Professional Documents

Culture Documents

Equity Research Methodology: Morningstar Research Report October

Uploaded by

mitin1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Research Methodology: Morningstar Research Report October

Uploaded by

mitin1Copyright:

Available Formats

Equity Research Methodology

Morningstar Research Report October

Morningstar, Inc. All rights reserved. The information in this document is the property of Morningstar, Inc. Reproduction or transcription by any means, in whole or in part, without the prior written consent of Morningstar, Inc., is prohibited.

When we launched the Morningstar Rating for stocks in August 2001, we set out to help investors answer the most difficult question in stock investing: Is a company worth the price that the market asks for its shares? The Morningstar Rating for stocks identies stocks trading at a discount or premium to their intrinsic worth or fair value, in Morningstars terminology. Five-star stocks are trading at the most attractive prices relative to their fair values, whereas 1-star stocks are trading at premiums to fair value. There are three key components to the Morningstar Rating for stocks: our analysts estimate of the stocks fair value, our assessment of the rms business risk, and the stocks current market price. Our fair value estimates are based on our projection of a companys future cash ows and our estimate of the appropriate discount rate to apply to those cash ows. Our analysts follow their companies daily, and if their inputs change, we update our assessment of their stocks fair values. Once we determine the fair value of a stock, we then compare it to the stocks current market price. Here we take the business risk of the company into account. In other words, the riskier the company, the more undervalued it has to be to earn a 5-star buy rating. There are no predened distributions of starsthat is, the percentage of stocks earning 5 stars can uctuate dailyso the star ratings can also be used as a general gauge of the broader markets valuation. When there are many 5-star stocks, the stock market as a whole is more undervalued than when very few companies garner our highest stock star rating. Determining Fair Value Our analysts use a standardized, proprietary valuation model to assign fair values. Our model has three distinct periods: the rst ve years, year six to perpetuity, and perpetuity. By summing the discounted free cash ows from each period, we arrive at an enterprise value for the rm. Then, by subtracting debt and adjusting for any off-balance-sheet assets or liabilities, we arrive at a fair value of the common stock. The model's key features consist of the following: First Stage Our analysts make detailed forecasts of each company's performance over the next ve years, including revenue growth, prot margins, tax rates, changes in working-capital accounts, and capital spending. This veyear period is the rst stage of our model. Second Stage The length of the second stage depends on the strength of the company's economic moat. Economic moat is a term used by Warren Buffett to describe the predictability and sustainability of a company's future prots. The competitive forces in a free-market economy will tend to chip away at above-average returns on invested capital (ROICs). If a company earns a high ROIC, it attracts competitors, which then capture a portion of those excess returns. Only companies with wide economic moatssomething inherent in their businesses that competitors cannot replicatecan hope to keep these competitive forces at bay for a prolonged period. We dene the second stage of our model as the period it will take for the companys marginal ROICthe return on capital for the last dollar investedto decline (or rise) to its cost of capital. We forecast this period to be anywhere from ve years (for companies with no economic moat) to 20 years (for wide-moat companies). During this period, we forecast cash ows using three assumptions: an investment rate in year ve,

incremental ROIC in year six, and years to perpetuity. The investment rate and marginal ROIC will decline smoothly until the perpetuity year. In the case of rms not earning their cost of capital, we assume marginal ROICs rise to the rm's cost of capital, and we may truncate the second model period. Perpetuity Finally, once a companys marginal ROICs hit its cost of capital, we assume it remains in this perpetuity state forever. At perpetuity, the return on new investment is set equal to the rms weighted average cost of capital (WACC), which is our discount rate minus ination. At this point we believe the rm will no longer be able to earn a prot greater or less than its cost of capital. The company could be generating signicant free cash owthe more free cash ow, the higher the fair valuebut any additional capital invested in the business adds no value. Thus, our fair value for a stock is the sum of the cash ows from years 1-5, the cash ows during the interim period, and the perpetuity value, all discounted to present value using the WACC. For nancial companies such as banks, insurance rms, and REITs, we use different valuation models. The guiding principles are the same, but the calculations are different. Discount Rates In deciding the rate to discount future cash ows, we ignore stock-price volatility (which drives most estimates of beta) because we welcome volatility if it offers opportunities to buy a stock at a discount to its fair value. Instead, we focus on the fundamental risks facing a company's business. Ideally, we'd like our discount rates to reect the risk of permanent capital loss to the investor. When assigning a cost of equity to a stock, our analysts score a company in the following areas: Financial leverage Cyclicality Size Free cash ows The lower the debt, the better. The less cyclical the rm, the better. We penalize very small rms. The higher as a percentage of sales and the more sustainable, the better.

