Professional Documents

Culture Documents

Final Accounts of A Company

Uploaded by

manoramanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Accounts of A Company

Uploaded by

manoramanCopyright:

Available Formats

Corporate Accounting Unit-3 Final Accounts of a Company:

Final Accounts

Trading & Profit and Loss A/c

Balance sheet

Trading and P&L A/c and Balance sheet are prepared at the end of the year or at end of the part. So it is called Final Account. 1. Trading and Profit and Loss A/c is prepared to find out Profit or Loss. 2. Balance Sheet is prepared to find out financial position a if concern. Revenue account of trading concern is divided into two-part i.e. 1. Trading Account and 2. Profit and Loss Account. (A) Trading account Trading is the basic process of business. Manufacturing companies, for example, buy in raw materials and use them to make products for sale, whereas retail companies buy in finished goods for sale at a higher price; this is the basis of their trade. The trading account for either of these types of business shows how much profit the firm makes by this basic business process, ignoring other expenses the company may incur. It simply looks at how profitably the firm makes goods or processes them for sale to customers. The profit earned by this process is known as the gross profit. Items appearing in the Debit side of Trading Account. 1. Opening Stock: Stock on hand at the commencement of the year or period is termed as the Opening Stock. 2. Purchases: It indicates total purchases both cash and credit made during the year. 3. Purchases Returns or Returns out words: Purchases Returns must be subtracted from the total purchases to get the net purchases. Net purchases will be shown in the trading account. 4. Direct Expenses on Purchases: Some of the Direct Expenses are. i. Wages: It is also known as productive wages or Manufacturing wages. ii. Carriage or Carriage Inwards: iii. Doctroi Duty: Duty paid on goods for bringing them within municipal limits. iv. Customs duty, dock dues, clearing charges, Import duty etc. v. Fuel, Power, Lighting charges related to production.

Rama Mittal Page 1

Corporate Accounting Unit-3 Oil, Grease and Waste. Packing charges: Such expenses are incurred with a view to put the goods in the Saleable Condition. Items appearing on the credit side of Trading Account 1. Sales: Total Sales (Including both cash and credit) made during the year. 2. Sales Returns or Return Inwards: Sales Returns must be subtracted from the Total Sales to get Net sales. 3. Closing stock: Generally, Closing stock does not appear in the Trial Balance. It appears outside the Trial balance. It represents the value of goods at the end of the trading period. (B) Profit and loss account Trading account reveals Gross Profit or Gross Loss. Gross Profit is transferred to credit side of Profit and Loss A/c. Gross Loss is transferred to debit side of the Profit Loss Account. Thus Profit and Loss A/c is commenced. This Profit & Loss A/c reveals Net Profit or Net loss at a given time of accounting year. Items appearing on Debit side of the Profit & Loss A/c The Expenses incurred in a business is divided in too parts. i.e. one is Direct expenses are recorded in trading A/c., and another one is Indirect expenses, which are recorded on the debit side of Profit & Loss A/c. Indirect Expenses are grouped under four heads: 1. Selling Expenses: All expenses relating to sales such as Carriage outwards, travelling Expenses, Advertising etc., 2. Office Expenses: Expenses incurred on running an office such as Office Salaries, Rent, Tax, Postage, Stationery etc., 3. Maintenance Expenses: Maintenance expenses of assets. It includes Repairs and Renewals, Depreciation etc. 4. Financial Expenses: Interest Paid on loan, Discount allowed etc., are few examples for Financial Expenses. Item appearing on Credit side of Profit and Loss A/c Gross Profit is appeared on the credit side of P & L. A/c. Also other gains and incomes of the business are shown on the credit side. Typical of such gains are items such as Interest received, Rent received, Discounts earned, Commission earned. vi. vii.

