Professional Documents

Culture Documents

Capital Gains Tax Return

Uploaded by

Suzette BalucanagCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gains Tax Return

Uploaded by

Suzette BalucanagCopyright:

Available Formats

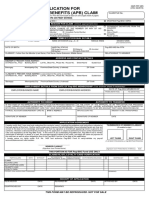

(To be filled up by the BIR)

Repu blika n g P ilipinas Kagawara n n g P anana lapi K awanihan ng Rentas Internas

Capital Gains Tax Return

2 Amended Return? Yes

1707

Code

4 ATC II 030 IC 110

Corporati

BIR Form No .

For Onerous Transfer of Shares of Stock Not T raded Through the Local Stock Exchange

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 Date of Transaction ( MM / DD / YYYY ) Part I 5 TIN Seller 3 No. of Sheets Attached No

July, 1999 ( ENCS )

Individua

Background Information 6 RDO Code 7 TIN Buyer

8 RDO Code Code ode C

Seller's Name

13 Zip Code Yes

10 Buyer's Name 12 Registered Address

11 Registered Address

No Foreclosure Sale If yes, specify Others (specify)

13 Zip Code

15 Are you availing of tax relief under an International Tax Treaty or Special Law? 16 Description of Transaction Cash Sale Installment Sale 17 Details of Installment Sale: 17 A Selling Price/Fair Market Value 17 B 17 C 17 D 17 E 17 Cost and Expenses Mortgage Assumed No. of installments Amount of Installment for this Payment Period

F Date of Collection of Installment for this Payment Period (MM/DD/YYYY) Total Collection (Downpayment and Installments) during the Year of Sale Compu tation of Tax

18 19 20 21

17 G PART II

18 Taxable Base - For Cash Sale/ Foreclosure Sale (Schedule 1) 19 Less: Cost and Other Allowable Expenses (Schedule 2)

20 Net Capital Gain/(Loss) 21 Tax Due on the Entire Transaction (5% on the first 100,000 ; 10% over 100,000)(Cash Sale/Foreclosure Sale); or 22 Tax Due for this Payment Period Computation of the Tax Due (If tax is payable under the installment method of computation) 23 Less: Tax Paid in Return Previously Filed, if this is an Amended Return

22

23 24

24 Tax Payable/(Overpayment)(Item 21 or 22 less Item 23) 25 Add: Penalties Surcharge

25A 25B

Interest

25C

Compromise

25D 26

26 Total Amount Payable/(Overpayment) (Sum of Items 24 & 25D) Schedule 1 Name of Corporate Stock Description of Shares of Stock (attach additional sheets, if necessary) Stock Certificate No. No. of Shares

Taxable Base Selling Price or FMV whichever is higher

27 Total (To Item 18) I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 28 Part III Taxpayer/Authorized Agent Signature over Printed Name D e t a i l s of P a y m e n t Drawee Bank/ M M D Agency Number Date

D Y Y Y Y

30 31B 32A 33A 33B 31C 32B 33C 31D 32C 33D

29 Title/Position of Signatory Amount

rticulars

30 Cash/Bank Memo 31 Check 32 Tax Debit Memo 33 Others

31A

Stamp of Receivin Office and Date o Receipt

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

apital Gains ax Return

1707

July, 1999 ( ENCS )

Individual Corporation

BIR Form No .

8 RDO Code

Taxable Base

Stamp of Receiving Office and Date of Receipt

BIR FORM 1707 (ENCS)-PAGE 2 Schedule 2 Schedule of Cost and Other Allowable Expenses Particulars Amount

34

Total (To Item 19) BIR Form 1707 - Capital Gains Tax Return (For Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange) Guidelines and Instructions

Who shall file barter, exc domestic co This return shall b through the juridical person, reside exchange or otherNot ov onero domestic corporation, c On any through the local stock ex Penalties The term Capita

Penalties The term Capita taxpayer (whether or not Ther but does not1. includesurc A sto property of a kindfollow whic inventory of the taxpaye a. year, or property held ordinary course ofb. trad trade or business of allowance for depreciati business. c.

