Professional Documents

Culture Documents

ICICI Bank Continues Strong Growth Momentum in Q3

Uploaded by

businessviewsreviewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Bank Continues Strong Growth Momentum in Q3

Uploaded by

businessviewsreviewsCopyright:

Available Formats

ICICI Bank continues strong growth momentum in Q3: Change is working!

ICICI Bank continues strong growth momentum in Q3

Change is working!

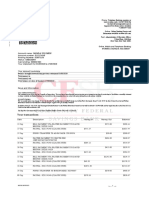

ICICI Bank has reported strong jump in its consolidated net profit

during the third quarter of financial year 2010-11. The largest

private sector bank in the country notched up consolidated PAT

growth of 77.5% Y-o-Y to Rs. 2,039 crore (US$ 456 million) in

Q3FY11 from Rs. 1,149 crore (US$ 257 million) in the

corresponding quarter of the previous financial year i.e., Q3FY10.

For refreshing business insights: log on to www.businessviewsreviews.blogspot.com

ICICI Bank continues strong growth momentum in Q3: Change is working!

ICICI Bank is India's second-largest bank, after the state-owned

SBI, with total assets of Rs. 3,634.00 billion (US$ 81 billion) at

March 31, 2010.

The Mumbai-headquartered bank’s standalone net profit was up

30.50% at Rs 1,437 crore versus Rs 1,101.1 crore, during the said

period.

The bank’s standalone net interest income grew 12.34% y-o-y to Rs.

2,312 crore in Q3FY11 from Rs. 2,058 crore in Q3FY10.

In another positive, its Current and Savings Account (CASA) ratio

increased to 44.2% at December 31, 2010 from 39.6% at

December 31, 2009.

Advances too grew by 15.3% Y-o-Y to Rs. 206,692 crore (US$ 46.2

billion) at December 31, 2010 from Rs. 179,269 crore (US$ 40.1

billion) at December 31, 2009.

However, the bank’s Operating expenses (including direct

marketing agency expenses) increased 27.2% to Rs. 1,707 crore

(US$ 382 million) in Q3FY11 from Rs. 1,342 crore (US$ 300 million)

in Q3FY10, primarily due to costs relating to new branches added

over the last year and full impact of cost of erstwhile Bank of

Rajasthan, during the quarter.

For refreshing business insights: log on to www.businessviewsreviews.blogspot.com

ICICI Bank continues strong growth momentum in Q3: Change is working!

Provisions decreased 53.6% to Rs. 465 crore (US$ 104 million) in

Q3-2011 from Rs. 1,002 crore (US$ 224 million) in Q3-2010.

The bank’s Net Non-Performing Asset (NPA) ratio also declined to

1.16% at December 31, 2010 from 2.19% at December 31, 2009.

In absolute terms, the bank’s Net NPA decreased by 34.9% to Rs.

2,873 crore (US$ 643 million) at December 31, 2010 from Rs. 4,416

crore (US$ 988 million) at December 31, 2009.

Its Provision coverage ratio increased to 71.8% at December 31,

2010 from 69.0% at September 30, 2010 (51.2% at December 31,

2009).

The bank’s CAR (capital adequacy ratio) stood at a solid 19.98%,

with Tier-1 capital adequacy of 13.72%, as per Basel II norms. This

is well above RBI’s requirement of total capital adequacy of 9.0%

and Tier-1 capital adequacy of 6.0%.

Performance in the 9-Month period of FY 2010-11

The bank’s standalone Profit after tax for the 9-month period of FY

2010-11 grew by 22.5% to Rs. 3,699 crore (US$ 827 million)

compared to Rs. 3,019 crore (US$ 675 million) during the same

period of the previous fiscal year;

For refreshing business insights: log on to www.businessviewsreviews.blogspot.com

ICICI Bank continues strong growth momentum in Q3: Change is working!

Consolidated PAT for the 9-month period increased by 36.0% to R

4,525 crore (US$ 1.0 billion) for 9M-2011 compared to Rs. 3,328

crore (US$ 744 million) for 9M-2010.

Change@work

According to a statement by the country’s largest private sector

lender, it has continued with its strategy of pursuing profitable

credit growth by leveraging on its improved fund mix, lower credit

costs and efficiency improvement, and cost rationalization. In

this direction, the Bank continues to leverage its expanded branch

network to enhance its deposit franchise and create an integrated

distribution network for both asset and liability products.

