Professional Documents

Culture Documents

What Is A Pitch Book

Uploaded by

donjaguar50Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is A Pitch Book

Uploaded by

donjaguar50Copyright:

Available Formats

Whats In a Pitch Book?

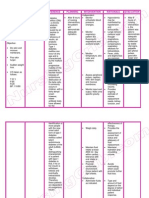

If youve been reading this site awhile, youve seen a number of references to pitch books whether theyre in day-in-the-life accounts, explanations of what bankers actually do, or even horror stories from other sources. But there hasnt been much detail on what goes into pitch books, why you spend so much time on them, where you can get some samples, and how you can learn to make them. So lets get started. Types of Pitch Books People use the term pitch book for almost any type of PowerPoint presentation that you create in investment banking. But this is too broad for our purposes, so Im going to split pitch books into the 3 main types of presentations you create: 1. Market Overviews / Bank Introductions Introducing your bank and giving updates to potential clients. 2. Deal Pitches Sell-side M&A, buy-side M&A, IPOs, debt issuances, and so on. 3. Management Presentations Pitching a client to investors once youve actually won the client. There are other types and sub-types, but 99% of your work in PowerPoint falls into one of these 3 categories. Common Elements These 3 main variants have a few common elements: 1. Title Slide with the date, bank or client logo, and description of the presentation. 2. Table of Contents listing the different sections right after the Title Slide. 3. Slides with bulleted text and slides with graphs / diagrams. There are no fancy transitions, animations, 3d effects, or anything else: pitch books are printed out 99% of the time, so none of that makes sense. The length varies widely some presentations might be 10 pages and others might be 150 pages depending on the category, where youre working, and how much your MD wants you to suffer. Market Overviews / Bank Introductions This is the simplest type of pitch book its usually around 10-20 slides that introduce your bank and give an overview of recent market activity to prove that your bank knows what its talking about. Common elements: 1. Slides showing your banks organization, the different departments, and how global you are. 2. Several tombstone slides that show recent deals your bank has done in a particular sector. So if youre presenting to Exxon Mobil, you might show recent energy M&A deals, IPOs, and debt offerings you have advised on. Along with these, you might create league table slides that show how your bank ranks in different areas like tech M&A deals, equity issuances, and so on. 3. Market overview slides showing recent trends and deals in the market and data on how similar companies (comps) have been performing lately. These types of pitch books are the least painful for investment banking analysts because you mostly just copy slides from elsewhere and update existing data. Some banks dont even use these types of presentations at all theyre more common at smaller banks where you actually need to introduce yourself. Sell-Side M&A Pitch Books Heres where the fun begins. These pitch books are the longest and most complex, and can sometimes be well over 100 slides. You create these when a company says, We want to sell, and were holding a bake-off to select a bank to represent us. You get to play create a presentation and then pitch us on why we should choose you. The usual contents: 1. Bank Overview This is similar to #1 and #2 above, but theres more of an emphasis on cutting data in creative ways to make your bank look better than it actually is. Were not #1 in energy deals over $1 billion? Try $1.5 billion try North America only try between $750 million and $1.5 billion! 2. Situation / Positioning Overview Heres where you create a few textual slides on what makes the company attractive and how you would pitch it to potential buyers. You might also create graphs showing how quickly the market is growing and how this company dominates the competition, even if it doesnt. 3. Valuation Summary This is where you exaggerate the companys value and make bold promises so that your bank can win the deal. You start off with a textual summary, then present the infamous football field graph showing the companys valuation according to different methodologies.

