Professional Documents

Culture Documents

2009 B-2 Lecture

Uploaded by

Sachin DuaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2009 B-2 Lecture

Uploaded by

Sachin DuaCopyright:

Available Formats

Business Environment & Concepts 2

1. 2. 3. 4. 5. 6. 7. 8. 9.

Business cycles and reasons for business fluctuations ......................................................... 3 Economic measures and reasons for changes in the economy ............................................ 14 Market influences on business strategies......................................................................... 28 Implications of dealing in foreign currencies .................................................................... 67 Appendix I: Homework reading...................................................................................... 80 Appendix II: Homework reading .................................................................................... 84 Appendix III: Homework reading ................................................................................... 88 Terminology ............................................................................................................... 97 Class questions ........................................................................................................... 99

Business Environment & Concepts 2

B2-2

Becker CPA Review

Business Environment & Concepts 2

BUSINESS CYCLES AND REASONS FOR BUSINESS FLUCTUATIONS I. BUSINESS CYCLES A. INTRODUCTION Business cycles refer to the rise and fall of economic activity relative to its long-term growth trend (i.e., the swings in total national output, income, and employment over time). Although the economy tends to grow over time, the growth in economic activity is not stable. Rather, economic activity is characterized by fluctuations, and these fluctuations are known as business cycles. Business cycles vary in duration and severity. Some cycles are quite mild. Others are characterized by large increases in unemployment and/or inflation. The analysis of business cycles is part of the field of macroeconomics. Macroeconomics is the study of the economy as a whole. It examines the determinants of national income, unemployment, and inflation and how monetary and fiscal policies affect economic activity. On the other hand, microeconomics studies consumers, producers, and suppliers operating in a narrowly defined market. B. MEASURING ECONOMIC ACTIVITY: GROSS DOMESTIC PRODUCT Because business cycles refer to the rise and fall of economic activity, it is important to first examine how economic activity is measured. The most common measure of the economic activity or output of an economy is Gross Domestic Product (GDP). GDP is the total market value of all final goods and services (the term "final goods and services" excludes used goods that have been resold) produced within the borders of a nation in a particular time period (i.e., the nation's output of goods and services). Note that GDP includes all final goods and services produced by resources within a country regardless of who owns the resources. Thus, U.S. GDP includes the output of foreign-owned factories in the U.S. but excludes the output of U.S.-owned factories operating abroad. C. NOMINAL VERSUS REAL GDP 1. Nominal GDP Nominal GDP (unadjusted) measures the value of all final goods and services in prices prevailing at the time of production. That is, nominal GDP measures the value of all final goods and services in current prices. 2. Real GDP a. Definition Real GDP (adjusted) measures the value of all final goods and services in constant prices. That is, real GDP is adjusted to account for changes in the price level (i.e., it removes the effects of inflation by using a price index). Real GDP is the most commonly used measure of economic activity and national output (i.e. the total output of an economy). b. Price Index (GDP Deflator) The price index used to calculate real GDP is called the GDP Deflator. It is a price index for all goods and services included in GDP. Using the GDP deflator, real GDP is calculated as the ratio of nominal GDP to the GDP deflator times 100.

Real GDP = Nominal GDP 100 GDP Deflator

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-3

Business Environment & Concepts 2

Becker CPA Review

D.

REAL GDP PER CAPITA AND ECONOMIC GROWTH Real Per Capita GDP (Real GDP per Capita) is real GDP divided by population. Real GDP per capita is typically used to compare standards of living across countries or across time. Real GDP per capita is also used to measure economic growth. Economic growth is the increase in real GDP per capita over time.

E.

SUMMARY COMPOSITION OF BUSINESS CYCLES As noted above, economic activity is characterized by fluctuations, and these fluctuations are known as business cycles. Business cycles are typically comprised of: 1. Expansionary Phase An expansionary phase is characterized by rising economic activity (real GDP) and growth. During an expansionary phase, economic activity is rising above its long-term growth trend. Firm profits are likely to be rising during an expansionary phase as the demand for goods and services increases. Firms are also likely to increase the size of their workforce during an expansion, and the price of goods and services is likely to be rising. 2. Peak A peak is a high point of economic activity. It marks the end of an expansionary phase and the beginning of a contractionary phase in economic activity. At the peak of a business cycle, firm profits are likely to be at their highest level. Firms are also likely to face capacity constraints and input shortages (raw material and labor), leading to higher costs and a higher overall price level. 3. Contractionary Phase A contractionary phase is characterized by falling economic activity and growth and follows a peak. During a contractionary phase, firm profits are likely to be falling from their highest levels. 4. Trough A trough is a low point of economic activity. At this point of the business cycle, firm profits are likely to be at their lowest level. Firms are also likely to experience significant excess production capacity, leading them to reduce the size of their workforce and cut costs. 5. Recovery Phase A recovery phase follows a trough. During a recovery phase, economic activity begins to increase and return to its long-term growth trend. Further, firm profits typically begin to stabilize as the demand for goods and services begins to rise.

B2-4

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

II.

TERMINOLOGY USED IN DESCRIBING BUSINESS CYCLES A. RECESSION A recession occurs when the economy experiences negative real economic growth (declines in national output). Economists define a recession as two consecutive quarters of falling national output. During a recession, firm profits tend to fall and many firms incur losses. Firms are also likely to have excess capacity. As a result, during a recession, resources (including labor) are likely to be underutilized and unemployment is likely to be high. B. DEPRESSION A depression is a very severe recession. It is characterized by a relatively long period of stagnation in business activity and high unemployment rates. As a result, firms will experience significant excess capacity. Furthermore, due to the significant reduction in the demand for goods and services, it is likely that many firms will go out of business during a depression. C. ILLUSTRATION Graph A illustrates the business cycle.

Graph A Output (Real GDP) Contractionary Phase Peak

Long-term growth trend in national output

Expansionary Phase Peak

Recovery Phase Trough Trough

Time (Years)

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-5

Business Environment & Concepts 2

Becker CPA Review

III.

ECONOMIC INDICATORS Although business cycles tend to be irregular and unpredictable, economists nevertheless attempt to predict business cycles and their severity and duration using economic indicators. Economic indicators (gathered by The Conference Board) are variables that have historically correlated highly with economic activity. They can be "leading indicators," "lagging indicators," or "coincident indicators." A. LEADING INDICATORS Leading indicators tend to predict economic activity. The government routinely revises the numbers as more data becomes available. Thus, leading indicators are subject to change. They include: 1. 2. 3. 4. 5. 6. 7. 8. B. Average new unemployment claims Building permits for residences Average length of the workweek Money supply Prices of selected stocks Orders for goods Price changes of materials Index of consumer expectations

LAGGING INDICATORS Lagging indicators tend to follow economic activity. They give signals after the fact and include the following: 1. 2. 3. Prime rate charged by banks Average duration of unemployment Bank loans outstanding

C.

COINCIDENT INDICATORS Coincident indicators tend to occur coincident to economic activity. They include the following: 1. 2. Industrial production Manufacturing and trade sales

IV.

REASONS FOR FLUCTUATIONS While there are a variety of theories regarding the cause of business cycles, economists generally agree that business cycles result from shifts in aggregate demand and/or aggregate supply. Aggregate demand and aggregate supply curves can be used to illustrate the relationship between a country's output (real GDP) and price level (the GDP Deflator). They are also used to examine the causes of economic fluctuations. A. AGGREGATE DEMAND (AD) CURVE The aggregate demand (AD) curve illustrates the maximum quantity of all goods and services that households, firms, and the government are willing and able to purchase at any given price level. It shows the relationship between total output (real GDP) of the economy and the price level. Note that this "aggregate" demand curve is the macroeconomic demand curve of the "total" demand in the economy as a whole. This particular "line" just happens to be drawn as a straight line; although it is often drawn as a curve. The x-axis is real GDP.

