Professional Documents

Culture Documents

4 Year Money Back

Uploaded by

Harish ChandCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Year Money Back

Uploaded by

Harish ChandCopyright:

Available Formats

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

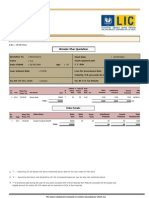

New Bima Gold (Plan - 179)

Insurance Proposal for : Mr. Akhilesh

Risk Cover Annual Returns

Year Age Normal Accidental Premium from L.I.C.

2010 30 300000 600000 19128 0

2011 31 300000 600000 19128 0

2012 32 300000 600000 19128 0

2013 33 300000 600000 19128 0

2014 34 300000 600000 19128 45000

After a thumping success of the 2015 35 300000 600000 19128 0

Bima Gold Plan, L.I.C. now

2016 36 300000 600000 19128 0

introduces its enhanced version

2017 37 300000 600000 19128 0

in a new Avtaar -

2018 38 300000 600000 19128 45000

2019 39 300000 600000 19128 0

New Bima Gold 2020 40 300000 600000 19128 0

A money back plan with flexible 2021 41 300000 600000 19128 0

premium payment options and 2022 42 150000 150000 0 189936

extended life cover. 2023 43 150000 150000 0 0

2024 44 150000 150000 0 0

Your benefits at-a-glance* 2025 45 150000 150000 0 0

2026 46 150000 150000 0 0

Premiums: Your premiums

2027 47 150000 150000 0 0

(excluding rider premiums if any)

are paid back to you during the 229536 279936

policy term in installments.

Loyalty Addition: In addition to the v Loyalty Addition: The maturity amount shown in the year 2022 includes a

return of premiums you will also loyalty addition of Rs. 54000. Please note that this is an estimation only and

receive loyalty addition (depending the actual loyalty amount will be depend upon the experience of L.I.C.

upon the experience of L.I.C.) at

the end of the policy term. v Tax Saving: You will save a tax of Rs. 5761 per annum @30.6% under Sec. 80

CCE by payment of annual premium.

Risk Cover: Despite the return of

premiums in installments there is a v Yield: The yield on this policy works out to 4.74% without considering the tax

full insurance cover to the tune of savings and 13.27 % after consideration of tax savings.

the sum assured in the policy.

Extended Cover: You also enjoy a

free risk cover of 50% of the sum

assured for half the extra term

beyond your policy term.

Auto-Cover: Keep the policy inforce

even if the premiums are not paid

for upto 2 years.

Choice of Terms: New Bima Gold

offers 3 term options to suit your

requirements. You can choose from

12, 16 and 20 year terms.

Loan Available: You can avail of

loan in this policy after the policy

acquires paid-up value.

Riders: Accident Rider is available

at a very nominal rate of Re.1 per

1000 sum assured.

* - Conditions Apply

You might also like

- New Bima GoldDocument1 pageNew Bima GoldHarish ChandNo ratings yet

- Mixing - 30-1-2021 0.49.22Document7 pagesMixing - 30-1-2021 0.49.22..No ratings yet

- LIC's Jeevan Saral Plan Presentation HighlightsDocument3 pagesLIC's Jeevan Saral Plan Presentation HighlightsRohit Kumar DasNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- Report Mr. XXXXX - 917 25 1 Age 1 SA 50000Document5 pagesReport Mr. XXXXX - 917 25 1 Age 1 SA 50000gyanugautam575No ratings yet

- Jeevan Saral Plan Presentation: Harish ChandDocument3 pagesJeevan Saral Plan Presentation: Harish ChandHarish ChandNo ratings yet

- Pooja & Pooja Team Profit-and-Loss-StatementDocument5 pagesPooja & Pooja Team Profit-and-Loss-StatementPOOJA SUNKINo ratings yet

- GM - DhanSanchay - 21-7-2022 3.51.32Document4 pagesGM - DhanSanchay - 21-7-2022 3.51.32GRV KakashiNo ratings yet

- Mixing - 30-1-2021 0.47.0Document8 pagesMixing - 30-1-2021 0.47.0..No ratings yet

- Harish Chand: Magic Yield PresentationDocument6 pagesHarish Chand: Magic Yield PresentationHarish ChandNo ratings yet

- Business Plan of Event Management: Submitted To: Miss Gurpreet KaurDocument21 pagesBusiness Plan of Event Management: Submitted To: Miss Gurpreet KaurPrashantNo ratings yet

- Session 8 - Final Accounts - Practice ProblemsDocument16 pagesSession 8 - Final Accounts - Practice ProblemsanandakumarNo ratings yet

- Mr. Kumar Gaurav: Insurance Proposal ForDocument6 pagesMr. Kumar Gaurav: Insurance Proposal ForHarish ChandNo ratings yet

- Sales-Brochure 108Document4 pagesSales-Brochure 108nirmal kumarNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Jeevan Saral Plan Presentation: R. SubramaniDocument3 pagesJeevan Saral Plan Presentation: R. SubramaniSiva GNo ratings yet

- Customer - DhanRekha - 13-7-2022 5.20.56Document6 pagesCustomer - DhanRekha - 13-7-2022 5.20.56Iswarya SelvarajNo ratings yet

- Marketing Plan For Easy MaintenanceDocument21 pagesMarketing Plan For Easy MaintenancefarazNo ratings yet

