Professional Documents

Culture Documents

Re Misdated BofA Assignment

Uploaded by

AC FieldOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Re Misdated BofA Assignment

Uploaded by

AC FieldCopyright:

Available Formats

IN THE LAND COURT OF THE STATE OF HAWAII

» ~

<:::)

-;

::r:

:::0::;; .."

rt1 .L.:

""rr: OJ -

C) . '·PI.:,

-~ N

cn~· N rot·

-f:c.

::o~ :n. fTl"""'c-

l>~ tJ~.£

;;:0""; :r

-.r "r'O -.. .. _

l-': \.0 ~ :J',_~

::r: .. J> .. _

:z: ..

rT1 ......, In the Matter of the Application of ) Application No.1 069 )

THE ESTATE OF JAMES CAMPBELL, ) 1 L.D. Case No. 10-1-3068

DECEASED. )

)

------------~)

PETITIONERS FREDERICK ANTOINE WALLER AND TANYA DAVELYN-SANTIAGO WALLER'S MEMORANDUM IN OPPOSITION TO RESPONDENT'S MOTION FOR SUMMARY JUDGMENT AS TO THEIR PETITION TO AMEND TRANSFER CERTIFICATE OF TITLE 806,482 AND TO STRIKE AND EXPUNGE TRANSFER CERTIFICATE OF TITLE 970,858, FILED SEPTEMBER 28, 2010

EXHIBITS 1 THROUGH 7

CERTIFICATE OF SERVICE

DATE: February 28,2011

TIME: 3:00 p.m.

JUDGE: Gary W.B. Chang

GARY VICTOR DUBIN 3181 FREDERICK J. ARENSMEYER 8471 BENJAMIN R. BROWER 9070 Dubin Law Offices

Suite 3100

55 Merchant Street Honolulu, Hawaii 96813 (808) 537-2300

Attorneys for Petitioners

PETITIONERS FREDERICK ANTOINE WALLER AND TANYA DAVEL YN-SANTIAGO WALLER'S MEMORANDUM IN OPPOSITION TO RESPONDENT'S MOTION FOR SUMMARY JUDGMENT AS TO THEIR PETITION TO AMEND TRANSFER CERTIFICATE OF TITLE 806,482 AND TO STRIKE AND EXPUNGE TRANSFER CERTIFICATE OF TITLE 970,858, FILED SEPTEMBER 28, 2010

A. Introduction

This case began on February 23, 2010 as an ejectment action following a

nonjudicial foreclosure sale, which was assigned to the Honorable Karl K. Sakamoto in

Civil No. 10-1-0405-02 KKS, who, after hearing Respondent's motion for summary

judgment there, denied Respondent's motion for failure to submit into evidence certified

copies of supporting documents in violation of Land Court Section 501-88 of the Hawaii

Revised Statutes, and thereafter stayed the ejectment action pending a decision by this

Land Court as to the validity of the underlying supporting documents once certified.

Set forth in Exhibit 1 for the convenience of the Court, of which judicial notice

may be taken, is a copy of the docket sheet in the underlying ejectment action, together

with the Court's Minutes, no formal order having been entered before that action was

stayed in favor of a decision by this Court.

The Respondent has now filed its motion for summary judgment in this Court,

although curiously again falling, after being warned once already by Judge Sakamoto,

to submit certified copies of its supporting documents.

Assuming that this Court nevertheless, unlike Judge Sakamoto, chooses to

consider Respondent's motion for summary judgment, Petitioners hereby oppose the

motion on the grounds set forth in their sworn and verified Petition, a copy of which

without its exhibits is set forth in Exhibit 2, of which this Court may take judicial notice.

B. Summary Judgment Standards of Review

The policy of the law favors disposition of litigation on the merits. Webb v.

Harvey, 103 Haw. 63, 67,'79 P.3d 681, 685 (2003) (citing Compass Development, Inc. v. Blevins, 10 Haw. App. 388,402,876 P.2d 1335,1341 (1994»; Rearden Family Trust v. Wisenbaker, 101 Haw. 237, 255, 65 P.3d 1046 (2003) (citing Oahu Plumbing & Sheet Metal. Inc. v. Kona Constr.! Inc., 60 Haw. 372, 380, 590 P.2d 570, 576 (1979) (noting "the preference for giving parties an opportunity to litigate claims or defenses on the merits").

Summary judgment should not be granted by a trial court unless the entire record shows a right to judgment with such clarity as to leave no room for controversy and establishes affirmatively that the opposing party cannot prevail under any circumstances. Balthazar v. Verizon Hawaii. Inc., 109 Haw. 69, 123 P.3d 194 (2005).

On ruling on a motion for summary judgment, a Court must view the evidence and all inferences that can be drawn therefrom in a manner most favorable to the opposing party. Nuuanu Valley Ass'n v. City and County of Honolulu, 119 Haw. 90, 96, 194 P.3d 531, 537 (2008) (quoting Kahale v. City and County of Honolulu, 104 Haw. 341,344,90 P.3d 233, 236 (2004».

