Professional Documents

Culture Documents

Trading Day 3rd May - MacroBusiness

Uploaded by

ChrisBeckerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trading Day 3rd May - MacroBusiness

Uploaded by

ChrisBeckerCopyright:

Available Formats

Trading Day Tuesday, 3rd May 2011

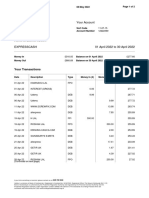

S&P/ASX200 Index

Midday Summary

The S&P/ASX 200 is down over 1%, or 51 points at 4773 at 1pm AEST, below support at 4800 points.

Momentum and other technical indicators are very negative as this broad selloff continues to hit all sectors.

Three consecutive closes below the 15 day moving average are indicative of a correction pattern, but medium

term momentum and cyclical indicators do not confirm a correction yet. The next support level is 4700 points,

but a correction could overshoot to 4500 points, particularly if the RBA applies the brakes and raises rates, thus

increasing the AUD (again) and pushing the industrials further into negative territory.

Eyes are still on the banks which report earnings this week, with ANZ reporting record profit but the stock falling

over 1%. This may bode ill for the other banks, with NAB in particular already overbought in the short term.

Chart 1. Daily candlestick with 15 and 260 day moving average (pink/blue lines)

ABOUT DISCLAIMER

The Prince is a full The content of this document should not be taken as investment advice or construed as a

time trader with recommendation to buy or sell any security or financial instrument, or to participate in any

extensive experience particular trading or investment strategy. The views expressed are the opinion of the author

in equities and only. The author may have a position in any of the securities mentioned. Any action that you

derivatives trading take as a result of information or analysis is ultimately your responsibility. Consult someone

and portfolio who claims to have a qualification before making any investment decisions.

management.

MacroBusiness Trading Day The Prince Page 1

Tuesday, 3rd May 2011

Daily Stock Scan

How to read What does “position” mean?

These watchlists are the results of end-of-week Bullish = looking to add/start long position

scans, using a medium term trading system to Bearish = looking to add/start short position

ascertain the strength, direction and momentum of Hold = maintained current position

trends.

Avoid = wait for direction/catalyst

This intra-day report will pinpoint possible entries

Go to the glossary at the end of the report for more

and exits based on a short term trading system.

information.

ASX100 Select

Name Code Pattern/Stance Position Notes

AGL Energy AGK Sideways bullish AVOID Intraday buying support is growing and developing

into a possible new trend. Watch for breakout

above $14.60

AMP Limited AMP Sideways bullish AVOID Becoming oversold with some buying support -

down almost 1.5%. No entry signal here

ANZ Banking ANZ Sideways bullish AVOID Market not happy about earnings news, down over

1%, but still going sideways. Wait until other 3

report earnings to see how the financials react.

ASX Limited ASX Medium term BEARISH Still in “rounding top” bearish formation - down

downtrend almost 1%

BHP-Billiton BHP Sideways bullish HOLD Finding very strong support at $45.50 - down 1%

Bluescope Steel BSL Medium term BEARISH Up slightly on finding support, dangerous territory

downtrend, meeting here. Tighten stops to $1.80 or lower

support

Boral BLD Sideways bearish AVOID Still slipping - overall pattern is “head and

shoulders” - very limited upside potential

Caltex CTX Sideways bullish AVOID Found support at $14 - no further action yet

Coca-Cola Amatil CCL Medium term uptrend HOLD Down a little this morning, but still within a tentative

hitting resistance medium term trend. Good defensive stock IMO

Cochlear COH Medium term uptrend HOLD Found some support at $80 - not bad value at that

complete - sideways price, but no short term action yet

Commonwealth CBA Sideways bullish HOLD “Running out of puff” - keep waiting for earnings

Bank

CSL CSL Sideways volatile AVOID Finding support at up 0.6% - AUD dollar still

weighing on this Very Good company

CSR CSR Medium term BEARISH Steady - could see a “dead cat bounce” rally from

downtrend here - tighten stops to $3.00 even

David Jones DJS Sideways bullish AVOID Still tracking sideways, up a little this morning

Fairfax Media FXJ Medium term BEARISH Down 7% this morning on trading update - this

downtrend merits re-valuing as FXJ is at GFC lows....

MacroBusiness Trading Day The Prince Page 2

Tuesday, 3rd May 2011

ASX100 Select (continued)

Name Code Pattern/Stance Position Notes

Fortescue Metals FMG Sideways bullish, AVOID Down lightly this morning, but some buyers

meeting resistance stepping in - overall pattern is still sideways

Harvey Norman HVN Medium term downtrend BEARISH Although down 0.7%, has been sideways for 3

days now. Tighten stops to $2.72 or cover half

JB Hi-Fi JBH Sideways bearish AVOID Up slightly, but cautious consumer meme

continues - upside potential will be squashed if

RBA raises rates. Avoid

Macquarie Group MQG Medium term downtrend, AVOID “Watch for breakout above 63 EMA” - just missed

hitting support it! Down today - no entry signal yet

Myer Holdings MYR Sideways bearish AVOID Up 1%, but nothing happening here - still in

bearish triangle pattern.