B2-6

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

B.

AGGREGATE SUPPLY (AS) CURVE The aggregate supply (AS) curve illustrates the maximum quantity of all goods and services producers are willing and able to produce at any given price level. Note that this "aggregate" supply curve is the macroeconomic supply curve of the "total" supply in the economy as a whole. 1. Short-Run Aggregate Supply Curve The short-run aggregate supply (SRAS) curve is upward sloping, illustrating the fact that as the price level rises, firms are willing to produce more goods and services. 2. Long-Run Aggregate Supply Curve The long-run aggregate supply (LRAS) curve is vertical, illustrating the fact that in the long-run, if all resources are fully utilized, output is determined solely by the factors of production. This curve corresponds to the potential level of output in the economy. 3. Potential Level of Output (Potential GDP) Potential GDP refers to the level of real GDP (national output) that the economy would produce if its resources (capital and labor) were fully employed. When real GDP is below the potential level of output, the economy will typically be experiencing a recession. Similarly, when real GDP rises above the potential level of output, the economy will typically be experiencing an expansion.

C.

ILLUSTRATION Graph B illustrates the aggregate demand and aggregate supply curves for an economy.

Graph B Price Level

Long-Run Aggregate Supply Short-Run Aggregate Supply

P0

Aggregate Demand Y* Real GDP

The intersection of the Short-Run Aggregate Supply (SRAS) curve and the Aggregate Demand (AD) curve determines the level of output (real GDP) and price level in the short run. The position of the long-run aggregate supply (LRAS) curve determines the level of output in the long run. The LRAS curve is vertical at the economys potential level of output. Y* = GDP at the potential (equilibrium) level of output.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-7

Business Environment & Concepts 2

Becker CPA Review

D.

AGGREGATE DEMAND, AGGREGATE SUPPLY, AND ECONOMIC FLUCTUATIONS Business cycles, or economic fluctuations, are the result of shifts in aggregate demand and short-run aggregate supply (note that shifts in the long-run aggregate supply curve are associated with long-run growth in the economy and do not affect business cycles). 1. Reduction in Demand If circumstances cause individuals, businesses, or governments to reduce their demand for goods and services, economic activity (real GDP) will decline, leading to a contraction in economic activity and possibly a recession. As a result, a reduction in demand tends to cause firm profits to decline. Firms are also likely to experience an increase in excess capacity, leading them to reduce the size of their workforce. 2. Increase in Demand In contrast, if circumstances cause individuals, businesses, and governments to increase their demand for goods and services, economic activity will rise, leading to a recovery or an expansion in economic activity. As a result, an increase in demand tends to cause firm profits to rise. Firms are also likely to experience a reduction in excess capacity, leading them to increase the size of their workforce. 3. Reduction of Supply If circumstances cause firms to reduce their supply of goods and services, economic activity will fall, leading to a contraction or possibly a recession. As firms reduce their supply, they are also likely to reduce the size of their workforce, leading to higher unemployment. 4. Increase in Supply If circumstances cause firms to increase their supply of goods and services, economic activity will rise, leading to an expansionary phase of economic activity. As firms increase their supply, they are also likely to increase the size of their workforce, leading to lower unemployment. Graphs C and D illustrate recessions caused by shifts in aggregate demand and short-run aggregate supply.

Graph C Price Level LRAS SRAS

Graph D Price Level LRAS SRAS1 SRAS

P0 P1 AD AD1 Y1 Y0 Output (Real GDP)

P1 P0

AD Y1 Y0 Output (Real GDP)

A recession caused by a shift in the aggregate demand curve: A decrease in aggregate demand causes actual GDP to fall below potential GDP. This is illustrated as the leftward shift in aggregate demand. As a result, real GDP falls from Y0 to Y1.

A recession caused by a shift in the short run aggregate supply curve: A decrease in short-run aggregate supply causes actual GDP to fall below potential GDP. This is illustrated as the leftward shift in the short run aggregate supply curve. As a result, real GDP falls from Y0 to Y1.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-8

Becker CPA Review

Business Environment & Concepts 2

E.

FACTORS THAT SHIFT AGGREGATE DEMAND The primary factors that shift aggregate demand are: 1. Changes in Wealth a. Increase in Wealth An increase in wealth causes the aggregate demand curve to shift to the right. Thus, an increase in wealth causes the economy to expand and leads to an increase in national output (real GDP). b. Decrease in Wealth A decrease in wealth causes the aggregate demand curve to shift to the left. A decrease in wealth does the opposite of an increase in wealth. For example, a large decline in stock prices would decrease consumer wealth and therefore shift the aggregate demand curve to the left. As a result, national output would fall, causing a contraction and possibly a recession. 2. Changes in Real Interest Rates a. Increase in Real Interest Rates An increase in interest rates increases the cost of capital and, therefore, tends to reduce consumer demand for durable goods such as new cars and homes and firm demand for new plants and equipment. b. Decrease in Real Interest Rates A decrease in real interest rates does the opposite of an increase in real interest rates. A decrease in real interest rates reduces the cost of capital, thereby increasing the demand for investment goods and shifting the aggregate demand curve to the right, causing national output to rise. Conversely, an increase in real interest rates causes the cost of capital to rise and shifts the aggregate demand curve to the left, causing national output to fall. 3. Changes in Expectations about the Future Economic Outlook (Consumer Confidence) a. Confident Economic Outlook If households become confident about the economic outlook (consumer confidence increases), the willingness to acquire investment and consumer goods increases and the aggregate demand curve shifts right, causing national output to rise. b. Uncertain Economic Outlook When the economic outlook appears more uncertain, consumers tend to reduce current spending, shifting aggregate demand to the left and causing national output to fall.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-9

Business Environment & Concepts 2

Becker CPA Review

4.

Changes in Exchange Rates a. Appreciated Currencies If the currency of a country appreciates in real terms relative to the currencies of its trading partners, its goods will become relatively expensive for foreigners, while foreign goods will become relatively cheap for its residents. As a result, net exports (exports minus imports) will fall, shifting the aggregate demand curve to the left and causing national output to fall. b. Depreciated Currencies If the currency of a country depreciates in real terms relative to the currencies of its trading partners, its goods will become relatively cheap for foreigners, while foreign goods will become relatively expensive for its residents. As a result, net exports (exports minus imports) will rise, shifting the aggregate demand curve to the right and causing national output to rise.

5.

Changes in Government Spending a. Increase in Government Spending An increase in government spending shifts the aggregate demand curve to the right, causing national output to rise. b. Decrease in Government Spending A decrease in government spending shifts the aggregate demand curve to the left, causing national output to fall.

6.

Changes in Consumer Taxes a. Increase in Consumer Taxes An increase in consumer taxes (e.g., the personal income tax) reduces the disposable income (gross income minus taxes) of consumers and, therefore, shifts the aggregate demand curve to the left, causing national output to fall. b. Decrease in Consumer Taxes A decrease in taxes increases the disposable income of consumers and therefore shifts the aggregate demand curve to the right causing national output to rise.

B2-10

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

7.

Illustration: Changes in Government Spending and/or Taxes Graph E illustrates the effect of an increase in government spending and/or a decrease in taxes (known as expansionary fiscal policy), and Graph F illustrates the effect of a decrease in government spending and/or an increase in taxes (known as contractionary fiscal policy).

