Professional Documents

Culture Documents

Mike Hope Campaign Response

Uploaded by

Curtis CartierOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mike Hope Campaign Response

Uploaded by

Curtis CartierCopyright:

Available Formats

July 11, 2011 Honorable members of the Public Disclosure Commission, Please accept this as a formal response to the

complaint, 12-001, claiming that I failed to adequately disclose a trip to Spokane, WA on 09/13/2010, 09/17/2010 and 10/12/2010. I have drafted a separate response regarding the complainants misconceptions of what 100 Ideas WA is and its role. The Citizens for the Lakewood Law Enforcement Memorial Act, of which I was a Co-Chair, furnished the airfare expense for two trips to Spokane, which both were under $250. The trip in September was $177.40 and the one in October was $230.40. In addition, the Lakewood Campaign also purchased my hotel room at the Davenport for $97.20 for lodging. The September trip was made for the express purpose of attending an editorial board meeting in support of the Remember Lakewood Campaign, in my capacity as Co-Chair for the Citizens for the Lakewood Law Enforcement Memorial Act. The October trip was made to do radio and television interviews for the Remember Lakewood Campaign. The position of Co-Chair with the Citizens for the Lakewood Law Enforcement Memorial Act is an uncompensated position and was not made in the ofcial capacity of my position as State Legislator, but rather as a campaign co-chair . The expenses for these trips were made for the exact amount of the air travel and lodging for the October 12th Trip. As you can clearly see from the Citizens for the Lakewood Law Enforcement Memorial Act webpage (www.rememberlakewood.com), I had served as the Chair/Co-Chair of this campaign committee since its inception. The committee is appropriately registered with the Public Disclosure Commission, and has timely led all expenses and contributions related to the campaign. When determining income, employment, compensation, food, travel, and seminars required to be disclosed by elected state ofcials on their F-1 and F-1 Supplemental lings, one must look at two specic sections of RCW. First, RCW 42.17.241(1) (a)& (f), which dictates income, employment, and compensation, required to be disclosed on the F-1, Personal Financial Affairs Statement. Secondly, RCW 42.52, and more specically 42.52.010(10)(d) dictates scenarios in which elected state ofcials must disclose travel expenses on the F-1 Supplemental form. The complaint alleges a violation of the latter, RCW 42.52.010(10)(d) which states: "Payments by a governmental or nongovernmental entity of reasonable expenses incurred in connection with a speech, presentation, appearance, or trade mission made in an ofcial capacity. As used in this subsection, 'reasonable expenses' are limited to travel, lodging and subsistence expenses incurred the day before through the day after the event." I would like to highlight the sentence which reads Payments by a governmental or nongovernmental entity of reasonable expenses incurred in connection with a speech, presentation, appearance, or trade mission made in an ofcial capacity. (EMPHASIS ADDED) As you can see, this appearance was not made in an ofcial capacity as a State Representative of Washington, nor was it paid for at taxpayer expense. The sheer fact that this trip to Spokane was not paid for by state revenues should have clearly indicated to the complainant that this trip was not in an ofcial capacity. Instead my trip was in the capacity of a campaign event as co-chair of the Remember Lakewood Campaign. While RCW 42.17.241 does not apply in my case either, I would simply note that state elected ofcials who take in more than $2,000 worth of income/employment/compensation during a reporting period are required to disclose such with the Public Disclosure Commission. The

Personal Financial Affairs Statement Instruction Manual from January 2011 clearly states examples of when state elected ofcials are required to report, including if they receive over $2,000 worth of honoraria, travel expenses (received as compensation for speeches or other appearances, rather than as reportable food, travel, or seminars as discussed beginning on page 28. (pg. 9 of F1 Personal Financial Affairs January 2011 manual). As you can clearly see, an expenditure of less than $505.00 for all travel and lodging made by a political action committee, Citizens for the Lakewood Law Enforcement Memorial Act, does not meet these selected criteria either. Furthermore, the F1 Personal Financial Affairs instruction manual does not clearly differentiate between travel expenses which are required to be reported under the F1 Statement of Financial Affairs Income Section/Part 1 versus the F-1 Supplemental form for food, travel, and seminars. In summation, I would ask that you drop this complaint which has no merit. I was serving in a capacity as campaign co-chair for Citizens for the Lakewood Law Enforcement Memorial Act, not in an ofcial capacity as a state elected ofcial. Neither the State of Washington nor its taxpayers paid for the airfare, something that would seem very pertinent to show intent of working in an ofcial capacity as a State Representative. Sincerely, Mike Hope Co-Chair, Citizens for the Lakewood Law Enforcement Memorial Act

You might also like

- IRS Letter, Complaint Letter Regarding Foundation For Excellence in EducationDocument3 pagesIRS Letter, Complaint Letter Regarding Foundation For Excellence in EducationPat DavisNo ratings yet