Then you show individual methodologies such as public comps, precedent transactions, and a DCF. Senior bankers usually know how much a company is worth, so they give you a number and you have to work backward to make the data support it. Yet another reason why banking is not rocket science. 4. Potential Buyers This is where you give an exhaustive list of everyone who could potentially buy this company. You might split this into strategic acquirers (normal companies) and financial sponsors (PE firms and hedge funds), and you include a summary slide in the beginning followed by detailed descriptions (company profiles) afterward. This can easily be the most painful section of the entire pitch book. Imagine looking up a companys business description, products, executives, and financial information and pasting all of that into PowerPoint now repeat that 20 times. 5. Summary / Recommendations You give advice and recommend how many buyers the company should approach, how long it will take, and what your bank is going to do in this section. These are almost always templated slides taken from other presentations, so this part isnt too painful. 6. Appendix This contains all the data that no one reads. You might paste more detailed models, backup data, and even lengthier lists of company profiles into this section. Bankers like to make presentations as long as possible so thick appendices are very common. Buy-Side M&A Pitch Books These are similar to sell-side M&A pitch books, so I wont repeat everything the key differences: 1. Theyre shorter because not as much data is stuffed into the appendix. 2. Rather than listing potential buyers, you list potential acquisition candidates this list may be much longer and you may create more profiles for these companies. 3. Theres not as much information on the companys own valuation youre buying another company, not being sold. Despite being shorter, buy-side pitch books may be more annoying because you have more time-consuming company profiles. Debt Financing or IPO Pitch Books These are both similar to the sell-side and buy-side pitch books above. The differences: 1. There are no company profiles and no potential buyers / potential acquisitions sections. 2. You include relevant financing models for example, an IPO model showing what multiple a company might go public at and how much in proceeds it will receive. With no company profiles, these presentations are somewhat less painful than M&A pitch books. Management Presentations These pitch books created for real clients instead of prospective clients are less quantitative and are more focused on the clients strengths. Youre pitching the company itself to investors (for debt / equity offerings) or to potential buyers (for sell-side M&A) so you use the clients colors and presentation theme rather than your banks. The structure depends on the clients industry a management presentation for a bank will look much different than a presentation for a tech company. If we assume that the company is a standard one selling products or services to customers, a typical structure might be: 1. Executive Summary / Company Highlights 2. Market Overview 3. Products & Services 4. Sales & Marketing 5. Customers 6. Expansion Opportunities 7. Org Chart 8. Historical & Projected Financial Performance You never use company profiles, information about your own bank, information onother companies (e.g. showing the comps), or valuation data in these presentations. You still use a mix of bulleted text slides and graph/diagram slides, but its harder to generalize the exact slides you might see. Common slide types: Bar graph showing the total addressable market each year; graphical display of all the companys products; customers by geography, industry, and size; historical and projected income statements and the most recent balance sheet. For asset-heavy industries like financial institutions and oil & gas, it doesnt make sense to discuss products or customers so you would instead give more detail on their assets, proven and unproven reserves, and so on.