National Aust. NAB Sideways bullish HOLD Down 0.5%. Rally has gone on long enough - risk

Bank is growing of a reversal. Tighten stops

Newcrest Mining NCM Sideways bullish HOLD Still in holding pattern on gold volatility

Onesteel Ltd OST Medium term downtrend COVER “this ain’t over yet” yeah it is - up 3% on a bullish

reversal day - tighten stop to $2.20 but be

prepared for DCB

Oz Minerals OZL Sideways bearish AVOID No close below $1.40 yet - bouncing along like

the other resource stocks. Avoid

Qantas Airways QAN Medium term downtrend, AVOID Up 1.5%, sliding along a potential buy zone at

hitting support $2.10 - watch a fall in oil prices (but not AUD) for

a possible rally

QBE Insurance QBE Sideways bullish AVOID Down 1% - but still medium term bullish sideways

QR National QRN Sideways bullish AVOID 4% breakout yesterday has no follow up - wait

Rio Tinto Ltd RIO Sideways bullish HOLD Finding support at $82 - mimicking BHP

Suncorp Group SUN Sideways bearish AVOID Still bouncing - down almost 1%

Tabcorp TAH Medium term uptrend HOLD Up 0.8% lots of selling pressure above here

Telecom Corp. TEL Sideways bearish AVOID Ascending triangle pattern failed - down 0.3%

Telstra TLS Sideways bearish AVOID Up slightly - failed stage 2 rally - avoid for now

Wesfarmers WES Sideways bullish HOLD Down another 1%, but very slowly. Nothing to see

Westpac Bank WBC Sideways bullish HOLD Down almost 1% - wait on earnings

Woodside WPL Sideways bullish, trend HOLD Down almost 1% - watch for close below $46

stalling

WorleyParsons WOR Sideways bullish HOLD Change to bullish sideways - indicators suggest

end of trend

Woolworths WOW Sideways bearish AVOID Lots of buying support in last 3 days and up 0.4%

today against the broader market selloff. Watch

MacroBusiness Trading Day The Prince Page 3

Tuesday, 3rd May 2011

ASX Small Ords

Name Code Pattern/Stance Position Notes

Acrux ACR Medium term uptrend BULLISH Down again - maintain stop at $3.35

Billabong BBG Medium term downtrend BEARISH Up slightly and decelerating - tighten stop to $6.85

Centro Retail CER Medium term uptrend, HOLD Still firming for possible upside breakout here -

meeting resistance watch the close for small initial position

Energy Resources ERA Medium term downtrend BEARISH Down another 5.6% - this is waaaaay oversold

Graincorp GNC Medium term uptrend BULLISH Up 0.5%, but probably sideways from here

Kingsgate Consol. KCN Medium term downtrend BEARISH Down 4% broke support

Matrix C & E MCE Sideways bearish BEARISH “Close below 63 EMA is ominous” - and keeps

falling, spooking investors.

1300 Smiles ONT Sideways bearish - BEARISH This Wonderful company is down 7% on very

broke through support illiquid trade - can’t short but you can buy at these

prices which are below value.

REA Group REA Medium term uptrend, HOLD Still firming for possible downside breakout here -

meeting resistance watch the close

Regis Resources RRL Sideways bullish AVOID “not much upside from here’ down almost 3%

Sedgman SDM Sideways bearish AVOID Down 2% this morning, but buyers have stepped

in - what is it with engineering services companies

at the moment?

Sigma Pharma. SIP Sideways bullish, short BULLISH Down 3% - but still in trend channel, although

term trend sideways - tighten to $0.35

Super Retail SUL Medium term uptrend HOLD “Breakout - Looks toppy at these prices” - what

would I know? Up 2% on a gap. Mmm

The Reject Shop TRS Medium term downtrend, AVOID Is $11 support for this Very Good Company?

finding support Getting towards good buy zone for investors only.

Whitehaven Coal WHC Short term downtrend - BEARISH Gapped down 3% today through support - this is

accelerating very fast. Tighten stops in ready for rebound.

Wotif.com WTF Medium term uptrend BULLISH Up 1% again - this volatile little Good Company is

back on trend. Stay the course

MacroBusiness Trading Day The Prince Page 4

Tuesday, 3rd May 2011

Calendar

Date Event/Company Notes

Tuesday, 3rd May RBA Cash rate/RBA rate statement

Tuesday, 3rd May ANZ Earnings

Wednesday, 4th May WBC, CCL Earnings/Update

Thursday, 5th May ABS Building approvals, Retail Sales

Thursday, 5th May NAB Earnings

Friday, 6th May USA Unemployment rate

Tuesday, 10th May Commonwealth Bank (CBA) March QTR Trading update

For more up to date information on upcoming events go here.