Summary judgment must be used by a Court with due regard for its purpose and should be cautiously invoked so that no party will be improperly deprived of a trial of disputed factual issues. Bhatka v. County of Maui, 109 Haw. 198, 124 P.3d 943 (2005).

In summary judgment adjudications in this State, the moving party must establish the absence of each and every element of the claim for relief. GECC Financial Corp. v.

2

Jaffarian, 79 Haw. 516, 521-22, 904 P.2d 530 (App. 1995), modified on other grounds, 80 Haw. 118,905 P.2d 624 (1995).

In such summary adjudications, a Court may not under any circumstances resort

to speculation beyond inferences of which the evidence is reasonably susceptible.

Waimea Falls Park, Inc. v. Brown, 6 Haw. App. 83, 97,712 P.2d 1136, 1146 (1985).

Moreover, in summary adjudications, judgment for the moving party is universally

considered to be a drastic remedy, depriving a party of the right to a trial on the merits

of the dispute, and therefore must always only be cautiously invoked. IndyMac Bank v.

Miguel, 117 Haw. 506, 519,184 P.3d 821, 834 (App. 2008) (citing Ocwen Fed. Bank,

FSB v. Russell, 99 Haw. 173, 182, 53 P.3d 312, 321 (App.2002)).

The same strict evidentiary burdens imposed upon a party moving for summary

judgment are not imposed upon those opposing summary judgment. In Miller v. Manuel,

9 Haw. App. 56, 66, 828 P.2d 286, 292 (1991), cerl. denied, 72 Haw. 618, 841 P.2d

1075 (1992), the Hawaii Intermediate Court of Appeals explained:

Courts will treat the documents submitted in support of a motion for summary judgment differently from those in opposition. Although they carefully scrutinize the materials submitted by the moving party to ensure compliance with the requirements of Rule 56(e), HRCP (1990), the courts are more indulgent towards the materials submitted by the nonmoving party. This is because of the drastic nature of summary judgment proceedings, which should not become a substitute for existing methods of determining factual issues.

U[A]ny doubt concerning the propriety of granting the motion [for summary

judgment] should be resolved in favor of the non-moving party." IndyMac Bank, 117

Haw. at 519, 184 P.3d at 834 (quoting GECC Financial Corp. v. Jaffarian, 79 Haw. 516, 521,904 P.2d 530, 535 (App. 1995), modified on other grounds, 80 Haw. 118,905 P.2d

624 (1995)).

3

B. Why Summary Judgment Should Not Be Granted

Not only are Respondent's uncertified arguments nonsensical as a matter of law.

Its uncertified exhibits actually contradict and defeat its own motion for summary

judgment, its own exhibits evidencing that that the claimed 2006 assignment to its

alleged predecessor assignee, through which it solely claims ownership of the

underlying promissory note and mortgage, was a complete sham in violation of not only

Land Court Rules, but the criminal laws and the notary laws of the State of Hawaii, and

now constitutes an attempted fraud on this Court.

Point One

Petitioners Are Not Precluded From Challenging The Validity Of The Subject 2006 ASSignment Of Mortgage Due To New Century's Bankruptcy Petition.

It is axiomatic pursuant to 11 U.S.C. §959 of the United States Code that when

an entity files for Chapter 11 protection, that entity loses its prior status and assumes

the new status of a Debtor in Possession until and unless a Trustee is appointed by the

Bankruptcy Court, whereupon it must conduct its business affairs in its new federal

statutory capacity and standing as Debtor in Possession, signing in that capacity only

and cannot sell or otherwise transfer its assets pursuant to 11 U.S.C. ~363 except on

motion and only thereupon with a formal sale and with formal Bankruptcy Court

approval, none of which has been exhibited as none exists here.

Moreover, the alleged 2006 Assignment of Mortgage on its face shows, as

Respondent is forced to admit, was not executed by the Debtor, but by the pre-petition

entity, New Century Mortgage, that by filing for Bankruptcy protection had already lost

its capacity to act post-petition over its property.

4

This is not a situation in which the Petitioners are seeking to set aside that 2006

Assignment in Bankruptcy Court as fraudulent against creditors there as Petitioners are

not creditors of that Bankruptcy Estate, but where the Petitioners here are disputing the

validity of its Land Court recordation here as fraudulent and invalid.

Point Two

The 2006 Promissory Note and 2006 Mortgage Were Not Properly Transferred To The Respondent's Assignee LaSalle, as Trustee, As A Matter Of Law.

The validity of Respondent's claim for summary judgment first depends upon the

validity of the assignment from New Century to Respondent's predecessor, LaSalle, as

Trustee, shown as Exhibit "C" attached to the moving papers.

Assuming that New Century in bankruptcy had the capacity and the standing

without Bankruptcy Court approval, which remains at the very least disputed and

nowhere proven in the moving papers, to have assigned its interest in the 2006

Promissory Note and Mortgage to anyone, that 2006 Assignment is fraudulent and

invalid on its face.