We set the minimum cost of equity at 8.0%, which corresponds to a risk-free rate of 5.5% (the 10-year rolling average yield on the 10-year Treasury Note) and an equity-risk premium of 2.5%. Based on each company's score on the fundamental risk factors outlined above, we assign it a higher cost of equity. As of September 2004, our cost of equity for domestic, non-nancial companies ranged from 8% to 16%, with the median at 11%. Because we are valuing the cash ows to both equity and debt holders, we use the weighted average cost of capital (WACC) for our discount rate. For the cost of debt, we typically use the higher of a) current yields on the rms outstanding bonds; and b) our estimate of the company's marginal cost to borrow. Hidden Assets/Liabilities: Options, Pensions, Etc. In arriving at our fair value estimate, we also add back any hidden assets and subtract out hidden liabilities. Hidden assets might include real estate that's undervalued on the rm's books. Hidden liabilities mainly include underfunded pension obligations and the cost of stock-option grants. We believe that employee stock options represent a real cost to existing shareholders and must be deducted from fair value.

The Morningstar Rating for Stocks In addition to a fair value estimate, we also incorporate a risk rating when assigning a star rating to a stock. Our analysts assign stocks to one of four "business risk" groupingsbelow average, average, above average, and speculativeby scoring each rm on two factors. Economic moat Event risk Our measure of a companys competitive strength and the predictability of its free cash ows. Our assessment of how vulnerable the rm is to shocks with outcomes that are difficult to incorporate into our cash ow forecasts, such as litigation, single-product risk, regulatory changes, etc.

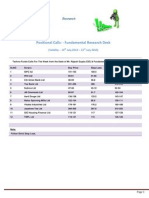

For example, if a company has a wide economic moat and low event risk, it falls in the "below average" business risk group. Likewise, a company with no moat and high event risk falls in the "above average" group. The table below shows, for each risk group, the expected three-year annualized returns that we associate with each star rating. Notice that for riskier stocks, we expect a higher three-year return than for less-risky stocks. These are the returns we expect from each risk group on averagenot necessarily for each individual stock within each group. When we ascertain a signicant risk of permanent capital loss to the investor, or when scenario analysis results in a wide distribution of outcomes, we assign the speculative rating.

3-Year Annualized Expected Returns Business Risk 5 stars 4 stars Below Average >15.5% 14.25% Average >20.5% 17.75% Above Average >30.5% 24.25% Speculative >40.5% 35.25%

3 stars 9.5% 10.5% 12.5% 18.5%

2 stars 3.0% 4.25% 6.25% 6.25%

1 star <0.0% <2.5% <5.5% <5.5%

To calculate these expected returns, we started by centering a three-star rating around the average cost of equity for rms within each risk group. Currently those averages are about 9.5% for the below-average group, 10.5% for the average-risk group, and 12.5% for the above-average-risk group. If a stock trades near our fair value estimate, the stock's future return will, by denition, closely match its cost of equity (assuming our fair value estimate is correct). In other words, the stock will offer a return that compensates investors for the risk of owning the stock. We dene this "fair return" as 3 stars and build out from there. We set the maximum expected return for a 1-star stock at 5.5%, which is our risk-free rate. We feel this is a common-sense way to dene our 1-star band: We don't think investors will likely even earn the risk-free rate if they invest in 1-star stocks. Thus, they will not be compensated for the risks inherent in owning equities.