When and Where to Fil

FORM 1707 (ENCS)-PAGE 2

mount

, exchange or other dispositio stic corporation, classified as ca gh the local stock exchange:

Not over P100,000 On any amount in excess of P10

ties

ties

There shall be imposed and co A surcharge of twenty five per following violations: a. Failure to file any return or installment due on or b b. Unless otherwise authori filing a return with a pe those with whom it is requ c. Failure to pay the full or shown on the return, or for which no return is before the due date;

You might also like

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaNo ratings yet

- 1706Document2 pages1706May Chan Cuyos100% (1)

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Chase Mortgage Finance Trust 2007-S6 ProspectusDocument214 pagesChase Mortgage Finance Trust 2007-S6 ProspectusBrenda ReedNo ratings yet

- 2018 Form I Individual Income Tax Return 2017Document20 pages2018 Form I Individual Income Tax Return 2017KSeegurNo ratings yet

- Antichreses - SanchezDocument2 pagesAntichreses - SanchezJo SanchezNo ratings yet

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelNo ratings yet

- Form No. NTC 1 24 AFFIDAVIT OF OWNERSHIP AND LOSS WITH UNDERTAKING R6Document1 pageForm No. NTC 1 24 AFFIDAVIT OF OWNERSHIP AND LOSS WITH UNDERTAKING R6Gavino Jr GaboNo ratings yet

- Metro Board of Directors Agenda, Feb. 2020Document15 pagesMetro Board of Directors Agenda, Feb. 2020Metro Los AngelesNo ratings yet

- Individual Tax Returns - IRS 2009Document200 pagesIndividual Tax Returns - IRS 2009Steve EldridgeNo ratings yet

- Contract To Sell Lai CADocument2 pagesContract To Sell Lai CADM HernandezNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- Florida Homestead AplicationDocument4 pagesFlorida Homestead AplicationJohn DollNo ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- Affidavit of No Income JaucianDocument1 pageAffidavit of No Income JaucianMCDDA SERVENo ratings yet

- PA Individual Income Tax Declaration for Electronic FilingDocument4 pagesPA Individual Income Tax Declaration for Electronic FilingDiana JuanNo ratings yet

- Capital Gains Tax LAW 101Document41 pagesCapital Gains Tax LAW 101Chit ComisoNo ratings yet

- Tax Form Certificate of CompensationDocument8 pagesTax Form Certificate of CompensationRafael ZamoraNo ratings yet

- Annual Return To Report Transactions With Foreign TrustsDocument6 pagesAnnual Return To Report Transactions With Foreign TrustsCarmita Keepitmovin FosterNo ratings yet

- Pdic Certification-FinalDocument1 pagePdic Certification-FinalmutedchildNo ratings yet

- Sample Format of Individual Income Tax Return y A 2017 2018Document3 pagesSample Format of Individual Income Tax Return y A 2017 2018Chathuranga LSISNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- Apply for Free Land PatentDocument5 pagesApply for Free Land PatentRonz RoganNo ratings yet

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Document1 page0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNo ratings yet

- Certificate of TitleDocument1 pageCertificate of Titleceleste LorenzanaNo ratings yet

- Tax Cases - Atty CatagueDocument264 pagesTax Cases - Atty CatagueJo-Al GealonNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- Annex C.2: Sworn Application For Tax ClearanceDocument1 pageAnnex C.2: Sworn Application For Tax ClearanceIan Bernales OrigNo ratings yet

- Individual Tax ReturnDocument4 pagesIndividual Tax ReturnmacNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- 2316Document13 pages2316Ariel BarkerNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SalegilbertNo ratings yet

- Income Tax Guide to Key Sections, Rates and RemediesDocument23 pagesIncome Tax Guide to Key Sections, Rates and RemediesAlyanna CabralNo ratings yet

- Aoa Sample CommentedDocument12 pagesAoa Sample CommentedxYrIsNo ratings yet

- Audit Reconsideration Memorandum Baker SCRIBDDocument7 pagesAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoNo ratings yet

- Affidavit (Mr. Martin)Document1 pageAffidavit (Mr. Martin)arlynNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- Tax Return Receipt ConfirmationDocument1 pageTax Return Receipt ConfirmationKisu Shute60% (5)

- Loan Guidelines Us BankDocument12 pagesLoan Guidelines Us BankcraigscNo ratings yet

