Professional Documents

Culture Documents

InMobi TLS EmergingMarkets

Uploaded by

Sumit RoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InMobi TLS EmergingMarkets

Uploaded by

Sumit RoyCopyright:

Available Formats

THOUGHT LEADERSHIP

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

MOBILE WORLD CONGRESS

SERIES

www.inmobi.com

14 - 17 FEB, 2011

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

THOUGHT LEADERSHIP SERIES: DEFINING THE NEXT PHASE OF MOBILE ADVERTISING

13 February, 2011 As 2010 came to a close, it was clear that the debate over if this will be the year of mobile advertising ended with it. Good riddance! Mobile advertising is clearly here to stay and its absolutely huge. Ad spending gures aside, consumers have announced their intentions by ocking to mobile, and advertisers have no choice but to follow. While the journalists and bloggers busily draft lists and make predictions, at InMobi, we decided to take a slightly different approach. Rather than simply add to the noise, we took a step back and asked ourselves what will dene the next phase of mobile advertising? We chose to develop a series of whitepapers and offer in depth analysis, for a select number of topics. For the series we discuss three concepts that we think will dene the next phase of mobile advertising. We invited partners in the industry to collaborate with us, and invite you to join the conversation on twitter@inmobi or on our blog at www.inmobi.com/inmobiblog. James Lamberti VP, Global Marketing and Research InMobi

ABOUT INMOBI InMobi is the worlds largest independent mobile advertising network. With ofces on four continents we provide advertisers, publishers and developers with a uniquely global solution for advertising. Our network is growing fast and we now deliver the unprecedented ability to reach 194 Million consumers, in over 115 countries, through more than U.S. $31.5 Billion mobile ad impressions monthly. We recently were selected as a 2010 AlwaysOn Global 250 Company to Watch in Silicon Valley. InMobi is venture-backed with marquee investors including: Kleiner, Perkins, Caueld & Byers and Sherpalo Ventures. The company has ofces in London, San Francisco, Bangalore, Tokyo, and Singapore.

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 1

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

THE VALUE OF EMERGING MARKETS IN GLOBAL Emerging markets continue to garner much media attention. But is it all just hype? The industry is still questioning whether emerging markets are really valuable. The common misperception in the developed world is that the U.S., UK, France, Germany, Japan, Australia, and Singapore, still represent the vast majority of revenues in the mobile ecosystem. Most people in developed markets nd emerging markets interesting and exotic, but dont believe they are actually very valuable. In order to help establish the real value of emerging markets InMobi has used the latest market data from Informa Telecoms & Media. We combined their research on Mobile Data Services Revenues & Growth with our InMobi Network Data report, to form a more complete picture of the emerging mobile ecosystem. Together our research demonstrates that emerging markets are not just hype. Globalization is in fact real, and emerging markets are positioned to become the most important mobile media markets in the world. Informa Telecoms & Media estimates that the global mobile data services market , including mobile advertising, was worth U.S. $224 billion in 2010. Over the next four years the market will increase to U.S. $340 billion in 2014. With limited growth prospects in developed countries, the emerging markets represent high growth areas and are becoming a key focus for the mobile industry including: mobile operators, handset manufacturers, infrastructure vendors, as well as the data services platform, advertising and technology vendors. Its our belief that these emerging markets will soon eclipse the developer world and represent the vast majority of the global mobile ecosystem. Why? Because mobile adoption in the developed world is happening at blistering pace and the sheer scale of these markets will soon dwarf that of developed markets. FIGURE 1. MOBILE DATA SERVICES REVENUES BY REGION, 2008-2014

Mobile Data Services Revenues (US$ bil.)

160 140 120 100 80 60 40 20 0 2008 2009 2010 2011 2012 2013 2014

1

Asia Pacic North America Western Europe Eastern Europe Latin American Middle East Africa

DATA SERVICES ARE PROJECTED TO GROW OVER 14% ANNUALLY THROUGH 2014. GLOBAL MOBILE DATA SERVICES REVENUES, 2008 - 2014

(US$ bil.) Global Total

2008 175.2

2009 200.8

2010 224.1

2011 248.0

2012

2013

2014 CAGR (%) 240.8 14.2%

276.8 307.0

Source: Informa Telecoms & Media

1

Informa Telecoms & Media denes mobile data services, also referred to as value-added services, as all mobile services except voice calls. Mobile messaging, including P2P SMS, is also considered to be a mobile data service.

