo ratings yet

- Development AdministrationDocument3 pagesDevelopment AdministrationJean Aspiras WongNo ratings yet

- Robbins mgmt14 PPT 18bDocument19 pagesRobbins mgmt14 PPT 18bAmjad J AliNo ratings yet

- Summer Internship Report: Submitted byDocument53 pagesSummer Internship Report: Submitted byruchi mishraNo ratings yet

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Document19 pagesA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooNo ratings yet

- INFOSYSDocument9 pagesINFOSYSSai VasudevanNo ratings yet

- Dr. Reddy CaseDocument1 pageDr. Reddy Caseyogesh jangaliNo ratings yet

- Universiti Teknologi Mara Final Examination: CourseDocument7 pagesUniversiti Teknologi Mara Final Examination: Coursemuhammad ali imranNo ratings yet

- How To Turn Your HR StrategyDocument99 pagesHow To Turn Your HR StrategyKhinphone OoNo ratings yet

- China Water Purifier Production: 4.2.2 by SegmentDocument3 pagesChina Water Purifier Production: 4.2.2 by SegmentWendell MerrillNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Assignement - Case Study - Fortis & ABN AMRODocument3 pagesAssignement - Case Study - Fortis & ABN AMROMuhammad Imran Bhatti86% (7)

- Turkey DataDocument499 pagesTurkey DataisaNo ratings yet

- International Business: by Charles W.L. HillDocument31 pagesInternational Business: by Charles W.L. HillFahad KhanNo ratings yet

- A True Indicator of The Success of A BusinessDocument4 pagesA True Indicator of The Success of A BusinessNguyen Ngoc Yen VyNo ratings yet

- Maybank Market Strategy For InvestmentsDocument9 pagesMaybank Market Strategy For InvestmentsjasbonNo ratings yet

- Capacity Development AgendaDocument7 pagesCapacity Development AgendaApple PoyeeNo ratings yet

- Tom Brass Unfree Labour As Primitive AcumulationDocument16 pagesTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNo ratings yet

- Chapter OneDocument13 pagesChapter OneSofonias MenberuNo ratings yet