Glossary of Terms

Term Description

Bullish Biased towards an uptrend in the stock, either trend continuing or a new trend to develop

Bearish Biased towards a downtrend in a stock, or lack of potential for growth, or to add to a short

Long/Short The buying/selling of a security (or derivative thereof) with expectation it will rise/fall in value

Sideways Usually with a bullish/bearish bias, the stock is consolidating and not moving in a medium

term basis, but may move in between a channel of prices through short term trends.

Hold To maintain the position and examine risk management (e.g tighten stops)

Avoid To avoid a position entirely, but not to stop watching for future potential

Resistance An upper price level that a stock or index can trade to, but not exceed.

Support A lower price level that a stock or index can trade down to, but not drop below.

Momentum The rate of change or acceleration of prices, either upwards or downwards.

SUBSCRIBE TO REPORT Via RSS Feed: Trading Day at MacroBusiness

MacroBusiness Trading Day The Prince Page 5

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Assignment No. 3Document4 pagesAssignment No. 3Sherren Marie Nala100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- Audit Engagement LetterDocument3 pagesAudit Engagement LetterMakeup Viral StudiosNo ratings yet

- Schneider Square DDocument17 pagesSchneider Square Dshayamj87No ratings yet

- Financial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument26 pagesFinancial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EMutiara Inas SariNo ratings yet

- Forecasting Business Investment Using The Capital Expenditure SurveyDocument10 pagesForecasting Business Investment Using The Capital Expenditure SurveyChrisBeckerNo ratings yet

- ANZ Commodity Daily 631 250512Document5 pagesANZ Commodity Daily 631 250512ChrisBeckerNo ratings yet

- Er 20120815 Bull Consumer SentimentDocument2 pagesEr 20120815 Bull Consumer SentimentChrisBeckerNo ratings yet

- GNW 1Q12 Australia IPO Announcement FinalDocument3 pagesGNW 1Q12 Australia IPO Announcement FinalChrisBeckerNo ratings yet

- Land Report Media Release Dec 11 QTRDocument2 pagesLand Report Media Release Dec 11 QTRChrisBeckerNo ratings yet

- Economics: Issues: Global Food Price Inflation Risks Rising Again?Document6 pagesEconomics: Issues: Global Food Price Inflation Risks Rising Again?ChrisBeckerNo ratings yet

- Wage Price Index: Chart Pack Updating The Latest Granular Information On Australia WagesDocument36 pagesWage Price Index: Chart Pack Updating The Latest Granular Information On Australia WagesChrisBeckerNo ratings yet

- ANZ Commodity Daily 605 180412Document5 pagesANZ Commodity Daily 605 180412ChrisBeckerNo ratings yet

- 2012m03 Press ReleaseDocument10 pages2012m03 Press ReleaseChrisBeckerNo ratings yet

- ANZ April Rates Review FINAL - ZyxDocument2 pagesANZ April Rates Review FINAL - ZyxChrisBeckerNo ratings yet

- Er 20120418 Bull Leading IndexDocument1 pageEr 20120418 Bull Leading IndexChrisBeckerNo ratings yet

- ANZ Commodity Daily 603 130412Document5 pagesANZ Commodity Daily 603 130412ChrisBeckerNo ratings yet

- Er 20120413 Bull Ausconhsepriceexpt AprDocument2 pagesEr 20120413 Bull Ausconhsepriceexpt AprChrisBeckerNo ratings yet

- Presbe2012 9eDocument2 pagesPresbe2012 9eChrisBeckerNo ratings yet

- Er20120413BullPhat Dragon ADocument1 pageEr20120413BullPhat Dragon AChrisBeckerNo ratings yet

- ANZ Ag Morning Note - 120410Document4 pagesANZ Ag Morning Note - 120410ChrisBeckerNo ratings yet

- June 2011 Annual Superannuation BulletinDocument52 pagesJune 2011 Annual Superannuation BulletinChrisBeckerNo ratings yet

- ANZ Job Ads March 2012Document17 pagesANZ Job Ads March 2012ChrisBeckerNo ratings yet

- Australian Economics Weekly 120330Document17 pagesAustralian Economics Weekly 120330ChrisBeckerNo ratings yet

- 0900 B 8 C 084 Eb 89 e 5Document18 pages0900 B 8 C 084 Eb 89 e 5ChrisBeckerNo ratings yet

- 2012m03 Press ReleaseDocument10 pages2012m03 Press ReleaseChrisBeckerNo ratings yet