Graph E Price Level LRAS SRAS

Graph F Price Level LRAS SRAS

P1 P0 AD1 AD Y0 Y1 Output (Real GDP) Y1 Y0 AD P0 P1

AD1

Output (Real GDP)

In graph E, the economy is initially in a recession, illustrated as output level Y0, which is below the potential level of output Y1. The government can stimulate the economy by increasing government spending or decreasing taxes (or both) shifting the aggregate demand curve to the right and causing national output (real GDP) to rise.

In graph F, the economy is initially in an expansionary phase, illustrated as output level Y0, which is above the potential level of output Y1. The government can contract the economy by decreasing government spending or increasing taxes (or both), shifting the aggregate demand curve to the left and causing national output (real GDP) to fall.

F.

THE MULTIPLIER EFFECT The multiplier effect refers to the fact that an increase in consumer, firm, or government spending, produces a multiplied increase in the level of economic activity. For example, a $1 increase in government spending results in a greater than $1 increase in real GDP. The multiplier effect stems from the fact that increases in spending generate income for firms, which in turn spend that income. Their spending gives other households and firms income, and so on. Therefore, the effect of a $1 increase in spending is magnified by the multiplier effect. The multiplier effect results from the marginal propensity to consume (MPC). The MPC is the change in consumption due to a $1 increase in income. Because people tend to save part of their income, the MPC is typically less than one. Using the MPC, the size of the multiplier effect can be calculated using the following formula:

Multiplier = 1 Change in Spending (1 MPC)

Note: The examiners could refer to "1 MPC" as the marginal propensity to save (MPS), so be aware of this terminology as well.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-11

Business Environment & Concepts 2

Becker CPA Review

For example, suppose the MPC is 0.8 (i.e., the change in consumption due to a $1 increase in income is 80 cents) and that spending increases by $100. Then the multiplier would be:

Multiplier = 1 $100 = $500 (1 0.8)

Thus a $100 dollar increase in spending results in a $500 increase in real GDP. G. FACTORS THAT SHIFT SHORT-RUN AGGREGATE SUPPLY Recall that shifts in long-run aggregate supply are associated with economic growth NOT business cycles. Therefore, when discussing business cycles we focus on shifts in the shortrun aggregate supply curve. The primary factors that shift short-run aggregate supply are: 1. Changes in Input (Resource) Prices a. Increase in Input Prices An increase in input prices (raw material prices, wages, etc.) causes the shortrun aggregate supply curve to shift left. Thus, an increase in input prices causes the economy to contract and leads to a decrease in national output (real GDP).

EXAMPLE

For example, a large increase in oil prices (oil is a primary input in production) would shift the short-run aggregate supply curve to the left. As a result, national output would fall, causing a contraction and possibly a recession. This is illustrated in Graph D. b. Decrease in Input Prices A decrease in input prices causes the short-run aggregate supply curve to shift to the right. A decrease in input prices causes the economy to expand and leads to an increase in national output (real GDP). 2. Supply Shocks a. Supplies are Plentiful If resource supplies become more plentiful, the short-run aggregate supply curve will shift to the right, causing national output to increase. b. Supplies are Curtailed If resource supplies are curtailed (e.g., crop failures, damage to infrastructure caused by earthquakes, etc.) the short-run supply curve will shift to the left, causing national output (real GDP) to decline.

B2-12

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

H.

SHIFTS IN AGGREGATE DEMAND AND SUPPLY AND THE EFFECTS ON FIRM BUSINESS OPERATIONS Shifts in either the aggregate demand or aggregate supply curve affect the business conditions of firms. 1. Example As was discussed above, when the aggregate demand curve shifts right (an increase in aggregate demand), firm profits tend to increase. In addition, firms are likely to experience a decrease in excess capacity, leading them to increase the size of their workforce. 2. Effect of Economic Events on the Firm When economic events (such as those discussed above) cause either the aggregate demand curve or short-run aggregate supply curve to shift, they also affect the business conditions of firms. a. Shifts in Aggregate Demand Economic events that cause aggregate demand to increase (e.g., an increase in wealth or a decrease in interest rates) tend to cause firm profits to rise. In contrast, economic events that cause aggregate demand to decrease (e.g., a decline in consumer confidence) tend to cause firm profits to fall. b. Shifts in Aggregate Supply Economic events that shift the aggregate supply curve also affect firm profits, employment, and other conditions. For example, a rise in input costs tends to reduce firm profits and cause firms to reduce the size of their workforce.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-13

Business Environment & Concepts 2

Becker CPA Review

ECONOMIC MEASURES AND REASONS FOR CHANGES IN THE ECONOMY

I.

OVERVIEW Economists and policy-makers rely on a host of economic measures or indicators to determine the overall state of economic activity. Some of the most commonly cited economic measures are: (1) real Gross Domestic Product (real GDP), (2) the unemployment rate, (3) the inflation rate, and (4) interest rates. It is important to remember that these economic measures tend to move together. For example, when real GDP is rising, unemployment tends to be falling. Similarly, when the unemployment rate is rising the inflation rate tends to be falling.

II.

THE NATIONAL INCOME ACCOUNTING SYSTEM The National Income and Product Accounting (NIPA) system was developed by the U.S. Department of Commerce in order to monitor the health and performance of the U.S. economy. The two approaches to measuring GDP (expenditure approach and income approach, both discussed in detail below) are calculated using NIPA. The combined economic output of the following four sectors is called Gross Domestic Product (GDP), the total dollar value of all new final goods and services produced within the economy in a given time period. Households (or Consumers) Businesses Federal, State, and Local Governments The Foreign Sector Remember that GDP was introduced on page B2-3 where nominal GDP and real GDP were discussed. A. TWO METHODS OF MEASURING GDP The two methods of measuring GDP are the expenditure approach and the income approach. 1. The Expenditure Approach Under the expenditure approach, GDP is the sum of the following four components:

G I C E

Government purchases of goods and services Gross private domestic investment (nonresidential fixed investment, residential fixed investment, and change in business inventories) Personal consumption expenditures (durable goods, non-durable goods, and services) Net exports (exports minus imports)

B2-14

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

2.

The Income Approach The income approach accounts for GDP as the value of resource costs and incomes generated during the measurement period. a. b. The income approach includes business profits, rent, wages, interest, depreciation, and business taxes. Calculate GDP through the income approach by using the following mnemonic:

I P I R A T E D

B.

Income of proprietors Profits of corporations Interest (net) Rental income Adjustments for net foreign income and miscellaneous items Taxes (indirect business taxes) Employee compensation (wages) Depreciation (also known as capital consumption allowance)

COMPARISON OF APPROACHES The different approaches to preparing an "income statement" for the domestic economy (the GDP) are shown in the table below. 1. 2. The aggregate expenditures approach on the left is a flow-of-product approach (at market prices). The income approach on the right is a flow of earnings and costs approach (valueadded items plus taxes).

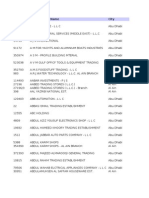

Table 1 (Billions of Dollars)

Expenditures Approach (Flow-of-Product) Government purchases Investment Consumption Exports (net) $1,314.7 1,014.4 4,698.7 (96.4)

Income Approach (Earnings and Cost) Income of proprietors Profits of corporations Interest (net) Rental income Adjustments for net foreign income/miscellaneous Taxes (indirect business) Employee compensation Depreciation (consumption of fixed capital) Domestic Income $ 450.9 526.5 392.8 116.6 45.0 572.5 4,008.3 818.8 $6,931.4

Aggregate Expenditure

$6,931.4

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-15

Business Environment & Concepts 2

Becker CPA Review

C.

