Professional Documents

Culture Documents

Cash Flow Presentation

Uploaded by

Ankit Tyagi0 ratings0% found this document useful (0 votes)

26 views2 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views2 pagesCash Flow Presentation

Uploaded by

Ankit TyagiCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

You are on page 1of 2

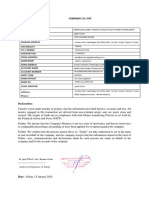

Cash Flow Statement for the year ended 31st March, 2009

Year Ended Year Ended

31-03-2009

31-03-2008

Rupees crores

Rupees crores

A. Cash Flow from Operating Activities :

Net Profit before tax 7,315.61

7,066.36

Adjustments for :

Depreciation 973.40 834.61

(Profit)/Loss on sale of Assets/Discarded Assets written off 6.43 (28.26)

(Profit)/Loss on sale of other investments (186.46) (0.03)

Impairment of Assets – 0.06

(Gain)/Loss on cancellation of forward covers/options (26.62) (124.30)

Provision for diminution in value of investments 0.10 –

Interest and income from current investment (336.81) (142.53)

Income from other investments (101.62) (88.42)

Interest charged to Profit and Loss Account 1,489.50 929.03

Amortisation of employee separation compensation 222.34 226.18

Provision for Wealth Tax 1.00 0.95

Contribution for sports infrastructure written off – 150.00

Exchange (Gain)/Loss on revaluation of foreign

currency loans 67.91 (743.60)

Amortisation of long term loan expenses 32.71 57.99

2,141.88

1,071.68

Operating Profit before Working Capital Changes 9,457.49

8,138.04

Adjustments for :

Trade and Other Receivables (159.25) (143.44)

Inventories (875.49) (272.00)

Trade Payable and Other Liabilities 1,772.03 591.80

737.29

176.36

Cash Generated from Operations 10,194.78

8,314.40

Direct Taxes paid (2,797.56)

(2,060.20)

Net Cash from Operating Activities 7,397.22

6,254.20

B. Cash Flow from Investing Activities :

Purchase of fixed assets (2,786.29) (2,458.97)

Sale of fixed assets 15.18 63.88

Purchase of investments (59,903.25) 31,605.12)

Purchase of investments in Subsidiaries (4,439.80) (29,587.40)

Sale of investments 57,181.61 34,110.46

Inter-corporate deposits 90.73 85.80)

Interest and income from current investments received 312.12 155.95

Dividend received 101.62 88.42

Net Cash used in Investing Activities (9,428.08)

29,318.58)

C. Cash Flow from Financing Activities :

Issue of Equity Capital 0.25 4,881.45

Issue of Cumulative Convertible Preference Shares 0.14 5,472.52

Proceeds from borrowings 6,494.43 17,632.70

Repayment of borrowings (894.39) (10,386.61)

Amount received on cancellation of forward covers/options (10.17) 134.41

Long term loan expenses (32.51) (202.38)

Interest paid (1,213.96) (746.07)

Dividends paid (1,187.37) (937.95)

Net Cash from Financing Activities 3,156.42

15,848.07

Net increase/(decrease) in Cash or Cash equivalents (A+B+C) 1,125.56

(7,216.31)

Opening Cash and Cash equivalents 465.04

(iv) 7,681.35

Closing Cash and Cash equivalents (v) 1,590.60

(v) 465.04

Notes : (i) Figures in brackets represent outflows.

(ii) Interest paid is exclusive of and purchase of fi xed assets is inclusive of interest capitalised Rs. 29.11 crores

(31.03.2008 : Rs. 12.24 crores).

(iii) Investment in subsidiaries represents the portion of purchase consideration discharged in cash during the period and

includes application money on investments Rs. 4,439.80 crores (31.03.2008 : Rs. 29,587.40 crores).

(iv) Includes Rs. 7,225.94 crores ringfenced for a specifi c purpose.

(v) Includes Rs. 0.24 crores (31.03.2008 : Rs. 5.65 crores) refund orders issued on account of over subscription of Rights

Issue of Equity Shares not encashed as on 31st March, 2009.