Rama Mittal

Page 2

Corporate Accounting Unit-3 (C) Balance sheet The Word Balance Sheet is defined as a Statement which sets out the Assets and Liabilities of a business firm and which serves to ascertain the financial position of the same on any particular date. On the left hand side of this statement, the liabilities and capital are shown. On the right hand side, all the assets are shown. Therefore the two sides of the Balance sheet must always be equal. Capital arrives Assets exceeds the liabilities. Objectives of balance sheet: 1. It shows accurate financial position of a firm. 2. It is a gist of various transactions at a given period. 3. It clearly indicates, whether the firm has sufficient assents to repay its liabilities. 4. The accuracy of final accounts is verified by this statement 5. It shows the profit or Loss arrived through Profit & Loss A/c.

Major headings of the assets and liabilities-side of a companys balances sheet as per Schedule VI, Part I. Major headings of Assets side i. ii. iii. iv. v. Fixed Assets Investments Current Assets, Loans and Advances: Current Assets, Loans and Advances Miscellaneous Expenditures Profit & Loss Account (Loss in Business)

Major headings of Liabilities side i. ii. iii. iv. v. Share Capital Reserves and Surplus Secured Loans Unsecured Loans Current Liabilities and Provisions a. Current Liabilities b. Provisions What is contingent liability? A possible future liability, which depends on the happenings of certain uncertain event, is called contingent liability. These liabilities are not shown in the total of liability side, but are shown as a footnote to the balance sheet.

Rama Mittal Page 3

Corporate Accounting Unit-3 The following are some examples of contingent liabilities: i. ii. iii. iv. v. Uncalled liabilities on partly paid shares Liabilities under Guarantee Arrears of dividends on cumulative preference shares Claim against the company now acknowledged as debts Liabilities on Bills Receivable discounted but not matured.

Difference between a trial balance and a balance sheet

Trial Balance

1. It shows the balances of all ledger accounts. 2. It is prepared after the completion of the ledger accounts or arrival of the balances. 3. Its object is to check the arithmetical accuracy. 4. Items shown in the Trial balance are not in order. 5. It shows the opening stock 6. It has the headings, debit and credit.

Balance Sheet

1. It shows the balances of personal and real accounts only. 2. It is prepared after the completion of Trading and P&L A/c. 3.Its object is to reveal the financial position of the business 4. But in the B/S, the items shown must be in order. 5. It shows the closing stock 6.It has the heading of Assets and Liabilities

Example- under what headings will you shows the following items in the balance sheet of a company: i. ii. iii. iv. v. Goodwill Unclaimed Dividends Provision for Tax Share Premium Account Loose Tools

Answer: Items Goodwill Unclaimed Dividend Headings Fixed Assets Current Liabilities and Provisions Sub-headings Current Liabilities

Rama Mittal

Page 4

Corporate Accounting Unit-3 Provision for Tax Current Liabilities and Provisions Provisions Current Assets

Share Premium Reserves and Surplus A/c Loose Tools Current Assets, Loans and Advances

Example- Give the headings under which the following items will be shown in a companys balance sheet as per Schedule VI, Part I: i. ii. iii. iv. v. Sundry Creditors Debentures Sinking Fund Bills Receivable Discount on Issue of Debentures Motor Car

Answer: Items Sundry Creditors Headings Current Liabilities and Provisions Current Asset, Loans and Advances Miscellaneous Expenditures Fixed Assets Sub-headings Current Liabilities Loans and Advances

Debentures Sinking Fund Reserves and Surplus Bills Receivable Discount on Issue of Debentures Motor Car

Example- Give the headings under which any four of the following items will be shown in Companys Balance Sheet. i. ii. iii. iv. v. Debentures Interest accrued on investment Goodwill Preliminary Expenses Bills of Exchange

Answer: Items Debentures

Rama Mittal

Headings Secured Loans

Sub-headings

Page 5

Corporate Accounting Unit-3 Interest accrued on Investment Goodwill Preliminary Expenses Bills of Exchange Current Assets, Loans and Advances Fixed Assets Miscellaneous Expenditures Current Assets, Loans and Advances Current Assets Loans and Advances