OTHER MEASURES OF NATIONAL INCOME While GDP is the most common measure of national income and an economy's output and performance, there are several other noteworthy measures. These measures are calculated by making specific deductions and additions to GDP and include: Net Domestic Product (NDP), Gross National Product (GNP), Net National Product (NNP), National Income (NI), Personal Income (PI), and Disposable Income (DI). 1. Net Domestic Product Net domestic product (NDP) is GDP minus depreciation (the capital consumption allowance), the expenditure necessary to maintain production capacity (or "depreciation" to accountants). 2. Gross National Product (GNP) GNP is defined as the market value of final goods and services produced by residents of a country in a given time period. GNP differs from GDP because GNP includes goods and services that are produced overseas by U.S. firms and excludes goods and services that are produced domestically by foreign firms. For example, if BMW produces cars in the U.S., that production is counted as part of U.S. GDP, but it is not counted as part of U.S. GNP because BMW is a foreign-owned company. 3. Net National Product (NNP) Net national product (NNP) is defined as the total income of a country's residents less losses from economic depreciation (i.e., losses in the value of capital goods due to age and wear). Thus, NNP equals GNP minus economic depreciation. This depreciation is not accounting depreciation, which is allocation of costs to accounting periods. 4. National Income (NI) National income (NI) is NNP less indirect business taxes (e.g., sales tax). It measures the income received by all factors of production within a country. 5. Personal Income (PI) Personal Income (PI) is the income received by households and noncorporate businesses. Specifically,

NI Less: Undistributed corporate profits (retained earnings) Net interest Contributions for social measures (social security contributions) Corporate income taxes Government transfer payments to individuals Personal interest income Business transfer payments/dividends PI

Plus: =

6.

Disposable Income (DI) Disposable Income (DI) is personal income less personal taxes. It is the amount of income households have available either to spend or save.

B2-16

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

III.

THE UNEMPLOYMENT RATE The unemployment rate measures the ratio of the number of people classified as unemployed to the total labor force. The total labor force includes all non-institutionalized individuals 16 years of age or older who are either working or actively looking for work. (An unemployed person is defined as a person 16 years of age or older who is available for work and who has actively sought employment during the previous four weeks.) Note that to be counted as unemployed a person must be actively looking for work. The unemployment rate can be expressed as:

Unemployment Rate = Number of Unemployed 100 Total Labor Force

A.

TYPES OF UNEMPLOYMENT 1. Frictional Unemployment Frictional unemployment is normal unemployment resulting from workers routinely changing jobs or from workers being temporarily laid off. It is the unemployment that arises because of the time needed to match qualified job seekers with available jobs. 2. Structural Unemployment Structural unemployment occurs when: a. b. 3. Jobs available in the market do not correspond to the skills of the work force, and Unemployed workers do not live where the jobs are located.

Seasonal Unemployment Seasonal unemployment is the result of seasonal changes in the demand and supply of labor. For example, shortly before Christmas, the demand for labor increases and then decreases again after Christmas.

4.

Cyclical Unemployment Cyclical unemployment is the amount of unemployment resulting from declines in real GDP during periods of contraction or recession or in any period when the economy fails to operate at its potential. When real GDP is below the potential level of output, cyclical unemployment is positive. When real GDP is above the potential level of output, cyclical unemployment is negative. Thus, cyclical unemployment rises during a recession and falls during an expansion.

B.

NATURAL RATE OF UNEMPLOYMENT AND THE MEANING OF FULL EMPLOYMENT 1. Natural Rate of Unemployment The natural rate of unemployment is the "normal" rate of unemployment around which the unemployment rate fluctuates due to cyclical unemployment. Thus, the natural rate of unemployment is the sum of frictional, structural, and seasonal unemployment or the employment rate that exists when the economy is at its potential output level (recall that the position of the Long-Run Aggregate Supply (LRAS) curve is determined by the potential level of output). 2. Full Employment Full employment is defined as the level of unemployment when there is no cyclical unemployment. Full employment does not mean zero unemployment. When the economy is operating at full employment, there is still frictional, structural, and seasonal unemployment.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-17

Business Environment & Concepts 2

Becker CPA Review

C.

THE LINK BETWEEN UNEMPLOYMENT AND OUTPUT (REAL GDP) The unemployment rate and national output (real GDP) tend to move in opposite directions. That is, when real GDP is rising, the unemployment rate tends to be falling. Similarly, when real GDP is falling (for example, when the economy is in a recession), the unemployment rate tends to be rising. The reason for the link between the two variables is straightforward. When the demand for goods and services increases (when real GDP is rising), firms typically need to hire additional workers to produce the additional goods and services demanded and hence the unemployment rate tends to fall. Obviously the opposite is true when the demand for goods and services decreases.

IV.

THE PRICE LEVEL AND INFLATION A. DEFINITIONS 1. Inflation Inflation is defined as a sustained increase in the general prices of goods and services. It occurs when prices on average are increasing over time. 2. Deflation Deflation is defined as a sustained decrease in the general prices of goods and services. It occurs when prices on average are falling over time. Most economists believe deflation is a much bigger economic problem than inflation. During periods of deflation, firms are likely to experience significant excess production capacity. This occurs because consumers tend to hold off purchasing goods and services during a period of deflation because they realize the price of goods and services is likely to continue to fall. Consequently, firm profits are likely to be falling during periods of deflation. 3. Inflation/Deflation Rate The inflation or deflation rate is typically measured as the percentage change in the Consumer Price Index (CPI) from one period to the next. a. Consumer Price Index (CPI) The CPI is a measure of the overall cost of a fixed basket of goods and services purchased by an average household. (The Producer Price Index (PPI) measures the overall cost of a basket of goods and services typically purchased by firms.) b. Formula Using the CPI, the inflation rate is calculated as the percentage change in the CPI from one period to the next:

CPI this period CPI last period CPI last period 100

Inflation Rate =

B2-18

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

B.

CAUSES OF INFLATION AND DEFLATION Inflation and deflation are caused by shifts in the aggregate demand and short-run aggregate supply curves. A shift right in the aggregate demand curve will cause the price level to rise, leading to inflation. Similarly, a shift left in the short-run aggregate supply curve will also cause the price level to rise, leading to inflation. 1. Demand-Pull Inflation Demand-pull inflation is caused by increases in aggregate demand. Thus, demand-pull inflation could be caused by factors such as: a. b. c. d. 2. Increases in government spending, Decreases in taxes, Increases in wealth, and Increases in the money supply.

Cost-Push Inflation Cost-push inflation is caused by reductions in short-run aggregate supply. Thus, costpush inflation could be caused by factors such as: a. b. An increase in oil prices, or An increase in nominal wages.

3.

Illustrations Graphs G and H illustrate demand-pull and cost-push inflation using the aggregate demand and short-run aggregate supply curves.

Graph G Price Level SRAS

Graph H Price Level SRAS1 SRAS

P1 P0 AD1 AD Y0 Y1 Output (Real GDP)

P1 P0

AD

Y1 Y0 Output (Real GDP)

Demand-Pull Inflation: An increase in aggregate demand causes the short-run equilibrium price level to rise from P0 to P1.

Cost-Push Inflation: A decrease in shortrun aggregate supply causes the short-run equilibrium price level to rise from P0 to P1.

4.

Deflation Deflation is also caused by shifts in aggregate demand or short-run aggregate supply. A shift left in aggregate demand (perhaps brought about by a stock market crash or a large increase in taxes) will cause the aggregate price level to fall. Similarly, a shift right in the short-run aggregate supply curve will also cause the aggregate price level to fall.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-19

Business Environment & Concepts 2

Becker CPA Review

C.