Management Presentations are less repetitive to create than other types of pitch books, but they also take more time to complete. You might throw together a sell-side M&A pitch book in a few days, but management presentations often take weeks. Thats not because theyre longer most of the time theyre actually shorter, in the 30-50 slide range. Instead, they take more time because you need to interact with the client, get their feedback, and go through more iterations. Regional Variances The US tends to have the lengthiest pitch books bankers there like to do work for the sake of doing work. In emerging markets, such as investment banking in Saudi Arabia, pitch books tend to be simpler and less focused on numbers. English is the predominant language used in pitch books, but sometimes you see local languages depending on the market the best example is Japan, where you pretty much need to know the language or you cant do anything. Other Types of Pitch Books There are a couple other types of pitch books and sub-types of the ones described above: 1) Combo Pitch Book / Scenario Analysis A company isnt sure whether it wants to go public or sell so you create a pitch book with both scenarios and show the tradeoffs. You might also do this if youre pitching a restructuring deal and you want to show what happens if the company sells vs. declares bankruptcy vs. restructures itself vs. refinances its debt. 2) Targeted Deal Pitch Book A buyer has just approached your client with an acquisition offer and you want to show accretion / dilution under different scenarios. In this case you would skip all the upfront materials about your bank and just get into business, showing mostly numbers from your analysis. 3) Client Update Presentations You create these if youre running an M&A deal and you want to update the client on your progress. You would skip all the fluff and just create a few slides showing who youve contacted, what theyve said, and a summary of any offers received so far. 4) Fairness Opinions You do these right before a deal is officially announced they consist of detailed valuations that prove the price your client is receiving (or paying) is fair. Again, you skip all the fluff and get straight into business with a few slides that summarize the offer terms and then a whole lot of slides with valuation graphs and data. Differences at Boutiques vs. Bulge Brackets Pitch books are similar no matter what bank youre at, but there can be a few differences: 1. Bulge brackets tend to be more numbers-focused while smaller places may be more qualitative and market-focused. 2. Bulge brackets often show more scenarios than boutiques and therefore have lengthier pitch books. In Other Areas of Finance Sometimes you see similar types of presentations in private equity, hedge funds, and asset management. But these presentations are shorter and have less fluff compared to investment banking pitch books. Some buy-side firms like to make analysts and associates create investment memos that summarize everything for the Partners before they make an investment decision. These look similar to the Management Presentations described above whether or not you do them depends on your firms culture. Why Do You Spend So Much Time On Them? You never create pitch books from scratch youre always working off of templates and pasting in data from other sources. So that raises the question If pitch books arent rocket science, why do you spend so much time on them? Much of this goes back to why bankers work so much so lets go through the reasons. Attention to Detail You will spend a lot of time making sure that everything is properly footnoted, that all your sentences end with periods, and that the employee counts for all 50 of your company profiles are 100% correct. Conflicting Changes If youve read Monkey Business, you already know about this one: yup, nothing has changed in 20+ years. When you distribute your pitch book, the Associate will make one set of changes, the VP will make another, and the MD will make another which results in conflicts on every single slide. You will also spend a lot of time receiving marked-up pitch book faxes at 3 AM and then implementing all the changes.

Dozens of Revisions Its not uncommon to see v73 and other large numbers at the end of each file name sometimes you go through over 100 revisions of a single pitch book. These have diminishing returns after the first few major changes, but bankers follow the 20/80 rule instead of the 80/20 rule. Youll also spend a lot of time trying to decipher what your VP meant when you cant read anything he marked up in red pen on your latest draft. Inefficiencies & Pride Its one thing if a senior banker wants to sketch out a new graph for you to create, but often they re-write the text of entire slides on the printouts of those slides. That alone takes longer than re-typing it in the first place, but then it also costs you time because you have to read their markup, interpret it, and type it all over yourself. Why? Because senior bankers are above editing PowerPoint files directly. Irrational Obsessions Finally, bankers have irrational obsessions: if youre not murdering people in your bathtub, youre changing minutiae in a pitch book instead. When youre pitching a company, relationships and the actual in-person pitch matter far more than the presentation - but rather than focusing on those, bankers like to spend time on tasks they feel more comfortable with, like changing font sizes in a presentation. Where Can You Get Example Pitch Books? Theyre quite tough to come by leaked pitch books are easy to trace back to whoever leaked them because they include bank logos and specific company names. So its far more difficult to get sample pitch books than it is to find sample Excel models. Still, you can find a few if you scour the Internet: 1. NASDAQ OMX & ICE Proposal to Acquire NYSE Euronext 2. Leaked UBS Market Overview / Bank Introduction Pitch Book 3. Leaked Bear Stearns Presentation to Nortel / Avaya 4. Credit Suisse Fairness Opinion on SunGard LBO Public Record 5. Wells Fargo Securities Investment Banking & Capital Markets 6. Raymond James Introductory Presentation 7. Morgan Stanley Real Estate 8. Morgan Stanley International: European Overview Update 9. Time Warner The Lazard Report While some of these are quite old, bankers are creatures of habit and pitch books barely change from year to year so theyre still accurate. Another Option If youre looking for another way to learn, weve just added a full set of PowerPoint tutorials to Breaking Into Wall Street (the timing of this article is purely coincidental of course). These tutorials walk you through the process of creating a buy-side M&A pitch book and theres also a more targeted pitch book for the Microsoft / Yahoo deal in theAdvanced Modeling tutorials. These arent 100% representative of what youd see at a bank because they skip over the bank introduction section but you dont do much original work there as an analyst anyway. What Do You Do With Them? Before you start working in banking, you should get familiar with the layout of these different types of pitch books and try to learn some PowerPoint basics. Dont go crazy with it because a lot of the process depends on your bank, but its always good to know the structure and how to arrange slides, text, and objects before you start working. More questions? Ask away.