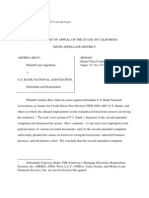

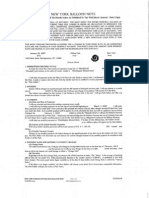

The Court will note that the 2006 Assignment of Mortgage was dated and

notarized on July 6, 2006, and at that time supposedly assigned with a rubber stamp to

"LaSalle Bank National Association, as trustee for the C-BASS Mortgage Loan Asset-

Backed Certificates, Series 2006-CB7, without recourse," as shown on the following

page.

However, thanks to Respondent's thoughtful submission into evidence of its

Exhibit "T" containing a partial copy of the underlying 2006 Pooling and Servicing

Agreement that created that securitized entity of which LaSalle became Trustee, we now know that it was impossible for that rubber stamp to have been placed on that

5

Assignment of Mortgage when it was notarized, for that Pooling and Servicing

Agreement creating that Trusteeship of LaSalle was not even in existence until

"September 1,2006," as shown on the following page.

CoaIaollwalda/Stateof ell, ~c~~O~wCE

On this 6t:b day of o7al.y

.2006

• bamro ~ a NOImy. paraoaaUy 8ppC8rcd .s~~ t-. JJR~ <i

to me persooally knowD, who, being by me duly swam (or ~ did say thBt bel_ is ~'.P.IAtC46.M ~~

. ofJlew Cenbu:y Yortp.ge ~.ti.oD

aud bt 1hc IIC8l ~ to tho instruImIDt u the c:mpandB fI:I!;8l oftbe ~on (or .assocImcn) by II1thcrit.y orBs boW of dinIc10rJ (or t:rmt=s). and

1oo7B30791

For Valuc Ra:aivcd, thB ~ boIdr:r of. Martga&e (harcia "Alaipar'") wtae address is 1.8"'~O Vcm. ~,

Sa:i.te 1000, k'rilie, ca. 92112 .

dors l-aeby gnmt. .n. IIII$igD, tnDsfer mi cocvey, 1IDtO La$Il1eSlllkltllloNl ~ ...

.,. C.fWIS MoItgag8l.G11ft~ •

a corpantion orpui:I=d and exlICing ~ tho bIws af CedfatIt. Sl!iet3X,l8.(;S7............ (linin • Assipe"),

wDOie address is ,.ldIlIWa St,a._ClltillD.l-, ,

• o:naln MortppI dIdai MaJ' 17, .zOOS • mado 8IIIl ~ by

!'RZtI1IllXCS &1ftOID. DT.LI;' and. UlI1D.. na.-vm.D-~ Dtal£R, 1lusband aDd. 101., b

lreuantll br the btint,r

to aDd in favor of Rew c-.~ 1Ia=~av- em:po_u,aa.

tbUowing ckscm"bcd ~ sitmda1 in JlOROLlIU1 .

see ~ D __ ipUolII. A~ Be2:eto .aD4 Had. • »-=t: .8~

"']JIlt' AJ4; 9~-/1,J.1 ?iUI1A~ J'~ ~

I 11~?'tu / ,LIZ 9,,707

•

\Jpootho

County. &Ito o£lIawdi:

10018W197

6

LASALLE BANK NATIONAL ASSOCIATION, Trustee

POOLING AND SERVICING AGREEMENT

Dated as of September I, 2006

C-BASS 2006-CB7 Trust

C-BASS Mortgage Loan Asset-Backed Certificates, Series 2006-CB7

On the 5th day of October 2006, before me, Christine M. Orsi, a notary public in and for said State, personally appeared Michelle Duffy, known to me to be a Vice President of LaSalle Bank N.A., one of the corporations that executed the within instrument, and also known to me to be the person who executed it on behalf of said corporation, and acknowledged to me that such corporation executed the within instrument.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal the day and year in this certificate first above written.

Christine M. o!si My Commission Expires: 05/05/2010

Mortgage fraud has become a much talked about topic in the United States in

recent months, and here we have a clear instance of fraud upon this Court, the Land

Court System, the State Bureau of Conveyances, and Hawaii's system of criminal

justice for that matter -- that 2006 Assignment of Mortgage having been deliberately

signed and notarized and recorded in violation of at least six controlling Sections of the

Hawaii Revised Statutes, in addition to other numerous common law protections and

remedies against such fraud and deceit in Hawaii:

7

1. Section 708-852 (prohibition against forgery);

2. Section 710-1061 (prohibition against false swearing in official matters);

3. Section 456-8 (prohibition against violation of rules governing notaries);

4 Section 501-196 (prohibition against recordation of fraudulent memoranda);

5. Section 502-41 (prohibition against false signature acknowledgments); and

6. Section 502-3 (prohibition against validity of false acknowledgments).

Such invalid notarization, since time immemorial, has rendered mortgages unrecordable in Hawaii and subject to expungement, currently pursuant to Sections 502-41, 502-42, 502-43 and 502-53 of the Hawaii Revised Statutes, making any such unauthorized recordation an absolute nullity, Lalakea v. Hilo Sugar Co., 15 Haw. 570, 576 (1904) as a matter of Hawaii statutory and case law.