INFLATION AND THE VALUE OF MONEY Inflation has an inverse relationship with purchasing power. As the price level rises, the value of money declines. 1. Definitions a. Monetary Assets and Liabilities Monetary assets and liabilities (e.g., cash, accounts receivable, notes payable, etc.) are fixed in dollar amounts regardless of changes in specific prices or the general price level. b. Non-Monetary Assets and Liabilities The value of non-monetary assets (e.g., a building, land, machinery, etc.) and non-monetary liabilities will fluctuate with inflation and deflation. 2. Holding Monetary Assets During a period of inflation, those with a fixed amount of money or income (e.g., retired persons) will be hurt (i.e., their purchasing power will be eroded). Similarly, firms that lend out money at fixed interest rates are likely to be hurt by inflation. 3. Holding Monetary Liabilities During a period of inflation, those with a fixed amount of debt (e.g., those with home mortgages) will be aided (i.e., the debt will be repaid with inflated dollars). Thus, inflation also tends to be benefit firms with large amounts of outstanding debt. OPEC and the Stagflation of the 1970s

Between 1973 and 1974, OPEC (Organization of Petroleum Exporting Countries) substantially curtailed its production of crude oil. As a result, the price of a barrel of crude oil rose from approximately $2.00 per barrel in late 1973 to $10.00 per barrel in late 1974.

EXAMPLE

B2-20

This increase in the price of crude oil had a substantial effect on the U.S. economy. Specifically, rising crude oil prices represented an increase in input costs for U.S. firms. As a result, firms cut back production and the short-run aggregate supply curve shifted left. This is the situation depicted in Graph D. As the short-run aggregate supply curve shifted left, national output (real GDP) began to decline, unemployment began to rise, and the aggregate price level began to rise (cost-push inflation). The combination of falling national output and a rising price level is known as stagflation. The actions of OPEC in 197374 led to a recession in the U.S. that was particularly harsh because not only was the unemployment rate rising, but the newly unemployed were facing higher prices for goods and services due to inflation!

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

The Great Depression and Deflation The Great Depression began with the stock market crash of October 24, 1929. By 1932, the Dow Jones industrial average had fallen 89% from its peak in 1929. In addition, shortly before the stock market crash, the Federal Reserve (the Central Bank of the U.S.) increased interest rates in an attempt to control inflation. It then increased interest rates again in early 1931. While the stock market crash was not the only cause of the great depression, it does mark the beginning of the depression. The depression was caused by a number of factors including ill-timed interest rate hikes by the Federal Reserve, the stock market crash, and protectionist trade policies. Table 1 shows what happened to real GDP, the unemployment rate, and the price level (as measured by the CPI) between 1929 and 1933. Table 1 Year

EXAMPLE

Real GDP (Billions of 1987 Dollars) 821.8 748.9 691.3 599.7 587.1

Unemployment Rate 3.15% 8.71% 15.91% 23.65% 24.87%

Price Level (CPI) 17.1 16.7 15.2 13.7 13.0

1929 1930 1931 1932 1933

As the table illustrates, the Great Depression was characterized by falling output (falling real GDP), rising unemployment and deflation. The deflation that occurred can be seen by noting that between 1929 and 1933 the price level fell continuously. Furthermore, at the height of the Great Depression, one out of every four workers was unemployed! The data suggests that the Great Depression was caused by a shift left in aggregate demand, as in Graph C. Specifically, the stock market crash reduced household wealth, which shifted the aggregate demand curve to the left. In addition, the interest rate hikes, orchestrated by the Federal Reserve, increased the cost of capital, thereby decreasing the demand for investment goods and shifting the aggregate demand curve even further to the left. As aggregate demand fell, the price level also fell and the nation experienced a period of deflation.

V.

INVERSE RELATIONSHIP BETWEEN INFLATION AND UNEMPLOYMENT A. THE PHILLIPS CURVE Inflation and unemployment are traditionally thought to have an inverse relationship in the short run. The Phillips Curve illustrates the inverse relationship between the rate of inflation and the unemployment rate. It illustrates the tradeoff that exists in the short run between inflation and unemployment. While unemployment and inflation have historically moved in opposite directions, during the oil shocks of the 1970s the Phillips Curve broke down. Specifically, the oil shocks (negative supply shocks) of the 1970s led to a situation where both unemployment and the price level were rising.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-21

Business Environment & Concepts 2

Becker CPA Review

B.

ILLUSTRATION OF THE PHILLIPS CURVE The Phillips Curve is illustrated in Graph I.

Inflation Rate

Graph I

The Phillips Curve illustrates the tradeoff between inflation and unemployment. When unemployment is high, inflation tends to be low, and when unemployment is very low, inflation tends to be high.

Unemployment Rate

VI.

BUDGET DEFICITS AND SURPLUSES The budget is the federal government's plan for spending funds and raising revenues through taxation, fees, and other means (and for borrowing funds if necessary). The budget deficit and the budget surplus are important indicators of the current and future health of an economy. A. BUDGET DEFICITS A budget deficit occurs when a country spends more than it takes in (mostly in the form of taxes). 1. Financing Budget Deficits Budget deficits are usually financed by government borrowing, which affects interest rates. The government could also finance budget deficits by printing new money. However, financing budget deficits by printing money causes inflation. 2. Cyclical Budget Deficit A cyclical budget deficit is caused by temporarily low economic activity. For example, a cyclical budget deficit might be caused by a recession. 3. Structural Budget Deficit A structural budget deficit is one that is caused by a structural imbalance between government spending and revenue. Structural deficits are not caused by temporarily low economic activity. B. BUDGET SURPLUSES A budget surplus occurs when government revenues exceed government spending during the year.

B2-22

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

VII.

INTEREST RATES A. NOMINAL AND REAL INTEREST RATES 1. Nominal Interest Rate The nominal interest rate is the amount of interest paid (or earned) measured in current dollars. When the economy experiences inflation, nominal interest rates are not a good measure of how much borrowers really pay or lenders really receive when they take out or make a loan. A more accurate measure of the interest borrowers pay or lenders receive is the real interest rate. 2. Real Interest Rate The real interest rate is defined as the nominal interest rate minus the inflation rate. It is a measure of the purchasing power of interest earned or paid. Real Interest Rate = Nominal Interest Rate Inflation Rate

EXAMPLE

For example, if you take out a loan with a 10% nominal interest rate and the inflation rate is 3%, then your real interest rate is only 7%. That is, after adjusting for the fact that the dollars with which you will repay the loan in the future are worth less than current dollars due to inflation, you are really only paying 7% to borrow the money! 3. Relationship Between Nominal Interest Rates and Inflation Nominal interest rates and inflation tend to move together. When the inflation rate increases, so does the nominal interest rate. The relationship between nominal interest rates and inflation may be shown by rearranging the above equation for real interest rates as follows: Nominal Interest Rate = Real Interest Rate + Inflation Thus, if real interest rates do not change, a 1% increase in the inflation rate will lead to a 1% increase in nominal interest rates.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-23

Business Environment & Concepts 2

Becker CPA Review

Illustration: Nominal Interest Rates and Inflation (Graph J)

Nominal Interest Rates and Inflation

20.00% 18.00% 16.00% 14.00% Interest Rate/Inflation Rate 12.00% 10.00% 8.00% 6.00% 4.00% Inflation Rate 2.00% 0.00% 1955

Nominal Interest Rate

1960

1965

1970

1975 Year

1980

1985

1990

1995

Note the close relationship between nominal interest rates and the inflation rate. As the inflation rate increases, the nominal interest rate also increases. Also note that around 1974/1975 the inflation rate was actually higher than the nominal interest rate implying real interest rates were negative! B. DEFINITION OF MONEY AND THE MONEY SUPPLY Money is the set of liquid assets that are generally accepted in exchange for goods and services. The money supply is defined as the stock of all liquid assets available for transactions in the economy at any given point in time. There are several definitions of money supply. M1 and M2 are the most common measures of money supply and are reported (periodically) in financial publications such as the Wall Street Journal. M1 is defined broadly as money that is used for purchases of goods and services. It typically includes coins, currency, checkable deposits (accounts that allow holders to write checks against interest-bearing funds within them), and traveler's checks. M1 does not typically include savings accounts or certificates of deposit (CDs). M2 is defined broadly as M1 plus liquid assets that cannot be used as a medium of exchange but that can be converted easily into checkable deposits or other components of M1. These include time certificates of deposit less than $100,000, money market deposit accounts at banks, mutual fund accounts, and savings accounts. M3 includes all items in M2 as well as time certificates of deposit in excess of $100,000.