- CONTRACT To SELL - Gomercindo AranasDocument3 pagesCONTRACT To SELL - Gomercindo AranasrjpogikaayoNo ratings yet

- Pag-IBIG Provident Benefits Claim FormDocument2 pagesPag-IBIG Provident Benefits Claim FormCarlo Beltran Valerio0% (2)

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJeffreyNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- 1701A Annual Income Tax ReturnDocument1 page1701A Annual Income Tax ReturnmoemoechanNo ratings yet

- SPL Articles of Association As at 22 October 2012Document27 pagesSPL Articles of Association As at 22 October 2012HirsutePursuitNo ratings yet

- Estate Tax - UstDocument14 pagesEstate Tax - UstKyle MerillNo ratings yet

- 2550 MDocument2 pages2550 MJose Venturina Villacorta100% (3)

- Bir Forms 1706 (99) Capital Gains Tax ReturnDocument5 pagesBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- CGT ReturnDocument2 pagesCGT Returnmborja15No ratings yet

- Ra 7875Document27 pagesRa 7875Sj EclipseNo ratings yet

- 1702 NewDocument11 pages1702 NewDIVINE WAGTINGANNo ratings yet

- FemaleBenefitForm Aug2009Document6 pagesFemaleBenefitForm Aug2009Suzette BalucanagNo ratings yet

- General IEC 01162015Document36 pagesGeneral IEC 01162015Suzette BalucanagNo ratings yet

- Omnibus Rules Book 5Document17 pagesOmnibus Rules Book 5Suzette BalucanagNo ratings yet

- NPO Acct ManualDocument26 pagesNPO Acct ManualdavidkongNo ratings yet

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDocument12 pagesRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- Personal Data SheetDocument4 pagesPersonal Data SheetLeonil Estaño100% (7)

- Philhealth November UpdatesDocument25 pagesPhilhealth November UpdatesSuzette BalucanagNo ratings yet

- 2007 Procedure ManualDocument91 pages2007 Procedure ManualSuzette BalucanagNo ratings yet

- Motion To Reduce BailDocument2 pagesMotion To Reduce BailSuzette Balucanag88% (16)

- Taxation CasesDocument120 pagesTaxation CasesSuzette Balucanag100% (5)

- Affidavit of No IncomeDocument1 pageAffidavit of No IncomeSuzette Balucanag88% (32)

- SEC FormsDocument6 pagesSEC FormsSuzette Balucanag40% (10)

- Professional Code of Ethics For Teachers of PhilippinesDocument6 pagesProfessional Code of Ethics For Teachers of PhilippinesMichael Pagaduan97% (35)

- Documentary Stamp Tax ReturnDocument6 pagesDocumentary Stamp Tax ReturnSuzette BalucanagNo ratings yet

- Business OrgDocument19 pagesBusiness OrgSuzette BalucanagNo ratings yet

- Prelims. CasesDocument25 pagesPrelims. CasesSuzette BalucanagNo ratings yet

- Taxation Real Property CasesDocument38 pagesTaxation Real Property CasesSuzette BalucanagNo ratings yet

- Evidence2008 6thsetDocument24 pagesEvidence2008 6thsetSuzette BalucanagNo ratings yet

- Drilon Vs ErmitaDocument36 pagesDrilon Vs ErmitaSuzette Balucanag100% (2)

- Evidence2008 7thsetDocument14 pagesEvidence2008 7thsetSuzette BalucanagNo ratings yet

- Evidence2008 5thsetDocument22 pagesEvidence2008 5thsetSuzette Balucanag100% (1)

- Evidence2008 4thsetDocument74 pagesEvidence2008 4thsetSuzette BalucanagNo ratings yet

- TAX1 FinalsDocument22 pagesTAX1 FinalsSuzette BalucanagNo ratings yet

- Evidence2008 3rdsetDocument46 pagesEvidence2008 3rdsetSuzette BalucanagNo ratings yet

- Evidence2008 2ndsetDocument38 pagesEvidence2008 2ndsetSuzette BalucanagNo ratings yet

- Provrem UneditedDocument28 pagesProvrem UneditedSuzette BalucanagNo ratings yet

- Evidence 2008Document98 pagesEvidence 2008Suzette Balucanag100% (1)