When a defective acknowledgment is found to have been recorded, the universal remedy in the case law throughout the United States, including Hawaii, has always been expungement and nonenforcement, which has been affirmed in virtually every reported case in American history which has directly or indirectly addressed the issue.

Therefore, the 2006 Assignment should, sua sponte, be expunged by this Land Court in its supervisory authority over the integrity of Land Court recordations.

For example, in In re School Street Land Title, 32 Haw. 680, 682-683 (1933), the Supreme Court of the Territory of Hawaii, well before Statehood, adopted the jurisdictional principle that Courts have the authority and the responsibility to expunge mortgage instruments and to ignore their enforcement where not properly notarized.

8

In Missouri, in Monia v. Oberle, 530 S.W. 2d 452, 454 (1976), the Missouri Court of Appeals, with an identical recording statute as here in Hawaii, held that an instrument must be properly acknowledged before it can be recorded, the accepted remedy for the violation of which is to strike the instrument from the State's official records and refuse enforcement.

In New Jersey, in In re Buchholz, 224 B.R. 13 (D. N.J. 1998), the United States Bankruptcy Court for the Northern District of New Jersey, finding that the challenged, recorded document, again in a State with an identical recording statute as here in Hawaii, was not property acknowledged, held that it could not thus be recorded as a matter of state law and was therefore wholly ineffective and unenforceable.

In New York, in Sobel v. Wolf, 216 N.Y. S. 2d 132 (1961), the Supreme Court for Westchester County, again in a State with an identical recording statute as here in Hawaii, held that in the absence of a valid acknowledgment, the mortgage could not be recorded, and if it was, it must be cancelled by being judicially expunged, if necessary sua sponte.

In Indiana, in Walters v. Hartwig, 106 Ind. 123, 6 N.E. 5 (1886), the Supreme Court of Indiana, again in a State with an identical recording statute as here in Hawaii, recognized a landowner's right to maintain an action to cancel an instrument not properly acknowledged.

The governing statutes in Hawaii are virtually identical to those in use throughout the United States since time immemorial as illustrated above.

Section 502-41 of the Hawaii Revised Statutes, supra, mandates moreover the form of acknowledgment required for every recorded instrument in this State.

9

And Section 502-53 of the Hawaii Revised Statutes, supra, further mandates that "no certificate of acknowledgment contrary to this chapter is valid in a court of the State, nor is it entitled to be recorded in the bureau of conveyances."

This strict recording requirement was not invented in Hawaii, but is universally enforced in every American jurisdiction, 1A Corpus Juris Secundum, Acknowledgments, Section 14 ("[A]n instrument not acknowledged as required by the recording acts is inadmissible to record.").

What is especially unique in Hawaii is that the subject property is registered in Land Court at the Hawaii State Bureau of Conveyances, and with Land Court titles, no interests in land exist unless and until properly recorded.

A mortgage assignment of Land Court Property when signed creates only contractual rights and does not affect ownership of mortgage rights affecting title to Land Court property until the date that the mortgage assignment is properly signed and notarized and recorded in Land Court at the Hawaii State Bureau of Conveyances, Section 501-101 of the Hawaii Revised Statutes; In the Matter of the Application of Bishop Trust Company, Limited, to Reregister and Confirm Title. to Land, 35 Haw. 816, 825 (1941); Honolulu Memorial Park, Inc. v. City and County of Honolulu, 50 Haw. 189, 193-194,436 P.2d 207,210 (1967).

Justice Black explained the absolute necessity for rejecting such "fraud upon the court" in Hazel-Atlas Glass Co. v. Ha.rtford-Empire Co., 322 U.S. 238, 246 (1944) (involving the fabrication of trial evidence), in the following terms: "[T]ampering with the administration of justice in the manner indisputably shown here involves far more than an injury to a single litigant. It is a wrong against the institutions set up to protect and

10

safeguard the public, institutions in which fraud cannot complacently be tolerated consistently with the good order of society. Surely it cannot be that the preservation of the integrity of the judicial process must always wait upon the diligence of litigants. The public welfare demands that the agencies of public justice be not so impotent that they must always be mute and helpless victims of deception and fraud."

And that is not the only thing highly suspicious if not outright fraudulent in the

moving papers, for with respect to the Promissory Note, on July 22, 2010 Respondent

submitted a version of that Note to Judge Sakamoto bearing no rubber-stamped

assignment to LaSalle, accompanied by a sworn Declaration from someone at "Litton"

stating that it was a true and correct copy, as shown in Exhibit 3 attached hereto.

Whereas, for its new motion before Judge Chang, Respondent has now a few

months later submitted on February 2, 2011 a new version of that Note this time bearing

a rubber-stamped assignment to LaSalle, again accompanied by a sworn Declaration

from someone else at "Litton" this time stating that it is also a true and correct copy, as

shown in Exhibit 4 attached hereto.