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 2

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

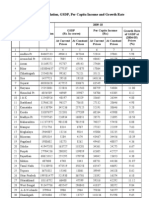

FIFTEEN EMERGING MARKETS HAVE SIGNIFICANT SCALE IN MOBILE Today fteen emerging markets account for more mobile subscriptions than the rest of the world combined and this trend will continue over the next ve years. These markets are China, India, Indonesia, South Africa, Nigeria, Egypt, Turkey, Israel, Saudi Arabia, Brazil, Mexico, Argentina, Russia, Poland and Ukraine. Due to the sheer volume of mobile subscriptions in these markets, and continuing mobile penetration, they offer substantial investment opportunities for the telecom and advertising industries.

FIGURE 2. MOBILE SUBSCRIPTIONS IN THE 15 GROWTH MARKETS ALREADY REPRESENT MORE USERS THAN THE REST OF THE WORLD.

MobileSubscriptionsGrowth,2008-2014

15GrowthMarkets RestofWorld

3,500 3,000

Subscriptions(mil.)

2,500 2,000 1,500 1,000 500 0 2008 2009 2010 2011 2012 2013 2014

Note: Figures refer to year-end estimates

Source: Informa Telecoms & Media

Market data from Informa Telecoms & Media indicates that these 15 emerging markets generated around 30% of mobile data services revenues in 2010, globally. With the revenue contribution expected to continue increasing over the next four years. In 2014, these 15 markets are expected to account for close to 36% of the global mobile data services revenues. The key driver of mobile data services growth in emerging markets is the increasing availability of low-cost feature-rich mobile phones. Mobile Internet and multimedia-capable handsets are now available for under U.S. $50 in most emerging markets. When we combine low xed-Internet penetration with availability of these low-cost Internet-capable devices, strong adoption and increased usage of mobile data services, the logical outcome fuels the underlying growth that is projected in these developing economies.

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 3

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

FIGURE 3. EMERGING MARKETS REVENUE GROWTH WILL OUTPACE THE REST OF THE WORLD

MobileDataRevenues,2008-2014

15EmergingMarket 250 200 US$Billions 150 100 50 46 57 129 144 158 188 203 RestofWorld 219

172

67

77

89

104

122

2008

2009

2010

Source: Informa Telecoms & Media

2011

2012

2013

2014

THE RAPID GROWTH OF MOBILE DATA SERVICE USAGE IN EMERGING MARKETS SMS has historically been the preferred service for deploying mobile data services in emerging markets, but this will change in the coming years and is particularly true given the increasing availability of 3G services in developing markets. For example, India has recently launched 3G and continues to rollout the technology across multiple carriers in the region. InMobi network data trended over the past x months clearly shows the impact on mobile advertising of 3G competition in the 2nd largest consumer market in the world. Similar trends are occurring in the other emerging markets as well. China and India had nearly 334 million mobile Internet users by the end of 2010, Informa believes that this number will grow to around 730 million mobile Internet users by 2014. This shows the huge potential for mobile Internet advertising growth in the Asia Pacic developing region. What does this mean for Mobile Advertising? Informa Telecoms & Media believes that the total global mobile advertising market was worth U.S. $3.5 billion in 2010. Over the next ve years, the market is expected to grow signicantly and generate revenues of over U.S. $24 billion in 2015. In 2015, the largest share (around 31%) of mobile advertising revenues is expected to come from the Asia Pacic developing region, driven by strong growth in China and India. These projections are further supported with InMobis network data. In January 2011, InMobi received 31.6 billion ad requests, up from 6.8 billion a year prior, growing 4.5 times over in 12 months. This growth is among both smartphones and advanced phones, with smartphones increasing at a faster rate. Smartphones now represent 36% of global ad requests, up from 13% a year ago.

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 4

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

FIGURE 4. SMARTPHONES CONTINUE TO PENETRATE THE MARKET GLOBALLY AND GAIN SHARE. IN JANUARY 2011, SMARTPHONES REPRESENT 36% OF GLOBAL MOBILE AD IMPRESSIONS.