You might also like

- Nursing Care Plan Diabetes Mellitus Type 1Document2 pagesNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- Brown-Forman Initiating CoverageDocument96 pagesBrown-Forman Initiating CoverageRestructuring100% (1)

- 3 Crispin Odey PresentationDocument23 pages3 Crispin Odey PresentationWindsor1801No ratings yet

- Excel Shortcuts For ValuationDocument13 pagesExcel Shortcuts For ValuationsmithNo ratings yet

- Eminence CapitalMen's WarehouseDocument0 pagesEminence CapitalMen's WarehouseCanadianValueNo ratings yet

- Third Point Investor PresentationDocument29 pagesThird Point Investor PresentationValueWalkNo ratings yet

- Agrogrnja Teaser Draft v9 - EnglishDocument5 pagesAgrogrnja Teaser Draft v9 - Englishspartak_serbiaNo ratings yet

- A Note On Valuation in Entrepreneurial SettingsDocument4 pagesA Note On Valuation in Entrepreneurial SettingsUsmanNo ratings yet

- UBS Outlook 2024Document120 pagesUBS Outlook 2024Vivek TiwariNo ratings yet

- Jazz Pharmaceuticals Investment Banking Pitch BookDocument20 pagesJazz Pharmaceuticals Investment Banking Pitch BookdaniellimzyNo ratings yet

- IBIG 04 01 Core ConceptsDocument32 pagesIBIG 04 01 Core ConceptsKrystleNo ratings yet

- How To Create Investment Banking Pitch BooksDocument7 pagesHow To Create Investment Banking Pitch BooksRaviShankarDuggiralaNo ratings yet

- Biotech Valuation Model 2Document21 pagesBiotech Valuation Model 2w_fibNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookZefi KtsiNo ratings yet

- Valuation Q&A McKinseyDocument4 pagesValuation Q&A McKinseyZi Sheng NeohNo ratings yet

- How To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldDocument12 pagesHow To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldLindsey SantosNo ratings yet

- Corporate Professionals Sum of Parts ValuationDocument4 pagesCorporate Professionals Sum of Parts ValuationCorporate Professionals100% (1)

- Equity Research On Square Pharmaceutical Limited PDFDocument8 pagesEquity Research On Square Pharmaceutical Limited PDFNur Md Al Hossain100% (1)

- Buy-Side Business Attribution - TABB VersionDocument11 pagesBuy-Side Business Attribution - TABB VersiontabbforumNo ratings yet

- PWC Deals Retail Consumer Insights q2 2016Document5 pagesPWC Deals Retail Consumer Insights q2 2016Peter ShiNo ratings yet

- Arlington Value 2006 Annual Shareholder LetterDocument5 pagesArlington Value 2006 Annual Shareholder LetterSmitty WNo ratings yet

- Cashflow.comDocument40 pagesCashflow.comad9292No ratings yet

- Merits of CFROIDocument7 pagesMerits of CFROIfreemind3682No ratings yet

- Business Valuation Project Presentation: Sector: Pharmaceutical Stock, India: Cipla LTD Stock, USA: Mylan IncDocument32 pagesBusiness Valuation Project Presentation: Sector: Pharmaceutical Stock, India: Cipla LTD Stock, USA: Mylan Incpuneet.glennNo ratings yet

- S&PIndustryReport PharmaceuticalsDocument58 pagesS&PIndustryReport PharmaceuticalsJessa RosalesNo ratings yet

- Modeling Peak ProfitabiliytDocument23 pagesModeling Peak ProfitabiliytBrentjaciow100% (1)

- PWC New M& A Accounting 2009Document24 pagesPWC New M& A Accounting 2009wallstreetprepNo ratings yet

