Professional Documents

Culture Documents

Form 16

Uploaded by

Ebanezer PaulrajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16

Uploaded by

Ebanezer PaulrajCopyright:

Available Formats

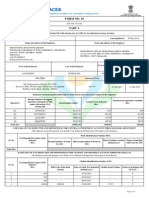

FORM NO.

16

[See rule 31(1)(a)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source from income chargeable under the head Salaries

Name and address of the Employer PAN No. of the Deductor TAN No. of the Deductor Name and designation of the Employee PAN No. of the Employee

Acknowledgement Nos. of all quarterly statements of TDS under sub-section (3) of section 200 as provided by TIN Facilitation Centre or NSDL web-site Quarter Acknowledgement No. From

Period

Assessment year

To

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. (a) (b) (c)

(d) 2.

Gross salary Salary as per provisions contained in section 17(1) Value of perquisites u/s 17(2) (as per Form No. 12BA, wherever applicable) Profits in lieu of salary under section 17(3) (as per Form No. 12BA, wherever applicable) Total Less : Allowance to the extent exempt under section 10 Allowance Rs.

Rs.

Rs.

Rs.

Rs.

Rs. Rs.

3. 4.

Balance (1 2) Deductions : (a) Entertainment allowance (b) Tax on Employment Aggregate of 4(a) and (b)

Income chargeable under the head Salaries (3 - 5)

Rs. Rs.

5. 6. 7.

Rs. . Rs.

Add : Any other income reported by the employee

[TR 62; 16, ] I 1

Printed from Taxmanns Income-tax Rules, 2007

Rs.

8. 9.

Gross total income (6 + 7) Deductions under Chapter VI-A (A) sections 80C, 80CCC and 80CCD Gross amount (a) section 80C (i) (ii) (iii) (iv) (v) (vi) (b) section 80CCC Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs.

Rs. Rs. Deductible amount

Rs. Rs.

(c) section 80CCD Rs. Rs. Notes : 1. Aggregate amount deductible under section 80C shall not exceed one lakh rupees. 2. Aggregate amount deductible under the three sections, i.e., 80C, 80CCC and 80CCD, shall not exceed one lakh rupees. (B) other sections (e.g., 80E, 80G etc.) under Chapter VI-A (a) section (b) section (c) section (d) section (e) section

10. 11. 12. 13. Aggregate of deductible amount under Chapter VI-A

Gross amount Rs. Rs. Rs. Rs. Rs.

Qualifying amount Rs. Rs. Rs. Rs. Rs.

Deductible amount Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs.

Total income (8-10) Tax on total income Surcharge (on tax computed at S. No. 12) Education Cess @2% (on tax at S. No. 12 plus surcharge at S. No. 13) Tax payable (12+13+14) Relief under section 89 (attach details) Tax payable (15-16) Rs. Less : (a) Tax deducted at source u/s 192(1) (b) Tax paid by the employer on behalf of the employee u/s 192(1A) on perquisites u/s 17(2)

Rs. Rs. Rs.

14. 15.

16.

17. 18.

Rs. Rs. Rs. Rs.

Rs. Rs. Rs. Rs.

[TR 62; 16, ] I 1

Printed from Taxmanns Income-tax Rules, 2007

19.

Tax payable/refundable (17-18)

Rs.

Rs.

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT (The Employer is to provide payment-wise details of tax deducted and deposited)

S. No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. TDS Rs. Surcharge Rs. Education Cess Rs. Total tax deposited Rs. Cheque/DD No. (if any) BSR Code of Bank branch Date on which tax deposited (dd/mm/yy) Transfer voucher/Challan Identification No.

I, , son/daughter of working in the capacity of (designation) do hereby certify that a sum of Rs. [Rupees (in words)] has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on the books of account, documents and other available records.