Form of Balance Sheet Part 1 to Schedule VI of the Indian Companies Act, 1956 gives the format in which the balance sheet is to be prepared. The schedule gives 2 types of formats, the horizontal format and the vertical format. A company can prepare its balance sheet in either of the 2 formats. In the horizontal format, the liabilities including the share capital are placed on the left side and assets of all types on the right. The main heads in this form are arranged as under: BALANCE SHEET As on. (Horizontal Form)

Liabilities (a) Share Capital (b) Reserves and surplus c) Loans d) Current liabilities & Provisions

Assets (a) Fixed assets (b) Investments c) Current assets, loans and advances (d) Miscellaneous expenditure (e) Profit & Loss Account

Rama Mittal

Page 6

Corporate Accounting Unit-3 Format of balance sheet (in horizontal form) according to the requirements of Schedule VI of the Companies Act 1956. Balance Sheet As onLiabilities (Rs.) (1) Share Capital Authorised Capital: Shares of Rs. each Issued Capital: Equity Shares of Rs. each Preference Share of Rs. each Subscribed Capital: Equity Shares of Rs. each Rs. Called up XXX Preference Share of Rs. each Rs. Called up XXX Less Calls Unpaid XXX (i) By directors XXX (ii) By Others XXX Add Forfeited shares XXX (2) RESERVES AND SURPLUS: 1. Capital Reserve, not available for Dividend 2. Capital Redemption Reserve 3. Share Premium Account 4. Other Reserves specifying the nature of reserve and the amount in respect thereof.Less: Debit balance in Profit & Loss account (if any) Amount (Rs.) Assets (Rs.) (1) FIXED ASSETS: 1. Goodwill XXX 2. Land 3. Building XXX 4. Leaseholds XXX 5. Railway Sidings 6. Plant and Machinery 7. Furniture and Fittings 8. Development of Property 9. Patents, Trade Marks 10. Live Stocks 11. Vehicles etc. XXX (2) INVESTMENTS: (3) CURRENT ASSETS, LOANS AND ADVANCES: XXX (A) Current Assets: XXX 1. Interest accrued on investments XXX 2. Stores and Spare parts XXX 3. Loose Tools XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Amount (Rs.)

Rama Mittal

Page 7

Corporate Accounting Unit-3 5. Surplus, that is balance in Profit and Loss account after providing for proposed allocation 6. Proposed addition to reserves 7. Sinking Funds XXX 4. Stock in trade XXX

XXX 5. Work in progress XXX 6. Sundry Debtors: Less: Provision

XXX

XXX XXX XXX XXX

(3) SECURED LOANS: 1. Debentures 2. Loans and Advances from Banks.

7. (a) Cash balance in hand (b) Bank balance XXX (B) Loans and Advances: XXX 8. (a) Advances and loans to subsidiaries(b) advances and loans to partnership firms in which the Company or any of its subsidiaries is a partner XXX 9. Bills of Exchange XXX 10. Advances recoverable in cash or in kind (e.g. Rates, Taxes, Insurance, etc. prepaid) XXX 11. Balances with customs, Port Trusts, and excise authorities etc. (4) MISCELLANEOUS EXPENDITURE: XXX 1. Preliminary Expenses XXX 2. Expenses, including commission or Brokerage on under writing XXX 3. Discount allowed on the issue of Shares or Debentures

3. Loans and Advances from subsidiaries 4. Other Loans and Advances

XXX XXX

5. Interest accrued and due on secured loans (4) UNSECURED LOANS: 1. Fixed Deposits 2. Loans and Advances from subsidiaries 3. Short Term Loans and Advances a. From Banks b. From Others 4. Other Loans and Advances (From Bank or others) (5) CURRENT LIABILITIES AND PROVISIONS: (A) Current Liabilities:

Rama Mittal

XXX

XXX XXX

XXX

XXX 4. Interest paid out of capital during construction period 5. Development expenditure 6. Other sums (specifying