- ANZ Rates Strategy Update 30 March 2012Document7 pagesANZ Rates Strategy Update 30 March 2012ChrisBeckerNo ratings yet

- Economics: Update: Australian March PSIDocument4 pagesEconomics: Update: Australian March PSIChrisBeckerNo ratings yet

- ANZ Commodity Daily 600 100412Document8 pagesANZ Commodity Daily 600 100412ChrisBeckerNo ratings yet

- ANZ Commodity Daily 599 050412Document5 pagesANZ Commodity Daily 599 050412ChrisBeckerNo ratings yet

- ANZ Commodity Daily 598 040412Document5 pagesANZ Commodity Daily 598 040412ChrisBeckerNo ratings yet

- March 2012 Manufacturing PMIDocument2 pagesMarch 2012 Manufacturing PMIChrisBeckerNo ratings yet

- ANZ Commodity Daily 597 300312Document5 pagesANZ Commodity Daily 597 300312ChrisBeckerNo ratings yet

- Er 20120330 Bull April RBAMeetingDocument3 pagesEr 20120330 Bull April RBAMeetingChrisBeckerNo ratings yet

- State Economic Update - Mar 2012Document11 pagesState Economic Update - Mar 2012ChrisBeckerNo ratings yet

- Financial Management: Liquidity DecisionsDocument10 pagesFinancial Management: Liquidity Decisionsaryanboxer786No ratings yet

- Mansa-X KES Fact Sheet Q1 2023Document1 pageMansa-X KES Fact Sheet Q1 2023KevinNo ratings yet

- Uniswap V3 Success Surpasses V2 Volume in Under 2 WeeksDocument6 pagesUniswap V3 Success Surpasses V2 Volume in Under 2 WeeksRoaryNo ratings yet

- Working CapitalDocument102 pagesWorking CapitaldasaripandurangaNo ratings yet

- Announcement of Interim Results For The Six Months Ended 30 June 2020Document45 pagesAnnouncement of Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- Development Bank of The Philippines V CA 1998Document2 pagesDevelopment Bank of The Philippines V CA 1998Thea P PorrasNo ratings yet

- California Online E-File Return Authorization For Individuals 8453-OL 2019Document1 pageCalifornia Online E-File Return Authorization For Individuals 8453-OL 2019Alex PanNo ratings yet

- Business Studies SoW 2010-1 (IGCSE Y78)Document40 pagesBusiness Studies SoW 2010-1 (IGCSE Y78)Yenny TigaNo ratings yet

- HBL Schedule of Bank ChargesDocument25 pagesHBL Schedule of Bank ChargesJohn Wick60% (5)

- NCLT Order Appointing IRP (Where The Debtor Breached The Consent Terms in Previous Petition)Document7 pagesNCLT Order Appointing IRP (Where The Debtor Breached The Consent Terms in Previous Petition)anantNo ratings yet

- Applying the Importance Performance Matrix to analyze Singapore's financial clusterDocument29 pagesApplying the Importance Performance Matrix to analyze Singapore's financial clusterAlexNo ratings yet

- Concept of InsuranceDocument4 pagesConcept of InsuranceNazrul HoqueNo ratings yet

- Finance-Careers VVFDocument51 pagesFinance-Careers VVFRay FBNo ratings yet

- Great Group Holdings 2011 Annual ReportDocument92 pagesGreat Group Holdings 2011 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- Compensation Problems With A Global Workforce: Case PresentationDocument13 pagesCompensation Problems With A Global Workforce: Case Presentationthundercoder9288No ratings yet

- JD Analyst RIS 2023-24Document1 pageJD Analyst RIS 2023-24Aishwarya GuptaNo ratings yet

- Understand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsDocument11 pagesUnderstand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsmohihsanNo ratings yet

- Time Value of Money CalculatorDocument22 pagesTime Value of Money CalculatorSuganyaNo ratings yet

- BT Australian Shares Index W: Growth of $10,000Document3 pagesBT Australian Shares Index W: Growth of $10,000Ty ForsythNo ratings yet

- Research On Corporate Social Risponsibility and Access To FinanceDocument35 pagesResearch On Corporate Social Risponsibility and Access To FinanceAlene AmsaluNo ratings yet

- SSRN Id923557 PDFDocument11 pagesSSRN Id923557 PDFMuhammad Ali HaiderNo ratings yet

- Accounts Nitin SirDocument11 pagesAccounts Nitin Sirpuneet.sharma1493No ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument3 pagesFiber Monthly Statement: This Month's SummarySwamy BudumuriNo ratings yet

- Certified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Document10 pagesCertified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Chaiz MineNo ratings yet

- Business FinanceDocument2 pagesBusiness FinancejonaNo ratings yet