Point Three

The 2006 Promissory Note and 2006 Mortgage Were Not Properly Transferred To The Respondent From Assignee LaSalle, as Trustee, As A Matter Of Law.

The moving papers appear to have included the merger papers for Mellon Bank

and not those relevant here. It appears that the moving memorandum is arguing that

LaSalle and Respondent merged, but that argument would be another nonsensical

attempt to confuse this Court, for it is claimed that it was "LaSalle Bank National

Association" in its individual corporate capacity that merged with Respondent and not

11

LaSalle in its fiduciary capacity as "LaSalle Bank National Association, as trustee for the

C-Bass Mortgage Loan Asset-Backed Certificates, Series 2006-CB7."

That distinction is critical, lest we throw out all traditional legal rules, for the

Respondent is mistaken to claim that the alleged corporate merger in any way

transferred trustee obligations as a matter of trust law, the two legal capacities being

completely different, as any transfer of trustee obligations would instead depend upon

the terms and conditions of the trust instrument controlling the replacement and

succession of trustees as well as the merger agreement, neither of which has been

submitted into evidence in these proceedings, but for a carefully selected few pages of

the Pooling and Servicing Agreement set forth in Respondent's Exhibit "T'.

What is factually compelling is that a cursory Internet search has revealed that

LaSalle Bank National Association is alive and well as of today, functioning nationwide

in its fiduciary capacity as a securitization Trustee, as shown in Exhibit 5 (see "starred"

highlighted portions), of which this Court may take judicial notice, conducting

foreclosure sales in its own fiduciary name, LaSalle Bank National Association, as

Trustee (and not in the name of this Respondent!), contradicting the disingenuous,

sleight-of-hand, non-evidentiary representations of this Respondent in faking its claim to

superior title here without full documentation.

Point Four

Respondent's Quitclaim Deed Is Similarly Suspect.

The Quitclaim Deed (Respondent's Exhibit "H") through which Respondent

claims superior title here is similarly suspect, in that it is signed before a notary in the

State of Texas by two alleged officers of Respondent, "Diane Dixon" and "Denise

Bailey," who purport to be the Assistant Vice President and Assistant Secretary of the

12

Bank of America whose offices are not in the State of Texas, when in fact these same

two "robo-signer" individuals have been representing themselves in similar corporate

capacities, signing foreclosure instruments nationwide at one and the same time, for a

number of separate companies similarly not located in the State of Texas, such as

Mortgage Electronic Registration Systems, HSBC Bank USA, National Association,

Deutsche Bank National Trust Company, and Fremont Investment & Loan, and for

many others (see Exhibit 6), of which this Court may take judicial notice.

Such false posturing by alleged secondary mortgage market "trustees," including

especially this Movant in other cases, and by its alleged boilerplate officers, is becoming

commonplace in mortgage foreclosure proceedings throughout the United States, and

state courts everywhere are questioning the standing of such phantom mortgagees to

prosecute such cases without first proving something as elemental as that they are in

fact the owners of the mortgage and the underlying note, resulting from an unbroken

chain of title.

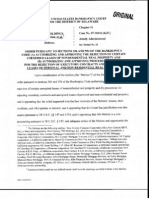

Such well publicized trickery is what in part led Judge Watanabe in another of

this same opposing counsel's cases, HSBC Bank. USA at Trustee. etc. v. Freepartner.

et al.. Civil No. 09-1-0233, to reject summary judgment in a virtually identical ejectment

attempt (see Exhibit 7, pages 2-3), of which this Court may take judicial notice, finding

that:

Upon considering the written submissions of the parties, reviewing the records and files in this case, and hearing the oral arguments of counsel, the Court finds that numerous genuine issues of material fact remain in dispute, which issues include but may not be limited to the following:

'It * * *

13

2. Whether Plaintiff HSBC Bank USA lacks standing to sue for ejectment for any and all of the following reasons:

a. Whether the Assignment of Mortgage and Note ("Assignment") by MERS as nominee for the Lender, Freemont Investment & Loan, to Plaintiff HSBC Bank USA on October 17, 2008 was null and void given Freemont's bankruptcy status at the time;

b. Whether the signatories on the October 17, 2008 Assignment, Marti Noriega and Denise Bailey, intentionally and/or materially misrepresented under oath their official capacities and authorities as purported corporate officers of MERS and thereby fraudulently assigned the note and mortgage to Plaintiff HSBC Bank USA, rendering the Assignment legally null and void; and

c. Whether the signatories on the May 8, 2009 Quitclaim Deed, Diane Dixon and Denise Bailey, intentionally and/or materially misrepresented under oath their official capacities and authorities as purported corporate officers of Plaintiff HSBC Bank USA, rendering the Quitclaim Deed legally null and void.

While it is true that Respondent has now presently this Court with "proof' that

these two robo-signers were so authorized (see Respondent's Exhibit "K"), that

authorization is suspiciously recorded four months after the signing and recording on

the Quitclaim Deed.