For example, suppose a stock with above-average business risk trades for $20, and we think its fair value is $35. To calculate the three-year expected return, we rst estimate what the fair value will be in three years. We dene the future fair value as: Future Fair Value = Current Fair Value * (1 + Average Cost of Equity) ^ 3 In our example, this would be $35 * (1.125 ^ 3), or $49.83. We then assume that the stock will migrate to this fair value over the three-year period. We can then solve the following equation for the expected annualized return: Current Stock Price * (1 + expected return) ^ 3 = Future Fair Value Plugging in the current stock price of $20 and the future fair value of $49.83 gives us an expected three-year annualized return of 36%. Glancing at the table above, this return is high enough to qualify for 5 stars. We update our star ratings daily, based on the closing price of each stock. The star rating can change because the analyst changes the fair value or the business risk of the stock, or because the price of the stock changes. Our rating is unique in that a sudden price change immediately triggers a rating change. (If the analyst needs time to incorporate new information into the valuation model, we put the rating "under review" until the new fair value is published.) In order to reduce the number of rating changes due to small uctuations in the stock price, we have a small buffer around the cutoffs between any two ratings. The buffer prevents the rating from ip-opping back and forth between adjacent star ratings based simply on very small uctuations in the price.

You might also like

- MorningStar Valuation MethodDocument4 pagesMorningStar Valuation MethodIN Home INNo ratings yet

- Investment and Performance ManagementDocument19 pagesInvestment and Performance ManagementBhagvanji HathiyaniNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- 06 Cost of CapitalDocument13 pages06 Cost of Capitallawrence.dururuNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Margin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikDocument12 pagesMargin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikmusiboyinaNo ratings yet

- WACC Computation: Is The Cost of Equity, KDocument4 pagesWACC Computation: Is The Cost of Equity, Kderek_lee_34No ratings yet

- Liquidation Value: Term Yr Average Life of AssetsDocument5 pagesLiquidation Value: Term Yr Average Life of Assetsdeepbhatt07No ratings yet

- Cost of Capital 1Document7 pagesCost of Capital 1Tinatini BakashviliNo ratings yet

- Group 3Document54 pagesGroup 3SXCEcon PostGrad 2021-23No ratings yet

- Estimating Hurdle Rate For FirmsDocument95 pagesEstimating Hurdle Rate For FirmsFarzad TouhidNo ratings yet

- Revenue Approach: Price To Sales (P/S)Document9 pagesRevenue Approach: Price To Sales (P/S)HariNo ratings yet

- An Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsFrom EverandAn Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsNo ratings yet

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingFrom EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingNo ratings yet

- Investment SocietyDocument28 pagesInvestment SocietyFidias IeridesNo ratings yet

- Cfa Prepare Part 4Document12 pagesCfa Prepare Part 4Роберт МкртчянNo ratings yet

- Risk and Rates of ReturnDocument9 pagesRisk and Rates of ReturnMecyZ.GomezNo ratings yet

- Steps For Fundamental AnalysisDocument7 pagesSteps For Fundamental AnalysisRaghav SagarNo ratings yet

- Risk Quantification - ERMDocument20 pagesRisk Quantification - ERMSeth ValdezNo ratings yet

- Name of Project Names of Participants References IndexDocument8 pagesName of Project Names of Participants References IndexChirag JaniNo ratings yet

- Corporate ValuationDocument23 pagesCorporate ValuationRakesh GuptaNo ratings yet

- Why CAGR Is Often BetterDocument17 pagesWhy CAGR Is Often BetterPrince AdyNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Estimating Hurdle Rates I: Defining & Measuring RiskDocument12 pagesEstimating Hurdle Rates I: Defining & Measuring RiskAnshik BansalNo ratings yet

- Price Earning (P/E) RatioDocument8 pagesPrice Earning (P/E) RatioKapilNo ratings yet

- C11 An Introduction To Security ValuationDocument37 pagesC11 An Introduction To Security Valuationharisali55No ratings yet

- Cost of CapitalDocument36 pagesCost of CapitalMonica YaduvanshiNo ratings yet

- Equity AnalysisDocument6 pagesEquity AnalysisVarsha Sukhramani100% (1)