35.0 B

GlobalInMobiSmartphoneImpressionsGrowth

30.0 B

25.0 B

20.0 B

15.0 B

10.0 B

5.0 B

.0 B Jan 10 Apr 10 Jul 10 Oct 10 Jan 11

Source: InMobi Network Data, January 2010 January 2011

When analyzing ad requests by region, emerging markets command a signicant share of this ecosystem. Fifteen emerging countries represent 48% of all global impressions and continue to grow. FIGURE 5. THE 15 EMERGING MARKETS ALREADY REPRESENT NEARLY HALF OF THE INMOBI NETWORK.

InMobi Network Share of Impressions - January 2011

EmergingMarkets48% Rest of World 52%

Source: InMobi Network Data, January 2011

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 5

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

Much of this growth in mobile advertising comes from emerging markets including India and Indonesia. In these emerging markets, identifying and sourcing compelling content from publishers for mobile Internet display advertising and making sure that the ads are relevant to a large audience despite the diverse cultural differences is a big challenge. Another issue is to ensure the delivery of the ads on a large number of different devices, including legacy devices, feature phones, basic handsets and smartphones. Informa Telecoms & Media believes that mobile will become an integral part of the advertising mix of more and more brands in the emerging markets over the next ve years. Due to the high level of interactivity possible on mobile phones, brands will increasingly depend on mobile advertising to boost customer retention and loyalty, and also to drive sales for their business. A Lack of Channels Options in Emerging Markets Will Make Mobile a Primary One for Advertisers Another key factor that will inuence the value of mobile advertising in developing markets relative to the established economies is more subtle and amount to the classic business paradigm of the innovators dilemma. In developed markets, there are several established media channels with nearly 100% consumer penetration and long entrenched businesses built around these channels. These include TV, Print, Radio, Fixed Internet, and even Outdoor. With the onset of mobile, despite its incredibly appealing media dimensions, major agencies and advertisers will be slow to move given the wealth of other options in media. Said another way, there is no forcing function for rapid change. The exact opposite is true in developing markets. Not only are there fewer channels overall, but those that exist have less penetration in comparison to developed markets. In developing markets, mobile already offers better reach than existing media and the pace of adoption along with composition of spend will be much higher in these regions as a result. MOBILE ADVERTISING MONETIZATION BY REGION Monetization of impressions in these emerging markets is a key factor to total ad revenues generated. It is apparent from the InMobi network data that the inventory exists and consumer demand will increase, but how does monetization in these emerging markets compare to developed mobile markets? The answer is not what many industry veterans would guess. When analysing eCPMs across regions, InMobi data shows that Western European countries lead monetization, followed by Africa, North America and Middle East. FIGURE 6. ECPMS BY REGION, DO NOT VARY BY ORDERS OF MAGNITUDE. THE DELTA IS NOT NEARLY AS GREAT AS MANY EXPERTS BELIEVE. MOBILE eCPM INDEX BY REGION

44 50 69 MIddle East North America Africa W. Europe 50 100 150 Source: InMobi Network Data, January 2011 200 Latin America Eastern Europe Asia Pacic 102 120 152 239 250

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 6

www.inmobi.com

THE VALUE OF EMERGING MARKETS IN THE MOBILE ECOSYSTEM

INMOBI MOBILE WORLD CONGRESS

Looking at the data, we see that eCPMs range from Latin America on the low-end to Western Europe on the high-end, where monetization in Western Europe is 5 times greater than Latin America. This contradicts common perceptions in the industry, likely based on xed PC web monetization, that Western Europe and US monetization is 10 times higher than any developed markets. Over time, as advertisers perceived value of mobile advertising increases, eCPMs in emerging markets will continue to grow and close the gap with Western Europe and North America. CONCLUSION The sheer size and scale of emerging markets mobile user base combined with, the rapid growth of data services and the lack of alternatives to for advertising channels all will create signicant monetization opportunities in emerging markets. These markets currently dened as emerging will soon constitute the majority of mobile advertising revenues and redenition of the term emerging markets will be in order.

