Professional Documents

Culture Documents

Apiinfographic

Uploaded by

editorial.onlineOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apiinfographic

Uploaded by

editorial.onlineCopyright:

Available Formats

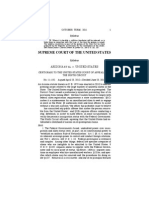

The Administration’s February 2009 February 2009 February 2009 February 2009 November 2009 January 2010 March

February 2009 February 2009 February 2009 November 2009 January 2010 March 2010 March 2010 April 2010 May 2010 May 2010 June 2010 June 2010 July 2010 November 2010

policy of stopping

vital new oil and The administration delayed

the process for finalizing the

upcoming 5-Year OCS Oil and

The administration delayed

the issuance of a second

round of oil-shale research

The administration cancelled

oil and gas leases on 77

parcels of federal lands in

The administration proposed

billions of dollars of tax

increases and additional

The administration took

unilateral action to shorten

the lease terms for certain

The administration announced

changes to the onshore leasing

process that are expected to

The administration canceled

the remaining lease sales in

the Beaufort and Chukchi

Already a year behind the

normal schedule for completing

an OCS leasing program, the

After a delay of over a year,

the administration announced

that it would accept scoping

The administration suspended

61 leases that were issued

in Montana as part of an

The administration canceled

the Virginia offshore lease

sale, which had bipartisan

The administration imposed

a 6-month moratorium on

deep water drilling activities

The administration postponed

the EIS scoping hearings for

the 2012-2017 offshore

The administration issued

an Executive Order that

established a new framework

The administration announced

that it was initiating work on

a supplemental environmental

natural gas supplies Gas Leasing Program (2010-

2015), despite the fact that

thousands of comments in

favor of expanded development

and development leases in

Colorado and Utah. They also

slashed the size of these

commercial leases by 87%,

Utah to add additional review,

even though the lease sales

had already gone through the

necessary, rigorous planning

fees on U.S. upstream

operations. While these

proposals were not enacted

by Congress, they have been

OCS leases. Shortening the

lease terms effectively

discourages investment in

projects that can take years

create additional regulatory

hurdles and more delays

before allowing companies

the opportunity to move

Seas under the then existing

2007-2012 offshore leasing

program, and withdrew Bristol

Bay from the program.

administration released its

offshore oil and natural gas

strategy, including its plans

for the leasing of OCS areas

comments on the environmental

impacts related to the pending

2012-2017 offshore leasing

program, and scheduled

agreement with special interest

groups, despite the fact that

environmental analysis had

already been conducted.

support from the VA governor

and the VA congressional

delegation. The administration

also canceled the remaining

even after all deep water rigs

were inspected for safety. This

moratorium was struck down

in Court. The administration

leasing program and extended

the opportunity for public

comment on the 2012-2017

offshore leasing program,

for managing uses of the

Outer Continental Shelf. This

will impose an unnecessary

regulatory regime that will

impact statement for the

remaining lease sales in the

2007-2012 offshore leasing

program, some seven months

and jobs is stopping were already received on the

Draft Proposed Program.

a move that diminished the

incentive for investing in the

technologies and operations

for developing oil shale. [Oil

and environmental study

process.

reintroduced with each

successive budget (2010

and 2011) and provide a

yearly signal to companies

to develop. The government

received less money in bonus

bids on these leases when

compared to the bids received

forward with domestic

investments. More than a

year later, details of this new

process have not yet been

in the period from 2012-2017.

This decision narrowed the

scope of the draft plan that

was issued in 2009 by taking

public scoping meetings. 2010 Gulf of Mexico lease

sales.

subsequently issued a second

moratorium and was held in

contempt for taking this

unlawful action.

thereby adding a fourth

review and extended delay.

duplicate a longstanding

and successful process for

development of OCS oil and

natural gas leasing and

after the Macondo incident

and four months after the

well was capped.

progress. shale deposits in the Rockies

are estimated to hold 800

billion barrels of oil.]

that the administration is

seeking to raise costs on

domestic oil and natural gas

operations.

on the same category of

leases in recent lease sales.

released. Pacific, Atlantic and Alaskan

areas out of the program. This

was simply an announcement

– the administration did not

development through the

Outer Continental Shelf

Lands Act, as established

by Congress.

take any steps that would

From the very beginning, this administration advance the progress of the

plan through the required

has taken specific steps to stop or delay administrative actions.

the development of domestic oil and natural

gas resources necessary to power our

nation’s economy, create jobs and enhance

our nation’s energy security.

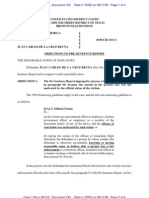

December 2010 December 2010 March 2011 Today Today Today Today Today Today Today Today Today

The results mean fewer American energy options.