C. Conclusion

For each and for all of the above reasons, Respondent's motion for summary

judgment should be denied, and since the trial of this matter is approaching, this Court

should proceed to enter findings of fact and conclusions of law striking and expunging

the invalid instruments above described upon which Respondent's legal arguments are

based.

Moreover, this Court should consider what other Courts have done, sua sponte,

faced with an increasing barrage of submission of loan-related document containing

false recordations, which is to order that counsel submitting such documentation must

14

submit Declarations under penalty of perjury and subject to discipllnary action that they have reviewed the chain of title of all such notes and mortgages and attest to the fact

that the copies they are submitting are henceforth genuine and valid.

DATED: Honolulu, Hawaii; Februa.ry 18, 2011.

GARY VICTOR DUBIN FREDERICK J. ARENSMEYER BENJAMIN R. BROWER Attorneys for Petitioners

15

You might also like

- 50Document38 pages50Spencer SheehanNo ratings yet

- Department of Justice V ITS Financial RulingDocument233 pagesDepartment of Justice V ITS Financial RulingKelly Phillips ErbNo ratings yet

- Michael and Julie Mardock v. Michael and Virginia McClaughryDocument17 pagesMichael and Julie Mardock v. Michael and Virginia McClaughryThe Department of Official InformationNo ratings yet

- Giannasca Supp Appellate Brief As Filed 03-17-2020 REVDocument59 pagesGiannasca Supp Appellate Brief As Filed 03-17-2020 REVRussinator0% (1)

- Loan Modification/Loss Mitigation Contacts and Phone Numbers ListDocument6 pagesLoan Modification/Loss Mitigation Contacts and Phone Numbers ListSteve Linnin100% (11)

- Memorandum in OppositionDocument7 pagesMemorandum in OppositionDaily Caller News FoundationNo ratings yet

- Quigg Vincent 108932 State of California Bar Multiple Bar Discipline Binder3Document109 pagesQuigg Vincent 108932 State of California Bar Multiple Bar Discipline Binder3AdamNo ratings yet

- Haddad v. Geegieh, Ariz. Ct. App. (2016)Document7 pagesHaddad v. Geegieh, Ariz. Ct. App. (2016)Scribd Government DocsNo ratings yet

- 2012 - Sierra County Property Tax Deadbeats!Document1,010 pages2012 - Sierra County Property Tax Deadbeats!Sophia PeronNo ratings yet

- June 2018 McCoy Court Document 1Document1 pageJune 2018 McCoy Court Document 1WGRZ-TVNo ratings yet

- No. 05-3-02755-1 Andrew Rife v. Jennifer Rife Aka Lesourd Nka MehaddiDocument1,592 pagesNo. 05-3-02755-1 Andrew Rife v. Jennifer Rife Aka Lesourd Nka MehaddiV Freitas LegalNo ratings yet

- Scan Atlanta by FrequencyDocument133 pagesScan Atlanta by FrequencyPeter EcholsNo ratings yet

- 01 Unraveling The Tangled Web of Realauction OwnershipDocument86 pages01 Unraveling The Tangled Web of Realauction OwnershipConflictsCheckNo ratings yet

- StanleymoskDocument9 pagesStanleymoskLEWISNo ratings yet

- Notary Process Identity Verification FormDocument4 pagesNotary Process Identity Verification Formumam hasaniNo ratings yet

- Suntrust Bank v. John H. Ruiz, 11th Cir. (2016)Document12 pagesSuntrust Bank v. John H. Ruiz, 11th Cir. (2016)Scribd Government DocsNo ratings yet

- Robinson Opinion On MDLDocument31 pagesRobinson Opinion On MDLCelebguardNo ratings yet

- Profit & Loss: The Bitcoin Foundation, IncDocument1 pageProfit & Loss: The Bitcoin Foundation, IncamyNo ratings yet

- Amended Information (Filed 5.31.2022)Document7 pagesAmended Information (Filed 5.31.2022)WXYZ-TV Channel 7 DetroitNo ratings yet

- DC - Issuers GINNIE MAEDocument8 pagesDC - Issuers GINNIE MAEPAtty BarahonaNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabHasanNo ratings yet

- Wells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Document24 pagesWells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Frank GregoireNo ratings yet

- WAMU Servicer GuideDocument136 pagesWAMU Servicer GuideHolly Hill100% (2)

- Legal Complaint SampleDocument2 pagesLegal Complaint SampleAngel PrezNo ratings yet

- 401 S. State Complaint Against RMU and RooseveltDocument258 pages401 S. State Complaint Against RMU and Rooseveltdannyecker_crain100% (1)

- PMT 8-K Acquires $140M Non-Performing Mortgage AssetsDocument2 pagesPMT 8-K Acquires $140M Non-Performing Mortgage Assetsank333No ratings yet

- Account statement activityDocument1 pageAccount statement activityZakaz SpainNo ratings yet