- Discounting Cash FlowDocument9 pagesDiscounting Cash FlowBhavinRamaniNo ratings yet

- Where Do You See This?: What Does Leverage Mean?Document6 pagesWhere Do You See This?: What Does Leverage Mean?abhijeet1828No ratings yet

- Smart Task 1 Vardhan ConsultingDocument10 pagesSmart Task 1 Vardhan Consulting2K19/PS/053 SHIVAMNo ratings yet

- Debt To Equity RatioDocument10 pagesDebt To Equity Ratio\sharmaNo ratings yet

- Chapter 6Document53 pagesChapter 6Naeemullah baigNo ratings yet

- Types Financial RatiosDocument8 pagesTypes Financial RatiosRohit Chaudhari100% (1)

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDocument5 pagesDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNo ratings yet

- Intelligent Investing ChecklistDocument136 pagesIntelligent Investing Checklistamaresh gautamNo ratings yet

- Handout For 7.8 FinmanDocument7 pagesHandout For 7.8 FinmanRed VelvetNo ratings yet

- Fundamental Analysis On Macquarie EdgeDocument5 pagesFundamental Analysis On Macquarie EdgeSanthosh MathewNo ratings yet

- How Do You Value A Company?Document3 pagesHow Do You Value A Company?Sumit DaniNo ratings yet

- Pick Six Stocks: Team 077Document19 pagesPick Six Stocks: Team 077Anshuman MoghaNo ratings yet

- 2009 ACE Limited Annual ReportDocument259 pages2009 ACE Limited Annual ReportACELitigationWatchNo ratings yet

- Sandhani Life UF GrowthDocument12 pagesSandhani Life UF Growthnahid250No ratings yet

- Afs RatioDocument25 pagesAfs Ratioansarimdfarhan100% (1)

- Valuation Gordon Growth ModelDocument25 pagesValuation Gordon Growth ModelwaldyraeNo ratings yet

- Ratio Analysis of Life Insurance - IBADocument116 pagesRatio Analysis of Life Insurance - IBANusrat Saragin NovaNo ratings yet

- Module Iv Capital Structure÷nd DecisionsDocument37 pagesModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNo ratings yet

- Fin622 Solved Mcqs For Exam PreparationDocument9 pagesFin622 Solved Mcqs For Exam PreparationLareb ShaikhNo ratings yet

- Finance QuestionsDocument16 pagesFinance QuestionsRUTHVIK NETHANo ratings yet

- Investment BrokerageDocument4 pagesInvestment BrokerageFileSharingNo ratings yet

- Theoretical PerspectiveDocument12 pagesTheoretical PerspectivepopliyogeshanilNo ratings yet

- 6 Basic Financial Ratios and What They RevealDocument6 pages6 Basic Financial Ratios and What They RevealtthorgalNo ratings yet

- Required Rate of ReturnDocument4 pagesRequired Rate of ReturnGladys Shen AgujaNo ratings yet

- Task 3 - Investment AppraisalDocument12 pagesTask 3 - Investment AppraisalYashmi BhanderiNo ratings yet

- 4-Limitations of Valuation Models PDFDocument41 pages4-Limitations of Valuation Models PDFFlovgrNo ratings yet

- The Altman Z ScoreDocument2 pagesThe Altman Z ScoreNidhi PopliNo ratings yet

- Bav TheoryDocument8 pagesBav TheoryPratik KhetanNo ratings yet

- On Buy Back Shares - NikhilDocument8 pagesOn Buy Back Shares - Nikhilnikhilgirhepunje100% (3)

- BUS328 TM 2015 Tutorial QuestionsDocument16 pagesBUS328 TM 2015 Tutorial Questionsjacklee19180% (1)

- Test BankDocument14 pagesTest BankJi YuNo ratings yet

- Curefoods Board CTC Allotment of CCPS PDFDocument18 pagesCurefoods Board CTC Allotment of CCPS PDFAbhishekShubhamGabrielNo ratings yet

- A Money-Making Machine: Partnership Net AssetsDocument2 pagesA Money-Making Machine: Partnership Net AssetsRoberto TanakaNo ratings yet