B2-24

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

C.

MONETARY POLICY AND THE MONEY SUPPLY Monetary policy is the use of the money supply to stabilize the economy. The Federal Reserve uses monetary policy to increase or decrease the money supply in an effort to promote price stability and full employment. Understanding the effects of changes in the money supply is important because changes in the money supply lead to changes in interest rates, changes in the price level, and changes in national output (real GDP). The Fed controls the money supply through: 1. Open Market Operations (OMO) Open Market Operations (OMO) consist of the purchase and sale of government securities (Treasury Bills and bonds) in the open market. a. Increase in the Money Supply When the Fed purchases government securities, it increases the money supply (i.e., puts money into circulation to pay for the securities). b. Decrease in the Money Supply When the Fed sells government securities, it decreases the money supply (i.e., takes money out of circulation). 2. Changes in the Discount Rate The discount rate is the interest rate the Fed charges member banks for short-term (normally overnight) loans. a. b. c. 3. Member banks may borrow money from the Fed to cover liquidity needs, increase reserves, or make investments. Raising the discount rate discourages borrowing by member banks and decreases the money supply. Lowering the discount rate encourages borrowing by member banks and increases the money supply.

Changes in the Required Reserve Ratio (RRR) The Required Reserve Ratio (RRR) is the fraction of total deposits banks must hold in reserve. a. b. Raising the reserve requirement decreases the money supply. Lowering the reserve requirement increases the money supply.

D.

INTEREST RATES AND THE SUPPLY OF AND DEMAND FOR MONEY 1. Demand for Money is Inversely Related to Interest Rates Changes in the money supply have a direct effect on interest rates because interest rates are determined by the supply of and demand for money. The demand for money is the relationship between how much money individuals want to hold and the interest rate. The demand for money is inversely related to the interest rateas interest rates rise, it becomes more expensive to hold money (because holding money rather than saving or investing it means you do not earn interest), thus reducing the demand for money.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-25

Business Environment & Concepts 2

Becker CPA Review

2.

Supply of Money is Fixed at a Given Point in Time As noted above, the supply of money is determined by the Federal Reserve and is therefore fixed at any given point in time at the level set by the Federal Reserve. Graph K illustrates the demand for and supply of money. The intersection of the money demand curve and the money supply line determines the interest rate. a. b.

Graph K

An increase in the money supply will cause interest rates to fall. Conversely, a decrease in the money supply will cause interest rates to rise.

The Money Market MS MS1

Interest Rate

Equilibrium interest rate; I0 I1 Demand for Money

Quantity of Money The Money Market: The equilibrium interest rate is found where the demand for money intersects the supply of money. The money supply curve is vertical since the Federal Reserve controls the supply of money (thus it is independent of the interest rate). If the Fed increases the money supply, interest rates will fall, as illustrated by the fall in interest rates from I0 to I1.

VIII. MONETARY POLICY AND ITS EFFECTS ON INTEREST RATES, THE PRICE LEVEL, OUTPUT (REAL GDP) AND UNEMPLOYMENT When the Federal Reserve increases or decreases the money supply it has a direct effect on interest rates and an indirect effect on the price level, real GDP, and the unemployment rate. Specifically, when the Fed changes the money supply, it causes interest rates to either increase or decrease. As we saw earlier, changes in the interest rate directly affect the cost of capital and thus shift the aggregate demand curve. Finally, shifts in aggregate demand cause changes in the price level, real GDP, and the unemployment rate. A. EXPANSIONARY MONETARY POLICY (INCREASES IN THE MONEY SUPPLY) Expansionary monetary policy results when the Fed increases the money supply. Expansionary monetary policy affects the economy through the following chain of events: 1. 2. 3. 4.

B2-26

An increase in the money supply causes interest rates to fall. Falling interest rates reduce the cost of capital and hence stimulate the desired levels of firm investment and household consumption. Increases in desired investment and consumption cause an increase in aggregate demand. Aggregate demand shifts to the right, causing real GDP to rise, the unemployment rate to fall, and the price level to rise.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

B.

CONTRACTIONARY MONETARY POLICY (DECREASES IN THE MONEY SUPPLY) Contractionary monetary policy results when the Fed decreases the money supply. The effect of contractionary monetary policy is the exact opposite of expansionary monetary policy. Specifically: 1. 2. 3. 4. A decrease in the money supply causes interest rates to rise. Rising interest rates reduce the desired levels of firm investment and household consumption. Decreases in desired investment and consumption cause a decrease in aggregate demand. Aggregate demand shifts to the left, causing real GDP to fall, the unemployment rate to rise, and the price level to fall. The 2001 Recession and Monetary Policy

After growing steadily for almost a decade, the U.S. economy started to slow down at the end of 2000. The slowdown in the economy was accompanied by a large drop in stock prices that marked the end of the bull market of the late 1990's. In 2001, the U.S. economy experienced two consecutive quarters of negative real GDP growth implying the economy had slipped into a recession. As the economy began to falter, Alan Greenspan, the Chairman of the Federal Reserve, initiated expansionary monetary policy. Specifically, the Federal Reserve began lowering interest rates by increasing the money supply. Lower interest rates helped keep the economy from slipping even further into a recession. Specifically, lower interest rates led to a large increase in home purchases starting in 2001 and continuing through 2002. In addition, lower interest rates made it possible for the auto industry to offer attractive financing rates, including zero-percent financing! This helped increase consumer purchases of automobiles and overall demand for goods and services in the economy. The recession of 2001 and the actions taken by the Federal Reserve are illustrated in Graphs L and M. Graph L

Interest Rate

EXAMPLE

Graph M

Price Level MS0 MS1 LRAS SRAS

I0 P1 I1 Money Demand Mo M1 AD0 Quantity of Money Y0 Y1 Real GDP P0 AD1

Graph M illustrates the recession of 2001. During the recession, output (real GDP) is at Y0, which is below the potential level of output Y1, indicating a recession. Graph L illustrates the money market and the expansionary monetary policy of the Federal Reserve. By increasing the money supply, the Federal Reserve caused interest rates to fall from I0 to I1. Lower interest rates spurred new home investments and consumer consumption of durable goods such as automobiles. The increased consumption and investment led to a shift right in aggregate demand as depicted in graph M. As aggregate demand shifted right, real GDP began to increase and the economy began to recover from the recession.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-27