- Amended Notice of Motion For Order To Reconsider Remand To State CourtDocument24 pagesAmended Notice of Motion For Order To Reconsider Remand To State CourtCindy Brown100% (2)

- Aaron Greenspan LawsuitDocument146 pagesAaron Greenspan Lawsuitrobinwauters100% (2)

- Statement of Issues To Be Raised FiledDocument18 pagesStatement of Issues To Be Raised FiledEdward RichardsonNo ratings yet

- Suit To Have DA Meg Heap Removed From Chatham County Jail Probe, IndictmentsDocument17 pagesSuit To Have DA Meg Heap Removed From Chatham County Jail Probe, Indictmentssavannahnow.comNo ratings yet

- SMUD vs. Bank of AmericaDocument181 pagesSMUD vs. Bank of AmericaKathleenHaleyNo ratings yet

- Borrower Requested Solicitation Filled OutDocument11 pagesBorrower Requested Solicitation Filled Outmichael ellisNo ratings yet

- Untitled PDFDocument1 pageUntitled PDFAnonymous GUy5EdNfNo ratings yet

- Bank Seal: Demand Draft / Manager'S ChequeDocument2 pagesBank Seal: Demand Draft / Manager'S ChequeParveen KumarNo ratings yet

- Certificate of Ownership Template 08Document2 pagesCertificate of Ownership Template 08RichardwilsonNo ratings yet

- Supreme Court of The United States: Petitioners Pro SeDocument72 pagesSupreme Court of The United States: Petitioners Pro SeNye LavalleNo ratings yet

- 2nd Deposition of Jeffrey Stephan - GMAC's Assignment - Affidavit SlaveDocument26 pages2nd Deposition of Jeffrey Stephan - GMAC's Assignment - Affidavit SlaveForeclosure FraudNo ratings yet

- Bill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)Document2 pagesBill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)David SmithNo ratings yet

- (D.E. 357) Deposition Frederick S. Snow, First American Bank General Counsel & EVP - "Inspections & Appraisals"Document25 pages(D.E. 357) Deposition Frederick S. Snow, First American Bank General Counsel & EVP - "Inspections & Appraisals"larry-612445No ratings yet

- Filed 6/8/12 Partial Pub. Order 7/3/12 (See End of Opn.)Document19 pagesFiled 6/8/12 Partial Pub. Order 7/3/12 (See End of Opn.)Foreclosure FraudNo ratings yet

- LPS Matthew Allen Banaszewski OHIO Nps1a93Document34 pagesLPS Matthew Allen Banaszewski OHIO Nps1a93John ReedNo ratings yet

- Anonymous Complaint Filed With The Office of Inspector General (OIG) Regarding APD Solution, LLCDocument38 pagesAnonymous Complaint Filed With The Office of Inspector General (OIG) Regarding APD Solution, LLCViola DavisNo ratings yet

- Bill of SaleDocument1 pageBill of Salec3389023No ratings yet

- M Fajar Abdillah: PT Bank Bni Syariah Branch Office Tanah Sareal BogorDocument1 pageM Fajar Abdillah: PT Bank Bni Syariah Branch Office Tanah Sareal Bogorfajar abdillahNo ratings yet

- Better Covid ThingDocument4 pagesBetter Covid ThingAuguste RiedlNo ratings yet

- PL MSJ & Response To Def MSJDocument13 pagesPL MSJ & Response To Def MSJAC Field100% (2)

- Debt Collection 2014 Ohio 625Document14 pagesDebt Collection 2014 Ohio 625dwisselNo ratings yet

- New Tenant Welcome LetterDocument1 pageNew Tenant Welcome Letterkristen uyemuraNo ratings yet

- Unknown PDFDocument206 pagesUnknown PDFLey SerranoNo ratings yet

- PaystubDocument1 pagePaystubjeehanhereNo ratings yet

- 06 SubtotalDocument13 pages06 Subtotaladitya chandNo ratings yet

- JunioDocument9 pagesJuniosamary2406hNo ratings yet

- Indigency Application (Completed) - Part2 PDFDocument2 pagesIndigency Application (Completed) - Part2 PDFdcarson90No ratings yet

- Depostion of Lawrence Nardi of JP Morgan Chase in The Waisoome Foreclosure Matter 5-2012Document330 pagesDepostion of Lawrence Nardi of JP Morgan Chase in The Waisoome Foreclosure Matter 5-201283jjmackNo ratings yet

- Giroux v. Federal National Mortgage, 1st Cir. (2016)Document10 pagesGiroux v. Federal National Mortgage, 1st Cir. (2016)Scribd Government DocsNo ratings yet

- 2017.08.074d17-2239 Schneider's Notice of Appeal (Pro Se)Document12 pages2017.08.074d17-2239 Schneider's Notice of Appeal (Pro Se)larry-612445No ratings yet