Informa plc is the leading international provider of specialist information and services for the academic and scientic, professional and commercial business communities. Informa has over 150 ofces in more than 34 countries and employs 9,250 staff around the world. Informa is the largest publicly-owned organiser of conferences and courses in the world with an output of over 10,000 events annually. Informa publishes over 2,500 subscription-based information services including academic journals, real-time news and structured databases of commercial intelligence. Informa's book business has more than 40,000 academic and business titles in print. Informa's products are founded on high value content in a wide variety of subject areas. These range from the arts and humanities through social sciences to physical science and technology; from the professional domains of nance and the law through to commercial elds such as telecommunications, maritime trade, energy, commodities, and agriculture. Informa Telecoms & Media delivers strategic insight founded on global market data and primary research. We work in partnership with our clients, informing their decision-making with practical services supported by analysts.

www.informatm.com Twitter: @informatm

2011 InMobi. The Value Of Emerging Markets In The Mobile Ecosystem

Page 7

www.inmobi.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Wereldleiders Op TwitterDocument24 pagesWereldleiders Op TwitterHerman CouwenberghNo ratings yet

- TRAI Data Till 31st March, 2014Document19 pagesTRAI Data Till 31st March, 2014Tamanna Bavishi ShahNo ratings yet

- NokiaDocument1 pageNokiaSumit RoyNo ratings yet

- Global Top 100 Most Valueable Brands Brandz2014 - Infographic PDFDocument1 pageGlobal Top 100 Most Valueable Brands Brandz2014 - Infographic PDFSumit RoyNo ratings yet

- World Health Days 2014: JanuaryDocument2 pagesWorld Health Days 2014: JanuaryIvy Jorene Roman RodriguezNo ratings yet

- Mobile Advertising Research Trends and InsightsDocument15 pagesMobile Advertising Research Trends and InsightsSumit RoyNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- Nightingales - Philips Healthcare Tie UpDocument3 pagesNightingales - Philips Healthcare Tie UpSumit RoyNo ratings yet

- Risk Factors From Hepatitis BCDDocument1 pageRisk Factors From Hepatitis BCDSumit RoyNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- The State of Airline Marketing Airlinetrends Simpliflying April2013Document21 pagesThe State of Airline Marketing Airlinetrends Simpliflying April2013Sumit RoyNo ratings yet

- Calendário de Jogos Do Mundial de Futebol-Brasil 2014Document0 pagesCalendário de Jogos Do Mundial de Futebol-Brasil 2014Miguel RodriguesNo ratings yet

- Mediamind Comscore Research Dwelling On EntertainmentDocument20 pagesMediamind Comscore Research Dwelling On EntertainmentSumit RoyNo ratings yet

- FINAL - Mobile Advertising DeckDocument73 pagesFINAL - Mobile Advertising DecksumitkroyNo ratings yet

- Calendar 14Document57 pagesCalendar 14Hanan AhmedNo ratings yet

- The State of Maternal Health, D Nutrition in Asia " World Vision DataDocument4 pagesThe State of Maternal Health, D Nutrition in Asia " World Vision DataSumit RoyNo ratings yet

- MGI China E-Tailing Executive Summary March 2013Document18 pagesMGI China E-Tailing Executive Summary March 2013Sumit RoyNo ratings yet

- World Health Statisitics FullDocument180 pagesWorld Health Statisitics FullClarice SalidoNo ratings yet

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- 2014 Bill and Melinda Gates Foundation Report On Global PovertyDocument28 pages2014 Bill and Melinda Gates Foundation Report On Global PovertySumit RoyNo ratings yet

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- The Evolution of Digital Advertising 3.0: Adobe Research InsightsDocument1 pageThe Evolution of Digital Advertising 3.0: Adobe Research InsightsSumit RoyNo ratings yet

- 10 Historical Speeches Nobody Ever HeardDocument20 pages10 Historical Speeches Nobody Ever HeardSumit Roy100% (1)

- Gender and Social Networking Activity :facebook Vs OthersDocument18 pagesGender and Social Networking Activity :facebook Vs OthersSumit RoyNo ratings yet

- Statewise GSDP PCI and G.RDocument3 pagesStatewise GSDP PCI and G.RArchit SingalNo ratings yet

- CEO Survey On Hiring, Profitability and PeopleDocument36 pagesCEO Survey On Hiring, Profitability and PeopleSumit RoyNo ratings yet

- CVD Atlas 16 Death From Stroke PDFDocument1 pageCVD Atlas 16 Death From Stroke PDFRisti KhafidahNo ratings yet

- India InfographicsDocument3 pagesIndia InfographicsSumit RoyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)