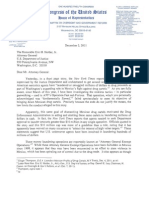

• Production from the Gulf of Mexico has been drilling offshore in the Gulf of Mexico. Last week, (by 2025) create 530,000 jobs, deliver $150

steadily declining since May of 2010. DOE’s there were just 25 rotary rigs operating in the billion more in tax, royalty and other revenue to

Energy Information Administration estimates Gulf of Mexico. the government, and boost domestic production

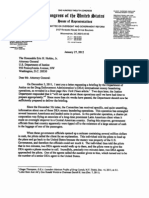

The administration announced The administration announced The administration sent Delays continue for the 2012- The administration has The administration has The administration has not The administration has yet The administration is still not The administration’s failure The administration decided The President announced production from the Gulf of Mexico will fall from by four million barrels of oil equivalent a day.

a revised leasing program for a newly-created “Wild Lands” the commercial oil shale 2017 offshore leasing plan. approved only a handful of approved a total of 43 permits acted on nearly 80 exploration to complete work on the issuing onshore leases within to move forward with energy to delay its decision on plans for a partnership with May 2010 production levels by 500,000 barrels • New well permits in the for the Gulf of Mexico Raising taxes on the industry with no increase

2012-2017 that removed the category, which establishes regulations back through The process normally requires deep water permits since last for new wells, with 38 of those and development plans. environmental analysis that the required 60-day timeline, projects in Alaska exposes whether or not to approve Brazil, under which the

Atlantic and Eastern Gulf of a new bureaucratic process the rulemaking process, two and a half years to finalize in shallow water. More than would allow companies to thereby delaying leasing at a the Trans-Alaska Pipeline the Keystone XL Pipeline United States would swap

a day by 2012. And the EIA projects a total dropped from 381 in 2006 to 171 in 2009 and in access could reduce domestic production by

April that allow operations

Mexico from consideration that will take additional as part of an agreement the plan. Most steps in the to resume. 80 percent of offshore oil move forward with crucial significant cost to successful System to unnecessary supply pending further environmental batteries for Brazilian oil. decline in Gulf production of nearly 500 million a low of 104 in 2010. So far this year, only 15 700,000 barrels of oil equivalent a day (in 2020),

until 2017 at the earliest. domestic resources off the with NGOs, despite the fact process have not yet begun, production and more than federal seismic studies in bidders. The GAO found that the vulnerabilities. Industry review, potentially threatening Rather than encourage the barrels through 2018. This equates to a loss of new wells have been approved. The approval sacrifice as many as 170,000 jobs (in 2014),

table and add further delays that the regulations were leaving serious doubt as to 40 percent of offshore natural the Atlantic. Applications to administration failed to issue expenditures of more than our country’s energy security, development of United more than $14 billion in government revenues. rate for new wells by this administration has and reduce revenue to the government by

to the onshore leasing process. finalized after months of whether a program will be in gas production come from perform seismic work in the 91% of leases on federal land $3 billion on offshore projects keeping more than 10,000 States’ oil supplies for the

This initiative is moving extensive and open public place on July 1, 2012 when deep water in the Gulf. Atlantic have been pending in a timely manner. The GAO have been met with years of union jobs directly related to benefit of the American

This revenue number is conservative given the dropped by 65% from pre-Macondo levels $128 billion dollars by 2025.

forward outside the scope of comment and included the the current program ends. for several years. also found that BLM has resistance to issue permits the pipeline construction on consumer, the administration latest EIA short term outlook, which projects a (14.5 approvals per month to 5.1 per month).

the Wilderness Act of 1964, recommendations of an routinely held millions of from both Interior and EPA. the sidelines, and ignoring has elected to encourage the steeper decline in production, and revenue • America’s oil and natural gas industry is

which gave Congress the 11-member task force. dollars in industry payments Projects planned for the the potential for an estimated importation of Brazilian oil impacts could be closer to $20 billion. • 2011 may be the first year without a Gulf lease responsible for 9.2 million jobs. Positive energy

authority to designate federal without issuing the underlying Chukchi and Beaufort Seas $34 billion to U.S. GDP in into the U.S. economy.

lands as Wilderness Areas. lease. For instance, in May have been continually delayed. 2015. Development of those same

sale since 1963 and the first year with no federal policy has the potential to increase that number,

Congress has designated 2010, BLM was holding nearly oil supplies here in the U.S. • Production today is the result of positive energy offshore lease sale since 1957. The revenue and negative policies such as those outlined

more than 750 areas as $100 million from unissued would create thousands of choices made years in advance. For instance, impacts are significant, considering that offshore above have the potential to put many of those

Wilderness Lands, occupying leases in Wyoming and Utah. American jobs, create billions the leases issued from 1996-2000 under the lease sales often bring billions into the federal 9.2 million jobs at risk. Energy is a global business

an area larger than the State of dollars in revenues for the

of California. Furthermore, U.S. government, and increase

Deep Water Royalty Relief Act of 1995 are treasury on an annual basis. and negative policies could shift these American

non-park, non-wilderness our energy security. producing tremendous volumes of oil and jobs offshore to other areas around the world.