- RR - HCGDocument318 pagesRR - HCGapi-3703542No ratings yet

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet

- UBS Pitch BookDocument19 pagesUBS Pitch Bookmmillig22No ratings yet

- Buffett On ValuationDocument7 pagesBuffett On ValuationAyush AggarwalNo ratings yet

- Cadbury Trian LetterDocument14 pagesCadbury Trian Letterbillroberts981No ratings yet

- Fixed Income Securities NumericalsDocument5 pagesFixed Income Securities NumericalsNatraj PandeyNo ratings yet

- Equities Crossing Barriers 09jun10Document42 pagesEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- Third Point Q3 2019 LetterDocument13 pagesThird Point Q3 2019 LetterZerohedge100% (2)

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocument12 pagesBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonNo ratings yet

- UBS Equity Compass May - EN (1) - 1Document41 pagesUBS Equity Compass May - EN (1) - 1Bondi BeachNo ratings yet

- High Yield Bond Basics USDocument4 pagesHigh Yield Bond Basics USJDNo ratings yet

- Valuation Errors - HBSDocument13 pagesValuation Errors - HBSlaliaisondangereuseNo ratings yet

- Cio Spotlight ReportDocument9 pagesCio Spotlight Reporthkm_gmat4849No ratings yet

- Bank ValuationsDocument20 pagesBank ValuationsHenry So E DiarkoNo ratings yet

- Intrinsic Value CalculatorDocument11 pagesIntrinsic Value CalculatorKrishnamoorthy SubramaniamNo ratings yet

- GS ESS - newfWAssessingFairValueEmergMktsDocument26 pagesGS ESS - newfWAssessingFairValueEmergMktsKasey OwensNo ratings yet

- Cleveland Research Company Stock Pitch 2016 EntryDocument24 pagesCleveland Research Company Stock Pitch 2016 EntryNguyen D. Nguyen100% (1)

- Credit Suisse Global Investment Returns Yearbook 2018 enDocument43 pagesCredit Suisse Global Investment Returns Yearbook 2018 enbayarearad100% (1)

- PWC Chems Q3 2010Document20 pagesPWC Chems Q3 2010kanishkagaggarNo ratings yet

- JP Morgan - 2021 Capital Market AssumptionsDocument130 pagesJP Morgan - 2021 Capital Market AssumptionsHiroshi Hishida100% (2)

- Investment ChecklistDocument4 pagesInvestment ChecklistlowbankNo ratings yet

- Fundamental Analysis - BNY Melon - HimaniDocument8 pagesFundamental Analysis - BNY Melon - HimaniAnjali Angel ThakurNo ratings yet

- DCF Model TemplateDocument6 pagesDCF Model TemplateHamda AkbarNo ratings yet

- Goldman Sachs - A Guide To GuidanceDocument17 pagesGoldman Sachs - A Guide To Guidancegneyman100% (2)

- Competitive Advantage PeriodDocument6 pagesCompetitive Advantage PeriodAndrija BabićNo ratings yet

- Focus InvestorDocument5 pagesFocus Investora65b66inc7288No ratings yet

- Valuation FundamentalsDocument18 pagesValuation Fundamentalstheakj100% (3)

- Top Performing Venture Capital FundsDocument4 pagesTop Performing Venture Capital FundsLeon P.No ratings yet

- Distressed Debt Investing - Trade Claims PrimerDocument7 pagesDistressed Debt Investing - Trade Claims Primer10Z2No ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachFrom EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Kyoto Seika UniversityDocument27 pagesKyoto Seika UniversityMalvinNo ratings yet

- Part-II Poem Article and Report For College Magazine-2015-16 Dr.M.Q. KhanDocument4 pagesPart-II Poem Article and Report For College Magazine-2015-16 Dr.M.Q. KhanTechi Son taraNo ratings yet