XXX XXX XXX

Page 8

Corporate Accounting Unit-3 nature) 1. Acceptances XXX 5. PROFIT & LOSS ACCOUNT: (This is shown only when its debit balance count not be written off out of others reserves) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

2. Sundry Creditors 3. Subsidiary Companies 4. Unclaimed Dividends 5. Interest accrued but not due on loans 6. Advance payments and unexpired discounts 7. Other Liabilities (if any) (B) Provisions: 8. Proposed Dividends 9. Provision for Taxation 10. Provision for Provident Fund schemes 11. Provision for insurance, pension and similar staff benefit schemes. 12. Other Provisions Total

Rama Mittal

Page 9

Corporate Accounting Unit-3

In the vertical format, the various heads of liabilities and assets are arranged vertically and current liabilities are shown as deduction, from current assets. Whatever information is required to be given in the horizontal format must also be given in the vertical format. Summarized prescribed vertical form of balance sheet is given below: Format of balance sheet (in vertical form) according to the requirements of Schedule VI of the Companies Act 1956.

BALANCE SHEET As on.

(Vertical Form)

Particulars Am. as on the last Am. as on the last

date of current year date of previousyear I. Sources of Funds (1) Shareholders funds (2) Loan funds Total

II Application of Funds (1) Fixed assets (2) Investments (3) Current assets, loans and advances Less: Current liabilities & provisions (4) (a) Miscellaneous expenditure. (b) Profit & Loss Account Total

Rama Mittal

Page 10

You might also like

- Summary of IAS 12Document4 pagesSummary of IAS 12Shah Rukh N. BashirNo ratings yet

- "Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadDocument17 pages"Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadMuthu KonarNo ratings yet

- Advanced Financial Accounting-Part 2Document4 pagesAdvanced Financial Accounting-Part 2gundapola83% (6)

- Finiii MaDocument311 pagesFiniii MamanishaNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument11 pagesUnit 2: Ledgers: Learning Outcomesviveo23100% (1)

- Lecture 10 - Prospective Analysis - ForecastingDocument15 pagesLecture 10 - Prospective Analysis - ForecastingTrang Bùi Hà100% (1)

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

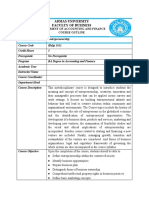

- Admas University Faculty of Business: Department of Accounting and Finance Course OutlineDocument3 pagesAdmas University Faculty of Business: Department of Accounting and Finance Course Outlineeyob astatkeNo ratings yet

- Advanced Corporate Accounting On13april2016 PDFDocument198 pagesAdvanced Corporate Accounting On13april2016 PDFDidier NkonoNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Accounting Level 3 Assessment - Cluster 8Document8 pagesAccounting Level 3 Assessment - Cluster 8Stephen PommellsNo ratings yet

- Final AccountsDocument65 pagesFinal AccountsAmit Mishra100% (1)

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Financial System of BangladeshDocument2 pagesFinancial System of BangladeshFardin Ahmed MugdhoNo ratings yet

- Unit 3Document15 pagesUnit 3TIZITAW MASRESHANo ratings yet

- Bank Credit Management TechniquesDocument35 pagesBank Credit Management TechniquesMuralidharprasad AyaluruNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Branch AccountingDocument7 pagesBranch AccountingAmit KumarNo ratings yet

- Principles of AuditingDocument148 pagesPrinciples of AuditingAsteway MesfinNo ratings yet

- Meaning and Types of Trail BalanceDocument4 pagesMeaning and Types of Trail Balancesujan BhandariNo ratings yet

- BRS, IASB FRMWKDocument4 pagesBRS, IASB FRMWKNadir MuhammadNo ratings yet

- Accounting Basics 17 Pages Master FileDocument21 pagesAccounting Basics 17 Pages Master Filedhabekarsharvari07No ratings yet

- Government and NFP Assignment SolutionDocument5 pagesGovernment and NFP Assignment SolutionHabte DebeleNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Chapter 1 (Cansingnment Account)Document24 pagesChapter 1 (Cansingnment Account)Bravish GowardhanNo ratings yet