- Dallas 2011Document3 pagesDallas 2011Karen KleissNo ratings yet

- 2014-08-01 10th Legislative District Letter To Auditor KelleyDocument2 pages2014-08-01 10th Legislative District Letter To Auditor KelleyGrowlerJoeNo ratings yet

- Hehr 2011Document2 pagesHehr 2011Karen KleissNo ratings yet

- Webber 2011Document3 pagesWebber 2011Karen KleissNo ratings yet

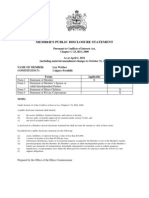

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Auto BOND Insurance Evidence Financial ResponsibilityDocument5 pagesAuto BOND Insurance Evidence Financial Responsibilitycrystal100% (8)

- Johnson OCE Complaint 11.13.23Document6 pagesJohnson OCE Complaint 11.13.23Aaron ParnasNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Olson 2011Document3 pagesOlson 2011Karen KleissNo ratings yet

- Hehr 2012 PDFDocument2 pagesHehr 2012 PDFKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument2 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Proof of Funds and Budget For Work and Travel ProgramDocument2 pagesProof of Funds and Budget For Work and Travel ProgramOpen Hearts Int'l EducationNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Presidential TravelDocument8 pagesPresidential TravelAllison SylteNo ratings yet

- Taft 2011Document3 pagesTaft 2011Karen KleissNo ratings yet

- City of Boulder - Travel Expense FormDocument5 pagesCity of Boulder - Travel Expense FormBob MackinNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Johnson - J 2012 PDFDocument5 pagesJohnson - J 2012 PDFKaren KleissNo ratings yet

- Letter To FEC Requesting Investigation of Jason ChaffetzDocument12 pagesLetter To FEC Requesting Investigation of Jason ChaffetzLarryDCurtis100% (1)

- Member'S Public Disclosure StatementDocument6 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- January 2012 Columbia River Crossing White PaperDocument81 pagesJanuary 2012 Columbia River Crossing White PapergoosefeathersNo ratings yet

- Elitelawyersapplication Civil LitigationDocument2 pagesElitelawyersapplication Civil Litigationapi-518204892No ratings yet

- AVR Letter To The Apple Valley Town CouncilDocument3 pagesAVR Letter To The Apple Valley Town CouncilGreg RavenNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdChapter 11 DocketsNo ratings yet

- Ross, Patricia.2022 RPTDocument8 pagesRoss, Patricia.2022 RPTThomas JonesNo ratings yet

- NoticeletterDocument4 pagesNoticeletterRick Macosky100% (3)

- Hale 2012 PDFDocument5 pagesHale 2012 PDFKaren KleissNo ratings yet

- Helm Spring 2011 NewsletterDocument4 pagesHelm Spring 2011 NewsletterPAHouseGOPNo ratings yet

- Member'S Public Disclosure StatementDocument6 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument3 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Treasurers Report 1-9-10 CC CorrectedDocument3 pagesTreasurers Report 1-9-10 CC CorrectedKani MozhiNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Dallas 2012Document3 pagesDallas 2012Karen KleissNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Blakeman 2012Document3 pagesBlakeman 2012Karen KleissNo ratings yet

- Bills Stadium BoxDocument11 pagesBills Stadium BoxjodatoNo ratings yet

- Horne 2012 PDFDocument4 pagesHorne 2012 PDFKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- LLP Partnership Agreement CaliforniaDocument8 pagesLLP Partnership Agreement Californiaapi-25948763100% (1)

- Eby Clark OpinionDocument26 pagesEby Clark OpinionBob MackinNo ratings yet

- United States Bankruptcy Court District of DelawareDocument27 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- Bilous 2012Document2 pagesBilous 2012Karen KleissNo ratings yet

- Mitzel 2011Document3 pagesMitzel 2011Karen KleissNo ratings yet

- Member'S Public Disclosure StatementDocument3 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Notice of Conditional AcceptanceDocument11 pagesNotice of Conditional AcceptanceMichael Kovach100% (12)

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Denis 2012Document3 pagesDenis 2012Karen KleissNo ratings yet

- Housekeeping For State Assemblies ReviewedDocument3 pagesHousekeeping For State Assemblies Reviewedpaula_morrill668No ratings yet

- Understanding The UCCDocument8 pagesUnderstanding The UCCBobby Souza95% (22)

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Michael Hastings Autopsy ResultsDocument17 pagesMichael Hastings Autopsy ResultsRobert WenzelNo ratings yet

- Crystal Cox OpinionDocument13 pagesCrystal Cox OpinionCurtis CartierNo ratings yet

- AlanONeill PCDocuementsDocument1 pageAlanONeill PCDocuementsCurtis CartierNo ratings yet

- DOJ SPD InvestigationDocument67 pagesDOJ SPD InvestigationCurtis CartierNo ratings yet

- Jarlik Bell IndictmentDocument10 pagesJarlik Bell IndictmentCurtis CartierNo ratings yet