- Syracuse Broadcasting Corporation v. Samuel I. Newhouse, The Herald Company, The Post-Standard Company and Central New York Broadcasting Corporation, 271 F.2d 910, 2d Cir. (1959)Document8 pagesSyracuse Broadcasting Corporation v. Samuel I. Newhouse, The Herald Company, The Post-Standard Company and Central New York Broadcasting Corporation, 271 F.2d 910, 2d Cir. (1959)Scribd Government DocsNo ratings yet

- Ex. 25 Req. Stay Pending Appeal S. Brad AxelDocument11 pagesEx. 25 Req. Stay Pending Appeal S. Brad Axellarry-612445No ratings yet

- Order Certifying MERS QuestionsDocument4 pagesOrder Certifying MERS QuestionsAC FieldNo ratings yet

- 2007 Allonge P 163Document186 pages2007 Allonge P 163AC Field100% (2)

- Congressional Testimony of Former Moody's Vice President and Senior Credit Officer Richard MichalekDocument21 pagesCongressional Testimony of Former Moody's Vice President and Senior Credit Officer Richard MichalekAC FieldNo ratings yet

- Abigail Field Trustee 2014Document2 pagesAbigail Field Trustee 2014AbigailField100% (1)

- Lavalle Report Small PrintedDocument147 pagesLavalle Report Small PrintedMartin AndelmanNo ratings yet

- United States Securities and Exchange Commission Advisory Committee On Small and Emerging CompaniesDocument3 pagesUnited States Securities and Exchange Commission Advisory Committee On Small and Emerging CompaniesAC FieldNo ratings yet

- CORREIADocument7 pagesCORREIAAC FieldNo ratings yet

- Pleading in Intervention - (TIME STAMPED)Document27 pagesPleading in Intervention - (TIME STAMPED)AC Field100% (1)

- 2007 Allonge P 163Document186 pages2007 Allonge P 163AC Field100% (2)

- Homeowners Sue BofA and All Over BofA/BNY SettlementDocument212 pagesHomeowners Sue BofA and All Over BofA/BNY SettlementAC Field100% (2)

- New Century v. BraxtonDocument7 pagesNew Century v. BraxtonAC FieldNo ratings yet

- Report Analyzing Servicing Part of BofA/BNY Proposed SettlementDocument26 pagesReport Analyzing Servicing Part of BofA/BNY Proposed SettlementAC FieldNo ratings yet

- 10 MERS Certifying OfficersDocument30 pages10 MERS Certifying OfficersAC Field100% (3)

- Beneficial Maine Inc V Carter Maine SC 07 Jul 2011Document13 pagesBeneficial Maine Inc V Carter Maine SC 07 Jul 2011William A. Roper Jr.No ratings yet

- US Bank NA V Kimball Joseph Supreme Court OpinionDocument14 pagesUS Bank NA V Kimball Joseph Supreme Court OpinionAC Field0% (1)

- Lease Payments Owed To Food Lion, LLC Debtor - David's Steak and Spirits and Charles R. LanceDocument2 pagesLease Payments Owed To Food Lion, LLC Debtor - David's Steak and Spirits and Charles R. LanceDGWBCSNo ratings yet

- Repurchase Claims and Indemnification ClaimsDocument250 pagesRepurchase Claims and Indemnification ClaimsJesse SchachterNo ratings yet

- New Century Order Allowing Executory Contracts To Be RejectedDocument6 pagesNew Century Order Allowing Executory Contracts To Be RejectedAC FieldNo ratings yet

- Norse Energy BankruptcyDocument17 pagesNorse Energy BankruptcyJames "Chip" NorthrupNo ratings yet

- Norse Energy BankruptcyDocument17 pagesNorse Energy BankruptcyJames "Chip" NorthrupNo ratings yet

- Citi Dec in Support of ROSDocument3 pagesCiti Dec in Support of ROSAC FieldNo ratings yet

- Amended Claim #12 Filed by US BankDocument30 pagesAmended Claim #12 Filed by US BankAC FieldNo ratings yet

- Nickless V HSBC Exhibits Part 2Document51 pagesNickless V HSBC Exhibits Part 2AC FieldNo ratings yet

- Amended Claim #13 Filed by US BankDocument15 pagesAmended Claim #13 Filed by US BankAC FieldNo ratings yet

- DB Proof of Claim No EndDocument33 pagesDB Proof of Claim No EndAC FieldNo ratings yet

- "Sister Wives" Stars Kody & Meri Brown Bankruptcy Filing 2005Document41 pages"Sister Wives" Stars Kody & Meri Brown Bankruptcy Filing 2005borninbrooklynNo ratings yet

- Memo Denying Relief of Stay Versus CitiMortgageDocument4 pagesMemo Denying Relief of Stay Versus CitiMortgageJoseph Arthur RobertsNo ratings yet

- DB Ex With EndDocument22 pagesDB Ex With EndAC FieldNo ratings yet

- DB Motion With EndDocument13 pagesDB Motion With EndAC FieldNo ratings yet

- Citi Endorsed NoteDocument29 pagesCiti Endorsed NoteAC FieldNo ratings yet