- Corporations By-Laws Restricting Stock TransfersDocument4 pagesCorporations By-Laws Restricting Stock TransfersiajoyamatNo ratings yet

- TWSGuide PDFDocument1,593 pagesTWSGuide PDFRafael MunhozNo ratings yet

- Lib by Sample Chapter 5Document58 pagesLib by Sample Chapter 5nazagame157794No ratings yet

- Managing Small FirmsDocument41 pagesManaging Small FirmsTusher SahaNo ratings yet

- Technical Analysis As A Forensic Tool in The Investigation of The Flash CrashDocument7 pagesTechnical Analysis As A Forensic Tool in The Investigation of The Flash CrashDavid WaggonerNo ratings yet

- TRADING COURSE'sDocument51 pagesTRADING COURSE'sDHAVAL40% (5)

- Income Statement: Case 1: RevenuesDocument3 pagesIncome Statement: Case 1: RevenuesRajivNo ratings yet

- Business Organization TypesDocument18 pagesBusiness Organization TypesKaifa FebrianaNo ratings yet

- Amendment To The Commercial Code in Slovakia - News FlashDocument4 pagesAmendment To The Commercial Code in Slovakia - News FlashAccaceNo ratings yet

- Secondary Market GuideDocument11 pagesSecondary Market GuideJeffry MahiNo ratings yet

- The Guide - LCMDocument25 pagesThe Guide - LCMMansi NaikNo ratings yet

- Accounting StandardsDocument105 pagesAccounting Standardskrishnakantpachouri026No ratings yet

- Greenlam Initiation JBWA 041022Document7 pagesGreenlam Initiation JBWA 041022PavanNo ratings yet

- Work Cap QuizDocument8 pagesWork Cap QuizLieza Jane AngelitudNo ratings yet

- Tolerance LimitsDocument17 pagesTolerance LimitssapmmgNo ratings yet

- Chapter 17 Hybrid and Derivative Securities: Principles of Managerial Finance, 13e, Global Edition (Gitman)Document44 pagesChapter 17 Hybrid and Derivative Securities: Principles of Managerial Finance, 13e, Global Edition (Gitman)Ariel Dimalanta100% (2)

- Managing Stock To Meet Customer NeedsDocument5 pagesManaging Stock To Meet Customer Needssmct0893No ratings yet

- Week 1: Introduction To Financial MarketsDocument11 pagesWeek 1: Introduction To Financial Marketsbanana lalaNo ratings yet

- Taxation LawDocument10 pagesTaxation LawflorNo ratings yet

- Chapter 1: Forms of Business Ownership 1.1 Sole TraderDocument15 pagesChapter 1: Forms of Business Ownership 1.1 Sole TraderBrandon LuuNo ratings yet

- Fundamental AnalysisDocument32 pagesFundamental AnalysisfahreezNo ratings yet

- Taxation1529664932 PDFDocument70 pagesTaxation1529664932 PDFÂNøøp SureshNo ratings yet

- Solution For FM Extra QuestionsDocument130 pagesSolution For FM Extra Questionsdeepu deepuNo ratings yet

- Regulating Initial Public Offerings in EthiopiaDocument17 pagesRegulating Initial Public Offerings in EthiopiaAbnet BeleteNo ratings yet

- Supreme Court: Augusto Kalaw For Petitioner. Sison, Dominguez & Associates For Private RespondentDocument9 pagesSupreme Court: Augusto Kalaw For Petitioner. Sison, Dominguez & Associates For Private RespondentViner Hernan SantosNo ratings yet

- DaveLandrys10Best Swing Trading Patterns and StratigiesDocument191 pagesDaveLandrys10Best Swing Trading Patterns and Stratigiesvenkatakrishna1nukal100% (7)

- Working CapitalDocument56 pagesWorking CapitalharmitkNo ratings yet

- Ratio Analysis Theory and ProblemsDocument133 pagesRatio Analysis Theory and ProblemsRohit Panpatil100% (1)

- Test Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisDocument126 pagesTest Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisJessa De GuzmanNo ratings yet

- NISM Series-X-B-IA (Level 2) WorkbookDocument274 pagesNISM Series-X-B-IA (Level 2) WorkbookDeep SanghaviNo ratings yet