Professional Documents

Culture Documents

Prop Tax Cap Senate Bill 2706 LTR 020111

Uploaded by

jspectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prop Tax Cap Senate Bill 2706 LTR 020111

Uploaded by

jspectorCopyright:

Available Formats

February 1, 2011

RE: Property Tax Cap/Senate Bill 2706 (Skelos, at request of the Governor)

Dear Senator:

New York property taxes are nearly 80% above the national average. While controlling the level of local

government property tax growth sounds like something positive, actually reducing these taxes and

addressing their root causes is far more important.

For counties, the major cost drivers are delivering state services and other fixed costs. Our fixed costs

include employee health care insurance benefits and pension contributions, which rise and fall with

economic circumstances. Pension costs are rising now because the recession caused the investment

income in the state retirement system to plummet. Pension costs, alone, consume over $500 million

annually and are expected to rise substantially over the next several years.

The other major cost drivers are unfunded and underfunded state mandates, the largest of which is

Medicaid. There are nine State mandates that consume 90% of the county property taxes levied

statewide outside NYC. State mandates account for $4 billion of the $4.4 billion in county property taxes

levied last year. Medicaid alone costs county taxpayers outside New York City over $2 Billion annually

and automatically increases over $60 million every year.

The increased costs of Medicaid and pensions alone—programs over which counties have no control—

will far exceed any allowable property tax growth under the proposed cap. The resulting fiscal gaps for

counties will reach into the hundreds of millions of dollars in the first year of implementation, and these

state imposed fiscal gaps will remain for many years unless existing and new unfunded mandates are

reduced or eliminated.

Simply capping property taxes without enacting corresponding meaningful relief from existing and new

unfunded mandates does nothing to reduce the costs of these and many other State services that

counties must pay for and implement at the local level. And, worse off, preserves the distinction of NY

having the highest property taxes in the nation. This continues to drive people and businesses out of New

York and acts as a deterrent to re-location to our state.

NYSAC encourages all parties, state and local, to do better. NYSAC urges the Governor and Legislat ure

to enact legislation to CUT STATE SPENDING and to reform the service delivery system and address the

root cause of high property taxes. Taking these bold steps will in turn reduce the property tax burden and

not preserve the status quo.

Sincerely,

Stephen J. Acquario

Enc: Cutting Property Taxes through Mandate Reform

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NC III REVIEW c1Document18 pagesNC III REVIEW c1Hannah Sophia Imperial100% (2)

- Chanakya - Manual 4 0Document69 pagesChanakya - Manual 4 0viv3kswamyNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument7 pagesChapter 4 Financial Statement AnalysisAnnaNo ratings yet

- CIR V CTADocument2 pagesCIR V CTAylessinNo ratings yet

- Investment PhilosophyDocument5 pagesInvestment PhilosophyDan KumagaiNo ratings yet

- Visa Annual ReportDocument164 pagesVisa Annual Reportcaoxx274No ratings yet

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

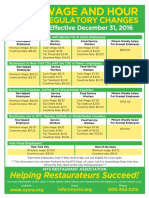

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Evaluate Financial MisstatementsDocument11 pagesEvaluate Financial MisstatementsSebastian GarciaNo ratings yet

- 2.1. Perfect CompetitionDocument73 pages2.1. Perfect Competitionapi-3696178100% (5)

- 2020 Financial PerformanceDocument166 pages2020 Financial PerformanceYenny AngkasaNo ratings yet

- 2015 11 SP Accountancy Solved 04 PDFDocument4 pages2015 11 SP Accountancy Solved 04 PDFcerlaNo ratings yet

- CA Amit Goyal-ResumeDocument2 pagesCA Amit Goyal-ResumeKanu ShreeNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- Shopping For CreditDocument8 pagesShopping For CreditmooNo ratings yet

- Sergeant-Major's Everyday Low Pricing Strategy MemoDocument6 pagesSergeant-Major's Everyday Low Pricing Strategy Memoneelpatel34150% (1)

- CTA Case Against Cosmetic Surgeon for Tax EvasionDocument52 pagesCTA Case Against Cosmetic Surgeon for Tax EvasionMaria Diory RabajanteNo ratings yet

- DipIFR D24-J25 Syllabus and Study Guide - FinalDocument15 pagesDipIFR D24-J25 Syllabus and Study Guide - FinalFrans R. Calderon MendozaNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument256 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationRaoul TurnierNo ratings yet

- Sources of Business FinanceDocument4 pagesSources of Business FinancedrywitNo ratings yet

- PT Davomas Abadi Tbk. Cocoa Company Shareholder and Financial HighlightsDocument4 pagesPT Davomas Abadi Tbk. Cocoa Company Shareholder and Financial HighlightsIshidaUryuuNo ratings yet

- Canara Bank Employees Pension Regulations, 1995Document84 pagesCanara Bank Employees Pension Regulations, 1995Latest Laws TeamNo ratings yet

- Venezuela's Oil Nationalization: Redefined Dependence and Legitimization of ImperialismDocument23 pagesVenezuela's Oil Nationalization: Redefined Dependence and Legitimization of ImperialismDiego Pérez HernándezNo ratings yet

- COPQ: Cost of Poor QualityDocument24 pagesCOPQ: Cost of Poor Qualityrrvalero0% (1)

- Management Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCADocument28 pagesManagement Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCASohag KhanNo ratings yet

- Examination Question and Answers, Set A (Multiple Choice), Chapter 2 - Analyzing TransactionsDocument4 pagesExamination Question and Answers, Set A (Multiple Choice), Chapter 2 - Analyzing TransactionsJohn Carlos DoringoNo ratings yet

- Segment reporting and discontinued operationsDocument12 pagesSegment reporting and discontinued operationsAnalie Mendez100% (2)

- RCA Solutions Mod5Document5 pagesRCA Solutions Mod5Danica Austria DimalibotNo ratings yet

- Industrial Visit Repot Kitex KizhakkambalamDocument68 pagesIndustrial Visit Repot Kitex KizhakkambalamMidhun ManoharNo ratings yet

- The Impact of Earnings Management On The Value Relevance of EarningsDocument25 pagesThe Impact of Earnings Management On The Value Relevance of Earningsanubha srivastavaNo ratings yet

- CIMB Group 2012 Annual Report HighlightsDocument382 pagesCIMB Group 2012 Annual Report HighlightsEsplanadeNo ratings yet

- Ratio Analysis of Nepal Telecom Corporation (NTCDocument47 pagesRatio Analysis of Nepal Telecom Corporation (NTCHimani SubediNo ratings yet