- Monthly Reports: Figure 1.1: Revenue/Assistance/Loan Report Me/He 21Document13 pagesMonthly Reports: Figure 1.1: Revenue/Assistance/Loan Report Me/He 21GedionNo ratings yet

- Unit 4Document21 pagesUnit 4Yonas0% (1)

- IAS 12 Income Taxes Study GuideDocument42 pagesIAS 12 Income Taxes Study GuideHaseeb Ullah KhanNo ratings yet

- Accounting exercises on transactionsDocument12 pagesAccounting exercises on transactionsNeelu AggrawalNo ratings yet

- Tally ERP9 FinalDocument357 pagesTally ERP9 FinalPranaykant Singh PanwarNo ratings yet

- Activity-Based Costing and Management Systems Chapter ReviewDocument63 pagesActivity-Based Costing and Management Systems Chapter ReviewVanessa HaliliNo ratings yet

- Practice Exam 1 - With SolutionsDocument36 pagesPractice Exam 1 - With SolutionsMd Shamsul Arif KhanNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- Income Statement CH 4Document6 pagesIncome Statement CH 4Omar Hosny100% (1)

- Indoco Annual Report FY16Document160 pagesIndoco Annual Report FY16Ishaan MittalNo ratings yet

- FINANCIAL ACCOUNTING TESTDocument7 pagesFINANCIAL ACCOUNTING TESTSoumyadip DasNo ratings yet

- Chapter 12 HomeworkDocument4 pagesChapter 12 HomeworkMargareta JatiNo ratings yet

- 2 Sem - Bcom - Advanced Financial AccountingDocument39 pages2 Sem - Bcom - Advanced Financial AccountingpradeepNo ratings yet

- Chap 9 - Prospective Analysis PDFDocument19 pagesChap 9 - Prospective Analysis PDFWindyee TanNo ratings yet

- Chapter 1 - Introduction To Cost & Management AccountingDocument30 pagesChapter 1 - Introduction To Cost & Management AccountingJiajia MoxNo ratings yet

- Match DFD and flowchart segmentsDocument1 pageMatch DFD and flowchart segmentsNguyễn HồngNo ratings yet

- CH 21Document108 pagesCH 21Aizhan AnarkulovaNo ratings yet

- IAS-12 BinderDocument27 pagesIAS-12 Binderzahid awanNo ratings yet

- Lecture 02 Topic 1B Management Accounting Systems (Complete)Document5 pagesLecture 02 Topic 1B Management Accounting Systems (Complete)kitasa swaalihiin100% (1)

- Directors Report: Tanzania Financial Reporting Standard (TFRS) 1Document15 pagesDirectors Report: Tanzania Financial Reporting Standard (TFRS) 1Dafrosa Honor100% (1)

- CH-1 PeachtreeDocument52 pagesCH-1 PeachtreeRACHEL KEDIRNo ratings yet

- Manufacturing AccountsDocument21 pagesManufacturing AccountsVainess S Zulu100% (1)

- Investment & Portfolio MGT AssignmentDocument2 pagesInvestment & Portfolio MGT AssignmentAgidew ShewalemiNo ratings yet

- Bank Reconciliation Statement (BRS) Questions PDFDocument11 pagesBank Reconciliation Statement (BRS) Questions PDFAjitesh anandNo ratings yet

- Journalizing, Posting and BalancingDocument21 pagesJournalizing, Posting and Balancinganuradha100% (1)

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- CSE Commerce and Accountancy Syllabus - 2015-2016 - UPSCsyllabusDocument4 pagesCSE Commerce and Accountancy Syllabus - 2015-2016 - UPSCsyllabusankit sinhaNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument29 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.No ratings yet

- IFRS 2 Share Based PaymentsDocument14 pagesIFRS 2 Share Based Paymentsniichauhan100% (1)