federal lands have traditionally natural gas for the country today. However, in • The administration’s approach to energy policy We have already seen rigs leave the Gulf and

been managed effectively for order to maintain a steady flow of supply, the is to propose and support energy taxes. However, move to Africa and South America.

multiple uses – including

energy development – for the

administration must approve offshore permits a new study by Wood Mackenzie concludes

benefit of the American public. at a steady pace and must move forward with a increased access to domestic oil and natural 1220 L Street, NW

steady flow of lease sales on an annual basis. gas—rather than increased taxes on the U.S. oil Washington, DC 20005-4070

USA

and natural gas industry—is the best strategy

• Four days before the Deepwater Horizon accident for increasing government revenue, jobs and Copyright 2011 – American Petroleum

Institute, all rights reserved.

(April 20, 2010) there were 55 rotary rigs actually energy production. Increased access could Digital Media: 2011-067 | 03.11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Houston (02.18.13) PDFDocument2 pagesHouston (02.18.13) PDFeditorial.onlineNo ratings yet

- March 1 RequestDocument21 pagesMarch 1 Requesteditorial.onlineNo ratings yet

- Julian Zapata Espinoza - Statement of FactsDocument12 pagesJulian Zapata Espinoza - Statement of Factseditorial.onlineNo ratings yet

- Parking Locations Map Media Friendly 03.01.2013 FINALDocument1 pageParking Locations Map Media Friendly 03.01.2013 FINALeditorial.onlineNo ratings yet

- Hobby Master PlanDocument5 pagesHobby Master Planeditorial.onlineNo ratings yet

- Arizona v. United StatesDocument76 pagesArizona v. United StatesDoug MataconisNo ratings yet

- Shooting Timeline 19p CDocument1 pageShooting Timeline 19p Ceditorial.onlineNo ratings yet

- Hospital Ratings 59p CDocument1 pageHospital Ratings 59p CdanajthomNo ratings yet

- Chron Front PageDocument1 pageChron Front Pageeditorial.onlineNo ratings yet

- Heil ComplaintDocument1 pageHeil Complainteditorial.onlineNo ratings yet

- Hans ComplaintDocument4 pagesHans Complainteditorial.onlineNo ratings yet

- Dangerous Wild Animal RegulationsDocument18 pagesDangerous Wild Animal Regulationseditorial.onlineNo ratings yet

- Secretary Sebelius Letter To The Governors 071012Document3 pagesSecretary Sebelius Letter To The Governors 071012editorial.onlineNo ratings yet

- Miller v. AlabamaDocument62 pagesMiller v. AlabamaDoug MataconisNo ratings yet

- MGB and 3rd Parties Motion For Sanctions W Fax Conf To RHDocument7 pagesMGB and 3rd Parties Motion For Sanctions W Fax Conf To RHeditorial.onlineNo ratings yet

- Reply To Response To Motion For SanctionsDocument12 pagesReply To Response To Motion For SanctionsHouston ChronicleNo ratings yet

- Allen Stanford Accuses Receiver and Baker Botts Attorney Kevin Sadler of Criminal ConductDocument14 pagesAllen Stanford Accuses Receiver and Baker Botts Attorney Kevin Sadler of Criminal ConductStanford Victims Coalition100% (1)

- Response Filed by Marshall David Brown JRDocument10 pagesResponse Filed by Marshall David Brown JRHouston ChronicleNo ratings yet

- 1 MainDocument14 pages1 Maineditorial.onlineNo ratings yet

- Allen Stanford Accuses Receiver and Baker Botts Attorney Kevin Sadler of Criminal ConductDocument14 pagesAllen Stanford Accuses Receiver and Baker Botts Attorney Kevin Sadler of Criminal ConductStanford Victims Coalition100% (1)

- 1 4Document8 pages1 4editorial.onlineNo ratings yet

- TX Letter 3.15.12Document2 pagesTX Letter 3.15.12editorial.onlineNo ratings yet

- 1 3Document2 pages1 3editorial.onlineNo ratings yet

- Ramos GarciaDocument16 pagesRamos Garciaeditorial.onlineNo ratings yet

- Steve Jobs FBIDocument191 pagesSteve Jobs FBIJay Yarow100% (1)

- Webb WebbDocument3 pagesWebb Webbeditorial.onlineNo ratings yet

- ATFTraffickingDocument2 pagesATFTraffickingeditorial.onlineNo ratings yet

- Issa Letter 2Document2 pagesIssa Letter 2editorial.onlineNo ratings yet

- De La Cruz Reyna ObjectionDocument4 pagesDe La Cruz Reyna Objectioneditorial.onlineNo ratings yet

- Issa Letter To Holder IDocument2 pagesIssa Letter To Holder Ieditorial.onlineNo ratings yet