Place Date

. Signature of the person responsible for deduction of tax Full Name Designation ___________ __________

[TR 62; 16, ] I 1

Printed from Taxmanns Income-tax Rules, 2007

You might also like

- The Fallout of War: The Regional Consequences of the Conflict in SyriaFrom EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNo ratings yet

- TDS certificate form 16Document4 pagesTDS certificate form 16yogesh.b.lokhande9022No ratings yet

- Form No 16Document3 pagesForm No 16thapalNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- Ministry of Finance amends Income Tax RulesDocument7 pagesMinistry of Finance amends Income Tax RulesShabeer UppotungalNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesDetails of Salary Paid and Any Other Income and Tax DeductedPapar Rao GNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16 TDS certificateDocument8 pagesForm 16 TDS certificateVikas PattnaikNo ratings yet

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- TDS Certificate SalariesDocument2 pagesTDS Certificate Salariesjwadje1No ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS Certificatessanju_bhatNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Wages Act Annual Returns FormDocument5 pagesWages Act Annual Returns FormSUDHIR KUMARNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateHari Krishnan ElangovanNo ratings yet

- 317 Form16 (2005 06)Document6 pages317 Form16 (2005 06)sachin584No ratings yet

- Form 16Document6 pagesForm 16Ravi DesaiNo ratings yet

- None - FORM IV - KA - PWDocument2 pagesNone - FORM IV - KA - PWKishore KanthrajNo ratings yet

- Form No 16 in Excel With FormuleDocument3 pagesForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- Form 16 TDS Salary CertificateDocument3 pagesForm 16 TDS Salary CertificatesagarNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument5 pagesForm 16 Part A: WWW - Taxguru.inDarshan PatelNo ratings yet

- Form 26Document7 pagesForm 26pviveknaiduNo ratings yet

- Form 16Document3 pagesForm 16ganesh_korgaonkarNo ratings yet

- NBR 73Document3 pagesNBR 73regforsoftNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16 TDS SummaryDocument4 pagesForm 16 TDS SummarySushma Kaza DuggarajuNo ratings yet

- Income Tax On Dollar To InrDocument1 pageIncome Tax On Dollar To InrApki mautNo ratings yet

- Form No. 15CB: B 1. Country To Which Remittance Is MadeDocument3 pagesForm No. 15CB: B 1. Country To Which Remittance Is MadeDaman GillNo ratings yet

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesFrom EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNo ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortFrom EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNo ratings yet

- Gazzated Officer Certificate FormateDocument1 pageGazzated Officer Certificate FormateJayNo ratings yet

- Bankers List in IndiaDocument2 pagesBankers List in IndiaJayNo ratings yet

- Instructions NEW Pan Application - 1.11.2011Document14 pagesInstructions NEW Pan Application - 1.11.2011JayNo ratings yet

- New PAN Application Form W.E.F. 1.11.2011Document2 pagesNew PAN Application Form W.E.F. 1.11.2011JayNo ratings yet

- BIOMATRIC Ration Card InstructionDocument4 pagesBIOMATRIC Ration Card InstructionJayNo ratings yet

- Budget Highlights 2011-12Document2 pagesBudget Highlights 2011-12JayNo ratings yet

- SWRC DocumentDocument1 pageSWRC DocumentJayNo ratings yet

- Tds Rate Chart Asst Yr 12-13Document1 pageTds Rate Chart Asst Yr 12-13JayNo ratings yet

- Learning Licence FormDocument4 pagesLearning Licence FormJayNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Tandurasti Tamara HathmaDocument43 pagesTandurasti Tamara HathmaJayNo ratings yet

- Authority For PAN RegistrationDocument1 pageAuthority For PAN RegistrationJayNo ratings yet

- Form No 16aaDocument4 pagesForm No 16aaJayNo ratings yet

- Business Women 2010Document1 pageBusiness Women 2010JayNo ratings yet

- VARIOUS MOBILE BrandDocument1 pageVARIOUS MOBILE BrandJayNo ratings yet

- Form 16a - TDS - Blank 16aDocument1 pageForm 16a - TDS - Blank 16aJayNo ratings yet

- Spirit GUJARATIDocument4 pagesSpirit GUJARATIJayNo ratings yet

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (46)

- Jai HanumanDocument1 pageJai HanumanJayNo ratings yet

- Health ChartDocument1 pageHealth ChartJayNo ratings yet

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- New TDS ProvisionDocument1 pageNew TDS ProvisionJayNo ratings yet