Business Environment & Concepts 2

Becker CPA Review

MARKET INFLUENCES ON BUSINESS STRATEGIES I. INTRODUCTION The strategic goals of a firm are influenced by the market in which the firm operates. The ability of a firm to achieve success is a direct result of how well the strategic plan fits the market in which the firm operates and how well the firm carries out its strategic plan. The firm must create an overall plan (a strategic plan) to assist in combating competition and helping it to develop an approach to achieve its objectives (in line with the firm's vision and mission statement). Strategic thinking encompasses a wide variety of issues with various types of benefits, such as the unification of organizational and operational decisions, goal-orientation toward the desired company achievements, directed focus on planning for flexible responses for new developments in the market, the creation of bases for evaluation, and the overall company focus on the vision, mission statement, and objectives of the firm. A. STEPS IN STRATEGIC MANAGEMENT (STRATEGIC POSITIONING) Strategic management (positioning) normally involves defining the mission, identifying the strategy, identifying the critical success factors, and analyzing those success factors by recognition of strengths, weaknesses, opportunities, and threats. 1. Define the Firm's Vision and Mission Statements Organizational mission statements usually represent one or two line descriptions of what the organization is in business to do. Ultimately, however, mission philosophies fall into one of three basic categories that impact the overall manner in which the organization carries out its business. a. Build Missions Build missions are for organizations that accommodate a volume or range of work as a means of accomplishing organizational objectives. Organizations with build missions tend to take a long-term view and are likely to invest in significant capital projects. b. Hold Missions Hold missions are for organizations that maintain their current competitive position. c. Harvest Missions Harvest missions are for organizations that reap immediate benefits from the organization. Organizations with harvest missions tend to have a short-term view, are less likely to invest in significant capital projects, and are more likely to focus on net income, cash flows, and immediate return. 2. Set the Goals of the Firm Organizations can choose any number of ways to achieve their missions. Generally, however, there are two broad and distinct paths for achieving organizational goals: cost leadership and differentiation. Each path has its own characteristics and implications for operational planning, budgeting, and corporate culture and will be discussed in detail later in this lecture.

B2-28

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

3.

Define the Objectives of the Firm a. Financial Objectives Financial objectives are the improvement of the overall financial outcomes of a firm's strategy. b. Non-Financial Objectives Non-financial objectives are the improvement of the overall ability of the firm to compete in the market in the long run, which is the ultimate focus for overall shareholder wealth maximization.

4.

Decide What to Measure and Take a Baseline Measurement Organizations use various measures of success to determine the achievement of strategic objectives. These measures are generally referred to as critical success factors, which may be either financial or non-financial. a. Financial Measures (Financial) Financial measures of success are generally derived from the financial reporting system of the organization or the marketplace. Examples of financial measures include sales or earnings growth, dividend growth, and growth in the market value of the organization's stock, credit ratings, cash flows, etc. b. Internal Business Processes (Non-Financial) Internal business process measures of success generally relate to non-financial measures of efficiency or production effectiveness derived from internal records. Internal business process measures of success include quality measures, cycle time computations, yields, reduction in waste, etc. c. Customer Measures (Non-Financial) Customer measures of success are non-financial measures of organizational effectiveness derived from information provided directly or indirectly by customers or from data derived from responses to customers. Customer measures of success include market share data, customer satisfaction data, brand recognition information, on-time delivery data, etc. d. Advance Learning and Innovation (Non-Financial) Learning and innovation measures of success are internal measures of effective use of human resources including morale and corporate culture, innovation in new products and methods, education and training, etc.

5.

Strategic Analysis (SWOT) Organizations use strategic or SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis to ascertain the overall strategy and critical success factors that the organization will measure. Factors internal to an organization that impact strategy are the sources of strengths and weaknesses. Outstanding skills that represent strengths in relation to competitors are referred to as core competencies. Factors external to the organization are the sources of opportunities and threats. As managers review these factors, the organization builds clarity regarding the mission, consensus as to strategy, critical success factors, and the impact of internal and external factors on the business.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-29

Business Environment & Concepts 2

Becker CPA Review

6.

Create the Strategic Plan a. Focus of the Plan In general, a strategic plan of a company must create a set of steps to achieve the objectives of the firm while staying in line with the firm's vision and mission statement. The plan must provide an environment and a model under which the goals and profitability of the firm can be achieved. The plan must focus on the ways the company will: (1) (2) (3) (4) b. Conduct business operations, Respond to competitive movements and other issues, Achieve/maintain competitive advantage, and Provide a way to address the needs and preferences of its customers.

Strategic Plans Vary Based on Segments Strategic plans may vary for each segment of an organization based on the characteristics of that segment. Characteristics that will affect strategic planning include: (1) (2) (3) (4) (5) (6) Growth potential as indicated by industry maturity and regulatory constraints Profitability Discretionary cash flow Contribution margins Levels of risk Management talent (e.g., limited career opportunities in low-growth industries and markets will reduce the pool of talent available for management)

7.

Implement the Strategic Plan In general, the overall vision, mission statement, objectives, and strategy of the firm must be embraced and executed at various levels within the organization. The plan should be able to address those areas that will be applicable at all the different levels of the firm so that the plan is executed as a team that shares a common goal. The levels (from top to bottom) include: a. b. c. d. Corporate level, Business level, Functional level, and Operating level.

8.

Evaluate and Revise the Plan as Necessary The plan must be evaluated and revised as necessary.

B2-30

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

B.

CONTINUAL REVISION AND EVALUATION OF THE PLAN (CONTINGENCY PLANNING) Contingency planning addresses development of alternative plans in the event that adopted plans do not work, assumed variables prove to be faulty, or objectives become impractical or irrelevant. Contingency planning will first consider the impact of changes in variables and then document and quantify management's corrective action to deal with those changes. For example, contingency plans that are part of the strategic plan focus on the ability of the firm to change products or adapt to new markets. 1. Three Questions a Firm Should Ask Itself The firm must have an on-going process of attempting to determine three things: a. b. c. 2. Do the goals of the firm continue to be aligned with the mission statement and current strategy? Has the firm been able to attain or maintain competitive advantage? Is the firm able to be profitable under the current strategy?

Flexibility of the Plan is Necessary The selected strategic plan of the firm must be flexible to adapt to changes in such things as: a. b. c. d. e. Technology, Competition, Crisis situations, Regulatory laws, and Customer preferences.

3.

Proper Reaction is Essential The firm must have a strategic plan that will allow it to be able to react to the changes in the market in such a way as to still maintain competitive advantage and attain its goals in line with its vision and mission statement. Sustaining competitive advantage is crucial to the success of a firm.

C.

CHOICE OF A BUSINESS MODEL Once a strategic plan is in place, the company will choose a business model concerned with cash flows and profits under which it believes the company will best be able to achieve its strategic plan.

II.

THE LAWS OF DEMAND AND SUPPLY Basic principles of microeconomic theory are very important on the CPA Exam, but understanding the fundamentals is also important to the business manager. Managers are more likely to be successful if they understand how their actions and various governmental policies or collusive actions (e.g., cartels) affect their market and firm. A market is simply a collection of buyers and sellers meeting or communicating in order to trade goods or services.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-31

Business Environment & Concepts 2

Becker CPA Review

A.

DEMAND 1. Definitions a. Demand Curve The demand curve illustrates the maximum quantity of a good consumers are willing and able to purchase at each and every price (at any given price), all else equal. Note that this demand curve is similar to the aggregate demand curve discussed on page B2-6 except that the x-axis here is quantity and not real GDP. It does, however, illustrate the same kind of relationship. However, this demand curve is the microeconomics demand curve for a certain good or product and not the total demand in the economy as a whole. b. Quantity Demanded Quantity demanded is defined as the quantity of a good (or service) individuals are willing and able to purchase at each and every price (at any given price), all else equal. c. Change in Quantity Demanded A change in quantity demanded is a change in the amount of a good demanded resulting solely from a change in price. Changes in quantity demanded are shown by movements along the demand curve (D). When the assumptions regarding price or quantity change, then the "demand point" will change along this demand curve. For example, if the price of a product increases, there will be a move up the demand curve. d. Change in Demand A change in demand is a change in the amount of a good demanded resulting from a change in something other than the price of the good. A change in demand cannot be due to a change in price. A change in demand causes a shift in the demand curve. 2. Fundamental Law of Demand The fundamental law of demand states that the price of a product (or service) and the quantity demanded of that product (or service) are inversely related. As the price of the product increases, the quantity demanded decreases. Quantity demanded is inversely related to price for two reasons: a. Substitution Effect The substitution effect refers to the fact that consumers tend to purchase more (less) of a good when its price falls (rises) in relation to the price of other goods. The substitution effect exists because people tend to substitute one similar good for another when the price of a good they usually purchase increases. For example, if the price of Pepsi-Cola decreases, it will be used as a substitute for Coca-Cola (a similar good). b. Income Effect The income effect means that as prices are lowered with income remaining constant (i.e., as purchasing power or real income increases), people will purchase more of all of the lower priced products. For example, a decrease in the price of a good increases a consumer's real income even when nominal income remains constant. As a result, the consumer can purchase more of all goods.

B2-32

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

3.

Factors that Shift Demand Curves (Factors Other than Price) Mnemonic: W R I T E N

W R

a.

Changes in Wealth For example, people whose wealth increases may increase their demand for luxury cars.

b.

Changes in the Price of Related Goods (substitutes and complements) For example, if the price of a similar good (a substitute good) increases, the demand curve will shift to the right (increase) for the original good, now perceived as a bargain. If the price of a good used in conjunction with the original good (referred to as a complementary good) decreases, then the demand for the original good will increase (e.g., if personal computer prices diminish, demand increases for peripherals such as monitors and laser printers).

I T E N

c.

Changes in Consumer Income For example, an increase in income will shift the demand curve to the right (depicted as the shift from D1 to D2).

d.

Changes in Consumer Tastes or Preferences for a Product For example, in the clothing industry, a revival of the "1960s era" will increase the demand for bell-bottom jeans (retro clothing). This is also depicted as the shift from D1 to D2.

e.

Changes in Consumer Expectations For example, if consumers anticipate that there will be a future price increase, immediate demand will increase for that product (at the current lower price).

f.

Changes in the Number of Buyers Served by the Market For example, an increase in the number of buyers will shift the demand curve to the right.

Graph A: Change in Quantity Demanded

Graph B: Change in Demand D3 D1 D2 An increase in demand Price (in $) A decrease in demand D2 D1 D3 Quantity

Price (in $) PX1 PX 2

D X1 X2 Quantity

Changes in price cause movements along the demand curve

Shift in demand curve or change in demand caused by external influences (other than the price of the good)

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-33

Business Environment & Concepts 2

Becker CPA Review

4.

Market Demand Market demand is the total amount of a good all individuals are willing and able to purchase at each and every price, all else equal. The market demand curve for a good is the sum total of all the individual demand curves and is also downward sloping (demonstrating the inverse relationship between price and quantity demanded). The market demand curve is derived by summing the quantities demanded at each price over all individuals. Graph C illustrates how the market demand curve is constructed when the market contains just two individuals.

Graph C

Price Price Price

P2 P1

P2 P1

P2 P1

Quantity

Quantity

11

Quantity

Individual 1's demand curve

Individual 2's demand curve

The market demand curve

B.

SUPPLY 1. Definitions The fundamental law of supply states that price and quantity supplied are positively related (i.e., they have a positive correlation). The higher the price received for a good, the more sellers will produce (higher quantity). a. Supply Curve The supply curve illustrates the maximum quantity of a good sellers are willing and able to produce at each and every price (at any given price), all else equal. Note that this supply curve is similar to the aggregate supply curve discussed on page B2-7 except that the x-axis here is quantity and not real GDP. It does, however, illustrate the same kind of relationship. However, this supply curve is the microeconomics supply curve for a certain good or product and not the total demand in the economy as a whole. b. Quantity Supplied Quantity supplied is the amount of a good that producers are willing and able to produce at each and every price (at any given price), all else equal. c. Change in Quantity Supplied A change in quantity supplied is a change in the amount producers are willing and able to produce resulting solely from a change in price. A change in quantity supplied is represented by a movement along the supply curve. When price changes, move up or down the supply curve to find the new quantity that will be supplied. d. Change in Supply A change in supply is a change in the amount of a good supplied resulting from a change in something other than the price of the good. A change in supply cannot be due to a change in price. A change in supply causes a shift in the supply curve.

B2-34

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Business Environment & Concepts 2

2.

Factors that Shift Supply Curves Mnemonic: ECOST

a.

Changes in Price Expectations of the Supplying Firm For example, if prices are expected to decrease, the firm will supply more now at each price level to take advantage of the currently higher prices. This is represented by the shift in the supply curve from supply curve S1 to supply curve S2.

b.

Changes in Production Costs (Price of Inputs) For example, a decrease in wages paid to workers would cause a shift to the right in the supply curve because for the same total amount of production dollars, the firm is willing to supply more product. This is represented by the shift in the supply curve from supply curve S1 to supply curve S2.

O S T

c.

Changes in the Price or Demand for Other Goods For example, a decrease in the demand for another good supplied by a firm would cause the firm to shift its resources and increase the supply of its remaining goods.

d.

Changes in Subsidies or Taxes For example, a decrease in taxes or an increase in subsidies would increase the amount supplied at each price level.

e.

Changes in Production Technology For example, an improvement in technology would cause a shift to the right of the supply curve.

Graph D: Change in Quantity Supplied

Price (in $) S Price (in $)

Graph E: Change in Supply

S3 S1 S2 A decrease in supply

P2 P1 An increase in supply

X1

X2

Quantity Shifts in supply caused by external factors (other than price)

Quantity

Changes in price cause movements along the supply curve

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-35

Business Environment & Concepts 2

Becker CPA Review

3.

Market Supply Market supply is the total amount of a good all producers are willing and able to produce at each and every price, all else equal. The market supply curve for a good is the sum total of all the individual supply curves, and is also upward sloping (demonstrating the positive relationship between price and quantity supplied). The market supply curve is derived in the same manner as the market demand curve, namely, by summing the quantities supplied at each price over all producers. Graph F illustrates how the market supply curve is constructed when the market contains just two producers.

Graph F

Price

Price

Price

P2 P1

P2 P1

P2 P1

10

Quantity

Quantity

15

Quantity

Producer 1's supply curve

Producer 2's supply curve

The market supply curve

C.

MARKET EQUILIBRIUM A market is in equilibrium when there are no forces acting to change the current price/quantity combination. 1. 2. 3. The market's equilibrium price and output (quantity) is the point where the supply and demand curves intersect. The interaction of demand and supply determines equilibrium price. Graph G illustrates equilibrium price.

Graph G P

D $12 Price (P) 10 9 S Shortage Surplus S for example, minimum wage Equilibrium price ceiling price D QD

QS

QE

a.

As illustrated above, price (P) is $10 at equilibrium and the quantity supplied (Q) is QE.

2009 DeVry/Becker Educational Development Corp. All rights reserved.

B2-36

Becker CPA Review

Business Environment & Concepts 2

b. c. 4.

If price is set below the equilibrium price, the quantity demanded will exceed the quantity supplied, and a shortage will result. If price is set above the equilibrium price, the quantity demanded will be less than the quantity supplied, and a surplus will result.

Changes in Equilibrium If supply and/or demand curves shift, the equilibrium price and quantity will change. a. Effects of a Change in Demand on Equilibrium A shift right (increase) in demand from curve D to curve D1, as shown in Graph H, will result in an increase in price (from P to P1) and an increase in market clearing quantity (from Q to Q1). Conversely, a shift left (decrease) in demand from curve D to curve D1, as shown in Graph I, will result in a decrease in price (from P to P1) and a decrease in market clearing quantity (from Q to Q1).

Graph H Price S Price

Graph I S

P1 P D Q Q1 Quantity D1

P P1 D1 Q1 Q Quantity D

b.