(vi) Previous year fi gures have been recast/restated wherever necessary.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CIS-KYC-Only-Sierra-Group - PDF 10012024Document2 pagesCIS-KYC-Only-Sierra-Group - PDF 10012024Filipe Emanuel MangueNo ratings yet

- BCM-ETH Controller: BAC P I C SDocument6 pagesBCM-ETH Controller: BAC P I C SMeezan BatchaNo ratings yet

- Service Rutin Genset September 2020Document10 pagesService Rutin Genset September 2020Wahyu Alfa OmegaNo ratings yet

- ZONE 12 - Super Markets & GroceryDocument1 pageZONE 12 - Super Markets & GroceryDeepak Saravanan100% (1)

- IAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RDocument5 pagesIAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RSOURAV CHATTERJEE100% (2)

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- Case Analysis - 1Document3 pagesCase Analysis - 1Tanjeela RahmanNo ratings yet

- SK COA Annex 6 REGISTER OF CASH IN BANK AND OTHER RELATED FINANCIAL TRANSACTIONSDocument1 pageSK COA Annex 6 REGISTER OF CASH IN BANK AND OTHER RELATED FINANCIAL TRANSACTIONSJune Anthony DobleNo ratings yet

- Online Shopping in IndiaDocument6 pagesOnline Shopping in Indiabhar4tpNo ratings yet

- Bank Branch Audit - Planning, Documentation - 10.3.23 PDFDocument39 pagesBank Branch Audit - Planning, Documentation - 10.3.23 PDFSHAHNo ratings yet

- LA Metro - 550Document4 pagesLA Metro - 550cartographica100% (2)

- Financial Accounting Assignment: DescriptionDocument4 pagesFinancial Accounting Assignment: DescriptionMujahidNo ratings yet

- Apply Loan RHBDocument13 pagesApply Loan RHBaida_faisal81No ratings yet

- Key Answer of Chapter 22 of Nonprofit Organization by GuereroDocument8 pagesKey Answer of Chapter 22 of Nonprofit Organization by GuereroArmia MarquezNo ratings yet

- Maf651 S1 Supply Chain ManagementDocument19 pagesMaf651 S1 Supply Chain ManagementMOHAMMAD ASYRAF NAZRI SAKRINo ratings yet

- Worksheet 11 - B.studiesDocument22 pagesWorksheet 11 - B.studiesVanshikaNo ratings yet

- Financial Accounting Standards Board (FASB) : Introduction To Accounting PrinciplesDocument4 pagesFinancial Accounting Standards Board (FASB) : Introduction To Accounting PrinciplesJasmine TorioNo ratings yet

- Payroll: Compensation AnalysisDocument4 pagesPayroll: Compensation AnalysisAlexanderJacobVielMartinezNo ratings yet

- DownloadDocument101 pagesDownloadsriram.srikanthNo ratings yet

- Nurse's Role in Medication ReconciliationDocument24 pagesNurse's Role in Medication ReconciliationDeamon SakaragaNo ratings yet

- Air Training InstitutesDocument5 pagesAir Training InstitutesRaj Mehta100% (1)

- CCNA 3 Chapter 8 v5Document14 pagesCCNA 3 Chapter 8 v5Juan palominoNo ratings yet

- AlfaAWUS1900 UG-RTDocument27 pagesAlfaAWUS1900 UG-RTjalal MagheribiNo ratings yet

- Money Transfer - Global Money Transfer - Western UnionDocument3 pagesMoney Transfer - Global Money Transfer - Western UnionMohammed BarakatNo ratings yet

- European Distribution and Supply Chain Logistics PDFDocument2 pagesEuropean Distribution and Supply Chain Logistics PDFCharlesNo ratings yet

- Case StudyDocument6 pagesCase StudyAndrea Romero100% (2)

- Name: OBJECTIVE: To Test The Employees Identifying, Analyzation and Journalizing. Highlight Your AnswersDocument7 pagesName: OBJECTIVE: To Test The Employees Identifying, Analyzation and Journalizing. Highlight Your AnswersErica NicolasuraNo ratings yet

- Inventory Control (PPIC)Document15 pagesInventory Control (PPIC)exsiensetyoprini100% (1)

- Wel Come To Rashmi Agency / Umang Group OfcompaniesDocument20 pagesWel Come To Rashmi Agency / Umang Group OfcompaniesUmangNo ratings yet

- The Truth About Zero Percent Car FinacingDocument2 pagesThe Truth About Zero Percent Car FinacingStea100% (2)