- Salik Sa Mga Estudyante NG Hindi Wastong Pagsuot NG Uniporme NG Senior High School Sa Paaralang Ama Computer College Fairview CampusDocument1 pageSalik Sa Mga Estudyante NG Hindi Wastong Pagsuot NG Uniporme NG Senior High School Sa Paaralang Ama Computer College Fairview CampusIsrael ManansalaNo ratings yet

- PmtsDocument46 pagesPmtsDhiraj ZanzadNo ratings yet

- WB-Mech 120 Ch05 ModalDocument16 pagesWB-Mech 120 Ch05 ModalhebiyongNo ratings yet

- Tugas Farmasi Klinis: Feby Purnama Sari 1802036Document9 pagesTugas Farmasi Klinis: Feby Purnama Sari 1802036Feby Purnama SariNo ratings yet

- Copper For BusbarDocument60 pagesCopper For BusbarSunil Gadekar100% (3)

- Pre-Qin Philosophers and ThinkersDocument22 pagesPre-Qin Philosophers and ThinkersHelder JorgeNo ratings yet

- IBDP Physics Oxford David - Homer Course Ebook 4th Edition-2014 CH-1Document27 pagesIBDP Physics Oxford David - Homer Course Ebook 4th Edition-2014 CH-1Milek Anil KumarNo ratings yet

- Plasterboard FyrchekDocument4 pagesPlasterboard FyrchekAlex ZecevicNo ratings yet

- Adobe Scan 23-Feb-2024Document4 pagesAdobe Scan 23-Feb-2024muzwalimub4104No ratings yet

- Chapter 3Document26 pagesChapter 3Francis Anthony CataniagNo ratings yet

- MikroekonomiDocument1 pageMikroekonomiYudhaPrakosoIINo ratings yet

- Abbreviations For O&G IndustryDocument38 pagesAbbreviations For O&G IndustryMike George MeyerNo ratings yet

- Python Versus Matlab: Examples in Civil EngineeringDocument32 pagesPython Versus Matlab: Examples in Civil EngineeringNiranjanAryan100% (1)

- Apspdcl PDFDocument21 pagesApspdcl PDFK.sanjeev KumarNo ratings yet

- Accuracy of Transferring Analog Dental Casts To A Virtual ArticulatorDocument9 pagesAccuracy of Transferring Analog Dental Casts To A Virtual ArticulatorNetra TaleleNo ratings yet

- Science9 Q3 SLM1Document15 pagesScience9 Q3 SLM1Zandra Musni Delos ReyesNo ratings yet

- 2018-3-27 MIDAS Civil Presentation Curved BridgesDocument57 pages2018-3-27 MIDAS Civil Presentation Curved BridgesShishir Kumar NayakNo ratings yet

- T.Y.B.B.A. (CA) Sem VI Practical Slips 2019 PatternDocument30 pagesT.Y.B.B.A. (CA) Sem VI Practical Slips 2019 PatternJai Ramteke100% (2)

- Ga-Ta10 (LHH)Document181 pagesGa-Ta10 (LHH)Linh T.Thảo NguyễnNo ratings yet

- Continuous Improvement SYMPOSIUM SCRIPTDocument3 pagesContinuous Improvement SYMPOSIUM SCRIPTChanda Marie AsedillaNo ratings yet

- Habibillah Energi Adidaya Statement of QualificationsDocument56 pagesHabibillah Energi Adidaya Statement of QualificationsjakalegawaNo ratings yet

- Week 5 Teradata Practice ExerciseDocument14 pagesWeek 5 Teradata Practice ExerciseWooyeon ChoNo ratings yet

- SOP For Production DepartmentDocument5 pagesSOP For Production DepartmentDaniel SusantoNo ratings yet

- MODULE-6 Human Person As Embodied SpiritDocument18 pagesMODULE-6 Human Person As Embodied SpiritRoyceNo ratings yet

- ENG11H Realism 6-Outcasts of Poker FlatDocument3 pagesENG11H Realism 6-Outcasts of Poker FlatJosh Cauhorn100% (1)

- Active and Inactive Volcano LPDocument2 pagesActive and Inactive Volcano LPhorace hernandez100% (5)