- Alloway ReportDocument2 pagesAlloway ReportCurtis CartierNo ratings yet

- Housing DiscriminationDocument2 pagesHousing DiscriminationCurtis CartierNo ratings yet

- Discriminatory RentersDocument3 pagesDiscriminatory RentersCurtis CartierNo ratings yet

- Doe V Amazon ComplaintDocument13 pagesDoe V Amazon ComplaintEric GoldmanNo ratings yet

- Ndlovu PCDocument2 pagesNdlovu PCCurtis CartierNo ratings yet

- Raven Lang Brealan Charging DocsDocument6 pagesRaven Lang Brealan Charging DocsCurtis CartierNo ratings yet

- Kind Fire LawsuitDocument9 pagesKind Fire LawsuitCurtis CartierNo ratings yet

- Radio Communications of The Philippines Vs Sec. of LaborDocument6 pagesRadio Communications of The Philippines Vs Sec. of LaborbrendamanganaanNo ratings yet

- 1896 Philippine RevolutionDocument5 pages1896 Philippine RevolutionShaun LeeNo ratings yet

- MBC Cover Letter N Resume JyapjyapDocument3 pagesMBC Cover Letter N Resume Jyapjyapapi-397923551No ratings yet

- PF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Document4 pagesPF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Amit SinghNo ratings yet

- Request Form For Issuance of Dilg Certification: Remarks On The RequestDocument1 pageRequest Form For Issuance of Dilg Certification: Remarks On The RequestVan VanNo ratings yet

- Definitons of Church and Relation To ParachurchDocument11 pagesDefinitons of Church and Relation To ParachurchAnne Lavallee SpanNo ratings yet

- RE 01 03 Office Acquisition Case StudyDocument3 pagesRE 01 03 Office Acquisition Case StudyAnonymous bf1cFDuepPNo ratings yet

- Land Titles - Oliva VS RepublicDocument1 pageLand Titles - Oliva VS RepublicShine BillonesNo ratings yet

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- Bia Africa - Commercial Offer 2022 SMS - Feb 2023 - Eur - 230406 - 100334Document12 pagesBia Africa - Commercial Offer 2022 SMS - Feb 2023 - Eur - 230406 - 100334Kouakou Affran Rania maryliseNo ratings yet

- Comrade-Ayatollah O1 PDFDocument705 pagesComrade-Ayatollah O1 PDFhamick100% (3)

- Modern Hunter User ManualDocument16 pagesModern Hunter User ManualJim GregsonNo ratings yet

- Markesinis & DeakinDocument54 pagesMarkesinis & DeakinSaydul ImranNo ratings yet

- Alan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFDocument469 pagesAlan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFkaranNo ratings yet

- Education. Legal Education.: Powerpoint Project Made by Geo MorariuDocument28 pagesEducation. Legal Education.: Powerpoint Project Made by Geo MorariuAntoniu17No ratings yet

- FM Lecture 2 Time Value of Money S2 2020.21Document75 pagesFM Lecture 2 Time Value of Money S2 2020.21Quỳnh NguyễnNo ratings yet

- Nathan Dunlap Photos and NarrativeDocument4 pagesNathan Dunlap Photos and NarrativeMichael_Lee_RobertsNo ratings yet

- Simla Deputation PDFDocument2 pagesSimla Deputation PDFMirahmed MiraliNo ratings yet

- Dalaguete Executive Summary 2021Document5 pagesDalaguete Executive Summary 2021AUDREY MARIEL CANDORNo ratings yet

- Petition For Notarial CommissionDocument11 pagesPetition For Notarial CommissionKaye Miranda LaurenteNo ratings yet

- Script For Client CounselDocument2 pagesScript For Client CounseluminadzNo ratings yet

- Jimenez-Cruz Driving RecordDocument4 pagesJimenez-Cruz Driving RecordAnonymous YhHeJsNo ratings yet

- 03 - Residence and Scope of Total IncomeDocument44 pages03 - Residence and Scope of Total IncomeTushar RathiNo ratings yet

- Payment of GratuityDocument5 pagesPayment of Gratuitypawan2225No ratings yet

- Module For CLJ 106 HumanRightsEd IntroDocument13 pagesModule For CLJ 106 HumanRightsEd IntrojoyjoyhongpNo ratings yet

- Games Workshop 2018 North American Retailer PolicyDocument7 pagesGames Workshop 2018 North American Retailer Policyjholt06No ratings yet

- UCU276239863 Auth LetterDocument3 pagesUCU276239863 Auth Letter紀宇恆No ratings yet

- The Heil Co.: - WeightDocument2 pagesThe Heil Co.: - WeightWilliam Avila AguilarNo ratings yet

- Contract of Lease With Option To PurchaseDocument3 pagesContract of Lease With Option To PurchaseNeilJuan JuanNo ratings yet

- FormA TNBDocument1 pageFormA TNBmohamad erwan sah rezan mohd sukorNo ratings yet