- MGT 368 Draft 2Document10 pagesMGT 368 Draft 2Md. Shakil Ahmed 1620890630No ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- LIC New Bhima KiranDocument3 pagesLIC New Bhima Kiranvirgoshee12No ratings yet

- My Maruti My IndusDocument2 pagesMy Maruti My IndusAbhijith uNo ratings yet

- Single Premium Endowment Plan Licindiagov - inDocument5 pagesSingle Premium Endowment Plan Licindiagov - inSampiNo ratings yet

- Loan From 3 Year Onwards: Are NTH Avi NG Rou ND Two Yea RsDocument1 pageLoan From 3 Year Onwards: Are NTH Avi NG Rou ND Two Yea RstsrajanNo ratings yet

- Capital Budgeting Reliance StudentDocument14 pagesCapital Budgeting Reliance StudentAnju VijayNo ratings yet

- Insurance savings quote for Vijay JonnalagaddaDocument1 pageInsurance savings quote for Vijay JonnalagaddaninthsevenNo ratings yet

- 936-Jeevan Labh Policy SummaryDocument6 pages936-Jeevan Labh Policy Summary09789993119No ratings yet

- Mr. Mariyappan: 945 - LIC's Jeevan UmangDocument9 pagesMr. Mariyappan: 945 - LIC's Jeevan UmangPranav SNo ratings yet

- UntitledDocument2 pagesUntitledAmeet ChandanNo ratings yet

- Report Mr. V 934 23 18 Age 2 SA 1000000Document5 pagesReport Mr. V 934 23 18 Age 2 SA 1000000basavarajbalagod8No ratings yet

- New Bima GoldDocument1 pageNew Bima GoldHarish ChandNo ratings yet

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Calculate bond amortization and journal entriesDocument9 pagesCalculate bond amortization and journal entriesClaudine LobrigasNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Jeevan Saral Plan Presentation: Harish ChandDocument3 pagesJeevan Saral Plan Presentation: Harish ChandHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- InternshipDocument4 pagesInternshipKushal KhagtaNo ratings yet

- 1663274292-Tax Cals-1Document1 page1663274292-Tax Cals-1Kriti GandhiNo ratings yet

- BenefitIllustration-1679808210447 230326 105345Document1 pageBenefitIllustration-1679808210447 230326 105345Ameet ChandanNo ratings yet

- Mr. Sanjay: Insurance Proposal ForDocument6 pagesMr. Sanjay: Insurance Proposal Forrajkamal eshwarNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Providing Children Quality Education and Helping Them Choosing A Better FutureDocument4 pagesProviding Children Quality Education and Helping Them Choosing A Better FutureShubhamSoodNo ratings yet

- Budgeted Income Statement AnalysisDocument3 pagesBudgeted Income Statement AnalysisAhmad Hafez100% (1)

- 5 3Document6 pages5 3Evelyn MorilloNo ratings yet

- LAB 4 Capital Budgeting 2024Document3 pagesLAB 4 Capital Budgeting 2024asthapatel.akpNo ratings yet

- Shivang 10Document2 pagesShivang 10Ameet ChandanNo ratings yet

- Skill V/s Salary Matrix Skill Salary Skill V/s Salary Matrix Skill SalaryDocument7 pagesSkill V/s Salary Matrix Skill Salary Skill V/s Salary Matrix Skill SalaryVaibhav kNo ratings yet

- Estimated Warranties and ProvisionsDocument2 pagesEstimated Warranties and ProvisionsDianaNo ratings yet

- This Is The Official Illustration Issued by HDFC Life Insurance Company Limited. Illustration of Any Other Type Is Not Supported by The CompanyDocument2 pagesThis Is The Official Illustration Issued by HDFC Life Insurance Company Limited. Illustration of Any Other Type Is Not Supported by The CompanyMANISH RATNANo ratings yet

- AFAR 1.4 - Installment SalesDocument7 pagesAFAR 1.4 - Installment SalesKile Rien MonsadaNo ratings yet

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- Birdie Golf-Hybrid Golf Merger AnalysisDocument8 pagesBirdie Golf-Hybrid Golf Merger AnalysisSiska Kurniawan0% (1)

- Sample+Profit+and+Loss+Statement +PDFDocument1 pageSample+Profit+and+Loss+Statement +PDFpdudhaneNo ratings yet

- ROI CALCULATION - MBA MKT 1 - Shivam JadhavDocument4 pagesROI CALCULATION - MBA MKT 1 - Shivam JadhavShivam JadhavNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Sujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsDocument6 pagesSujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsKilli ValavanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Jeevan AkshayDocument1 pageJeevan AkshayHarish ChandNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- Agency Presentation - ZTCDocument24 pagesAgency Presentation - ZTCHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Mr. Gupta: Insurance Proposal ForDocument8 pagesMr. Gupta: Insurance Proposal ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Rad 20356Document1 pageRad 20356Harish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 211 D0Document1 pageRad 211 D0Harish ChandNo ratings yet

- Premiums Due Statement: Harish ChandDocument1 pagePremiums Due Statement: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Rad 1 FDF9Document2 pagesRad 1 FDF9Harish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Harish Chand: Multi - Plan ChartDocument4 pagesHarish Chand: Multi - Plan ChartHarish ChandNo ratings yet

- Jeevan Saral IllustrationDocument3 pagesJeevan Saral IllustrationHarish ChandNo ratings yet