- CH 1 Cost Volume Profit Analysis Absorption CostingDocument21 pagesCH 1 Cost Volume Profit Analysis Absorption CostingNigussie BerhanuNo ratings yet

- Financial Accounting Quiz - Accounting CoachDocument3 pagesFinancial Accounting Quiz - Accounting CoachSudip BhattacharyaNo ratings yet

- Int'l Business Finance CourseDocument2 pagesInt'l Business Finance CourseSeifu BekeleNo ratings yet

- Types of Accounts and Rules of Debit & CreditDocument10 pagesTypes of Accounts and Rules of Debit & Creditعرفان لطیفNo ratings yet

- Final Accounts of A CompanyDocument10 pagesFinal Accounts of A CompanyAdityaNo ratings yet

- 14 - Financial Statement - I (175 KB) PDFDocument21 pages14 - Financial Statement - I (175 KB) PDFramneekdadwalNo ratings yet

- Contract of Sale of GoodsDocument1 pageContract of Sale of GoodsmanoramanNo ratings yet

- Planning Process (BMC)Document4 pagesPlanning Process (BMC)manoramanNo ratings yet

- ConsumerDocument17 pagesConsumermanoramanNo ratings yet

- MBODocument3 pagesMBOmanoramanNo ratings yet

- Capital Adequacy RatioDocument2 pagesCapital Adequacy RatiomanoramanNo ratings yet

- Competition Commission India Act 2002Document90 pagesCompetition Commission India Act 2002Muninder Pal SinghNo ratings yet

- GKDocument12 pagesGKmanoramanNo ratings yet

- Case Study of BE AnalysisDocument4 pagesCase Study of BE AnalysismanoramanNo ratings yet

- Chale NgesDocument2 pagesChale NgesmanoramanNo ratings yet

- MergerDocument15 pagesMergernkhljainNo ratings yet

- Current Affairs Multiple Choice QuestionsDocument24 pagesCurrent Affairs Multiple Choice QuestionsmanoramanNo ratings yet

- UCRECpres 1Document42 pagesUCRECpres 1manoramanNo ratings yet

- Employee Stock Ownership PlansDocument3 pagesEmployee Stock Ownership PlansmanoramanNo ratings yet

- Data MiningDocument11 pagesData MiningmanoramanNo ratings yet

- InsuranceDocument8 pagesInsurancemanoramanNo ratings yet

- Technology TransferDocument21 pagesTechnology TransfermanoramanNo ratings yet

- Knowledge Discovery in DatabasesDocument6 pagesKnowledge Discovery in DatabasesmanoramanNo ratings yet

- MergersDocument4 pagesMergersmanoramanNo ratings yet

- International Finance Corporation Final 2Document33 pagesInternational Finance Corporation Final 2manoramanNo ratings yet

- Leveraged BuyoutDocument8 pagesLeveraged Buyoutmanoraman0% (1)

- Capital MarketDocument12 pagesCapital MarketmanoramanNo ratings yet

- Free Trade ZoneDocument3 pagesFree Trade ZonemanoramanNo ratings yet

- WarehousingDocument15 pagesWarehousingmanoramanNo ratings yet

- ECGCDocument25 pagesECGCmanoramanNo ratings yet

- Fdi & FiiDocument12 pagesFdi & FiimanoramanNo ratings yet

- Trading Insider FinalDocument33 pagesTrading Insider FinalmanoramanNo ratings yet

- Fdi & FiiDocument12 pagesFdi & FiimanoramanNo ratings yet

- Exchange Rate of Rupee1Document10 pagesExchange Rate of Rupee1manoramanNo ratings yet

- ECGCDocument25 pagesECGCmanoramanNo ratings yet

- Sreeja.T: SR Hadoop DeveloperDocument7 pagesSreeja.T: SR Hadoop DeveloperAnonymous Kf8Nw5TmzGNo ratings yet

- Stare DecisisDocument7 pagesStare DecisisBirolal Jamatia100% (1)