- Itc LTD - Ratio Analysis: By: Isham, Sai Rohit, Rahul and DeepeshDocument45 pagesItc LTD - Ratio Analysis: By: Isham, Sai Rohit, Rahul and DeepeshPranay KolarkarNo ratings yet

- CCMDocument3 pagesCCMSahiba MaingiNo ratings yet

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaNo ratings yet

- Dividend Policy: Kiran ThapaDocument21 pagesDividend Policy: Kiran ThapaRajesh ShresthaNo ratings yet

- 3017 Tutorial 2 SolutionsDocument2 pages3017 Tutorial 2 SolutionsNguyễn Hải100% (1)

- Equity Bank - Information Memorandum FinalDocument100 pagesEquity Bank - Information Memorandum FinalsurambayaNo ratings yet

- Agency Issues in AppleDocument5 pagesAgency Issues in AppleKhai EmanNo ratings yet

- Structuring Employee OwnershipDocument36 pagesStructuring Employee OwnershipJared HemingNo ratings yet

- The Influence of Managerial Ability On Future Performance: Journal of Economics, Business, and Government ChallengesDocument7 pagesThe Influence of Managerial Ability On Future Performance: Journal of Economics, Business, and Government ChallengesKevinNo ratings yet

- Balance Sheet of A BankDocument2 pagesBalance Sheet of A BankVinod GandhiNo ratings yet

- Case 11Document1 pageCase 11Angelica Jolie P BarbonNo ratings yet

- Greaves CottonDocument12 pagesGreaves CottonRevathy MenonNo ratings yet

- Usefulness of The Financial Information To Both Internal and ExternalDocument3 pagesUsefulness of The Financial Information To Both Internal and Externalgerry henryNo ratings yet

- Investments: Financial AccountingDocument12 pagesInvestments: Financial AccountingCamille MoralesNo ratings yet

- Company Law: Surendra Rao Erme Nazirah Mohd Matrudin (ZP00917) Mohd Lutfi Iskandar Amir BashahDocument19 pagesCompany Law: Surendra Rao Erme Nazirah Mohd Matrudin (ZP00917) Mohd Lutfi Iskandar Amir BashahSurendra RaoNo ratings yet

- Financial Statements Analysis of Companies (Non-Financial) Listed at Karachi Stock Exchange 2010-2015Document29 pagesFinancial Statements Analysis of Companies (Non-Financial) Listed at Karachi Stock Exchange 2010-2015Nazish HussainNo ratings yet

- Memorandum - Foreign Equity Restriction - PCABDocument3 pagesMemorandum - Foreign Equity Restriction - PCABGerardo J. Diaz, Jr.No ratings yet

- AAII StockInvestingStrategiesEBookDocument114 pagesAAII StockInvestingStrategiesEBookThomas SkowronskiNo ratings yet

- HW2 ch12bDocument10 pagesHW2 ch12bBAurNo ratings yet

- (Hamid) Case Study - The Study of Relationship Between Intellectual Capital and Its Growth Rate With Earning Management (In Accepted Companies in Tehran Stock Exchange) - ProQuestDocument1 page(Hamid) Case Study - The Study of Relationship Between Intellectual Capital and Its Growth Rate With Earning Management (In Accepted Companies in Tehran Stock Exchange) - ProQuesthemi fradillaNo ratings yet

- Corpo Law Review (Codal and Notes From Aquino) by Ruth Cepe - 1Document48 pagesCorpo Law Review (Codal and Notes From Aquino) by Ruth Cepe - 1Ruth CepeNo ratings yet

- She 110Document24 pagesShe 110You're WelcomeNo ratings yet

- World's Top Leading Public Companies ListDocument20 pagesWorld's Top Leading Public Companies ListbharatNo ratings yet

- Conso FS at The Date of AcquisitionDocument3 pagesConso FS at The Date of Acquisitionguliramsam5No ratings yet

- Weekly Techno-Funda CallsDocument2 pagesWeekly Techno-Funda CallsaltuwaijriNo ratings yet