ICICI Bank has 2,512 branches, the largest branch network

among private sector banks in the country, as on December 31,

2010.

(To read another of our story on ICICI Bank, click here)

For refreshing business insights: log on to www.businessviewsreviews.blogspot.com

ICICI Bank continues strong growth momentum in Q3: Change is working!

For refreshing business insights: log on to www.businessviewsreviews.blogspot.com

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- St. Mary's ICSE School First Assessment Mathematics Class: X (One Hour and A Half) Marks: 50Document3 pagesSt. Mary's ICSE School First Assessment Mathematics Class: X (One Hour and A Half) Marks: 50lilyNo ratings yet

- Greenlight Capital Letter (1-Oct-08)Document0 pagesGreenlight Capital Letter (1-Oct-08)brunomarz12345No ratings yet

- Bajaj FinanceDocument65 pagesBajaj FinanceAshutoshSharmaNo ratings yet

- Form A Scss Ac Opening Form 28 Nov 2016Document3 pagesForm A Scss Ac Opening Form 28 Nov 2016Suraj KumarNo ratings yet

- PayPal Raises Fees For Most Domestic Transaction Types To 3.49% + $0.49 - Hacker NewsDocument18 pagesPayPal Raises Fees For Most Domestic Transaction Types To 3.49% + $0.49 - Hacker NewsabcNo ratings yet

- MT940 PDFDocument15 pagesMT940 PDFCarlos SantosNo ratings yet

- Investment Banking Personal Cover LetterDocument1 pageInvestment Banking Personal Cover LetterbreakintobankingNo ratings yet

- Histori TransaksiDocument3 pagesHistori TransaksiHari SusantoNo ratings yet

- The Global Financial Crisis: Module 3 Housing and MortgagesDocument30 pagesThe Global Financial Crisis: Module 3 Housing and MortgagesAlanNo ratings yet

- Mrs Janada Solomon 500 Laurel Lane, Midland, Texas 79701Document2 pagesMrs Janada Solomon 500 Laurel Lane, Midland, Texas 79701SolomonNo ratings yet

- SodaPDF-converted-maina - 6 Months Bank StatementDocument5 pagesSodaPDF-converted-maina - 6 Months Bank StatementShashikant JoshiNo ratings yet

- Presentation On Indian Postal System::-Taminder MamDocument13 pagesPresentation On Indian Postal System::-Taminder MamSantanu KararNo ratings yet

- Mã Ngân Hàng: Bank CodesDocument20 pagesMã Ngân Hàng: Bank CodesJimmy Quan100% (1)

- Auto-Estradas / Motorways: Portagens / Toll SDocument9 pagesAuto-Estradas / Motorways: Portagens / Toll Scry19912617No ratings yet

- World Islamic Mint: NewsletterDocument16 pagesWorld Islamic Mint: NewsletterNurindah 'indah' SariiNo ratings yet

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiNo ratings yet

- Ziad Zakaria - JordanianDocument10 pagesZiad Zakaria - JordaniancdeekyNo ratings yet

- PWC Roadmap To An Ipo PDFDocument100 pagesPWC Roadmap To An Ipo PDFVenp Pe100% (1)

- Lecture 05 Classification of ServicesDocument6 pagesLecture 05 Classification of ServicesMari SenthilNo ratings yet

- 3 Phrasal Verbs + Idioms B2Document6 pages3 Phrasal Verbs + Idioms B2Abel GordilloNo ratings yet

- 60 Amada Resterio Vs PeopleDocument2 pages60 Amada Resterio Vs PeopleGSS100% (1)

- 12 Accounts Imp Ch4Document30 pages12 Accounts Imp Ch4ajay yadavNo ratings yet

- SIS Students - EnrollmentDocument7 pagesSIS Students - EnrollmentCathryn Dominique TanNo ratings yet

- Tally Material: Prepared byDocument81 pagesTally Material: Prepared byfarhanNo ratings yet

- E-Banking Consumer BehaviourDocument116 pagesE-Banking Consumer Behaviourahmadksath88% (24)

- Sales 1-5Document68 pagesSales 1-5Munchie MichieNo ratings yet

- Surgical Strike On Black MoneyDocument2 pagesSurgical Strike On Black MoneySoham ChatterjeeNo ratings yet

- Sec 17q June 2021Document40 pagesSec 17q June 2021Kendrick UyNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Cfa CalculatorDocument33 pagesCfa CalculatorTanvir Ahmed Syed100% (2)