- Training MatrixDocument4 pagesTraining MatrixJennyfer Banez Nipales100% (1)

- Eaton: Medium Duty Piston PumpDocument25 pagesEaton: Medium Duty Piston PumprazvanNo ratings yet

- Cybersecurity Case 4Document1 pageCybersecurity Case 4Gaurav KumarNo ratings yet

- CJ718 Board Functional Test ProcedureDocument13 pagesCJ718 Board Functional Test ProcedureYudistira MarsyaNo ratings yet

- Safety Data Sheet for Anionic Polymer LiquidDocument6 pagesSafety Data Sheet for Anionic Polymer LiquidZi Wei LeongNo ratings yet

- Antipsychotic DrugsDocument23 pagesAntipsychotic DrugsASHLEY DAWN BUENAFENo ratings yet

- Krautkramer USN 58R: The Ultrasonic Instrument For The Workshop, Even For Automated InspectionsDocument1 pageKrautkramer USN 58R: The Ultrasonic Instrument For The Workshop, Even For Automated InspectionsAli MohsinNo ratings yet

- OBURE Understanding How Reits Market WorksDocument3 pagesOBURE Understanding How Reits Market WorksJohn evansNo ratings yet

- Ans: DDocument10 pagesAns: DVishal FernandesNo ratings yet

- Hand Sanitizer Solution: Sanipure: "Safe, Effective, Innovative"Document19 pagesHand Sanitizer Solution: Sanipure: "Safe, Effective, Innovative"Daniel Mariano LeãoNo ratings yet

- Material Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationDocument4 pagesMaterial Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationPecel LeleNo ratings yet

- 72-76 kW 310SK/310SK TC Compact Track Loader SpecsDocument10 pages72-76 kW 310SK/310SK TC Compact Track Loader SpecsPerrote Caruso PerritoNo ratings yet

- A Tidy GhostDocument13 pagesA Tidy Ghost12345aliNo ratings yet

- Kantian vs Utilitarian Ethics in BusinessDocument2 pagesKantian vs Utilitarian Ethics in BusinessChris Connors67% (3)

- BAMBUDocument401 pagesBAMBUputulNo ratings yet

- Deckers v. Comfy - Minute OrderDocument2 pagesDeckers v. Comfy - Minute OrderSarah BursteinNo ratings yet

- Political Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationDocument9 pagesPolitical Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationFeline Joy SarinopiaNo ratings yet

- Wind Energy Potential in BangladeshDocument10 pagesWind Energy Potential in BangladeshAJER JOURNALNo ratings yet

- Manual LubDocument25 pagesManual LubMota Guine InformaçõesNo ratings yet

- CSCI369 Lab 2Document3 pagesCSCI369 Lab 2Joe Ong ZuokaiNo ratings yet

- Effects of Job Evaluation On Workers' Productivity: A Study of Ohaukwu Local Government Area, Ebonyi State, NigeriaDocument6 pagesEffects of Job Evaluation On Workers' Productivity: A Study of Ohaukwu Local Government Area, Ebonyi State, Nigeriafrank kipkoechNo ratings yet

- Circumferential CrackingDocument6 pagesCircumferential CrackingMagdykamelwilliamNo ratings yet

- Brightspot Training ManualDocument97 pagesBrightspot Training ManualWCPO 9 NewsNo ratings yet

- Grasshopper VB Scripting Primer IntroductionDocument28 pagesGrasshopper VB Scripting Primer Introductionfagus67No ratings yet

- Dleg0170 Manual PDFDocument20 pagesDleg0170 Manual PDFEmmanuel Lucas TrobbianiNo ratings yet

- Manual Aeroccino 3Document30 pagesManual Aeroccino 3UltrabetoNo ratings yet

- Literature Review Economics SampleDocument8 pagesLiterature Review Economics Sampleafmzynegjunqfk100% (1)

- Cepej Report 2020-22 e WebDocument164 pagesCepej Report 2020-22 e WebGjorgji AndonovNo ratings yet