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- Income Tax Jurisdiction - 2Document4 pagesIncome Tax Jurisdiction - 2Jay0% (1)

- Income Tax JurisdictionDocument3 pagesIncome Tax JurisdictionJay0% (1)

- Income Tax Jurisdiction - 1Document2 pagesIncome Tax Jurisdiction - 1JayNo ratings yet

- Time Pass - FunnyDocument3 pagesTime Pass - FunnyJayNo ratings yet

- TDS Limites - Union Budget 2010Document1 pageTDS Limites - Union Budget 2010JayNo ratings yet

- Key Features of Budget 2010-2011Document14 pagesKey Features of Budget 2010-2011api-25886395No ratings yet

- Kankaria Maninagar Sahakarti BankDocument2 pagesKankaria Maninagar Sahakarti BankJayNo ratings yet

- Name: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawDocument11 pagesName: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawPîyûsh KôltêNo ratings yet

- FABM2 Q2 Mod13Document29 pagesFABM2 Q2 Mod13Fretty Mae Abubo100% (3)

- Comparative Statement of Profit and LossDocument2 pagesComparative Statement of Profit and LossAnindya BatabyalNo ratings yet

- SuperSonic Task Sheet For Rbi PDFDocument7 pagesSuperSonic Task Sheet For Rbi PDFPragati SrivastavaNo ratings yet

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresNo ratings yet

- Fin 4500 sAMPLE Midterm Questions and AnswersDocument6 pagesFin 4500 sAMPLE Midterm Questions and AnswersmohamedNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather SaleemMalikKamranAsifNo ratings yet

- Chapter I: Introduction of Study: Goods and Service Tax (GST)Document73 pagesChapter I: Introduction of Study: Goods and Service Tax (GST)Prajakta KambleNo ratings yet

- Computation Part2Document4 pagesComputation Part2Jeane Mae BooNo ratings yet

- Payslip Dec 2022Document1 pagePayslip Dec 2022VickySaravananNo ratings yet

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. EB Case Nos. 1801 & 1808 (C.T.A. Case No. 8988), (October 14, 2019) PDFDocument22 pagesGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. EB Case Nos. 1801 & 1808 (C.T.A. Case No. 8988), (October 14, 2019) PDFKriszan ManiponNo ratings yet

- VAT Imposition and Principles ExplainedDocument29 pagesVAT Imposition and Principles ExplainedRai MarasiganNo ratings yet

- Ch-1 To 4 - FY 22-23Document56 pagesCh-1 To 4 - FY 22-23SaNo ratings yet

- Meaning of Canons of TaxationDocument2 pagesMeaning of Canons of TaxationVaishanaviNo ratings yet

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Document6 pages(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNo ratings yet

- Fringe BenefitsDocument5 pagesFringe BenefitsZandra LeighNo ratings yet

- Salary slip templateDocument1 pageSalary slip templatePtesgNo ratings yet

- Bryan Moises PDFDocument5 pagesBryan Moises PDFMary DenizeNo ratings yet

- Residence & Scope of Total IncomeDocument17 pagesResidence & Scope of Total IncomeSatyam Kumar AryaNo ratings yet

- Capstone Project - NormalizationDocument17 pagesCapstone Project - NormalizationRosè MaximoNo ratings yet

- Taxation TheoriesDocument3 pagesTaxation TheoriesJefther RegalaNo ratings yet

- W-8BEN: ColombiaDocument1 pageW-8BEN: ColombiaJhonNo ratings yet

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaNo ratings yet

- CDocument1 pageCAakash GuptaNo ratings yet

- Tax II CasesDocument3 pagesTax II CasesRichardEnriquezNo ratings yet

- BUS 168A Midterm ReviewDocument5 pagesBUS 168A Midterm ReviewcalebrmanNo ratings yet

- 2021 Lumbera Transcript - AdsalvadorDocument14 pages2021 Lumbera Transcript - AdsalvadorLakas PhilNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- CPAR General Principles (Batch 93) - HandoutDocument12 pagesCPAR General Principles (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet